Junior Finance Executive Resume Examples

Jul 18, 2024

|

12 min read

Crafting a junior finance executive resume: Balance your skills for investment in your future position

Rated by 348 people

Junior Executive in Financial Analysis

Junior Financial Planning Executive

Junior Finance Executive for Risk Management

Junior Investment Finance Executive

Junior Corporate Finance Executive

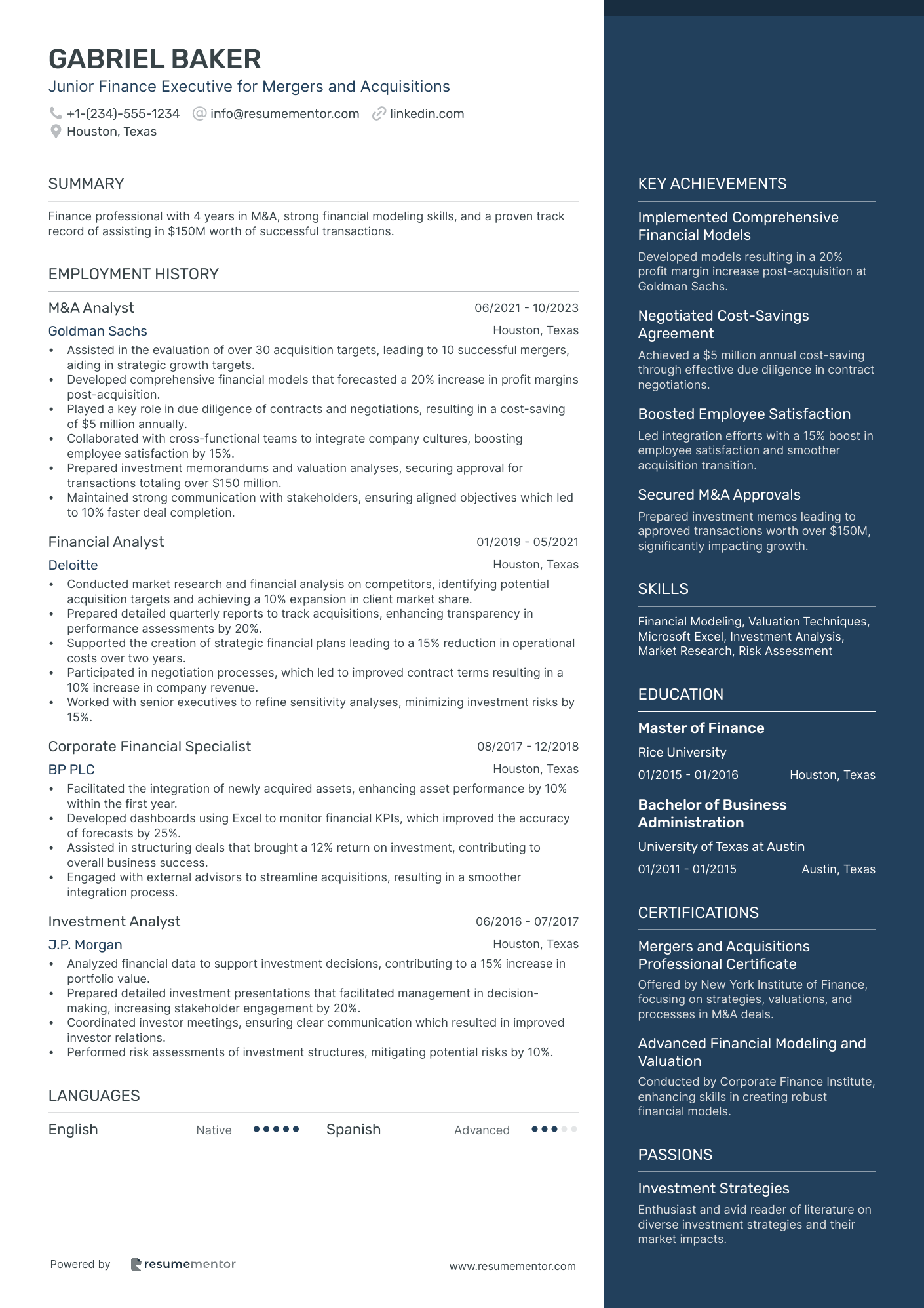

Junior Finance Executive for Mergers and Acquisitions

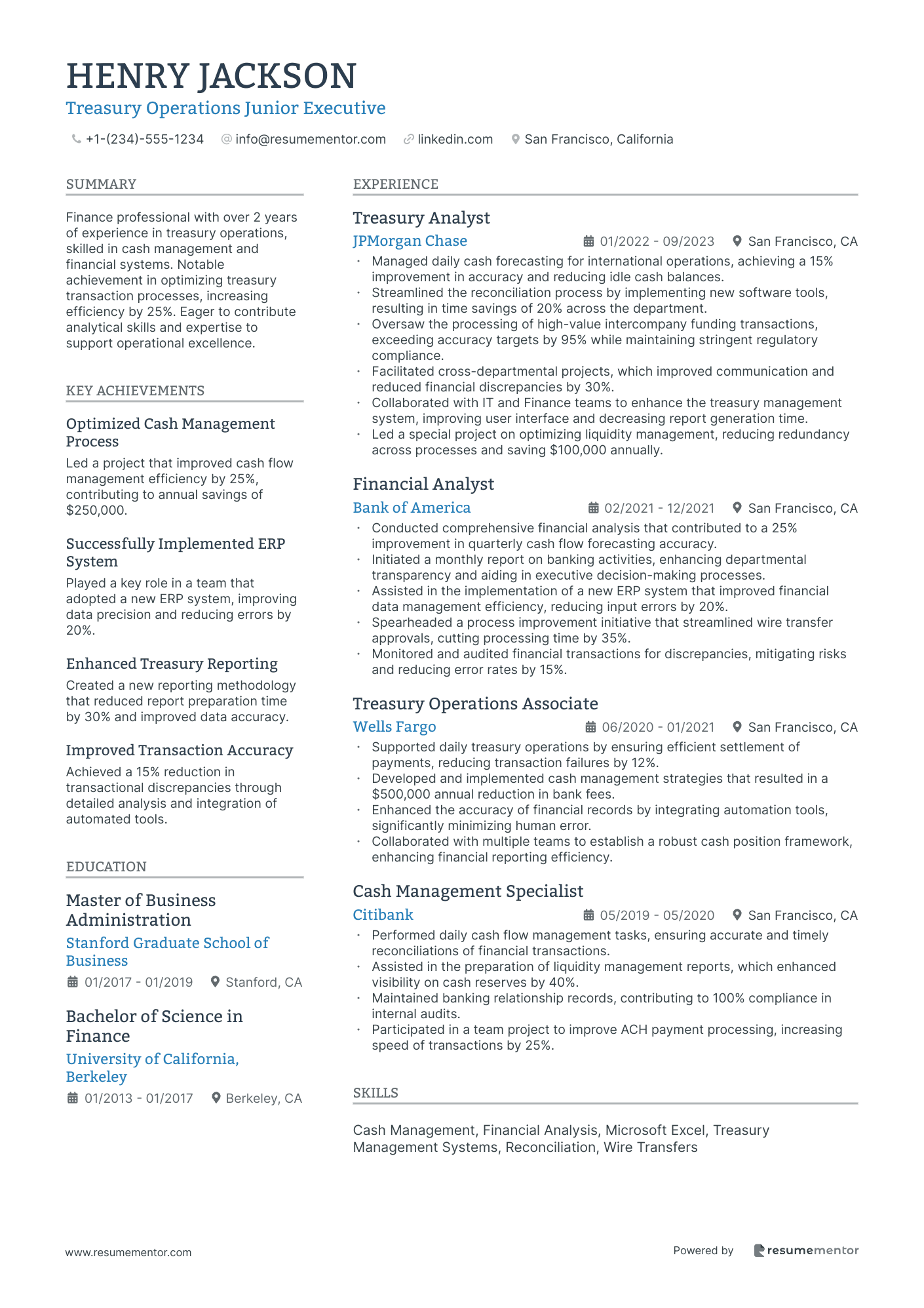

Treasury Operations Junior Executive

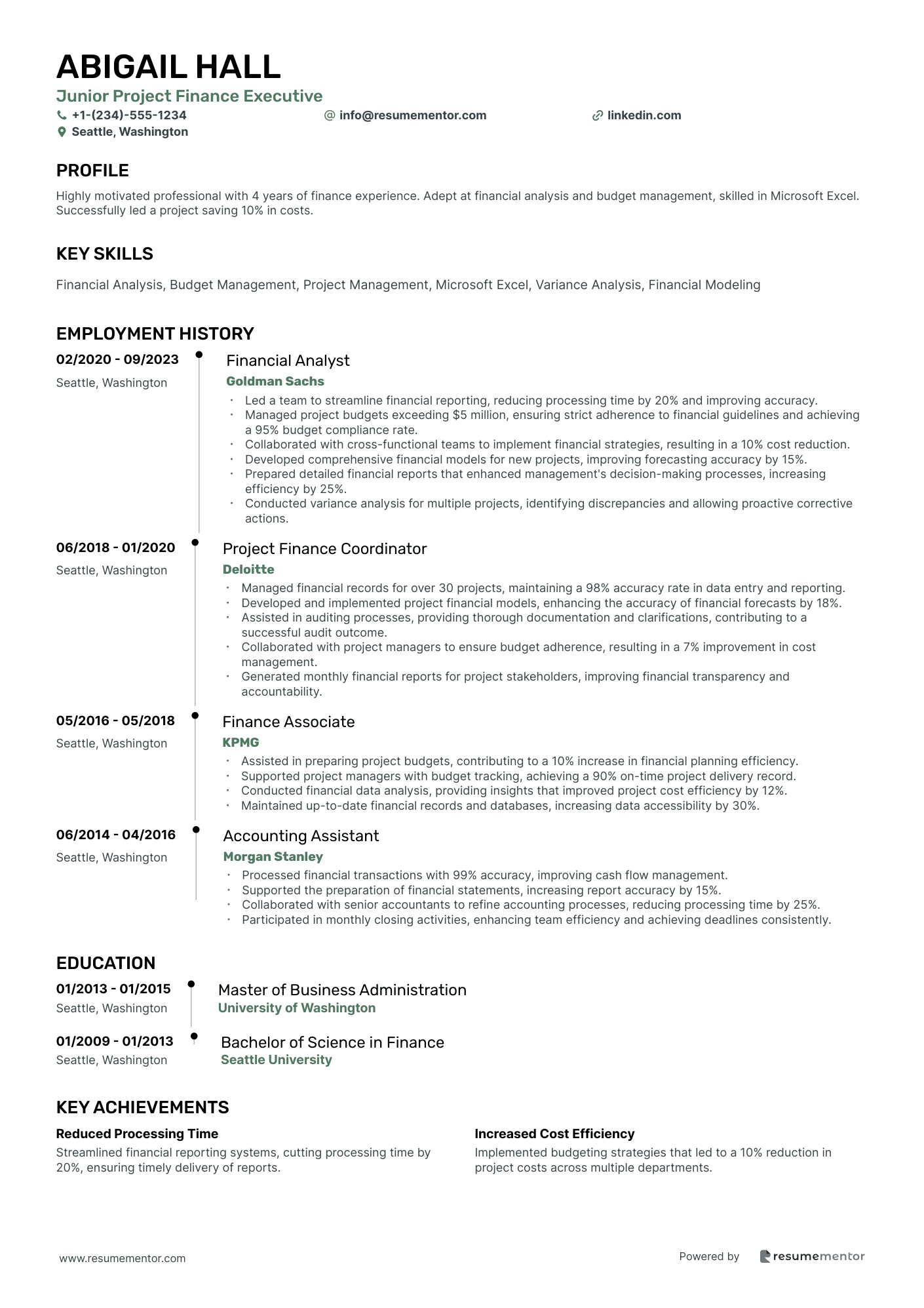

Junior Project Finance Executive

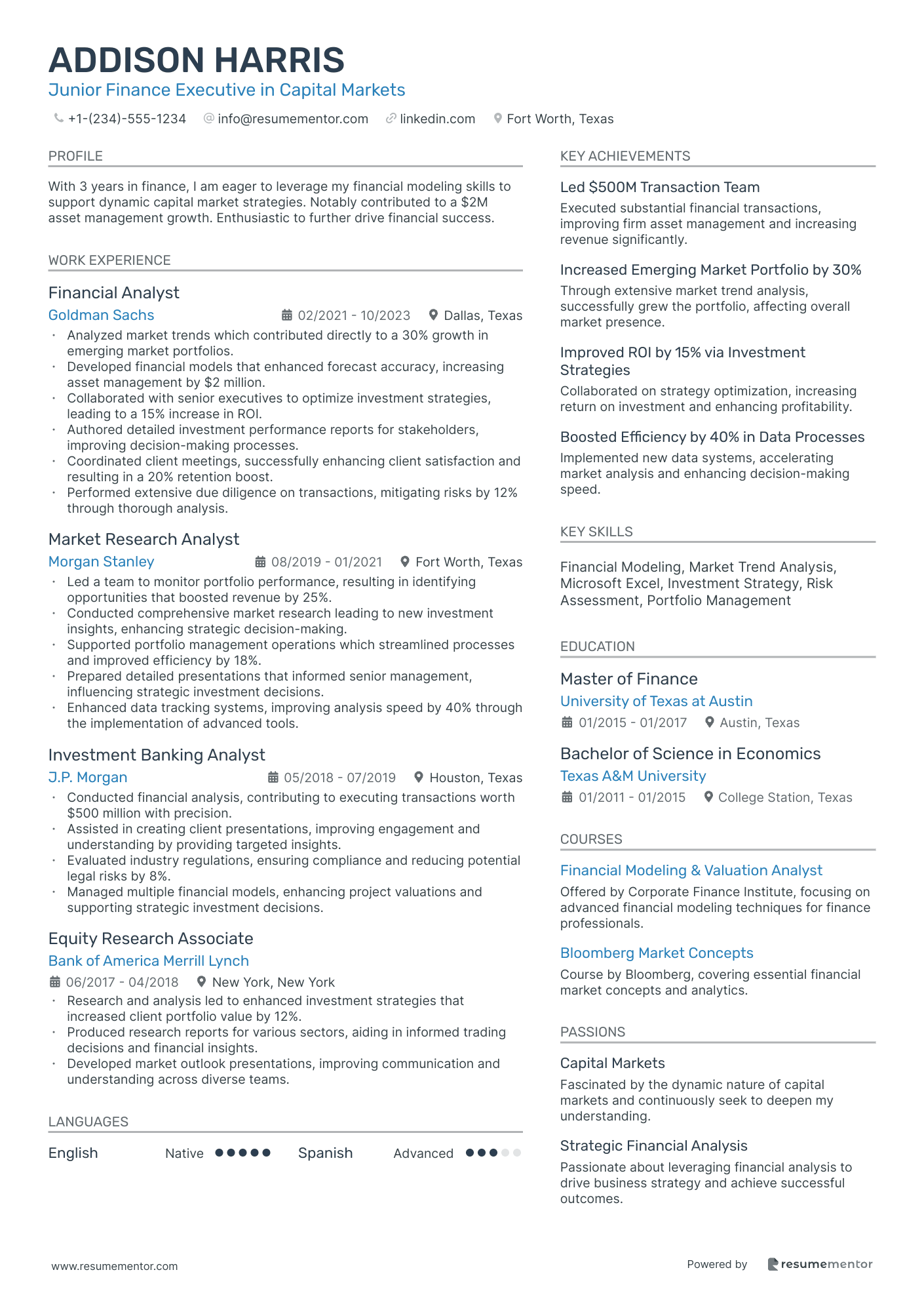

Junior Finance Executive in Capital Markets

Junior Executive in Financial Reporting

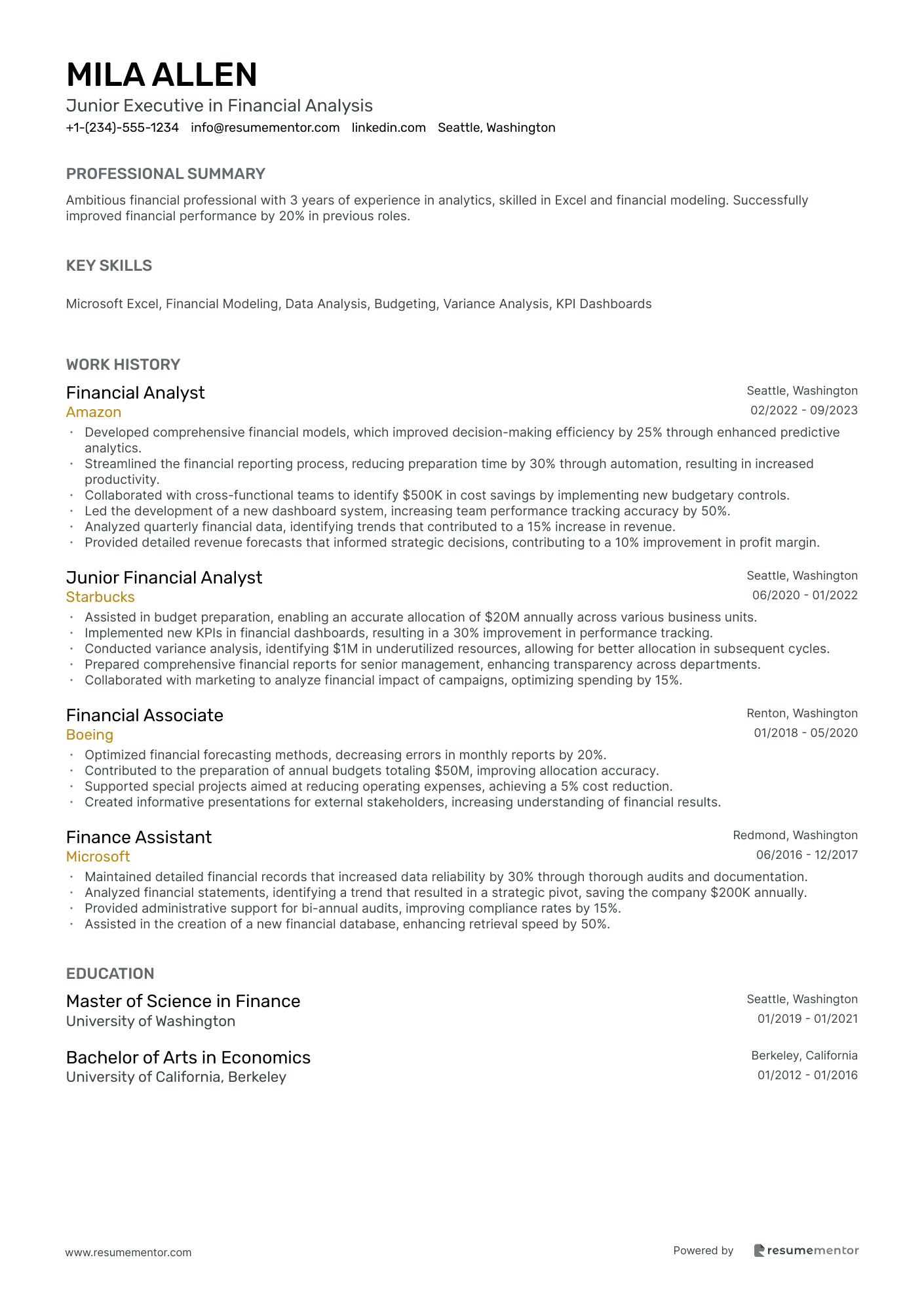

Junior Executive in Financial Analysis resume sample

- •Developed comprehensive financial models, which improved decision-making efficiency by 25% through enhanced predictive analytics.

- •Streamlined the financial reporting process, reducing preparation time by 30% through automation, resulting in increased productivity.

- •Collaborated with cross-functional teams to identify $500K in cost savings by implementing new budgetary controls.

- •Led the development of a new dashboard system, increasing team performance tracking accuracy by 50%.

- •Analyzed quarterly financial data, identifying trends that contributed to a 15% increase in revenue.

- •Provided detailed revenue forecasts that informed strategic decisions, contributing to a 10% improvement in profit margin.

- •Assisted in budget preparation, enabling an accurate allocation of $20M annually across various business units.

