GST Accountant Resume Examples

Jul 18, 2024

|

12 min read

"Creating a standout GST accountant resume: a guide to balance your skills and experience like a pro"

Rated by 348 people

GST Compliance Accountant

Indirect Tax (GST) Accountant

GST Auditing Accountant

GST Filing Specialist Accountant

GST Advisory Accountant

GST Transaction Accountant

Goods and Services Tax (GST) Accountant

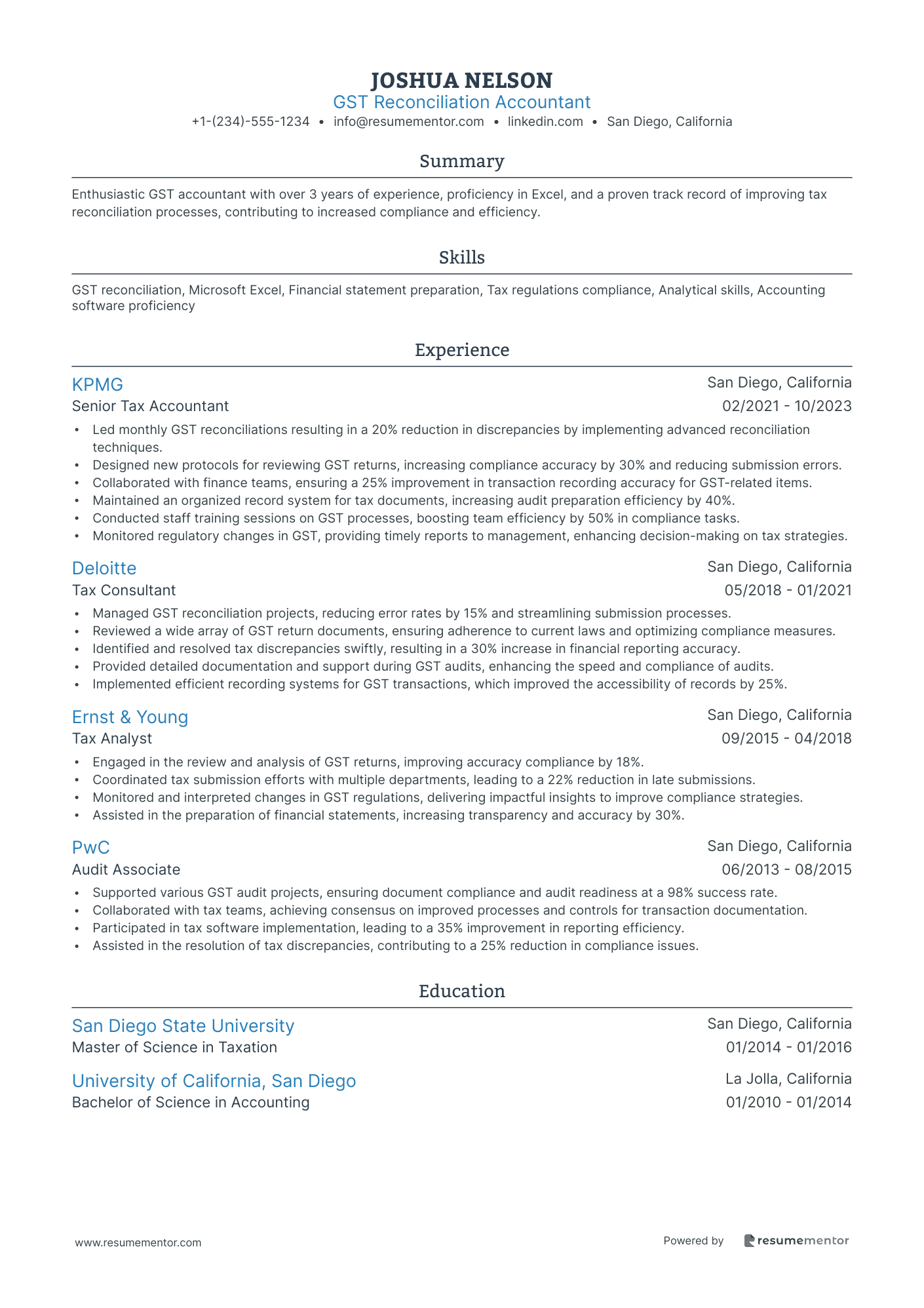

GST Reconciliation Accountant

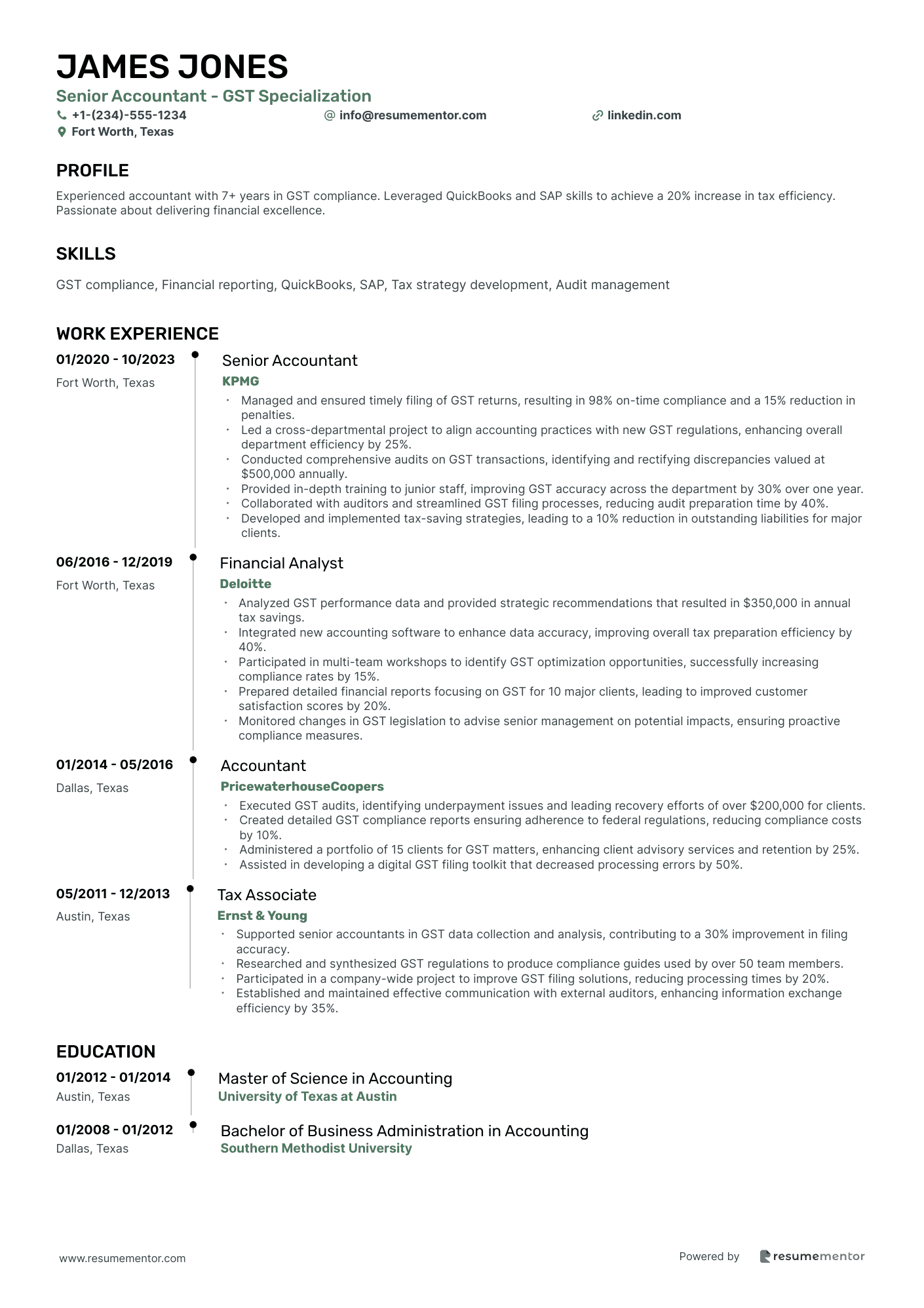

Senior Accountant - GST Specialization

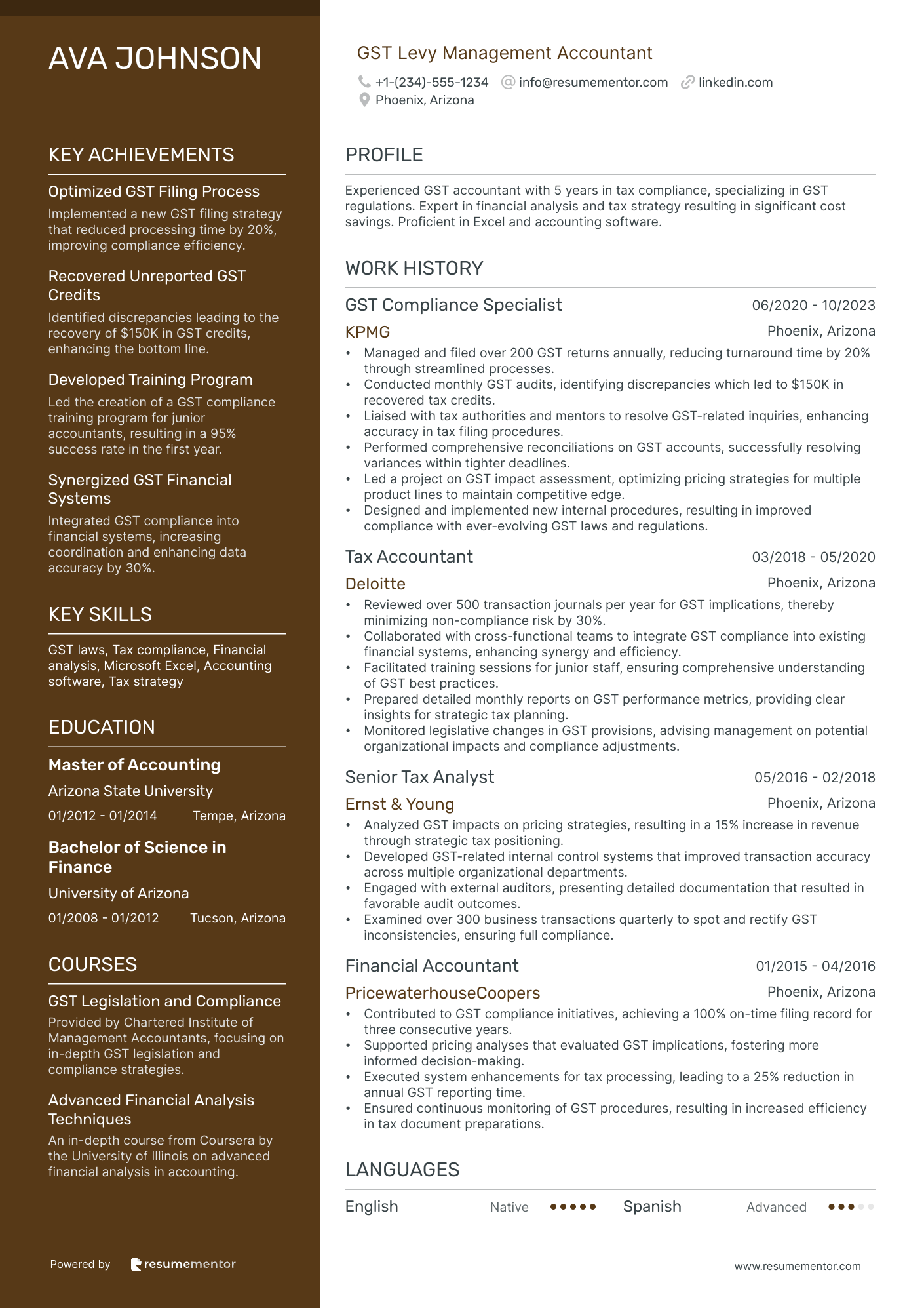

GST Levy Management Accountant

GST Compliance Accountant resume sample

- •Streamlined GST return filing processes, improving efficiency by 20% over two fiscal years.

- •Developed comprehensive GST compliance procedures, reducing errors by 15% and enhancing accuracy in tax submissions.

- •Managed GST reporting for a diverse client portfolio, resulting in a 100% compliance rate consistently.

- •Guided finance teams on complex GST issues, aiding in quick resolution and improved understanding across departments.

- •Conducted internal audits of GST transactions, identifying discrepancies and recommending corrective measures promptly.

- •Stayed updated with GST legislative changes, ensuring the company was proactive in compliance adjustments.

- •Reconciled GST accounts monthly, improving financial accuracy and compliance by 25% over two years.

- •Prepared detailed GST reports for internal review, enhancing transparency and tax audit preparedness.

- •Collaborated with IT professionals to integrate tax software solutions, reducing reporting time by 30%.

- •Conducted training sessions on GST compliance for staff, raising awareness and accuracy across departments.

- •Supported cross-functional teams in compiling documentation for GST audits, enhancing audit readiness.

- •Led the preparation of GST return filings for multinational clients, maintaining a compliance rate of 99%.

- •Implemented a quality control framework for GST reporting, reducing processing errors by 18%.

- •Monitored updates in GST regulations, preemptively adjusting strategies to maintain compliance.

- •Facilitated inter-departmental workshops on taxation best practices, improving cross-functional efficiency.

