Quickbooks Accountant Resume Examples

Jul 18, 2024

|

12 min read

Mastering your quickbooks accountant resume: tips to record your path to success. Learn to balance skills, experience, and achievements to capture your dream job.

Rated by 348 people

QuickBooks Payroll Accountant

QuickBooks Certified Public Accountant

QuickBooks Tax Specialist

Financial Forensics Accountant in QuickBooks

QuickBooks Project Accountant

QuickBooks Accounts Receivable Specialist

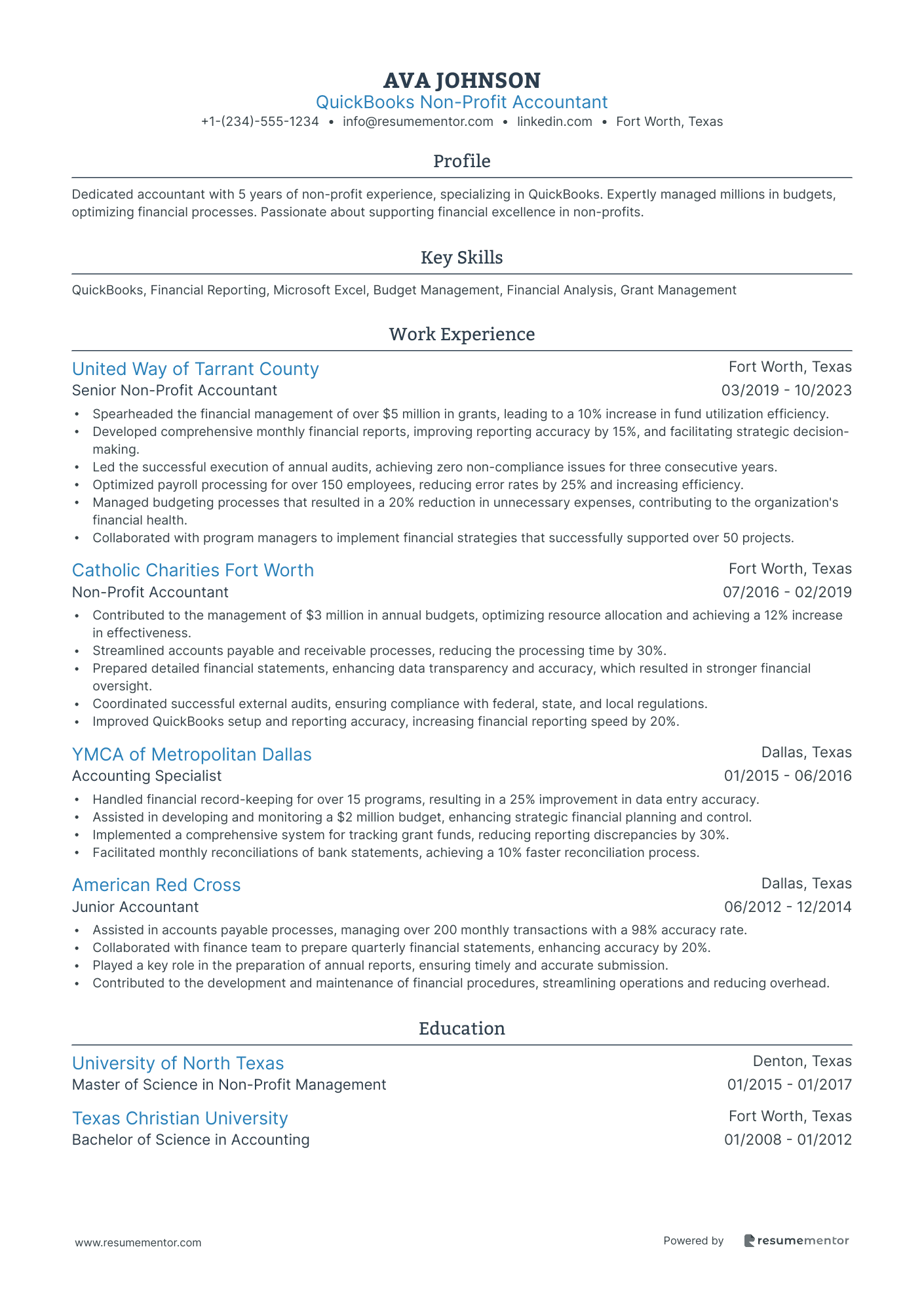

QuickBooks Non-Profit Accountant

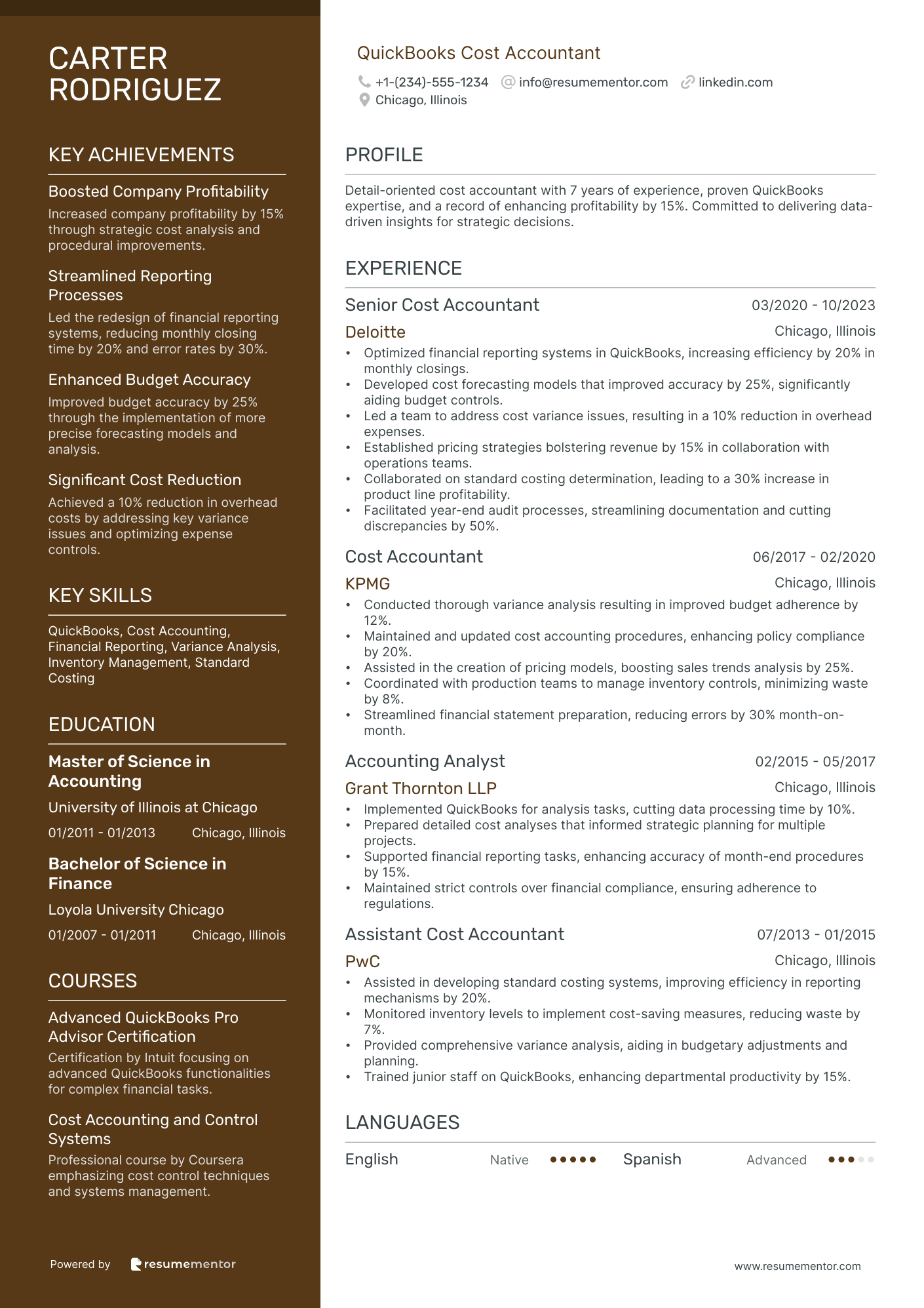

QuickBooks Cost Accountant

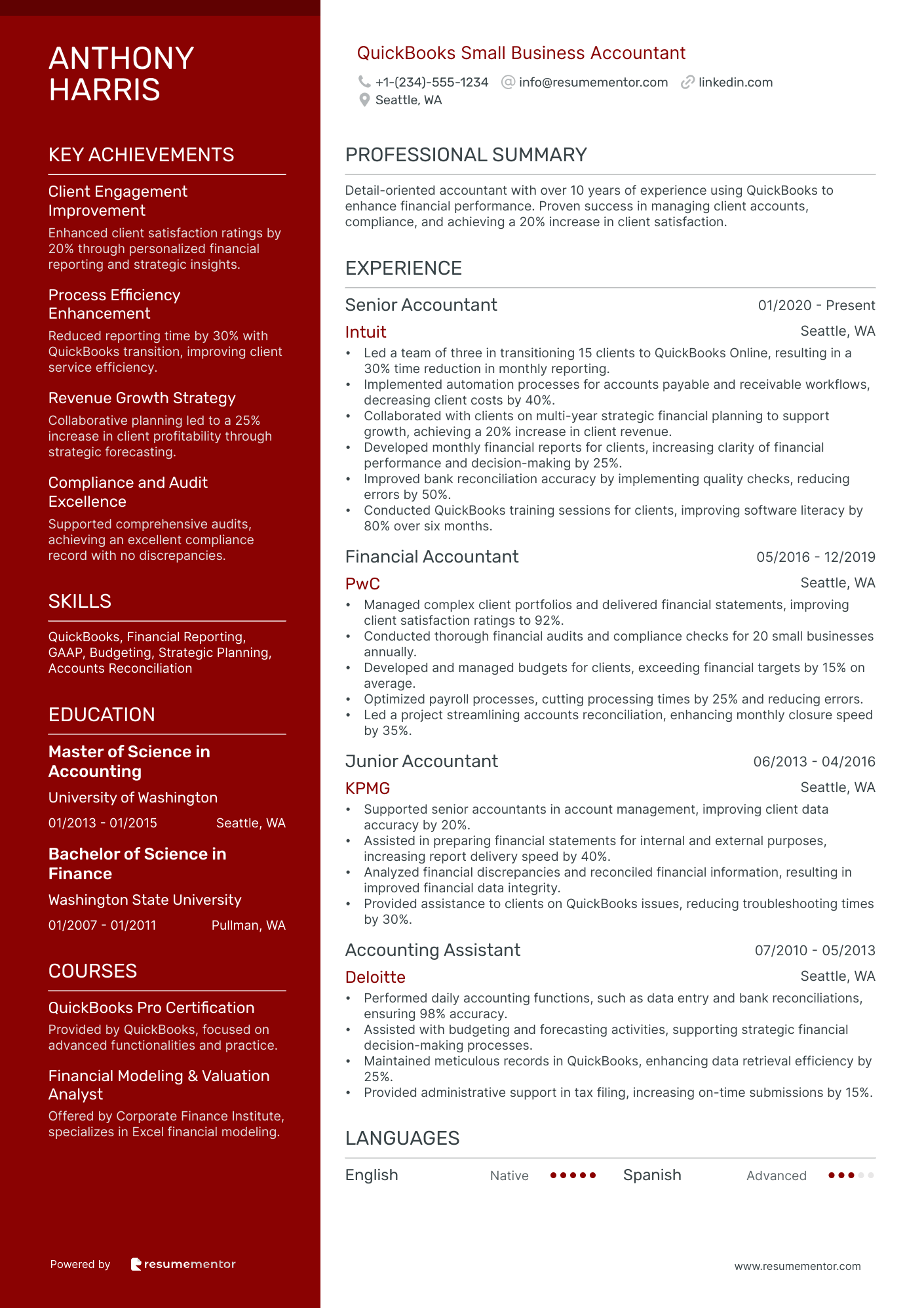

QuickBooks Small Business Accountant

QuickBooks Construction Industry Accountant

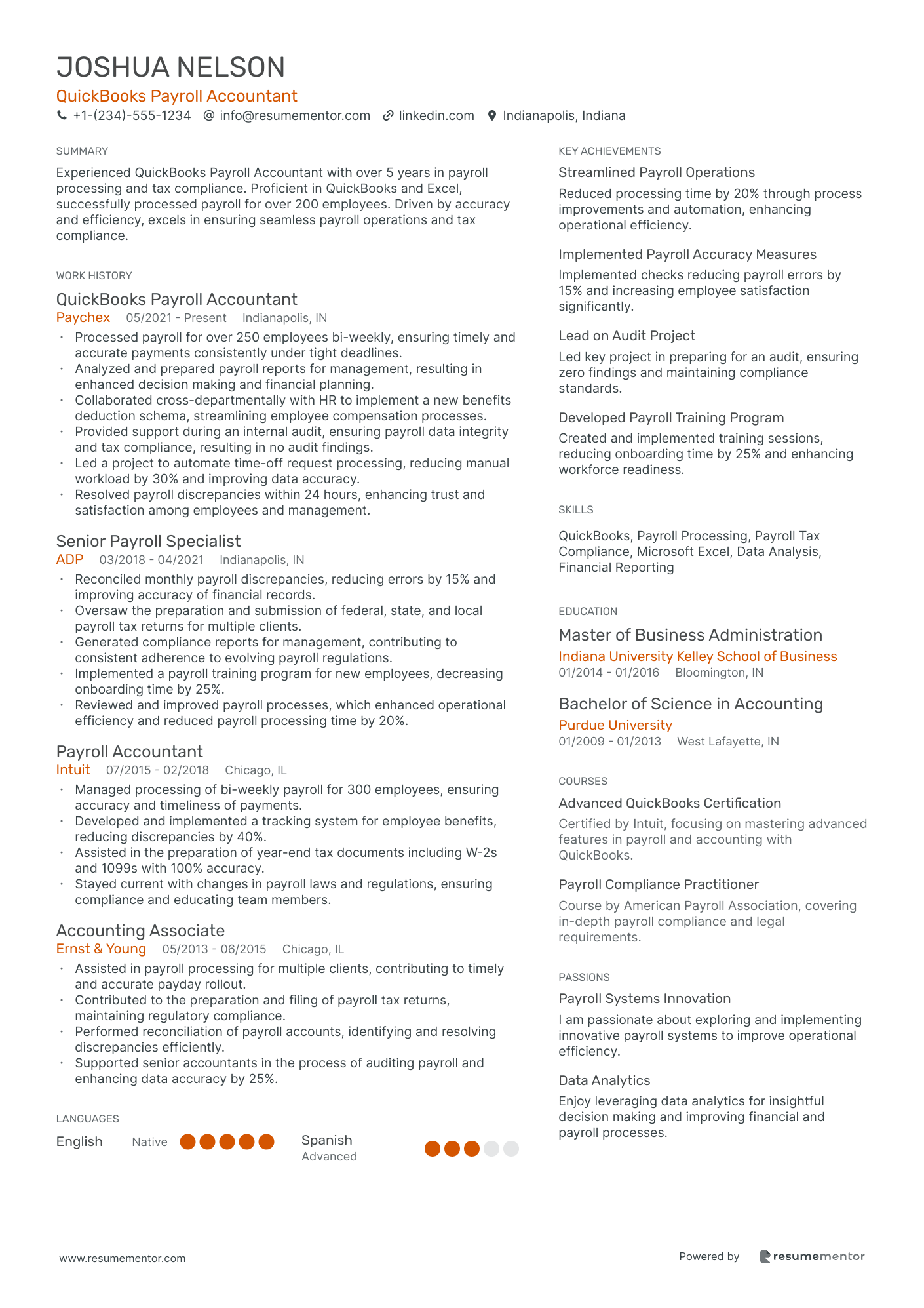

QuickBooks Payroll Accountant resume sample

- •Processed payroll for over 250 employees bi-weekly, ensuring timely and accurate payments consistently under tight deadlines.

