Finance Program Manager Resume Examples

Jul 18, 2024

|

12 min read

Finance program managers, here’s how to make your resume shine and show you have the “interest” and “principal” for the job. Learn clear steps to highlight your skills and experience to potential employers.

Rated by 348 people

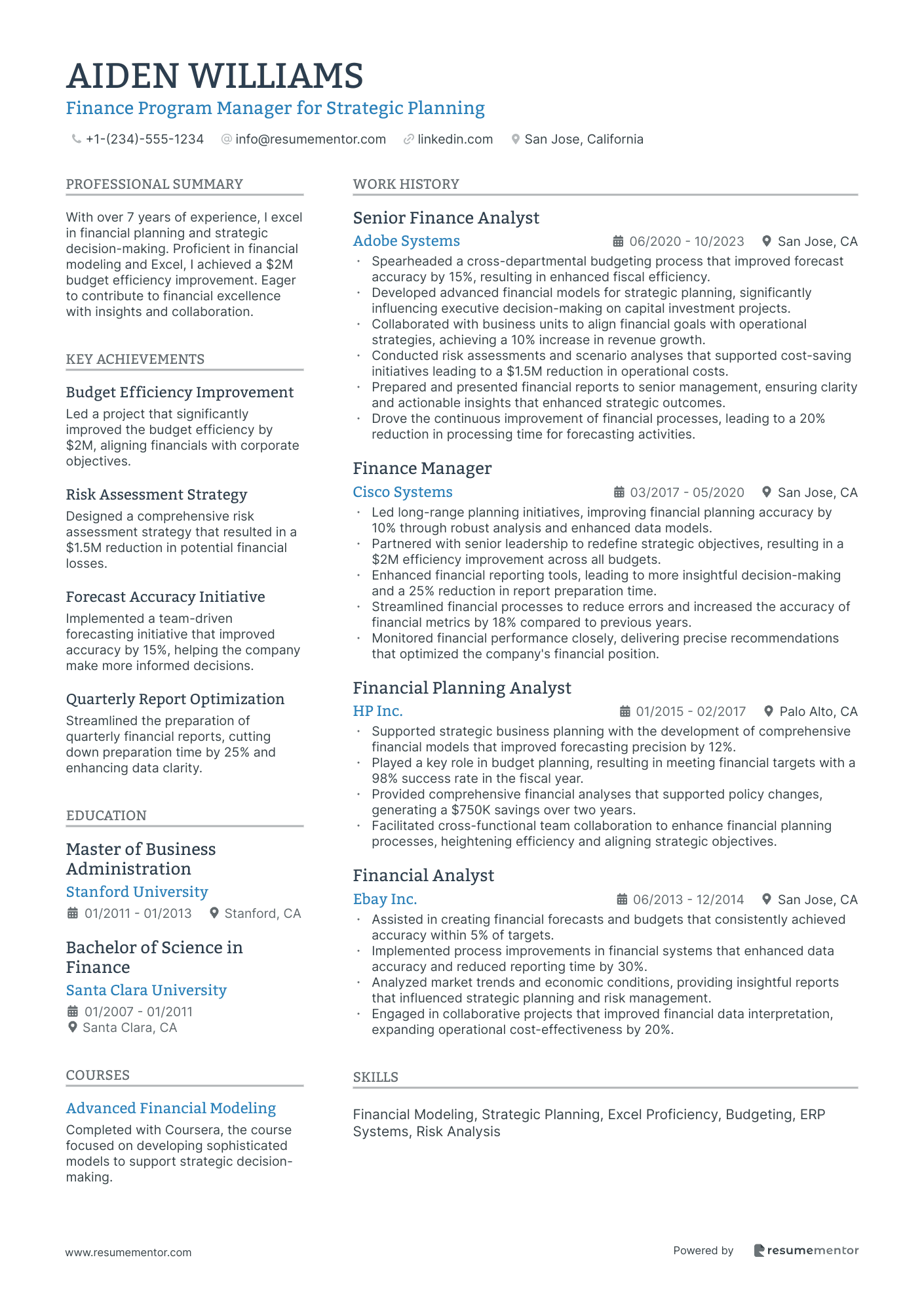

Finance Program Manager for Strategic Planning

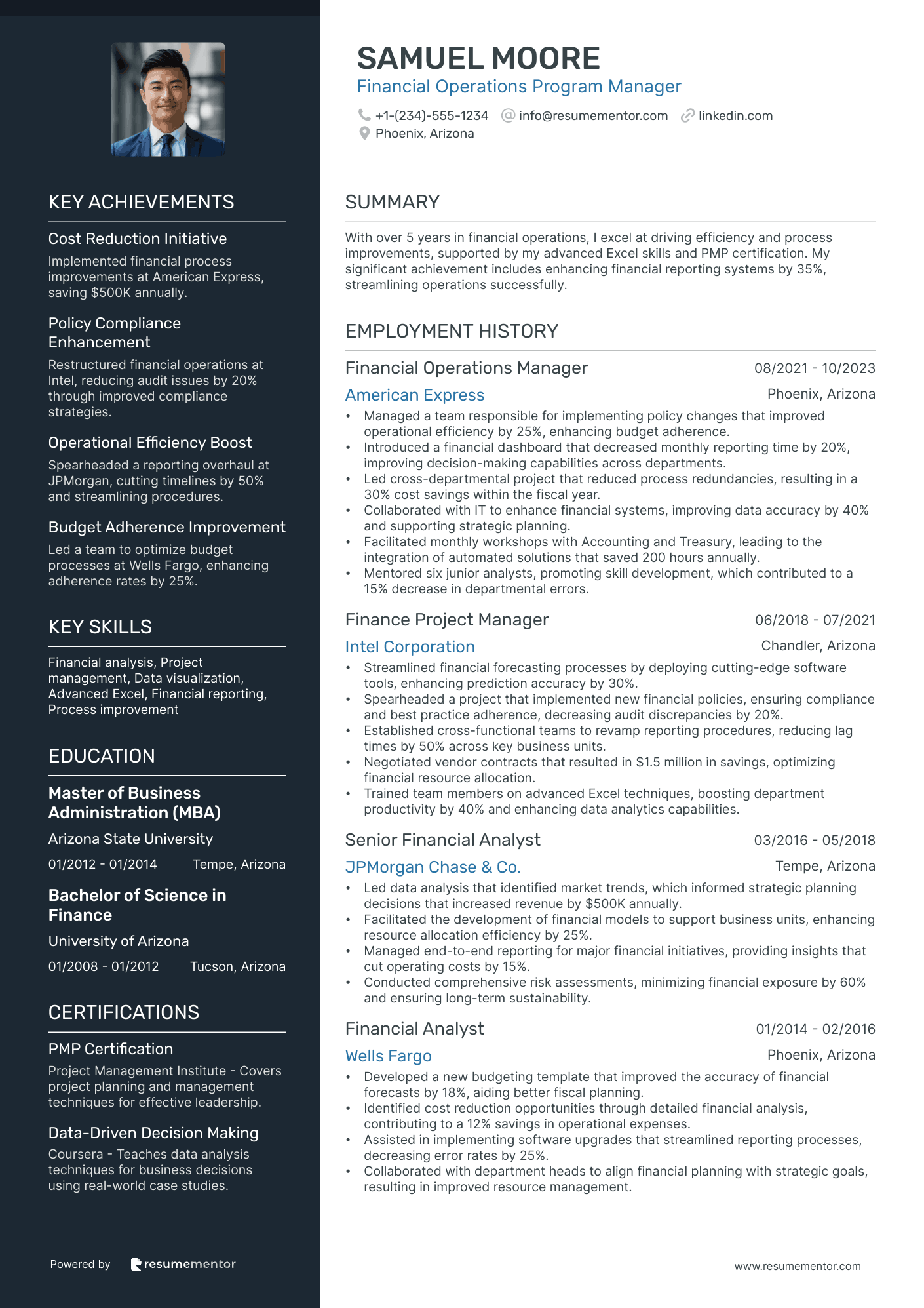

Financial Operations Program Manager

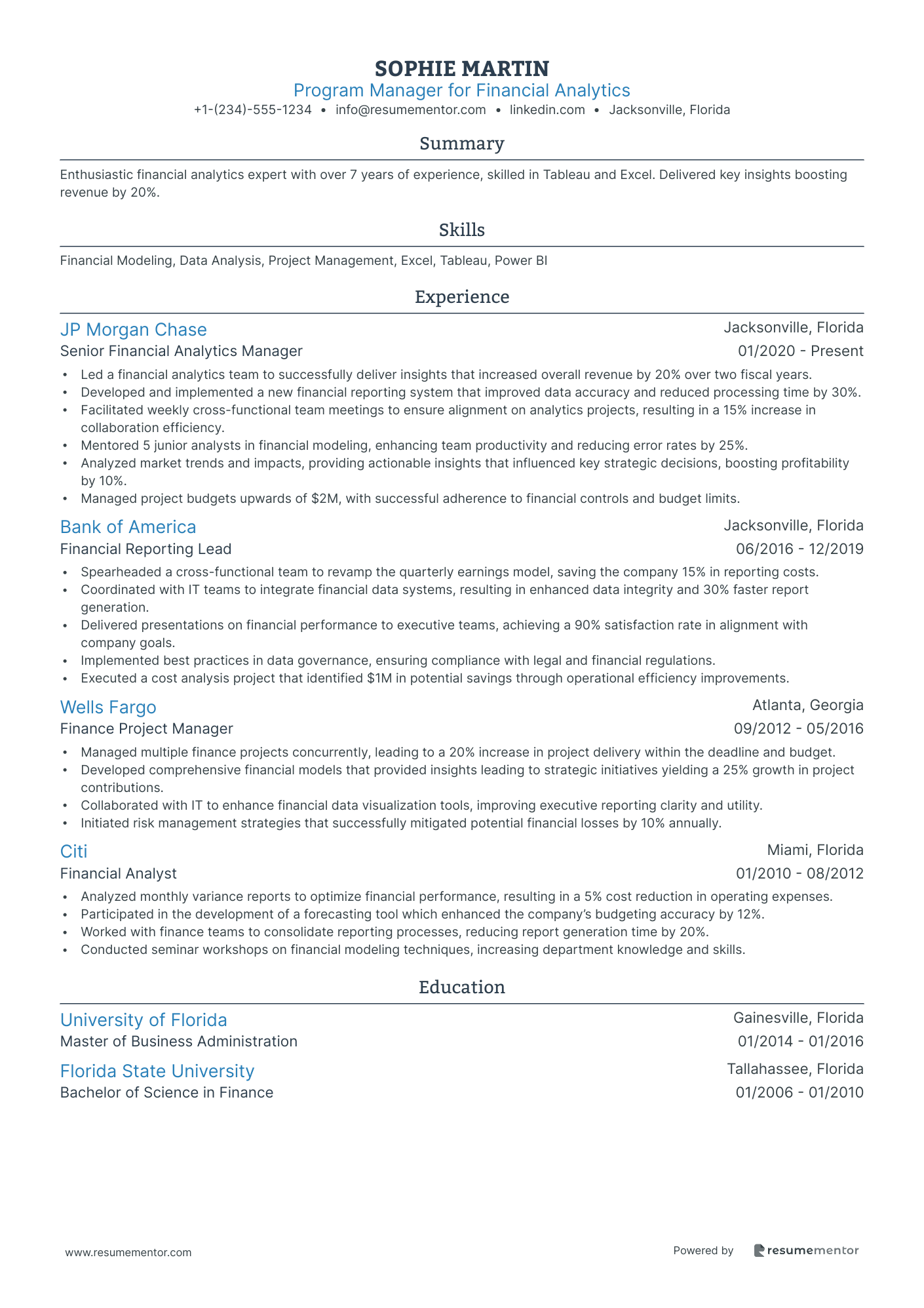

Program Manager for Financial Analytics

Risk Management Finance Program Manager

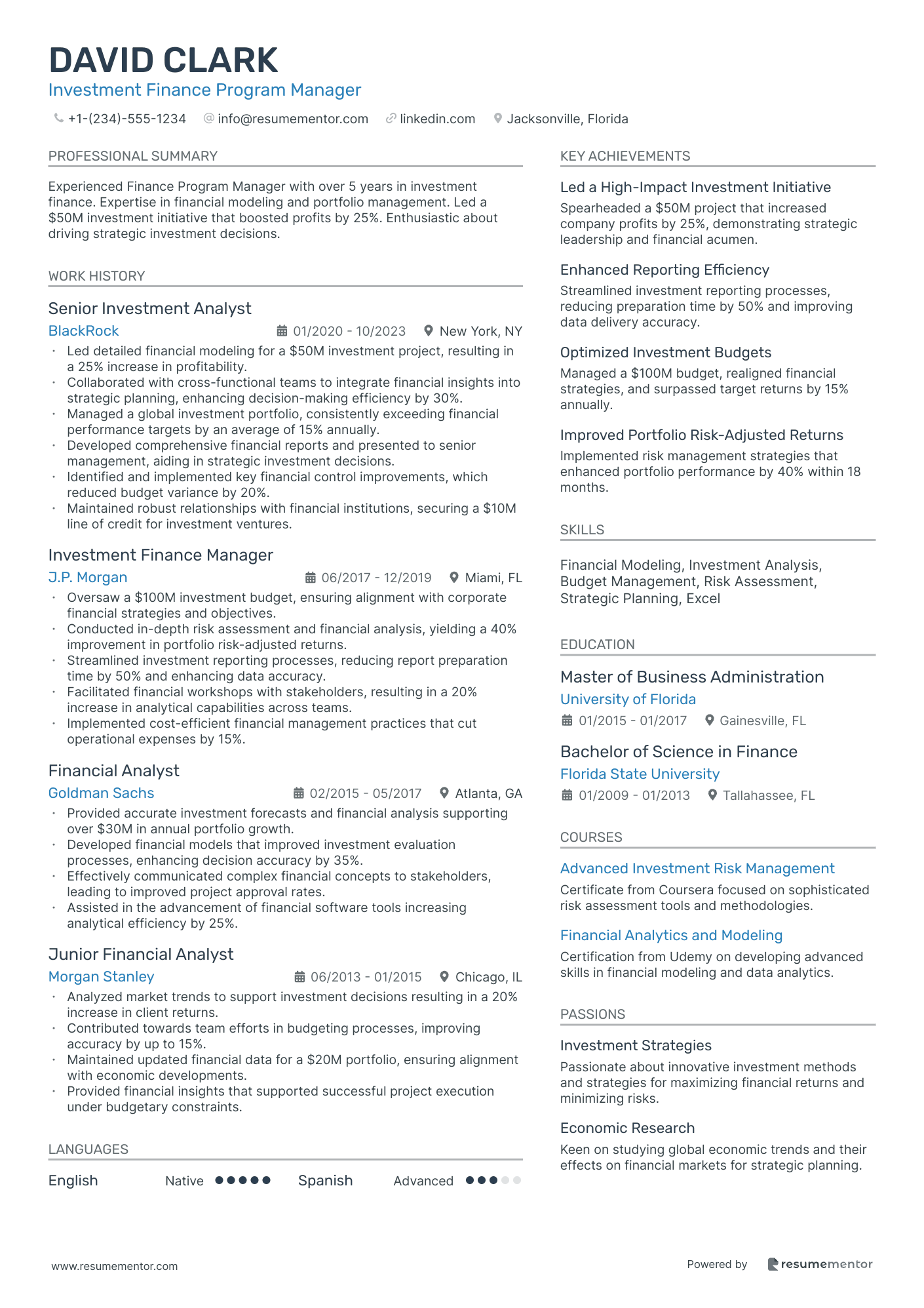

Investment Finance Program Manager

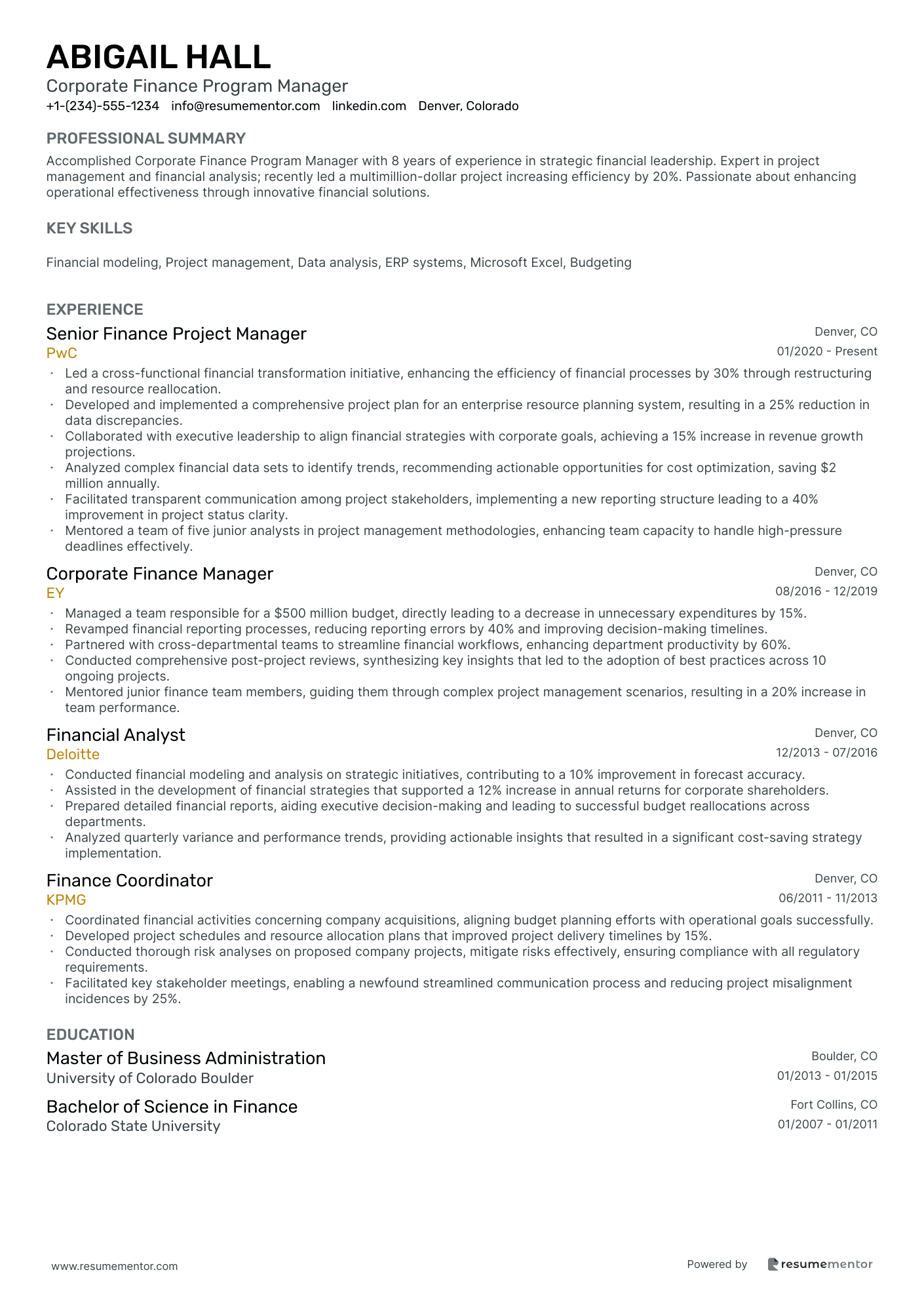

Corporate Finance Program Manager

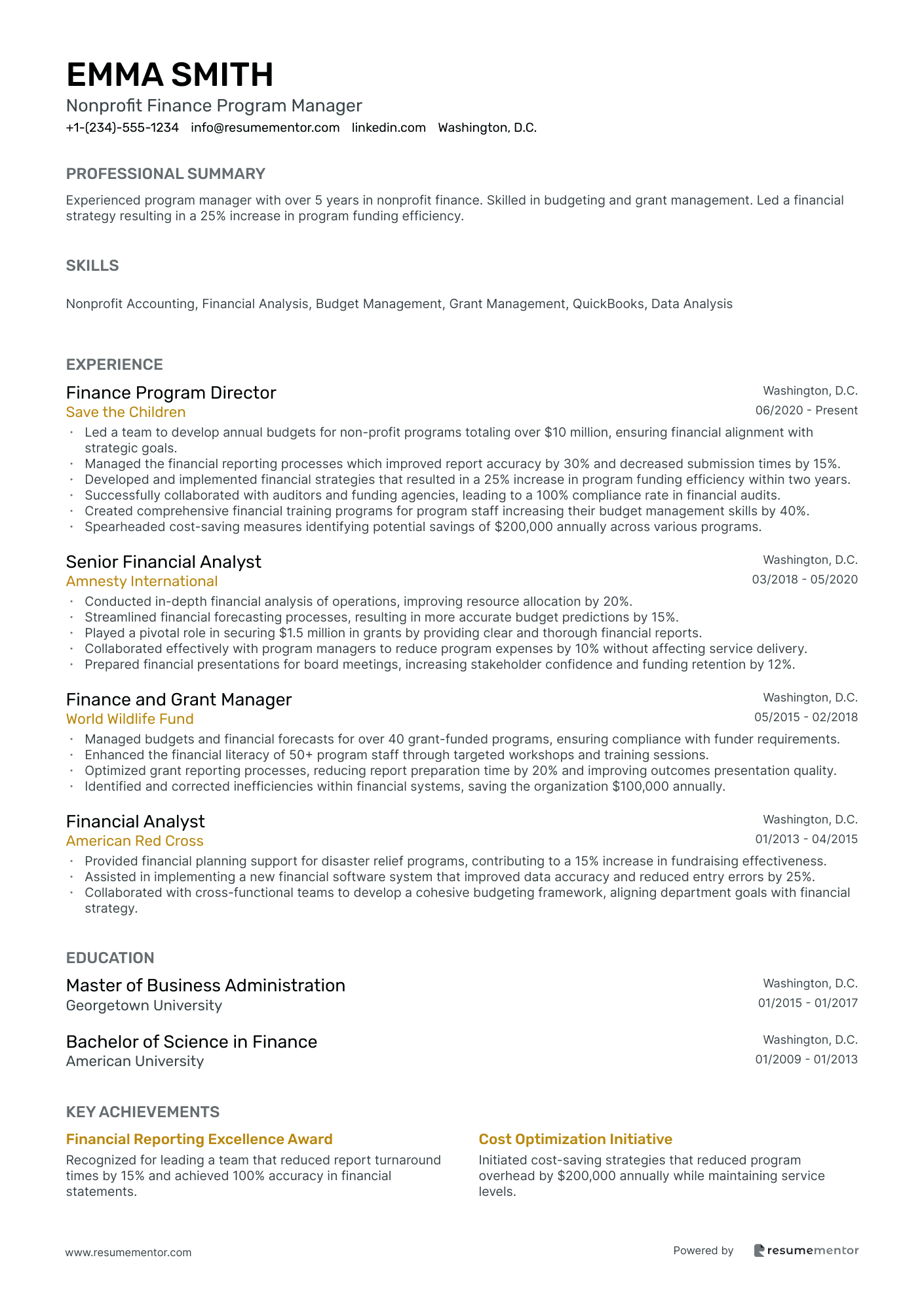

Nonprofit Finance Program Manager

Government Finance Program Manager

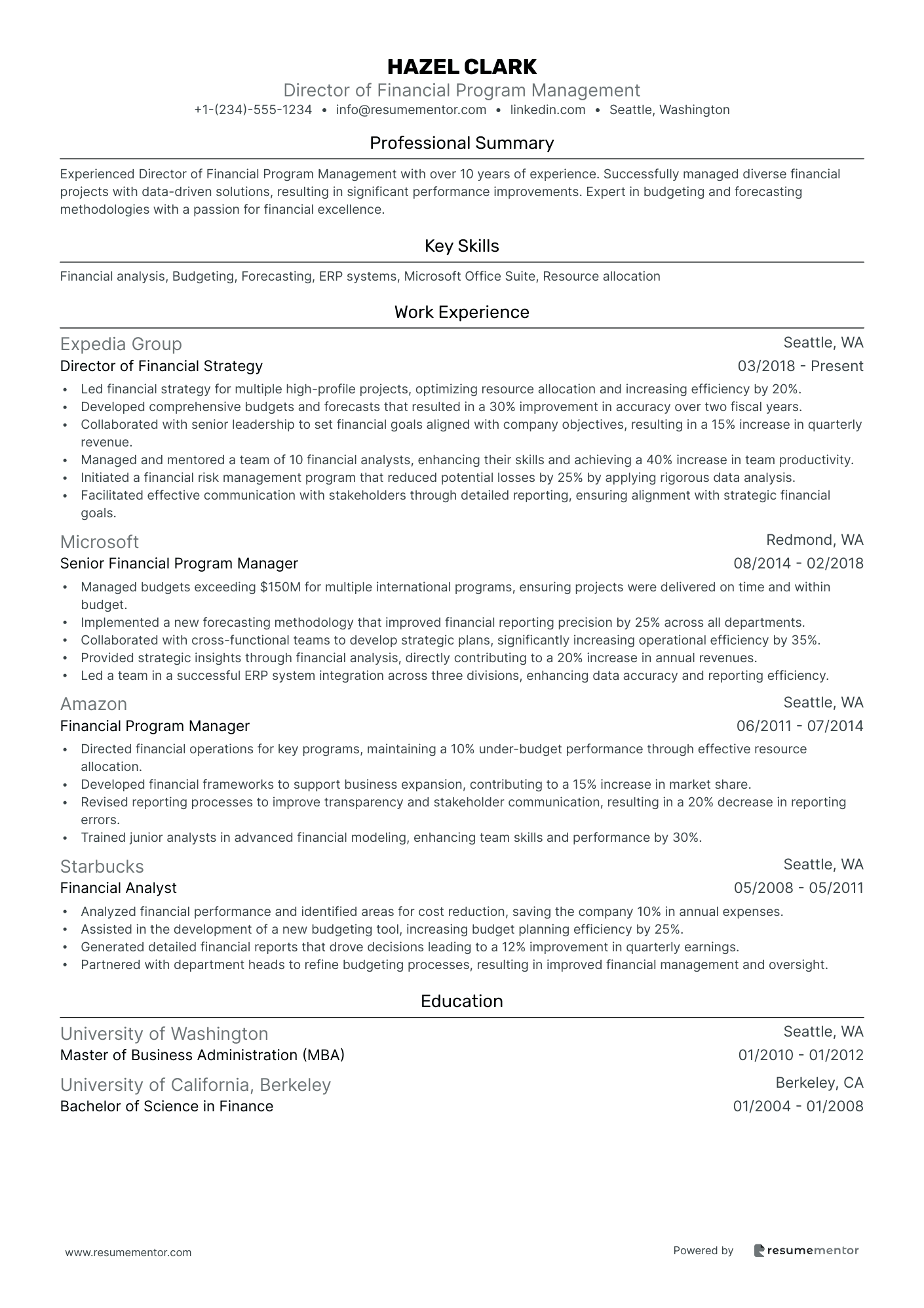

Director of Financial Program Management

