Mortgage Banking Resume Examples

Jul 18, 2024

|

12 min read

Crafting your mortgage banking resume: Elevate your career with these insider tips to stand out and secure your dream job. This guide makes writing your resume as easy as a perfect credit score!

Rated by 348 people

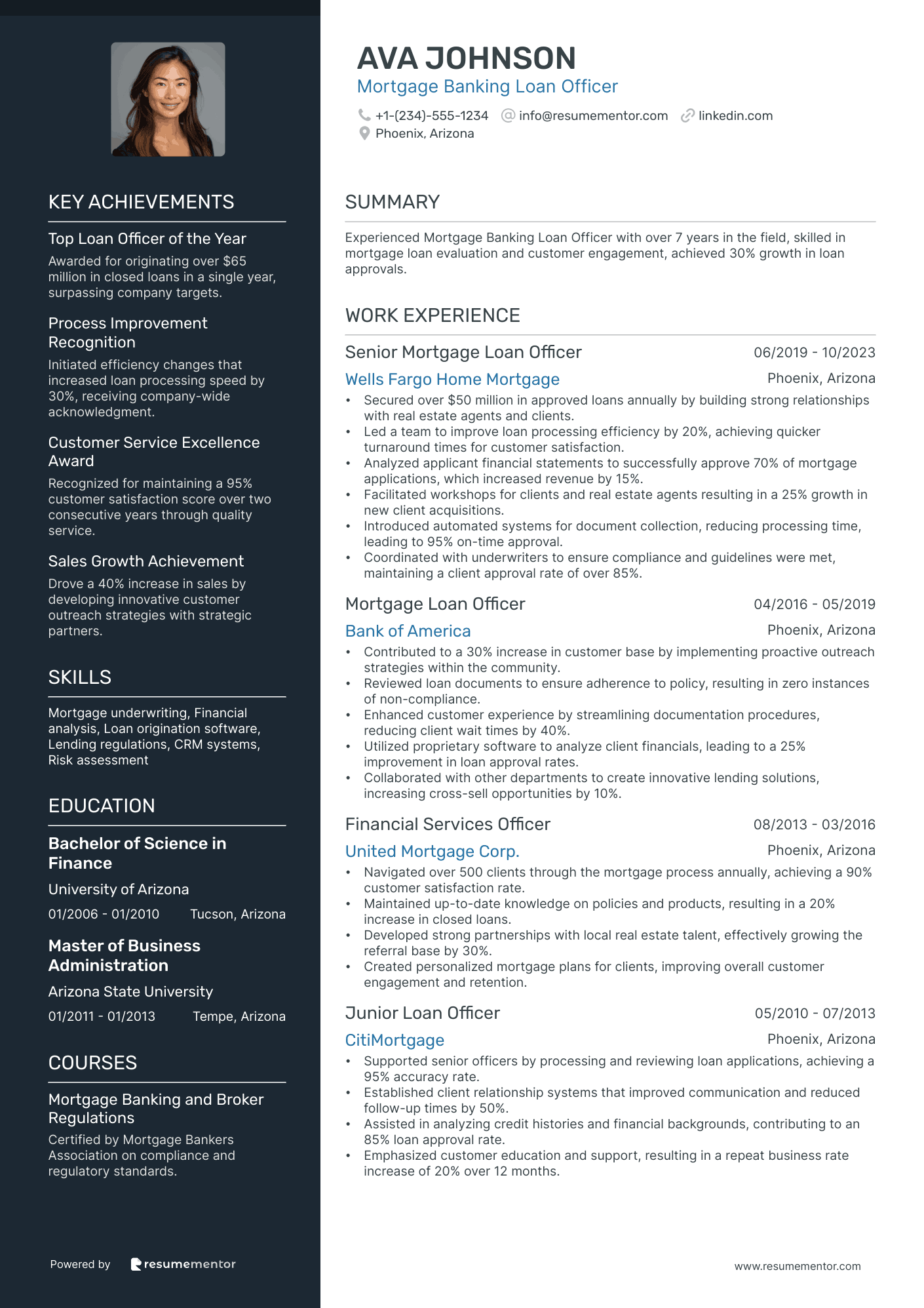

Mortgage Banking Loan Officer

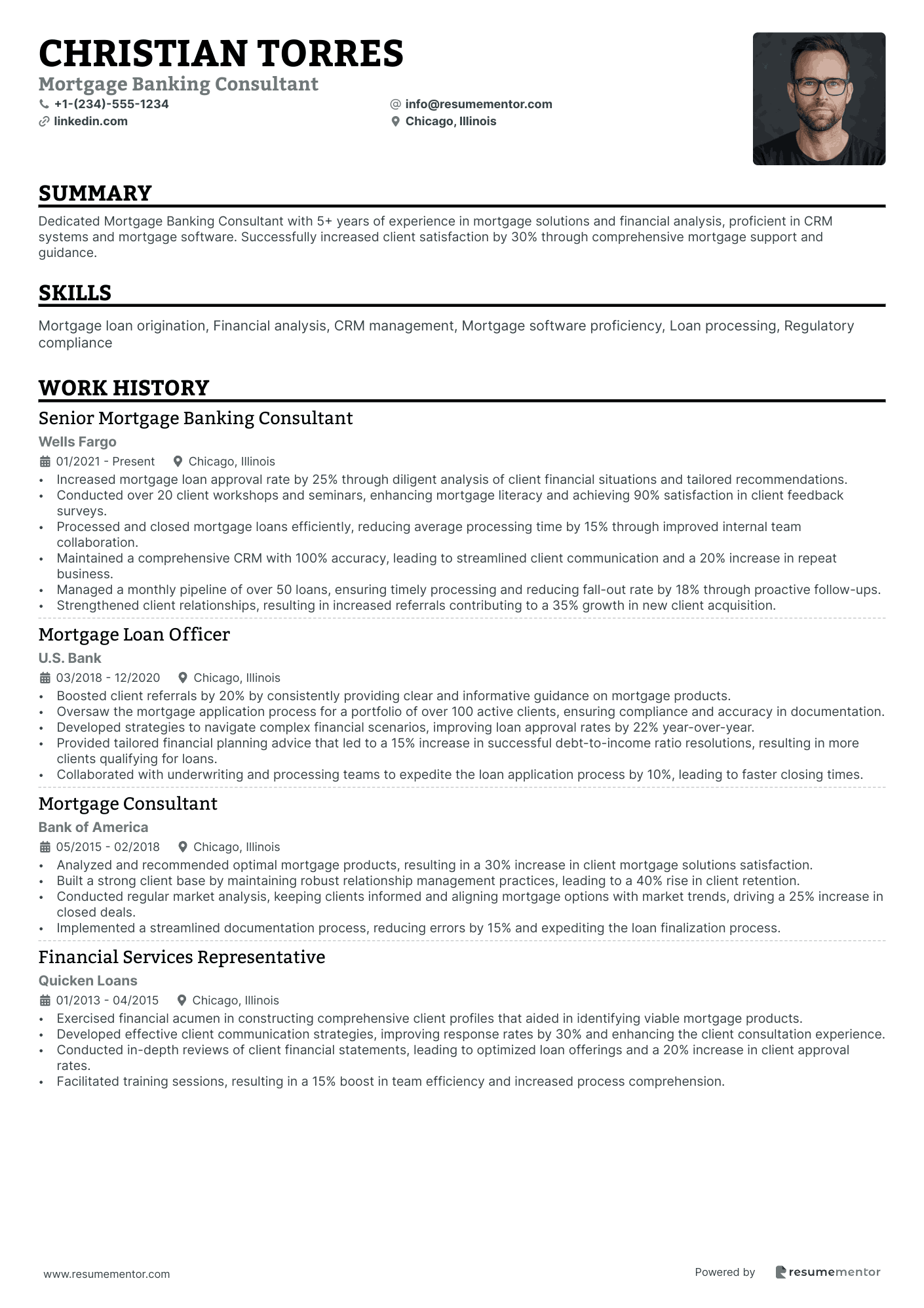

Mortgage Banking Consultant

Residential Mortgage Banker

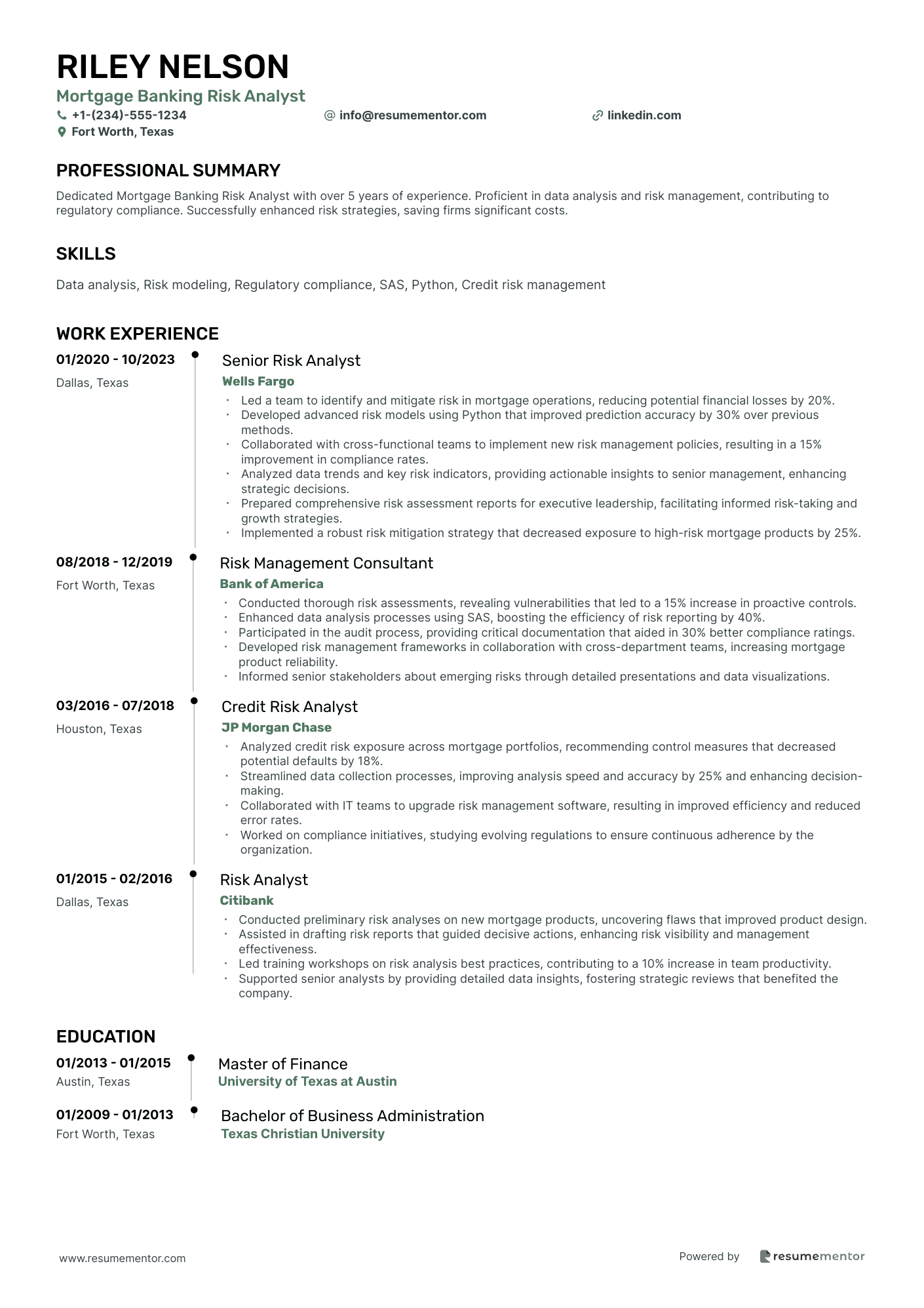

