Forensic Accountant Resume Examples

Jul 18, 2024

|

12 min read

"Get the job: your forensic accountant resume should be a true accounting masterpiece that tells your story while revealing the hidden financial details recruiters want to see."

Rated by 348 people

Fraud Examination Specialist

Litigation Support Accountant

Financial Investigation Consultant

Forensic Financial Analyst

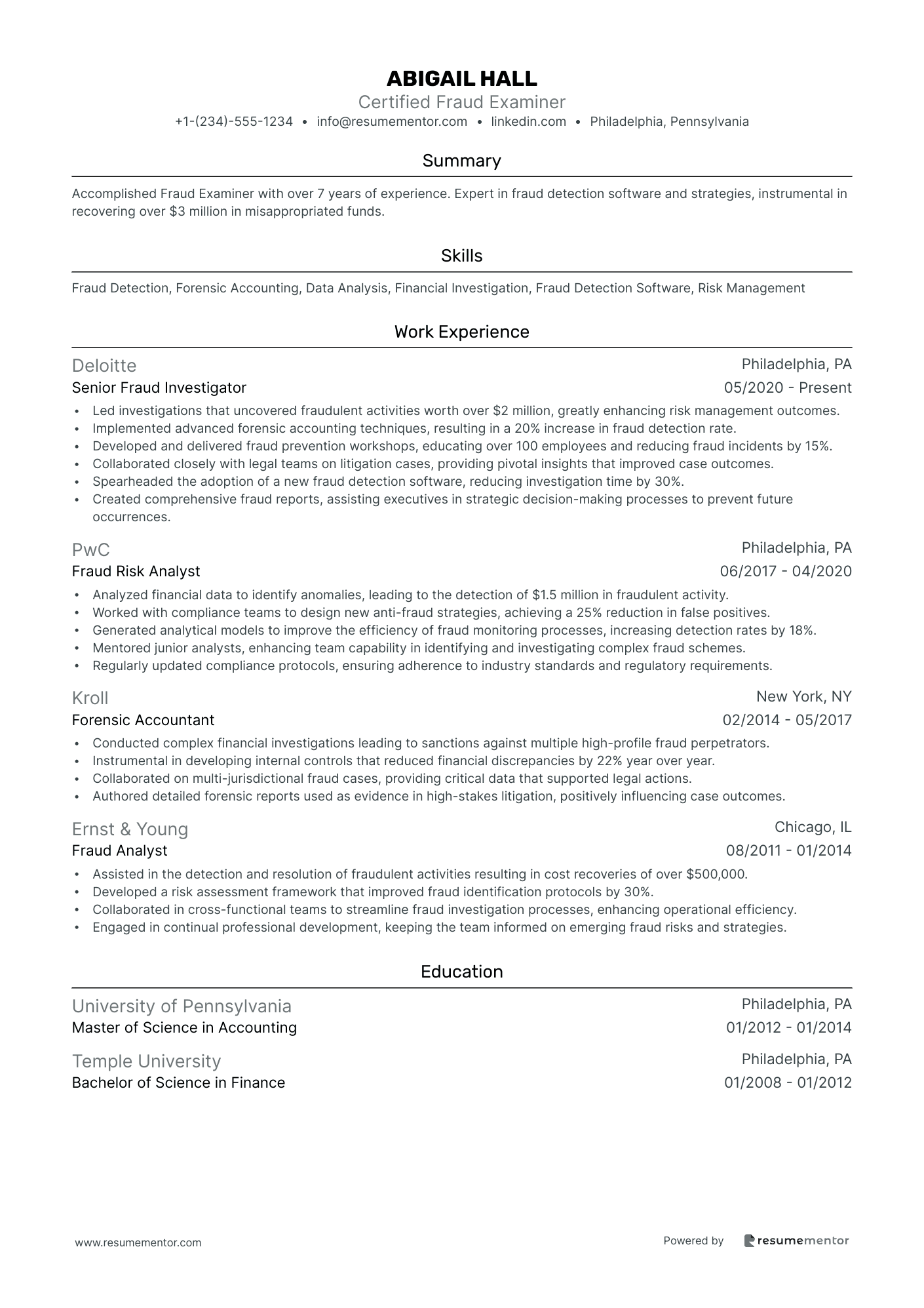

Certified Fraud Examiner

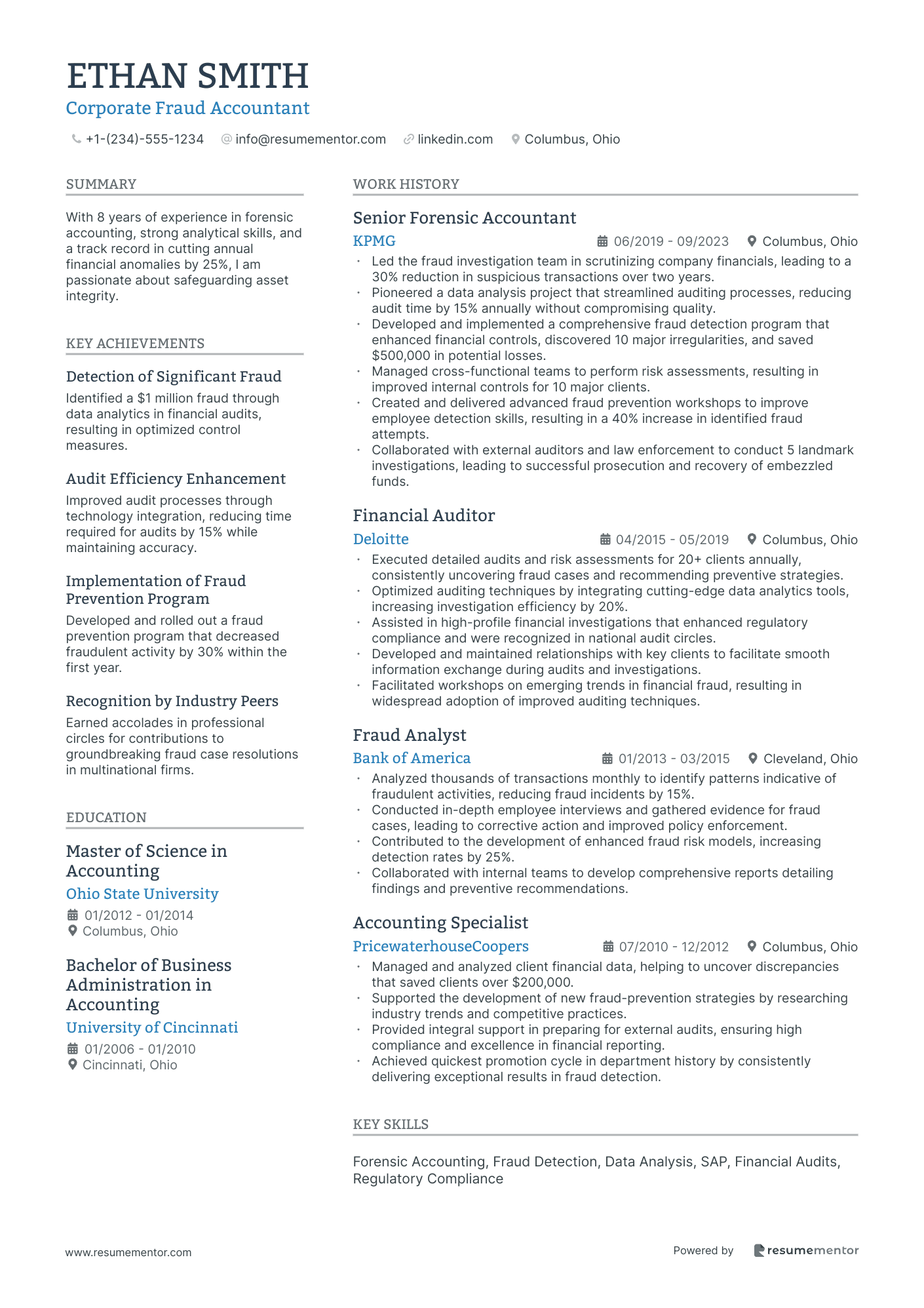

Corporate Fraud Accountant

