Fresher Accountant Resume Examples

Jul 18, 2024

|

12 min read

Master how to write a fresher accountant resume that balances your skills and ambitions. Impress hiring managers with a well-crafted CV that adds up to success in the finance world.

Rated by 348 people

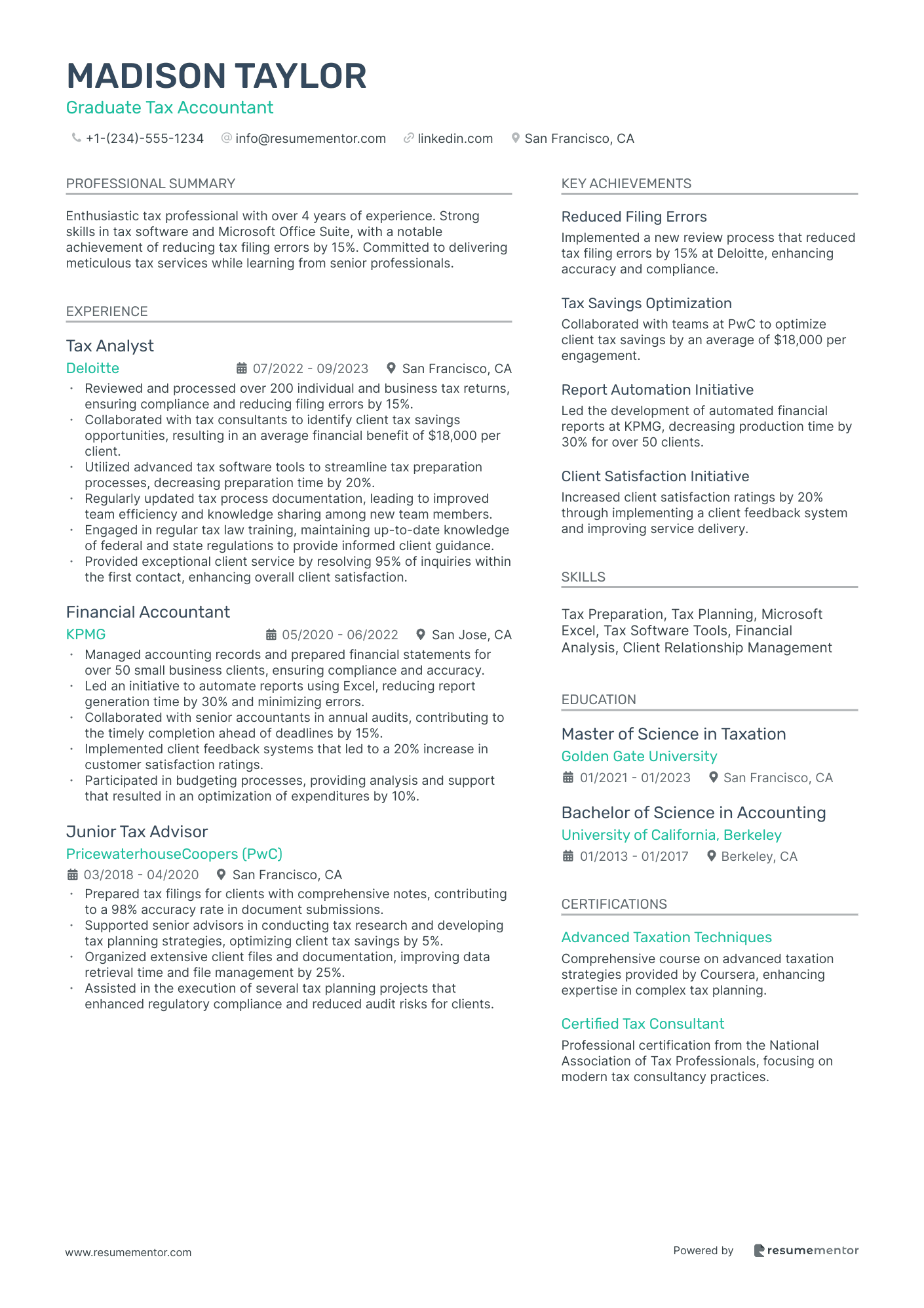

Graduate Tax Accountant

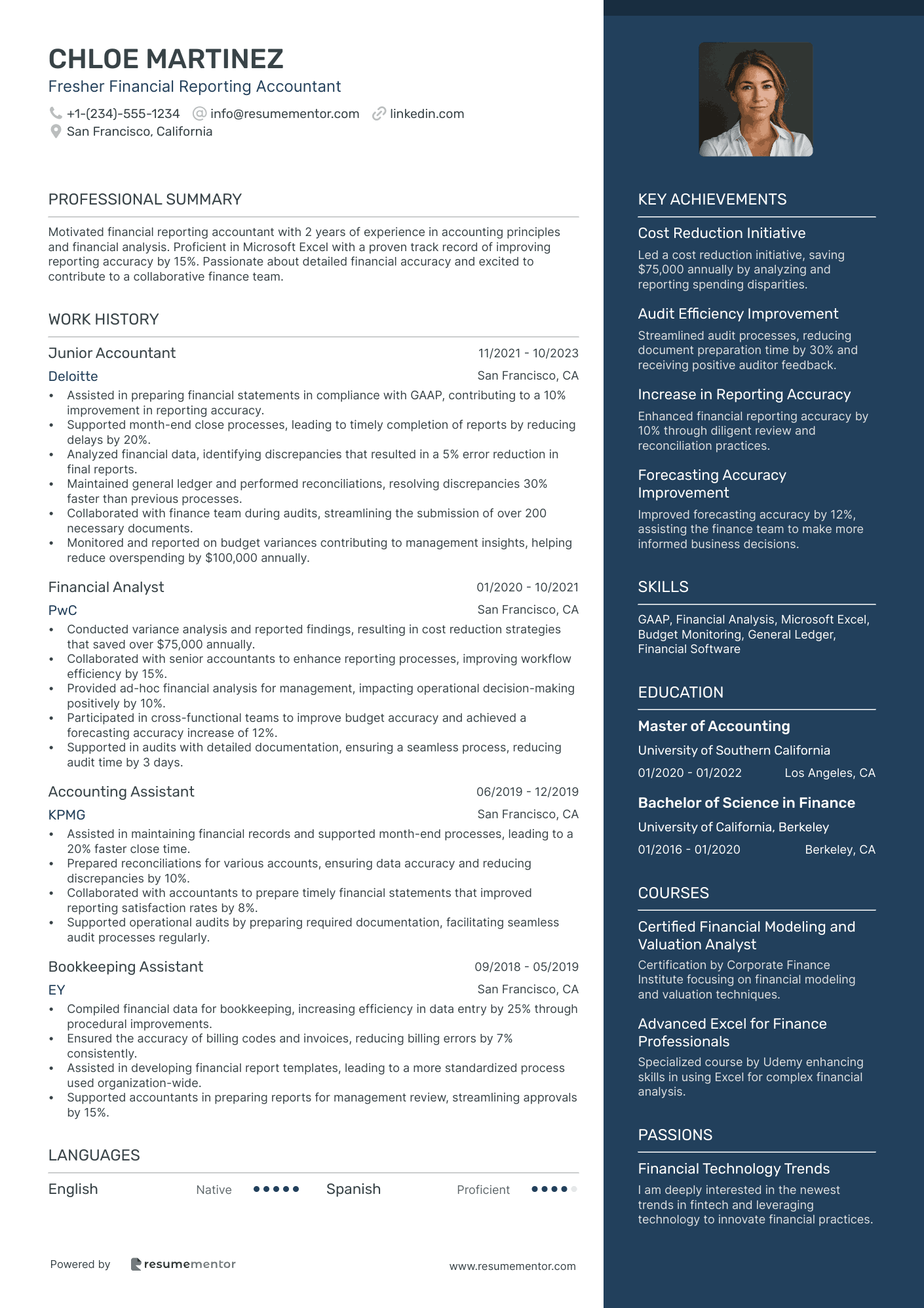

Fresher Financial Reporting Accountant

Entry Level Project Accountant

