Electronic Banking Specialist Resume Examples

Jul 18, 2024

|

12 min read

Unlock your potential: write a standout electronic banking specialist resume

Rated by 348 people

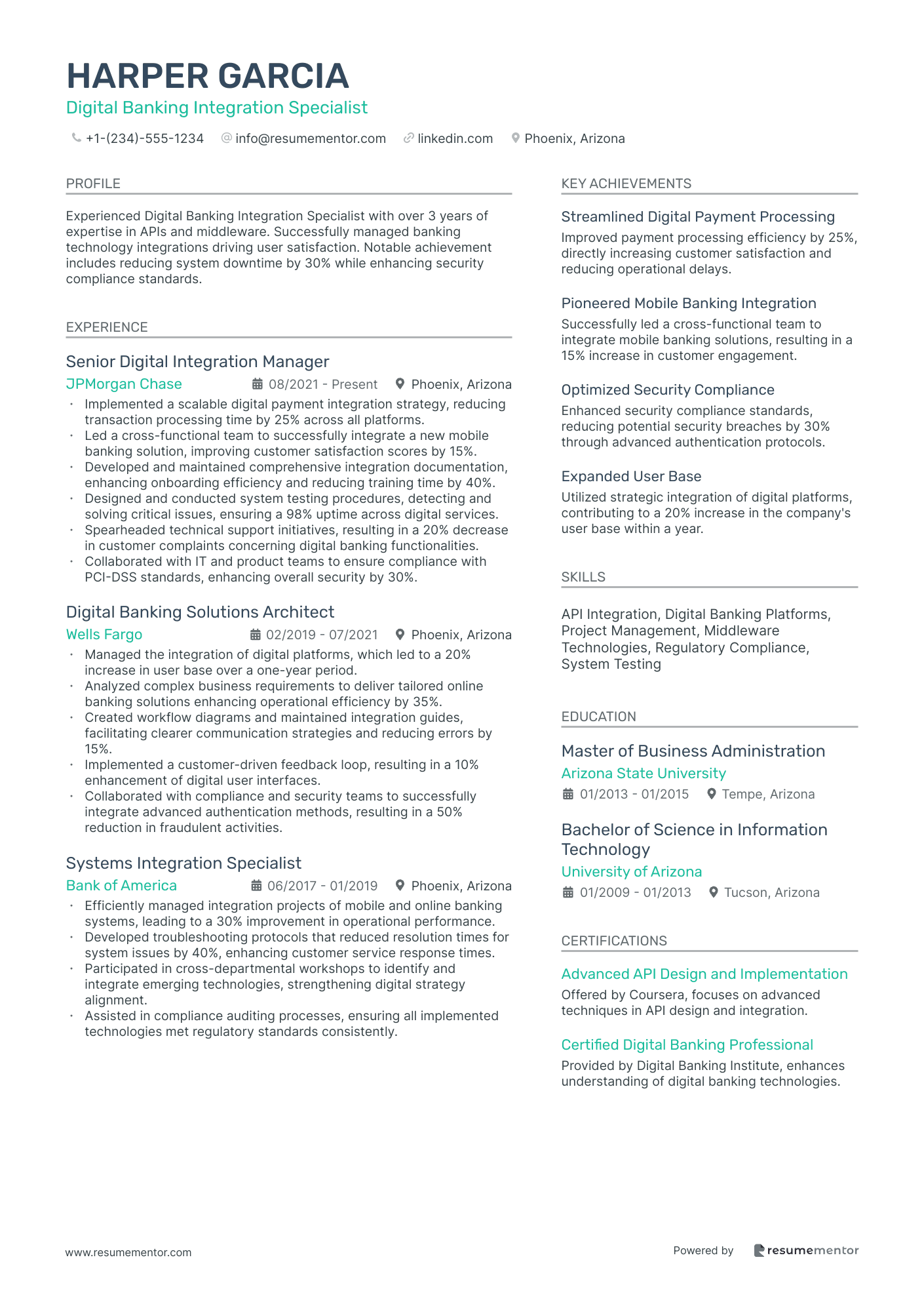

Digital Banking Integration Specialist

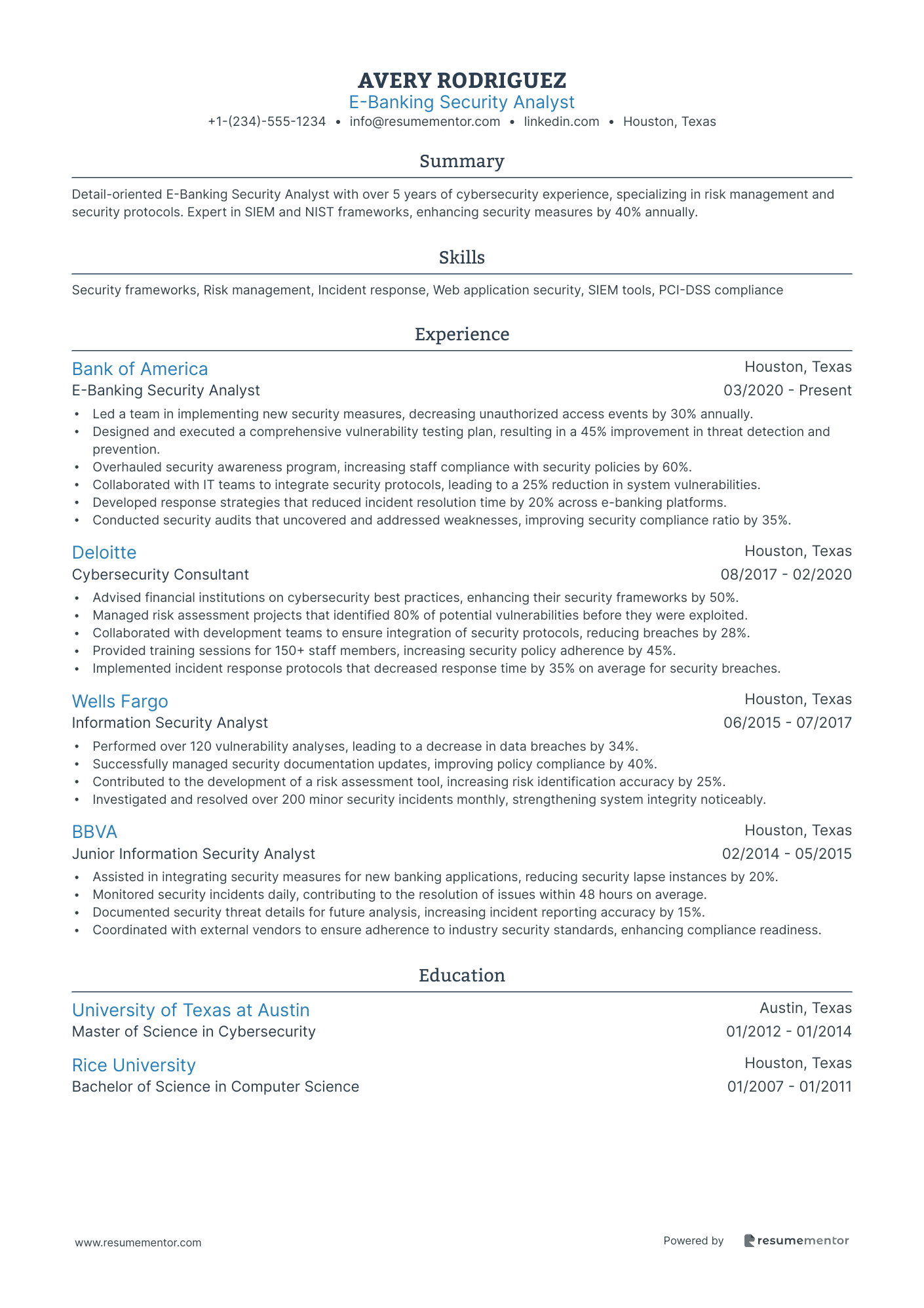

E-Banking Security Analyst

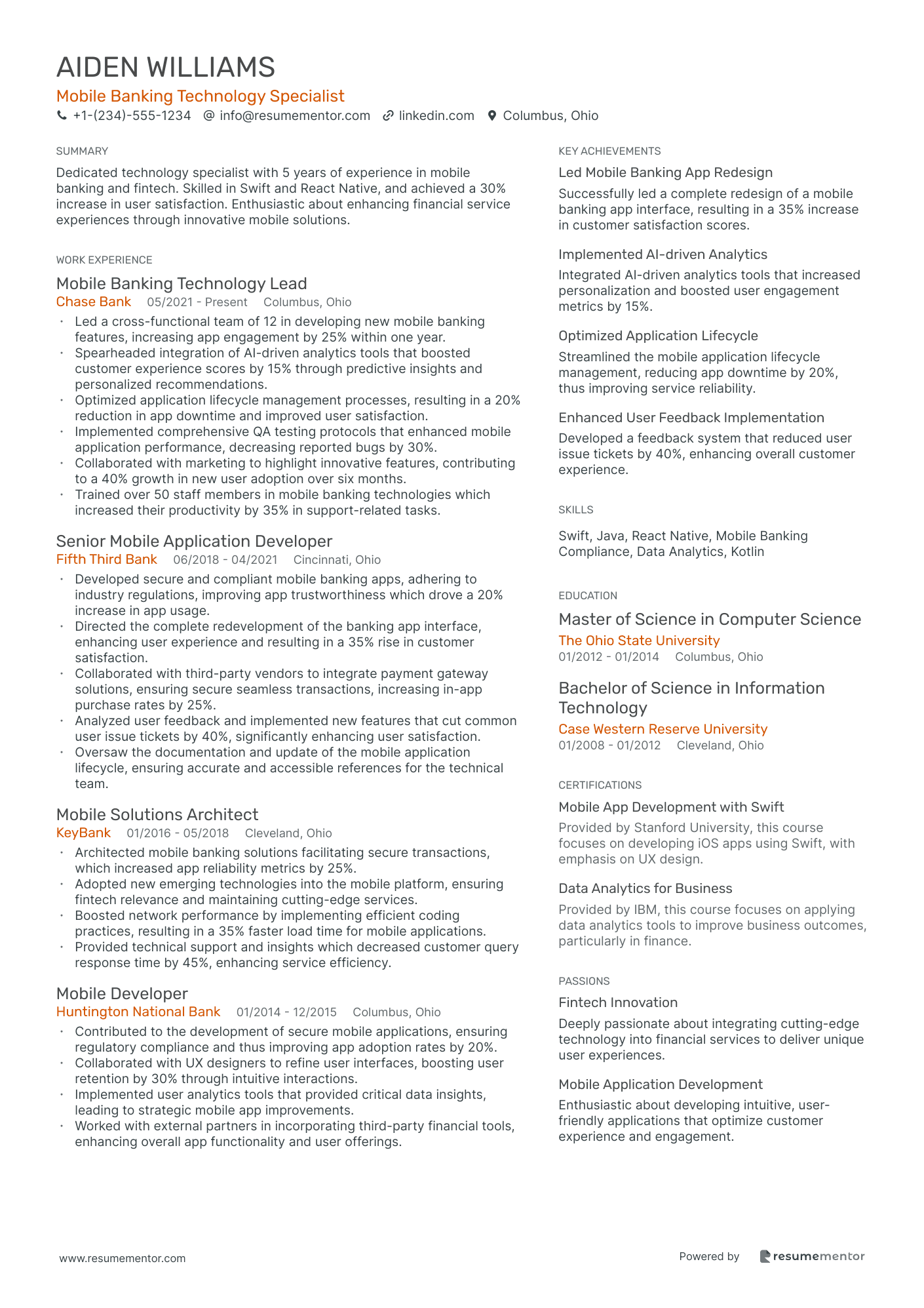

Mobile Banking Technology Specialist

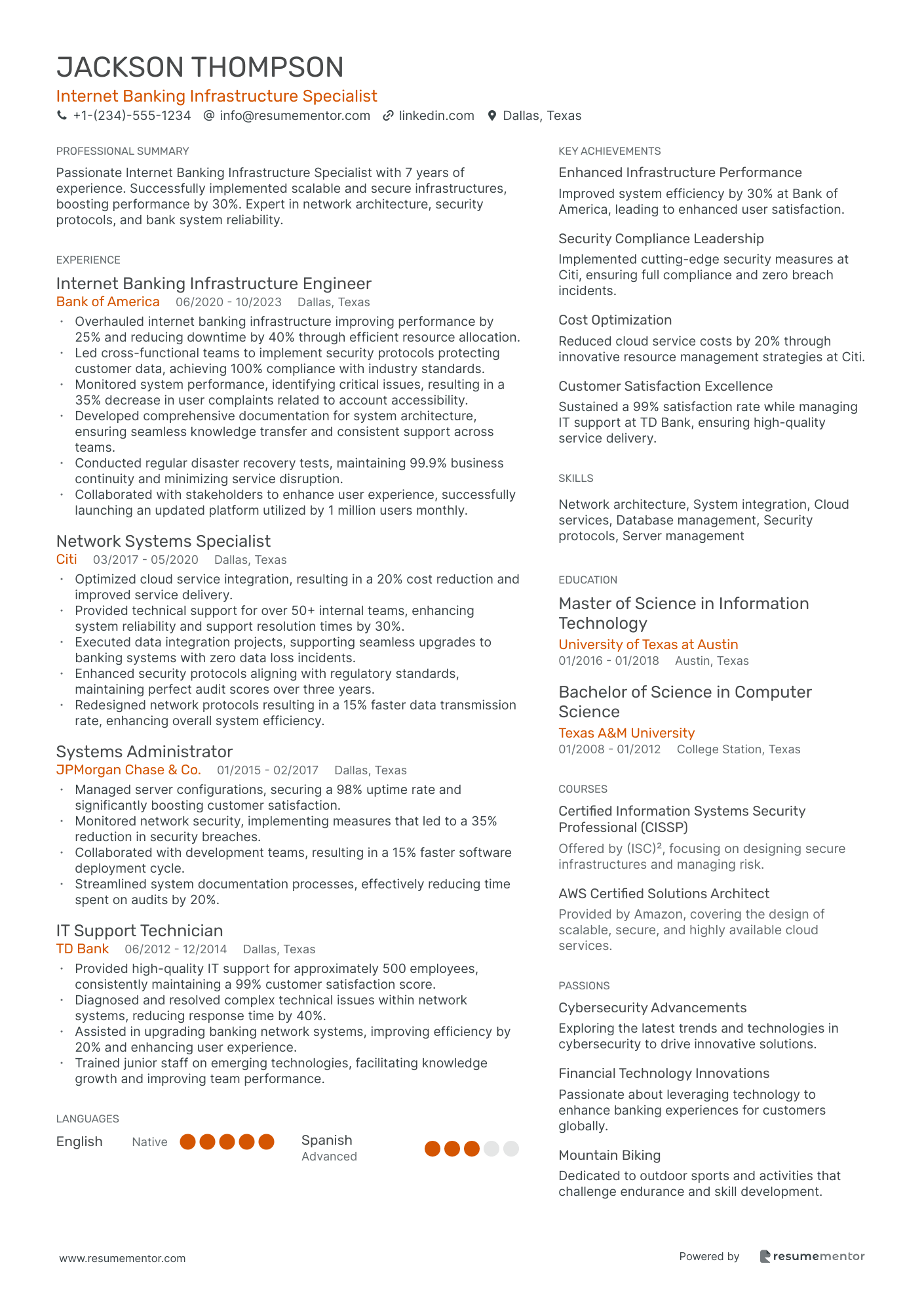

Internet Banking Infrastructure Specialist

Online Banking Fraud Prevention Expert

Electronic Payment System Specialist

Digital Financial Software Specialist

E-Banking Customer Support Specialist

Web-Based Banking Solutions Developer

Electronic Funds Transfer Specialist

Digital Banking Integration Specialist resume sample

When applying for this role, highlight your experience with API integrations and digital platform management. Showcase any familiarity with financial technologies, such as mobile banking apps or online payment systems. Mention any relevant courses, certifications, or projects related to digital transformation or system implementations. Use the 'skill-action-result' approach to illustrate how your expertise improved processes or customer experiences. Stress your ability to work cross-functionally and your problem-solving skills, as these are essential in facilitating smooth integrations and collaborations with stakeholders.

- •Implemented a scalable digital payment integration strategy, reducing transaction processing time by 25% across all platforms.

- •Led a cross-functional team to successfully integrate a new mobile banking solution, improving customer satisfaction scores by 15%.

- •Developed and maintained comprehensive integration documentation, enhancing onboarding efficiency and reducing training time by 40%.

- •Designed and conducted system testing procedures, detecting and solving critical issues, ensuring a 98% uptime across digital services.

- •Spearheaded technical support initiatives, resulting in a 20% decrease in customer complaints concerning digital banking functionalities.

- •Collaborated with IT and product teams to ensure compliance with PCI-DSS standards, enhancing overall security by 30%.

- •Managed the integration of digital platforms, which led to a 20% increase in user base over a one-year period.

- •Analyzed complex business requirements to deliver tailored online banking solutions enhancing operational efficiency by 35%.