- •Implemented new KPIs in financial dashboards, resulting in a 30% improvement in performance tracking.

- •Conducted variance analysis, identifying $1M in underutilized resources, allowing for better allocation in subsequent cycles.

- •Prepared comprehensive financial reports for senior management, enhancing transparency across departments.

- •Collaborated with marketing to analyze financial impact of campaigns, optimizing spending by 15%.

- •Optimized financial forecasting methods, decreasing errors in monthly reports by 20%.

- •Contributed to the preparation of annual budgets totaling $50M, improving allocation accuracy.

- •Supported special projects aimed at reducing operating expenses, achieving a 5% cost reduction.

- •Created informative presentations for external stakeholders, increasing understanding of financial results.

- •Maintained detailed financial records that increased data reliability by 30% through thorough audits and documentation.

- •Analyzed financial statements, identifying a trend that resulted in a strategic pivot, saving the company $200K annually.

- •Provided administrative support for bi-annual audits, improving compliance rates by 15%.

- •Assisted in the creation of a new financial database, enhancing retrieval speed by 50%.

Junior Financial Planning Executive resume sample

- •Developed and analyzed monthly financial reports, improving reliability by 20% through enhanced data accuracy.

- •Collaborated with cross-departmental teams to streamline operations, resulting in a 25% increase in efficiency.

- •Led budgeting processes that drove cost reductions of 10% across multiple departments.