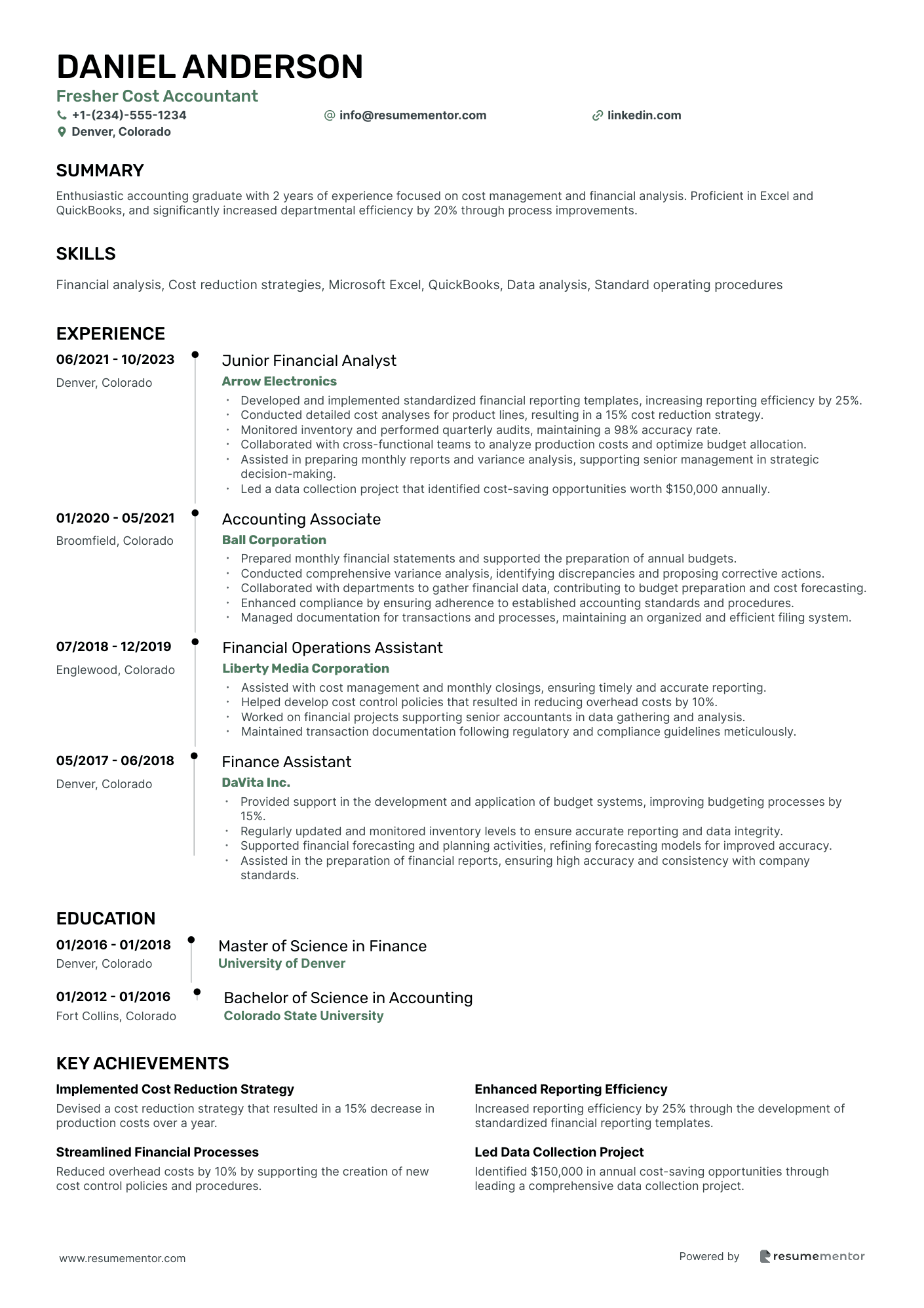

Fresher Cost Accountant

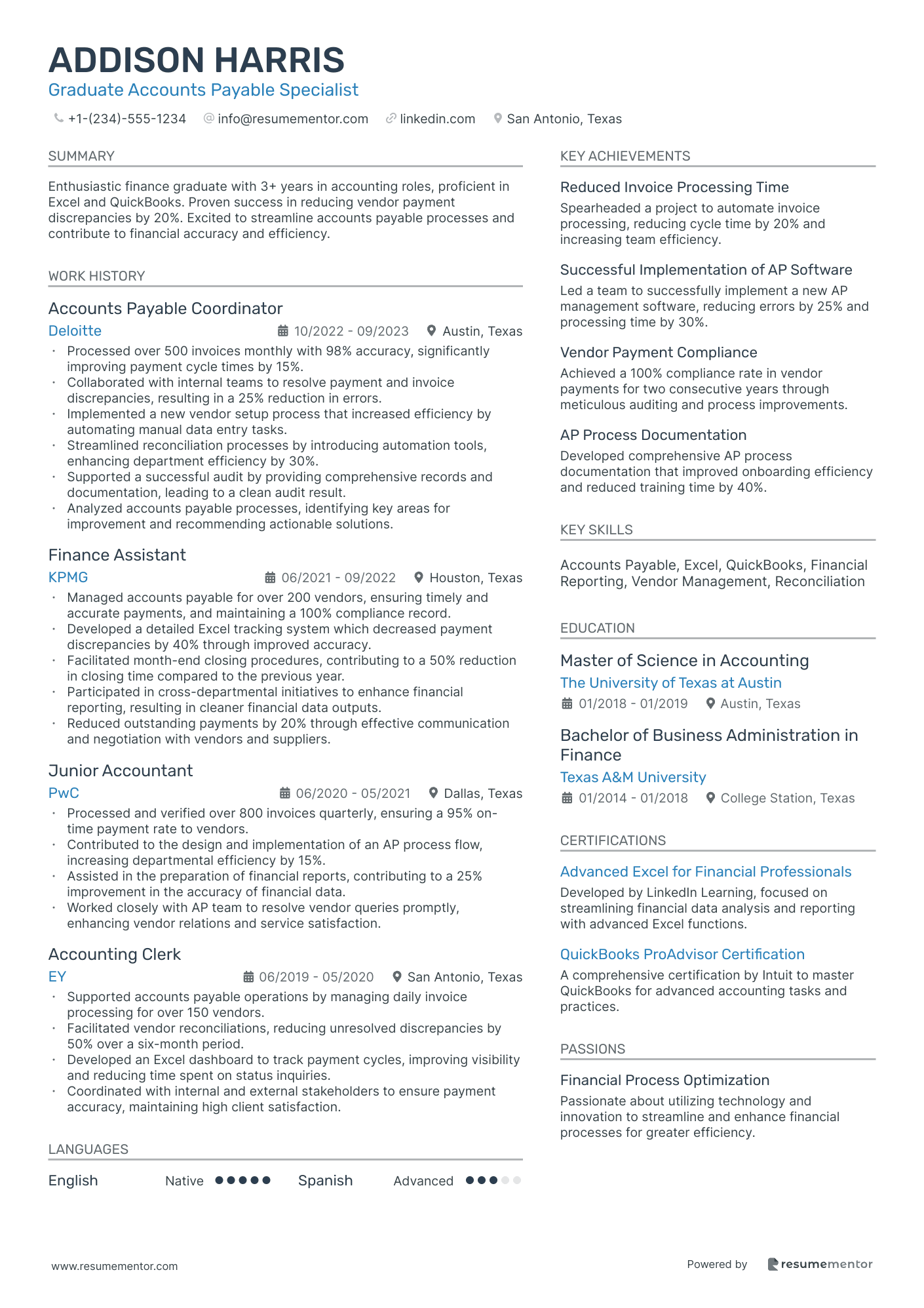

Graduate Accounts Payable Specialist

Entry Level Accounts Receivable Clerk

Fresher Forensic Accountant

Junior Internal Auditor

Entry Level Payroll Accountant

Graduate Tax Accountant resume sample

- •Reviewed and processed over 200 individual and business tax returns, ensuring compliance and reducing filing errors by 15%.