- •Created workflow diagrams and maintained integration guides, facilitating clearer communication strategies and reducing errors by 15%.

- •Implemented a customer-driven feedback loop, resulting in a 10% enhancement of digital user interfaces.

- •Collaborated with compliance and security teams to successfully integrate advanced authentication methods, resulting in a 50% reduction in fraudulent activities.

- •Efficiently managed integration projects of mobile and online banking systems, leading to a 30% improvement in operational performance.

- •Developed troubleshooting protocols that reduced resolution times for system issues by 40%, enhancing customer service response times.

- •Participated in cross-departmental workshops to identify and integrate emerging technologies, strengthening digital strategy alignment.

- •Assisted in compliance auditing processes, ensuring all implemented technologies met regulatory standards consistently.

- •Contributed to the seamless integration of middleware solutions, increasing transaction efficiency by 15% within six months.

- •Provided continuous support and enhancements for digital banking applications, which improved client retention rates by 8%.

- •Facilitated employee training sessions on new systems, leading to a 20% reduction in user-related system errors.

- •Monitored digital banking trends, leading to the adoption of cutting-edge APIs, strengthening competitive market positioning.

E-Banking Security Analyst resume sample

When applying for this role, it's important to highlight any experience in cybersecurity or IT security. Demonstrate your knowledge of data protection regulations and risk management strategies. Certifications such as Certified Information Systems Security Professional (CISSP) or CompTIA Security+ can boost your profile. Focus on your problem-solving skills and attention to detail, providing specific examples of how you identified vulnerabilities and implemented solutions. Use a 'skill-action-result' framework to showcase how your expertise has strengthened security measures at previous employers.

- •Led a team in implementing new security measures, decreasing unauthorized access events by 30% annually.

- •Designed and executed a comprehensive vulnerability testing plan, resulting in a 45% improvement in threat detection and prevention.

- •Overhauled security awareness program, increasing staff compliance with security policies by 60%.