Mortgage Banking Risk Analyst

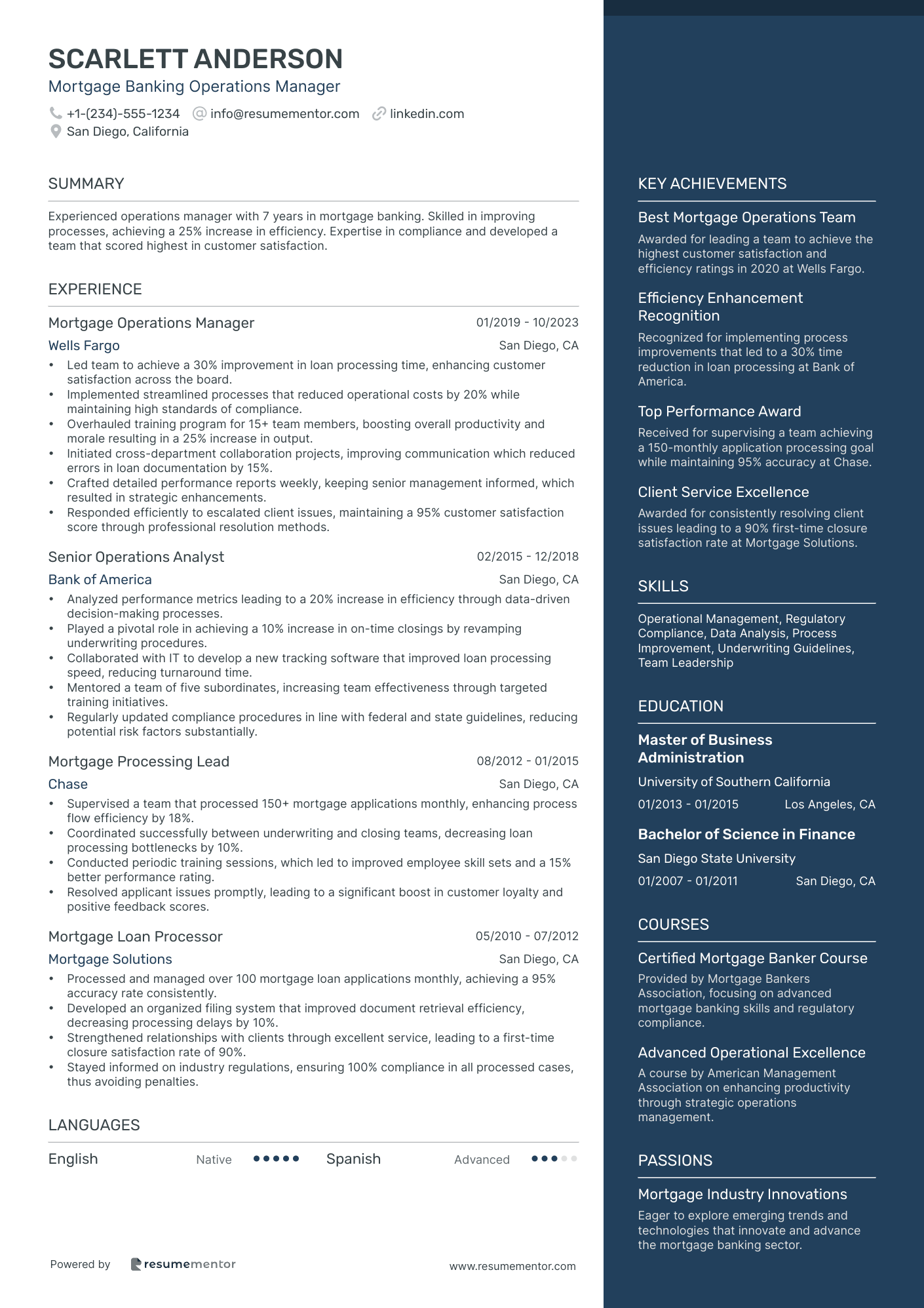

Mortgage Banking Operations Manager

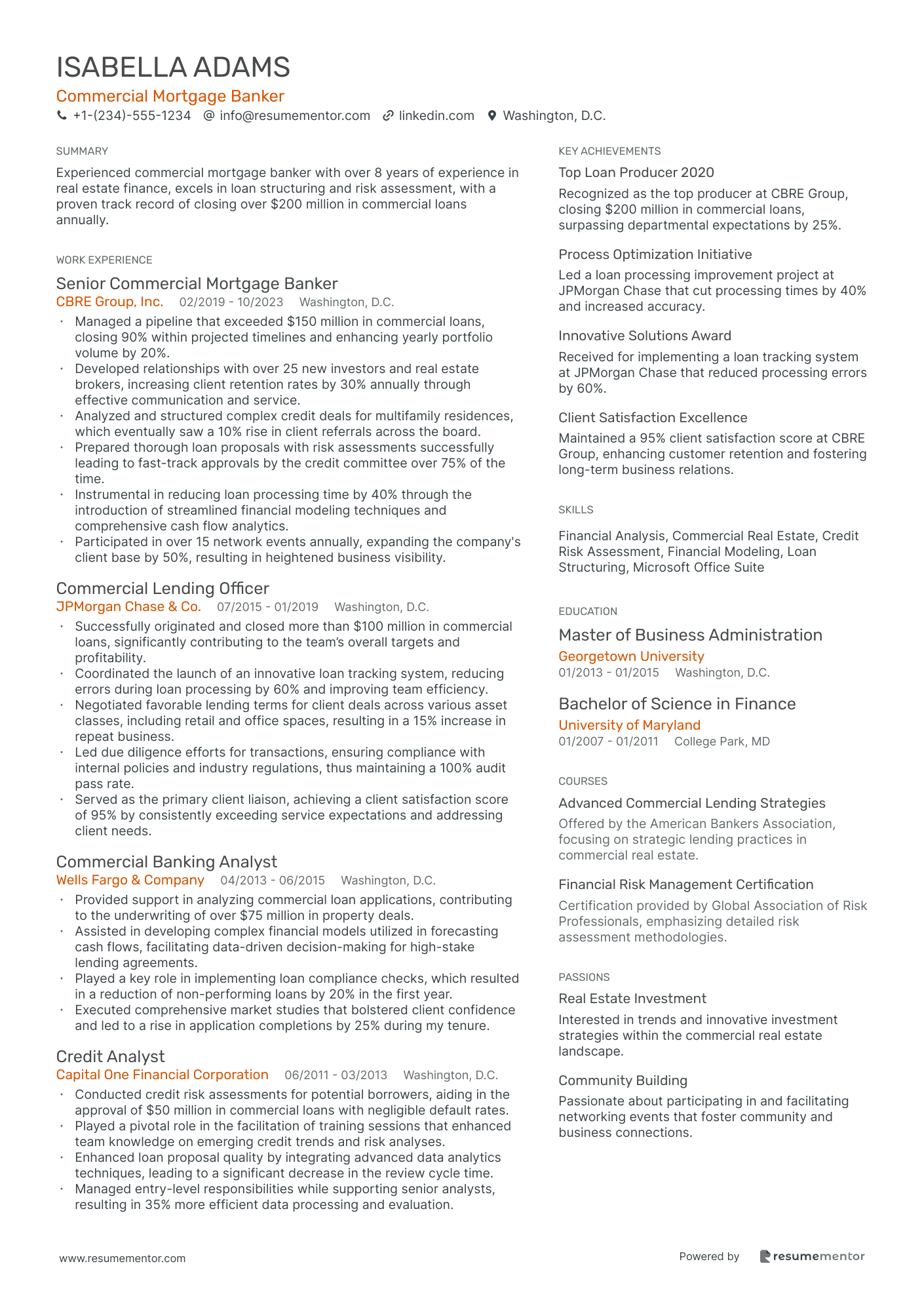

Commercial Mortgage Banker

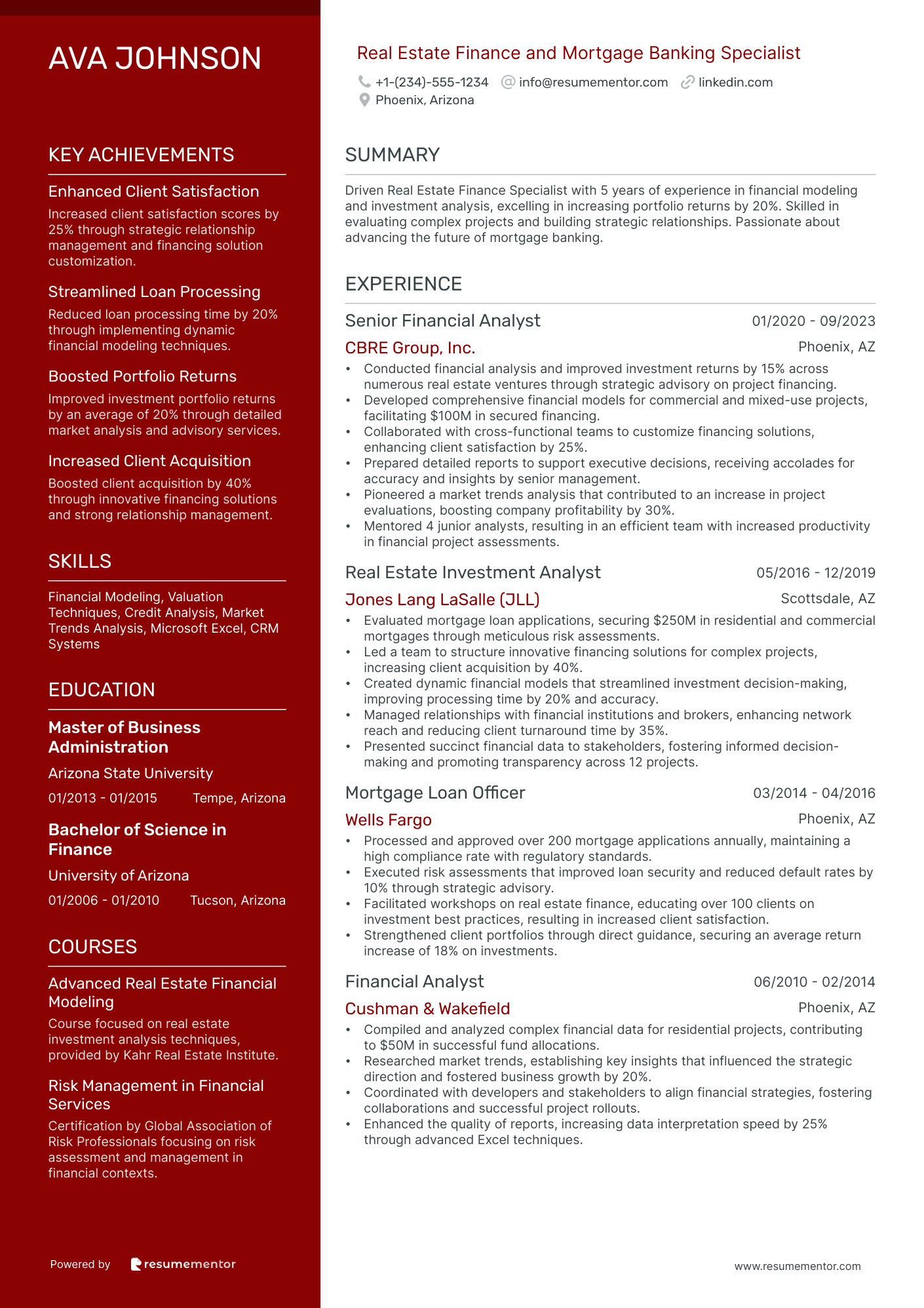

Real Estate Finance and Mortgage Banking Specialist

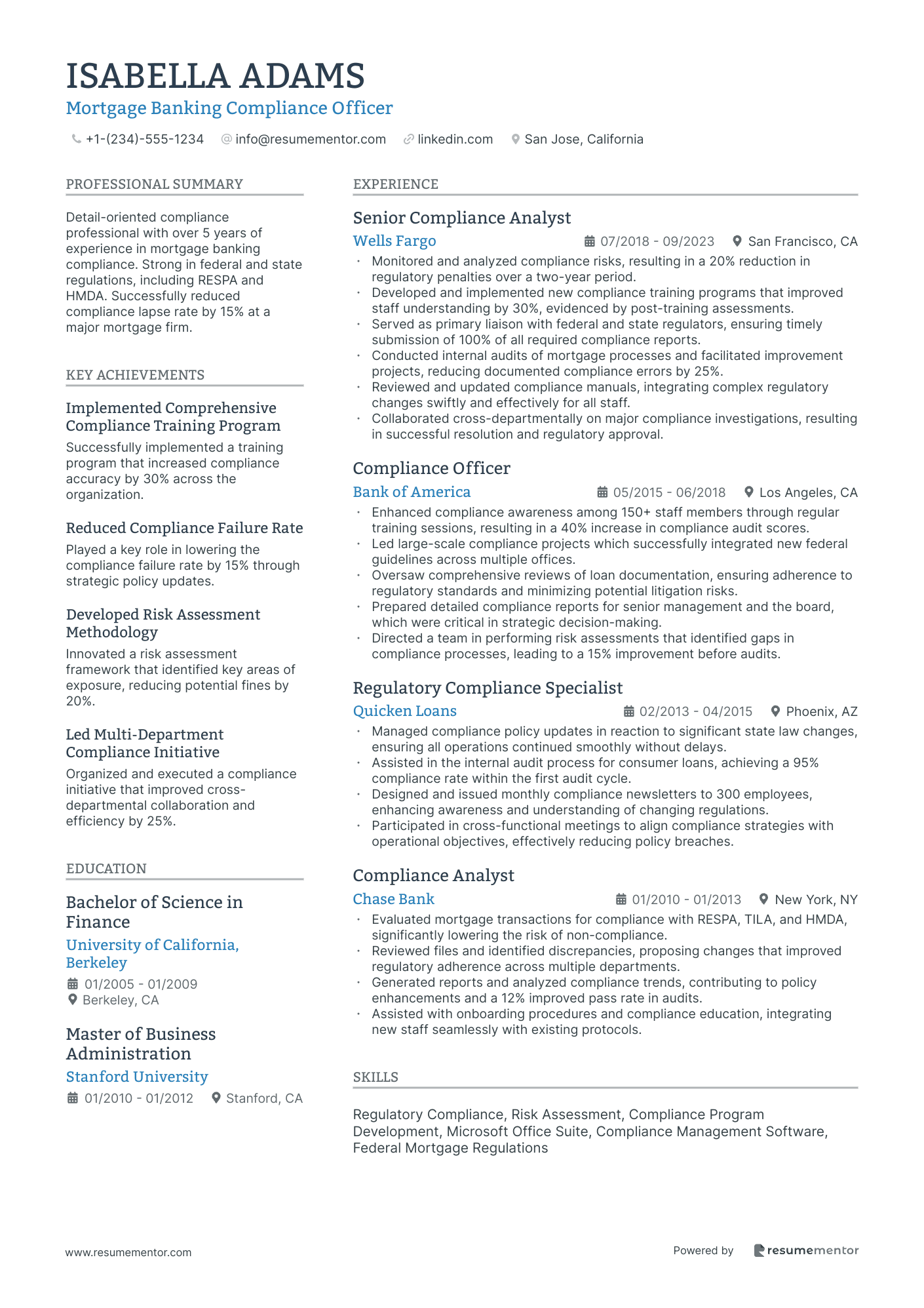

Mortgage Banking Compliance Officer

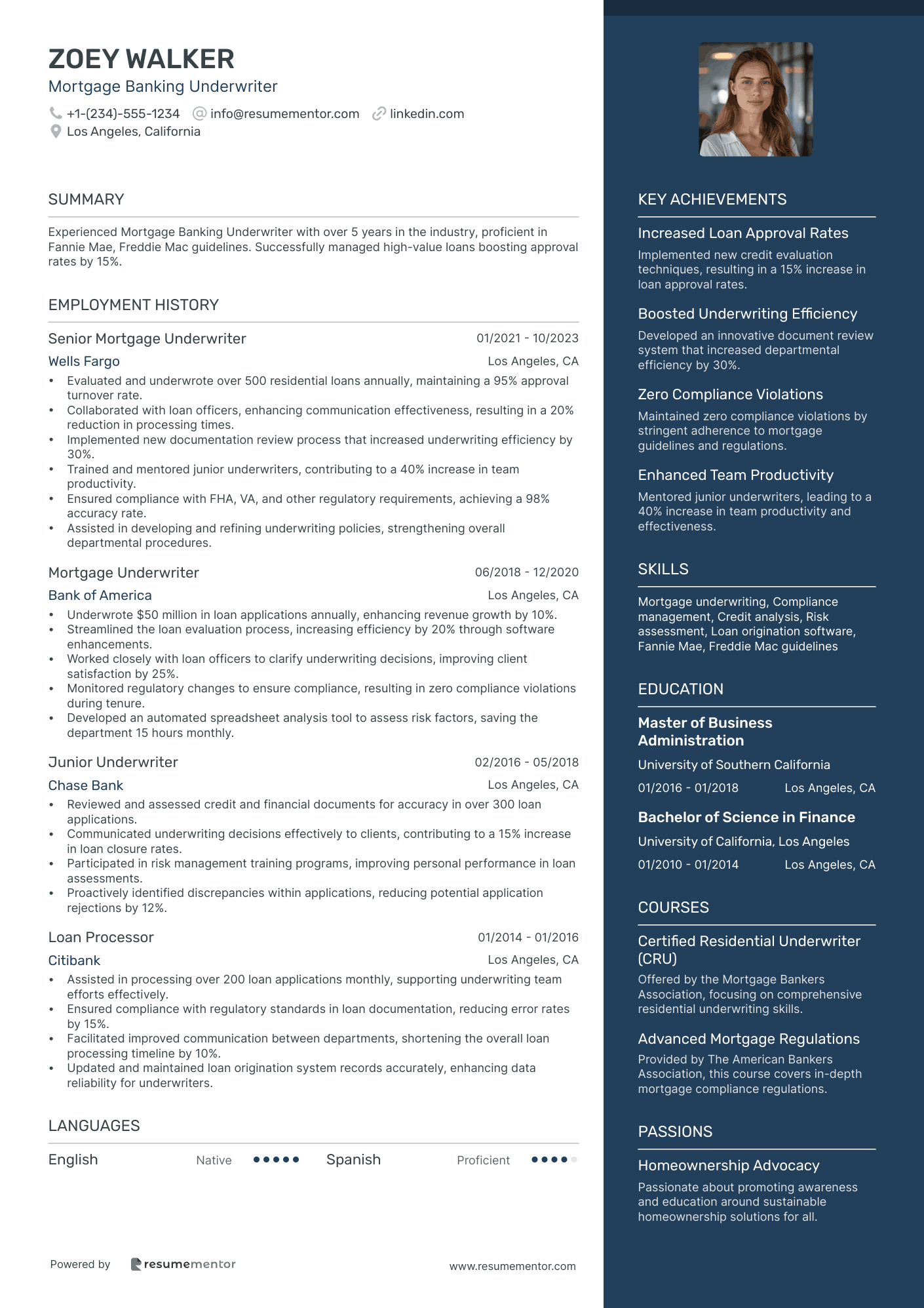

Mortgage Banking Underwriter

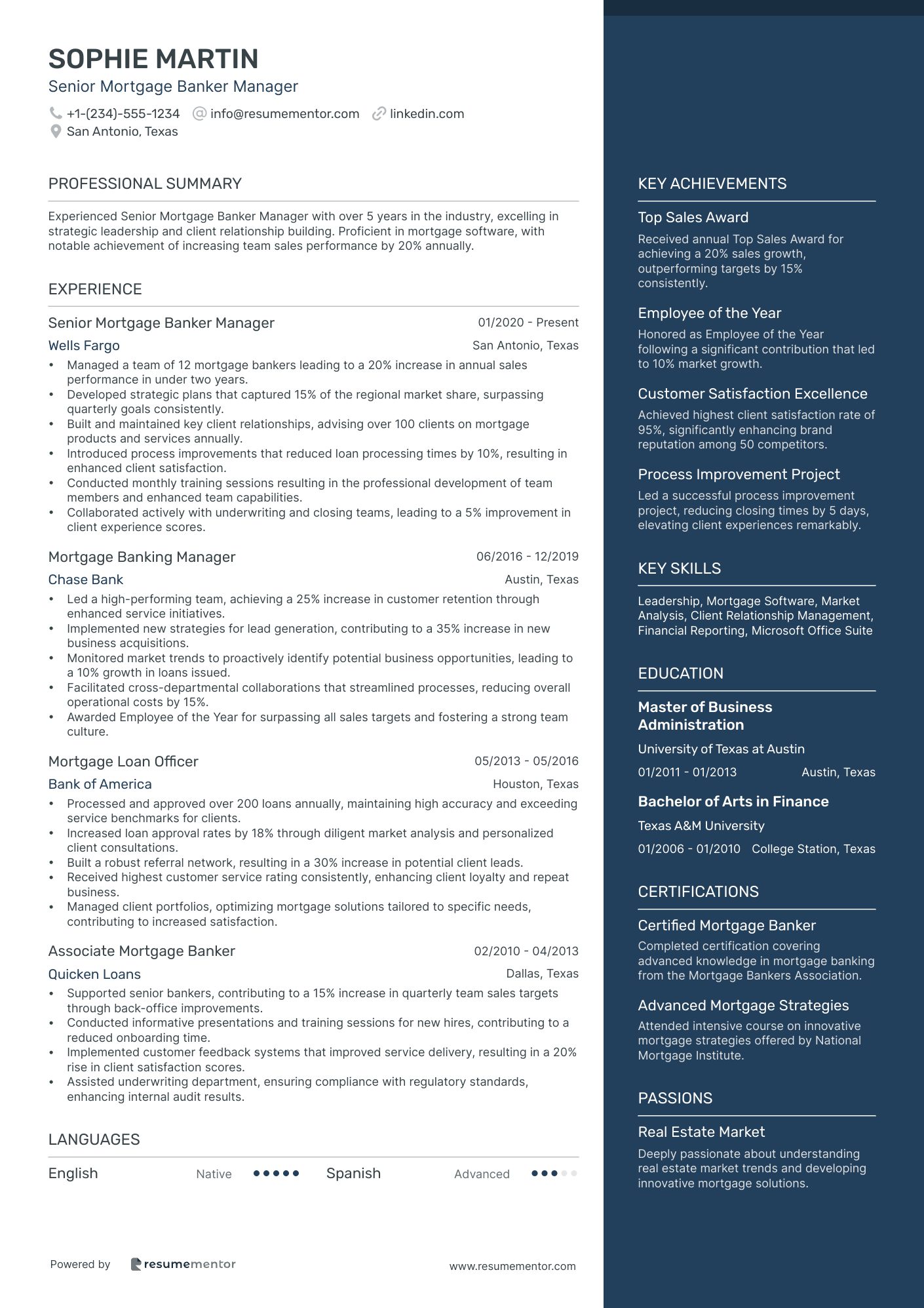

Senior Mortgage Banker Manager

Mortgage Banking Loan Officer resume sample

- •Secured over $50 million in approved loans annually by building strong relationships with real estate agents and clients.

- •Led a team to improve loan processing efficiency by 20%, achieving quicker turnaround times for customer satisfaction.

- •Analyzed applicant financial statements to successfully approve 70% of mortgage applications, which increased revenue by 15%.

- •Facilitated workshops for clients and real estate agents resulting in a 25% growth in new client acquisitions.

- •Introduced automated systems for document collection, reducing processing time, leading to 95% on-time approval.

- •Coordinated with underwriters to ensure compliance and guidelines were met, maintaining a client approval rate of over 85%.

- •Contributed to a 30% increase in customer base by implementing proactive outreach strategies within the community.

- •Reviewed loan documents to ensure adherence to policy, resulting in zero instances of non-compliance.