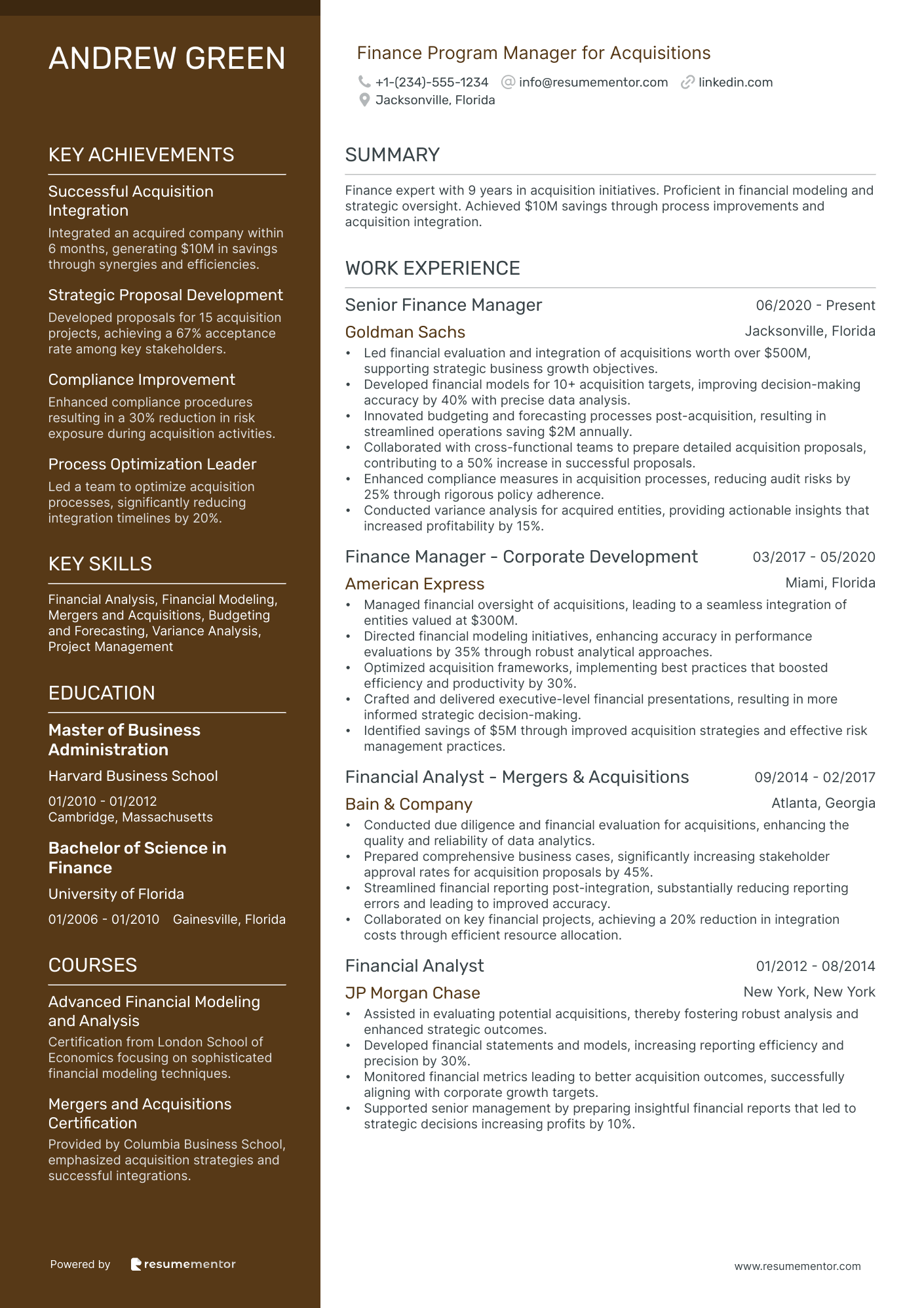

Finance Program Manager for Acquisitions

Finance Program Manager for Strategic Planning resume sample

- •Spearheaded a cross-departmental budgeting process that improved forecast accuracy by 15%, resulting in enhanced fiscal efficiency.

- •Developed advanced financial models for strategic planning, significantly influencing executive decision-making on capital investment projects.

- •Collaborated with business units to align financial goals with operational strategies, achieving a 10% increase in revenue growth.

- •Conducted risk assessments and scenario analyses that supported cost-saving initiatives leading to a $1.5M reduction in operational costs.

- •Prepared and presented financial reports to senior management, ensuring clarity and actionable insights that enhanced strategic outcomes.

- •Drove the continuous improvement of financial processes, leading to a 20% reduction in processing time for forecasting activities.