- •Collaborated with IT teams to integrate security protocols, leading to a 25% reduction in system vulnerabilities.

- •Developed response strategies that reduced incident resolution time by 20% across e-banking platforms.

- •Conducted security audits that uncovered and addressed weaknesses, improving security compliance ratio by 35%.

- •Advised financial institutions on cybersecurity best practices, enhancing their security frameworks by 50%.

- •Managed risk assessment projects that identified 80% of potential vulnerabilities before they were exploited.

- •Collaborated with development teams to ensure integration of security protocols, reducing breaches by 28%.

- •Provided training sessions for 150+ staff members, increasing security policy adherence by 45%.

- •Implemented incident response protocols that decreased response time by 35% on average for security breaches.

- •Performed over 120 vulnerability analyses, leading to a decrease in data breaches by 34%.

- •Successfully managed security documentation updates, improving policy compliance by 40%.

- •Contributed to the development of a risk assessment tool, increasing risk identification accuracy by 25%.

- •Investigated and resolved over 200 minor security incidents monthly, strengthening system integrity noticeably.

- •Assisted in integrating security measures for new banking applications, reducing security lapse instances by 20%.

- •Monitored security incidents daily, contributing to the resolution of issues within 48 hours on average.

- •Documented security threat details for future analysis, increasing incident reporting accuracy by 15%.

- •Coordinated with external vendors to ensure adherence to industry security standards, enhancing compliance readiness.

Mobile Banking Technology Specialist resume sample

When applying for this role, it's important to highlight your experience with mobile apps and digital banking tools. Mention any relevant projects where you've improved user experience or increased customer engagement. Focus on technical skills such as app development, troubleshooting, or software integration. Certifications in mobile technology or user interface design can set you apart. Include specific metrics to demonstrate your impact, such as reducing response times or increasing app downloads. Use examples to illustrate how your work has driven positive changes for users and the organization.