- •Collaborated with tax consultants to identify client tax savings opportunities, resulting in an average financial benefit of $18,000 per client.

- •Utilized advanced tax software tools to streamline tax preparation processes, decreasing preparation time by 20%.

- •Regularly updated tax process documentation, leading to improved team efficiency and knowledge sharing among new team members.

- •Engaged in regular tax law training, maintaining up-to-date knowledge of federal and state regulations to provide informed client guidance.

- •Provided exceptional client service by resolving 95% of inquiries within the first contact, enhancing overall client satisfaction.

- •Managed accounting records and prepared financial statements for over 50 small business clients, ensuring compliance and accuracy.

- •Led an initiative to automate reports using Excel, reducing report generation time by 30% and minimizing errors.

- •Collaborated with senior accountants in annual audits, contributing to the timely completion ahead of deadlines by 15%.

- •Implemented client feedback systems that led to a 20% increase in customer satisfaction ratings.

- •Participated in budgeting processes, providing analysis and support that resulted in an optimization of expenditures by 10%.

- •Prepared tax filings for clients with comprehensive notes, contributing to a 98% accuracy rate in document submissions.

- •Supported senior advisors in conducting tax research and developing tax planning strategies, optimizing client tax savings by 5%.

- •Organized extensive client files and documentation, improving data retrieval time and file management by 25%.

- •Assisted in the execution of several tax planning projects that enhanced regulatory compliance and reduced audit risks for clients.

- •Balanced ledgers and supported month-end closing procedures to maintain financial integrity for business operations.

- •Communicated with clients to address accounting discrepancies, ensuring client records were accurate and up-to-date.

- •Implemented new bookkeeping strategies within the department that improved transaction tracking by 40%.

- •Presented accounting process improvements during team meetings, fostering a collaborative team culture and improving process efficiency.

Fresher Financial Reporting Accountant resume sample

- •Assisted in preparing financial statements in compliance with GAAP, contributing to a 10% improvement in reporting accuracy.

- •Supported month-end close processes, leading to timely completion of reports by reducing delays by 20%.

- •Analyzed financial data, identifying discrepancies that resulted in a 5% error reduction in final reports.

- •Maintained general ledger and performed reconciliations, resolving discrepancies 30% faster than previous processes.

- •Collaborated with finance team during audits, streamlining the submission of over 200 necessary documents.

- •Monitored and reported on budget variances contributing to management insights, helping reduce overspending by $100,000 annually.

- •Conducted variance analysis and reported findings, resulting in cost reduction strategies that saved over $75,000 annually.

- •Collaborated with senior accountants to enhance reporting processes, improving workflow efficiency by 15%.

- •Provided ad-hoc financial analysis for management, impacting operational decision-making positively by 10%.

- •Participated in cross-functional teams to improve budget accuracy and achieved a forecasting accuracy increase of 12%.

- •Supported in audits with detailed documentation, ensuring a seamless process, reducing audit time by 3 days.

- •Assisted in maintaining financial records and supported month-end processes, leading to a 20% faster close time.

- •Prepared reconciliations for various accounts, ensuring data accuracy and reducing discrepancies by 10%.

- •Collaborated with accountants to prepare timely financial statements that improved reporting satisfaction rates by 8%.

- •Supported operational audits by preparing required documentation, facilitating seamless audit processes regularly.

- •Compiled financial data for bookkeeping, increasing efficiency in data entry by 25% through procedural improvements.

- •Ensured the accuracy of billing codes and invoices, reducing billing errors by 7% consistently.

- •Assisted in developing financial report templates, leading to a more standardized process used organization-wide.

- •Supported accountants in preparing reports for management review, streamlining approvals by 15%.

Entry Level Project Accountant resume sample

- •Spearheaded the financial management of projects valued at $300K, significantly enhancing accuracy and meeting deadlines 95% of the time.

- •Developed and implemented a new budgeting system leading to a 15% increase in cost efficiency across multiple projects.

- •Collaborated with project managers on financial performance tracking, resulting in timely budget adjustments and meeting project goals consistently.

- •Reduced reporting errors by 30% through meticulous data verification and cross-functional team collaboration.

- •Facilitated month-end closing for project accounts, ensuring comprehensive and accurate financial statements for stakeholder review.

- •Supported internal and external audits through detailed record-keeping and transparent communication with auditors, achieving a 100% compliance rate.

- •Managed accounts payable/receivable for projects, reducing outstanding payments by 25% over 6 months.

- •Executed monthly reconciliation of project accounts, identifying and resolving discrepancies promptly to maintain accurate financial records.

- •Assisted in preparing detailed project budgets and forecasts, aligning financial resources with strategic objectives.

- •Collaborated with cross-functional teams to provide monthly updates on budget variances and financial risks.

- •Contributed to financial software implementation, improving data integrity and real-time reporting capabilities.

- •Performed comprehensive financial analyses for project proposals, enabling informed decision-making and successful funding approvals.

- •Monitored financial metrics and key performance indicators, driving strategic insights for project optimization.

- •Prepared detailed monthly financial reports for upper management, ensuring data accuracy and clarity in presentation.

- •Automated financial data collection processes, saving the team 10 hours per month in manual data entry.

- •Supported the finance team in strategic planning, yielding a 10% improvement in resource allocation efficiency.

- •Assisted in the preparation and analysis of financial statements, providing support to senior accountants in project financial oversight.

- •Maintained detailed records of project expenses, ensuring compliance with company policies and procedures.

- •Participated in the closure of project accounts monthly, ensuring accuracy and completeness in financial reporting.

- •Coordinated with vendors and clients to resolve billing issues, minimizing discrepancies and improving stakeholder satisfaction.

Fresher Cost Accountant resume sample

- •Developed and implemented standardized financial reporting templates, increasing reporting efficiency by 25%.

- •Conducted detailed cost analyses for product lines, resulting in a 15% cost reduction strategy.

- •Monitored inventory and performed quarterly audits, maintaining a 98% accuracy rate.

- •Collaborated with cross-functional teams to analyze production costs and optimize budget allocation.

- •Assisted in preparing monthly reports and variance analysis, supporting senior management in strategic decision-making.

- •Led a data collection project that identified cost-saving opportunities worth $150,000 annually.

- •Prepared monthly financial statements and supported the preparation of annual budgets.

- •Conducted comprehensive variance analysis, identifying discrepancies and proposing corrective actions.

- •Collaborated with departments to gather financial data, contributing to budget preparation and cost forecasting.

- •Enhanced compliance by ensuring adherence to established accounting standards and procedures.

- •Managed documentation for transactions and processes, maintaining an organized and efficient filing system.

- •Assisted with cost management and monthly closings, ensuring timely and accurate reporting.

- •Helped develop cost control policies that resulted in reducing overhead costs by 10%.

- •Worked on financial projects supporting senior accountants in data gathering and analysis.

