Financial Consultant Cover Letter Examples

May 29, 2025

|

12 min read

Crafting your financial consultant cover letter: Gain interest with your skills and experience, and show potential employers you're not just another 'number cruncher' but the missing piece in their fiscal puzzle.

Rated by 348 people

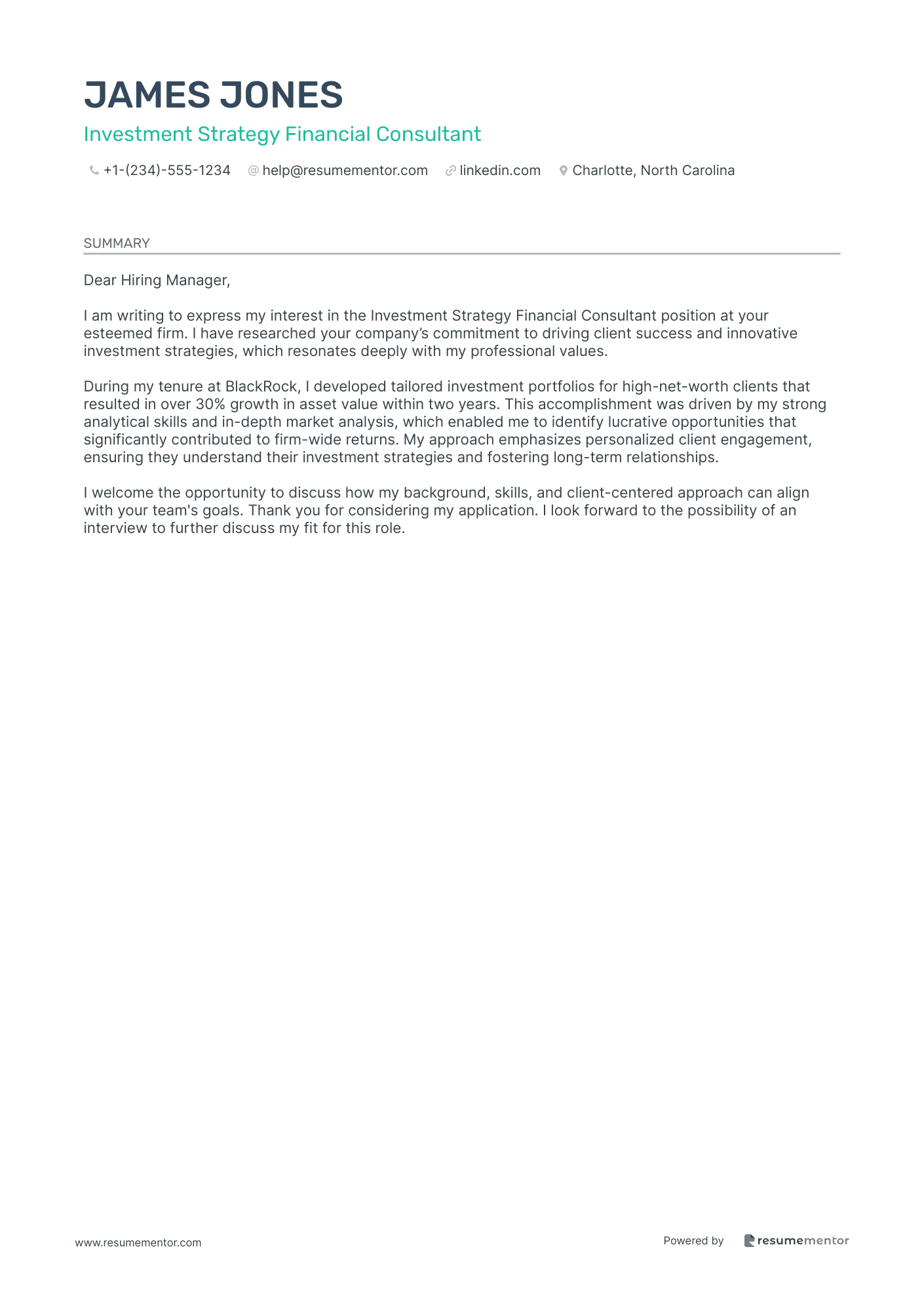