- •Led a cross-functional team of 12 in developing new mobile banking features, increasing app engagement by 25% within one year.

- •Spearheaded integration of AI-driven analytics tools that boosted customer experience scores by 15% through predictive insights and personalized recommendations.

- •Optimized application lifecycle management processes, resulting in a 20% reduction in app downtime and improved user satisfaction.

- •Implemented comprehensive QA testing protocols that enhanced mobile application performance, decreasing reported bugs by 30%.

- •Collaborated with marketing to highlight innovative features, contributing to a 40% growth in new user adoption over six months.

- •Trained over 50 staff members in mobile banking technologies which increased their productivity by 35% in support-related tasks.

- •Developed secure and compliant mobile banking apps, adhering to industry regulations, improving app trustworthiness which drove a 20% increase in app usage.

- •Directed the complete redevelopment of the banking app interface, enhancing user experience and resulting in a 35% rise in customer satisfaction.

- •Collaborated with third-party vendors to integrate payment gateway solutions, ensuring secure seamless transactions, increasing in-app purchase rates by 25%.

- •Analyzed user feedback and implemented new features that cut common user issue tickets by 40%, significantly enhancing user satisfaction.

- •Oversaw the documentation and update of the mobile application lifecycle, ensuring accurate and accessible references for the technical team.

- •Architected mobile banking solutions facilitating secure transactions, which increased app reliability metrics by 25%.

- •Adopted new emerging technologies into the mobile platform, ensuring fintech relevance and maintaining cutting-edge services.

- •Boosted network performance by implementing efficient coding practices, resulting in a 35% faster load time for mobile applications.

- •Provided technical support and insights which decreased customer query response time by 45%, enhancing service efficiency.

- •Contributed to the development of secure mobile applications, ensuring regulatory compliance and thus improving app adoption rates by 20%.

- •Collaborated with UX designers to refine user interfaces, boosting user retention by 30% through intuitive interactions.

- •Implemented user analytics tools that provided critical data insights, leading to strategic mobile app improvements.

- •Worked with external partners in incorporating third-party financial tools, enhancing overall app functionality and user offerings.

Internet Banking Infrastructure Specialist resume sample

When applying for this role, it's important to showcase your technical expertise in web-based banking systems and any experience with database management. Highlight your problem-solving skills and any experience in troubleshooting online banking issues. If you've completed courses in IT infrastructure or cybersecurity, be sure to include these details. Provide concrete examples of how your contributions led to improved system performance or enhanced user experience. Use the 'skill-action-result' framework to demonstrate your impact on previous projects and client satisfaction.

- •Overhauled internet banking infrastructure improving performance by 25% and reducing downtime by 40% through efficient resource allocation.

- •Led cross-functional teams to implement security protocols protecting customer data, achieving 100% compliance with industry standards.

- •Monitored system performance, identifying critical issues, resulting in a 35% decrease in user complaints related to account accessibility.

- •Developed comprehensive documentation for system architecture, ensuring seamless knowledge transfer and consistent support across teams.

- •Conducted regular disaster recovery tests, maintaining 99.9% business continuity and minimizing service disruption.

- •Collaborated with stakeholders to enhance user experience, successfully launching an updated platform utilized by 1 million users monthly.

- •Optimized cloud service integration, resulting in a 20% cost reduction and improved service delivery.

- •Provided technical support for over 50+ internal teams, enhancing system reliability and support resolution times by 30%.

- •Executed data integration projects, supporting seamless upgrades to banking systems with zero data loss incidents.

- •Enhanced security protocols aligning with regulatory standards, maintaining perfect audit scores over three years.

- •Redesigned network protocols resulting in a 15% faster data transmission rate, enhancing overall system efficiency.

- •Managed server configurations, securing a 98% uptime rate and significantly boosting customer satisfaction.

- •Monitored network security, implementing measures that led to a 35% reduction in security breaches.

- •Collaborated with development teams, resulting in a 15% faster software deployment cycle.

- •Streamlined system documentation processes, effectively reducing time spent on audits by 20%.

- •Provided high-quality IT support for approximately 500 employees, consistently maintaining a 99% customer satisfaction score.

- •Diagnosed and resolved complex technical issues within network systems, reducing response time by 40%.

- •Assisted in upgrading banking network systems, improving efficiency by 20% and enhancing user experience.

- •Trained junior staff on emerging technologies, facilitating knowledge growth and improving team performance.

Online Banking Fraud Prevention Expert resume sample

When applying for this role, it's essential to highlight any experience in risk analysis or fraud detection. Detail your ability to identify suspicious activities and the methods you’ve used to prevent fraud. If you’ve completed any relevant training or certifications in cybersecurity or fraud management, be sure to include those. Use specific examples to demonstrate how your proactive measures reduced fraud incidents, following the 'skill-action-result' format. Show how your analytical skills and attention to detail contribute to the security of online transactions.

- •Reduced online fraud incidents by 30% within the first year by implementing advanced monitoring technologies and strategies.

- •Conducted 200+ investigations per month into suspicious banking activities, enhancing fraud detection accuracy significantly.

- •Collaborated with cross-functional teams to design and implement fraud detection protocols, leading to a 15% increase in early fraud identification.

- •Led educational initiatives that increased customer awareness of fraud by 40%, contributing to improved customer satisfaction scores.

- •Played a crucial role in developing a real-time fraud alert system, resulting in a 20% reduction in fraudulent financial losses.

- •Generated quarterly fraud reports and performance metrics, presenting them to executive management, facilitating strategic decision-making.

- •Spearheaded a team project to implement a new fraud risk assessment model, reducing potential fraud risk by 25%.

- •Monitored daily online banking transactions of over 100,000 accounts, ensuring quick response to potential fraud threats.

- •Worked directly with law enforcement in the resolution of high-profile fraud cases, collaborating on investigations and sharing intel.

- •Trained over 150 team members in new fraud prevention techniques and tools, standardizing procedures across departments.

- •Reviewed and updated compliance policies related to fraud prevention, enhancing alignment with federal regulations and industry standards.

- •Analyzed transaction data using fraud detection software, leading to the identification and prevention of $500k in potential fraudulent activity.

- •Assisted in the deployment of a new secure online banking platform, reducing fraud-related customer complaints by 40%.

- •Coordinated with IT and security teams to develop a fraud response plan, improving incident response time by 20%.

- •Conducted training sessions for new hires, focusing on fraud detection and customer interaction best practices.

- •Investigated over 1,200 cases of suspected fraud, contributing to a 15% reduction in overall fraud cases within the branch.

- •Implemented targeted fraud prevention strategies, which resulted in saving the bank over $1 million annually.

- •Acted as a liaison between the legal department and external stakeholders to resolve complex fraud cases effectively.

- •Evaluated fraud detection tools and recommended improvements that enhanced system performance by 18%.

Electronic Payment System Specialist resume sample

When applying for this position, it is important to showcase any experience with payment processing systems or fintech platforms. Detail your familiarity with database management and troubleshooting payment issues. Highlight any relevant certifications such as 'Payments Processing' or 'Fintech Fundamentals'. Include specific examples of how you streamlined payment procedures or improved transaction accuracy in previous roles. Use the 'skill-action-result' method to demonstrate how your contributions led to increased efficiency or customer satisfaction, making your application stand out to potential employers.