- •Created and maintained financial models that supported strategic decision-making and business planning.

- •Conducted comprehensive market research to support financial forecasting and competitive analysis strategies.

- •Prepared detailed presentation materials for stakeholders, leading to improved strategic insights.

- •Assisted in financial planning initiatives that increased revenue by 12% through strategic insights.

- •Monitored variance reports and provided actionable recommendations that improved financial planning accuracy by 15%.

- •Worked closely with senior members to set and track financial goals, resulting in stronger budget adherence.

- •Conducted competitive analysis, identifying key market trends that influenced decision-making.

- •Facilitated the development of financial reporting tools that increased data accessibility by 30%.

- •Supported the implementation of new financial planning software, reducing process completion time by 40%.

- •Engaged in analytical projects, enhancing forecasting accuracy and business performance metrics.

- •Collaborated with financial managers to track performance metrics, significantly improving interpretability.

- •Improved client satisfaction by managing ad-hoc financial requests and delivering personalized reporting solutions.

- •Performed detailed data analysis which contributed to strategic budget enhancements.

- •Assisted in monthly and quarterly financial closings, improving report accuracy by ensuring data integrity.

- •Streamlined financial reporting processes, reducing the preparation time by 25%.

- •Provided support for financial projects, efficiently prioritizing tasks to meet tight deadlines.

