Securities Attorney Resume Examples

Jul 18, 2024

|

12 min read

Crafting your securities attorney resume: picking the right words to secure your next role

Rated by 348 people

Securities Transactions Attorney

Securities Compliance Attorney

Corporate Securities Attorney

Securities Fraud Attorney

Derivatives and Securities Attorney

Securities Regulation Attorney

Investment Management Securities Attorney

Securities Prosecution Attorney

Public Securities Attorney

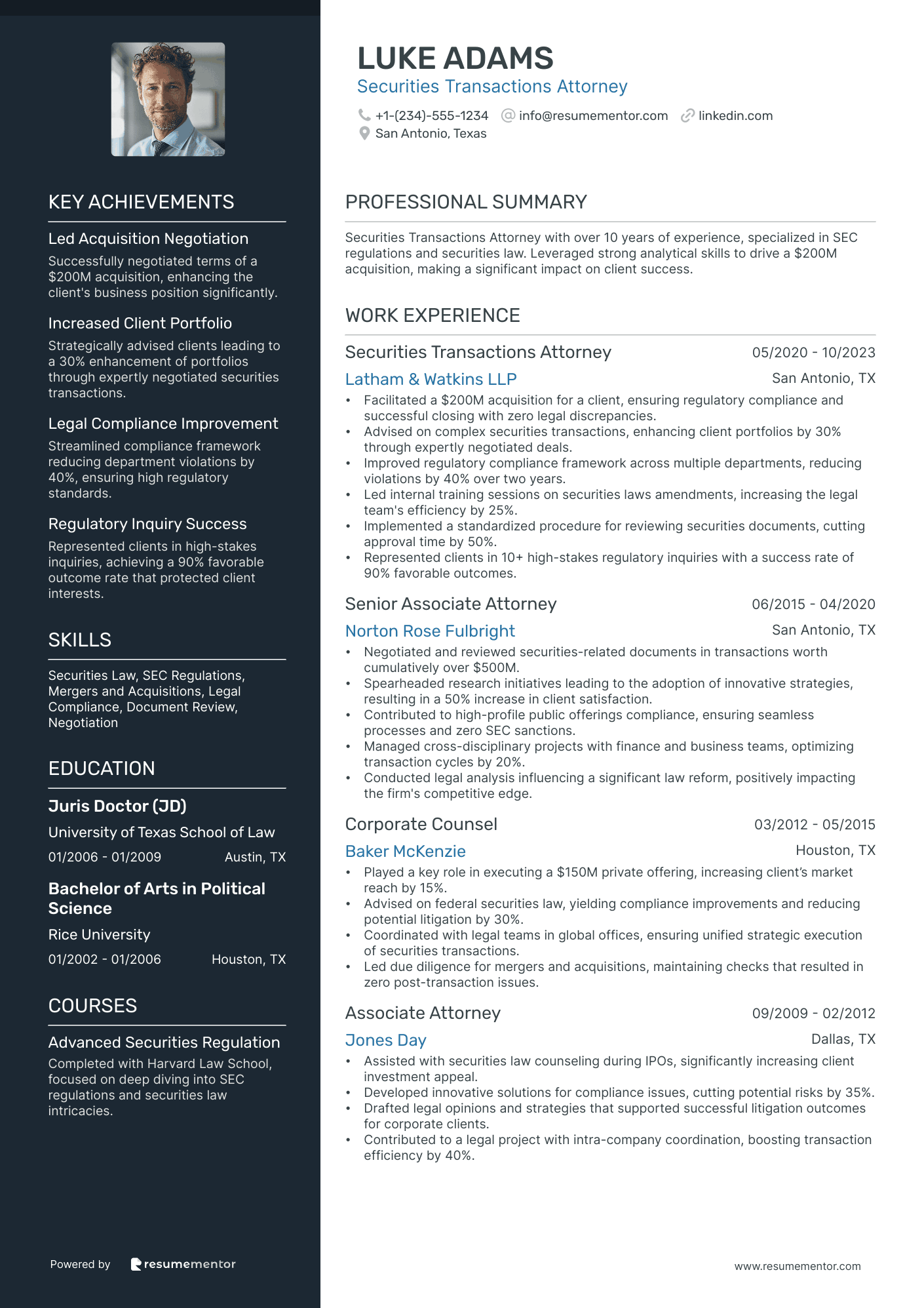

Securities Transactions Attorney resume sample

- •Facilitated a $200M acquisition for a client, ensuring regulatory compliance and successful closing with zero legal discrepancies.