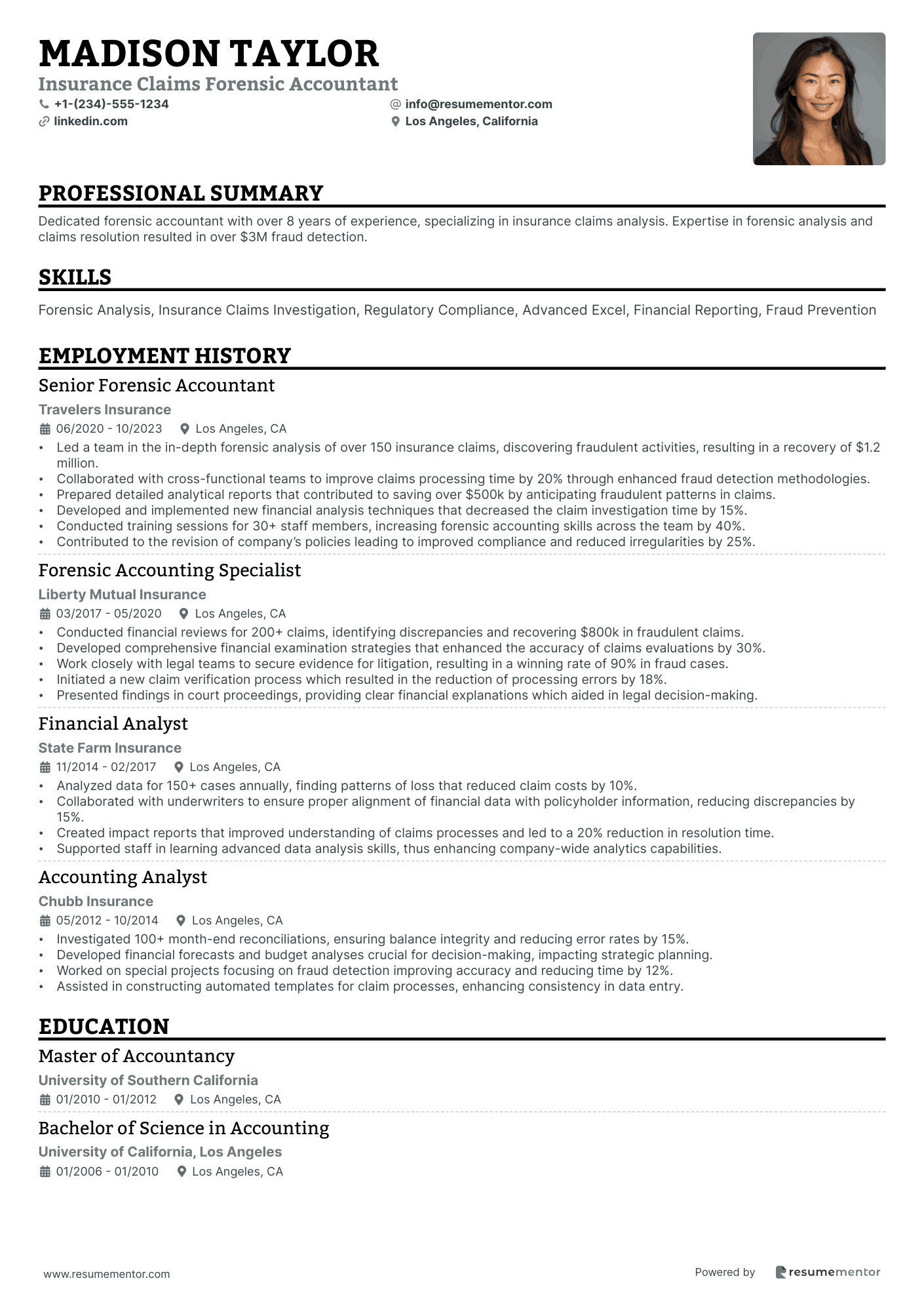

Insurance Claims Forensic Accountant

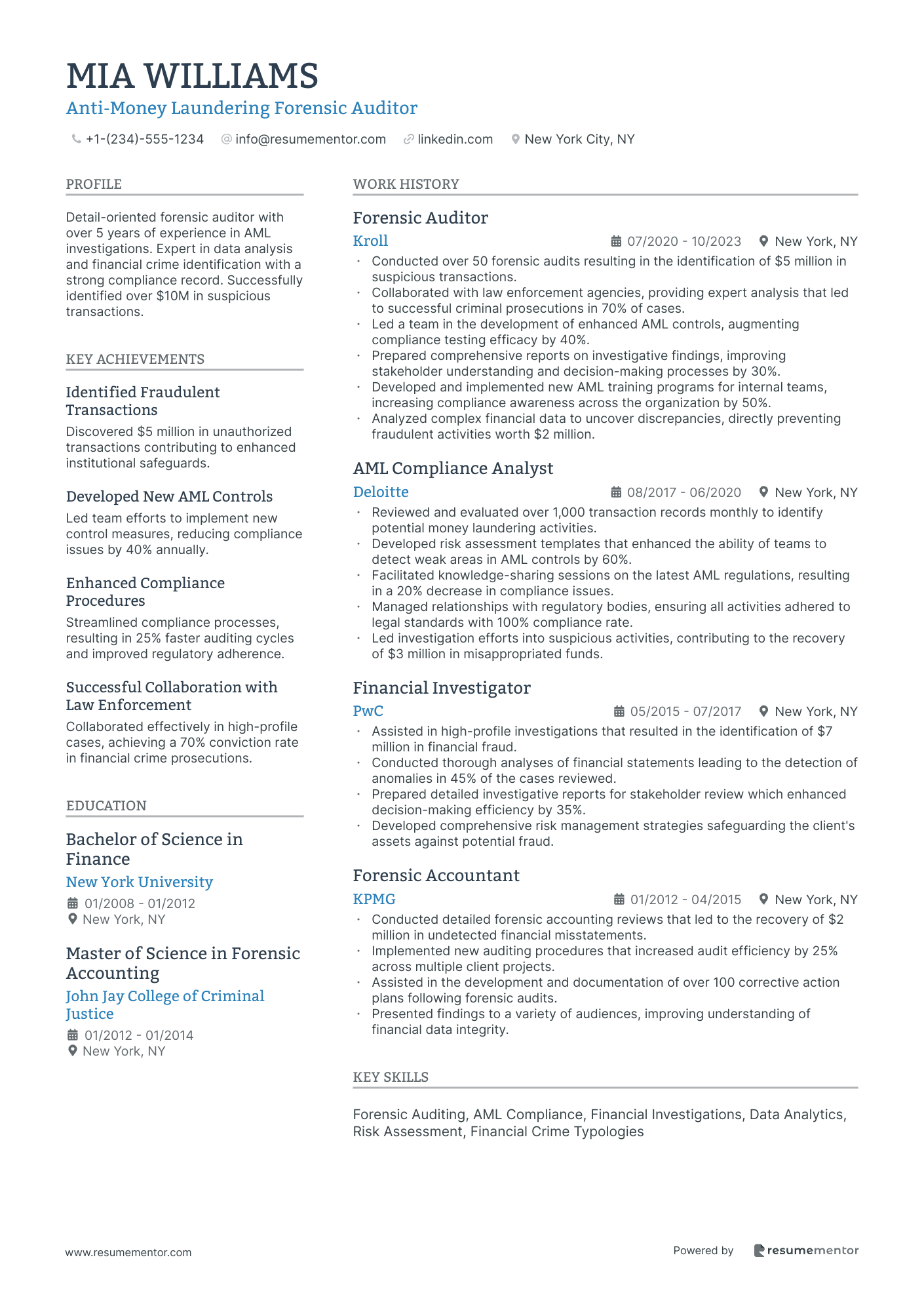

Anti-Money Laundering Forensic Auditor

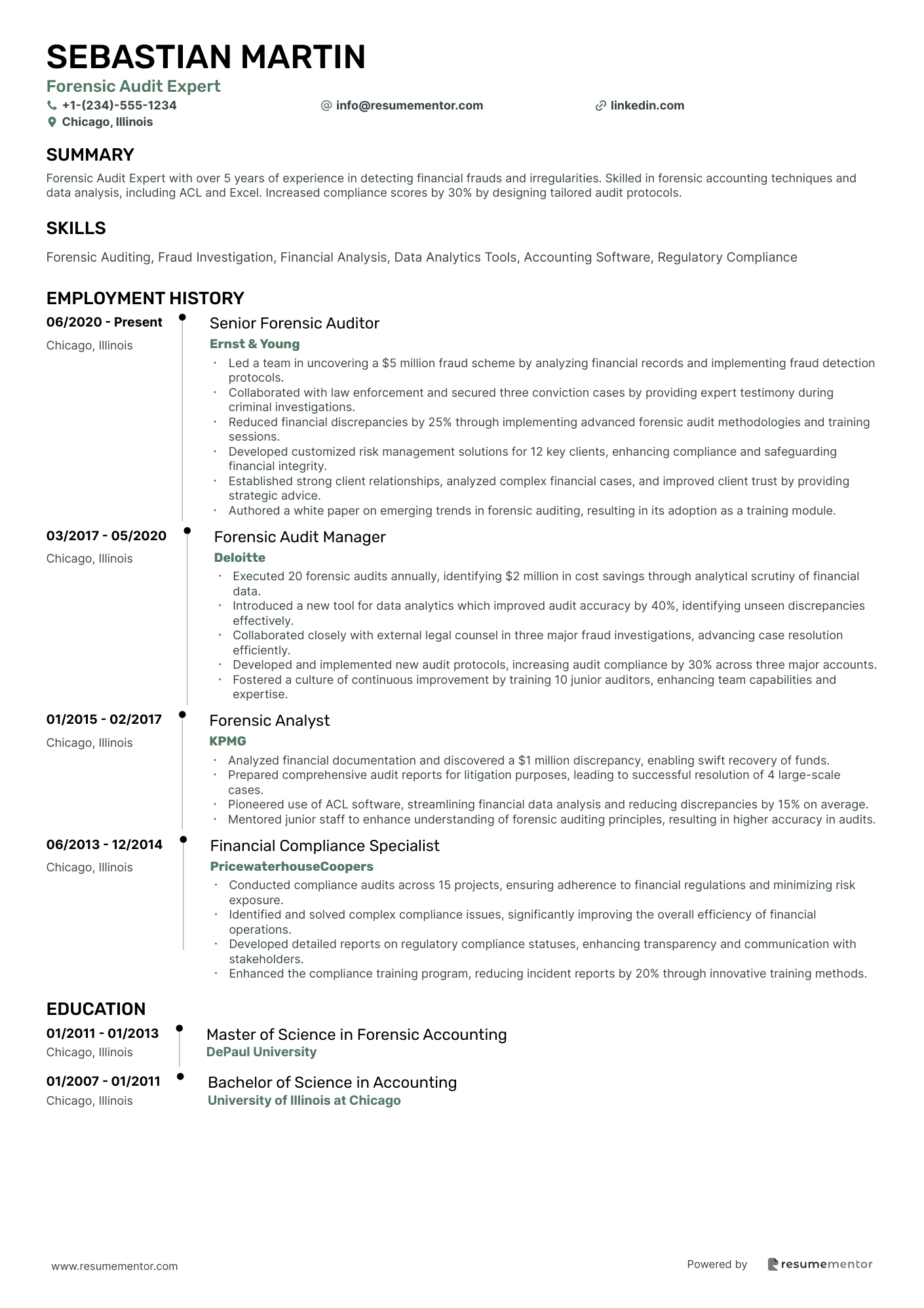

Forensic Audit Expert

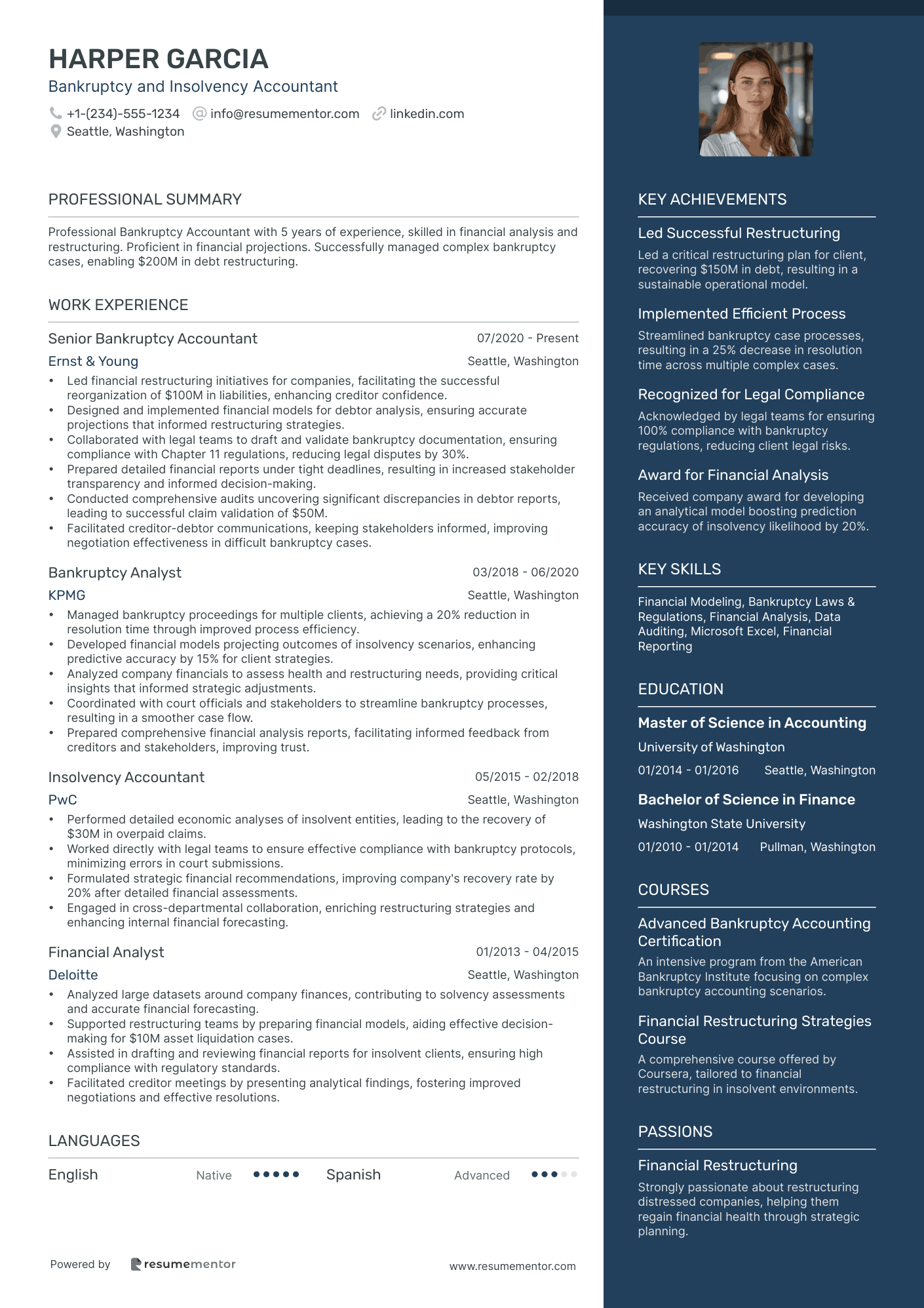

Bankruptcy and Insolvency Accountant

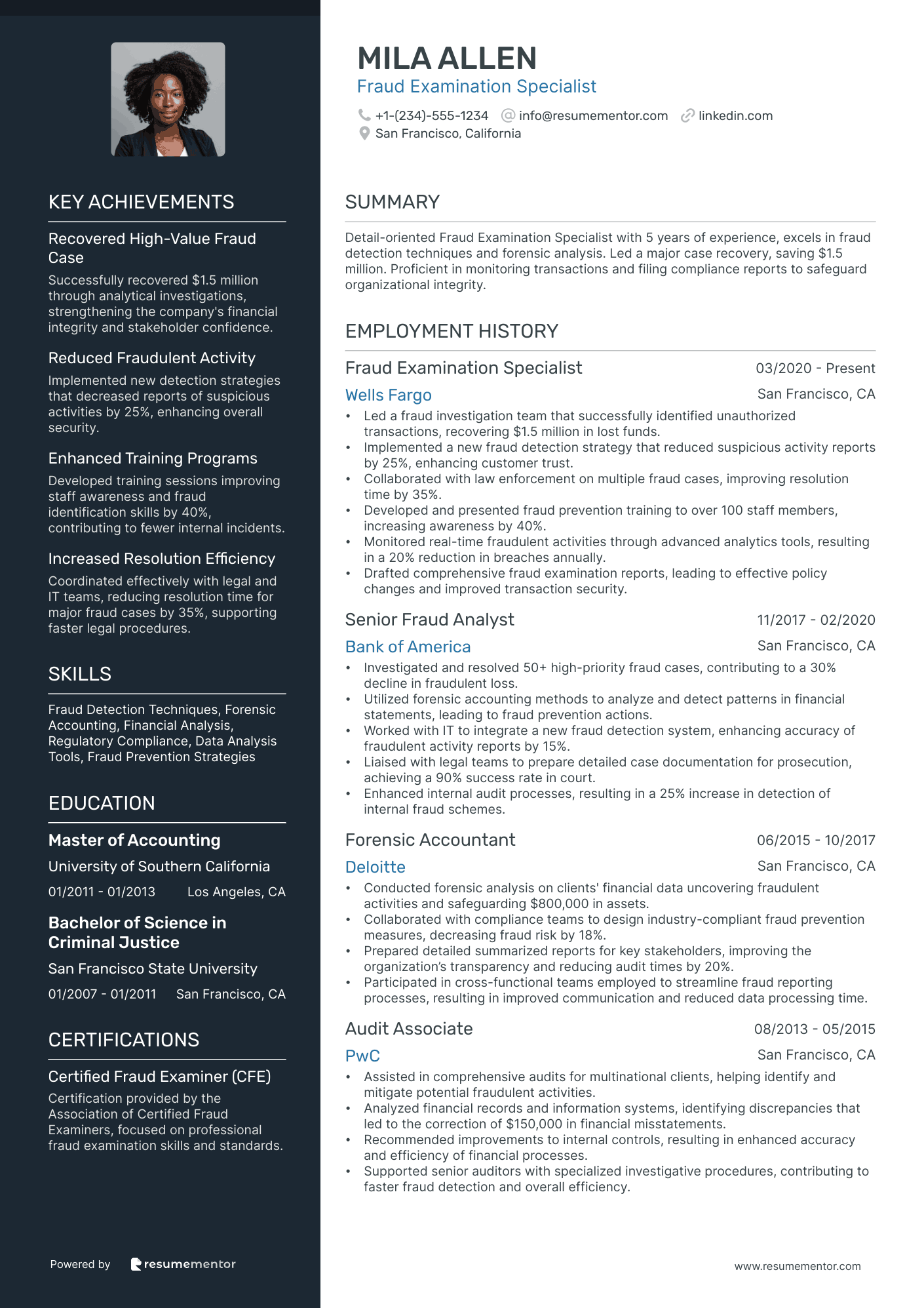

Fraud Examination Specialist resume sample

- •Led a fraud investigation team that successfully identified unauthorized transactions, recovering $1.5 million in lost funds.

- •Implemented a new fraud detection strategy that reduced suspicious activity reports by 25%, enhancing customer trust.

- •Collaborated with law enforcement on multiple fraud cases, improving resolution time by 35%.

- •Developed and presented fraud prevention training to over 100 staff members, increasing awareness by 40%.

- •Monitored real-time fraudulent activities through advanced analytics tools, resulting in a 20% reduction in breaches annually.

- •Drafted comprehensive fraud examination reports, leading to effective policy changes and improved transaction security.