- •Led a team to revamp Fiserv's electronic payment systems, optimizing transaction speed by 25%, resulting in a notable increase in customer satisfaction.

- •Developed and enforced robust payment security protocols, reducing data breach incidents by over 30% annually.

- •Devised comprehensive payment processing reports, identifying a 15% trend in transaction errors that were promptly corrected.

- •Collaborated closely with IT and finance departments to resolve complex payment issues, decreasing system downtime by 40%.

- •Trained 20+ staff on updated electronic payment procedures, improving operational efficiency and accuracy by 18%.

- •Maintained strategic relationships with third-party payment processors, enhancing the overall system integration and reducing processing costs by 10%.

- •Oversaw daily payment system operations, managing over 30,000 transactions monthly with an error margin below 0.5%.

- •Supported the successful implementation of PayPal's new payment gateway, increasing processing capabilities by 40%.

- •Conducted in-depth analyses on payment metrics, which led to a 20% improvement in fraud detection accuracy.

- •Ensured full compliance with PCI DSS standards, resulting in zero compliance-related issues during audits.

- •Worked with cross-functional teams to integrate new payment systems, decreasing the onboarding duration by 25%.

- •Advised on the optimization of financial systems architecture, increasing overall performance efficiency by 15% over six months.

- •Engineered custom solutions for electronic payments, resulting in a 10% increase in client acquisition.

- •Led the adoption of a new database management tool, enhancing data retrieval processes by 50%.

- •Facilitated workshops for over 50 clients, enhancing understanding and utilization of advanced payment solutions.

- •Conducted thorough requirements analysis to enhance existing business and payment systems, improving system reliability by 15%.

- •Collaborated with developers to design a tailored payment processing system, decreasing client complaint rates by 12%.

- •Monitored system performance metrics, achieving optimal processing speeds across multiple payment platforms.

- •Implemented strategic solutions for process automation, reducing manual efforts by 30%.

Digital Financial Software Specialist resume sample

When applying for a role in this field, be sure to highlight any experience with financial software or technology. Detail your technical skills, including familiarity with platforms like ERP or accounting software. Certifications in areas like 'Financial Technology' or 'Software Analytics' can set you apart, so include them. Share specific examples of how your technical expertise has streamlined processes or improved user satisfaction, focusing on the 'skill-action-result' method. Emphasize your ability to collaborate with cross-functional teams to drive project success and enhance product offerings.

- •Led a team to implement digital financial software, achieving a 30% reduction in processing time by optimizing workflows.

- •Collaborated with cross-functional teams to integrate ERP systems, resulting in enhanced interdepartmental communication and a 15% increase in efficiency.

- •Trained end-users on new financial software, ensuring 90% adoption rate within the first quarter post-implementation.

- •Analyzed financial data, improving the decision-making process by identifying cost-saving opportunities worth $500,000 annually.

- •Conducted regular software audits, maintaining data integrity and compliance with all financial regulations, reducing compliance issues by 25%.

- •Developed comprehensive training documentation, improving user confidence and reducing helpdesk queries by 35%.

- •Facilitated the successful rollout of a major financial software project, enhancing reporting accuracy by 40% within six months.

- •Worked closely with IT to resolve complex software issues, reducing system downtime by 20%, boosting productivity.

- •Developed custom financial reporting tools, enabling real-time analysis that improved cost tracking by 30%.

- •Led workshops to identify opportunities for financial process improvements, decreasing overall workflow times by 25%.

- •Monitored and reported on system performance, proactively addressing potential issues and ensuring seamless financial operations.

- •Assisted in configuring financial software to align with evolving business needs, improving operational efficiency by 35%.

- •Gathered and documented user requirements, ensuring software adaptations aligned with business strategies.

- •Partnered with finance teams to develop data visualization dashboards, leading to a 30% increase in insight-driven decisions.

- •Provided first-line support for financial applications, ensuring user satisfaction levels exceeded 95% consistently.

- •Generated in-depth financial reports, enabling leadership to make informed strategic decisions resulting in a 10% revenue growth.

- •Utilized advanced Excel functions to streamline data analysis, enhancing accuracy and saving 10 hours of manual work weekly.

- •Coordinated with teams to improve processes, resulting in the introduction of automation tools reducing task time by 20%.

- •Maintained financial systems documentation, improving compliance adherence and reducing audit preparation time by 15%.

E-Banking Customer Support Specialist resume sample

When applying for a role in this field, it’s important to showcase any prior experience in customer support or technical assistance. Emphasize your ability to troubleshoot issues quickly while maintaining a positive attitude. Highlight communication skills, especially if you have experience in managing inquiries via phone, chat, or email. Include examples of how you handled challenging situations or improved customer satisfaction. Mention any relevant certifications or training, and provide specific metrics that demonstrate your effectiveness, such as response times or resolution rates.

- •Resolved over 95% of customer issues on first contact by providing comprehensive guidance on online banking tools.

- •Increased customer satisfaction ratings by 35% through effective troubleshooting and personalized service approaches.

- •Implemented a new customer feedback system, resulting in a 25% increase in user engagement with digital banking features.

- •Collaborated with IT department to streamline processes, reducing ticket resolution time by 40% on average.

- •Trained new hires in technical support processes, enhancing team performance and reducing onboarding time by 20%.

- •Maintained up-to-date knowledge of banking regulations and digital trends, positively impacting customer advisement capabilities.

- •Led a team of 12 representatives, achieving a 98% customer satisfaction score for six consecutive quarters.

- •Developed training programs for e-banking services, which increased efficiency by 30% across the department.

- •Collaborated with developers to enhance mobile app functionality, leading to a 40% increase in app usage.

- •Reduced customer call handling time by 20% through process improvements and agent coaching.

- •Managed critical escalations and resolved complex issues, preserving major client accounts worth over $500,000 annually.

- •Provided specialized support for digital payment systems, resolving 500+ technical issues monthly with minimal follow-up.

- •Implemented customer feedback loops that increased online banking satisfaction scores by 50% within six months.

- •Educated clients on security best practices, leading to a 15% decrease in unauthorized access incidents.

- •Assisted in the development of an online help center that reduced incoming support requests by 25%.

- •Supervised a team of 8 tellers, improving customer wait times by 30% through process enhancements.

- •Achieved a monthly error rate below 0.2%, setting a new benchmark for operational excellence.

- •Coached staff on upselling strategies, leading to a 15% increase in business account openings.

- •Conducted weekly audits to ensure compliance, exceeding standard regulatory requirements consistently.

Web-Based Banking Solutions Developer resume sample

When applying for this role, it’s essential to showcase any experience with coding languages such as Java, Python, or JavaScript. Highlight your familiarity with web development frameworks and APIs, as they are critical for creating seamless banking solutions. Mention any relevant projects you've completed, emphasizing how they solved specific problems or improved user experience. Additionally, certifications in web development or database management should be included to demonstrate your commitment to ongoing education in this area. Provide metrics or results that reflect your contributions to previous projects.