- •Analyzed and prepared payroll reports for management, resulting in enhanced decision making and financial planning.

- •Collaborated cross-departmentally with HR to implement a new benefits deduction schema, streamlining employee compensation processes.

- •Provided support during an internal audit, ensuring payroll data integrity and tax compliance, resulting in no audit findings.

- •Led a project to automate time-off request processing, reducing manual workload by 30% and improving data accuracy.

- •Resolved payroll discrepancies within 24 hours, enhancing trust and satisfaction among employees and management.

- •Reconciled monthly payroll discrepancies, reducing errors by 15% and improving accuracy of financial records.

- •Oversaw the preparation and submission of federal, state, and local payroll tax returns for multiple clients.

- •Generated compliance reports for management, contributing to consistent adherence to evolving payroll regulations.

- •Implemented a payroll training program for new employees, decreasing onboarding time by 25%.

- •Reviewed and improved payroll processes, which enhanced operational efficiency and reduced payroll processing time by 20%.

- •Managed processing of bi-weekly payroll for 300 employees, ensuring accuracy and timeliness of payments.

- •Developed and implemented a tracking system for employee benefits, reducing discrepancies by 40%.

- •Assisted in the preparation of year-end tax documents including W-2s and 1099s with 100% accuracy.

- •Stayed current with changes in payroll laws and regulations, ensuring compliance and educating team members.

- •Assisted in payroll processing for multiple clients, contributing to timely and accurate payday rollout.

- •Contributed to the preparation and filing of payroll tax returns, maintaining regulatory compliance.

- •Performed reconciliation of payroll accounts, identifying and resolving discrepancies efficiently.

- •Supported senior accountants in the process of auditing payroll and enhancing data accuracy by 25%.

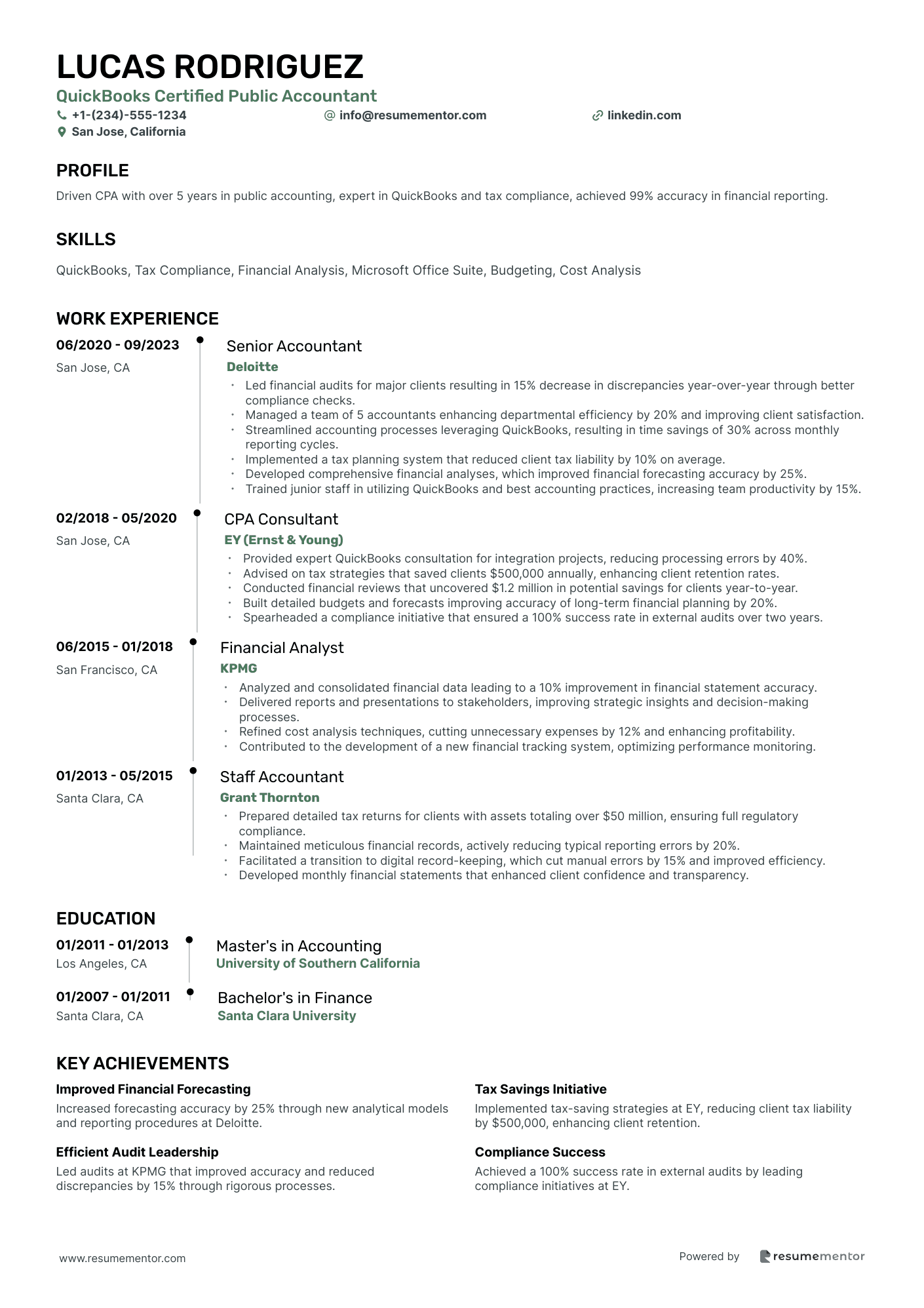

QuickBooks Certified Public Accountant resume sample

- •Led financial audits for major clients resulting in 15% decrease in discrepancies year-over-year through better compliance checks.

- •Managed a team of 5 accountants enhancing departmental efficiency by 20% and improving client satisfaction.

- •Streamlined accounting processes leveraging QuickBooks, resulting in time savings of 30% across monthly reporting cycles.

- •Implemented a tax planning system that reduced client tax liability by 10% on average.

- •Developed comprehensive financial analyses, which improved financial forecasting accuracy by 25%.

- •Trained junior staff in utilizing QuickBooks and best accounting practices, increasing team productivity by 15%.

- •Provided expert QuickBooks consultation for integration projects, reducing processing errors by 40%.

- •Advised on tax strategies that saved clients $500,000 annually, enhancing client retention rates.

- •Conducted financial reviews that uncovered $1.2 million in potential savings for clients year-to-year.

- •Built detailed budgets and forecasts improving accuracy of long-term financial planning by 20%.

- •Spearheaded a compliance initiative that ensured a 100% success rate in external audits over two years.

- •Analyzed and consolidated financial data leading to a 10% improvement in financial statement accuracy.

- •Delivered reports and presentations to stakeholders, improving strategic insights and decision-making processes.

- •Refined cost analysis techniques, cutting unnecessary expenses by 12% and enhancing profitability.

- •Contributed to the development of a new financial tracking system, optimizing performance monitoring.

- •Prepared detailed tax returns for clients with assets totaling over $50 million, ensuring full regulatory compliance.

- •Maintained meticulous financial records, actively reducing typical reporting errors by 20%.

- •Facilitated a transition to digital record-keeping, which cut manual errors by 15% and improved efficiency.

- •Developed monthly financial statements that enhanced client confidence and transparency.

QuickBooks Tax Specialist resume sample

- •Managed over 150 client accounts, yielding a 98% satisfaction rate by optimizing tax strategies using QuickBooks.

- •Reduced client tax liabilities by 25% on average, by developing personalized tax strategies aligned with current tax regulations.