- •Led long-range planning initiatives, improving financial planning accuracy by 10% through robust analysis and enhanced data models.

- •Partnered with senior leadership to redefine strategic objectives, resulting in a $2M efficiency improvement across all budgets.

- •Enhanced financial reporting tools, leading to more insightful decision-making and a 25% reduction in report preparation time.

- •Streamlined financial processes to reduce errors and increased the accuracy of financial metrics by 18% compared to previous years.

- •Monitored financial performance closely, delivering precise recommendations that optimized the company's financial position.

- •Supported strategic business planning with the development of comprehensive financial models that improved forecasting precision by 12%.

- •Played a key role in budget planning, resulting in meeting financial targets with a 98% success rate in the fiscal year.

- •Provided comprehensive financial analyses that supported policy changes, generating a $750K savings over two years.

- •Facilitated cross-functional team collaboration to enhance financial planning processes, heightening efficiency and aligning strategic objectives.

- •Assisted in creating financial forecasts and budgets that consistently achieved accuracy within 5% of targets.

- •Implemented process improvements in financial systems that enhanced data accuracy and reduced reporting time by 30%.

- •Analyzed market trends and economic conditions, providing insightful reports that influenced strategic planning and risk management.

- •Engaged in collaborative projects that improved financial data interpretation, expanding operational cost-effectiveness by 20%.

Financial Operations Program Manager resume sample

- •Managed a team responsible for implementing policy changes that improved operational efficiency by 25%, enhancing budget adherence.