- •Led a team of developers to create a responsive online banking platform that increased user satisfaction by 30% in the first year.

- •Developed and implemented secure coding practices leading to zero data breaches over a two-year period.

- •Collaborated with product managers to translate requirements into high-performance technical solutions, reducing project timelines by 25%.

- •Enhanced application performance, resulting in a 40% decrease in load times, improving user experience significantly.

- •Introduced an automated CI/CD pipeline, cutting deployment times by 50% and increasing deployment frequency to weekly.

- •Champion for agile methodologies, helping reduce bugs by 35% and facilitating smoother sprint transitions.

- •Developed complex web applications using React, improving front-end efficiency by 45% and reducing maintenance costs.

- •Implemented RESTful API integrations, leading to a 20% reduction in data access times across all banking platforms.

- •Conducted regular code reviews and session training, enhancing team technical standards and coding practices.

- •Reduced downtime of banking applications by 10% through efficient troubleshooting and resolution strategies.

- •Played a key role in a successful project to revamp the bank’s digital infrastructure, resulting in a 50% increase in uptime.

- •Boosted transaction speed of web applications by 25% through optimization of back-end processes.

- •Collaborated with cross-functional teams to design user-friendly interfaces, improving customer engagement by 15%.

- •Maintained compliance with banking regulations, resulting in a flawless audit record over two years.

- •Managed database performance improvements that reduced query times by 35%, enhancing overall system efficiency.

- •Participated in upgrading the user interface of core banking systems, increasing customer interface usability by 40%.

- •Worked with a team to redesign the bank’s home page, leading to a 50% increase in online banking transactions.

- •Maintained application security, contributing to zero vulnerability exposures during service period.

- •Optimized existing web applications, which decreased server errant responses by 20%.

Electronic Funds Transfer Specialist resume sample

When applying for this role, it's important to showcase any experience with payment processing and transaction management. Highlight your familiarity with banking regulations and compliance standards. Detail your problem-solving skills, especially in resolving transaction issues or customer inquiries effectively. If you have certifications in financial services or technology, be sure to mention those. Use the 'skill-action-result' format to describe how your initiatives improved transaction accuracy or enhanced customer satisfaction. This will demonstrate your impact and commitment to the role.

- •Efficiently managed over 1,500 electronic fund transfer transactions monthly, achieving a 98% accuracy rate.

- •Conducted monthly compliance audits, identifying and resolving discrepancies, resulting in zero compliance breaches.

- •Collaborated with IT to streamline EFT processing software, improving transaction speed by 20%.

- •Enhanced client satisfaction by 15% through prompt resolution of EFT inquiries and issues.

- •Led a team training session on EFT procedures, elevating team productivity by 25% over a three-month period.

- •Implemented strict documentation procedures, reducing record discrepancies by 30% within the first six months.

- •Processed daily ACH and wire transfers, monitoring over 500 transactions for compliance with regulatory requirements.

- •Initiated an audit process for EFT transactions, uncovering fraud and saving the company $50,000 annually.

- •Provided mentoring to junior analysts, leading to a 40% improvement in their processing accuracy.

- •Worked with cross-functional teams to tackle complex transaction issues, reducing resolution time by 10%.

- •Developed a comprehensive EFT policy guideline, resulting in stronger adherence to state and federal regulations.

- •Assisted in the transition to a new EFT system, contributing to a seamless changeover with zero downtime.

- •Regularly updated EFT operational manuals, ensuring team compliance with the latest industry standards.

- •Responded to EFT-related client queries, achieving a 95% customer satisfaction rate.

- •Collaborated with the compliance department to ensure all electronic transfers adhered to latest regulatory mandates.

- •Managed incoming and outgoing wire transfers, maintaining accuracy above 97% consistently within the period.

- •Participated in a project to reduce EFT processing errors, resulting in a 20% drop in error rates.

- •Executed monthly cross-verification of EFT records with bank statements, uncovering and addressing discrepancies promptly.

- •Enhanced monthly report generation process, resulting in a 15% reduction in report preparation time.

Crafting a resume as an electronic banking specialist can feel like navigating a complex system, where each detail matters. Just as you balance technical expertise with precision when handling transactions, you must also present your skills clearly on paper. Your resume is more than just a list of qualifications; it’s your ticket to landing the perfect job.

To capture a recruiter's attention, you need to effectively present your achievements and skills in electronic banking. While you’re adept at managing online platforms and security protocols, conveying that expertise in a resume requires a thoughtful approach. This is where using a resume template can help. A template offers a streamlined way to organize your content, letting you focus on highlighting your strengths.

By using a template, you ensure your resume is as polished as your technical skills, making it stand out in a competitive field. Tailoring your resume for each job application becomes easier, allowing you to emphasize the details that matter most. Ultimately, your resume should be as meticulous and dependable as the services you provide, accurately reflecting your professional journey and future aspirations.

Key Takeaways

- Effectively present achievements and skills in electronic banking to capture a recruiter's attention.

- Use a resume template to streamline content organization and focus on highlighting strengths.

- Your resume should reflect your professional journey and future aspirations with precision and clarity.

- Incorporate both soft and hard skills as strategic keywords to make the resume standout.

- Include sections like Contact Information, Professional Summary, Experience, Skills, Education, and Certifications.

What to focus on when writing your electronic banking specialist resume

Your resume as an electronic banking specialist should focus on how you can make digital banking services more efficient and customer-friendly. Highlighting your ability to manage electronic banking platforms and your deep understanding of cybersecurity protocols is crucial—this establishes a firm base for emphasizing your expertise and achievements within the electronic banking sector.

How to structure your electronic banking specialist resume

- Contact Information: Including your full name, phone number, email address, and LinkedIn profile makes it easy for recruiters to contact you. Clear and straightforward contact details are essential—ensuring they are up-to-date and professional will set a positive first impression.

- Professional Summary: Offering a concise overview of your experience in electronic banking is key here. Emphasize your skills in managing digital transactions, improving customer service, and streamlining operations—these are pivotal areas that recruiters are keen to see. Your summary should capture your ability to deliver results in an ever-evolving digital banking environment.

- Professional Experience: Delve into your work history by detailing how you effectively managed online banking solutions and enhanced security measures. Demonstrating specific accomplishments, such as successfully launching a new digital platform or reducing transaction errors, will help underline your capabilities—showing your direct impact on business success.

- Skills: Listing relevant abilities like expertise in electronic payment systems, compliance with evolving banking regulations, and mastery of cybersecurity techniques highlights your technical competence and adaptability. These skills are especially valuable in today's digital landscape where security and compliance standards are ever-changing.

- Education: Present your educational background by focusing on degrees or certifications in finance or information technology. This not only strengthens your candidacy but also provides context for your technical and analytical skills—vital components in tackling complex electronic banking challenges.

- Certifications: Mentioning certifications like Certified Electronic Banking Specialist or other relevant industry credentials adds another layer of credibility to your resume—indicating that you are committed to continuous professional development in this fast-paced field.