- •Assisted in the development of GST compliance strategies that increased compliance metrics by 10%.

- •Reviewed and classified financial transactions for GST, enhancing accuracy and compliance.

- •Supported senior accountants with detailed tax documentation, aiding swift and accurate GST filings.

- •Participated in GST compliance training programs, contributing to organizational tax education.

Indirect Tax (GST) Accountant resume sample

- •Led a team to prepare and file GST returns for 10 jurisdictions, achieving a 0% late filing record.

- •Analyzed and interpreted new tax legislation, minimizing compliance risk and improving reporting accuracy by 20%.

- •Facilitated audits resulting in clean compliance reports, strengthening company reputation with tax authorities.

- •Streamlined internal GST procedures, reducing reconciliation discrepancies by 30%, saving significant time and resources.

- •Trained 50+ staff in GST compliance best practices, enhancing organizational knowledge and cohesiveness.

- •Developed forecasting models for GST, improving budgeting precision by 15% over the previous fiscal year.

- •Managed GST compliance across 8 jurisdictions, ensuring all deadlines were consistently met without exceptions.

- •Collaborated with cross-functional teams to implement tax-effective processes, reducing errors by 35%.

- •Acted as key liaison with tax authorities, resolving queries which safeguarded organizational interests.

- •Enhanced GST reconciliation process with new procedures, improving accuracy by 40%.

- •Performed reviews of indirect tax processes, identifying improvements that doubled efficiency levels in filing practices.

- •Prepared and filed GST returns for multiple business units, leading to a 98% compliance accuracy rate.

- •Reviewed changes in GST laws, implementing required modifications that enhanced compliance by 25%.

- •Supported external audits that resulted in zero financial penalties imposed on the organization.

- •Coordinated tax training workshops, which clarified compliance protocols and reduced errors by 20%.

- •Assisted in the preparation of GST returns, leading to a 95% on-time submission rate across the board.

- •Explored legislative changes impacting GST, providing strategic advice that improved compliance protocols.