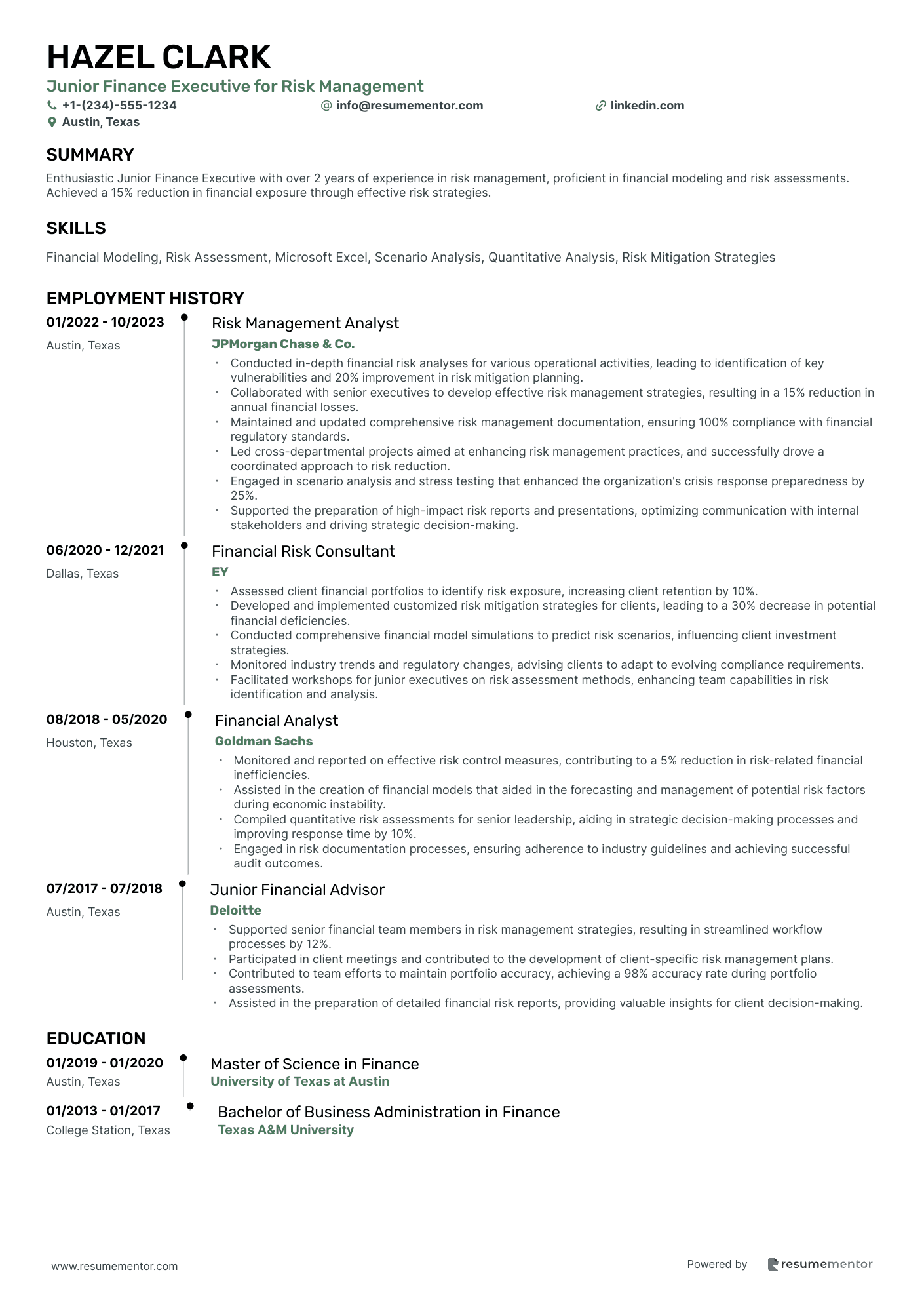

Junior Finance Executive for Risk Management resume sample

- •Conducted in-depth financial risk analyses for various operational activities, leading to identification of key vulnerabilities and 20% improvement in risk mitigation planning.

- •Collaborated with senior executives to develop effective risk management strategies, resulting in a 15% reduction in annual financial losses.

- •Maintained and updated comprehensive risk management documentation, ensuring 100% compliance with financial regulatory standards.

- •Led cross-departmental projects aimed at enhancing risk management practices, and successfully drove a coordinated approach to risk reduction.

- •Engaged in scenario analysis and stress testing that enhanced the organization's crisis response preparedness by 25%.

- •Supported the preparation of high-impact risk reports and presentations, optimizing communication with internal stakeholders and driving strategic decision-making.

- •Assessed client financial portfolios to identify risk exposure, increasing client retention by 10%.

- •Developed and implemented customized risk mitigation strategies for clients, leading to a 30% decrease in potential financial deficiencies.

- •Conducted comprehensive financial model simulations to predict risk scenarios, influencing client investment strategies.

- •Monitored industry trends and regulatory changes, advising clients to adapt to evolving compliance requirements.

- •Facilitated workshops for junior executives on risk assessment methods, enhancing team capabilities in risk identification and analysis.

- •Monitored and reported on effective risk control measures, contributing to a 5% reduction in risk-related financial inefficiencies.

- •Assisted in the creation of financial models that aided in the forecasting and management of potential risk factors during economic instability.

- •Compiled quantitative risk assessments for senior leadership, aiding in strategic decision-making processes and improving response time by 10%.

- •Engaged in risk documentation processes, ensuring adherence to industry guidelines and achieving successful audit outcomes.

- •Supported senior financial team members in risk management strategies, resulting in streamlined workflow processes by 12%.

- •Participated in client meetings and contributed to the development of client-specific risk management plans.

- •Contributed to team efforts to maintain portfolio accuracy, achieving a 98% accuracy rate during portfolio assessments.

- •Assisted in the preparation of detailed financial risk reports, providing valuable insights for client decision-making.

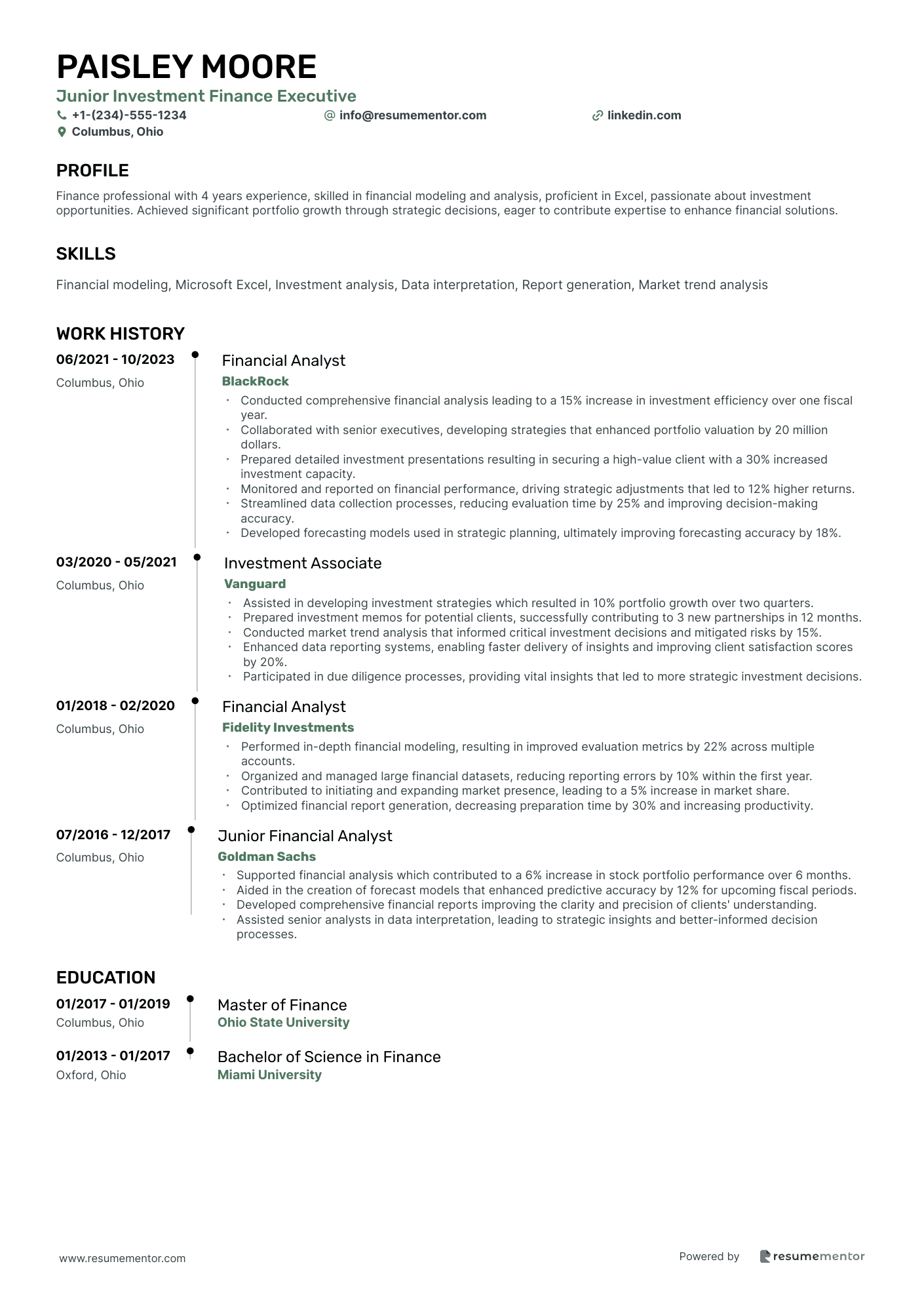

Junior Investment Finance Executive resume sample

- •Conducted comprehensive financial analysis leading to a 15% increase in investment efficiency over one fiscal year.