- •Investigated and resolved 50+ high-priority fraud cases, contributing to a 30% decline in fraudulent loss.

- •Utilized forensic accounting methods to analyze and detect patterns in financial statements, leading to fraud prevention actions.

- •Worked with IT to integrate a new fraud detection system, enhancing accuracy of fraudulent activity reports by 15%.

- •Liaised with legal teams to prepare detailed case documentation for prosecution, achieving a 90% success rate in court.

- •Enhanced internal audit processes, resulting in a 25% increase in detection of internal fraud schemes.

- •Conducted forensic analysis on clients' financial data uncovering fraudulent activities and safeguarding $800,000 in assets.

- •Collaborated with compliance teams to design industry-compliant fraud prevention measures, decreasing fraud risk by 18%.

- •Prepared detailed summarized reports for key stakeholders, improving the organization’s transparency and reducing audit times by 20%.

- •Participated in cross-functional teams employed to streamline fraud reporting processes, resulting in improved communication and reduced data processing time.

- •Assisted in comprehensive audits for multinational clients, helping identify and mitigate potential fraudulent activities.

- •Analyzed financial records and information systems, identifying discrepancies that led to the correction of $150,000 in financial misstatements.

- •Recommended improvements to internal controls, resulting in enhanced accuracy and efficiency of financial processes.

- •Supported senior auditors with specialized investigative procedures, contributing to faster fraud detection and overall efficiency.

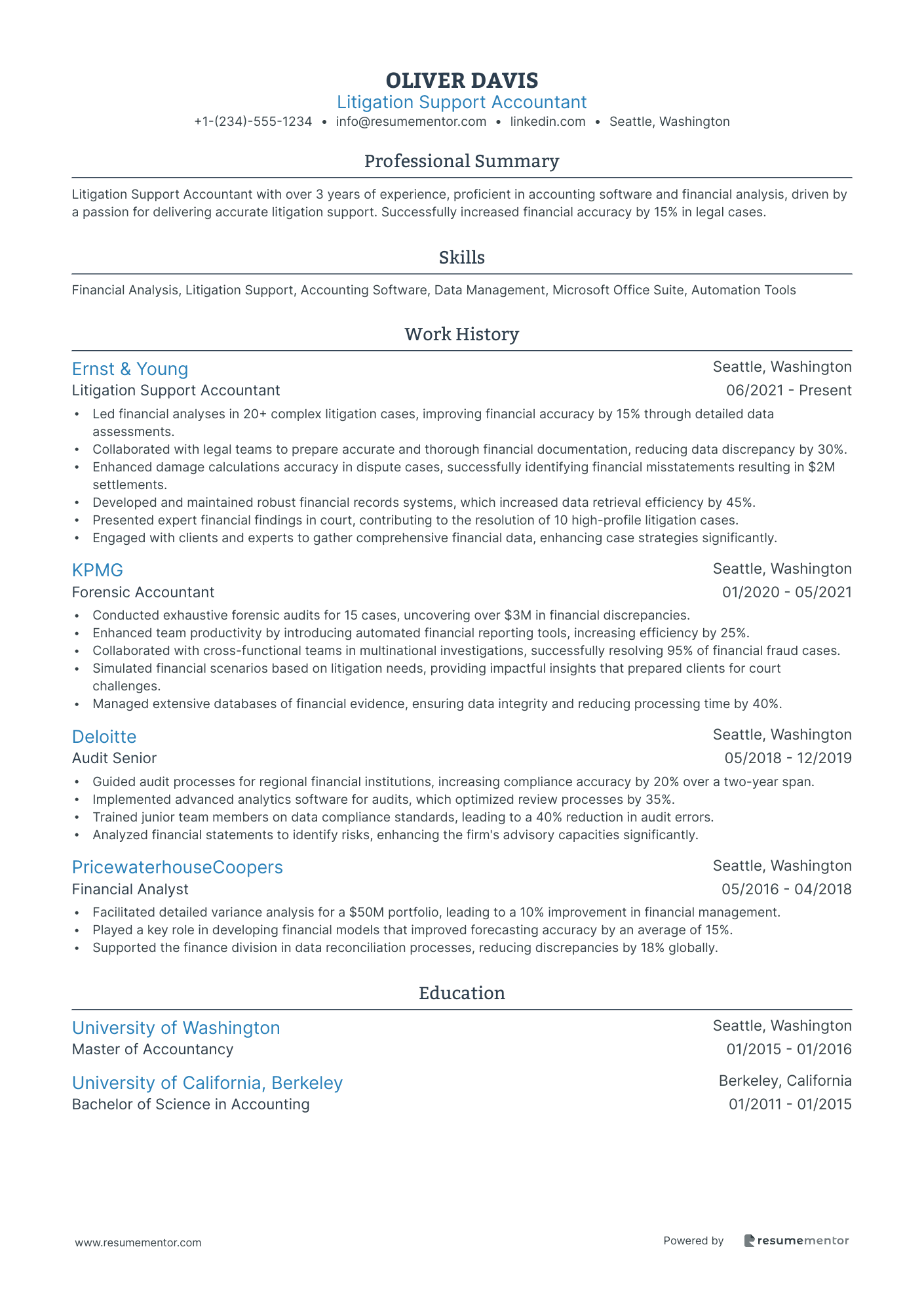

Litigation Support Accountant resume sample

- •Led financial analyses in 20+ complex litigation cases, improving financial accuracy by 15% through detailed data assessments.

- •Collaborated with legal teams to prepare accurate and thorough financial documentation, reducing data discrepancy by 30%.

- •Enhanced damage calculations accuracy in dispute cases, successfully identifying financial misstatements resulting in $2M settlements.

- •Developed and maintained robust financial records systems, which increased data retrieval efficiency by 45%.

- •Presented expert financial findings in court, contributing to the resolution of 10 high-profile litigation cases.

- •Engaged with clients and experts to gather comprehensive financial data, enhancing case strategies significantly.

- •Conducted exhaustive forensic audits for 15 cases, uncovering over $3M in financial discrepancies.

- •Enhanced team productivity by introducing automated financial reporting tools, increasing efficiency by 25%.

- •Collaborated with cross-functional teams in multinational investigations, successfully resolving 95% of financial fraud cases.

- •Simulated financial scenarios based on litigation needs, providing impactful insights that prepared clients for court challenges.

- •Managed extensive databases of financial evidence, ensuring data integrity and reducing processing time by 40%.

- •Guided audit processes for regional financial institutions, increasing compliance accuracy by 20% over a two-year span.

- •Implemented advanced analytics software for audits, which optimized review processes by 35%.

- •Trained junior team members on data compliance standards, leading to a 40% reduction in audit errors.

- •Analyzed financial statements to identify risks, enhancing the firm's advisory capacities significantly.

- •Facilitated detailed variance analysis for a $50M portfolio, leading to a 10% improvement in financial management.

- •Played a key role in developing financial models that improved forecasting accuracy by an average of 15%.

- •Supported the finance division in data reconciliation processes, reducing discrepancies by 18% globally.