Investment Strategy Financial Consultant

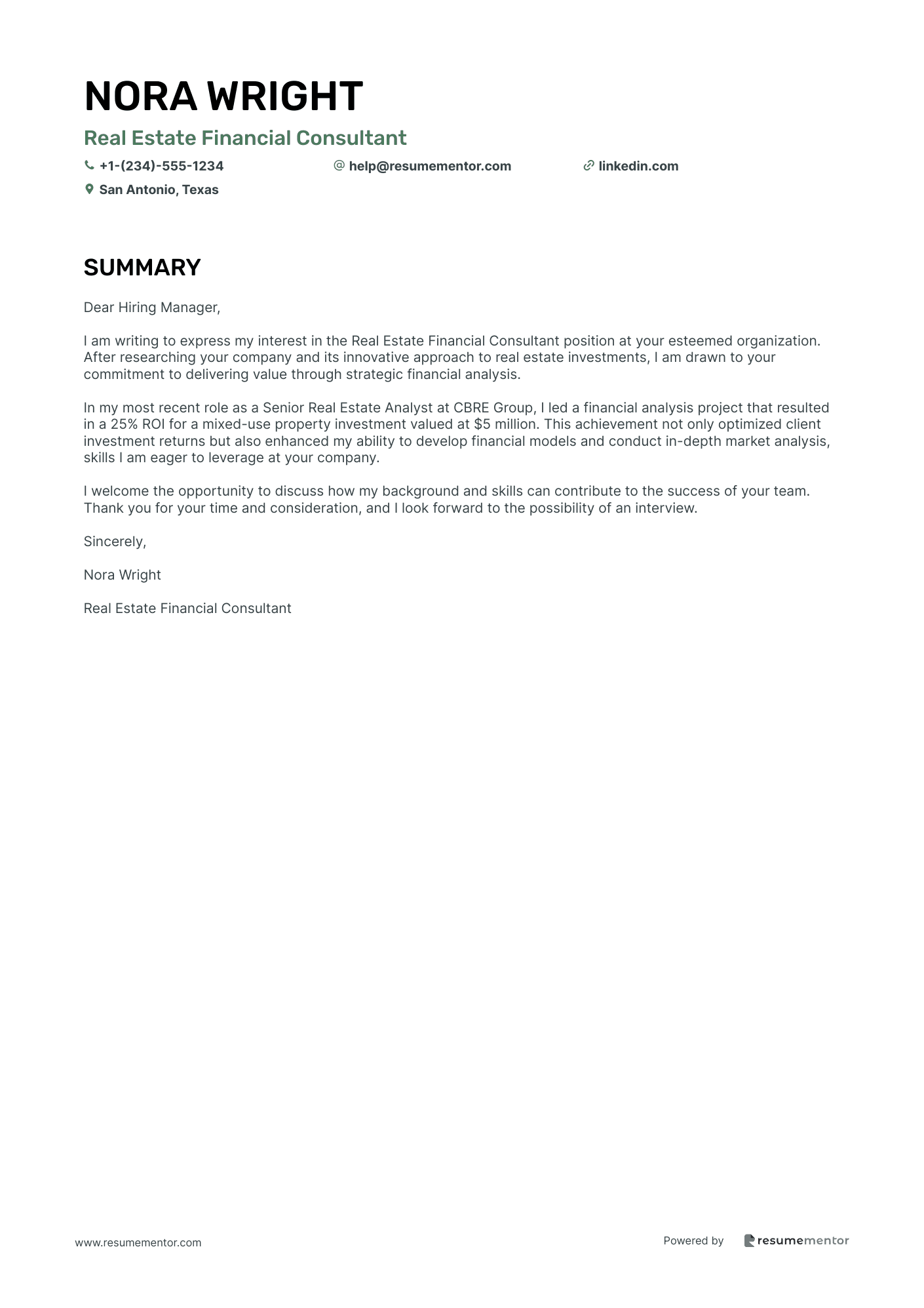

Real Estate Financial Consultant

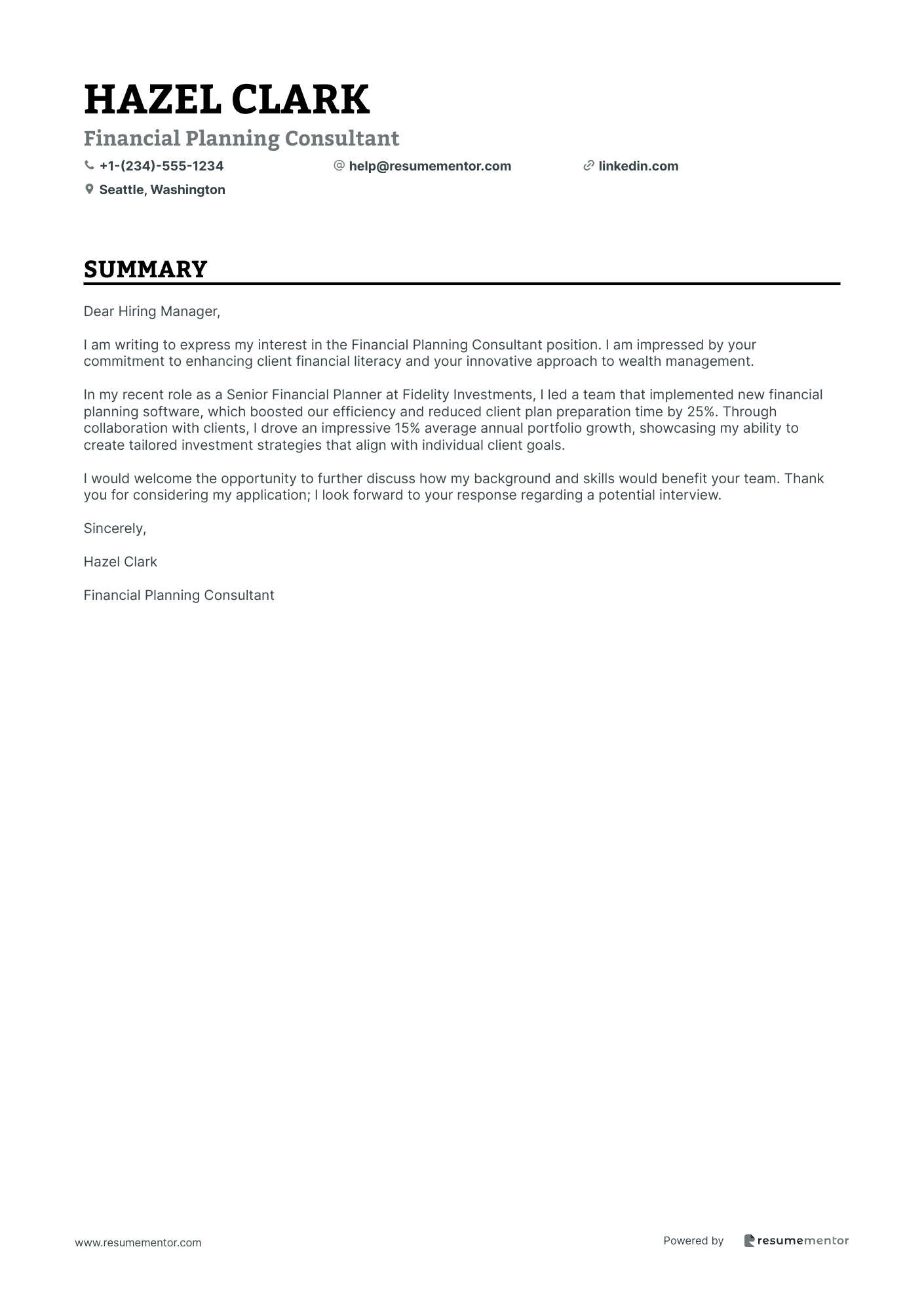

Financial Planning Consultant

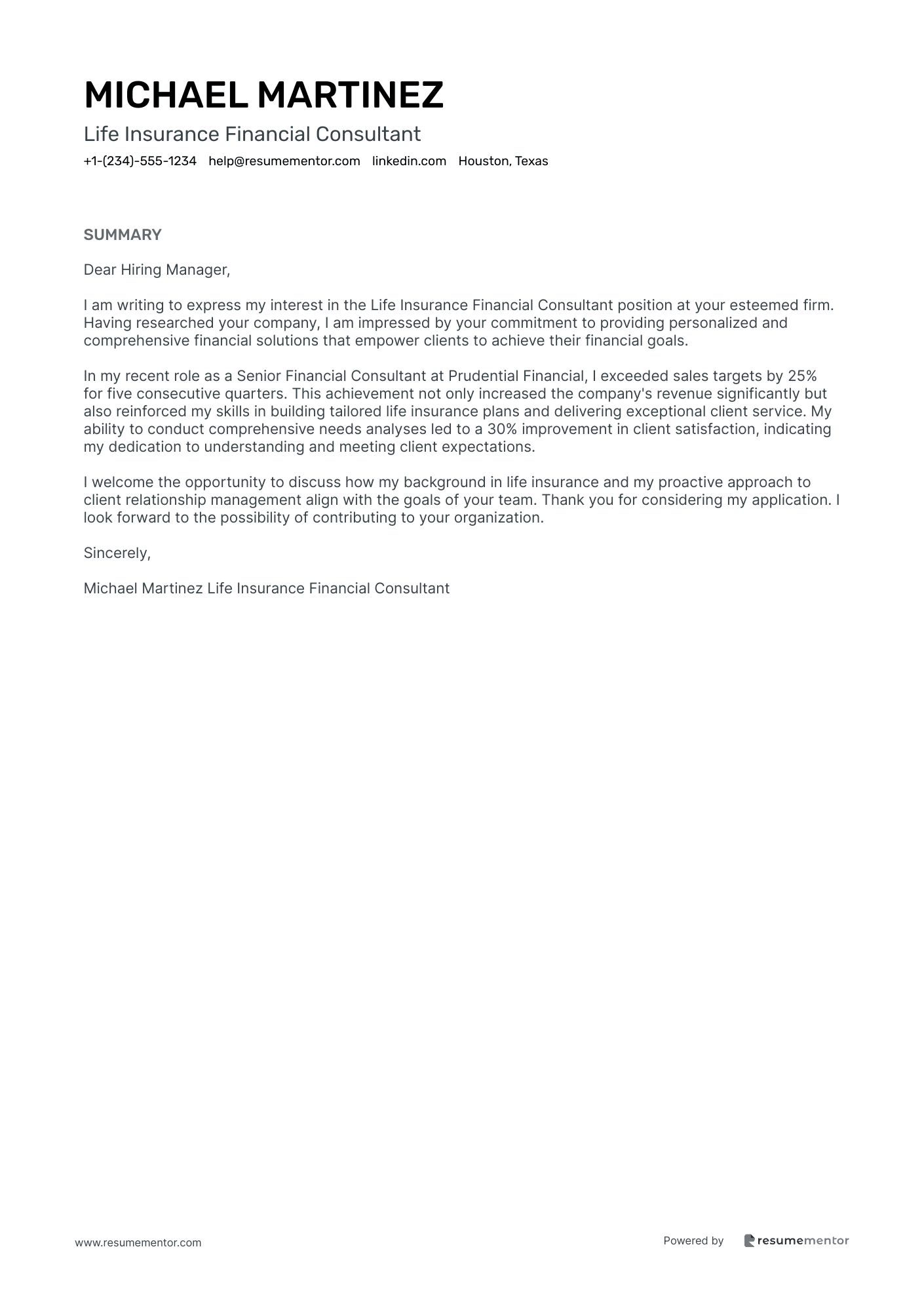

Life Insurance Financial Consultant

Taxation Financial Consultant

Retirement Planning Financial Consultant

Mergers and Acquisitions Financial Consultant

Portfolio Management Financial Consultant

Financial Analytics Consultant

Risk Management Financial Consultant

Investment Strategy Financial Consultant cover letter sample

Real Estate Financial Consultant cover letter sample

Financial Planning Consultant cover letter sample

Life Insurance Financial Consultant cover letter sample

Taxation Financial Consultant cover letter sample

Retirement Planning Financial Consultant cover letter sample

Mergers and Acquisitions Financial Consultant cover letter sample

Portfolio Management Financial Consultant cover letter sample

Financial Analytics Consultant cover letter sample

Risk Management Financial Consultant cover letter sample

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.