- •Advised on complex securities transactions, enhancing client portfolios by 30% through expertly negotiated deals.

- •Improved regulatory compliance framework across multiple departments, reducing violations by 40% over two years.

- •Led internal training sessions on securities laws amendments, increasing the legal team's efficiency by 25%.

- •Implemented a standardized procedure for reviewing securities documents, cutting approval time by 50%.

- •Represented clients in 10+ high-stakes regulatory inquiries with a success rate of 90% favorable outcomes.

- •Negotiated and reviewed securities-related documents in transactions worth cumulatively over $500M.

- •Spearheaded research initiatives leading to the adoption of innovative strategies, resulting in a 50% increase in client satisfaction.

- •Contributed to high-profile public offerings compliance, ensuring seamless processes and zero SEC sanctions.

- •Managed cross-disciplinary projects with finance and business teams, optimizing transaction cycles by 20%.

- •Conducted legal analysis influencing a significant law reform, positively impacting the firm's competitive edge.

- •Played a key role in executing a $150M private offering, increasing client’s market reach by 15%.

- •Advised on federal securities law, yielding compliance improvements and reducing potential litigation by 30%.

- •Coordinated with legal teams in global offices, ensuring unified strategic execution of securities transactions.

- •Led due diligence for mergers and acquisitions, maintaining checks that resulted in zero post-transaction issues.

- •Assisted with securities law counseling during IPOs, significantly increasing client investment appeal.

- •Developed innovative solutions for compliance issues, cutting potential risks by 35%.

- •Drafted legal opinions and strategies that supported successful litigation outcomes for corporate clients.

- •Contributed to a legal project with intra-company coordination, boosting transaction efficiency by 40%.

Securities Compliance Attorney resume sample

- •Led a team to achieve a 25% reduction in SEC filing errors through enhanced training and strict procedural updates over 12 months.

- •Advised on over $300 million worth of transactions ensuring complete compliance with the Securities Exchange Act of 1934.

- •Implemented corporate governance strategies that increased board engagement by 40%, strengthening overall responsibilities and fiduciary duties.

- •Coordinated a response strategy that successfully managed five regulatory inquiries, eliminating any legal complications.

- •Developed and delivered compliance training that improved employee understanding of securities laws, impacting over 500 staff members.

- •Facilitated collaboration between finance teams to align on investor communications, enhancing clarity and reducing query response time by 15%.

- •Enhanced SEC filing processes resulting in a 20% faster preparation time for registration statements and reports.

- •Monitored changes in securities law, providing bi-monthly updates and recommended compliance strategies to senior management.

- •Conducted comprehensive legal analyses on corporate governance practices, advising on over 50 board meeting agendas and charter reviews.

- •Collaborated with external legal counsel on two significant M&A transactions mitigating legal risk and ensuring regulatory compliance.

- •Led a project that identified key areas for procedural improvement in compliance policies, achieving a 30% increase in staff policy adherence.

- •Provided legal advice on securities compliance issues, ensuring adherence to both state and federal regulations.

- •Reviewed and updated corporate governance documents leading to enhanced compliance with best practices and standards.

- •Participated in company initiatives that led to the identification and resolution of compliance risks before impacting operations.

- •Established a reporting system for regulatory changes, ensuring timely dissemination of information among legal and corporate teams.

- •Assisted in drafting and filing SEC documentation, contributing to the successful completion of numerous high-profile filings.

- •Conducted legal research and supported senior attorneys in advising on securities regulations and compliance strategies.

- •Managed communications with regulatory bodies during compliance audits, facilitating a smooth audit process for multiple clients.

- •Collaborated with the litigation team on securities-related cases, enhancing understanding of regulatory impact on business practices.