- •Collaborated with senior executives, developing strategies that enhanced portfolio valuation by 20 million dollars.

- •Prepared detailed investment presentations resulting in securing a high-value client with a 30% increased investment capacity.

- •Monitored and reported on financial performance, driving strategic adjustments that led to 12% higher returns.

- •Streamlined data collection processes, reducing evaluation time by 25% and improving decision-making accuracy.

- •Developed forecasting models used in strategic planning, ultimately improving forecasting accuracy by 18%.

- •Assisted in developing investment strategies which resulted in 10% portfolio growth over two quarters.

- •Prepared investment memos for potential clients, successfully contributing to 3 new partnerships in 12 months.

- •Conducted market trend analysis that informed critical investment decisions and mitigated risks by 15%.

- •Enhanced data reporting systems, enabling faster delivery of insights and improving client satisfaction scores by 20%.

- •Participated in due diligence processes, providing vital insights that led to more strategic investment decisions.

- •Performed in-depth financial modeling, resulting in improved evaluation metrics by 22% across multiple accounts.

- •Organized and managed large financial datasets, reducing reporting errors by 10% within the first year.

- •Contributed to initiating and expanding market presence, leading to a 5% increase in market share.

- •Optimized financial report generation, decreasing preparation time by 30% and increasing productivity.

- •Supported financial analysis which contributed to a 6% increase in stock portfolio performance over 6 months.

- •Aided in the creation of forecast models that enhanced predictive accuracy by 12% for upcoming fiscal periods.

- •Developed comprehensive financial reports improving the clarity and precision of clients' understanding.

- •Assisted senior analysts in data interpretation, leading to strategic insights and better-informed decision processes.

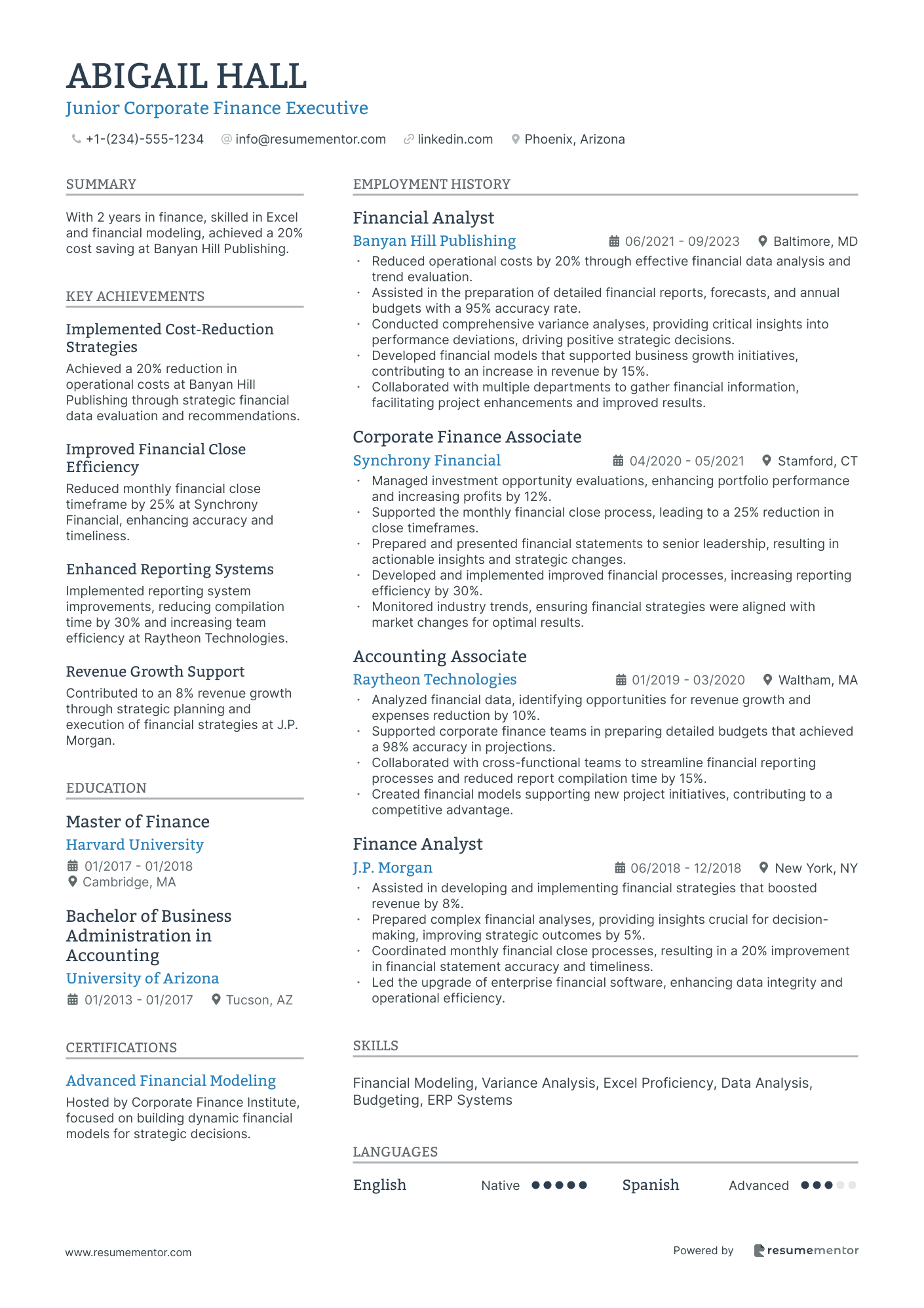

Junior Corporate Finance Executive resume sample

- •Reduced operational costs by 20% through effective financial data analysis and trend evaluation.

- •Assisted in the preparation of detailed financial reports, forecasts, and annual budgets with a 95% accuracy rate.

- •Conducted comprehensive variance analyses, providing critical insights into performance deviations, driving positive strategic decisions.

- •Developed financial models that supported business growth initiatives, contributing to an increase in revenue by 15%.

- •Collaborated with multiple departments to gather financial information, facilitating project enhancements and improved results.

- •Managed investment opportunity evaluations, enhancing portfolio performance and increasing profits by 12%.

- •Supported the monthly financial close process, leading to a 25% reduction in close timeframes.

- •Prepared and presented financial statements to senior leadership, resulting in actionable insights and strategic changes.

- •Developed and implemented improved financial processes, increasing reporting efficiency by 30%.

- •Monitored industry trends, ensuring financial strategies were aligned with market changes for optimal results.

- •Analyzed financial data, identifying opportunities for revenue growth and expenses reduction by 10%.

- •Supported corporate finance teams in preparing detailed budgets that achieved a 98% accuracy in projections.

- •Collaborated with cross-functional teams to streamline financial reporting processes and reduced report compilation time by 15%.

- •Created financial models supporting new project initiatives, contributing to a competitive advantage.

- •Assisted in developing and implementing financial strategies that boosted revenue by 8%.

- •Prepared complex financial analyses, providing insights crucial for decision-making, improving strategic outcomes by 5%.

- •Coordinated monthly financial close processes, resulting in a 20% improvement in financial statement accuracy and timeliness.

- •Led the upgrade of enterprise financial software, enhancing data integrity and operational efficiency.

Junior Finance Executive for Mergers and Acquisitions resume sample

- •Assisted in the evaluation of over 30 acquisition targets, leading to 10 successful mergers, aiding in strategic growth targets.

- •Developed comprehensive financial models that forecasted a 20% increase in profit margins post-acquisition.

- •Played a key role in due diligence of contracts and negotiations, resulting in a cost-saving of $5 million annually.

- •Collaborated with cross-functional teams to integrate company cultures, boosting employee satisfaction by 15%.

- •Prepared investment memorandums and valuation analyses, securing approval for transactions totaling over $150 million.

- •Maintained strong communication with stakeholders, ensuring aligned objectives which led to 10% faster deal completion.

- •Conducted market research and financial analysis on competitors, identifying potential acquisition targets and achieving a 10% expansion in client market share.

- •Prepared detailed quarterly reports to track acquisitions, enhancing transparency in performance assessments by 20%.