- •Maintained transaction documentation following regulatory and compliance guidelines meticulously.

- •Provided support in the development and application of budget systems, improving budgeting processes by 15%.

- •Regularly updated and monitored inventory levels to ensure accurate reporting and data integrity.

- •Supported financial forecasting and planning activities, refining forecasting models for improved accuracy.

- •Assisted in the preparation of financial reports, ensuring high accuracy and consistency with company standards.

Graduate Accounts Payable Specialist resume sample

- •Processed over 500 invoices monthly with 98% accuracy, significantly improving payment cycle times by 15%.

- •Collaborated with internal teams to resolve payment and invoice discrepancies, resulting in a 25% reduction in errors.

- •Implemented a new vendor setup process that increased efficiency by automating manual data entry tasks.

- •Streamlined reconciliation processes by introducing automation tools, enhancing department efficiency by 30%.

- •Supported a successful audit by providing comprehensive records and documentation, leading to a clean audit result.

- •Analyzed accounts payable processes, identifying key areas for improvement and recommending actionable solutions.

- •Managed accounts payable for over 200 vendors, ensuring timely and accurate payments, and maintaining a 100% compliance record.

- •Developed a detailed Excel tracking system which decreased payment discrepancies by 40% through improved accuracy.

- •Facilitated month-end closing procedures, contributing to a 50% reduction in closing time compared to the previous year.

- •Participated in cross-departmental initiatives to enhance financial reporting, resulting in cleaner financial data outputs.

- •Reduced outstanding payments by 20% through effective communication and negotiation with vendors and suppliers.

- •Processed and verified over 800 invoices quarterly, ensuring a 95% on-time payment rate to vendors.

- •Contributed to the design and implementation of an AP process flow, increasing departmental efficiency by 15%.

- •Assisted in the preparation of financial reports, contributing to a 25% improvement in the accuracy of financial data.

- •Worked closely with AP team to resolve vendor queries promptly, enhancing vendor relations and service satisfaction.

- •Supported accounts payable operations by managing daily invoice processing for over 150 vendors.

- •Facilitated vendor reconciliations, reducing unresolved discrepancies by 50% over a six-month period.

- •Developed an Excel dashboard to track payment cycles, improving visibility and reducing time spent on status inquiries.

- •Coordinated with internal and external stakeholders to ensure payment accuracy, maintaining high client satisfaction.

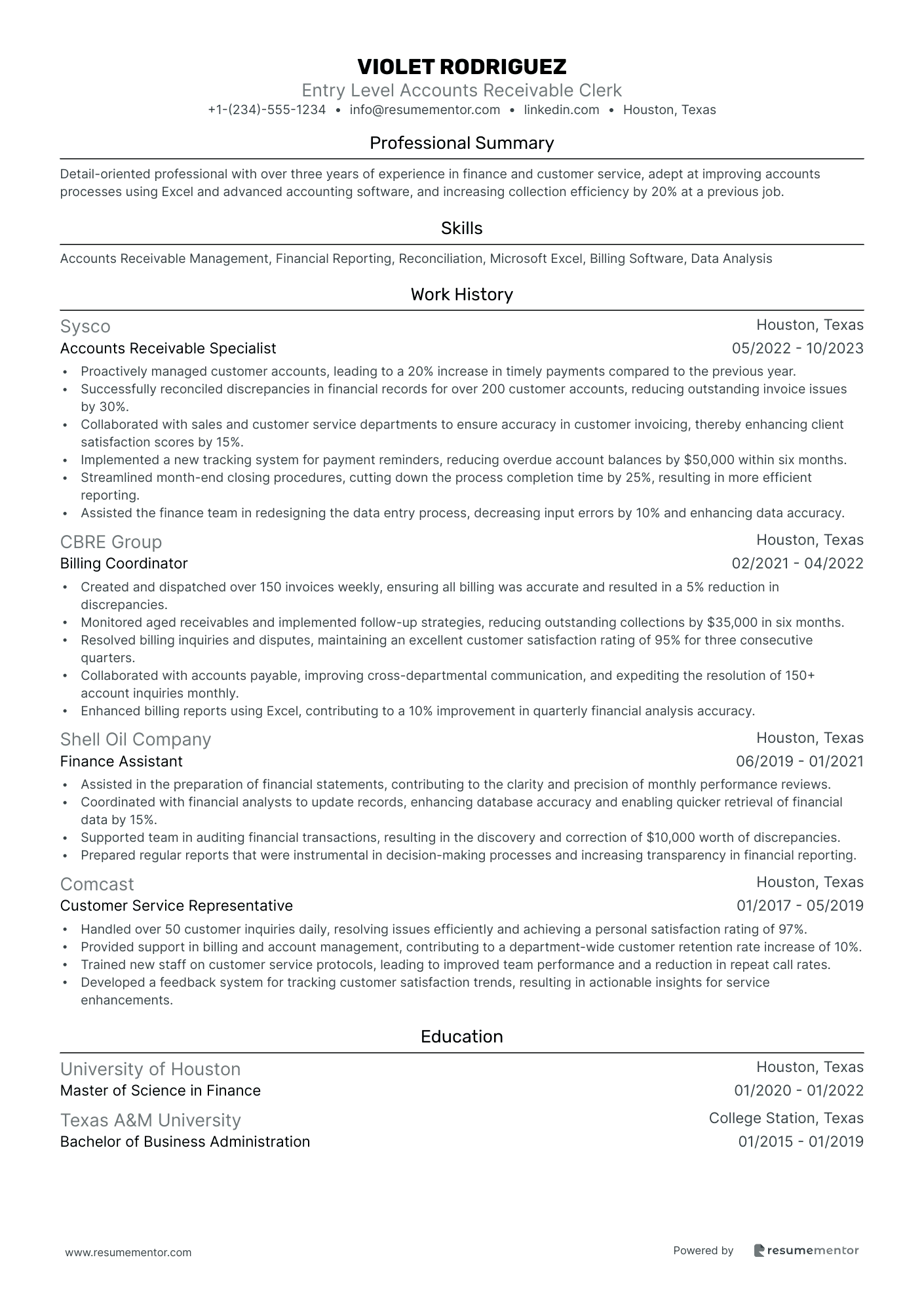

Entry Level Accounts Receivable Clerk resume sample

- •Proactively managed customer accounts, leading to a 20% increase in timely payments compared to the previous year.

- •Successfully reconciled discrepancies in financial records for over 200 customer accounts, reducing outstanding invoice issues by 30%.

- •Collaborated with sales and customer service departments to ensure accuracy in customer invoicing, thereby enhancing client satisfaction scores by 15%.

- •Implemented a new tracking system for payment reminders, reducing overdue account balances by $50,000 within six months.

- •Streamlined month-end closing procedures, cutting down the process completion time by 25%, resulting in more efficient reporting.

- •Assisted the finance team in redesigning the data entry process, decreasing input errors by 10% and enhancing data accuracy.

- •Created and dispatched over 150 invoices weekly, ensuring all billing was accurate and resulted in a 5% reduction in discrepancies.

- •Monitored aged receivables and implemented follow-up strategies, reducing outstanding collections by $35,000 in six months.

- •Resolved billing inquiries and disputes, maintaining an excellent customer satisfaction rating of 95% for three consecutive quarters.

- •Collaborated with accounts payable, improving cross-departmental communication, and expediting the resolution of 150+ account inquiries monthly.

- •Enhanced billing reports using Excel, contributing to a 10% improvement in quarterly financial analysis accuracy.

- •Assisted in the preparation of financial statements, contributing to the clarity and precision of monthly performance reviews.

- •Coordinated with financial analysts to update records, enhancing database accuracy and enabling quicker retrieval of financial data by 15%.