- •Liaised with legal team to align tax strategy with compliance needs, reducing legal queries by 30%.

- •Contributed to GST audits, which consistently met all regulatory requirements with high standards.

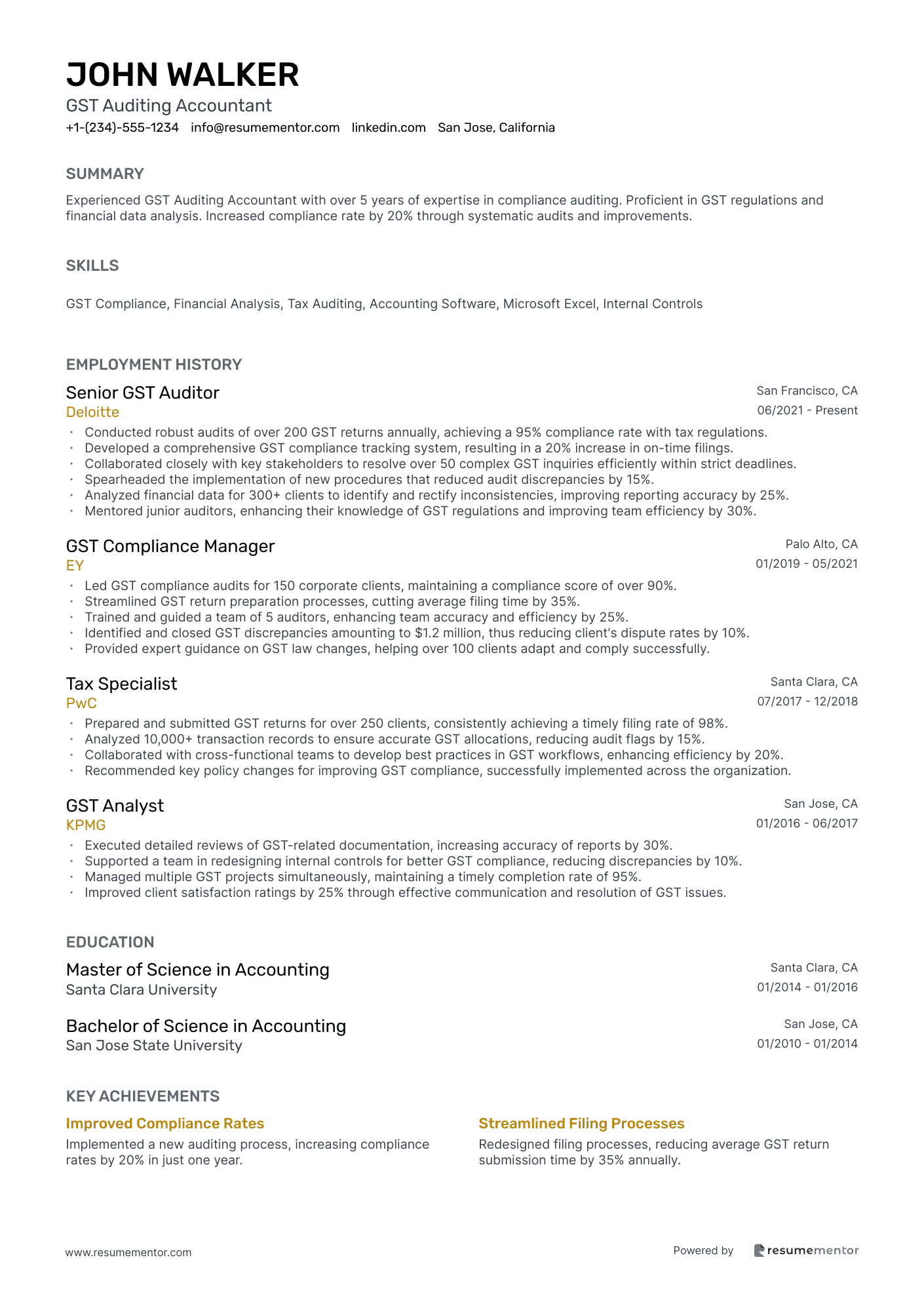

GST Auditing Accountant resume sample

- •Conducted robust audits of over 200 GST returns annually, achieving a 95% compliance rate with tax regulations.

- •Developed a comprehensive GST compliance tracking system, resulting in a 20% increase in on-time filings.

- •Collaborated closely with key stakeholders to resolve over 50 complex GST inquiries efficiently within strict deadlines.

- •Spearheaded the implementation of new procedures that reduced audit discrepancies by 15%.

- •Analyzed financial data for 300+ clients to identify and rectify inconsistencies, improving reporting accuracy by 25%.

- •Mentored junior auditors, enhancing their knowledge of GST regulations and improving team efficiency by 30%.

- •Led GST compliance audits for 150 corporate clients, maintaining a compliance score of over 90%.

- •Streamlined GST return preparation processes, cutting average filing time by 35%.

- •Trained and guided a team of 5 auditors, enhancing team accuracy and efficiency by 25%.

- •Identified and closed GST discrepancies amounting to $1.2 million, thus reducing client's dispute rates by 10%.

- •Provided expert guidance on GST law changes, helping over 100 clients adapt and comply successfully.

- •Prepared and submitted GST returns for over 250 clients, consistently achieving a timely filing rate of 98%.

- •Analyzed 10,000+ transaction records to ensure accurate GST allocations, reducing audit flags by 15%.

- •Collaborated with cross-functional teams to develop best practices in GST workflows, enhancing efficiency by 20%.

- •Recommended key policy changes for improving GST compliance, successfully implemented across the organization.

- •Executed detailed reviews of GST-related documentation, increasing accuracy of reports by 30%.

- •Supported a team in redesigning internal controls for better GST compliance, reducing discrepancies by 10%.

- •Managed multiple GST projects simultaneously, maintaining a timely completion rate of 95%.

- •Improved client satisfaction ratings by 25% through effective communication and resolution of GST issues.