- •Supported the creation of strategic financial plans leading to a 15% reduction in operational costs over two years.

- •Participated in negotiation processes, which led to improved contract terms resulting in a 10% increase in company revenue.

- •Worked with senior executives to refine sensitivity analyses, minimizing investment risks by 15%.

- •Facilitated the integration of newly acquired assets, enhancing asset performance by 10% within the first year.

- •Developed dashboards using Excel to monitor financial KPIs, which improved the accuracy of forecasts by 25%.

- •Assisted in structuring deals that brought a 12% return on investment, contributing to overall business success.

- •Engaged with external advisors to streamline acquisitions, resulting in a smoother integration process.

- •Analyzed financial data to support investment decisions, contributing to a 15% increase in portfolio value.

- •Prepared detailed investment presentations that facilitated management in decision-making, increasing stakeholder engagement by 20%.

- •Coordinated investor meetings, ensuring clear communication which resulted in improved investor relations.

- •Performed risk assessments of investment structures, mitigating potential risks by 10%.

Treasury Operations Junior Executive resume sample

- •Managed daily cash forecasting for international operations, achieving a 15% improvement in accuracy and reducing idle cash balances.

- •Streamlined the reconciliation process by implementing new software tools, resulting in time savings of 20% across the department.

- •Oversaw the processing of high-value intercompany funding transactions, exceeding accuracy targets by 95% while maintaining stringent regulatory compliance.

- •Facilitated cross-departmental projects, which improved communication and reduced financial discrepancies by 30%.

- •Collaborated with IT and Finance teams to enhance the treasury management system, improving user interface and decreasing report generation time.

- •Led a special project on optimizing liquidity management, reducing redundancy across processes and saving $100,000 annually.

- •Conducted comprehensive financial analysis that contributed to a 25% improvement in quarterly cash flow forecasting accuracy.

- •Initiated a monthly report on banking activities, enhancing departmental transparency and aiding in executive decision-making processes.

- •Assisted in the implementation of a new ERP system that improved financial data management efficiency, reducing input errors by 20%.

- •Spearheaded a process improvement initiative that streamlined wire transfer approvals, cutting processing time by 35%.

- •Monitored and audited financial transactions for discrepancies, mitigating risks and reducing error rates by 15%.

- •Supported daily treasury operations by ensuring efficient settlement of payments, reducing transaction failures by 12%.

- •Developed and implemented cash management strategies that resulted in a $500,000 annual reduction in bank fees.

- •Enhanced the accuracy of financial records by integrating automation tools, significantly minimizing human error.

- •Collaborated with multiple teams to establish a robust cash position framework, enhancing financial reporting efficiency.

- •Performed daily cash flow management tasks, ensuring accurate and timely reconciliations of financial transactions.

- •Assisted in the preparation of liquidity management reports, which enhanced visibility on cash reserves by 40%.

- •Maintained banking relationship records, contributing to 100% compliance in internal audits.

- •Participated in a team project to improve ACH payment processing, increasing speed of transactions by 25%.

Junior Project Finance Executive resume sample

- •Led a team to streamline financial reporting, reducing processing time by 20% and improving accuracy.

- •Managed project budgets exceeding $5 million, ensuring strict adherence to financial guidelines and achieving a 95% budget compliance rate.

- •Collaborated with cross-functional teams to implement financial strategies, resulting in a 10% cost reduction.

- •Developed comprehensive financial models for new projects, improving forecasting accuracy by 15%.

- •Prepared detailed financial reports that enhanced management's decision-making processes, increasing efficiency by 25%.

- •Conducted variance analysis for multiple projects, identifying discrepancies and allowing proactive corrective actions.

- •Managed financial records for over 30 projects, maintaining a 98% accuracy rate in data entry and reporting.

- •Developed and implemented project financial models, enhancing the accuracy of financial forecasts by 18%.

- •Assisted in auditing processes, providing thorough documentation and clarifications, contributing to a successful audit outcome.

- •Collaborated with project managers to ensure budget adherence, resulting in a 7% improvement in cost management.

- •Generated monthly financial reports for project stakeholders, improving financial transparency and accountability.

- •Assisted in preparing project budgets, contributing to a 10% increase in financial planning efficiency.

- •Supported project managers with budget tracking, achieving a 90% on-time project delivery record.

- •Conducted financial data analysis, providing insights that improved project cost efficiency by 12%.

- •Maintained up-to-date financial records and databases, increasing data accessibility by 30%.

- •Processed financial transactions with 99% accuracy, improving cash flow management.

- •Supported the preparation of financial statements, increasing report accuracy by 15%.

- •Collaborated with senior accountants to refine accounting processes, reducing processing time by 25%.

- •Participated in monthly closing activities, enhancing team efficiency and achieving deadlines consistently.

Junior Finance Executive in Capital Markets resume sample

- •Analyzed market trends which contributed directly to a 30% growth in emerging market portfolios.

- •Developed financial models that enhanced forecast accuracy, increasing asset management by $2 million.

- •Collaborated with senior executives to optimize investment strategies, leading to a 15% increase in ROI.

- •Authored detailed investment performance reports for stakeholders, improving decision-making processes.

- •Coordinated client meetings, successfully enhancing client satisfaction and resulting in a 20% retention boost.

- •Performed extensive due diligence on transactions, mitigating risks by 12% through thorough analysis.

- •Led a team to monitor portfolio performance, resulting in identifying opportunities that boosted revenue by 25%.

- •Conducted comprehensive market research leading to new investment insights, enhancing strategic decision-making.

- •Supported portfolio management operations which streamlined processes and improved efficiency by 18%.

- •Prepared detailed presentations that informed senior management, influencing strategic investment decisions.

- •Enhanced data tracking systems, improving analysis speed by 40% through the implementation of advanced tools.

- •Conducted financial analysis, contributing to executing transactions worth $500 million with precision.

- •Assisted in creating client presentations, improving engagement and understanding by providing targeted insights.

- •Evaluated industry regulations, ensuring compliance and reducing potential legal risks by 8%.

- •Managed multiple financial models, enhancing project valuations and supporting strategic investment decisions.

- •Research and analysis led to enhanced investment strategies that increased client portfolio value by 12%.

- •Produced research reports for various sectors, aiding in informed trading decisions and financial insights.

- •Developed market outlook presentations, improving communication and understanding across diverse teams.

Junior Executive in Financial Reporting resume sample

- •Led the refinement of monthly financial reporting procedures, reducing report generation time by 25% through optimization.

- •Collaborated with cross-functional teams to enhance data accuracy, resulting in a 15% reduction in reporting discrepancies.

- •Assisted in the preparation of financial statements, ensuring compliance with GAAP standards and improving audit readiness by 20%.

- •Managed variance analysis for quarterly earnings, contributing detailed insights that supported strategic management decisions.

- •Built custom financial reporting models in Excel, resulting in improved forecast accuracy and time savings of up to 10 hours per month.

- •Partnered with IT to integrate new financial reporting tools, enhancing overall process efficiency by 10%.

- •Facilitated financial close processes, ensuring accuracy and reducing error rates by 20% through meticulous reconciliation.

- •Supported the external audit team by compiling and providing necessary documentation, resulting in a seamless audit experience.

- •Participated in cross-departmental meetings to gather financial data, improving data integrity and analysis outputs.

- •Assisted in developing financial reports for internal stakeholders, streamlining report delivery by 30%.

- •Enhanced compliance checks, leading to a 10% improvement in adherence to financial policies and procedures.

- •Assisted in monthly financial reconciliations, increasing accuracy and reducing mismatches by 15%.

- •Contributed to the improvement of financial reporting practices, achieving a 20% decrease in report finalization time.

- •Maintained detailed records and documentation, supporting a cleaner audit trail with minimal discrepancies.

- •Facilitated communication between departments, improving the flow of financial information and decreasing errors.

- •Supported the finance team with the preparation of routine reports, contributing to time savings of 10 hours per quarter.

- •Participated in data entry refinement, enhancing accuracy and decreasing database errors by 15% through attention to detail.

- •Helped streamline processes by implementing standardized financial documentation, resulting in better compliance tracking.

- •Improved the data integrity by conducting thorough reviews, leading to more reliable financial analyses.