We will now cover each section in more depth, ensuring you have all the tools needed to craft an impactful electronic banking specialist resume.

Which resume format to choose

Creating a resume for an electronic banking specialist requires a clear and strategic approach to ensure your experience shines. The reverse-chronological format is highly effective for this purpose. By listing your most recent positions and achievements first, you put a spotlight on your progression and expertise in the industry, which is what potential employers are keen to see.

Your font choice subtly influences the professional impression your resume makes. Opt for modern fonts like Rubik, Lato, or Montserrat that offer a clean, contemporary look without detracting from the content. These fonts ensure that your resume is both stylish and easy to read, helping it to stand out among others while maintaining a professional tone.

File format is another critical aspect. Always convert your resume to a PDF before submitting it. PDFs preserve your formatting across all devices, ensuring that your resume appears exactly as you designed it. This consistency is important in presenting yourself as detail-oriented and professional.

Finally, the layout of your resume is completed by using standard margins, typically set at about one inch on all sides. This choice provides ample white space, making the text easier to read and preventing your resume from looking overcrowded. A well-organized layout underscores your ability to present information clearly, a valuable trait in the electronic banking field.

By carefully considering these elements, you'll create a resume that not only highlights your strengths as an electronic banking specialist but also presents them in the most appealing and professional way possible.

How to write a quantifiable resume experience section

The experience section of your electronic banking specialist resume is crucial for grabbing employers’ attention by showcasing your achievements and skills in managing electronic banking systems. Begin with your latest role and go back only 10–15 years unless earlier experiences are highly relevant, ensuring a focused presentation. Highlight responsibilities that align with the job you're applying for, using dynamic action words like "optimized," "implemented," and "enhanced." These words energize your accomplishments and make them stand out. Quantifying your results, such as increasing customer satisfaction or efficiency, adds a compelling touch. Tailoring each job listing to mirror the position you’re targeting ensures your resume resonates with employers.

- •Optimized digital banking, cutting transaction errors by 30%.

- •Implemented mobile payments, boosting user adoption by 25%.

- •Increased customer satisfaction scores by 40% with better online support.

- •Collaborated on cybersecurity to cut fraud incidents by 15%.

This enhanced experience section seamlessly connects your roles and achievements, reflecting the core functions of an electronic banking specialist. By using quantifiable metrics, you vividly illustrate the impact you've made, which further aligns with your tailored job applications. Active verbs and specific numbers create a vivid portrayal of your contributions, ensuring employers clearly see your value. Each element works in harmony to present you as a standout candidate who consistently enhances workplace performance.

Collaboration-Focused resume experience section

A collaboration-focused electronic banking specialist resume experience section should clearly demonstrate your ability to work effectively in team settings and communicate skillfully with colleagues. Begin by identifying key projects where collaboration was crucial and detail your unique contributions. Using straightforward language, describe how these efforts led to successful outcomes while highlighting your ability to forge strong relationships and share ideas effectively. This approach underscores the value of teamwork in driving advancements in electronic banking initiatives.

To bring this to life, craft bullet points that reflect your active role in team projects, using action verbs to highlight your contributions. Each point should not only detail an achievement or learning experience but also its impact on the organization. Tailor this section to emphasize your interpersonal skills and cooperative mindset, which are vital in leveraging new technologies and enhancing customer service within the banking industry.

Electronic Banking Specialist

XYZ Financial Services

March 2020 - Present

- Collaborated with a cross-functional team to implement a new digital payment system, cutting transaction processing time by 30%.

- Organized weekly brainstorming sessions to find innovative ways to boost customer satisfaction in mobile banking services.

- Worked with the IT team to ensure smooth integration of new software systems, enhancing user experience.

- Led a team of five in redesigning the online banking interface, increasing online customer interactions by 25%.

Innovation-Focused resume experience section

A resume experience section for an innovation-focused electronic banking specialist should clearly showcase how you've driven transformation in digital banking. Start by highlighting roles where you've introduced impactful innovations, demonstrating your ability to enhance processes and develop forward-thinking solutions. Use bullet points to emphasize your achievements and the tangible improvements you've made. It's important to show how your initiatives led to better customer experiences or increased operational efficiency.

When detailing your accomplishments, quantify your results to provide a clear picture of your impact. Explain how you identified opportunities and crafted creative solutions to enhance banking services. Write in a way that smoothly connects the ideas, emphasizing the value you brought to past roles. This approach helps hiring managers easily understand your potential contributions to their organization.

Electronic Banking Specialist

Innovative Bank Solutions

March 2018 - June 2021

- Led a team of 10 in developing a mobile banking app that increased user engagement by 30%.

- Implemented AI-driven chatbots for customer service, reducing response times by 40%.

- Initiated a digital payment system that improved transaction efficiency by 20% while ensuring security.

- Conducted market analysis to identify technological advancements, boosting digital product sales by 15%.

Result-Focused resume experience section

A result-focused electronic banking specialist resume experience section should effectively highlight your achievements and the value you brought to your previous roles. Begin by stating your job title, workplace, and employment dates to provide context. Focus on detailing the specific actions you took that led to measurable improvements, making sure to showcase your responsibilities and achievements in a way that highlights your direct impact. This approach will emphasize how your efforts enhanced security, boosted customer satisfaction, or streamlined operations within the organization.

Incorporate action verbs and quantitative details to make your accomplishments more compelling. For instance, mention the development of an anti-fraud system that significantly reduced incidents or the implementation of processes that lowered transaction errors. Tailor each point to resonate with the job you're seeking by highlighting relevant aspects of your past work. This cohesive strategy not only underscores your fit for the electronic banking specialist role but also ensures your resume stands out.

Electronic Banking Specialist

ABC Bank

January 2020 - Present

- Streamlined electronic banking processes, reducing transaction time by 30% and improving customer satisfaction scores.

- Developed a new fraud detection algorithm that lowered fraud cases by 15%.

- Trained over 50 employees on the latest banking software, resulting in a 20% increase in overall team productivity.

- Collaborated with cross-functional teams to launch a mobile banking app feature, increasing user adoption by 25%.

Leadership-Focused resume experience section

A leadership-focused electronic banking specialist resume experience section should effectively highlight your achievements in guiding teams and driving innovation. Start by detailing specific leadership roles that demonstrate how you've managed teams and driven projects to improve processes. Showcase the technical and interpersonal skills that have led to successful outcomes, making sure to include tangible impacts on team performance or customer satisfaction.

Use clear, strong action verbs in the bullet points to vividly describe your leadership. Illustrate how you led teams to achieve goals by solving problems and enhancing efficiencies. Highlight your involvement in strategic planning or development projects, emphasizing your ability to inspire and deliver results. This approach gives potential employers a clear understanding of the positive changes you can bring to their organization.

Senior Electronic Banking Specialist

TechBank Solutions, Inc.

June 2018 - Present

- Directed a team of 10 specialists to redesign the online banking interface, leading to a 25% uptick in user engagement.

- Created a training program that boosted team efficiency by 30%, enhancing overall customer satisfaction.