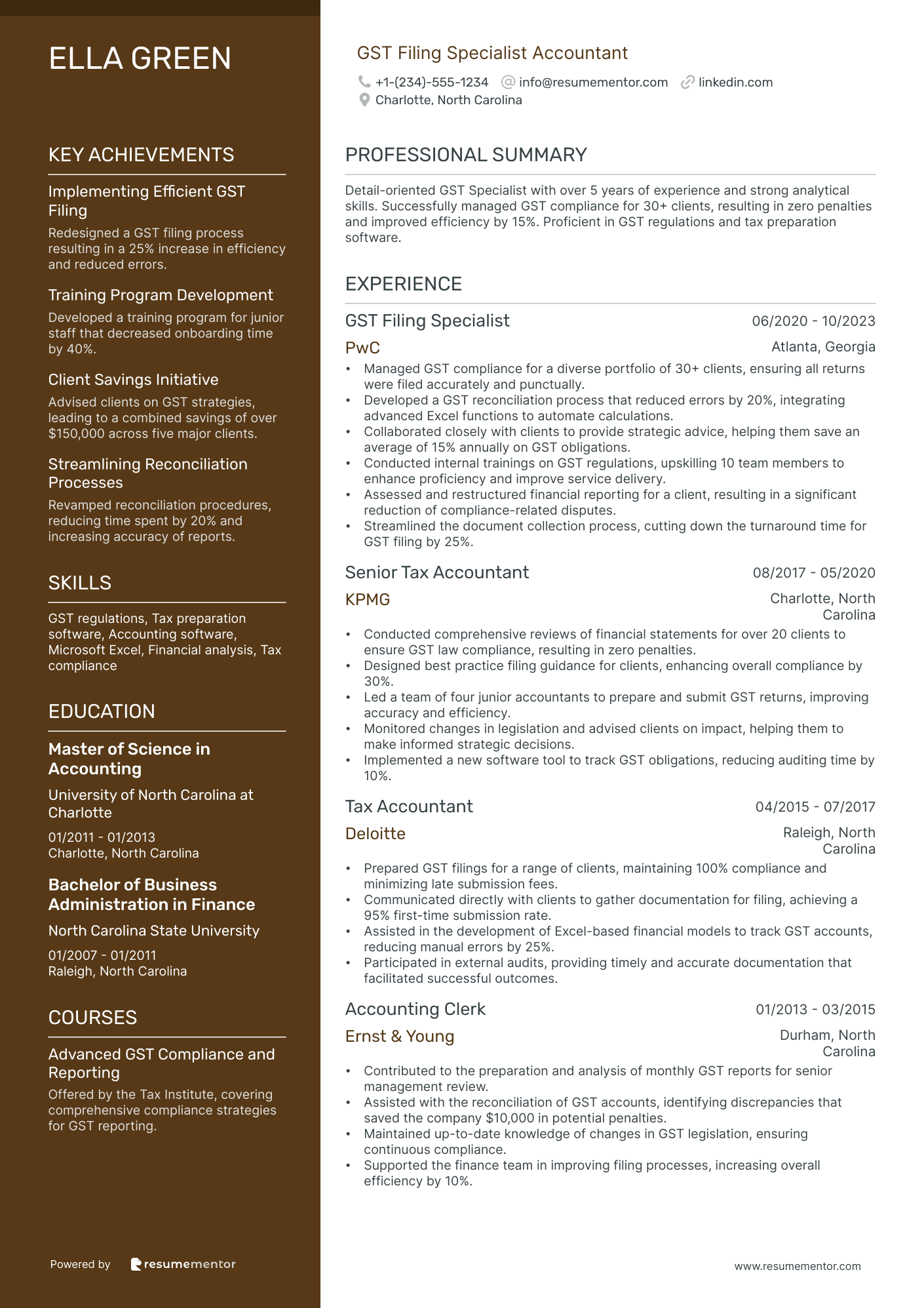

GST Filing Specialist Accountant resume sample

- •Managed GST compliance for a diverse portfolio of 30+ clients, ensuring all returns were filed accurately and punctually.

- •Developed a GST reconciliation process that reduced errors by 20%, integrating advanced Excel functions to automate calculations.

- •Collaborated closely with clients to provide strategic advice, helping them save an average of 15% annually on GST obligations.

- •Conducted internal trainings on GST regulations, upskilling 10 team members to enhance proficiency and improve service delivery.

- •Assessed and restructured financial reporting for a client, resulting in a significant reduction of compliance-related disputes.

- •Streamlined the document collection process, cutting down the turnaround time for GST filing by 25%.

- •Conducted comprehensive reviews of financial statements for over 20 clients to ensure GST law compliance, resulting in zero penalties.

- •Designed best practice filing guidance for clients, enhancing overall compliance by 30%.

- •Led a team of four junior accountants to prepare and submit GST returns, improving accuracy and efficiency.

- •Monitored changes in legislation and advised clients on impact, helping them to make informed strategic decisions.

- •Implemented a new software tool to track GST obligations, reducing auditing time by 10%.

- •Prepared GST filings for a range of clients, maintaining 100% compliance and minimizing late submission fees.

- •Communicated directly with clients to gather documentation for filing, achieving a 95% first-time submission rate.

- •Assisted in the development of Excel-based financial models to track GST accounts, reducing manual errors by 25%.

- •Participated in external audits, providing timely and accurate documentation that facilitated successful outcomes.

- •Contributed to the preparation and analysis of monthly GST reports for senior management review.

- •Assisted with the reconciliation of GST accounts, identifying discrepancies that saved the company $10,000 in potential penalties.

- •Maintained up-to-date knowledge of changes in GST legislation, ensuring continuous compliance.

- •Supported the finance team in improving filing processes, increasing overall efficiency by 10%.

GST Advisory Accountant resume sample

- •Provided expert GST advisory services leading to a 20% reduction in compliance issues for a diverse client portfolio.

- •Successfully managed and filed over 150 GST returns annually, ensuring 95% on-time submission rate for clients.

- •Identified $1.5M in savings opportunities through comprehensive GST impact assessments for multinational clients.

- •Led cross-functional teams to develop GST optimization strategies, enhancing process efficiency by 30% for key clients.

- •Developed and delivered GST training workshops that improved team knowledge and boosted client service ratings by 25%.

- •Maintained updates on GST legislation, resulting in timely information distribution that improved client trust by 40%.

- •Conducted detailed reviews of GST processes, identifying improvement areas that increased compliance by 15%.

- •Managed GST audits for high-profile clients, resolving issues that reduced audit findings by 60% over two years.

- •Collaborated with finance teams to implement GST solutions, resulting in streamlined tax processes saving $2M annually.

- •Authored GST compliance manuals that standardized procedures for 50+ staff, boosting accuracy and efficiency by 20%.

- •Led initiatives that aligned GST practices with local regulations, resulting in a 90% client retention rate.

- •Supported GST compliance efforts for a portfolio of 25 international clients, ensuring 100% adherence to local regulations.

- •Identified cost-saving strategies during GST impact assessments, leading to savings of $700K over three fiscal quarters.

- •Worked on GST optimization projects that improved transaction processes by 15% for small and mid-sized enterprises.

- •Communicated GST legislative changes to clients, resulting in a 50% reduction in compliance-related inquiries.

- •Assisted in preparing and reviewing GST returns, leading to a 98% accuracy rate for client submissions.

- •Collaborated on GST audit support projects that facilitated a reduction in client penalties by 30%.

- •Developed client-facing materials on GST topics, enhancing client understanding and satisfaction post-consultation by 20%.

- •Monitored GST regulatory updates and communicated necessary actions to ensure clients maintained compliance.