- •Introduced a financial dashboard that decreased monthly reporting time by 20%, improving decision-making capabilities across departments.

- •Led cross-departmental project that reduced process redundancies, resulting in a 30% cost savings within the fiscal year.

- •Collaborated with IT to enhance financial systems, improving data accuracy by 40% and supporting strategic planning.

- •Facilitated monthly workshops with Accounting and Treasury, leading to the integration of automated solutions that saved 200 hours annually.

- •Mentored six junior analysts, promoting skill development, which contributed to a 15% decrease in departmental errors.

- •Streamlined financial forecasting processes by deploying cutting-edge software tools, enhancing prediction accuracy by 30%.

- •Spearheaded a project that implemented new financial policies, ensuring compliance and best practice adherence, decreasing audit discrepancies by 20%.

- •Established cross-functional teams to revamp reporting procedures, reducing lag times by 50% across key business units.

- •Negotiated vendor contracts that resulted in $1.5 million in savings, optimizing financial resource allocation.

- •Trained team members on advanced Excel techniques, boosting department productivity by 40% and enhancing data analytics capabilities.

- •Led data analysis that identified market trends, which informed strategic planning decisions that increased revenue by $500K annually.

- •Facilitated the development of financial models to support business units, enhancing resource allocation efficiency by 25%.

- •Managed end-to-end reporting for major financial initiatives, providing insights that cut operating costs by 15%.

- •Conducted comprehensive risk assessments, minimizing financial exposure by 60% and ensuring long-term sustainability.

- •Developed a new budgeting template that improved the accuracy of financial forecasts by 18%, aiding better fiscal planning.

- •Identified cost reduction opportunities through detailed financial analysis, contributing to a 12% savings in operational expenses.

- •Assisted in implementing software upgrades that streamlined reporting processes, decreasing error rates by 25%.

- •Collaborated with department heads to align financial planning with strategic goals, resulting in improved resource management.

Program Manager for Financial Analytics resume sample

- •Led a financial analytics team to successfully deliver insights that increased overall revenue by 20% over two fiscal years.

- •Developed and implemented a new financial reporting system that improved data accuracy and reduced processing time by 30%.

- •Facilitated weekly cross-functional team meetings to ensure alignment on analytics projects, resulting in a 15% increase in collaboration efficiency.

- •Mentored 5 junior analysts in financial modeling, enhancing team productivity and reducing error rates by 25%.

- •Analyzed market trends and impacts, providing actionable insights that influenced key strategic decisions, boosting profitability by 10%.

- •Managed project budgets upwards of $2M, with successful adherence to financial controls and budget limits.

- •Spearheaded a cross-functional team to revamp the quarterly earnings model, saving the company 15% in reporting costs.

- •Coordinated with IT teams to integrate financial data systems, resulting in enhanced data integrity and 30% faster report generation.

- •Delivered presentations on financial performance to executive teams, achieving a 90% satisfaction rate in alignment with company goals.

- •Implemented best practices in data governance, ensuring compliance with legal and financial regulations.

- •Executed a cost analysis project that identified $1M in potential savings through operational efficiency improvements.

- •Managed multiple finance projects concurrently, leading to a 20% increase in project delivery within the deadline and budget.

- •Developed comprehensive financial models that provided insights leading to strategic initiatives yielding a 25% growth in project contributions.

- •Collaborated with IT to enhance financial data visualization tools, improving executive reporting clarity and utility.

- •Initiated risk management strategies that successfully mitigated potential financial losses by 10% annually.

- •Analyzed monthly variance reports to optimize financial performance, resulting in a 5% cost reduction in operating expenses.

- •Participated in the development of a forecasting tool which enhanced the company’s budgeting accuracy by 12%.

- •Worked with finance teams to consolidate reporting processes, reducing report generation time by 20%.

- •Conducted seminar workshops on financial modeling techniques, increasing department knowledge and skills.

Risk Management Finance Program Manager resume sample

- •Led development of a new risk management framework that improved compliance by 25% across financial operations.

- •Directed cross-functional collaboration, identifying and mitigating risks that resulted in a savings of $2 million annually.

- •Analyzed financial trends and proactively recommended strategies leading to a 30% decrease in potential risks.

- •Prepared and delivered detailed risk management reports to senior leadership, enhancing decision-making efficiency by 40%.

- •Facilitated organization-wide training sessions boosting risk awareness, participation increased by 50%.

- •Ensured compliance with all regulatory requirements, achieving 100% passing during annual audits.

- •Consulted with clients to develop tailored risk management programs, directly reducing exposure by 15%.

- •Led a team in conducting risk assessments, creating 12 comprehensive contingency plans for different scenarios.

- •Engaged with regulators and insurance providers ensuring alignment with best practices, enhancing client relations.

- •Streamlined risk documentation processes reducing time spent on policy updates by 20%.

- •Presented insights and recommendations during board meetings, assisting in key strategic financial decisions.

- •Developed risk assessment models that identified and mitigated $4 million in potential annual risk contingencies.

- •Managed stakeholder relationships with auditors and regulators, facilitating smooth audit processes.

- •Contributed to compliance strategies, achieving a 10% increase in audit efficiency.

- •Worked collaboratively to assess risk impacts, leading to more informed investment strategies.

- •Implemented standard risk management procedures enhancing overall efficiency by 10%.

- •Facilitated communication across departments ensuring consistent adherence to risk management protocols.

- •Monitored compliance of financial operations, performing risk reviews that improved response times by 20%.

- •Helped develop junior staff's understanding of risk management principles, improving team capabilities.

Investment Finance Program Manager resume sample

- •Led detailed financial modeling for a $50M investment project, resulting in a 25% increase in profitability.

- •Collaborated with cross-functional teams to integrate financial insights into strategic planning, enhancing decision-making efficiency by 30%.

- •Managed a global investment portfolio, consistently exceeding financial performance targets by an average of 15% annually.

- •Developed comprehensive financial reports and presented to senior management, aiding in strategic investment decisions.

- •Identified and implemented key financial control improvements, which reduced budget variance by 20%.

- •Maintained robust relationships with financial institutions, securing a $10M line of credit for investment ventures.

- •Oversaw a $100M investment budget, ensuring alignment with corporate financial strategies and objectives.

- •Conducted in-depth risk assessment and financial analysis, yielding a 40% improvement in portfolio risk-adjusted returns.

- •Streamlined investment reporting processes, reducing report preparation time by 50% and enhancing data accuracy.

- •Facilitated financial workshops with stakeholders, resulting in a 20% increase in analytical capabilities across teams.

- •Implemented cost-efficient financial management practices that cut operational expenses by 15%.

- •Provided accurate investment forecasts and financial analysis supporting over $30M in annual portfolio growth.

- •Developed financial models that improved investment evaluation processes, enhancing decision accuracy by 35%.

- •Effectively communicated complex financial concepts to stakeholders, leading to improved project approval rates.

- •Assisted in the advancement of financial software tools increasing analytical efficiency by 25%.

- •Analyzed market trends to support investment decisions resulting in a 20% increase in client returns.

- •Contributed towards team efforts in budgeting processes, improving accuracy by up to 15%.

- •Maintained updated financial data for a $20M portfolio, ensuring alignment with economic developments.

- •Provided financial insights that supported successful project execution under budgetary constraints.

Corporate Finance Program Manager resume sample

- •Led a cross-functional financial transformation initiative, enhancing the efficiency of financial processes by 30% through restructuring and resource reallocation.

- •Developed and implemented a comprehensive project plan for an enterprise resource planning system, resulting in a 25% reduction in data discrepancies.

- •Collaborated with executive leadership to align financial strategies with corporate goals, achieving a 15% increase in revenue growth projections.

- •Analyzed complex financial data sets to identify trends, recommending actionable opportunities for cost optimization, saving $2 million annually.

- •Facilitated transparent communication among project stakeholders, implementing a new reporting structure leading to a 40% improvement in project status clarity.

- •Mentored a team of five junior analysts in project management methodologies, enhancing team capacity to handle high-pressure deadlines effectively.

- •Managed a team responsible for a $500 million budget, directly leading to a decrease in unnecessary expenditures by 15%.

- •Revamped financial reporting processes, reducing reporting errors by 40% and improving decision-making timelines.

- •Partnered with cross-departmental teams to streamline financial workflows, enhancing department productivity by 60%.

- •Conducted comprehensive post-project reviews, synthesizing key insights that led to the adoption of best practices across 10 ongoing projects.