- •Supported team in auditing financial transactions, resulting in the discovery and correction of $10,000 worth of discrepancies.

- •Prepared regular reports that were instrumental in decision-making processes and increasing transparency in financial reporting.

- •Handled over 50 customer inquiries daily, resolving issues efficiently and achieving a personal satisfaction rating of 97%.

- •Provided support in billing and account management, contributing to a department-wide customer retention rate increase of 10%.

- •Trained new staff on customer service protocols, leading to improved team performance and a reduction in repeat call rates.

- •Developed a feedback system for tracking customer satisfaction trends, resulting in actionable insights for service enhancements.

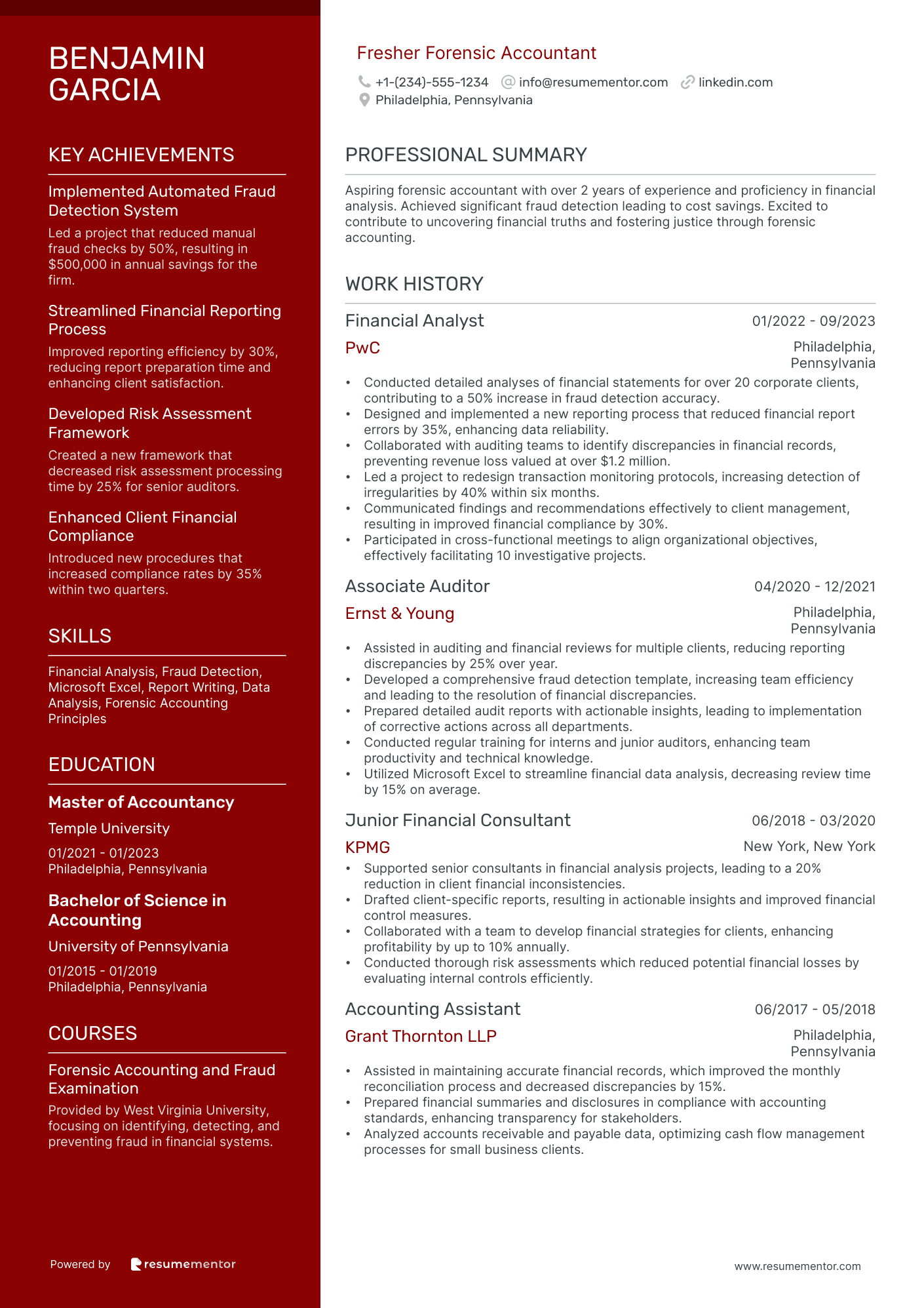

Fresher Forensic Accountant resume sample

- •Conducted detailed analyses of financial statements for over 20 corporate clients, contributing to a 50% increase in fraud detection accuracy.

- •Designed and implemented a new reporting process that reduced financial report errors by 35%, enhancing data reliability.

- •Collaborated with auditing teams to identify discrepancies in financial records, preventing revenue loss valued at over $1.2 million.

- •Led a project to redesign transaction monitoring protocols, increasing detection of irregularities by 40% within six months.

- •Communicated findings and recommendations effectively to client management, resulting in improved financial compliance by 30%.

- •Participated in cross-functional meetings to align organizational objectives, effectively facilitating 10 investigative projects.

- •Assisted in auditing and financial reviews for multiple clients, reducing reporting discrepancies by 25% over year.

- •Developed a comprehensive fraud detection template, increasing team efficiency and leading to the resolution of financial discrepancies.

- •Prepared detailed audit reports with actionable insights, leading to implementation of corrective actions across all departments.

- •Conducted regular training for interns and junior auditors, enhancing team productivity and technical knowledge.

- •Utilized Microsoft Excel to streamline financial data analysis, decreasing review time by 15% on average.

- •Supported senior consultants in financial analysis projects, leading to a 20% reduction in client financial inconsistencies.

- •Drafted client-specific reports, resulting in actionable insights and improved financial control measures.

- •Collaborated with a team to develop financial strategies for clients, enhancing profitability by up to 10% annually.

- •Conducted thorough risk assessments which reduced potential financial losses by evaluating internal controls efficiently.

- •Assisted in maintaining accurate financial records, which improved the monthly reconciliation process and decreased discrepancies by 15%.

- •Prepared financial summaries and disclosures in compliance with accounting standards, enhancing transparency for stakeholders.

- •Analyzed accounts receivable and payable data, optimizing cash flow management processes for small business clients.