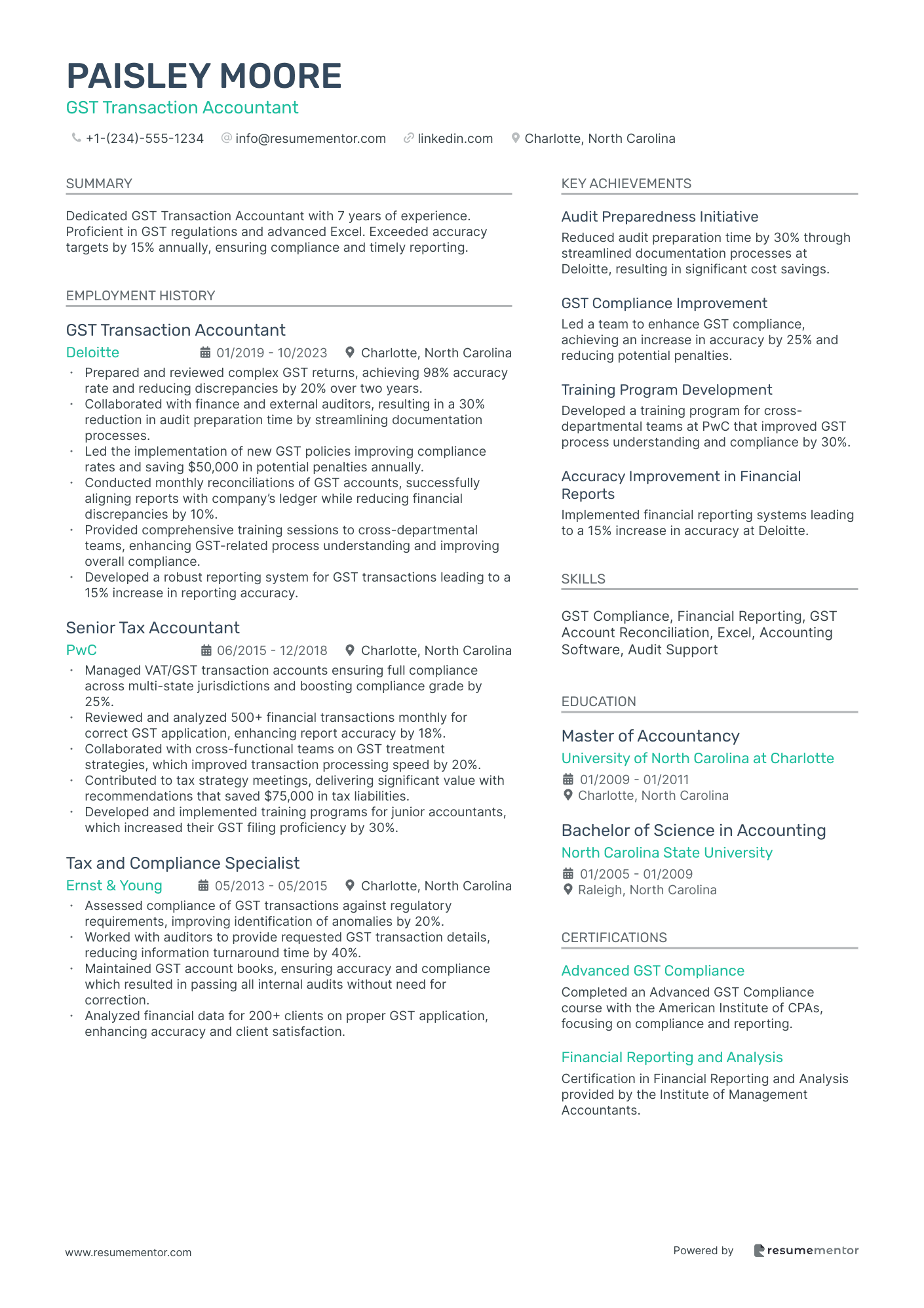

GST Transaction Accountant resume sample

- •Prepared and reviewed complex GST returns, achieving 98% accuracy rate and reducing discrepancies by 20% over two years.

- •Collaborated with finance and external auditors, resulting in a 30% reduction in audit preparation time by streamlining documentation processes.

- •Led the implementation of new GST policies improving compliance rates and saving $50,000 in potential penalties annually.

- •Conducted monthly reconciliations of GST accounts, successfully aligning reports with company’s ledger while reducing financial discrepancies by 10%.

- •Provided comprehensive training sessions to cross-departmental teams, enhancing GST-related process understanding and improving overall compliance.

- •Developed a robust reporting system for GST transactions leading to a 15% increase in reporting accuracy.

- •Managed VAT/GST transaction accounts ensuring full compliance across multi-state jurisdictions and boosting compliance grade by 25%.

- •Reviewed and analyzed 500+ financial transactions monthly for correct GST application, enhancing report accuracy by 18%.

- •Collaborated with cross-functional teams on GST treatment strategies, which improved transaction processing speed by 20%.

- •Contributed to tax strategy meetings, delivering significant value with recommendations that saved $75,000 in tax liabilities.

- •Developed and implemented training programs for junior accountants, which increased their GST filing proficiency by 30%.

- •Assessed compliance of GST transactions against regulatory requirements, improving identification of anomalies by 20%.

- •Worked with auditors to provide requested GST transaction details, reducing information turnaround time by 40%.

- •Maintained GST account books, ensuring accuracy and compliance which resulted in passing all internal audits without need for correction.

- •Analyzed financial data for 200+ clients on proper GST application, enhancing accuracy and client satisfaction.

- •Processed financial data into concise reports, which aided in executive decision-making, increasing financial efficiency by 15%.

- •Identified key financial trends and discrepancies on a monthly basis, improving forecasting accuracy by 10%.

- •Collaborated with accounting teams on special projects, ensuring timely and accurate completion which increased project efficiency by 25%.

- •Supported senior accountants by providing detailed month-end reports that reduced discrepancies by 20%.

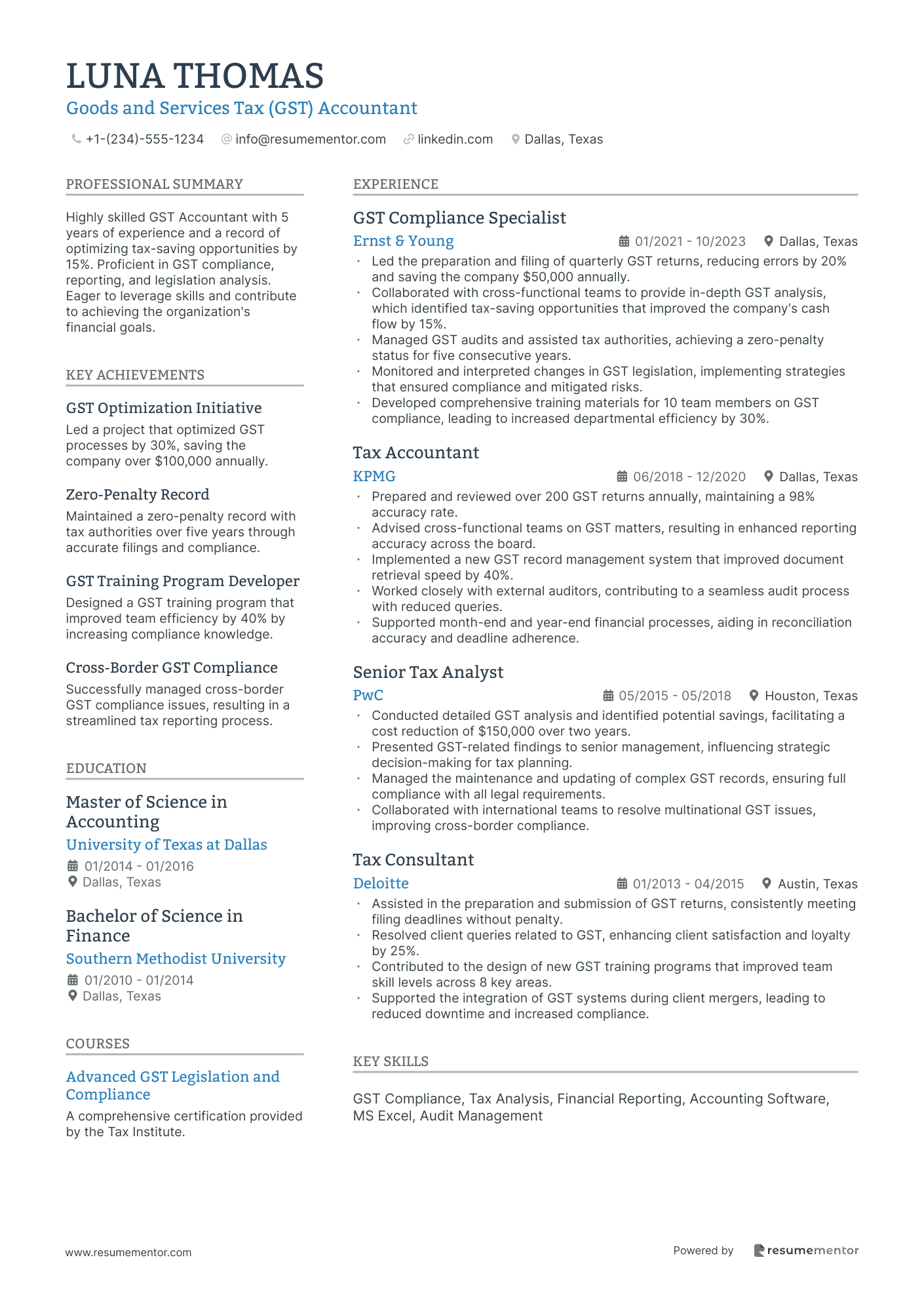

Goods and Services Tax (GST) Accountant resume sample

- •Led the preparation and filing of quarterly GST returns, reducing errors by 20% and saving the company $50,000 annually.