- •Revised financial statements for accuracy, resulting in zero audit findings from federal and state agencies for three years.

- •Developed and delivered QuickBooks training sessions, improving client self-management skills by 40%.

- •Efficiently filed tax documents for federal, state, and local returns, achieving a 100% on-time filing record.

- •Designed new methods for data organization, enhancing process efficiency by 20% for the entire team.

- •Successfully managed a portfolio of 100+ business and individual tax preparations yearly, meeting all deadlines.

- •Implemented automated accounting processes using QuickBooks, improving financial data accuracy by 30%.

- •Collaborated on a software development project that improved tax reporting efficiency, reducing processing time by 15%.

- •Achieved a 90% client retention rate through effective communication and personalized tax advising.

- •Reduced bookkeeping errors by 40% through rigorous financial statement and tax record reviews.

- •Provided in-depth tax advisory services to over 80 high-net-worth clients, maintaining compliance with IRS regulations.

- •Increased efficiency in tax filing processes by redesigning client documentation systems, leading to a 20% reduction in processing time.

- •Prepared complex tax returns, improving overall profitability by identifying significant deductions and credits.

- •Educated junior associates, boosting their tax preparation proficiency by 50% through structured training workshops.

- •Addressed over 200 client tax inquiries annually, enhancing understanding and compliance with tax obligations.

- •Conducted comprehensive tax analysis resulting in strategically minimizing tax payments for various clients.

- •Increased client portfolio by 10% through successful cross-selling of firm services.

- •Regularly updated knowledge on tax legislation and changes, ensuring advisory services remained current and comprehensive.

Financial Forensics Accountant in QuickBooks resume sample

- •Led a complex forensic accounting investigation that identified $500,000 in financial discrepancies, improving overall financial accuracy by 30%.

- •Collaborated with law enforcement agencies, presenting evidence that resulted in the conviction of a fraud case worth $2M.

- •Prepared detailed reports on audit findings, leading to the implementation of ten strategic financial controls.

- •Conducted forensic audits for high-profile clients using QuickBooks to uncover fraudulent accounting practices.

- •Trained and mentored a team of five junior accountants, enhancing their efficiency by over 20%.

- •Partnered with legal representation during litigation processes to recover $750,000 in lost assets.

- •Executed forensic accounting analyses, detecting embezzlement activities, which led to recovering $1.5 million.

- •Utilized QuickBooks to streamline audit processes, reducing processing time by 15% across investigations.

- •Delivered comprehensive financial reports to clients, earning a 9.5/10 satisfaction rating for clear presentations of complex data.

- •Participated in cross-functional teams addressing international financial misconduct cases at a global scale.

- •Advised client firms on mitigating financial risks, reducing the occurrence of future fraud cases by 25%.

- •Conducted audits revealing $800,000 in corporate losses through exhaustive analysis of financial records.

- •Implemented innovative auditing techniques with QuickBooks, enhancing data accuracy by 40%.

- •Engaged closely with clients to develop risk assessments that improved their internal controls by 35%.

- •Collaborated with internal teams to identify and investigate financial misstatements, resulting in $300,000 in savings.

- •Assisted in conducting detailed audits that clarified discrepancies and enhanced processes saving $200,000 annually.

- •Aided in the recovery of assets amounting to $1 million by collating and analyzing documentation.

- •Utilized QuickBooks to streamline client reporting, achieving 20% faster delivery times.

- •Supported senior accountants in preparing audit documentation that passed regulatory inspections with 95% accuracy.

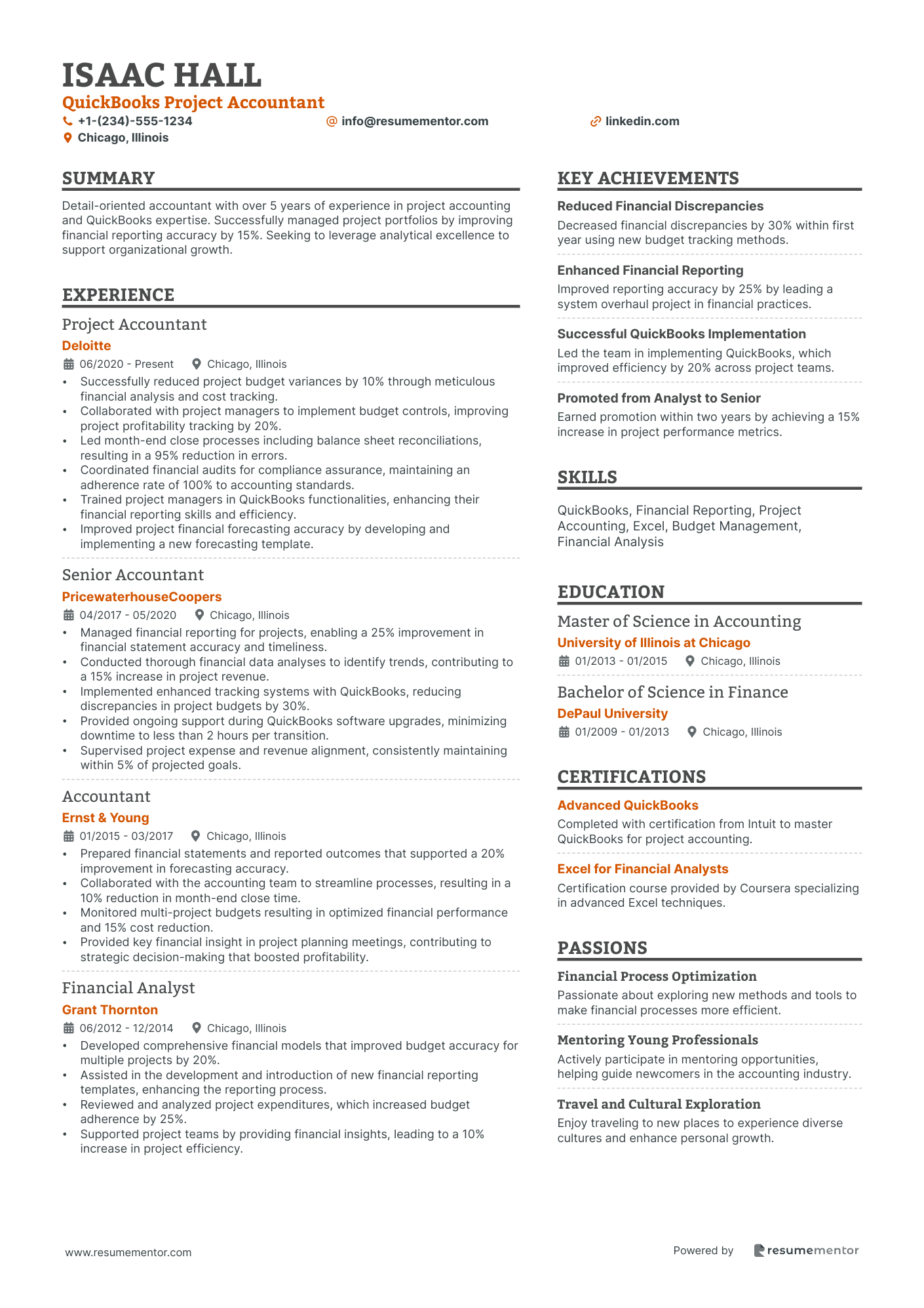

QuickBooks Project Accountant resume sample

- •Successfully reduced project budget variances by 10% through meticulous financial analysis and cost tracking.

- •Collaborated with project managers to implement budget controls, improving project profitability tracking by 20%.

- •Led month-end close processes including balance sheet reconciliations, resulting in a 95% reduction in errors.

- •Coordinated financial audits for compliance assurance, maintaining an adherence rate of 100% to accounting standards.

- •Trained project managers in QuickBooks functionalities, enhancing their financial reporting skills and efficiency.

- •Improved project financial forecasting accuracy by developing and implementing a new forecasting template.