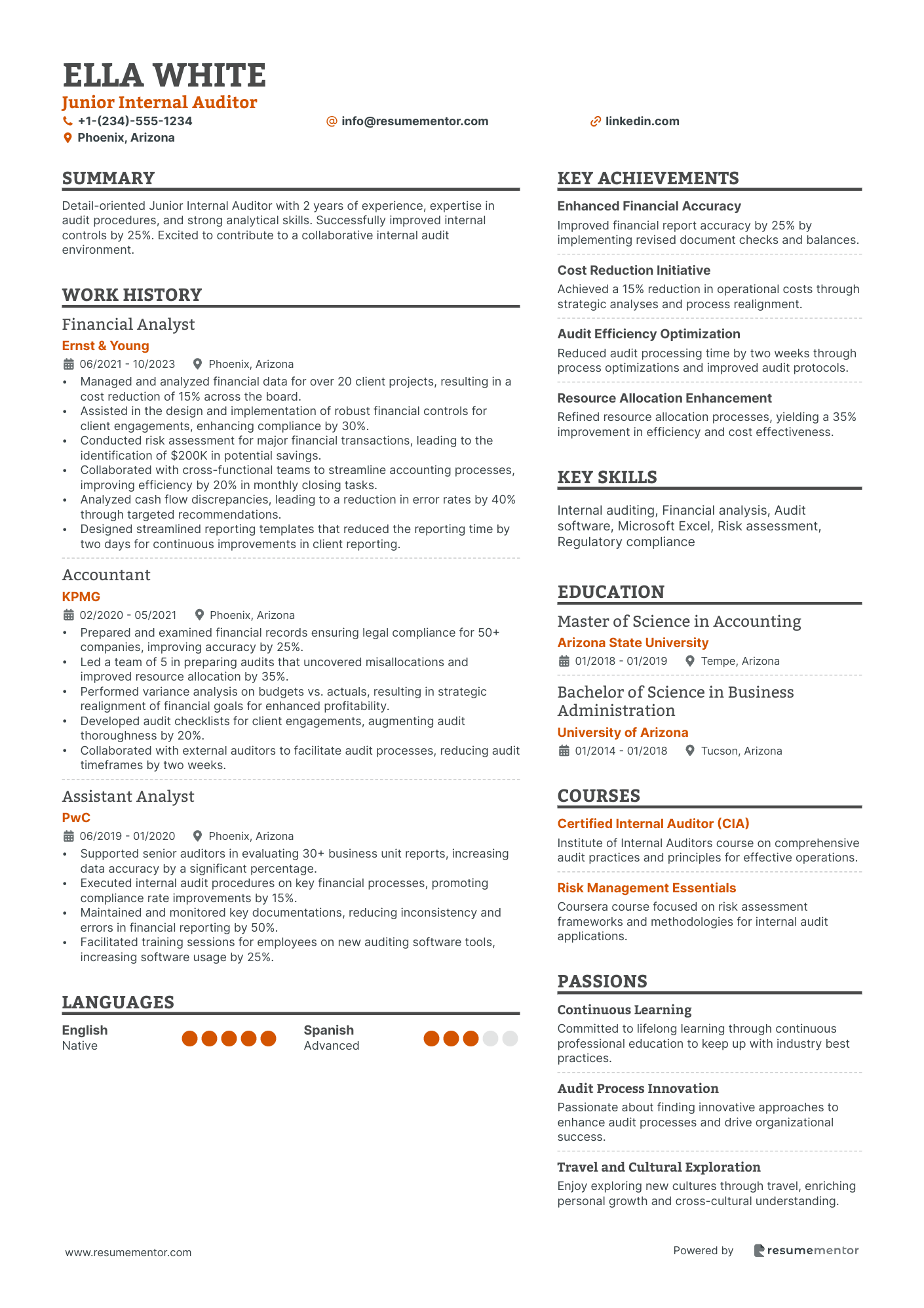

Junior Internal Auditor resume sample

- •Managed and analyzed financial data for over 20 client projects, resulting in a cost reduction of 15% across the board.

- •Assisted in the design and implementation of robust financial controls for client engagements, enhancing compliance by 30%.

- •Conducted risk assessment for major financial transactions, leading to the identification of $200K in potential savings.

- •Collaborated with cross-functional teams to streamline accounting processes, improving efficiency by 20% in monthly closing tasks.

- •Analyzed cash flow discrepancies, leading to a reduction in error rates by 40% through targeted recommendations.

- •Designed streamlined reporting templates that reduced the reporting time by two days for continuous improvements in client reporting.

- •Prepared and examined financial records ensuring legal compliance for 50+ companies, improving accuracy by 25%.

- •Led a team of 5 in preparing audits that uncovered misallocations and improved resource allocation by 35%.

- •Performed variance analysis on budgets vs. actuals, resulting in strategic realignment of financial goals for enhanced profitability.

- •Developed audit checklists for client engagements, augmenting audit thoroughness by 20%.

- •Collaborated with external auditors to facilitate audit processes, reducing audit timeframes by two weeks.

- •Supported senior auditors in evaluating 30+ business unit reports, increasing data accuracy by a significant percentage.

- •Executed internal audit procedures on key financial processes, promoting compliance rate improvements by 15%.

- •Maintained and monitored key documentations, reducing inconsistency and errors in financial reporting by 50%.

- •Facilitated training sessions for employees on new auditing software tools, increasing software usage by 25%.

Entry Level Payroll Accountant resume sample

- •Spearheaded the implementation of a new payroll software system, reducing processing time by 30% and increasing accuracy.

- •Managed bi-weekly payroll for over 500 employees, ensuring timely and compliant distribution of $1 million in wages monthly.

- •Collaborated with HR to update payroll records, resulting in a 15% reduction in payroll errors related to benefits deductions.

- •Developed and implemented a training program for new hires, reducing onboarding time by 20% and increasing team efficiency.

- •Assisted in payroll audits, successfully providing complete documentation and resolving discrepancies within one audit cycle.

- •Streamlined the payroll tax filing process, achieving a 100% on-time filing rate and avoiding penalties.

- •Streamlined accounts payable processes, reducing invoice processing time by 25% and enhancing vendor relationships.

- •Managed monthly closing activities and ensured accurate recording of expenses, supporting financial reporting accuracy.

- •Reconciled over 300 vendor accounts, reducing outstanding balances by 15% and improving cash flow.

- •Played a key role in transitioning to a paperless invoice system, cutting processing costs by 20% annually.

- •Led a cross-department initiative to improve invoice accuracy, reducing errors by 40% and enhancing stakeholder confidence.

- •Assisted in monthly budget analysis, identifying areas for cost savings that contributed to a 10% reduction in expenses.

- •Maintained and reconciled general ledger accounts, ensuring accuracy for monthly financial statements.

- •Assisted in the preparation of tax return documentation, ensuring compliance with federal and state regulations.

- •Participated in the implementation of a new accounting software, resulting in improved financial reporting capabilities.

- •Processed accounts receivable, ensuring accurate and timely recording of customer payments.

- •Provided support for the annual external audit, contributing to a successful audit with zero compliance issues.

- •Assisted in inventory reconciliations, identifying discrepancies that prevented potential financial losses.

- •Supported accounts payable tasks, maintaining supplier relations and timely payment of invoices.

Landing your first job as a fresh accountant can feel like navigating a complex financial report, especially when it comes to crafting the perfect resume. You might find it challenging to highlight your skills and experience effectively. It's crucial to make your education and budding technical expertise the star of your resume because they are the foundation of your career story. You're not alone in facing these challenges; many others struggle with how to make their resumes stand out.

Think of your resume as a vital financial statement for job hunting. It’s your opening pitch to potential employers, and it needs to clearly convey your potential. To make this process less daunting, using a resume template can be a game-changer. Templates give your resume a professional look effortlessly, saving you from the hassle of creating it from scratch. If you need a solid starting point, explore these resume templates to find one that fits your needs.

This approach allows you to focus more on what matters—highlighting your educational background along with any relevant internships or projects. Even if your experience is limited, emphasizing your skills and education shows you're ready to embrace new challenges. With a well-organized template, you're not just creating a resume; you’re crafting a narrative that offers employers a clear view of your capabilities and eagerness to learn.

Key Takeaways

- Creating a fresh accountant resume involves emphasizing education and foundational skills, supported by professional templates to ensure a polished presentation.

- Your resume should clearly communicate your readiness to contribute to a company’s success, with sections like contact information, objective statement, education, skills, and experience highlighted.

- Using quantifiable achievements and action verbs in your experience section helps demonstrate your potential and effectiveness to employers.

- A resume summary introduces you and aligns your skills with the employer’s needs, while certifications validate your technical proficiency and dedication to the field.

- Enhance your resume with extra sections like languages spoken, hobbies, volunteer work, and books to showcase diverse skills and interests beyond technical abilities.

What to focus on when writing your fresher accountant resume

A fresher accountant resume should communicate your readiness to contribute to a company's financial success through your accounting knowledge and attention to detail. Recruiters want to see that you're eager to learn and grow within their team, making you a promising candidate.