- •Collaborated with cross-functional teams to provide in-depth GST analysis, which identified tax-saving opportunities that improved the company's cash flow by 15%.

- •Managed GST audits and assisted tax authorities, achieving a zero-penalty status for five consecutive years.

- •Monitored and interpreted changes in GST legislation, implementing strategies that ensured compliance and mitigated risks.

- •Developed comprehensive training materials for 10 team members on GST compliance, leading to increased departmental efficiency by 30%.

- •Prepared and reviewed over 200 GST returns annually, maintaining a 98% accuracy rate.

- •Advised cross-functional teams on GST matters, resulting in enhanced reporting accuracy across the board.

- •Implemented a new GST record management system that improved document retrieval speed by 40%.

- •Worked closely with external auditors, contributing to a seamless audit process with reduced queries.

- •Supported month-end and year-end financial processes, aiding in reconciliation accuracy and deadline adherence.

- •Conducted detailed GST analysis and identified potential savings, facilitating a cost reduction of $150,000 over two years.

- •Presented GST-related findings to senior management, influencing strategic decision-making for tax planning.

- •Managed the maintenance and updating of complex GST records, ensuring full compliance with all legal requirements.

- •Collaborated with international teams to resolve multinational GST issues, improving cross-border compliance.

- •Assisted in the preparation and submission of GST returns, consistently meeting filing deadlines without penalty.

- •Resolved client queries related to GST, enhancing client satisfaction and loyalty by 25%.

- •Contributed to the design of new GST training programs that improved team skill levels across 8 key areas.

- •Supported the integration of GST systems during client mergers, leading to reduced downtime and increased compliance.

GST Reconciliation Accountant resume sample

- •Led monthly GST reconciliations resulting in a 20% reduction in discrepancies by implementing advanced reconciliation techniques.

- •Designed new protocols for reviewing GST returns, increasing compliance accuracy by 30% and reducing submission errors.

- •Collaborated with finance teams, ensuring a 25% improvement in transaction recording accuracy for GST-related items.

- •Maintained an organized record system for tax documents, increasing audit preparation efficiency by 40%.

- •Conducted staff training sessions on GST processes, boosting team efficiency by 50% in compliance tasks.

- •Monitored regulatory changes in GST, providing timely reports to management, enhancing decision-making on tax strategies.

- •Managed GST reconciliation projects, reducing error rates by 15% and streamlining submission processes.

- •Reviewed a wide array of GST return documents, ensuring adherence to current laws and optimizing compliance measures.

- •Identified and resolved tax discrepancies swiftly, resulting in a 30% increase in financial reporting accuracy.

- •Provided detailed documentation and support during GST audits, enhancing the speed and compliance of audits.

- •Implemented efficient recording systems for GST transactions, which improved the accessibility of records by 25%.

- •Engaged in the review and analysis of GST returns, improving accuracy compliance by 18%.

- •Coordinated tax submission efforts with multiple departments, leading to a 22% reduction in late submissions.

- •Monitored and interpreted changes in GST regulations, delivering impactful insights to improve compliance strategies.

- •Assisted in the preparation of financial statements, increasing transparency and accuracy by 30%.

- •Supported various GST audit projects, ensuring document compliance and audit readiness at a 98% success rate.

- •Collaborated with tax teams, achieving consensus on improved processes and controls for transaction documentation.

- •Participated in tax software implementation, leading to a 35% improvement in reporting efficiency.

- •Assisted in the resolution of tax discrepancies, contributing to a 25% reduction in compliance issues.

Senior Accountant - GST Specialization resume sample

- •Managed and ensured timely filing of GST returns, resulting in 98% on-time compliance and a 15% reduction in penalties.

- •Led a cross-departmental project to align accounting practices with new GST regulations, enhancing overall department efficiency by 25%.

- •Conducted comprehensive audits on GST transactions, identifying and rectifying discrepancies valued at $500,000 annually.

- •Provided in-depth training to junior staff, improving GST accuracy across the department by 30% over one year.

- •Collaborated with auditors and streamlined GST filing processes, reducing audit preparation time by 40%.

- •Developed and implemented tax-saving strategies, leading to a 10% reduction in outstanding liabilities for major clients.

- •Analyzed GST performance data and provided strategic recommendations that resulted in $350,000 in annual tax savings.

- •Integrated new accounting software to enhance data accuracy, improving overall tax preparation efficiency by 40%.

- •Participated in multi-team workshops to identify GST optimization opportunities, successfully increasing compliance rates by 15%.

- •Prepared detailed financial reports focusing on GST for 10 major clients, leading to improved customer satisfaction scores by 20%.

- •Monitored changes in GST legislation to advise senior management on potential impacts, ensuring proactive compliance measures.

- •Executed GST audits, identifying underpayment issues and leading recovery efforts of over $200,000 for clients.

- •Created detailed GST compliance reports ensuring adherence to federal regulations, reducing compliance costs by 10%.

- •Administered a portfolio of 15 clients for GST matters, enhancing client advisory services and retention by 25%.

- •Assisted in developing a digital GST filing toolkit that decreased processing errors by 50%.

- •Supported senior accountants in GST data collection and analysis, contributing to a 30% improvement in filing accuracy.

- •Researched and synthesized GST regulations to produce compliance guides used by over 50 team members.

- •Participated in a company-wide project to improve GST filing solutions, reducing processing times by 20%.

- •Established and maintained effective communication with external auditors, enhancing information exchange efficiency by 35%.

GST Levy Management Accountant resume sample

- •Managed and filed over 200 GST returns annually, reducing turnaround time by 20% through streamlined processes.

- •Conducted monthly GST audits, identifying discrepancies which led to $150K in recovered tax credits.

- •Liaised with tax authorities and mentors to resolve GST-related inquiries, enhancing accuracy in tax filing procedures.

- •Performed comprehensive reconciliations on GST accounts, successfully resolving variances within tighter deadlines.

- •Led a project on GST impact assessment, optimizing pricing strategies for multiple product lines to maintain competitive edge.

- •Designed and implemented new internal procedures, resulting in improved compliance with ever-evolving GST laws and regulations.

- •Reviewed over 500 transaction journals per year for GST implications, thereby minimizing non-compliance risk by 30%.

- •Collaborated with cross-functional teams to integrate GST compliance into existing financial systems, enhancing synergy and efficiency.

- •Facilitated training sessions for junior staff, ensuring comprehensive understanding of GST best practices.

- •Prepared detailed monthly reports on GST performance metrics, providing clear insights for strategic tax planning.

- •Monitored legislative changes in GST provisions, advising management on potential organizational impacts and compliance adjustments.

- •Analyzed GST impacts on pricing strategies, resulting in a 15% increase in revenue through strategic tax positioning.

- •Developed GST-related internal control systems that improved transaction accuracy across multiple organizational departments.

- •Engaged with external auditors, presenting detailed documentation that resulted in favorable audit outcomes.

- •Examined over 300 business transactions quarterly to spot and rectify GST inconsistencies, ensuring full compliance.

- •Contributed to GST compliance initiatives, achieving a 100% on-time filing record for three consecutive years.

- •Supported pricing analyses that evaluated GST implications, fostering more informed decision-making.

- •Executed system enhancements for tax processing, leading to a 25% reduction in annual GST reporting time.

- •Ensured continuous monitoring of GST procedures, resulting in increased efficiency in tax document preparations.