- •Mentored junior finance team members, guiding them through complex project management scenarios, resulting in a 20% increase in team performance.

- •Conducted financial modeling and analysis on strategic initiatives, contributing to a 10% improvement in forecast accuracy.

- •Assisted in the development of financial strategies that supported a 12% increase in annual returns for corporate shareholders.

- •Prepared detailed financial reports, aiding executive decision-making and leading to successful budget reallocations across departments.

- •Analyzed quarterly variance and performance trends, providing actionable insights that resulted in a significant cost-saving strategy implementation.

- •Coordinated financial activities concerning company acquisitions, aligning budget planning efforts with operational goals successfully.

- •Developed project schedules and resource allocation plans that improved project delivery timelines by 15%.

- •Conducted thorough risk analyses on proposed company projects, mitigate risks effectively, ensuring compliance with all regulatory requirements.

- •Facilitated key stakeholder meetings, enabling a newfound streamlined communication process and reducing project misalignment incidences by 25%.

Nonprofit Finance Program Manager resume sample

- •Led a team to develop annual budgets for non-profit programs totaling over $10 million, ensuring financial alignment with strategic goals.

- •Managed the financial reporting processes which improved report accuracy by 30% and decreased submission times by 15%.

- •Developed and implemented financial strategies that resulted in a 25% increase in program funding efficiency within two years.

- •Successfully collaborated with auditors and funding agencies, leading to a 100% compliance rate in financial audits.

- •Created comprehensive financial training programs for program staff increasing their budget management skills by 40%.

- •Spearheaded cost-saving measures identifying potential savings of $200,000 annually across various programs.

- •Conducted in-depth financial analysis of operations, improving resource allocation by 20%.

- •Streamlined financial forecasting processes, resulting in more accurate budget predictions by 15%.

- •Played a pivotal role in securing $1.5 million in grants by providing clear and thorough financial reports.

- •Collaborated effectively with program managers to reduce program expenses by 10% without affecting service delivery.

- •Prepared financial presentations for board meetings, increasing stakeholder confidence and funding retention by 12%.

- •Managed budgets and financial forecasts for over 40 grant-funded programs, ensuring compliance with funder requirements.

- •Enhanced the financial literacy of 50+ program staff through targeted workshops and training sessions.

- •Optimized grant reporting processes, reducing report preparation time by 20% and improving outcomes presentation quality.

- •Identified and corrected inefficiencies within financial systems, saving the organization $100,000 annually.

- •Provided financial planning support for disaster relief programs, contributing to a 15% increase in fundraising effectiveness.

- •Assisted in implementing a new financial software system that improved data accuracy and reduced entry errors by 25%.

- •Collaborated with cross-functional teams to develop a cohesive budgeting framework, aligning department goals with financial strategy.

Government Finance Program Manager resume sample

- •Led the development of financial programs that ensured compliance with regulations, increasing compliance rates by 30%.

- •Managed a $50 million budget, optimizing allocation and reducing costs by 15% through strategic assessments.

- •Collaborated with 8 departments, integrating finance strategies to align with overarching business goals.

- •Developed and implemented a risk management program reducing financial risks by 20% within the first year.

- •Spearheaded financial audits and worked with external auditors, enhancing the accuracy of financial reports by 25%.

- •Delivered technical training for 50 government staff members on contemporary financial practices and tools.

- •Conducted comprehensive financial forecasts and variance reports, improving decision-making efficiency by 18%.

- •Reviewed and analyzed financial data, presenting findings to senior stakeholders, resulting in improved strategic financial planning.

- •Led monthly audits leading to a 15% increase in the accuracy of financial records and documentation.

- •Collaborated on policy development, resulting in the enhancement of financial procedures within the department.

- •Provided guidance on implementing cost-effective financial strategies, successfully reducing departmental expenditures by 10%.

- •Assisted in the preparation of annual budgets, contributing to a 12% increase in budget accuracy.

- •Evaluated financial performance metrics, offering insights that improved fiscal accountability by 20%.

- •Researched and stayed current on financial regulations, ensuring compliance and reducing the risk of penalties.

- •Developed financial reports, which improved transparency with internal and external stakeholders.

- •Supported the finance team with data collection and analysis, enhancing the credibility of reports by 15%.

- •Monitored departmental expenditures, contributing to a reduction in over-expenditures by 10%.

- •Worked on project to implement new financial tracking system, increasing efficiency by 25%.

- •Assisted senior analysts with audits, leading to a 10% decrease in reporting errors.

Director of Financial Program Management resume sample

- •Led financial strategy for multiple high-profile projects, optimizing resource allocation and increasing efficiency by 20%.

- •Developed comprehensive budgets and forecasts that resulted in a 30% improvement in accuracy over two fiscal years.

- •Collaborated with senior leadership to set financial goals aligned with company objectives, resulting in a 15% increase in quarterly revenue.

- •Managed and mentored a team of 10 financial analysts, enhancing their skills and achieving a 40% increase in team productivity.

- •Initiated a financial risk management program that reduced potential losses by 25% by applying rigorous data analysis.

- •Facilitated effective communication with stakeholders through detailed reporting, ensuring alignment with strategic financial goals.

- •Managed budgets exceeding $150M for multiple international programs, ensuring projects were delivered on time and within budget.

- •Implemented a new forecasting methodology that improved financial reporting precision by 25% across all departments.

- •Collaborated with cross-functional teams to develop strategic plans, significantly increasing operational efficiency by 35%.

- •Provided strategic insights through financial analysis, directly contributing to a 20% increase in annual revenues.

- •Led a team in a successful ERP system integration across three divisions, enhancing data accuracy and reporting efficiency.

- •Directed financial operations for key programs, maintaining a 10% under-budget performance through effective resource allocation.

- •Developed financial frameworks to support business expansion, contributing to a 15% increase in market share.

- •Revised reporting processes to improve transparency and stakeholder communication, resulting in a 20% decrease in reporting errors.

- •Trained junior analysts in advanced financial modeling, enhancing team skills and performance by 30%.

- •Analyzed financial performance and identified areas for cost reduction, saving the company 10% in annual expenses.

- •Assisted in the development of a new budgeting tool, increasing budget planning efficiency by 25%.

- •Generated detailed financial reports that drove decisions leading to a 12% improvement in quarterly earnings.

- •Partnered with department heads to refine budgeting processes, resulting in improved financial management and oversight.

Finance Program Manager for Acquisitions resume sample

- •Led financial evaluation and integration of acquisitions worth over $500M, supporting strategic business growth objectives.

- •Developed financial models for 10+ acquisition targets, improving decision-making accuracy by 40% with precise data analysis.

- •Innovated budgeting and forecasting processes post-acquisition, resulting in streamlined operations saving $2M annually.

- •Collaborated with cross-functional teams to prepare detailed acquisition proposals, contributing to a 50% increase in successful proposals.

- •Enhanced compliance measures in acquisition processes, reducing audit risks by 25% through rigorous policy adherence.

- •Conducted variance analysis for acquired entities, providing actionable insights that increased profitability by 15%.

- •Managed financial oversight of acquisitions, leading to a seamless integration of entities valued at $300M.

- •Directed financial modeling initiatives, enhancing accuracy in performance evaluations by 35% through robust analytical approaches.

- •Optimized acquisition frameworks, implementing best practices that boosted efficiency and productivity by 30%.

- •Crafted and delivered executive-level financial presentations, resulting in more informed strategic decision-making.

- •Identified savings of $5M through improved acquisition strategies and effective risk management practices.

- •Conducted due diligence and financial evaluation for acquisitions, enhancing the quality and reliability of data analytics.

- •Prepared comprehensive business cases, significantly increasing stakeholder approval rates for acquisition proposals by 45%.

- •Streamlined financial reporting post-integration, substantially reducing reporting errors and leading to improved accuracy.

- •Collaborated on key financial projects, achieving a 20% reduction in integration costs through efficient resource allocation.

- •Assisted in evaluating potential acquisitions, thereby fostering robust analysis and enhanced strategic outcomes.

- •Developed financial statements and models, increasing reporting efficiency and precision by 30%.

- •Monitored financial metrics leading to better acquisition outcomes, successfully aligning with corporate growth targets.

- •Supported senior management by preparing insightful financial reports that led to strategic decisions increasing profits by 10%.

Navigating the world of finance program management is like steering a ship through unpredictable waters, where your skills keep projects on course. But when it comes to writing your resume, the challenge shifts to effectively capturing your expertise. Highlighting both your analytical strengths and leadership skills is essential without losing key details.