- •Enhanced customer experience by streamlining documentation procedures, reducing client wait times by 40%.

- •Utilized proprietary software to analyze client financials, leading to a 25% improvement in loan approval rates.

- •Collaborated with other departments to create innovative lending solutions, increasing cross-sell opportunities by 10%.

- •Navigated over 500 clients through the mortgage process annually, achieving a 90% customer satisfaction rate.

- •Maintained up-to-date knowledge on policies and products, resulting in a 20% increase in closed loans.

- •Developed strong partnerships with local real estate talent, effectively growing the referral base by 30%.

- •Created personalized mortgage plans for clients, improving overall customer engagement and retention.

- •Supported senior officers by processing and reviewing loan applications, achieving a 95% accuracy rate.

- •Established client relationship systems that improved communication and reduced follow-up times by 50%.

- •Assisted in analyzing credit histories and financial backgrounds, contributing to an 85% loan approval rate.

- •Emphasized customer education and support, resulting in a repeat business rate increase of 20% over 12 months.

Mortgage Banking Consultant resume sample

- •Increased mortgage loan approval rate by 25% through diligent analysis of client financial situations and tailored recommendations.

- •Conducted over 20 client workshops and seminars, enhancing mortgage literacy and achieving 90% satisfaction in client feedback surveys.

- •Processed and closed mortgage loans efficiently, reducing average processing time by 15% through improved internal team collaboration.

- •Maintained a comprehensive CRM with 100% accuracy, leading to streamlined client communication and a 20% increase in repeat business.

- •Managed a monthly pipeline of over 50 loans, ensuring timely processing and reducing fall-out rate by 18% through proactive follow-ups.

- •Strengthened client relationships, resulting in increased referrals contributing to a 35% growth in new client acquisition.

- •Boosted client referrals by 20% by consistently providing clear and informative guidance on mortgage products.

- •Oversaw the mortgage application process for a portfolio of over 100 active clients, ensuring compliance and accuracy in documentation.

- •Developed strategies to navigate complex financial scenarios, improving loan approval rates by 22% year-over-year.

- •Provided tailored financial planning advice that led to a 15% increase in successful debt-to-income ratio resolutions, resulting in more clients qualifying for loans.

- •Collaborated with underwriting and processing teams to expedite the loan application process by 10%, leading to faster closing times.

- •Analyzed and recommended optimal mortgage products, resulting in a 30% increase in client mortgage solutions satisfaction.

- •Built a strong client base by maintaining robust relationship management practices, leading to a 40% rise in client retention.

- •Conducted regular market analysis, keeping clients informed and aligning mortgage options with market trends, driving a 25% increase in closed deals.

- •Implemented a streamlined documentation process, reducing errors by 15% and expediting the loan finalization process.

- •Exercised financial acumen in constructing comprehensive client profiles that aided in identifying viable mortgage products.

- •Developed effective client communication strategies, improving response rates by 30% and enhancing the client consultation experience.

- •Conducted in-depth reviews of client financial statements, leading to optimized loan offerings and a 20% increase in client approval rates.

- •Facilitated training sessions, resulting in a 15% boost in team efficiency and increased process comprehension.

Residential Mortgage Banker resume sample

- •Achieved a 20% increase in new client acquisitions year-over-year by enhancing referral partnerships and utilizing market insights.

- •Led a team to exceed quarterly loan origination targets by 15%, resulting in recognition as top producers for three consecutive quarters.

- •Implemented a client-centered approach, reducing application processing time by 10% and improving client satisfaction scores.

- •Developed detailed financial assessments, enabling clients to secure over $30M in mortgage loans annually.

- •Facilitated collaboration efforts with underwriting and processing teams to achieve a 95% on-time closing rate.

- •Participated in industry conferences, expanding the company's professional network and generating new business leads.

- •Consistently surpassed monthly sales targets by 18% through strategic relationship building with realtors and other referral sources.

- •Guided clients through the loan process, leading to a 30% increase in customer retention through successful end-to-end support.

- •Organized and led workshops on home financing, building community awareness and increasing lead generation by 25%.

- •Successfully navigated regulatory changes, maintaining a 100% compliance rating during audits for three years consecutively.

- •Collaborated with cross-functional teams to streamline processes, resulting in a 12% decrease in loan processing times.

- •Effectively managed a diverse portfolio of clients, closing over $45M in residential mortgages annually.

- •Reviewed and approved loan applications, maintaining a 90% approval rate through meticulous attention to detail.

- •Coordinated with appraisers and underwriters, resulting in seamless transactions and high loan closing success rates.

- •Trained junior team members on loan origination processes, increasing team productivity by 20%.

- •Rehabilitated underperforming loan portfolios, increasing revenue by 25% through strategic client engagement.

- •Conducted credit analysis and eligibility assessments, contributing to a 95% client satisfaction rate.

- •Developed personalized mortgage solutions, leading to a $10M increase in loan merchandise within two years.

- •Attended networking events, expanding professional network by 30% and increasing referral business significantly.

Mortgage Banking Risk Analyst resume sample

- •Led a team to identify and mitigate risk in mortgage operations, reducing potential financial losses by 20%.

- •Developed advanced risk models using Python that improved prediction accuracy by 30% over previous methods.

- •Collaborated with cross-functional teams to implement new risk management policies, resulting in a 15% improvement in compliance rates.

- •Analyzed data trends and key risk indicators, providing actionable insights to senior management, enhancing strategic decisions.

- •Prepared comprehensive risk assessment reports for executive leadership, facilitating informed risk-taking and growth strategies.

- •Implemented a robust risk mitigation strategy that decreased exposure to high-risk mortgage products by 25%.

- •Conducted thorough risk assessments, revealing vulnerabilities that led to a 15% increase in proactive controls.

- •Enhanced data analysis processes using SAS, boosting the efficiency of risk reporting by 40%.

- •Participated in the audit process, providing critical documentation that aided in 30% better compliance ratings.

- •Developed risk management frameworks in collaboration with cross-department teams, increasing mortgage product reliability.

- •Informed senior stakeholders about emerging risks through detailed presentations and data visualizations.

- •Analyzed credit risk exposure across mortgage portfolios, recommending control measures that decreased potential defaults by 18%.

- •Streamlined data collection processes, improving analysis speed and accuracy by 25% and enhancing decision-making.

- •Collaborated with IT teams to upgrade risk management software, resulting in improved efficiency and reduced error rates.

- •Worked on compliance initiatives, studying evolving regulations to ensure continuous adherence by the organization.

- •Conducted preliminary risk analyses on new mortgage products, uncovering flaws that improved product design.

- •Assisted in drafting risk reports that guided decisive actions, enhancing risk visibility and management effectiveness.

- •Led training workshops on risk analysis best practices, contributing to a 10% increase in team productivity.

- •Supported senior analysts by providing detailed data insights, fostering strategic reviews that benefited the company.

Mortgage Banking Operations Manager resume sample

- •Led team to achieve a 30% improvement in loan processing time, enhancing customer satisfaction across the board.

- •Implemented streamlined processes that reduced operational costs by 20% while maintaining high standards of compliance.

- •Overhauled training program for 15+ team members, boosting overall productivity and morale resulting in a 25% increase in output.

- •Initiated cross-department collaboration projects, improving communication which reduced errors in loan documentation by 15%.

- •Crafted detailed performance reports weekly, keeping senior management informed, which resulted in strategic enhancements.

- •Responded efficiently to escalated client issues, maintaining a 95% customer satisfaction score through professional resolution methods.

- •Analyzed performance metrics leading to a 20% increase in efficiency through data-driven decision-making processes.

- •Played a pivotal role in achieving a 10% increase in on-time closings by revamping underwriting procedures.

- •Collaborated with IT to develop a new tracking software that improved loan processing speed, reducing turnaround time.

- •Mentored a team of five subordinates, increasing team effectiveness through targeted training initiatives.

- •Regularly updated compliance procedures in line with federal and state guidelines, reducing potential risk factors substantially.

- •Supervised a team that processed 150+ mortgage applications monthly, enhancing process flow efficiency by 18%.

- •Coordinated successfully between underwriting and closing teams, decreasing loan processing bottlenecks by 10%.

- •Conducted periodic training sessions, which led to improved employee skill sets and a 15% better performance rating.

- •Resolved applicant issues promptly, leading to a significant boost in customer loyalty and positive feedback scores.

- •Processed and managed over 100 mortgage loan applications monthly, achieving a 95% accuracy rate consistently.

- •Developed an organized filing system that improved document retrieval efficiency, decreasing processing delays by 10%.

- •Strengthened relationships with clients through excellent service, leading to a first-time closure satisfaction rate of 90%.

- •Stayed informed on industry regulations, ensuring 100% compliance in all processed cases, thus avoiding penalties.

Commercial Mortgage Banker resume sample

- •Managed a pipeline that exceeded $150 million in commercial loans, closing 90% within projected timelines and enhancing yearly portfolio volume by 20%.

- •Developed relationships with over 25 new investors and real estate brokers, increasing client retention rates by 30% annually through effective communication and service.