- •Managed financial reporting for projects, enabling a 25% improvement in financial statement accuracy and timeliness.

- •Conducted thorough financial data analyses to identify trends, contributing to a 15% increase in project revenue.

- •Implemented enhanced tracking systems with QuickBooks, reducing discrepancies in project budgets by 30%.

- •Provided ongoing support during QuickBooks software upgrades, minimizing downtime to less than 2 hours per transition.

- •Supervised project expense and revenue alignment, consistently maintaining within 5% of projected goals.

- •Prepared financial statements and reported outcomes that supported a 20% improvement in forecasting accuracy.

- •Collaborated with the accounting team to streamline processes, resulting in a 10% reduction in month-end close time.

- •Monitored multi-project budgets resulting in optimized financial performance and 15% cost reduction.

- •Provided key financial insight in project planning meetings, contributing to strategic decision-making that boosted profitability.

- •Developed comprehensive financial models that improved budget accuracy for multiple projects by 20%.

- •Assisted in the development and introduction of new financial reporting templates, enhancing the reporting process.

- •Reviewed and analyzed project expenditures, which increased budget adherence by 25%.

- •Supported project teams by providing financial insights, leading to a 10% increase in project efficiency.

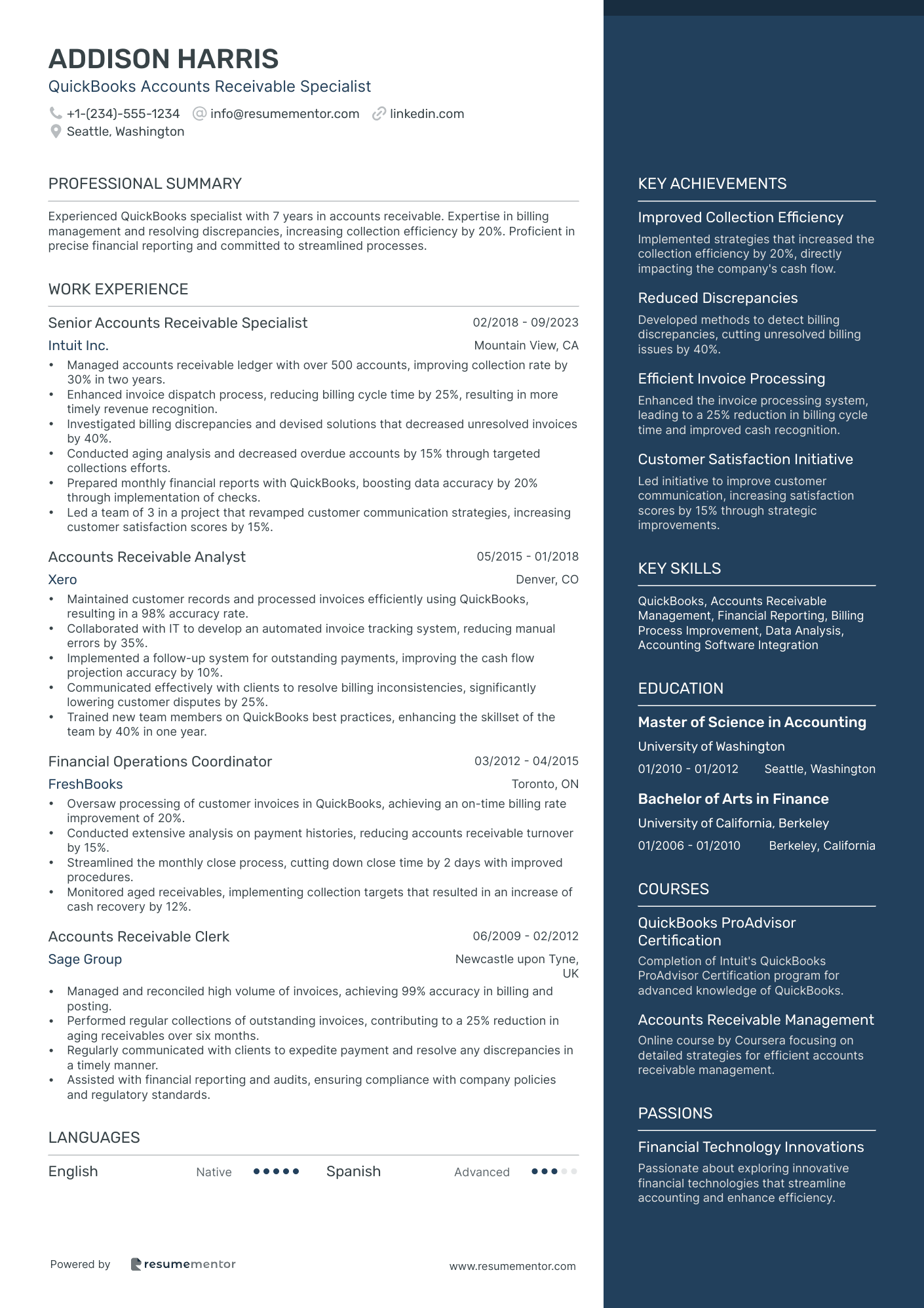

QuickBooks Accounts Receivable Specialist resume sample

- •Managed accounts receivable ledger with over 500 accounts, improving collection rate by 30% in two years.

- •Enhanced invoice dispatch process, reducing billing cycle time by 25%, resulting in more timely revenue recognition.

- •Investigated billing discrepancies and devised solutions that decreased unresolved invoices by 40%.

- •Conducted aging analysis and decreased overdue accounts by 15% through targeted collections efforts.

- •Prepared monthly financial reports with QuickBooks, boosting data accuracy by 20% through implementation of checks.

- •Led a team of 3 in a project that revamped customer communication strategies, increasing customer satisfaction scores by 15%.

- •Maintained customer records and processed invoices efficiently using QuickBooks, resulting in a 98% accuracy rate.

- •Collaborated with IT to develop an automated invoice tracking system, reducing manual errors by 35%.

- •Implemented a follow-up system for outstanding payments, improving the cash flow projection accuracy by 10%.

- •Communicated effectively with clients to resolve billing inconsistencies, significantly lowering customer disputes by 25%.

- •Trained new team members on QuickBooks best practices, enhancing the skillset of the team by 40% in one year.

- •Oversaw processing of customer invoices in QuickBooks, achieving an on-time billing rate improvement of 20%.

- •Conducted extensive analysis on payment histories, reducing accounts receivable turnover by 15%.

- •Streamlined the monthly close process, cutting down close time by 2 days with improved procedures.

- •Monitored aged receivables, implementing collection targets that resulted in an increase of cash recovery by 12%.

- •Managed and reconciled high volume of invoices, achieving 99% accuracy in billing and posting.

- •Performed regular collections of outstanding invoices, contributing to a 25% reduction in aging receivables over six months.

- •Regularly communicated with clients to expedite payment and resolve any discrepancies in a timely manner.

- •Assisted with financial reporting and audits, ensuring compliance with company policies and regulatory standards.

QuickBooks Non-Profit Accountant resume sample

- •Spearheaded the financial management of over $5 million in grants, leading to a 10% increase in fund utilization efficiency.

- •Developed comprehensive monthly financial reports, improving reporting accuracy by 15%, and facilitating strategic decision-making.

- •Led the successful execution of annual audits, achieving zero non-compliance issues for three consecutive years.

- •Optimized payroll processing for over 150 employees, reducing error rates by 25% and increasing efficiency.

- •Managed budgeting processes that resulted in a 20% reduction in unnecessary expenses, contributing to the organization's financial health.

- •Collaborated with program managers to implement financial strategies that successfully supported over 50 projects.

- •Contributed to the management of $3 million in annual budgets, optimizing resource allocation and achieving a 12% increase in effectiveness.

- •Streamlined accounts payable and receivable processes, reducing the processing time by 30%.

- •Prepared detailed financial statements, enhancing data transparency and accuracy, which resulted in stronger financial oversight.