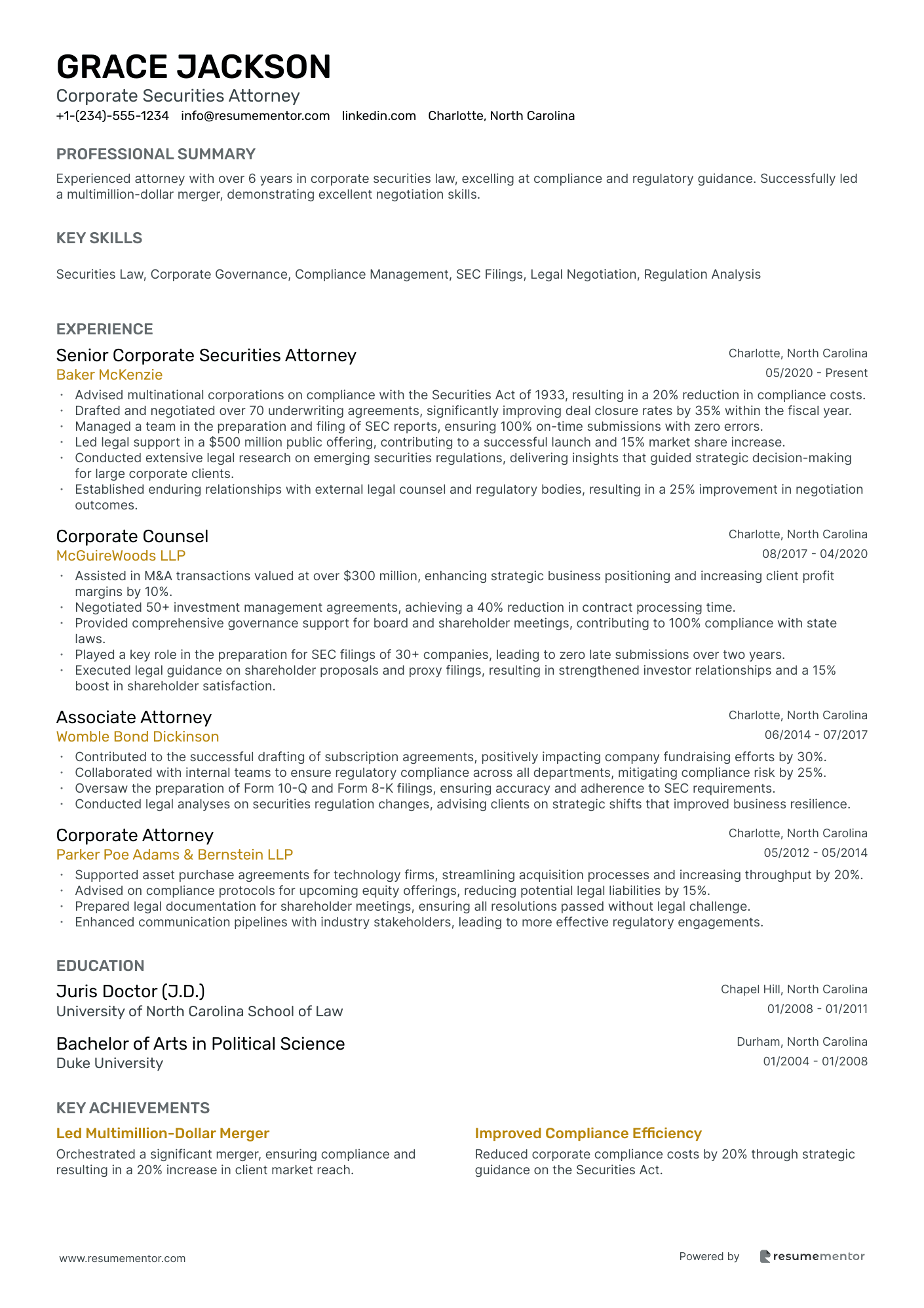

Corporate Securities Attorney resume sample

- •Advised multinational corporations on compliance with the Securities Act of 1933, resulting in a 20% reduction in compliance costs.

- •Drafted and negotiated over 70 underwriting agreements, significantly improving deal closure rates by 35% within the fiscal year.

- •Managed a team in the preparation and filing of SEC reports, ensuring 100% on-time submissions with zero errors.

- •Led legal support in a $500 million public offering, contributing to a successful launch and 15% market share increase.

- •Conducted extensive legal research on emerging securities regulations, delivering insights that guided strategic decision-making for large corporate clients.

- •Established enduring relationships with external legal counsel and regulatory bodies, resulting in a 25% improvement in negotiation outcomes.

- •Assisted in M&A transactions valued at over $300 million, enhancing strategic business positioning and increasing client profit margins by 10%.

- •Negotiated 50+ investment management agreements, achieving a 40% reduction in contract processing time.