- •Analyzed and structured complex credit deals for multifamily residences, which eventually saw a 10% rise in client referrals across the board.

- •Prepared thorough loan proposals with risk assessments successfully leading to fast-track approvals by the credit committee over 75% of the time.

- •Instrumental in reducing loan processing time by 40% through the introduction of streamlined financial modeling techniques and comprehensive cash flow analytics.

- •Participated in over 15 network events annually, expanding the company's client base by 50%, resulting in heightened business visibility.

- •Successfully originated and closed more than $100 million in commercial loans, significantly contributing to the team’s overall targets and profitability.

- •Coordinated the launch of an innovative loan tracking system, reducing errors during loan processing by 60% and improving team efficiency.

- •Negotiated favorable lending terms for client deals across various asset classes, including retail and office spaces, resulting in a 15% increase in repeat business.

- •Led due diligence efforts for transactions, ensuring compliance with internal policies and industry regulations, thus maintaining a 100% audit pass rate.

- •Served as the primary client liaison, achieving a client satisfaction score of 95% by consistently exceeding service expectations and addressing client needs.

- •Provided support in analyzing commercial loan applications, contributing to the underwriting of over $75 million in property deals.

- •Assisted in developing complex financial models utilized in forecasting cash flows, facilitating data-driven decision-making for high-stake lending agreements.

- •Played a key role in implementing loan compliance checks, which resulted in a reduction of non-performing loans by 20% in the first year.

- •Executed comprehensive market studies that bolstered client confidence and led to a rise in application completions by 25% during my tenure.

- •Conducted credit risk assessments for potential borrowers, aiding in the approval of $50 million in commercial loans with negligible default rates.

- •Played a pivotal role in the facilitation of training sessions that enhanced team knowledge on emerging credit trends and risk analyses.

- •Enhanced loan proposal quality by integrating advanced data analytics techniques, leading to a significant decrease in the review cycle time.

- •Managed entry-level responsibilities while supporting senior analysts, resulting in 35% more efficient data processing and evaluation.

Real Estate Finance and Mortgage Banking Specialist resume sample

- •Conducted financial analysis and improved investment returns by 15% across numerous real estate ventures through strategic advisory on project financing.

- •Developed comprehensive financial models for commercial and mixed-use projects, facilitating $100M in secured financing.

- •Collaborated with cross-functional teams to customize financing solutions, enhancing client satisfaction by 25%.

- •Prepared detailed reports to support executive decisions, receiving accolades for accuracy and insights by senior management.

- •Pioneered a market trends analysis that contributed to an increase in project evaluations, boosting company profitability by 30%.

- •Mentored 4 junior analysts, resulting in an efficient team with increased productivity in financial project assessments.

- •Evaluated mortgage loan applications, securing $250M in residential and commercial mortgages through meticulous risk assessments.

- •Led a team to structure innovative financing solutions for complex projects, increasing client acquisition by 40%.

- •Created dynamic financial models that streamlined investment decision-making, improving processing time by 20% and accuracy.

- •Managed relationships with financial institutions and brokers, enhancing network reach and reducing client turnaround time by 35%.

- •Presented succinct financial data to stakeholders, fostering informed decision-making and promoting transparency across 12 projects.

- •Processed and approved over 200 mortgage applications annually, maintaining a high compliance rate with regulatory standards.

- •Executed risk assessments that improved loan security and reduced default rates by 10% through strategic advisory.

- •Facilitated workshops on real estate finance, educating over 100 clients on investment best practices, resulting in increased client satisfaction.

- •Strengthened client portfolios through direct guidance, securing an average return increase of 18% on investments.

- •Compiled and analyzed complex financial data for residential projects, contributing to $50M in successful fund allocations.

- •Researched market trends, establishing key insights that influenced the strategic direction and fostered business growth by 20%.

- •Coordinated with developers and stakeholders to align financial strategies, fostering collaborations and successful project rollouts.

- •Enhanced the quality of reports, increasing data interpretation speed by 25% through advanced Excel techniques.

Mortgage Banking Compliance Officer resume sample

- •Monitored and analyzed compliance risks, resulting in a 20% reduction in regulatory penalties over a two-year period.

- •Developed and implemented new compliance training programs that improved staff understanding by 30%, evidenced by post-training assessments.

- •Served as primary liaison with federal and state regulators, ensuring timely submission of 100% of all required compliance reports.

- •Conducted internal audits of mortgage processes and facilitated improvement projects, reducing documented compliance errors by 25%.

- •Reviewed and updated compliance manuals, integrating complex regulatory changes swiftly and effectively for all staff.

- •Collaborated cross-departmentally on major compliance investigations, resulting in successful resolution and regulatory approval.

- •Enhanced compliance awareness among 150+ staff members through regular training sessions, resulting in a 40% increase in compliance audit scores.

- •Led large-scale compliance projects which successfully integrated new federal guidelines across multiple offices.

- •Oversaw comprehensive reviews of loan documentation, ensuring adherence to regulatory standards and minimizing potential litigation risks.

- •Prepared detailed compliance reports for senior management and the board, which were critical in strategic decision-making.

- •Directed a team in performing risk assessments that identified gaps in compliance processes, leading to a 15% improvement before audits.

- •Managed compliance policy updates in reaction to significant state law changes, ensuring all operations continued smoothly without delays.

- •Assisted in the internal audit process for consumer loans, achieving a 95% compliance rate within the first audit cycle.

- •Designed and issued monthly compliance newsletters to 300 employees, enhancing awareness and understanding of changing regulations.

- •Participated in cross-functional meetings to align compliance strategies with operational objectives, effectively reducing policy breaches.

- •Evaluated mortgage transactions for compliance with RESPA, TILA, and HMDA, significantly lowering the risk of non-compliance.

- •Reviewed files and identified discrepancies, proposing changes that improved regulatory adherence across multiple departments.

- •Generated reports and analyzed compliance trends, contributing to policy enhancements and a 12% improved pass rate in audits.

- •Assisted with onboarding procedures and compliance education, integrating new staff seamlessly with existing protocols.

Mortgage Banking Underwriter resume sample

- •Evaluated and underwrote over 500 residential loans annually, maintaining a 95% approval turnover rate.

- •Collaborated with loan officers, enhancing communication effectiveness, resulting in a 20% reduction in processing times.

- •Implemented new documentation review process that increased underwriting efficiency by 30%.

- •Trained and mentored junior underwriters, contributing to a 40% increase in team productivity.

- •Ensured compliance with FHA, VA, and other regulatory requirements, achieving a 98% accuracy rate.

- •Assisted in developing and refining underwriting policies, strengthening overall departmental procedures.

- •Underwrote $50 million in loan applications annually, enhancing revenue growth by 10%.

- •Streamlined the loan evaluation process, increasing efficiency by 20% through software enhancements.

- •Worked closely with loan officers to clarify underwriting decisions, improving client satisfaction by 25%.

- •Monitored regulatory changes to ensure compliance, resulting in zero compliance violations during tenure.

- •Developed an automated spreadsheet analysis tool to assess risk factors, saving the department 15 hours monthly.

- •Reviewed and assessed credit and financial documents for accuracy in over 300 loan applications.

- •Communicated underwriting decisions effectively to clients, contributing to a 15% increase in loan closure rates.

- •Participated in risk management training programs, improving personal performance in loan assessments.

- •Proactively identified discrepancies within applications, reducing potential application rejections by 12%.

- •Assisted in processing over 200 loan applications monthly, supporting underwriting team efforts effectively.

- •Ensured compliance with regulatory standards in loan documentation, reducing error rates by 15%.

- •Facilitated improved communication between departments, shortening the overall loan processing timeline by 10%.

- •Updated and maintained loan origination system records accurately, enhancing data reliability for underwriters.

Senior Mortgage Banker Manager resume sample

- •Managed a team of 12 mortgage bankers leading to a 20% increase in annual sales performance in under two years.

- •Developed strategic plans that captured 15% of the regional market share, surpassing quarterly goals consistently.

- •Built and maintained key client relationships, advising over 100 clients on mortgage products and services annually.

- •Introduced process improvements that reduced loan processing times by 10%, resulting in enhanced client satisfaction.

- •Conducted monthly training sessions resulting in the professional development of team members and enhanced team capabilities.

- •Collaborated actively with underwriting and closing teams, leading to a 5% improvement in client experience scores.

- •Led a high-performing team, achieving a 25% increase in customer retention through enhanced service initiatives.

- •Implemented new strategies for lead generation, contributing to a 35% increase in new business acquisitions.

- •Monitored market trends to proactively identify potential business opportunities, leading to a 10% growth in loans issued.

- •Facilitated cross-departmental collaborations that streamlined processes, reducing overall operational costs by 15%.

- •Awarded Employee of the Year for surpassing all sales targets and fostering a strong team culture.

- •Processed and approved over 200 loans annually, maintaining high accuracy and exceeding service benchmarks for clients.

- •Increased loan approval rates by 18% through diligent market analysis and personalized client consultations.

- •Built a robust referral network, resulting in a 30% increase in potential client leads.