As a GST accountant, creating a standout resume can feel as tangled as navigating tax codes. When job hunting, you may find yourself unsure of how to highlight your specific skills and experiences effectively. With so many other GST accountants vying for the same roles, it's easy to feel lost in the shuffle. Crafting your resume with the right focus can help you rise above the competition. Your expertise should shine brightly on paper, but it can be tricky to know where to start. That's where our guide steps in.

Make sure your GST accountant resume stands out by using a professional resume template. The right format can make all the difference, emphasizing your top qualifications and experiences clearly. Your resume should be easy to read and tailored specifically for the GST accounting field. This can capture the attention of hiring managers quickly.

Get started today with over 700 resume examples to help guide you in crafting the perfect resume.

Key Takeaways

- A GST accountant resume should highlight accounting skills, knowledge of GST regulations, and the ability to handle financial tasks accurately.

- Use a professional template to make your resume easy to read and tailored for the GST accounting field, capturing hiring managers' attention.

- Include essential sections like Contact Information, Professional Summary, Work Experience, Education, Skills, and Certifications to offer clarity and structure.

- Choose a reverse-chronological format to showcase your most recent and relevant experience first, and save the resume as a PDF.

- In the Experience section, emphasize achievements and quantifiable results using strong action words to make your resume more compelling.

What to focus on when writing your GST accountant resume

An effective GST accountant resume should tell recruiters that you possess strong accounting skills, deep knowledge of GST regulations, and the ability to handle financial tasks accurately. Your resume should show that you are detail-oriented and capable of managing compliance with complex tax laws. It's important to convey enthusiasm for staying updated with current tax laws, as well as proficiency in relevant accounting software.

To boost your resume's impact, consider including:

- Examples of successful GST compliance projects you’ve managed.

- Metrics showing the financial benefits or cost savings you've achieved.

- Any certifications or advanced training in GST or tax law.

- Skills in using accounting software like Tally, SAP, or QuickBooks.

Must have information on your GST accountant resume

Creating a winning GST accountant resume involves incorporating essential sections that highlight your expertise and experience in the field. The must-have sections include:

- Contact Information

- Professional Summary

- Work Experience

- Education

- Skills

- Certifications

Including these core sections will offer clarity and structure, making your resume easy to read for both hiring managers and ATS systems. You could also consider adding sections like "Professional Affiliations" and "Achievements" to showcase additional qualifications and accomplishments.

Which resume format to choose

Choosing the best resume format for a GST accountant is essential to highlight your skills and experience effectively. The reverse-chronological format is generally the most suitable, as it showcases your most recent and relevant experience first. For fonts, opt for modern choices like Rubik and Montserrat to give your resume a fresh, professional look. Always save your resume as a PDF to maintain formatting and ensure compatibility. Keep your margins at about one inch on all sides to make your resume easy to read. Use clear section headings that are ATS-friendly, such as "Experience" and "Skills," to help your resume get past automated screening software.

A GST accountant resume should include the following sections:

- Contact Information

- Professional Summary

- Experience

- Education

- Skills

- Certifications

- Relevant Projects

- Professional Affiliations

Ensure that your resume makes an impact by using consistent formatting and clear language. Resume Mentor's free resume builder can handle all these details for you, ensuring your resume looks polished and professional.

How to write a quantifiable resume experience section

The experience section of your GST Accountant resume is the core of your document. It's the part that employers scrutinize the most. We aim for clarity and impact, placing your latest work experience first and going back up to 10-15 years if relevant. Ensure you include job titles that are relevant to the GST Accountant role you're applying for. Tailoring your resume to the job description is key; use action words to highlight your achievements instead of just listing your duties. Words like "managed", "improved", and "delivered" can make your resume stand out.

Let's look at an example:

- •Responsible for GST filings

- •Worked with the finance team

- •Prepared reports

This example is not effective because it lists duties instead of achievements and lacks specific details. It does not showcase the candidate’s contributions or results. Let’s improve it:

- •Reduced GST liabilities by 15% through accurate filing and audits

- •Led a team of 4 junior accountants, improving accuracy by 20%

- •Implemented a new GST tracking system, cutting processing time by 30%

The second example is compelling because it emphasizes achievements and quantifiable results. It uses strong action words like "reduced," "led," and "implemented." These specifics show your impact in previous roles and make your resume more impressive to hiring managers.

To summarize, always start with your most recent job and work backward. Keep the experience section to the most relevant jobs for the role you're applying for. Tailor your resume to the job, and use action words to highlight your accomplishments. This approach will help you create a strong, impactful resume that stands out.

GST accountant resume experience examples

Ready to make your resume a taxing-less task? Let's break down various vital experiences that you might encounter in your career as a GST accountant. Each of these focused approaches will help you highlight your strengths on your journey to becoming a financial wizard!

Achievement-focused

Highlight your accomplishments by describing the outcomes you achieved.

Senior GST Accountant

FinServe Inc.

2019-2023

- Achieved a 20% reduction in tax liabilities through strategic tax planning.

- Successfully managed accounts for over 100 clients with 99% satisfaction rate.

- Implemented new software saving 100 man-hours monthly.

Skills-focused

Emphasize the key skills that make you a suitable candidate for the role.

GST Accountant

TaxMate Solutions

2018-2022

- Proficient in GST software and ERP systems.

- Excelled in financial reconciliation and reporting.

- Skilled in liaising with tax authorities and regulatory bodies.

Responsibility-focused

Describe the main responsibilities you held to show your reliability and competence.

GST Compliance Officer

AuditPro

2016-2020

- Oversaw and ensured timely GST return filing.

- Managed annual audits and liaised with external auditors.

- Maintained precise GST records and compliance documentation.

Project-focused

Talk about specific projects you worked on and their impacts.

Project Lead, GST Implementation

BlueFin Consulting

2020-2023

- Led a project to overhaul GST filing processes, resulting in improved accuracy.

- Implemented a digital GST compliance program saving $50,000 annually.

- Trained team on new GST software leading to increased efficiency.

Result-focused

Convey the quantifiable outcomes you've achieved to demonstrate your impact.

GST Analyst

ClientTax Services

2017-2021

- Reduced audit time by 30% through improved processes.

- Increased client retention rate by 15% with personalized GST solutions.

- Recovered $100,000 in claims for various clients.

Industry-Specific Focus

Display experience in industries that align with the job you’re targeting to highlight your specialized expertise.

GST Specialist

RetailTax Advisors

2015-2020

- Managed GST compliance for 50+ retail clients.

- Developed GST strategies tailored for retail businesses.

- Streamlined GST return processes, reducing errors by 25%.

Problem-Solving focused

Detail specific problems you’ve solved and the positive impact your solutions had.

GST Solutions Expert

FixTax Consultancy

2018-2022

- Resolved complex tax discrepancies saving clients $200,000.

- Identified and corrected long-standing filing errors.

- Advised on changes improving compliance with new regulations.

Innovation-focused

Showcase your ability to innovate and improve existing processes.

Innovation Lead, GST Compliance

NextGen Tax Services

2019-2023

- Pioneered a new tracking system reducing reporting errors by 40%.

- Developed a mobile app to simplify GST filing for clients.

- Initiated cloud-based solutions increasing team productivity.

Leadership-focused

Display your leadership skills by mentioning your leadership roles and achievements.

Team Lead, GST Department

Alpha Financial

2016-2021

- Led a team of 10 accountants to streamline GST processes.

- Mentored junior staff resulting in 20% increase in team efficiency.

- Managed cross-department projects enhancing overall compliance.

Customer-focused

Discuss how you’ve met and exceeded customer needs and expectations.

Client Account Manager

AdvisoryHub

2017-2022

- Maintained an 98% client satisfaction rate by providing tailored GST solutions.

- Conducted regular client meetings to ensure compliance and satisfaction.

- Solved client issues promptly reducing churn rate by 10%.