- •Provided comprehensive governance support for board and shareholder meetings, contributing to 100% compliance with state laws.

- •Played a key role in the preparation for SEC filings of 30+ companies, leading to zero late submissions over two years.

- •Executed legal guidance on shareholder proposals and proxy filings, resulting in strengthened investor relationships and a 15% boost in shareholder satisfaction.

- •Contributed to the successful drafting of subscription agreements, positively impacting company fundraising efforts by 30%.

- •Collaborated with internal teams to ensure regulatory compliance across all departments, mitigating compliance risk by 25%.

- •Oversaw the preparation of Form 10-Q and Form 8-K filings, ensuring accuracy and adherence to SEC requirements.

- •Conducted legal analyses on securities regulation changes, advising clients on strategic shifts that improved business resilience.

- •Supported asset purchase agreements for technology firms, streamlining acquisition processes and increasing throughput by 20%.

- •Advised on compliance protocols for upcoming equity offerings, reducing potential legal liabilities by 15%.

- •Prepared legal documentation for shareholder meetings, ensuring all resolutions passed without legal challenge.

- •Enhanced communication pipelines with industry stakeholders, leading to more effective regulatory engagements.

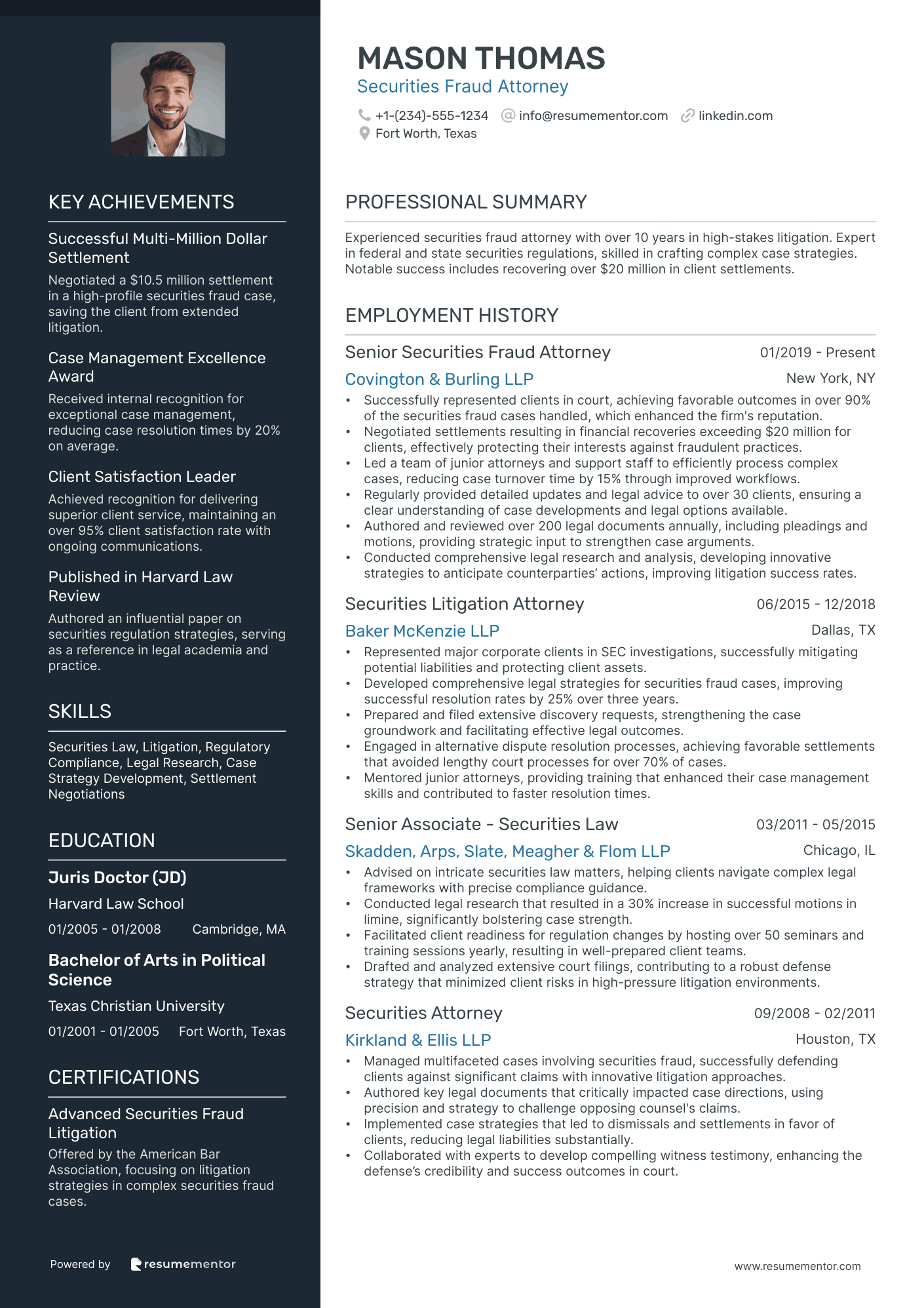

Securities Fraud Attorney resume sample

- •Successfully represented clients in court, achieving favorable outcomes in over 90% of the securities fraud cases handled, which enhanced the firm's reputation.

- •Negotiated settlements resulting in financial recoveries exceeding $20 million for clients, effectively protecting their interests against fraudulent practices.

- •Led a team of junior attorneys and support staff to efficiently process complex cases, reducing case turnover time by 15% through improved workflows.

- •Regularly provided detailed updates and legal advice to over 30 clients, ensuring a clear understanding of case developments and legal options available.