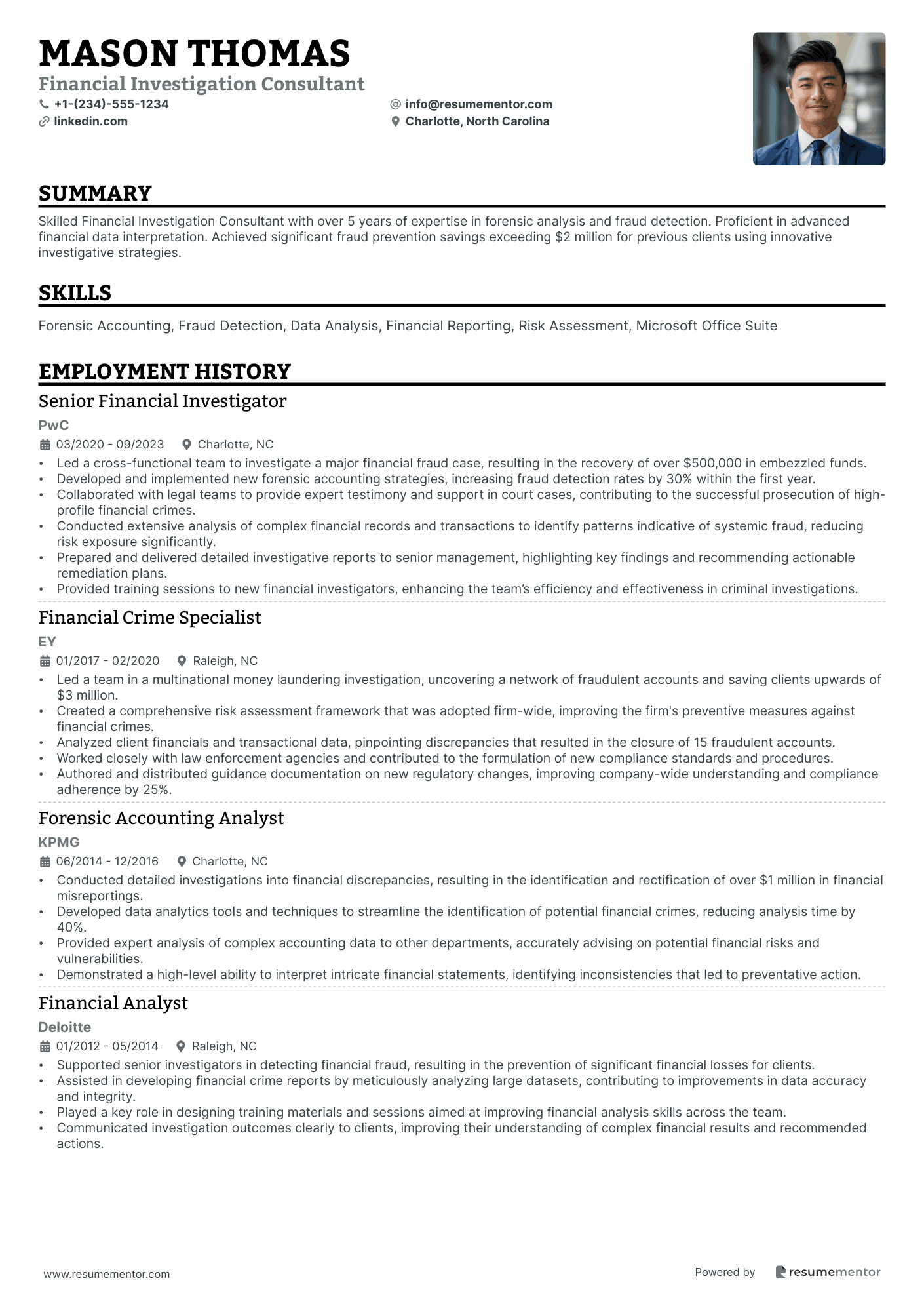

Financial Investigation Consultant resume sample

- •Led a cross-functional team to investigate a major financial fraud case, resulting in the recovery of over $500,000 in embezzled funds.

- •Developed and implemented new forensic accounting strategies, increasing fraud detection rates by 30% within the first year.

- •Collaborated with legal teams to provide expert testimony and support in court cases, contributing to the successful prosecution of high-profile financial crimes.

- •Conducted extensive analysis of complex financial records and transactions to identify patterns indicative of systemic fraud, reducing risk exposure significantly.

- •Prepared and delivered detailed investigative reports to senior management, highlighting key findings and recommending actionable remediation plans.

- •Provided training sessions to new financial investigators, enhancing the team’s efficiency and effectiveness in criminal investigations.

- •Led a team in a multinational money laundering investigation, uncovering a network of fraudulent accounts and saving clients upwards of $3 million.

- •Created a comprehensive risk assessment framework that was adopted firm-wide, improving the firm's preventive measures against financial crimes.

- •Analyzed client financials and transactional data, pinpointing discrepancies that resulted in the closure of 15 fraudulent accounts.

- •Worked closely with law enforcement agencies and contributed to the formulation of new compliance standards and procedures.

- •Authored and distributed guidance documentation on new regulatory changes, improving company-wide understanding and compliance adherence by 25%.

- •Conducted detailed investigations into financial discrepancies, resulting in the identification and rectification of over $1 million in financial misreportings.

- •Developed data analytics tools and techniques to streamline the identification of potential financial crimes, reducing analysis time by 40%.

- •Provided expert analysis of complex accounting data to other departments, accurately advising on potential financial risks and vulnerabilities.

- •Demonstrated a high-level ability to interpret intricate financial statements, identifying inconsistencies that led to preventative action.

- •Supported senior investigators in detecting financial fraud, resulting in the prevention of significant financial losses for clients.

- •Assisted in developing financial crime reports by meticulously analyzing large datasets, contributing to improvements in data accuracy and integrity.

- •Played a key role in designing training materials and sessions aimed at improving financial analysis skills across the team.

- •Communicated investigation outcomes clearly to clients, improving their understanding of complex financial results and recommended actions.

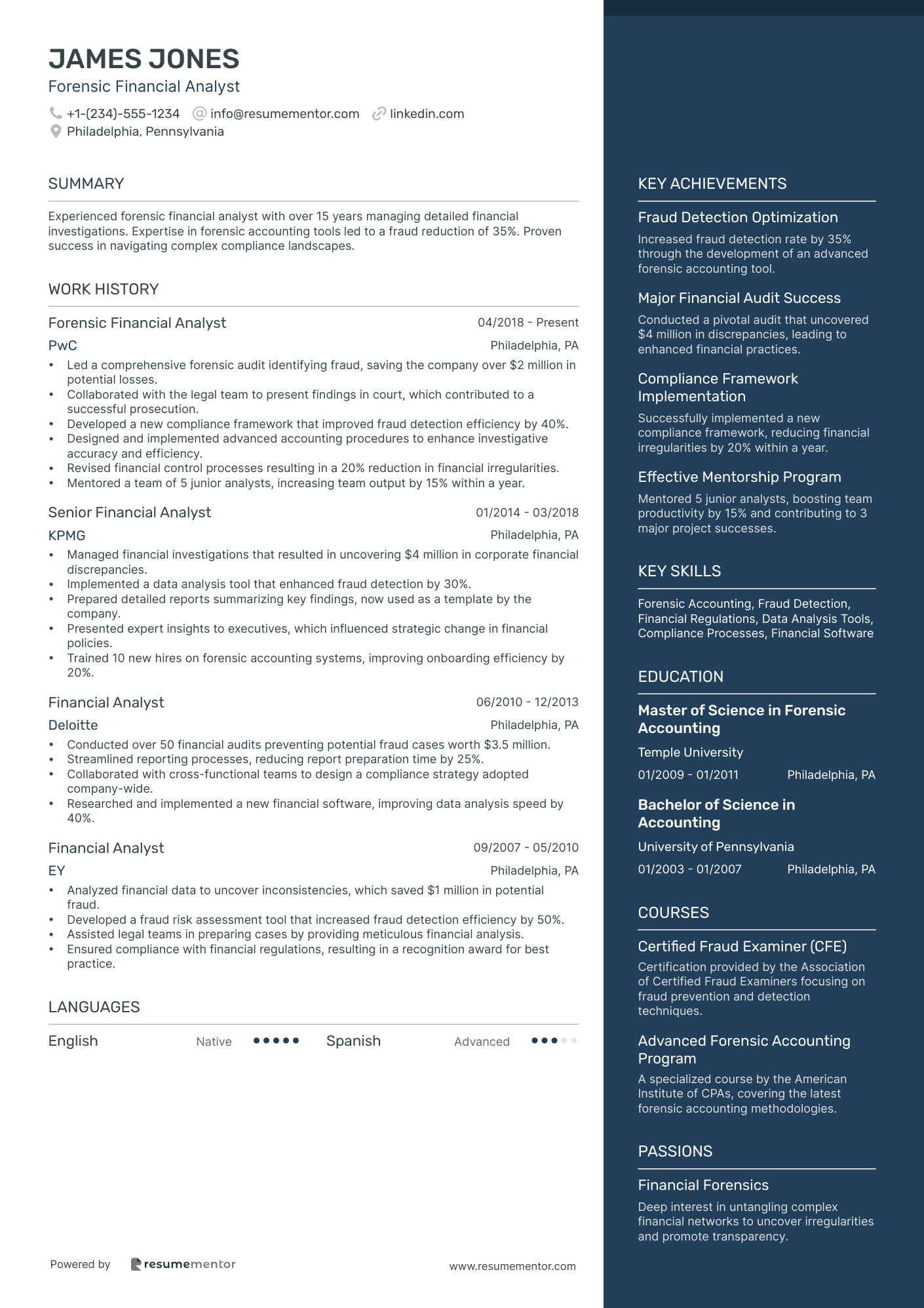

Forensic Financial Analyst resume sample

- •Led a comprehensive forensic audit identifying fraud, saving the company over $2 million in potential losses.

- •Collaborated with the legal team to present findings in court, which contributed to a successful prosecution.

- •Developed a new compliance framework that improved fraud detection efficiency by 40%.

- •Designed and implemented advanced accounting procedures to enhance investigative accuracy and efficiency.

- •Revised financial control processes resulting in a 20% reduction in financial irregularities.

- •Mentored a team of 5 junior analysts, increasing team output by 15% within a year.

- •Managed financial investigations that resulted in uncovering $4 million in corporate financial discrepancies.

- •Implemented a data analysis tool that enhanced fraud detection by 30%.

- •Prepared detailed reports summarizing key findings, now used as a template by the company.

- •Presented expert insights to executives, which influenced strategic change in financial policies.

- •Trained 10 new hires on forensic accounting systems, improving onboarding efficiency by 20%.

- •Conducted over 50 financial audits preventing potential fraud cases worth $3.5 million.

- •Streamlined reporting processes, reducing report preparation time by 25%.

- •Collaborated with cross-functional teams to design a compliance strategy adopted company-wide.

- •Researched and implemented a new financial software, improving data analysis speed by 40%.

- •Analyzed financial data to uncover inconsistencies, which saved $1 million in potential fraud.

- •Developed a fraud risk assessment tool that increased fraud detection efficiency by 50%.

- •Assisted legal teams in preparing cases by providing meticulous financial analysis.

- •Ensured compliance with financial regulations, resulting in a recognition award for best practice.

Certified Fraud Examiner resume sample

- •Led investigations that uncovered fraudulent activities worth over $2 million, greatly enhancing risk management outcomes.

- •Implemented advanced forensic accounting techniques, resulting in a 20% increase in fraud detection rate.

- •Developed and delivered fraud prevention workshops, educating over 100 employees and reducing fraud incidents by 15%.