Crafting a resume as a junior finance executive can feel like perfecting an elevator pitch because it's your chance to leave a strong impression. You need it to stand out by highlighting not just your financial skills and analytical abilities, but also your knack for solving problems in creative ways. Tackling the competitive finance job market can be daunting since others may have more experience; however, a strong resume can turn the tide by reflecting your expertise and potential.

A well-structured resume template serves as your guiding light, ensuring everything remains polished and professional. These templates simplify the design process, allowing you to concentrate on creating content that resonates. By telling a compelling story, your resume can connect powerfully with hiring managers who are eager to see your true capabilities.

Think of your resume as the first handshake with a potential employer. It's critical for you, as a junior executive, to grasp what finance recruiters are seeking, and a refined resume is your ticket to success. With the right template laying the groundwork, you're stepping confidently towards your next big opportunity in the finance world.

Key Takeaways

- Crafting a resume as a junior finance executive is akin to refining an elevator pitch, emphasizing not only your finance and analytical skills but also your creative problem-solving abilities.

- A well-structured resume template is crucial for maintaining professionalism and allowing you to focus on presenting compelling content that resonates with hiring managers.

- Effective resume experience sections should highlight quantifiable achievements and connect them to the role's responsibilities, using action verbs for clarity and impact.

- When detailing your skills, balance technical proficiencies like financial analysis and Excel with soft skills such as teamwork and communication to attract hiring managers and ATS systems.

- Extra sections like language proficiency, volunteer work, and personal interests can showcase your individuality and broaden your appeal to potential employers.

What to focus on when writing your junior finance executive resume

A junior finance executive resume should communicate your financial expertise and analytical abilities to the recruiter, showcasing your readiness to manage data and assist in strategic planning to meet company goals.

How to structure your junior finance executive resume

- Contact Information: Start with your full name, phone number, email address, and LinkedIn profile link, ensuring recruiters can easily reach you—these are the essential elements that set the stage for a professional first impression.

- Professional Summary: Follow this with a concise paragraph that highlights your finance skills, recent successes, and career objectives—this is your chance to grab attention and outline your unique value proposition.

- Education: List your degree in finance or a related field, along with the institution and graduation date. For recent graduates, relevant courses can underscore your foundation in finance—demonstrating both your academic achievements and your commitment to the field.

- Experience: Detail your past finance roles, focusing on achievements and contributions to projects, illustrating how you apply your education and skills in real-world scenarios—this builds a clear narrative of your career path and potential.

- Skills: Highlight specific abilities like budgeting, forecasting, or financial modeling, showcasing proficiency in tools like Excel or SAP to emphasize your technical capabilities—helping to illustrate your readiness to handle complex financial tasks.

- Certifications: Include certifications such as CFA Level I or CPA, which reflect your commitment to furthering your expertise in finance—these credentials can set you apart in a competitive job market.

In addition, sections like "Awards & Honors" or "Professional Affiliations" can enhance your resume by demonstrating your dedication and involvement in the financial field. Below, we'll cover each section more in-depth.

Which resume format to choose

Crafting a standout resume as a junior finance executive can help you get ahead in the finance field. Begin with a reverse-chronological format, which highlights your most recent experiences. This approach is beneficial in showcasing your latest skills and achievements, making it easier for potential employers to see your growth in the industry. Choosing the right font is important to ensure clarity; go for modern options like Raleway, Montserrat, or Lato. These fonts provide a fresh and professional look, enhancing readability without overwhelming the content.

Saving your resume as a PDF is vital. This file type preserves your formatting and ensures that your resume looks the same on any device, maintaining the professional appearance you've carefully crafted. Consistency in layout is also key; keeping margins about one inch all around helps maintain a clean and organized look. This attention to detail demonstrates professionalism and makes your resume more inviting for employers to read. By integrating these elements, you'll create a resume that effectively communicates your potential as a junior finance executive.

How to write a quantifiable resume experience section

Your experience section is crucial for showing employers your accomplishments and skills in finance. Highlight achievements with measurable results, seamlessly integrating keywords from the job you're targeting. Structure your work history in chronological order, focusing on the last 5-10 years of relevant roles. Use accurate job titles that reflect your responsibilities and choose action words like "managed," "analyzed," "implemented," and "optimized" to highlight your impact.

This section demonstrates the value you bring by blending your skills and contributions. Tailor each entry with keywords and responsibilities from the job ad, ensuring your experience aligns perfectly with employer needs. Each bullet point should convey specific and quantifiable impacts, drawing a clear picture of your past achievements.

Here’s a refined example of a junior finance executive resume experience:

- •Analyzed and optimized budget plans, achieving a 15% cost reduction over two fiscal quarters.

- •Prepared monthly financial reports that accurately projected quarterly earnings with a 2% variance.

- •Led cross-functional teams to streamline financial procedures, boosting efficiency by 25%.

- •Developed a new forecasting model, increasing accuracy by 20%.

This example effectively portrays what employers are seeking, creating a cohesive narrative of past successes. Each bullet point is crafted to interconnect through specific outcomes, illustrating how your actions led to concrete results. By using words like "analyzed" and "developed," you underline your active role, while tailoring the narrative to align with the job ensures each point highlights relevant skills. The cohesive format offers a professional, engaging overview, making it easy for hiring managers to quickly perceive your potential contributions.

Training and Development Focused resume experience section

A junior finance executive resume with a focus on training and development should effectively showcase how your skills and experiences match the job's key responsibilities. Start by selecting specific examples from your previous roles that highlight your ability to enhance financial knowledge and improve team skills. Including measurable outcomes, like a noticeable increase in team proficiency, helps to demonstrate the impact of your efforts. Be sure to use active, straightforward language, ensuring each bullet point is clear and concise.

Weave together a narrative of how you've grown professionally in finance training and development. Make it evident you've made a difference by highlighting achievements like leading workshops or crafting training materials. Through each bullet point, emphasize the results and benefits of your actions, not just for yourself, but for your team and organization. This approach not only underscores your financial expertise but also reflects your commitment to fostering a positive educational environment.

Junior Finance Executive

ABC Financial Services

June 2020 - Present

- Led a team in creating an online finance course that increased team proficiency by 30%

- Collaborated with senior executives to identify crucial training needs and tailored content to address them

- Facilitated weekly workshops that boosted junior staff confidence in financial analysis

- Implemented a mentorship program that paired new employees with experienced mentors, enhancing onboarding efficiency

Project-Focused resume experience section

A project-focused junior finance executive resume experience section should clearly emphasize your involvement in specific projects and the impact you had. Start by identifying key projects that effectively highlight your finance skills and contributions. Use strong action verbs to seamlessly articulate your roles and demonstrate your achievements. Each point should be concise, showing a clear benefit to the company or project, and reflect measurable outcomes or impacts for better coherence.

When writing your examples, focus on connecting your actions to the results achieved, illustrating your ability to effectively drive projects. Describing what you did, the methods you employed, and the outcomes provides a comprehensive view of your potential. As a junior finance executive, displaying your ability to learn, adapt, and contribute meaningfully to team efforts can significantly strengthen your application.

Junior Finance Executive

Tech Innovators Inc.

June 2022 - March 2023

- Created a streamlined budgeting process that reduced project costs by 15%

- Analyzed financial data to produce detailed reports for senior management

- Worked with cross-functional teams to improve financial forecasting accuracy

- Led training sessions to roll out new financial software tools across departments

Growth-Focused resume experience section

A growth-focused junior finance executive resume experience section should highlight your achievements and showcase your potential for advancement. Begin by using simple, clear language to describe the tasks you undertook, emphasizing how your contributions positively impacted the company. By incorporating numbers and results, you can clearly demonstrate your effectiveness and problem-solving skills. Highlight your successes in team settings, showing how you contributed to achieving company goals. It’s essential to tailor these experiences to the specific job you’re applying for, directly addressing what the employer seeks.

Start with your job title, company name, and the dates of your employment. Each bullet point should seamlessly convey your role, responsibilities, and achievements. Use strong action verbs such as "analyzed," "developed," or "managed" to start each bullet point. Whenever possible, quantify your achievements, as this adds more weight to your contributions. Clearly describe leadership experiences, efficiency improvements, or project growth support, focusing on experiences that demonstrate your capacity to progress in your financial career.