- •Coordinated successful external audits, ensuring compliance with federal, state, and local regulations.

- •Improved QuickBooks setup and reporting accuracy, increasing financial reporting speed by 20%.

- •Handled financial record-keeping for over 15 programs, resulting in a 25% improvement in data entry accuracy.

- •Assisted in developing and monitoring a $2 million budget, enhancing strategic financial planning and control.

- •Implemented a comprehensive system for tracking grant funds, reducing reporting discrepancies by 30%.

- •Facilitated monthly reconciliations of bank statements, achieving a 10% faster reconciliation process.

- •Assisted in accounts payable processes, managing over 200 monthly transactions with a 98% accuracy rate.

- •Collaborated with finance team to prepare quarterly financial statements, enhancing accuracy by 20%.

- •Played a key role in the preparation of annual reports, ensuring timely and accurate submission.

- •Contributed to the development and maintenance of financial procedures, streamlining operations and reducing overhead.

QuickBooks Cost Accountant resume sample

- •Optimized financial reporting systems in QuickBooks, increasing efficiency by 20% in monthly closings.

- •Developed cost forecasting models that improved accuracy by 25%, significantly aiding budget controls.

- •Led a team to address cost variance issues, resulting in a 10% reduction in overhead expenses.

- •Established pricing strategies bolstering revenue by 15% in collaboration with operations teams.

- •Collaborated on standard costing determination, leading to a 30% increase in product line profitability.

- •Facilitated year-end audit processes, streamlining documentation and cutting discrepancies by 50%.

- •Conducted thorough variance analysis resulting in improved budget adherence by 12%.

- •Maintained and updated cost accounting procedures, enhancing policy compliance by 20%.

- •Assisted in the creation of pricing models, boosting sales trends analysis by 25%.

- •Coordinated with production teams to manage inventory controls, minimizing waste by 8%.

- •Streamlined financial statement preparation, reducing errors by 30% month-on-month.

- •Implemented QuickBooks for analysis tasks, cutting data processing time by 10%.

- •Prepared detailed cost analyses that informed strategic planning for multiple projects.

- •Supported financial reporting tasks, enhancing accuracy of month-end procedures by 15%.

- •Maintained strict controls over financial compliance, ensuring adherence to regulations.

- •Assisted in developing standard costing systems, improving efficiency in reporting mechanisms by 20%.

- •Monitored inventory levels to implement cost-saving measures, reducing waste by 7%.

- •Provided comprehensive variance analysis, aiding in budgetary adjustments and planning.

- •Trained junior staff on QuickBooks, enhancing departmental productivity by 15%.

QuickBooks Small Business Accountant resume sample

- •Led a team of three in transitioning 15 clients to QuickBooks Online, resulting in a 30% time reduction in monthly reporting.

- •Implemented automation processes for accounts payable and receivable workflows, decreasing client costs by 40%.

- •Collaborated with clients on multi-year strategic financial planning to support growth, achieving a 20% increase in client revenue.

- •Developed monthly financial reports for clients, increasing clarity of financial performance and decision-making by 25%.

- •Improved bank reconciliation accuracy by implementing quality checks, reducing errors by 50%.

- •Conducted QuickBooks training sessions for clients, improving software literacy by 80% over six months.

- •Managed complex client portfolios and delivered financial statements, improving client satisfaction ratings to 92%.

- •Conducted thorough financial audits and compliance checks for 20 small businesses annually.

- •Developed and managed budgets for clients, exceeding financial targets by 15% on average.

- •Optimized payroll processes, cutting processing times by 25% and reducing errors.

- •Led a project streamlining accounts reconciliation, enhancing monthly closure speed by 35%.

- •Supported senior accountants in account management, improving client data accuracy by 20%.

- •Assisted in preparing financial statements for internal and external purposes, increasing report delivery speed by 40%.

- •Analyzed financial discrepancies and reconciled financial information, resulting in improved financial data integrity.

- •Provided assistance to clients on QuickBooks issues, reducing troubleshooting times by 30%.

- •Performed daily accounting functions, such as data entry and bank reconciliations, ensuring 98% accuracy.

- •Assisted with budgeting and forecasting activities, supporting strategic financial decision-making processes.

- •Maintained meticulous records in QuickBooks, enhancing data retrieval efficiency by 25%.

- •Provided administrative support in tax filing, increasing on-time submissions by 15%.

QuickBooks Construction Industry Accountant resume sample

- •Implemented a new QuickBooks system for job costing, resulting in a 20% increase in project profitability analysis accuracy.

- •Managed and accurately reported on work in progress for 15+ projects concurrently, optimizing cash flow and resource allocation.

- •Collaborated with project managers to clean up over $2 million in outstanding accounts receivable, improving cash management by 25%.

- •Streamlined monthly reconciliation processes for all bank statements across 10 construction sites, reducing time by 3 days monthly.

- •Developed a new financial reporting framework, enhancing real-time decision-making for senior management.

- •Played a key role in annual audit preparations, resolving over 95% of auditor inquiries swiftly, with no major findings.

- •Reduced project forecasting errors by 18% through detailed financial data analysis, providing valuable insights into budgeting tasks.

- •Facilitated a successful budget increase for a $500k project by aligning financial strategies with operational goals and priorities.

- •Spearheaded improvements in data accuracy for monthly financial statements, enhancing management reporting consistency and reliability.

- •Resolved complex accounts payable issues within a week by implementing rigorous controls, minimizing late payment risks by 30%.

- •Assessed compliance with current accounting regulations, ensuring 100% adherence and avoiding potential legal issues.

- •Oversaw financial reporting for construction projects worth up to $10 million, leading to improved client satisfaction by 22%.

- •Achieved a 15% reduction in unresolved billings and collections issues, boosting cash flow and financial efficiency.

- •Supported senior accountants in audit preparations by compiling crucial documentation, resulting in a seamless audit process.

- •Partnered with procurement teams to optimize supplier payments, negotiating discounts saving the company $100k yearly.

- •Contributed to a team that reconciled over 200 bank and vendor accounts, minimizing discrepancies by 50%.

- •Utilized QuickBooks to enhance data entry processes, cutting down errors by 30% and saving 90 administrative hours annually.

- •Led internal reports analysis, detecting inconsistencies which once resolved, improved financial reports accuracy by 18%.

- •Supported the payroll processing for over 300 employees, ensuring compliance with current labor laws and regulations.

As a QuickBooks accountant, entering the job market can sometimes feel like navigating a complex financial spreadsheet without a clear guide. While your expertise with QuickBooks is a valuable asset, translating that into a compelling resume presents its own challenges. The key is to express your skills and experiences clearly in a way that makes you stand out.

Your resume serves as a bridge between your accounting skills and potential employers, and it's vital that it highlights not only your QuickBooks proficiency but also your problem-solving abilities and attention to detail. A well-chosen resume template can streamline this process, ensuring your document is both organized and visually appealing. Consider exploring these resume templates to find one that resonates with your personal style.

To make a strong impression, tailor your resume to emphasize achievements specifically related to QuickBooks. Detail how you've improved financial systems or optimized accounting workflows, as this speaks volumes about your ability to add value. Each section should reflect what makes you unique in the accounting field.

Think of your resume as more than just a document—it's your personal marketing tool. It needs to showcase not only your past experience but also your potential for future growth. Crafting a standout resume will enable you to confidently navigate the competitive job market and secure the opportunities you deserve.

Key Takeaways

- Ensure your QuickBooks accountant resume showcases both your expertise with the software and your problem-solving abilities to stand out in the job market.

- Use a reverse-chronological format to highlight your most recent roles and accomplishments, making sure your experience and skills are easy to assess.

- Incorporate quantifiable metrics into your experience section to effectively illustrate the impact of your contributions using strong action verbs.

- A dedicated skills section should prominently feature both hard skills like QuickBooks proficiency and relevant soft skills such as attention to detail and communication.

- Include extra sections like language skills, hobbies, and volunteer work to provide a well-rounded view of your abilities beyond just technical expertise.