- •Collaborated closely with legal teams on litigation cases, providing pivotal insights that improved case outcomes.

- •Spearheaded the adoption of a new fraud detection software, reducing investigation time by 30%.

- •Created comprehensive fraud reports, assisting executives in strategic decision-making processes to prevent future occurrences.

- •Analyzed financial data to identify anomalies, leading to the detection of $1.5 million in fraudulent activity.

- •Worked with compliance teams to design new anti-fraud strategies, achieving a 25% reduction in false positives.

- •Generated analytical models to improve the efficiency of fraud monitoring processes, increasing detection rates by 18%.

- •Mentored junior analysts, enhancing team capability in identifying and investigating complex fraud schemes.

- •Regularly updated compliance protocols, ensuring adherence to industry standards and regulatory requirements.

- •Conducted complex financial investigations leading to sanctions against multiple high-profile fraud perpetrators.

- •Instrumental in developing internal controls that reduced financial discrepancies by 22% year over year.

- •Collaborated on multi-jurisdictional fraud cases, providing critical data that supported legal actions.

- •Authored detailed forensic reports used as evidence in high-stakes litigation, positively influencing case outcomes.

- •Assisted in the detection and resolution of fraudulent activities resulting in cost recoveries of over $500,000.

- •Developed a risk assessment framework that improved fraud identification protocols by 30%.

- •Collaborated in cross-functional teams to streamline fraud investigation processes, enhancing operational efficiency.

- •Engaged in continual professional development, keeping the team informed on emerging fraud risks and strategies.

Corporate Fraud Accountant resume sample

- •Led the fraud investigation team in scrutinizing company financials, leading to a 30% reduction in suspicious transactions over two years.

- •Pioneered a data analysis project that streamlined auditing processes, reducing audit time by 15% annually without compromising quality.

- •Developed and implemented a comprehensive fraud detection program that enhanced financial controls, discovered 10 major irregularities, and saved $500,000 in potential losses.

- •Managed cross-functional teams to perform risk assessments, resulting in improved internal controls for 10 major clients.

- •Created and delivered advanced fraud prevention workshops to improve employee detection skills, resulting in a 40% increase in identified fraud attempts.

- •Collaborated with external auditors and law enforcement to conduct 5 landmark investigations, leading to successful prosecution and recovery of embezzled funds.

- •Executed detailed audits and risk assessments for 20+ clients annually, consistently uncovering fraud cases and recommending preventive strategies.

- •Optimized auditing techniques by integrating cutting-edge data analytics tools, increasing investigation efficiency by 20%.

- •Assisted in high-profile financial investigations that enhanced regulatory compliance and were recognized in national audit circles.

- •Developed and maintained relationships with key clients to facilitate smooth information exchange during audits and investigations.

- •Facilitated workshops on emerging trends in financial fraud, resulting in widespread adoption of improved auditing techniques.

- •Analyzed thousands of transactions monthly to identify patterns indicative of fraudulent activities, reducing fraud incidents by 15%.

- •Conducted in-depth employee interviews and gathered evidence for fraud cases, leading to corrective action and improved policy enforcement.

- •Contributed to the development of enhanced fraud risk models, increasing detection rates by 25%.

- •Collaborated with internal teams to develop comprehensive reports detailing findings and preventive recommendations.

- •Managed and analyzed client financial data, helping to uncover discrepancies that saved clients over $200,000.

- •Supported the development of new fraud-prevention strategies by researching industry trends and competitive practices.

- •Provided integral support in preparing for external audits, ensuring high compliance and excellence in financial reporting.

- •Achieved quickest promotion cycle in department history by consistently delivering exceptional results in fraud detection.

Insurance Claims Forensic Accountant resume sample

- •Led a team in the in-depth forensic analysis of over 150 insurance claims, discovering fraudulent activities, resulting in a recovery of $1.2 million.

- •Collaborated with cross-functional teams to improve claims processing time by 20% through enhanced fraud detection methodologies.

- •Prepared detailed analytical reports that contributed to saving over $500k by anticipating fraudulent patterns in claims.

- •Developed and implemented new financial analysis techniques that decreased the claim investigation time by 15%.

- •Conducted training sessions for 30+ staff members, increasing forensic accounting skills across the team by 40%.

- •Contributed to the revision of company’s policies leading to improved compliance and reduced irregularities by 25%.

- •Conducted financial reviews for 200+ claims, identifying discrepancies and recovering $800k in fraudulent claims.

- •Developed comprehensive financial examination strategies that enhanced the accuracy of claims evaluations by 30%.

- •Work closely with legal teams to secure evidence for litigation, resulting in a winning rate of 90% in fraud cases.

- •Initiated a new claim verification process which resulted in the reduction of processing errors by 18%.

- •Presented findings in court proceedings, providing clear financial explanations which aided in legal decision-making.

- •Analyzed data for 150+ cases annually, finding patterns of loss that reduced claim costs by 10%.

- •Collaborated with underwriters to ensure proper alignment of financial data with policyholder information, reducing discrepancies by 15%.

- •Created impact reports that improved understanding of claims processes and led to a 20% reduction in resolution time.

- •Supported staff in learning advanced data analysis skills, thus enhancing company-wide analytics capabilities.

- •Investigated 100+ month-end reconciliations, ensuring balance integrity and reducing error rates by 15%.

- •Developed financial forecasts and budget analyses crucial for decision-making, impacting strategic planning.

- •Worked on special projects focusing on fraud detection improving accuracy and reducing time by 12%.

- •Assisted in constructing automated templates for claim processes, enhancing consistency in data entry.

Anti-Money Laundering Forensic Auditor resume sample

- •Conducted over 50 forensic audits resulting in the identification of $5 million in suspicious transactions.

- •Collaborated with law enforcement agencies, providing expert analysis that led to successful criminal prosecutions in 70% of cases.

- •Led a team in the development of enhanced AML controls, augmenting compliance testing efficacy by 40%.

- •Prepared comprehensive reports on investigative findings, improving stakeholder understanding and decision-making processes by 30%.

- •Developed and implemented new AML training programs for internal teams, increasing compliance awareness across the organization by 50%.

- •Analyzed complex financial data to uncover discrepancies, directly preventing fraudulent activities worth $2 million.

- •Reviewed and evaluated over 1,000 transaction records monthly to identify potential money laundering activities.

- •Developed risk assessment templates that enhanced the ability of teams to detect weak areas in AML controls by 60%.

- •Facilitated knowledge-sharing sessions on the latest AML regulations, resulting in a 20% decrease in compliance issues.

- •Managed relationships with regulatory bodies, ensuring all activities adhered to legal standards with 100% compliance rate.

- •Led investigation efforts into suspicious activities, contributing to the recovery of $3 million in misappropriated funds.

- •Assisted in high-profile investigations that resulted in the identification of $7 million in financial fraud.

- •Conducted thorough analyses of financial statements leading to the detection of anomalies in 45% of the cases reviewed.

- •Prepared detailed investigative reports for stakeholder review which enhanced decision-making efficiency by 35%.

- •Developed comprehensive risk management strategies safeguarding the client's assets against potential fraud.

- •Conducted detailed forensic accounting reviews that led to the recovery of $2 million in undetected financial misstatements.

- •Implemented new auditing procedures that increased audit efficiency by 25% across multiple client projects.

- •Assisted in the development and documentation of over 100 corrective action plans following forensic audits.

- •Presented findings to a variety of audiences, improving understanding of financial data integrity.

Forensic Audit Expert resume sample

- •Led a team in uncovering a $5 million fraud scheme by analyzing financial records and implementing fraud detection protocols.

- •Collaborated with law enforcement and secured three conviction cases by providing expert testimony during criminal investigations.

- •Reduced financial discrepancies by 25% through implementing advanced forensic audit methodologies and training sessions.

- •Developed customized risk management solutions for 12 key clients, enhancing compliance and safeguarding financial integrity.

- •Established strong client relationships, analyzed complex financial cases, and improved client trust by providing strategic advice.

- •Authored a white paper on emerging trends in forensic auditing, resulting in its adoption as a training module.

- •Executed 20 forensic audits annually, identifying $2 million in cost savings through analytical scrutiny of financial data.

- •Introduced a new tool for data analytics which improved audit accuracy by 40%, identifying unseen discrepancies effectively.

- •Collaborated closely with external legal counsel in three major fraud investigations, advancing case resolution efficiently.

- •Developed and implemented new audit protocols, increasing audit compliance by 30% across three major accounts.

- •Fostered a culture of continuous improvement by training 10 junior auditors, enhancing team capabilities and expertise.

- •Analyzed financial documentation and discovered a $1 million discrepancy, enabling swift recovery of funds.

- •Prepared comprehensive audit reports for litigation purposes, leading to successful resolution of 4 large-scale cases.

- •Pioneered use of ACL software, streamlining financial data analysis and reducing discrepancies by 15% on average.

- •Mentored junior staff to enhance understanding of forensic auditing principles, resulting in higher accuracy in audits.

- •Conducted compliance audits across 15 projects, ensuring adherence to financial regulations and minimizing risk exposure.

- •Identified and solved complex compliance issues, significantly improving the overall efficiency of financial operations.

- •Developed detailed reports on regulatory compliance statuses, enhancing transparency and communication with stakeholders.

- •Enhanced the compliance training program, reducing incident reports by 20% through innovative training methods.