Condensing your extensive experience into a clear format can feel overwhelming. The goal is to balance financial forecasting expertise with your ability to manage complex projects. With so many resumes landing on hiring managers' desks, a well-structured one helps you stand out and get noticed.

That's where a resume template comes in handy. It helps organize your achievements and skills in a straightforward way, ensuring nothing important slips through the cracks. By setting a professional tone, a template allows your experience to shine without distraction.

This guide is here to make the resume-writing process less daunting. You’ll discover how to create a document that not only highlights your finance program management expertise but also connects with hiring managers. Equip yourself with the right tools to confidently tell your career story and navigate your job search toward success.

Key Takeaways

- Writing a teacher resume requires highlighting both analytical strengths and leadership skills, while making sure to include key details in a clear, organized format.

- The use of a resume template can significantly help in structuring achievements and skills, allowing for a professional tone that ensures all important details are included.

- A finance program manager resume should emphasize the ability to manage projects, budgets, forecasts, and team coordination effectively, alongside showcasing strong communication skills.

- Choosing a reverse-chronological resume format places the most recent experience at the forefront, which is ideal for managerial roles, combined with appropriate font choices (Raleway, Lato, Montserrat) to enhance readability and professionalism.

- Incorporating quantifiable achievements in the experience section with clear metrics and action verbs, such as "spearheaded" or "optimized," helps demonstrate impact and align past roles with future potential.

What to focus on when writing your finance program manager resume

Your finance program manager resume should clearly express your ability to manage financial projects smoothly, showcasing your leadership skills and strategic planning prowess. Demonstrating how you handle budgets, forecasts, and team coordination effectively highlights your strengths. You should also emphasize your strong communication skills and ability to work seamlessly across different teams.

How to structure your finance program manager resume

- Contact Information — Start with your full name, phone number, email address, and LinkedIn profile to set a professional tone from the outset. Ensure all details are accurate and up to date, projecting reliability and an effortless first contact point for the recruiter. The use of a professional email address and an up-to-date LinkedIn profile reinforces your career-focused mindset, which is crucial for a finance program manager role.

- Professional Summary — This concise overview offers a snapshot of your experience, focusing on your achievements in finance program management. It should reflect your career goals and highlight your dedication to financial performance, presenting you as the candidate who can make a difference. A compelling summary becomes your elevator pitch, highlighting both your past successes and future potential. It sets the stage for a deeper dive into your qualifications.

- Work Experience — This section maps out your career journey, listing relevant job titles, employers, and dates of employment. Use bullet points to pinpoint key achievements and responsibilities, with specific emphasis on leadership roles and strategic financial management initiatives. Concrete results and quantifiable successes help differentiate you from other candidates. The section showcases your ability to lead and innovate in finance environments, providing a comprehensive view of how you have contributed to past organizations.

- Education — List your degrees, the institutions from which you graduated, and graduation dates. Highlight courses or certifications, such as an MBA or CFA, that are particularly relevant to financial management. Demonstrating a strong educational background reinforces your expertise and preparedness for high-level finance responsibilities. This part assures recruiters of your foundational knowledge, providing context for your work experience.

- Skills — Focus on capabilities like financial analysis, budgeting, project management, and risk assessment. Use industry-specific terms that align directly with the responsibilities of a finance program manager. In this section, highlight both technical and soft skills that are critical to excelling in this role, such as analytical thinking and team leadership. The right skills can affirm your suitability for the position, bridging the gap between your experience and the job requirements.

- Certifications/Professional Development — Include any relevant certifications such as PMP or completed courses that bolster your prowess in financial management. This section demonstrates your commitment to continuous learning and professional growth, an essential quality for staying competitive in the finance industry. Supplementing your resume with these credentials adds depth and credibility to your profile.

In the next sections, we'll cover each of these areas more in-depth to provide a complete guide on crafting a finance program manager resume that's both comprehensive and impactful.

Which resume format to choose

Creating a standout finance program manager resume starts with choosing the right format. A reverse-chronological layout is ideal because it puts your most recent experience at the forefront—exactly what recruiters are eager to see when evaluating candidates for managerial roles. Your employment history can tell a powerful story of growth and achievement when presented this way.

Next, consider the font as an extension of your professional image. Opt for Raleway, Lato, or Montserrat. These fonts are modern and crisp, ensuring your resume is not only easy to read but also visually appealing. They communicate professionalism without being overly traditional, striking the right balance for a managerial position in finance.

Saving your resume as a PDF is crucial to maintaining its integrity. This format preserves the layout, ensuring that what you see is exactly what the hiring manager will see, no matter what device or software they're using. A properly formatted PDF reflects your attention to detail, a crucial trait in finance.

Finally, pay attention to your margins. Keeping them around one inch on all sides ensures your content is well framed, making it easy for recruiters to explore the details. When your information is well-organized and accessible, it reflects the kind of clarity and precision that are key in financial management roles.

Together, these elements create a cohesive impression of professionalism and competence. By following these strategies, your resume will stand out in the finance industry as a well-crafted reflection of your skills and experience.

How to write a quantifiable resume experience section

A compelling experience section in a finance program manager resume can truly set you apart. It's important to highlight achievements with clear numbers that demonstrate your impact, linking your past roles to future potential. Start with your most recent job and work backward, covering around 10-15 years, unless an older role showcases significant successes. Tailoring your resume for each job is crucial; use keywords from the job ad to highlight your strengths as a finance program manager. Show your career growth through relevant job titles that reflect your evolving responsibilities. By incorporating action words like "spearheaded," "optimized," and "orchestrated," you emphasize your leadership and contributions. This section offers a concise view of what you’ve accomplished in past roles, which helps hiring managers understand your potential.

- •Led a cross-functional team, cutting overhead costs by 15% through process improvements.

- •Implemented a new financial software system, boosting forecasting accuracy by 20%.

- •Fine-tuned budget allocations and negotiated vendor contracts, saving $500K annually.

- •Directed a financial analysis project that found growth chances, increasing revenue by 25%.

The experience section stands out because it presents a cohesive picture of your professional journey. By connecting roles with quantifiable results, each bullet point reveals a narrative of consistent impact and expertise. The strategic use of action words energizes your achievements, making them memorable and relevant. Using keywords that match the job ad further aligns your experience with what employers are looking for, positioning you as the ideal candidate. This clear communication of your accomplishments and potential helps hiring managers quickly grasp the value you bring to the table.

Training and Development Focused resume experience section

A training and development-focused finance program manager resume experience section should clearly showcase your role in enhancing team capabilities and achieving measurable improvements. Start by listing your job title, workplace, and dates of employment to provide context. In each role, use bullet points to highlight your key contributions, ensuring each point begins with a strong action verb like "developed," "managed," or "implemented." By including tangible results, such as percentages or figures, you create a clear picture of your successes.

Connect your efforts in leading training initiatives to the growth and skill enhancement of the teams you managed. Describe how you strategically improved training programs and fostered collaboration across departments. Consider weaving in how your mentorship roles supported career development and knowledge sharing. Maintain clarity and conciseness to enable easy understanding, using straightforward language to let your achievements stand out.

Finance Program Manager

Global Finance Inc.

2018 - 2022

- Implemented training programs for over 100 finance professionals, leading to a 25% improvement in efficiency.

- Created a mentorship program that paired senior managers with new hires, boosting knowledge and career growth.

- Led cross-functional teams to design training modules, increasing financial understanding across departments.

- Streamlined training processes, reducing onboarding time for new staff by 40%.

Achievement-Focused resume experience section

A finance-focused program manager resume experience section should highlight your accomplishments in a compelling way. Start with a clear and engaging header that summarizes your achievements. Use active verbs, specific metrics, and tangible results to clearly show your impact, as these details make your contributions come to life for the reader. Incorporating storytelling techniques can help you demonstrate how you tackled challenges or provided key financial solutions, making your narrative more engaging.

When crafting your experiences, use specific examples and concise bullet points to ensure the section is easy to skim. Focus on initiatives where you led projects, enhanced financial processes, or contributed to increasing profitability, as these examples highlight your leadership and problem-solving skills. It's essential to tailor your examples to match the job description, which reinforces your role as a proactive, results-driven professional eager to add value to any organization.

Finance Program Manager

Tech Innovations Inc.