- Led cross-functional teams to adopt new banking technologies, cutting process times by 40%.

- Initiated a customer feedback program that reduced service complaints by 15%.

Write your electronic banking specialist resume summary section

A skills-focused Electronic Banking Specialist resume experience section should effectively catch the eye of recruiters by highlighting your key areas of expertise. Tailor this section to present your most impressive skills and achievements with clarity and impact. It should convey who you are professionally, what you excel at, and how you can contribute to the company’s success. Here's an example:

This summary effectively integrates your experience with your skills, providing a cohesive picture of your professional strengths. Mentioning your years of expertise and accomplishments like boosting customer satisfaction directly ties your experience to specific business outcomes. Highlighting key skills, such as data analysis and cybersecurity, ensures employers quickly understand your capabilities.

Understanding the difference between a resume summary and objective is crucial. A resume summary, like the example provided, is ideal for seasoned professionals, offering a succinct overview of your career history and skills. It contrasts with a resume objective, which is more suited for newcomers, focusing on career ambitions and future goals. A resume profile delves deeper, offering a comprehensive view of your professional journey. Meanwhile, a summary of qualifications presents key skills and achievements concisely, often useful for quick reference in networking contexts.

Choosing the right section depends on your career stage and what message you wish to send. Experienced professionals might prefer a resume summary, while those new to the field might opt for an objective. Tailoring these sections to reflect your stage helps you make the best impression possible.

Listing your electronic banking specialist skills on your resume

A well-crafted skills section on your electronic banking specialist resume should effectively capture attention by showcasing your unique strengths. Your skills can have their own dedicated section or blend seamlessly into your experience and summary, providing context and depth. Highlighting your strengths through soft skills is essential, as they reveal the personal traits that make you a collaborative and effective team member, like communication and problem-solving. In contrast, hard skills are the specific, teachable abilities, such as software proficiency and data analysis, needed to carry out your role efficiently.

By incorporating these skills and strengths as strategic keywords, you can make your resume stand out to potential employers. They use these keywords to seek out the right candidates, making it crucial for your resume to capture their attention quickly. Here's how a standalone skills section might look:

This format clearly and concisely emphasizes the expertise relevant to an electronic banking specialist role. It offers employers a straightforward overview of your abilities and highlights both your technical expertise and soft skills, signaling your versatility and adaptability.

Best hard skills to feature on your electronic banking specialist resume

Hard skills are vital for an electronic banking specialist, emphasizing your technical proficiency and industry know-how. These skills demonstrate your ability to handle technology, address problems, and effectively navigate the banking landscape.

Hard Skills

- Electronic Banking Software Proficiency

- Data Analysis

- Knowledge of Regulatory Compliance

- Digital Payment Systems

- Cybersecurity Practices

- CRM Tools

- Financial Transaction Processing

- Account Reconciliation

- Technical Documentation

- SQL and Database Management

- Business Analytics

- Fraud Detection

- Information Systems Management

- Project Management

- API Integration

Best soft skills to feature on your electronic banking specialist resume

In addition to hard skills, soft skills are crucial for showcasing your interpersonal strengths and work ethic. As an electronic banking specialist, these skills communicate your ability to work well with others, tackle problems head-on, and effectively manage customer interactions.

Soft Skills

- Attention to Detail

- Problem-Solving

- Communication

- Adaptability

- Customer Service Orientation

- Team Collaboration

- Time Management

- Empathy

- Critical Thinking

- Conflict Resolution

- Decision Making

- Professionalism

- Multi-tasking Ability

- Initiative

- Stress Management

How to include your education on your resume

The education section of your electronic banking specialist resume is crucial in showcasing your qualifications. It should be tailored to the job you're applying for, so only include relevant education. Including unrelated degrees can clutter your resume and divert attention from your pertinent skills. If your GPA is impressive, such as a 3.5 or higher, consider including it as it demonstrates your academic prowess. Indicate it in parentheses beside your degree, like this: Bachelor of Science in Finance, GPA: 3.7/4.0. Listing honors such as cum laude can further highlight your accomplishments. Position it right after your degree title, for instance, Bachelor of Science in Finance, cum laude.

Here are examples highlighting wrong and right education sections. The wrong example indicates education that doesn't align with an electronic banking role.

Now, here's a more suitable example for an electronic banking specialist:

This second example effectively showcases relevant education that aligns with the responsibilities of an electronic banking specialist. It highlights a degree in finance, a high GPA, and an honors distinction, all of which make you stand out as a qualified candidate.

How to include electronic banking specialist certificates on your resume

Including a Certificates section in your electronic banking specialist resume is crucial. This section showcases your additional skills and expertise relevant to the job. You can also feature your certificates in your resume header to immediately catch the employer’s attention.

List the name of the certificate clearly. Include the date you obtained each certificate. Add the issuing organization to validate your qualifications. Ensure you present the information concisely and orderly to make it easy for the recruiter to scan.

Example Header:

Jane Doe Electronic Banking Specialist Certified Information Systems Auditor (CISA), 2025 | International Institute of Banking Technology …

Example Standalone Section:

This example is good because it includes relevant and reputable certificates like CISA and CAMS. These certifications demonstrate your specialized knowledge in auditing and anti-money laundering, both critical areas for an electronic banking specialist. Also, listing the issuing organizations adds credibility to your qualifications.

Extra sections to include in your electronic banking specialist resume

Being an electronic banking specialist requires a combination of technical know-how and excellent customer service skills. Tailoring your resume to highlight a variety of experiences and skills can significantly enhance your candidacy.

- Language section — Include languages you speak fluently or proficiently as it can demonstrate your ability to communicate with diverse clients.

- Hobbies and interests section — Highlight hobbies that show your problem-solving skills or attention to detail, such as coding or playing strategic games.

- Volunteer work section — List relevant volunteer experiences to illustrate your commitment to the community and your willingness to go above and beyond.

- Books section — Mention books you’ve read on banking, finance, or technology to show your dedication to staying current in your field.

In Conclusion

In conclusion, crafting an effective resume as an electronic banking specialist involves a combination of clear communication and strategic presentation. Your resume serves as a snapshot of your career journey, reflecting not just where you've been, but also where you aspire to go. Focus on showcasing your technical skills and achievements in the electronic banking sector while also highlighting your soft skills like communication and problem-solving. The use of a template can make your resume professional and organized, which helps in emphasizing your technical and leadership capabilities effectively. Remember to tailor your resume for each job application to highlight the most relevant experiences that align with the role. Quantitative measures of your past successes, such as improved customer satisfaction scores or enhanced security measures, give tangible proof of your contributions. Also, choosing the right resume format and file type assures that your detailed work is preserved across different platforms. Adding certifications and specific sections like language skills or volunteer work can also make your profile stronger and more appealing to potential employers. Ultimately, a well-crafted resume not only captures your present achievements but also positions you as a proactive and insightful candidate ready to excel in a dynamic banking environment. By doing so, you enhance your chances of securing the role that not only matches your skill set but also propels your career forward.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2025. All rights reserved.

Made with love by people who care.