How to structure your fresher accountant resume

- Contact Information — Present your contact information clearly at the top of your resume to ensure recruiters can easily reach you. Include elements such as your full name, a professional email address, a phone number, and a LinkedIn profile if available. Your contact information sets the stage for your introduction before delving into other sections.

- Objective Statement — Craft a short statement that outlines your career aims and enthusiasm for accounting. This section should link to specific skills, such as analytical thinking and financial accuracy, that make you suitable for the role. By connecting your aspirations with practical skills, you demonstrate a focused approach to your career goals.

- Education — Highlight your educational foundation by detailing your degree in accounting or a related field. Mention relevant coursework and honors to underscore your expertise, and include the institution's name and your graduation date. This background lays the groundwork for the skills and experiences you will describe.

- Skills — List accounting-specific skills, such as spreadsheet software proficiency and familiarity with generally accepted accounting principles. This section should build upon your education and objective statement, showing how your abilities meet industry expectations. Emphasizing relevant skills enhances your profile's attractiveness to employers.

- Experience — Even with limited experience, it's valuable to include any internships or part-time jobs that illustrate your ability to apply financial skills in real-world situations. Volunteer experiences are also worthwhile to mention, as they demonstrate your readiness to work in a team. These experiences can provide practical context for your stated skills and educational background.

- Certifications — Mention any certifications you are pursuing or have attained, such as Excel proficiency or progress toward CPA exams. Certifications can signal your commitment to the accounting profession and boost your resume's appeal by indicating continuous growth. With these foundational sections in mind, we'll explore each area more thoroughly, delving into format and content optimization to make a strong impression.

Which resume format to choose

Creating your fresher accountant resume starts with picking the right format. A functional resume is ideal because it focuses on the strengths and skills you've developed, which is perfect for someone entering the accounting field without much experience yet. This format allows you to spotlight relevant skills like attention to detail and proficiency with accounting software.

Choosing the right font also plays a role in making your resume stand out. Fonts like Lato, Montserrat, or Raleway give your document a modern and professional appearance, making it visually distinct from more traditional resumes. These fonts are easy to read, which helps hiring managers quickly spot key information about your accounting capabilities.

Saving your resume as a PDF is crucial. PDFs ensure that your carefully chosen format and design appear exactly as intended on any device, preventing any misalignment that could occur with other file types. This consistency reflects the precision and reliability that are valuable traits in the accounting profession.

Setting your margins to one inch on each side creates a clean, organized look that is easy on the eyes. Proper spacing reflects your attention to detail, a quality that’s essential in accounting. It also allows room for white space, making your resume more inviting to read.

Writing clear and simple sentences throughout your resume ensures that employers can quickly and efficiently understand your strengths. Highlight your educational background, relevant coursework, and any internships or volunteer work that demonstrate your abilities in the field, making sure each section seamlessly supports the next.

How to write a quantifiable resume experience section

The experience section of your fresher accountant resume is key to making a strong impression on potential employers. Start by highlighting skills and achievements that match the job you want, focusing on your most recent experiences from the last 3-5 years. Even if you only have internships, volunteer work, or part-time roles, showing relevant job titles can make a big impact. Tailoring your resume to a job ad involves using specific keywords and action verbs like "analyzed," "managed," or "collaborated," which emphasize your proactive and effective nature.

Here's a fresher accountant resume experience example:

- •Conducted a detailed analysis of 100+ financial statements to identify errors, resulting in a 15% increase in reporting accuracy.

- •Collaborated with team members to streamline ledger processes, reducing reconciliation time by 20%.

- •Assisted in generating monthly financial reports, improving delivery time by 10%.

- •Managed data entry of over 200 invoices, enhancing efficiency and accuracy.

This experience section works effectively because it aligns with the expectations of an entry-level role. The bullet points clearly highlight measurable achievements, demonstrating your ability to add value to an employer. By using action verbs such as "Conducted," "Collaborated," "Assisted," and "Managed," you paint a picture of capability and drive. These accomplishments focus on key skills like efficiency, accuracy, and teamwork, directly connecting them to the job requirements.

By structuring your experiences in this way, you provide a cohesive narrative that showcases your potential to employers. The quantifiable accomplishments lend credibility to your contributions, while the focus on recent and relevant experiences ensures your resume remains both professional and targeted. This approach sets you up for success in a competitive job market, highlighting your readiness for the role you desire.

Industry-Specific Focus resume experience section

A fresher accountant-focused resume experience section should effectively highlight your academic achievements, relevant coursework, and any internships or volunteer work you've undertaken. Start each bullet point with a strong action verb to emphasize the specific skills or tools you employed, making sure to clearly relate how these experiences prepared you for an accounting role. Incorporate quantifiable achievements where possible, ensuring that each point remains concise yet impactful to convey your readiness.

The goal is to illustrate your potential as an accountant using real-life examples, even if they stem from academic or volunteer settings. By tailoring these experiences to reflect vital accounting skills such as attention to detail, analytical abilities, and proficiency in accounting software, you can make a compelling case for your capabilities. This strategy underscores your eagerness to contribute to an organization and helps you stand out as a promising candidate.

Accounting Intern

XYZ Firm

Summer 2022

- Collaborated with a team to manage and organize financial records, improving data accuracy by 15%.

- Used QuickBooks to assist in reconciling accounts, gaining hands-on experience with accounting software.

- Prepared financial reports for small projects, enhancing my understanding of accounting principles.

- Participated in weekly meetings with the finance team, refining communication and teamwork skills.

Achievement-Focused resume experience section

A fresher accountant's achievement-focused resume experience section should effectively highlight relevant skills and accomplishments in a manner that captures the employer's attention. Begin by showcasing experiences from internships, part-time jobs, or volunteer work that illustrate your accounting abilities. It’s crucial to use action verbs and measurable outcomes to clearly convey your successes, illustrating how you've applied your skills to manage financial data, navigate accounting software, and solve complex problems efficiently.

Incorporating outcome-based statements will provide context and evidence of your success. For example, if you've improved an accounting process, specify the resulting efficiency gains or time saved, ensuring your language is concise and role-specific. Tailor each entry to align with the skills and values pertinent to the job you’re applying for. Follow the structured example below to concisely and clearly present your achievements:

Accounting Intern

ABC Financial Services

June 2022 - August 2022

- Assisted in preparing financial statements, ensuring timely report submission.

- Streamlined data entry procedures, cutting down processing time by 20%.

- Worked with a team to conduct quarterly financial analyses, improving forecasting accuracy.

- Managed and reconciled accounts using accounting software, ensuring accurate records.

Responsibility-Focused resume experience section

A responsibility-focused fresher accountant resume experience section should emphasize your talent for managing financial tasks accurately and diligently. Start by bringing attention to any internships, volunteer work, or projects where you played a role in financial management or accounting practices. It's essential to highlight activities that display your attention to detail and preparedness for the accounting field. Even without formal accounting job experience, any relevant involvement can be valuable.

Organize your entries to clearly demonstrate what you achieved, such as maintaining financial records, assisting in audits, or utilizing accounting software. Each bullet point should narrate a specific task or responsibility, placing focus on the skills you applied or developed. By using straightforward language, you ensure your potential as a promising accounting professional shines through.

Accounting Intern

XYZ Financial Services

June 2022 - August 2022

- Assisted in preparing financial statements and reports

- Conducted data entry tasks, maintaining precise records

- Helped in the reconciliation of accounts through various software

- Participated in internal audits, ensuring compliance and accuracy

Growth-Focused resume experience section

A growth-focused fresher accountant resume experience section should highlight your skills and your eagerness to learn and advance. Begin by listing experiences that show your readiness to tackle new challenges, whether in internships or part-time roles. It's important to emphasize instances where you solved problems, demonstrated accuracy, or applied analytical skills, showing potential employers that you're capable and eager to make a positive impact.