Growth-focused

Talk about roles where you have driven growth, either in revenue, client base, or internally.

Growth Manager, Tax Division

GrowthyTax

2018-2023

- Expanded client base by 25% through strategic marketing initiatives.

- Increased revenue by 15% by optimizing GST consulting services.

- Developed growth strategies contributing to overall company success.

Efficiency-focused

Demonstrate your role in increasing efficiency and productivity within the organization.

Efficiency Officer, GST Department

Streamline Accounting

2019-2023

- Reduced processing time by 35% with new GST filing system.

- Enhanced data accuracy by automating key compliance tasks.

- Led cost-saving initiatives resulting in $50,000 annual savings.

Technology-focused

Highlight experience with various technologies and software relevant to GST accounting.

Tech-Savvy GST Accountant

TechTax

2017-2021

- Expert in GST software like SAP and QuickBooks.

- Implemented new data management systems reducing errors by 20%.

- Conducted training on new technology improving team proficiency.

Collaboration-focused

Talk about your ability to work well with others and the collaborative projects you’ve been involved in.

Collaborative GST Specialist

CollabFinance

2016-2020

- Worked with cross-functional teams to ensure compliance.

- Facilitated team meetings enhancing communication and efficiency.

- Collaborated with external auditors for seamless audit processes.

Training and Development focused

Describe roles where you’ve trained and developed others, enhancing their skills and knowledge.

Training Manager, GST Compliance

EduTax Learning Corp.

2018-2022

- Developed training programs improving staff knowledge by 40%.

- Mentored junior accountants, boosting team retention rates.

- Conducted workshops on GST updates ensuring compliance.

Write your GST accountant resume summary section

When writing your resume summary as a GST accountant, be clear about your skills and experience. Your goal is to grab the employer's attention quickly, summarizing what makes you the best fit for the job. Use simple and direct language to describe your background and your key achievements. Highlight your proficiency with GST regulations and your ability to help the company manage its tax obligations efficiently. Ensure the summary is tailored to reflect your top qualities, acting as a snapshot of your professional life.

It's vital to describe yourself in a way that conveys confidence and clarity. Use action-oriented words and specific details about your experience. Show your enthusiasm and reliability. A good summary should make the reader want to learn more about what you have to offer.

A resume summary, often confused with other similar sections, focuses on presenting a brief and engaging overview of your career. A resume objective, by contrast, states your career goals and is often used by individuals entering the job market or changing careers. A resume profile offers a more in-depth look at your professional life, combining elements of both summary and objective. A summary of qualifications lists your key skills and achievements upfront, providing a quick reference for employers.

This summary lacks specifics and fails to highlight unique qualifications. It is vague and does not provide concrete reasons why the candidate stands out.

This summary is detailed and specific. It highlights your experience, key strengths, and achievements. The use of strong action words and concrete examples make it compelling and effective.

Listing your GST accountant skills on your resume

When you're crafting the skills section of your GST accountant resume, you can either have a standalone section or incorporate your skills into other sections like experience and summary. Highlighting strengths and soft skills in this manner can showcase your well-rounded abilities and personality traits. Hard skills encompass specific, teachable abilities or knowledge, such as proficiency in accounting software or tax laws.

Skills and strengths, being highly relevant to your job role, can often be seen as resume keywords that help your resume get noticed by both human recruiters and applicant tracking systems (ATS). Including these keywords effectively can greatly increase the likelihood of your resume being selected for an interview.

Here’s an example of a standalone skills section:

This example is good because it lists specific skills relevant to a GST accountant's role, making it easy for employers to see your qualifications at a glance. Each skill is clear and concise, showcasing a mix of technical proficiencies and industry knowledge.

Best hard skills to feature on your GST accountant resume

Hard skills are those technical skills and knowledge needed for the role. They should communicate your expertise and your ability to perform job-specific tasks efficiently. Here are the most in-demand and popular hard skills for a GST accountant:

Hard Skills

- GST Compliance

- Tax Filing

- Financial Reporting

- Accounting Software Proficiency (e.g., SAP, QuickBooks)

- Auditing

- Budget Management

- Bookkeeping

- Regulatory Compliance

- Data Analysis

- Spreadsheets (e.g., Excel)

- Financial Analysis

- Payroll Management

- Revenue Recognition

- Inventory Management

- Risk Assessment

Best soft skills to feature on your GST accountant resume

Soft skills relate to your personality and interpersonal abilities. They should communicate your capability to work well with others and handle the work environment. Here are the most in-demand and popular soft skills for a GST accountant:

Soft Skills

- Attention to Detail

- Analytical Thinking

- Time Management

- Communication

- Problem Solving

- Adaptability

- Team Collaboration

- Ethics and Integrity

- Stress Management

- Critical Thinking

- Decision Making

- Organizational Skills

- Customer Service

- Professionalism

- Initiative

How to include your education on your resume

An education section is a crucial part of your GST accountant resume. It showcases your formal qualifications and helps a potential employer understand your expertise. Ensure this section is tailored to the job you're applying for, excluding any irrelevant education.

When including your GPA, write it clearly and only if it's impressive. Honors such as "cum laude" should be mentioned to highlight your academic achievements. List your degree along with the institution, graduation date, and relevant coursework.

Incorrect Example:

This example is poorly written because it lists an irrelevant degree (History) for a GST accountant position. This doesn't demonstrate expertise in accounting or tax.

Correct Example:

This example is good because it lists a relevant degree in Accounting, mentions honors (cum laude), and includes a strong GPA. This demonstrates your expertise and suitability for a GST accountant role.

How to include GST accountant certificates on your resume

A certificates section is an important part of your GST Accountant resume. Including certifications can showcase your expertise and qualifications. You can list certificates in a dedicated section or even place them in the header for visibility.

List the name of the certificate first. Include the date of issuance next. Add the name of the issuing organization. Ensure the title reflects the relevance to the GST Accountant role.

This example is well-organized and clear. It shows the titles and issuers, making it easy for employers to see your qualifications. The selected certifications are directly relevant to a GST Accountant position, adding value to your resume.

Extra sections to include in your GST accountant resume

As a GST accountant, showcasing a comprehensive and well-rounded resume is crucial to impress potential employers. Including diverse sections in your resume can highlight your multifaceted skills and experience, making you a more appealing candidate.

- Language section — List any languages you know as they can help in communicating with a broader client base and enhance your marketability.

- Hobbies and interests section — Share your hobbies to show your well-rounded nature and stress-relief practices, which can improve your job performance.

- Volunteer work section — Mention your volunteer work to reflect your commitment and community involvement, adding to your personal and professional growth.

- Books section — Highlight the books you've read related to accounting or personal development, showcasing your continuous learning and dedication to the field.

Including these sections can make your resume stand out and present you as a balanced, engaged candidate ready to take on various challenges of the GST accounting role.

Pair your GST accountant resume with a cover letter

A cover letter is a brief document you send with your resume when applying for a job. It introduces you to potential employers and highlights your most relevant experiences and skills. A well-crafted cover letter helps you stand out, showing why you are a good fit for the job and demonstrating your enthusiasm for the role.

For a GST accountant, your cover letter should focus on your expertise in tax regulations and financial reporting. Highlight your experience with GST compliance, audits, and your proficiency with accounting software. Show how your skills can meet the specific needs of the employer, using examples from past work to demonstrate your capabilities.

Creating a professional cover letter can be easy with Resume Mentor's cover letter builder. It simplifies the process, ensuring your content is clear and well-structured. With the added benefit of exporting your letter to PDF format, your formatting and information remain intact and professional. Ready to get started? Use Resume Mentor now and craft the perfect cover letter with ease!

Nora Wright

Jacksonville, Florida

+1-(234)-555-1234

help@resumementor.com

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.