Bankruptcy and Insolvency Accountant resume sample

- •Led financial restructuring initiatives for companies, facilitating the successful reorganization of $100M in liabilities, enhancing creditor confidence.

- •Designed and implemented financial models for debtor analysis, ensuring accurate projections that informed restructuring strategies.

- •Collaborated with legal teams to draft and validate bankruptcy documentation, ensuring compliance with Chapter 11 regulations, reducing legal disputes by 30%.

- •Prepared detailed financial reports under tight deadlines, resulting in increased stakeholder transparency and informed decision-making.

- •Conducted comprehensive audits uncovering significant discrepancies in debtor reports, leading to successful claim validation of $50M.

- •Facilitated creditor-debtor communications, keeping stakeholders informed, improving negotiation effectiveness in difficult bankruptcy cases.

- •Managed bankruptcy proceedings for multiple clients, achieving a 20% reduction in resolution time through improved process efficiency.

- •Developed financial models projecting outcomes of insolvency scenarios, enhancing predictive accuracy by 15% for client strategies.

- •Analyzed company financials to assess health and restructuring needs, providing critical insights that informed strategic adjustments.

- •Coordinated with court officials and stakeholders to streamline bankruptcy processes, resulting in a smoother case flow.

- •Prepared comprehensive financial analysis reports, facilitating informed feedback from creditors and stakeholders, improving trust.

- •Performed detailed economic analyses of insolvent entities, leading to the recovery of $30M in overpaid claims.

- •Worked directly with legal teams to ensure effective compliance with bankruptcy protocols, minimizing errors in court submissions.

- •Formulated strategic financial recommendations, improving company's recovery rate by 20% after detailed financial assessments.

- •Engaged in cross-departmental collaboration, enriching restructuring strategies and enhancing internal financial forecasting.

- •Analyzed large datasets around company finances, contributing to solvency assessments and accurate financial forecasting.

- •Supported restructuring teams by preparing financial models, aiding effective decision-making for $10M asset liquidation cases.

- •Assisted in drafting and reviewing financial reports for insolvent clients, ensuring high compliance with regulatory standards.

- •Facilitated creditor meetings by presenting analytical findings, fostering improved negotiations and effective resolutions.

Crafting a resume as a forensic accountant can feel like piecing together a complex financial puzzle where each section of your professional story must fit perfectly. In this field, how you present your forensic expertise can reveal your ability to uncover financial truths and solve intricate mysteries, making your resume your calling card.

Yet, translating these skills into a compelling document can be challenging. While you focus on crafting your resume, you might wonder how to highlight your analytical skills and attention to detail effectively. These qualities are exactly what employers seek as they look for someone adept at dissecting numbers and spotting discrepancies.

This is where a resume template becomes invaluable, offering a structured path to present your information smoothly. With these templates, you can organize your credentials in a concise and professional manner without getting bogged down in formatting. A resource like a resume template allows you to concentrate on crafting content that emphasizes your skills.

By choosing the right approach, your resume can clearly showcase your forensic accounting strengths and portray you as the solution your potential employers are seeking. Embrace the task, and let your resume vividly reflect your talent in uncovering financial secrets.

Key Takeaways

- Emphasize forensic accounting skills and include sections like certifications and volunteer work to illustrate expertise and commitment.

- Employ a chronological resume format and ensure clarity with modern fonts, consistent formatting, and standard margins.

- Highlight quantifiable achievements, collaboration, and problem-solving skills in experience sections to showcase impact.

- Incorporate hard skills like fraud detection and financial analysis, and soft skills like communication and teamwork strategically.

- Include relevant education details and certificates prominently to underscore qualifications and readiness for the role.

What to focus on when writing your forensic accountant resume

Your forensic accountant resume should spotlight your strong skills in analyzing financial data. Emphasize how your keen attention to detail helps uncover discrepancies and solve complex financial problems. Each section should communicate your unique value and align with what recruiters look for.

How to structure your forensic accountant resume

- Contact Information — Provide your full name, phone number, email address, and LinkedIn profile URL to make it easy for recruiters to reach you. Make sure your email address is professional and your LinkedIn profile is up-to-date with relevant information and achievements related to forensic accounting.

- Professional Summary — Offer a snapshot of your forensic accounting expertise, including your experience and key skills, especially in uncovering financial fraud. Use this section to highlight your most impressive accomplishments and how your unique abilities meet the needs of potential employers.

- Work Experience — Detail relevant roles by focusing on achievements, such as identifying fraudulent activities or improving financial systems, which demonstrate your impact. Include specific examples of how your actions led to concrete results, and quantify your achievements where possible to add credibility and proof of your expertise.

- Education — List your degrees and certifications, like CPA or CFE, which underscore your credibility and enhance your qualifications in forensic accounting. Mention any relevant coursework or projects that directly apply to forensic accounting, providing context to your academic background.

- Skills — Highlight your analytical abilities and proficiency in financial software, showing your readiness to tackle financial investigations. Detail specific tools and software you are skilled in, such as data analysis programs or accounting software, and emphasize your ability to learn and adapt to new technologies quickly.

To further show your dedication and expertise, consider adding sections like "Certifications" or "Volunteer Experience." These can illustrate your commitment to the field. Next, we’ll cover each section more in-depth and discuss the importance of a well-structured resume format.

Which resume format to choose

Creating a standout forensic accountant resume begins with choosing the right format, and a chronological layout is a top choice. In this field, your work history carries significant weight, and listing roles in order helps employers easily follow your career progress and see how your experience builds on itself to demonstrate your expertise.

When it comes to fonts, the goal is to project clarity and professionalism. Opt for modern fonts like Lato, Montserrat, or Raleway. These fonts not only offer a clean look but also convey a sense of precision and efficiency, traits that are critical in forensic accounting. Avoid overcrowding the text; your font choice should enhance readability and present you as detail-oriented.

Saving your resume as a PDF is a smart move. In forensic accounting, accuracy is everything, and a PDF ensures your formatting remains consistent. No matter how or where it's viewed, your resume will always look exactly as intended, reflecting the meticulous attention to detail you'd bring to the job.

Finally, maintaining standard one-inch margins on all sides contributes to a balanced and organized layout. This setup not only makes it easier for hiring managers to scan your information but also leaves space for notes during an interview. It underscores your ability to present information clearly, reinforcing your fit for the precise nature of forensic accounting work. By using these strategies, you present a polished and competent image to potential employers.

How to write a quantifiable resume experience section

A strong forensic accountant experience section highlights results-driven achievements that show your ability to uncover financial discrepancies, analyze complex data, and support legal proceedings. Start this section with your most recent position, using reverse chronological order to keep it organized. Focus on clarity and impact by using bullet points to showcase your successes. It's best to include relevant experience from the past 10-15 years, sticking to job titles related to forensic accounting for brevity. Tailor your resume by incorporating specific keywords from the job ad, ensuring it captures the employer's attention. Action words such as "analyzed," "investigated," and "uncovered" effectively convey your role and impact.

Here’s an example of an engaging forensic accountant experience section:

- •Analyzed over $50 million in transactions, uncovering fraudulent activities that led to a 20% recovery of misappropriated funds.

- •Collaborated with legal teams to provide detailed reports for litigation, boosting the case win rate by 30% through accurate financial analysis.

- •Developed a fraud detection framework that cut detection time by 25%, enhancing client trust and retention.

- •Led a team of 5 forensic accountants, improving departmental efficiency by 15% through process optimization.

This experience section excels by weaving together your critical skills and achievements with precise figures. Each bullet builds on your specialized forensic expertise, connecting to tangible impacts like uncovering fraud and supporting legal outcomes. By using quantifiable achievements, you demonstrate your ability to recover funds, collaborate with legal teams, and lead effectively. The action verbs create a dynamic picture of initiative and importance, with each point strengthening your profile through hard data. Tailoring these points to align with typical forensic accounting job requirements makes the section relevant and appealing to employers.

Training and Development Focused resume experience section

A forensic accountant training and development-focused resume experience section should start by showcasing the skills and accomplishments that highlight your expertise. Emphasize experiences where you’ve conducted audits, analyzed financial data, and created training programs. Use clear language to demonstrate how these experiences have enabled you to make meaningful contributions and grow professionally. Weave in achievements related to forensic accounting and educational development to underline your capabilities.

Clearly define your job title and workplace for each position, ensuring that you present your experiences in bullet points for clarity and impact. Incorporate quantifiable data to highlight your success and the positive changes you’ve led. This approach helps potential employers understand the full scope of your skills, making your experiences both compelling and relevant.

Senior Forensic Accountant

ABC Financial Solutions

January 2021 - Present

- Led over 50 training sessions, boosting team knowledge by 40%

- Designed a forensic audit program that increased financial investigation accuracy by 30%

- Guided 10 junior accountants, improving their ability to manage complex financial data

- Worked with cross-functional teams to refine accounting processes and improve workflow efficiency

Problem-Solving Focused resume experience section

A problem-solving-focused forensic accountant resume experience section should clearly demonstrate your ability to analyze financial data and detect irregularities. Begin by highlighting experiences where you effectively tackled complex financial issues, showcasing your analytical expertise. Quantify your achievements with numbers or percentages to emphasize the impact of your contributions. Use strong action verbs to convey your role and underscore your unique part in resolving financial challenges.