2020 - Present

- Implemented a new budgeting system, reducing department costs by 15%

- Led a cross-functional team to streamline financial reporting, saving 20 hours monthly

- Developed financial models that guided the CEO's strategic decisions

- Created cost-saving strategies that resulted in a $1M annual savings

Skills-Focused resume experience section

A skills-focused finance program manager resume experience section should zero in on the talents that align closely with the job you're targeting. Highlighting key duties and accomplishments showcases your expertise through clear, active verbiage. Quantifying achievements with numbers or percentages makes the impact more evident, ensuring each entry effectively communicates how you’ve applied your skills to achieve results.

Descriptions must remain concise while drawing attention to impactful skills in your past roles, like budget management, team leadership, and strategy development. Together, these details offer a cohesive view of not just what you’ve done, but how you’ve excelled. This approach gives potential employers a clear picture of the value you offer.

Finance Program Manager

ABC Financial Services

June 2018 - Present

- Managed budgets exceeding $5 million annually, ensuring efficient allocation and use of resources.

- Led a team of 10 finance professionals, boosting team productivity by 20%.

- Implemented a new financial forecasting tool, reducing variance by 15%.

- Developed and executed risk management strategies, decreasing financial risks by 30%.

Efficiency-Focused resume experience section

A finance-focused finance program manager resume experience section should emphasize your ability to enhance and simplify processes. Begin by highlighting significant changes you've driven, particularly those that boost performance or cut costs. It's crucial to include specific metrics or results that clearly demonstrate your efficiency. This approach not only underscores your skills but also shows the tangible benefits you've delivered in past roles.

Use clear language when describing each experience, employing action verbs to detail your role and contributions. Each bullet point should be concise yet adequately descriptive, allowing hiring managers to quickly recognize the value you bring. Tailor each work entry to link your previous responsibilities and achievements directly to the role you're targeting. Keep a consistent focus on your knack for improving efficiency, making your resume a compelling tool for capturing the attention of future employers.

Finance Program Manager

Tech Innovations Corp

June 2019 - Present

- Streamlined financial reporting processes, reducing completion time by 30% through automation.

- Implemented a cost-reduction strategy that saved the company $500,000 annually.

- Led a team to optimize resource allocation, increasing project profitability by 15%.

- Developed a forecasting model improving budget accuracy by 20%.

Write your finance program manager resume summary section

A finance-focused program manager resume summary should be concise yet impactful, capturing the essence of your professional experience. Start by identifying what makes you stand out in the finance sector and focus on showcasing your key skills and achievements that align with the specific role. Highlight your years of experience alongside your areas of expertise and notable accomplishments. By incorporating active language, you ensure that your summary is engaging and easy to read, offering a quick snapshot of the value you bring to potential employers. Consider this example:

This summary effectively connects your experience with the desired skills for the job. It underscores your capability through tangible achievements, such as managing large projects successfully, while also emphasizing crucial abilities like financial modeling. Understanding the differences between a resume summary and other sections, such as objectives, profiles, or qualifications, is vital. A summary offers a quick overview of your career, best suited for those with experience. In contrast, a resume objective focuses on what you hope to achieve, which can be advantageous if you’re new to the field. A resume profile merges aspects of both summary and objective, while a summary of qualifications lists key skills in bullet points. By choosing the section that best aligns with your career stage, you can enhance your resume’s appeal and effectiveness.

Listing your finance program manager skills on your resume

A finance-focused program manager resume should seamlessly integrate your skills and experiences to create a compelling narrative. Consider whether to showcase your skills in a standalone section or incorporate them into your experience and summary. Highlighting strengths and soft skills demonstrates how effectively you can lead and collaborate, while hard skills are the specific, teachable abilities you’ve acquired through experience or training.

These skills and strengths serve as crucial keywords, ensuring your resume grabs the attention of hiring managers and applicant tracking systems. With relevant keywords, your resume is more likely to stand out. Your skills section should zero in on the abilities that are most pertinent to the job you're aiming for.

Example of a standalone skills section:

This example is effective because it lists the essential skills a finance program manager needs in a concise and organized manner. The focus on relevant, industry-specific terms ensures that your resume is tailored to the role you're pursuing.

Best hard skills to feature on your finance program manager resume

Hard skills reflect your capability in financial management and project execution. These skills should demonstrate your ability to make informed decisions and effectively manage resources. Here are some of the most in-demand hard skills for this role:

Hard Skills

- Financial Analysis

- Budget Management

- Risk Management

- Financial Planning & Forecasting

- Stakeholder Management

- Regulatory Compliance

- Cost-Benefit Analysis

- Strategic Planning

- Contract Negotiation

- Audit Management

- Financial Reporting

- Cash Flow Management

- Data Analysis

- Investment Strategy

- Treasury Management

Best soft skills to feature on your finance program manager resume

Soft skills highlight your ability to effectively work with teams and communicate across all levels of an organization. They underscore your interpersonal skills and flexibility in various environments. Consider these top soft skills for your resume:

Soft Skills

- Leadership

- Communication

- Problem Solving

- Decision Making

- Negotiation

- Adaptability

- Teamwork

- Time Management

- Critical Thinking

- Emotional Intelligence

- Conflict Resolution

- Attention to Detail

- Organization

- Stress Management

- Creativity

How to include your education on your resume

An education section is an important part of your finance program manager resume. It highlights your academic background and credentials. Tailor this section to the job you are applying for by including only relevant education. If your degree is related to finance or management, it will showcase your qualifications effectively. Including your GPA on your resume can be beneficial if it is high, typically on a scale of 4.0. Listing cum laude honors can also attract positive attention by indicating academic excellence. Ensure you state your degree clearly, using the degree title followed by the institution's name.

- •Graduated cum laude

- •Completed a capstone project on financial risk management

The first example is inappropriate as it lists a degree unrelated to finance, making it less relevant for a finance program manager position. The second example is excellent because it is specifically tailored to the role. It includes a relevant degree, a high GPA, and honors such as cum laude. Additionally, listing a capstone project underlines specific expertise in financial risk management. This demonstrates to potential employers that you have the academic background and specialized skills needed for the position.

How to include finance program manager certificates on your resume

Having a certificates section on your finance program manager resume is crucial. This section highlights your specialized qualifications and reinforces your expertise. You can also incorporate certificates in the header for quick visibility.

List the name of each certificate clearly. Include the date you received each certification. Add the issuing organization to provide authenticity. Group relevant certificates together to maintain coherence. Use a simple format to keep your resume organized and easy to read.

An example of a standalone certificates section would look like this:

This example is effective because it includes valuable credentials relevant to a finance program manager role. Each certification is listed with essential details, making it easy for employers to assess your qualifications quickly.

Extra sections to include in your finance program manager resume

In today's competitive job market, a well-rounded resume can make all the difference for a finance program manager. Including diverse sections in your resume helps paint a fuller picture of who you are beyond just your professional qualifications.

Highlighting various aspects like language proficiency, hobbies, volunteer work, and favorite books can demonstrate your multifaceted personality. This can set you apart from other candidates and make you more memorable.

Language section — Showcase your language skills to enhance your global appeal. This can provide potential international opportunities and show your versatility.

Hobbies and interests — Include this section to display your well-rounded life outside work. This can make you relatable and help connect on a personal level with employers.

Volunteer work section — Demonstrate your commitment to community and social responsibility. Employers often look favorably upon candidates who give back to their communities.

Books section — Share your reading interests to exhibit your continuous learning mindset. This can highlight your alignment with industry trends and self-improvement efforts.

Adding these sections can make your resume more engaging and complete, potentially boosting your chances of landing that coveted finance program manager position.

In Conclusion

In conclusion, crafting an exceptional resume for a finance program manager role involves more than just listing your past job titles and responsibilities. It's an opportunity to highlight your unique skills, achievements, and experiences in a manner that resonates with potential employers. Striking the right balance between professional achievements and personal attributes can set you apart from other candidates. Leveraging a resume template can help ensure your application is both comprehensible and visually appealing, allowing your expertise to take center stage. By underscoring your capabilities with quantifiable achievements and active verbiage, you convey a clear picture of your potential contributions to a new organization. Tailoring your resume sections, such as work experience and education, to feature relevant details enhances your professional narrative. Incorporating aspects like certifications and additional sections on skills and interests further enriches your resume's content. These elements collectively help create a resume that reflects not just your qualifications but also your commitment to personal and professional growth. In a competitive landscape, connecting these dots effectively can guide you to successful career advancement in finance program management.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.