Make sure each bullet point showcases what you achieved or contributed, rather than just listing your responsibilities. Use detailed examples to illustrate how you handled real-world situations or completed projects. Include numbers where possible to demonstrate the impact of your work, like boosting efficiency or cutting down on errors. This approach allows hiring managers to see your value, and positions you as a standout candidate who is ready to grow and contribute effectively to their company.

Accounting Intern

Tech Innovators

June 2022 - August 2022

- Assisted in preparing monthly financial statements for a midsize tech firm.

- Collaborated with the team to automate data entry, increasing efficiency by 20%.

- Reviewed and verified invoices and financial documents to ensure accuracy.

- Supported the accounting team during the annual budget planning process.

Write your fresher accountant resume summary section

A fresher-focused accountant resume summary should quickly capture your potential and readiness to thrive. Think of it as an introduction to who you are and how your skills can benefit an employer. This section can showcase your strengths, even if your experience is limited. For example:

This example effectively highlights your educational background and your ability to apply relevant skills. Mentioning software like QuickBooks and Excel demonstrates you're equipped with essential accounting tools. Using traits such as "detail-oriented" and "motivated" crafts a positive image, while the word "eager" expresses your enthusiasm and willingness to learn.

Understanding the unique features of each type of resume summary can help you make informed choices. A resume summary gives a snapshot of your skills and minimal experience, which suits freshers transitioning into the workforce. Alternatively, a resume objective focuses on your career goals, making it perfect for those new to the field. Meanwhile, a resume profile combines elements of both summaries to present a comprehensive view of you as a candidate. A summary of qualifications lists your skills and achievements succinctly.

Customizing your summary or objective for the job you're applying to is vital. This shows employers why you’re a good fit for their team. Keep your language simple and direct to ensure easy readability. Aim for brevity, with just a few impactful sentences. Your resume summary or objective is your opening pitch to an employer—make it compelling!

Listing your fresher accountant skills on your resume

A skills-focused fresher accountant resume should effectively showcase what you bring to the table. Highlighting your skills as a separate section provides a clear view of your abilities. Alternatively, weaving your skills into your experience or summary offers a more comprehensive picture of your strengths. Soft skills, such as communication and teamwork, reveal your personality and interpersonal abilities. In contrast, hard skills, like financial analysis or using accounting software, demonstrate specific, teachable abilities essential for accounting.

Incorporating these skills and strengths as keywords throughout your resume can significantly enhance its visibility. By doing so, you underline your qualifications, making your resume more appealing to potential employers.

The skills section displayed above is tailored to align directly with an accountant's core responsibilities. Listing eight essential skills provides a well-rounded view of your capabilities as a fresh candidate entering the field. Each skill is critical for accounting tasks, making your resume more compelling to employers seeking new talent.

Best hard skills to feature on your fresher accountant resume

For a fresher accountant, showcasing hard skills is about demonstrating your technical proficiency and readiness to tackle financial tasks. These skills should indicate your ability to carry out accounting responsibilities accurately and efficiently.

Hard Skills

- Financial Analysis

- Bookkeeping

- Accounts Payable & Receivable

- Budgeting and Forecasting

- Excel Proficiency

- Tax Preparation

- Data Entry

- Accounting Software (QuickBooks, SAP, etc.)

- Auditing

- Financial Reporting

- General Ledger Reconciliation

- Cost Accounting

- Payroll Management

- Regulatory Compliance

- Inventory Management

Best soft skills to feature on your fresher accountant resume

Soft skills are crucial for a fresher accountant, highlighting your ability to work well with others and adapt to various situations. These skills demonstrate your aptitude for collaboration and effective communication in a professional setting.

Soft Skills

- Attention to Detail

- Problem Solving

- Time Management

- Communication

- Adaptability

- Teamwork

- Organizational Skills

- Initiative

- Critical Thinking

- Interpersonal Skills

- Stress Management

- Customer Focus

- Self-Motivation

- Conflict Resolution

- Ethical Judgment

How to include your education on your resume

The education section of your resume is critical, especially as a fresher accountant. This section highlights your academic achievements and credentials, offering proof of your foundation in accounting principles. Ensure that the education details you include are directly related to the job you’re pursuing. If a degree or course doesn’t add value to the position, it’s best to leave it out. Including your GPA on your resume can be beneficial if it’s impressive; typically, a GPA of 3.5 or higher can be highlighted. If you graduate with honors like cum laude, make sure to mention this distinction, as it can set you apart from other candidates. Correctly listing your degree involves stating the full name of your degree, followed by the institution, location, and graduation date.

The first example mixes irrelevant education for an accounting role, focusing instead on a degree in Literature with a lower GPA that doesn't make an impactful statement. The second example is well-crafted for a fresher accountant resume. It includes a bachelor’s degree in Accounting, honors designation, and a solid GPA, all relevant to the position. These elements underscore your preparedness and commitment, appealing directly to employers seeking qualified accounting professionals.

How to include fresher accountant certificates on your resume

Including a certificates section in your fresher accountant resume is crucial. It helps your resume stand out to potential employers, showcasing your specialized skills and commitment to continuous learning. List the name of each certificate clearly. Include the date when you earned the certification. Add the issuing organization that provided the certification. Certificates can also be included in the header, such as “Certified Public Accountant (CPA)” next to your name.

This example is good because it includes recognized certifications relevant to accounting. It provides the name of the certification, the issuing organization, and shows that you have invested in relevant skills. Having a CPA is particularly important in the accounting field, and a QuickBooks ProAdvisor certificate showcases your knowledge in essential accounting software. This combination of certificates will resonate well with hiring managers in the accounting field.

Extra sections to include in your fresher accountant resume

Starting as a fresher accountant, your resume should showcase not only your education and technical skills but also elements that highlight your personality and broader skill set. Including diverse sections can make you stand out to potential employers.

- Language section — List extra languages you speak to show you can communicate with a broader range of clients. Employers value this diversity in a global market.

- Hobbies and interests section — Share hobbies that demonstrate skills relevant to accounting, such as attention to detail or organization. This humanizes you and makes you memorable.

- Volunteer work section — Describe volunteer experiences to highlight your community involvement and teamwork skills. Employers appreciate candidates who give back and work well with others.

- Books section — Mention a few books related to accounting or personal development you’ve read. This illustrates your dedication to learning and improving your skill set.

In Conclusion

In conclusion, crafting a powerful resume as a fresher accountant is your first step toward entering the professional world. Your resume should act as a personal marketing tool, capturing your educational background, skills, and intrinsic potential in the simplest and most engaging way. It's essential to emphasize sections such as contact information, education, and a well-thought-out objective that aligns with your ambitions in accounting. The experience section, even if limited, should be quantified to demonstrate real-world impact, making your contributions unmistakable to potential employers. Unlike other professions, accounting thrives on precision, so showcasing relevant certifications and skills like financial analysis, bookkeeping, and software proficiency is crucial. Don't overlook the power of soft skills either—problem-solving and communication are integral to any accounting role. If applicable, add sections that reflect your personal interests and volunteer experiences; these can highlight your versatility and community spirit, making you a well-rounded candidate. Also, make sure the format and design are clean and professional, aiding readability and quick comprehension. Remember, every detail you include is a reflection of your attention to detail and preparation, key traits for success in accounting. By focusing on these elements, you not only make a strong first impression but also lay a solid foundation for a promising accounting career. With these steps, you're well on your way to not just finding your first job, but excelling in it.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.