- •Authored and reviewed over 200 legal documents annually, including pleadings and motions, providing strategic input to strengthen case arguments.

- •Conducted comprehensive legal research and analysis, developing innovative strategies to anticipate counterparties’ actions, improving litigation success rates.

- •Represented major corporate clients in SEC investigations, successfully mitigating potential liabilities and protecting client assets.

- •Developed comprehensive legal strategies for securities fraud cases, improving successful resolution rates by 25% over three years.

- •Prepared and filed extensive discovery requests, strengthening the case groundwork and facilitating effective legal outcomes.

- •Engaged in alternative dispute resolution processes, achieving favorable settlements that avoided lengthy court processes for over 70% of cases.

- •Mentored junior attorneys, providing training that enhanced their case management skills and contributed to faster resolution times.

- •Advised on intricate securities law matters, helping clients navigate complex legal frameworks with precise compliance guidance.

- •Conducted legal research that resulted in a 30% increase in successful motions in limine, significantly bolstering case strength.

- •Facilitated client readiness for regulation changes by hosting over 50 seminars and training sessions yearly, resulting in well-prepared client teams.

- •Drafted and analyzed extensive court filings, contributing to a robust defense strategy that minimized client risks in high-pressure litigation environments.

- •Managed multifaceted cases involving securities fraud, successfully defending clients against significant claims with innovative litigation approaches.

- •Authored key legal documents that critically impacted case directions, using precision and strategy to challenge opposing counsel's claims.

- •Implemented case strategies that led to dismissals and settlements in favor of clients, reducing legal liabilities substantially.

- •Collaborated with experts to develop compelling witness testimony, enhancing the defense’s credibility and success outcomes in court.