- •Received highest customer service rating consistently, enhancing client loyalty and repeat business.

- •Managed client portfolios, optimizing mortgage solutions tailored to specific needs, contributing to increased satisfaction.

- •Supported senior bankers, contributing to a 15% increase in quarterly team sales targets through back-office improvements.

- •Conducted informative presentations and training sessions for new hires, contributing to a reduced onboarding time.

- •Implemented customer feedback systems that improved service delivery, resulting in a 20% rise in client satisfaction scores.

- •Assisted underwriting department, ensuring compliance with regulatory standards, enhancing internal audit results.

As a mortgage banker, crafting the perfect resume is much like finding the best mortgage rate for your clients. In this competitive field, your resume is key to securing the position you desire, and it should present your extensive experience and industry-specific skills with clarity. Many find this task daunting, but it becomes manageable with a strategic approach. Highlighting your achievements and technical expertise in finance effectively is essential to impress potential employers.

While creating your resume, balancing conciseness with comprehensiveness and maintaining visual appeal while staying professional is crucial. A resume template can offer a structured format that effortlessly showcases your strengths. This enables you to emphasize your accomplishments and qualifications in a way that makes you stand out in the world of mortgage banking.

Demonstrating your ability to manage clients, close deals, and navigate mortgage regulations is equally important. Employers look for a proven track record of turning mortgage leads into satisfied clients, so showcasing your skill in these areas is vital. Additionally, highlighting your teamwork and leadership skills rounds out your professional profile, making you an attractive candidate.

Ultimately, your resume should reflect your unique journey in mortgage banking, clearly outlining your career path and achievements. With attention to detail and an organized approach, you can craft a document that authentically represents your professional identity. By combining these strategies with a well-designed resume template, you’ll be ready to step confidently into your next career opportunity.

Key Takeaways

- Crafting a standout teacher resume requires structuring your qualifications in a way that is both concise and comprehensive, highlighting key achievements and providing a clear career narrative.

- Your contact information, including name, phone number, professional email, and LinkedIn profile, should be prominently displayed at the top of the resume for easy access by recruiters.

- The professional summary on a teacher resume serves as an elevator pitch, succinctly summarizing years of experience, key skills, and standout achievements to pique a recruiter's interest.

- Provide detailed work experience using quantifiable results, strong action verbs, and relevant job titles, structured in reverse chronological order to showcase recent skills and contributions effectively.

- Highlight both hard skills, like curriculum planning and technology proficiency, and soft skills, such as communication and adaptability, to present a balanced skill set that aligns with the demands of teaching positions.

What to focus on when writing your mortgage banking resume

Your mortgage banking resume should seamlessly convey your expertise and experience to the recruiter—it's essential to highlight key areas effectively.

How to structure your mortgage banking resume

- Contact Information: This is your opportunity to make a great first impression. Your full name should appear prominently along with your phone number, professional email address, and LinkedIn profile. These elements must be easy to find at the top of your resume because they form the initial connection with potential employers.

- Professional Summary: Your professional summary is your elevator pitch—sum up your career in a nutshell. Focus on how many years you've been in mortgage banking, key skills like loan processing and customer service, and a standout achievement. This section sets the stage for what follows, giving recruiters a quick overview of why they should consider you.

- Work Experience: Dive deeper into your professional history by outlining specific roles you've held, relaying responsibilities and accomplishments. Emphasize actions that improved processing times or customer satisfaction, illustrating your ability to make an impact. Concrete results in this section can significantly influence a recruiter's decision.

- Skills: List mortgage-specific skills, such as proficiency with mortgage loan software and a strong grasp of mortgage regulations and risk assessment. Your skills need to align with the demands of the job and the needs of employers in the mortgage banking sector, showcasing your readiness to tackle day-to-day tasks.

- Education: Your educational background is crucial—mention your degrees, relevant courses, and any certifications like NMLS or mortgage broker licenses. These qualifications highlight your commitment to learning and your capability to navigate complex scenarios.

- Achievements: Recognize your accomplishments by stating measurable successes, such as a high number of loan approvals or awards for outstanding service. This section should powerfully reinforce your professionalism, showing a track record of excellence that sets you apart. Next, we’ll explore each section in more detail, uncovering strategies to enhance your resume format even further.

Which resume format to choose

Crafting a standout mortgage banking resume involves a few key elements that align with industry expectations. First, consider the format. A reverse-chronological format works best because it puts your most recent experience front and center. In mortgage banking, staying current with market trends and regulations is crucial, so naturally, employers want to see what you’ve done lately. This format allows them to grasp your recent contributions and your journey up to now.

Selecting the right font is the next step in creating a professional-looking resume. Raleway, Lato, or Montserrat are solid choices that offer a modern edge without sacrificing readability. A clear and contemporary font ensures that your resume feels up-to-date, reflecting positively on your attention to detail and professionalism, which are vital in mortgage banking.

Saving your resume as a PDF is essential because it maintains the integrity of your format. In mortgage banking, accuracy and attention to detail are paramount. A PDF guarantees that your layout and information appear as intended, displaying your commitment to precision—a trait highly valued by potential employers.

Finally, stick to one-inch margins on all sides for a clean and organized layout. The mortgage banking industry appreciates meticulousness and clarity, and a well-structured resume mirrors these values. It allows employers to focus on your key skills and achievements without getting lost in unnecessary clutter.

By incorporating these elements, you craft a resume that not only meets the practical demands of the job market but also resonates with the values and expectations of the mortgage banking industry.

How to write a quantifiable resume experience section

A strong experience section for your mortgage banking resume seamlessly highlights your relevant achievements while crafting a clear narrative of your career progression. By focusing on measurable results, you'll illustrate your responsibilities and show growth over time. Structuring this section in reverse chronological order brings your latest skills to the forefront, making it straightforward for hiring managers to grasp your most current qualifications. Including only job titles pertinent to the position you’re targeting helps maintain clarity and focus. As you consider how far back to go, typically covering 10-15 years can balance relevance and comprehensive career history.

Tailoring your resume to match the job ad ensures your experiences align with the specific skills and requirements sought by employers. Action verbs like "achieved," "led," or "improved" inject energy and clarity into your accomplishments. Concentrating on measurable outcomes in your bullet points showcases your ability to handle mortgage banking duties effectively, making your experience section both compelling and relevant.

Consider this example of a mortgage banking resume experience section in JSON format:

- •Increased loan origination volume by 25% year-over-year by developing targeted marketing strategies.

- •Streamlined the loan processing workflow, reducing approval time by 30%.

- •Collaborated with underwriters to achieve a 95% loan approval rate.

- •Ranked in the top 5% of loan officers regionally based on customer satisfaction scores.

This experience section excels by seamlessly weaving together quantifiable achievements, demonstrating a consistent track record of success. Each bullet point starts with a strong action verb, integrating specific percentages or rankings to offer a clear picture of your impact, such as "increased loan origination volume by 25%." This method not only communicates what you accomplished but highlights the quality of your work. By focusing on key outcomes important in mortgage banking, like loan approval rates and customer satisfaction, you effectively argue your value in the field, helping you stand out to potential employers.

Innovation-Focused resume experience section

A mortgage banking innovation-focused resume experience section should highlight your ability to bring about meaningful change through creative solutions. It’s important to showcase moments where you introduced new ideas or enhanced existing processes to improve client satisfaction and operational efficiency. This section demonstrates your proactive approach and your impact on achieving the organization's goals.

Begin by clearly stating your role and focus, then detail your key achievements in that position. Highlight results with specific numbers to show the real impact of your innovative efforts. Describe the new tools or programs you launched, emphasizing how they effectively addressed challenges or improved operations. By linking your contributions to broader company objectives, you illustrate how your work played a crucial part in the organization's success.

Innovation Manager

ABC Mortgage Bank

January 2020 - December 2022

- Led the creation of a digital mortgage application process, trimming application time by 30%.

- Developed a predictive analytics tool that reduced default risk, cutting delinquency rates by 15%.

- Introduced an AI-driven customer service system, boosting customer satisfaction by 20%.

- Organized cross-departmental workshops promoting innovation, leading to a 10% increase in new business solutions.

Project-Focused resume experience section

A project-focused mortgage banking resume experience section should showcase the specific projects where you’ve made a meaningful impact. Start by noting your job title, workplace, and dates, but place emphasis on highlighting projects where your contributions were vital. Use active language to seamlessly convey your responsibilities and achievements, showcasing your skills in the mortgage banking field. By articulating your role in each project clearly, and arranging your accomplishments into bullet points, you ensure clarity and focus.

Including specific numbers and outcomes in these bullet points can further demonstrate the tangible benefits you brought to your previous roles. Breaking down complex tasks into simple, result-oriented statements helps maintain clarity. By steering clear of jargon, you make each achievement easy for any reader to grasp. Ultimately, each point should naturally highlight your ability to handle high-impact projects and effectively solve problems.

Mortgage Banking Project Manager

HomeLoans Corp

June 2020 - Present

- Led a team of eight in developing a new mortgage product, resulting in a 25% increase in customer acquisition.