What to focus on when writing your quickbooks accountant resume

Your QuickBooks accountant resume should effectively communicate your expertise in financial management and proficiency with QuickBooks software, ensuring recruiters quickly see your ability to manage accounts accurately and efficiently—highlighting how each section of your resume plays a critical role in securing the job you want.

How to structure your quickbooks accountant resume

- Contact Information: It's essential to start with your full name, phone number, and a professional email address. Including easy access to your LinkedIn profile or any relevant professional websites can enhance your credibility and show you're engaged with industry networks, offering recruiters a way to explore your professional background further.

- Professional Summary: Following your contact details, a compelling short paragraph is crucial. This summary should synthesize your accounting experience and your QuickBooks skills, weaving in specific achievements that highlight your impact in previous roles. Providing context for these accomplishments helps set you apart as a focused and results-driven candidate.

- Skills: Next, list key skills relevant to the job, such as QuickBooks proficiency, financial analysis, payroll management, tax filing, and regulatory compliance. Connecting these skills directly to the responsibilities you’ll undertake highlights your readiness for the role and aligns your background with what hiring managers seek.

- Work Experience: Your job history should come next, detailing previous job titles, company names, and employment dates. By using bullet points to describe your duties and achievements, you offer clear evidence of your competency in roles similar to the one you’re targeting, helping recruiters visualize you in the position.

- Education: Following your work experience, mention your highest degree first, alongside any relevant certifications. Demonstrating your educational background, such as a “Bachelor’s Degree in Accounting,” enriches your resume by underscoring the foundation of your expertise and commitment to the field of accounting.

- Certifications: Finally, highlight specific certifications in QuickBooks and others, such as CPA or CMA. These credentials not only reinforce your skills but also indicate a dedication to professional growth, positioning you as a highly qualified candidate.

As we delve deeper into each section below, understanding how to format your resume effectively is equally important, ensuring each component of your QuickBooks accountant resume is presented in the best possible way.

Which resume format to choose

When writing a resume as a QuickBooks accountant, start with the right format. The reverse-chronological layout is ideal because it showcases your latest experience up front, helping potential employers quickly assess your skills and qualifications. Since software familiarity, like QuickBooks, is often central to these roles, leading with your most recent roles highlights your up-to-date expertise.

Choosing the right font is also key. Options like Rubik, Lato, or Montserrat not only offer a professional and modern look but also ensure readability, which is crucial when you're detailing complex accounting skills and responsibilities. A clean font helps your accomplishments and technical knowledge stand out without distraction.

Selecting PDF for your file type is crucial. PDFs lock in your resume’s layout and content, so it appears consistent on any device or operating system an employer might use. This reliability is important in accounting, where precision and attention to detail are valued.

Lastly, maintain a one-inch margin on all sides. This choice creates a clean and organized appearance, which is vital when listing detailed information like certifications, accounting methodologies, and experiences working with financial data. Together, these considerations ensure your resume is well-structured and effective for a QuickBooks accountant role.

How to write a quantifiable resume experience section

A powerful QuickBooks accountant resume experience section prioritizes your key achievements and how your skills have positively impacted previous employers. It showcases your capabilities and contributions with concrete examples of your performance. To achieve this, organize it in reverse chronological order, placing your latest role at the forefront. Cover around 10-15 years of experience, honing in on roles that directly relate to the job you're targeting. Tailoring your resume to the job ad is vital, aligning your skills and experience with the requirements and using strong action words like "achieved," "managed," and "streamlined" to emphasize effectiveness and capability.

This tailored approach involves choosing job titles that align closely with the position you’re aiming for, sometimes rephrasing past roles for better alignment. Concentrate on specific accomplishments, using quantifiable metrics to illustrate your success. These might include percentages, financial figures, or timelines to highlight the value you brought to previous teams.

- •Increased report accuracy by 30% by implementing advanced QuickBooks processes.

- •Cut monthly closing time by 20% through streamlined workflows and task automation.

- •Oversaw $2 million budgets, ensuring compliance and cost-effectiveness.

- •Trained 5 junior accountants in QuickBooks, boosting department efficiency by 25%.

The example effectively links each achievement to key responsibilities by using quantifiable results that underline your expertise and impact. For instance, by improving report accuracy by 30% and managing multi-million-dollar budgets, you directly relate your achievements to common duties of a QuickBooks accountant. Strong action verbs like "increased," "cut," and "oversaw" further depict a proactive and results-oriented professional.

Additionally, concise bullet points convey meaningful information swiftly, helping employers understand your potential at a glance. The section’s structured approach, coupled with a focus on measurable success, vividly illustrates your positive impact and proficiencies, making your experience section a standout element on your resume.

Achievement-Focused resume experience section

A QuickBooks-focused accountant resume experience section should underscore the significant impact of your contributions. Begin by highlighting the accomplishments you are most proud of, such as enhancing systems, reducing expenses, or streamlining processes. Use strong, clear action verbs to vividly depict your active role. Keep the details concise but comprehensive enough to demonstrate how you made a difference for your past employers or clients.

Incorporating numbers into your accomplishments adds a solid dimension and tells a compelling story. For example, rather than just stating you "managed accounts," emphasize that you "boosted accuracy by 30%." Always consider what potential employers value in a QuickBooks accountant and tailor your achievements to meet these expectations. By doing so, you highlight your unique skills while also illustrating a broader understanding of accounting’s importance to an organization.

QuickBooks Accountant

Financial Solutions Company

January 2020 - Present

- Improved financial report accuracy by 30% through system upgrades and employee training.

- Streamlined payroll processes, reducing processing time by 40%.

- Enhanced client satisfaction ratings by implementing efficient QuickBooks training sessions.

- Managed accounts for over 50 clients, leading to a 15% increase in client retention.

Leadership-Focused resume experience section

A leadership-focused QuickBooks accountant resume experience section should clearly demonstrate your ability to guide and impact teams and projects. Identify moments where you've showcased leadership, like managing a team, leading projects, or introducing new systems, and articulate them with strong action verbs. Start each bullet point with these verbs and add quantifiable achievements to give them weight. For instance, instead of just stating "Led a team," say "Managed a team of five accountants, boosting efficiency by 20%." This demonstrates not just leadership, but tangible results.

Seamlessly integrating context into each bullet point is crucial for telling a compelling story. Describe the circumstances, detail your actions, and highlight the outcomes to provide a complete picture. Focus on significant accomplishments that show the real difference your leadership made, convincing future employers of your value. By doing this, you’ll craft a narrative that ties together your leadership skills with the essential qualities needed in an accounting role.

Senior Accountant

ABC Financial Services

August 2019 - Present

- Managed a team of five accountants, boosting efficiency by 20%.

- Implemented a new QuickBooks module, cutting processing time by 30%.

- Trained junior staff, improving customer service ratings by 15%.

- Led quarterly financial reviews, uncovering cost-saving opportunities worth $50,000 annually.

Problem-Solving Focused resume experience section

A problem-solving-focused QuickBooks accountant resume experience section should highlight your ability to address and resolve challenges effectively. Begin by detailing key responsibilities that showcase your problem-solving skills with QuickBooks, emphasizing how you tackle technical issues and improve financial processes. Demonstrate your analytical abilities by using metrics to highlight successful outcomes, such as cost savings or enhanced efficiency, ensuring your descriptions are clear and concise.

To make this section stand out, provide detailed bullet points about specific tasks and accomplishments that emphasize your role in finding solutions. Describe common issues you resolved or new processes you implemented, and whenever possible, quantify the results to illustrate your effectiveness. Connect each action to its positive impact on the business, showing how your contributions made a difference. Tailor these entries to align with the job you're applying for, emphasizing your proactive approach to problem-solving.

Senior QuickBooks Accountant

ABC Financial Services

2018-2021

- Resolved recurring discrepancies in financial statements, reducing errors by 30% through enhanced auditing processes.

- Implemented new automated reporting tools in QuickBooks, increasing monthly close efficiency by 20%.