Junior Finance Executive

Acme Corp

June 2021 - Present

- Managed monthly financial reporting, ensuring 100% accuracy and always meeting deadlines.

- Assisted in preparing quarterly budgets, leading to a 10% cost-saving across departments.

- Developed a new financial model that cut down the forecasting process time by 20%.

- Worked with the investment team to enhance portfolio performance, achieving a 5% increase in returns over the fiscal year.

Responsibility-Focused resume experience section

A responsibility-focused junior finance executive resume experience section should clearly highlight the key roles and accomplishments that demonstrate your ability to contribute to the team’s success. Begin by pinpointing your main responsibilities and transform them into achievements. This approach not only shows which tasks you handled but also illustrates your direct impact on your team and organization. Each bullet should offer a snapshot of your work that’s relevant to the finance field, making it easy for potential employers to see the value you bring.

Strengthen your bullet points by starting each one with an action verb, showcasing your proactive nature. Emphasize the outcomes or improvements you facilitated, and use numbers or percentages to make these impacts tangible and impressive. This strategy translates your duties into meaningful contributions, allowing employers to quickly grasp your strengths and see how you can add value to their team.

Junior Finance Executive

ABC Financial Group

June 2021 - Present

- Developed financial reports that improved decision-making processes, resulting in a 15% increase in efficiency.

- Collaborated with the team to manage client transactions, ensuring a 100% compliance with regulatory requirements.

- Monitored company budgets, identifying cost-saving opportunities that reduced expenses by 10%.

- Assisted in audits and streamlined data collection processes, enhancing accuracy by 20%.

Write your junior finance executive resume summary section

A finance-focused junior finance executive resume summary should make a strong first impression. When crafting yours, focus on capturing your skills, experience, and what you bring to the company. Highlight your finance knowledge, your ability to work with numbers, and any relevant achievements. For example:

This example is effective because it combines strong adjectives with clear, concise language, showcasing both skills and results. It helps potential employers visualize your contributions by demonstrating what you’ve accomplished. This contrasts with a resume objective, which usually focuses on personal goals, like "Seeking to join ABC Corp to apply finance skills in a dynamic environment." Whereas a summary reflects your achievements, an objective outlines your aspirations. A resume profile blends elements of both. On the other hand, a summary of qualifications is a bulleted list emphasizing key skills and achievements, ideally quantified. Keep your summary straightforward and tailor it to the specific job to reflect the key aspects of your professional background. As employers sift through numerous resumes, yours should quickly convey why you’re a great fit. Use this opportunity to stand out with specific examples of your skills and results.

Listing your junior finance executive skills on your resume

A skills-focused junior finance executive resume should spotlight your abilities in a clear and compelling way. Whether you choose to feature your skills in a standalone section or blend them into your experience or summary, the aim is to highlight what makes you an ideal fit for the role. Your strengths and soft skills showcase your ability to collaborate effectively, communicate well, and adapt to changing situations. Meanwhile, hard skills specifically relate to your job duties, including measurable abilities such as financial analysis or data management.

These skills and strengths are the resume keywords that capture the attention of hiring managers and ATS systems. They play a vital role in getting your resume noticed. Here’s how a standalone skills section might look:

This example effectively lists relevant skills for a junior finance executive role. It highlights technical abilities like "Financial Analysis" and software proficiency with "MS Excel," while also emphasizing important qualities like "Attention to Detail" and "Time Management." Each skill acts as a vital keyword, increasing the resume's appeal to both people and technology.

Best hard skills to feature on your junior finance executive resume

As a junior finance executive, your hard skills demonstrate that you're prepared to handle the technical demands of the job. They show your capability in finance, software usage, and data analysis.

Hard Skills

- Financial Analysis

- Data Management

- Budgeting

- MS Excel

- Forecasting

- Financial Reporting

- QuickBooks

- Risk Assessment

- Tax Preparation

- Financial Modeling

- Accounts Reconciliation

- SAP Software

- Cost Analysis

- Ledger Management

- Investment Analysis

Best soft skills to feature on your junior finance executive resume

Soft skills for this role underscore how well you work with others and adapt to various challenges. They highlight your ability to communicate effectively, solve problems, and collaborate.

Soft Skills

- Communication

- Problem-Solving

- Time Management

- Attention to Detail

- Adaptability

- Teamwork

- Critical Thinking

- Leadership

- Negotiation

- Ethical Judgment

- Stress Management

- Decision Making

- Multitasking

- Initiative

- Empathy

How to include your education on your resume

The education section of your resume is crucial, especially for a position like a junior finance executive. This section highlights your academic achievements and should be tailored to the job you are applying for. Any irrelevant education can be left out to keep the focus sharp.

When listing your degree, start with the most recent and relevant one. If you've received any honors like cum laude, place them next to your degree. For GPAs, include them only if they are impressive or specifically requested by the employer. Generally, a GPA above 3.5 (on a 4.0 scale) is considered noteworthy.

Here is an example of a poorly written education section:

Now, here's an example of an outstanding education section for a junior finance executive:

This second example is strong because it directly relates to the job of a junior finance executive. The degree in finance and the high GPA show your competence and dedication. Including honors like "Magna Cum Laude" highlights your academic excellence. The timeline is realistic and indicates recent completion, appealing to recruiters interested in fresh talent. This approach effectively communicates your qualifications without overwhelming the reader with unnecessary details.

How to include junior finance executive certificates on your resume

Including a certificates section in your junior finance executive resume is crucial as it showcases your additional qualifications and commitment to ongoing education. First, list the name of the certificate clearly. Include the date when you earned the certification to demonstrate its recency. Add the issuing organization to validate the certificate's authenticity.

You can also include certificates in the header to immediately catch the recruiter's attention. For example, "John Doe, CFA Level 1, Financial Modeling Certified."

A good example of a standalone certificates section should look like this:

This example is good because it lists certifications that are highly relevant to a junior finance executive role. It includes recognizable and respected organizations, lending credibility to your expertise. The date of "Certified Financial Planner (2022)" shows your commitment to recent professional development. These concise details help make your resume stand out.

Extra sections to include in your junior finance executive resume

As a junior finance executive, your resume is your first chance to make a positive impression on potential employers. Beyond your education and work experience, including sections like languages, hobbies and interests, volunteer work, and books can help showcase your individuality and depth.

Language section — List any languages you speak along with your proficiency level to highlight your communication skills and cultural awareness, which are essential in a global finance environment. This can set you apart from other candidates, showing you're capable of handling diverse client interactions.

Hobbies and interests section — Share hobbies that demonstrate relevant skills such as analytical thinking, teamwork, or leadership. This can illustrate your well-rounded personality and ability to balance work with other interests.

Volunteer work section — Detail any volunteer work to show your commitment to community service and your ability to take initiative. Volunteering can also demonstrate soft skills such as teamwork, communication, and problem-solving.

Books section — Mention finance-related books you've read to display your ongoing interest in the field and commitment to professional growth. This can show your willingness to stay informed about industry trends and best practices, giving you an edge in the competitive finance sector.

These additional sections not only add personality to your resume but also illustrate your diverse skill set, making you a more attractive candidate to potential employers. This holistic view of your abilities can set you on a successful path in your finance career.

In Conclusion

In conclusion, crafting a resume as a junior finance executive requires careful thought and attention to detail. With a structured approach, you can present your skills and experiences effectively. Begin by showcasing your contact information prominently, ensuring potential employers have a clear path to reach you. Capture attention early with a strong professional summary that highlights your achievements and aspirations. Education should follow, especially if it's recent and highly relevant to the finance sector.

Your work experience section serves as the core of your resume, illustrating your capabilities through quantifiable achievements. Use action verbs and detail your contributions with clear, measurable outcomes to convey your impact. Don’t forget to incorporate relevant financial skills that resonate with potential employers. Listing certifications can further emphasize your commitment to professional excellence and ongoing learning.

Additionally, consider including sections that highlight your individuality, such as volunteer work, hobbies, or language proficiencies, providing a fuller picture of who you are beyond your professional capabilities. These elements personalize your resume and can make a significant difference in setting you apart in a crowded job market. An effective resume not only captures your past but meticulously aligns it with the future you are aiming to pursue in the finance industry.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.