- Streamlined project workflows, reducing process time by 15% and saving the company over $100,000 annually.

- Implemented a new risk assessment tool, decreasing loan default rates by 10%.

- Coordinated cross-departmental efforts to enhance customer experience, boosting satisfaction scores from 4.2 to 4.8 out of 5.

Efficiency-Focused resume experience section

A mortgage banking efficiency-focused resume experience section should clearly demonstrate how you've enhanced operational processes. Begin by identifying major changes or improvements you've led in your roles. Highlight specific actions you initiated and their successful outcomes, using strong action verbs and quantifiable data to effectively showcase your impact. Illustrate the direct connection between your skills and the improvements, such as reducing processing times or increasing customer satisfaction.

Ensure that each bullet point is concise and directly reflects a unique achievement or skill related to efficiency. Focus on instances where you introduced innovative tools or systems that resulted in significant time or cost savings. Include examples of how you collaborated with different teams to optimize workflow. This approach not only highlights your responsibilities but also underscores the tangible value you bring to a potential employer’s organization.

Mortgage Processing Manager

ABC Mortgage Solutions

June 2020 - Present

- Implemented a new loan processing system that reduced time per application by 30%

- Developed a training program that improved team productivity by 25%

- Streamlined communication between departments, increasing client satisfaction scores by 15%

- Led a team project that identified workflow bottlenecks and reduced costs by 20%

Customer-Focused resume experience section

A customer-focused mortgage banking resume experience section should highlight your ability to effectively understand and address clients' needs. Start by emphasizing your communication skills, illustrating how you listen actively to recommend the best mortgage options. Building strong relationships with clients and colleagues is crucial, so showcase your ability to foster trust and collaboration, which enhances overall client experience. Provide specific examples of how you've resolved issues or improved service to demonstrate your customer service excellence.

Highlight your results-driven approach next, ensuring you integrate metrics or outcomes that demonstrate your impact, such as increased client retention or enhanced satisfaction scores. Keep your descriptions concise yet comprehensive, demonstrating your capacity to manage multiple clients and consistently meet deadlines. A positive, proactive attitude underscores your commitment to providing excellent service. Bullet points help to clearly organize your achievements, providing tangible evidence of your success.

Mortgage Specialist

ABC Bank

June 2018 - Present

- Listened to clients’ needs and advised them on the best mortgage options, increasing client satisfaction scores by 15%.

- Built strong relationships with clients and colleagues, fostering trust and collaboration, resulting in a 20% increase in referral business.

- Resolved customer complaints efficiently, reducing issue response time by 30% and improving retention rates.

- Managed a portfolio of over 150 clients, consistently meeting deadlines and maintaining a high level of customer service.

Write your mortgage banking resume summary section

A mortgage-focused resume experience section should clearly highlight your career achievements, skills, and goals in a compelling summary. This concise paragraph is your opportunity to catch a hiring manager's attention right from the start by showcasing what makes you stand out. For those with experience, your resume might include something like this:

On the other hand, if you're just starting out or have less experience in mortgage banking, focusing on your ambitions and what you plan to bring to the industry can be effective:

[here was the JSON object 2]

Both examples are strategically crafted to reflect the candidates' strengths and aspirations in the field of mortgage banking. The experienced candidate focuses on past accomplishments and specific skills, while the entry-level candidate expresses a strong desire to learn and contribute. These summaries not only speak to your capabilities but also align with what employers are looking for in mortgage banking roles.

Choosing the right approach between a summary or an objective can further enhance how your value is perceived. A resume summary is ideal for experienced applicants, emphasizing career highlights and relevant skills. In contrast, a resume objective is more suited for entry-level candidates, focusing on future goals and aspirations. Understanding these distinctions helps you tailor your resume to best represent what you offer. Whether opting for a comprehensive summary or a focused objective, each serves to highlight unique aspects of your professional journey.

Listing your mortgage banking skills on your resume

A mortgage banking-focused resume should clearly highlight your various skills and strengths. Creating a dedicated skills section is crucial, as it allows employers to quickly recognize your qualifications. These skills can also be woven into the experience and summary sections, providing real-world context for how you've applied them in your career. It's important to showcase both your strengths—like being analytical or detail-oriented—and your soft skills, such as communication and teamwork. Hard skills, on the other hand, are technical abilities gained through training and experience, such as mastering financial software or managing loan portfolios.

Skills and strengths serve as essential resume keywords. These keywords help your resume stand out to both applicant tracking systems and hiring managers, aligning your qualifications with the job description.

This skills section effectively highlights your mortgage banking expertise. It's clear and concise, showcasing both the range and depth of your abilities. Each skill is directly relevant to the job, making your resume more appealing to employers.

Best hard skills to feature on your mortgage banking resume

In mortgage banking, hard skills are essential for evaluating financial situations, understanding legal guidelines, and using technology efficiently. These skills demonstrate your competence, precision, and ability to perform specific tasks with ease.

Hard Skills

- Loan Origination

- Credit Risk Management

- Financial Data Analysis

- Mortgage Underwriting

- Regulatory Compliance

- Financial Modeling

- Loan Processing

- Portfolio Management

- Fraud Detection

- Cost-Benefit Analysis

- Financial Software Proficiency

- Risk Assessment

- Mortgage Software Programs

- Accounting Principles

- Data Verification

Best soft skills to feature on your mortgage banking resume

Mortgage banking professionals require soft skills to communicate effectively, resolve conflicts, and collaborate with a team. These skills reflect your ability to interact professionally and build strong relationships with clients and colleagues.

Soft Skills

- Communication Skills

- Problem-Solving

- Attention to Detail

- Negotiation

- Time Management

- Customer Service

- Adaptability

- Team Collaboration

- Conflict Resolution

- Decision-Making

- Leadership

- Empathy

- Stress Management

- Integrity

- Initiative

How to include your education on your resume

An education section is a crucial part of your mortgage banking resume. It showcases your academic background and qualifications. Make sure it aligns with the job you're applying for by only including relevant education. If something doesn’t relate to the position, leave it out to keep the focus sharp. When listing your degree, include the full name and your institution. If you graduated cum laude, note this achievement beside your degree for added impact. When it comes to GPA, include it if it's impressive, such as 3.5 or higher, and always specify the scale, like 3.8/4.0.

Consider this incorrect example for perspective:

Now, here's an example that effectively communicates relevant achievements and details:

The second example is effective because it focuses on the relevant field of finance, which directly ties to mortgage banking. Additionally, highlighting a strong GPA and graduating cum laude shows academic excellence. This approach helps catch an employer's eye by clearly outlining your related qualifications.

How to include mortgage banking certificates on your resume

A certificates section is an important part of your mortgage banking resume. Including relevant certificates can demonstrate your specialized knowledge and dedication to the field. List the name of the certificate clearly. Include the date you received the certificate. Add the issuing organization to show credibility.

Certificates can also be included in the header for quick visibility. For example, you can write "Certified Mortgage Banker (CMB), 2022" next to your name. This showcases your expertise right away.

Here’s a detailed example:

These certificates are relevant and demonstrate your qualifications. Using well-recognized certifications gives you an edge over competing candidates. Make sure your resume portrays these achievements clearly and concisely.

Extra sections to include in your mortgage banking resume

In the competitive field of mortgage banking, a well-crafted resume can set you apart from the rest. Adding unique sections to your resume can showcase your diverse background, making it clear why you're the best fit for the job.

Language section — Highlight languages you’re fluent in to illustrate your ability to communicate with diverse clients. This can be a key asset when working with clients who speak different languages.

Hobbies and interests section — Include activities that show your leadership skills or analytical thinking. This can demonstrate that you have a well-rounded personality and are capable of thriving in high-pressure environments.

Volunteer work section — Present any volunteer activities that show your commitment to community and teamwork. This signals to employers that you have strong social responsibility and the ability to collaborate effectively.

Books section — List relevant books you’ve read that align with the industry to show your commitment to ongoing learning. This indicates you keep up-to-date with the latest trends and best practices in mortgage banking.

These sections can enrich your resume, providing potential employers with a fuller picture of your capabilities and interests. Consider carefully where to place each to enhance readability. Overall, using these sections strategically can significantly bolster your appeal as a holistic, well-prepared candidate.

In Conclusion

In conclusion, creating a standout resume in the mortgage banking industry requires thoughtful attention to detail and a clear presentation of your skills and achievements. Your resume is your personal marketing tool that sets you apart in a competitive job market. By strategically highlighting your experience, technical know-how, and achievements, you bring attention to your unique qualifications. This involves an organized layout, choosing contemporary fonts for a professional appearance, and saving your resume as a PDF to preserve its format. Emphasizing quantifiable success stories, using strong action verbs, and aligning your skills with job requirements enhance your overall appeal. Including special sections like certificates, languages, and even relevant hobbies adds depth, demonstrating a well-rounded professional eager to contribute to an employer’s success. Remember, your resume form is a reflection of your career path and aspirations. With careful crafting, you can present a compelling case that resonates with recruiters and opens doors to myriad opportunities in mortgage banking.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.