- Developed and trained a four-member team on new accounting software, improving department productivity.

- Collaborated with management to streamline payroll system, saving the company $10,000 annually.

Technology-Focused resume experience section

A technology-focused QuickBooks Accountant resume experience section should effectively showcase how you leverage technology to enhance financial management. Begin by clearly identifying your role and accomplishments, illustrating how your expertise in accounting software, especially QuickBooks, has streamlined financial processes. When you describe technological tasks, such as automating reports or implementing digital solutions, explain how these efforts have boosted organizational productivity. Highlight any experiences where you've mastered new software or contributed to technological upgrades to show your adaptability and commitment to continuous learning.

Sharing scenarios where your tech skills have saved time or reduced errors helps to connect your technical abilities with tangible outcomes. Additionally, emphasize your collaboration with IT or cross-functional teams, as teamwork is vital in tech-driven environments. Providing this level of detail not only underscores your specific technical skills but also paints a picture of how you drive results in a technology-enhanced accounting setting.

Senior QuickBooks Accountant

TechSolutions Financial

June 2019 - Present

- Optimized the use of QuickBooks to reduce financial report preparation time by 40%.

- Implemented automated invoicing and billing systems, leading to a 30% increase in payment efficiency.

- Trained team members on digital tools to ensure seamless integration of technology into daily accounting tasks.

- Collaborated with the IT department to upgrade financial software, minimizing system downtime by 15%

Write your quickbooks accountant resume summary section

A QuickBooks-focused accountant resume summary should quickly communicate your strengths and experience to potential employers. You want them to understand who you are and what you bring to the table in just a few sentences. Craft your summary to be brief but impactful, like this:

This summary sets the stage by highlighting your certification and experience, instantly establishing your credibility. It transitions smoothly into showcasing your skills, like managing records and enhancing financial reporting, which are crucial for the role. By mentioning your success in fast-paced environments, you highlight your adaptability, an essential trait. Personal attributes such as attention to detail and strong problem-solving abilities round out the picture, underlining your readiness to make a meaningful contribution.

Understanding the nuances between different sections of a resume can further enhance your application. While a resume summary emphasizes skills and achievements, a resume objective is more about your future goals, ideal for newcomers to the field. A resume profile offers a broader view of your professional persona, while a summary of qualifications lists achievements and skills in a bullet format. Knowing these differences, you can tailor your resume to best showcase your strengths and align with job expectations.

Listing your quickbooks accountant skills on your resume

A skills-focused QuickBooks accountant resume should clearly highlight your abilities to make you stand out to potential employers. You can choose to have a dedicated skills section that makes your abilities easy to find, or integrate these skills throughout your experience or summary sections. Your strengths and soft skills, such as problem-solving and communication, demonstrate your capability to collaborate and handle various tasks smoothly. In contrast, hard skills like expertise in QuickBooks and crafting financial reports are specific, teachable abilities that you bring to the table.

Including these skills and strengths isn’t just about showcasing your capabilities; it’s also about embedding keywords that hiring managers look for. The right keywords ensure your resume passes digital filters and lands in front of the hiring team.

Consider this example for a skills section in your resume:

This section works well because it focuses on skills essential for a QuickBooks accountant. It uses simple, clear language and highlights only the most relevant capabilities, making it easy for hiring managers to quickly understand your qualifications.

Best hard skills to feature on your quickbooks accountant resume

The hard skills you highlight as a QuickBooks accountant should emphasize your technical expertise and depth of knowledge. These skills signify your ability to handle accounting tasks, navigate software intricacies, and abide by financial regulations.

Hard Skills

- QuickBooks Proficiency

- Financial Reporting

- Accounts Payable/Receivable

- Tax Preparation

- Budgeting

- Forecasting

- Bank Reconciliation

- GAAP Compliance

- Payroll Management

- Auditing Procedures

- Spreadsheet Software

- Data Entry

- Financial Analysis

- Inventory Management

- Cost Accounting

Best soft skills to feature on your quickbooks accountant resume

Meanwhile, soft skills are crucial for effective communication and teamwork in a QuickBooks accountant role. They illustrate your ability to manage both relationships and tasks efficiently.

Soft Skills

- Attention to Detail

- Communication

- Problem-solving

- Time Management

- Teamwork

- Adaptability

- Critical Thinking

- Organization

- Customer Service

- Dependability

- Leadership

- Negotiation

- Patience

- Analytical Skills

- Multitasking

How to include your education on your resume

Including an education section in your QuickBooks accountant resume is crucial. It is important to tailor this section to the specific job you are applying for, ensuring that all listed education is relevant. If an educational background does not relate to the position, it should be omitted. When your Grade Point Average (GPA) is strong and recent, consider adding it to your resume. Mentioning honors like "cum laude" enhances your educational credentials, as it highlights academic excellence. Different degrees should be listed with their full names, specifying areas of study and the institutions attended. Here are examples of how to organize your education section correctly.

Wrong example:

Right example:

The second example is more effective because it focuses on a relevant degree, boosting your fit for the QuickBooks accountant role. This section demonstrates your proficiency in accounting, directly aligning with job expectations. Adding the "cum laude" accolade and high GPA reflects your commitment and aptitude in the field. Ensure your listed education strengthens your profile for the role you desire.

How to include quickbooks accountant certificates on your resume

Including a certificates section in your QuickBooks accountant resume is crucial. This section highlights your qualifications and skills, making you stand out to potential employers. You can add certificates in your resume header for a quick overview or in a separate section for more detail.

First, list the name of the certificate. Next, include the date you received it. Add the issuing organization's name. Make sure the format is consistent, which makes it easier for recruiters to read.

An example of this in your resume header could look like: Certified QuickBooks ProAdvisor, 2022, Intuit. This setup makes your credentials instantly visible.

A standalone certificates section should include certificates relevant to accounting and QuickBooks. Here is an example:

This example is good because it showcases top industry-recognized certificates, each with the issuing organization. It directly relates to the role of a QuickBooks accountant and demonstrates your ongoing commitment to professional development.

Extra sections to include in your quickbooks accountant resume

Crafting an effective resume is key to showcasing your skills and qualifications for a QuickBooks accountant position. Ensuring that your resume clearly reflects your capabilities can help you stand out to potential employers.

- Language section—Demonstrate fluency in different languages to highlight your ability to work with diverse clients and global teams. Impress employers with your communication skills by listing languages such as Spanish or Mandarin.

- Hobbies and interests section—Showcase your well-rounded personality by including hobbies like reading finance books or playing chess. Reflect your analytical skills and passion for continuous learning.

- Volunteer work section—Illustrate your commitment to community and teamwork by listing volunteer experiences like organizing charity events or teaching budgeting classes. Strengthen your resume with real-world applications of your accounting skills.

- Books section—Mention relevant books you’ve read, like "The E-Myth Accountant" or "Profit First." Show your engagement with industry knowledge and your drive to stay updated on accounting practices.

Incorporating these sections can make your QuickBooks accountant resume more attractive and well-rounded. With each section showcasing different aspects of your skill set, you can leave a lasting impression on hiring managers.

In Conclusion

In conclusion, crafting a standout QuickBooks accountant resume is essential in presenting yourself as a top candidate in the competitive job market. Your resume serves as a marketing tool that not only highlights your technical proficiency in QuickBooks but also showcases your problem-solving skills and attention to detail. Organizing your resume with sections that clearly define your contact information, professional summary, skills, work experience, and education ensures clarity and flow. Tailoring your accomplishments and using quantifiable results can effectively demonstrate your impact in previous roles. Including certifications enhances your credibility, while additional sections like languages, hobbies, and volunteer work convey a well-rounded character. Remember, your resume is not just a list of qualifications—it's an opportunity to present yourself as a complete package. Use simple language and strong action verbs to make your achievements shine. By following these guidelines, you can build a resume that captures your strengths and aligns with job expectations, ultimately helping you secure your desired position.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.