Next, make it clear that you're skilled at delving into financial records and identifying inconsistencies. Reference specific auditing activities you've undertaken, illustrating how your keen attention to detail played a crucial role. Highlight how your efforts directly supported successful financial investigations or audits. Select experiences that bring out your creative and efficient problem-solving abilities. Here's an example of how you can format this section:

Forensic Accountant

XYZ Financial Services

June 2018 - Present

- Identified $500,000 in fraudulent transactions during financial audits, significantly reducing company losses.

- Implemented new fraud detection software, improving investigation processes by 30%.

- Collaborated with legal teams to develop cases that resulted in a 50% increase in fraudulent case resolutions.

- Created detailed financial reports that informed executive decision-making, enhancing transparency.

Result-Focused resume experience section

A results-focused forensic accountant resume experience section should highlight your achievements and demonstrate how they positively impacted your previous employers. By showcasing accomplishments with specific numbers, percentages, or timeframes, you can effectively demonstrate the value of your work. Use strong action verbs at the beginning of each bullet point to convey your initiative and effectiveness, making sure your experience aligns with what potential employers seek in a forensic accounting role.

Reflect on your previous positions to identify instances where your efforts made a significant difference. Share examples of detecting fraud, enhancing financial security, or conducting audits that yielded substantial cost savings or asset recovery. Emphasize your ability to perform well under pressure and manage complex investigations, as these skills are essential in forensic accounting. Keep your descriptions concise yet detailed enough to convey the importance of your achievements. A well-crafted experience section not only showcases your skills but also keeps the reader engaged, making your resume stand out.

Senior Forensic Accountant

Nexus Financial Solutions

June 2018 - Present

- Recovered over $3 million in assets through meticulous audit procedures.

- Identified and resolved accounting discrepancies that led to a 25% reduction in error rates.

- Developed a risk assessment model that reduced annual fraud incidents by 40%.

- Collaborated with legal teams to provide evidence in over 50 financial fraud cases.

Collaboration-Focused resume experience section

A collaboration-focused forensic accountant resume experience section should showcase how working together with others has contributed to achieving significant outcomes. Reflect on your past roles where teamwork played a key part in investigating and resolving financial issues or fraud. Start with action words to describe your contributions and clearly demonstrate the positive impact of your collaborative efforts.

Your descriptions should flow naturally to highlight your ability to effectively engage with various teams to uncover financial discrepancies. Focus on instances where your cooperative approach led to successful outcomes, emphasizing your skill in coordinating with different departments or serving client needs through teamwork. By concentrating on achievements, you can underline the importance of working together in forensic accounting.

Senior Forensic Accountant

ABC Financial Services

June 2018 - Present

- Led a team to recover $1.2 million in misappropriated funds by working closely with internal audit and legal teams.

- Collaborated with IT and HR departments to improve data integrity, which boosted fraud detection by 25%.

- Designed cross-departmental workshops to teach staff about fraud prevention, cutting internal fraud incidents by 15%.

- Teamed up with law enforcement to streamline investigations, reducing case resolution time by 30%.

Write your forensic accountant resume summary section

A forensic accountant-focused resume summary should captivate potential employers by highlighting your top skills and experience. As someone skilled in investigating financial discrepancies and ensuring compliance, your summary needs to grab attention. Here's an engaging example:

This summary effectively emphasizes extensive experience, which builds trust with employers. Highlighting essential skills like data analysis and risk assessment demonstrates your capability in key areas. Mentioning collaboration with legal teams shows that you can work across different functions and understand the broader impact of your work.

Crafting a compelling resume summary involves using clear, impactful language that connects your past achievements to the needs of the job. Including metrics or specific outcomes further underscores your impact. Understanding the distinctions between resume summaries, objectives, profiles, and qualifications provides a strategic advantage. A resume summary offers a snapshot of your experience and skills, making it ideal for seasoned professionals. On the other hand, a resume objective focuses on career goals, suited for those starting out or making a switch. A profile intertwines skills and goals, while a summary of qualifications lists standout achievements. Knowing these nuances helps you tell your story effectively and align it with the employer's expectations.

Listing your forensic accountant skills on your resume

A skills-focused forensic accountant resume should effectively highlight both your hard and soft skills, making it a crucial part of your application. Skills can be showcased in a standalone section or seamlessly woven into your experience and summary sections. Highlighting your strengths, including soft skills like communication and teamwork, showcases your ability to collaborate and solve problems efficiently. On the other hand, hard skills are specific abilities acquired through education or training, such as financial analysis or data mining.

Both skills and strengths serve as essential resume keywords. These keywords help align your resume with job postings, making it more likely to catch the attention of employers and applicant tracking systems. Using the right keywords strategically can enhance your visibility and improve your chances of being noticed by hiring managers.

Here's an example of a standalone skills section formatted in JSON:

This well-organized skills section highlights key competencies like fraud detection and financial analysis, all crucial for a forensic accountant role. It clearly focuses on the forensic accounting field, ensuring hiring managers quickly recognize your qualifications.

Best hard skills to feature on your forensic accountant resume

Forensic accountants require hard skills that demonstrate their ability to analyze financial data and identify discrepancies effectively. These skills reflect a strong understanding of accounting principles and investigative techniques. Essential hard skills include:

Hard Skills

- Fraud detection

- Financial analysis

- Data mining

- Risk assessment

- Report writing

- Regulatory compliance

- Forensic accounting software

- Auditing techniques

- Financial modeling

- Case management

- Data visualization

- Tax law knowledge

- Business valuation

- Quantitative analysis

- IT forensic fundamentals

Best soft skills to feature on your forensic accountant resume

Equally important are the soft skills forensic accountants bring, highlighting their ability to interact with others and adapt to changing situations with ease. They underscore your interpersonal and problem-solving capabilities. Key soft skills include:

Soft Skills

- Attention to detail

- Communication

- Analytical thinking

- Problem-solving

- Integrity

- Teamwork

- Organizational skills

- Adaptability

- Critical thinking

- Time management

- Decision-making

- Persuasion

- Emotional intelligence

- Conflict resolution

- Strategic thinking

How to include your education on your resume

The education section is an essential part of your forensic accountant resume. It showcases your academic background and relevant qualifications to potential employers. This section should be tailored specifically to the job you're applying for, so only include relevant education. Irrelevant studies can make your resume unfocused. When listing your degree, clearly state the type of degree, major, and the institution's name. If you had a strong GPA, such as 3.5 or higher, it can impress employers, so consider including it. Similarly, if you graduated cum laude, mention this honor to highlight your academic achievement. The styling and placement can vary, but make sure the section is easy to read and stands out appropriately within your resume.

- •Graduated cum laude

- •Relevant Coursework: Forensic Accounting, Fraud Examination, Financial Analysis

The second example is robust and targeted for a forensic accountant position. It includes a relevant degree in Accounting from a recognized institution. The high GPA of 3.9 is highlighted, reflecting strong academic performance. Furthermore, graduating cum laude adds prestige and credibility. The addition of specific coursework in Forensic Accounting and related subjects underscores the applicant's readiness for the role. This focused approach not only communicates qualifications but also demonstrates a clear career path aligned with the job requirements.

How to include forensic accountant certificates on your resume

When crafting a forensic accountant resume, including a certificates section is essential. Certificates can showcase your qualifications and make you stand out. You can also integrate certificates in the header for quick visibility. List the name of the certificate, include the date you earned it, and add the issuing organization.

For example, in the header, you could write: "Jane Doe, Certified Forensic Accountant (2021), Certified Fraud Examiner (2022)." Placing certificates here can grab attention right away.

A standalone certificates section can also be beneficial. Here’s a good sample:

This example is effective because it includes relevant certifications. It specifies credible issuers to bolster your expertise. It’s clear, concise, and focuses on key qualifications that potential employers value. These certificates directly relate to forensic accounting, ensuring relevance.

Extra sections to include in your forensic accountant resume

Forensic accounting is a niche field offering unique challenges and rewards, where your expertise in uncovering financial discrepancies is invaluable. Crafting a resume as a forensic accountant involves highlighting skills and experiences that showcase your analytical prowess, integrity, and attention to detail.

- Language section — Show proficiency in multiple languages to enhance your investigative capabilities in diverse financial settings.

- Hobbies and interests section — Provide insight into your personality and analytical thinking through hobbies like chess, which reflects strategic planning and problem-solving skills.

- Volunteer work section — Demonstrate your commitment to ethics and community, offering a well-rounded perspective on your character and professional dedication.

- Books section— List influential books related to finance and forensic accounting to show your ongoing dedication to professional growth.

In Conclusion

In conclusion, creating a standout resume as a forensic accountant requires more than just listing your qualifications. Your resume should serve as a reflection of your unique abilities to unravel financial mysteries and solve complex discrepancies. By thoughtfully structuring each section, you can effectively highlight how your skills meet the needs of potential employers. Using a resume template can help you concentrate on content rather than formatting, ensuring a professional presentation. Be sure to accentuate your analytical skills, forensic techniques, and relevant experiences to showcase your capabilities accurately. Including certifications and relevant coursework in your education section can further support your specialization in this niche field. Remember to maintain clarity and professionalism throughout by selecting modern fonts and sticking to a consistent format like a PDF. An empowering summary will capture attention, while a well-crafted experience section will substantiate your claims with quantifiable achievements. Lastly, consider adding extra sections to offer a holistic view of your skills and personality. By doing so, you position yourself as an invaluable asset to any organization seeking to protect and bolster their financial integrity.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.