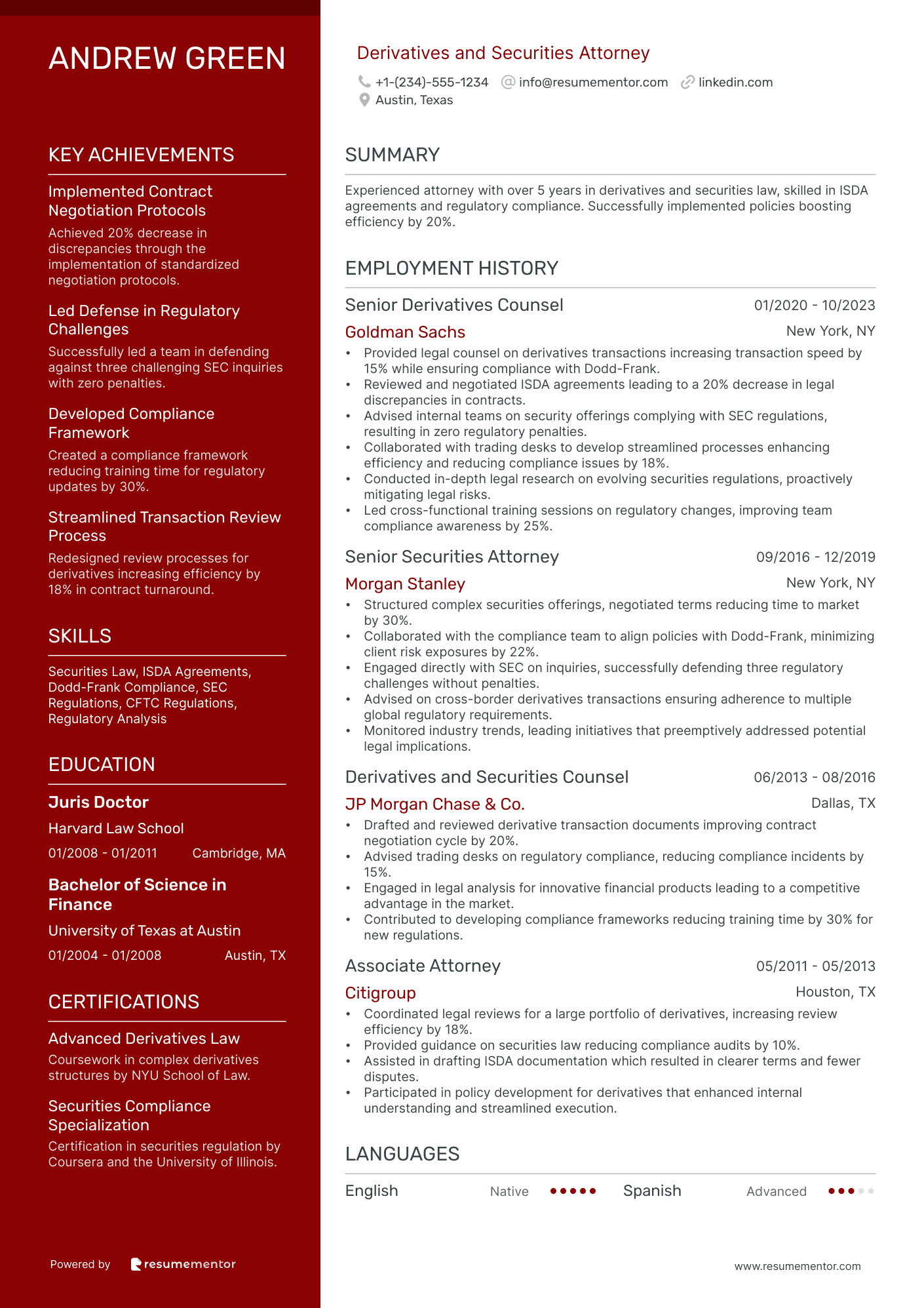

Derivatives and Securities Attorney resume sample

- •Provided legal counsel on derivatives transactions increasing transaction speed by 15% while ensuring compliance with Dodd-Frank.

- •Reviewed and negotiated ISDA agreements leading to a 20% decrease in legal discrepancies in contracts.

- •Advised internal teams on security offerings complying with SEC regulations, resulting in zero regulatory penalties.

- •Collaborated with trading desks to develop streamlined processes enhancing efficiency and reducing compliance issues by 18%.

- •Conducted in-depth legal research on evolving securities regulations, proactively mitigating legal risks.

- •Led cross-functional training sessions on regulatory changes, improving team compliance awareness by 25%.

- •Structured complex securities offerings, negotiated terms reducing time to market by 30%.

- •Collaborated with the compliance team to align policies with Dodd-Frank, minimizing client risk exposures by 22%.

- •Engaged directly with SEC on inquiries, successfully defending three regulatory challenges without penalties.

- •Advised on cross-border derivatives transactions ensuring adherence to multiple global regulatory requirements.

- •Monitored industry trends, leading initiatives that preemptively addressed potential legal implications.

- •Drafted and reviewed derivative transaction documents improving contract negotiation cycle by 20%.

- •Advised trading desks on regulatory compliance, reducing compliance incidents by 15%.

- •Engaged in legal analysis for innovative financial products leading to a competitive advantage in the market.

- •Contributed to developing compliance frameworks reducing training time by 30% for new regulations.

- •Coordinated legal reviews for a large portfolio of derivatives, increasing review efficiency by 18%.

- •Provided guidance on securities law reducing compliance audits by 10%.

- •Assisted in drafting ISDA documentation which resulted in clearer terms and fewer disputes.

- •Participated in policy development for derivatives that enhanced internal understanding and streamlined execution.

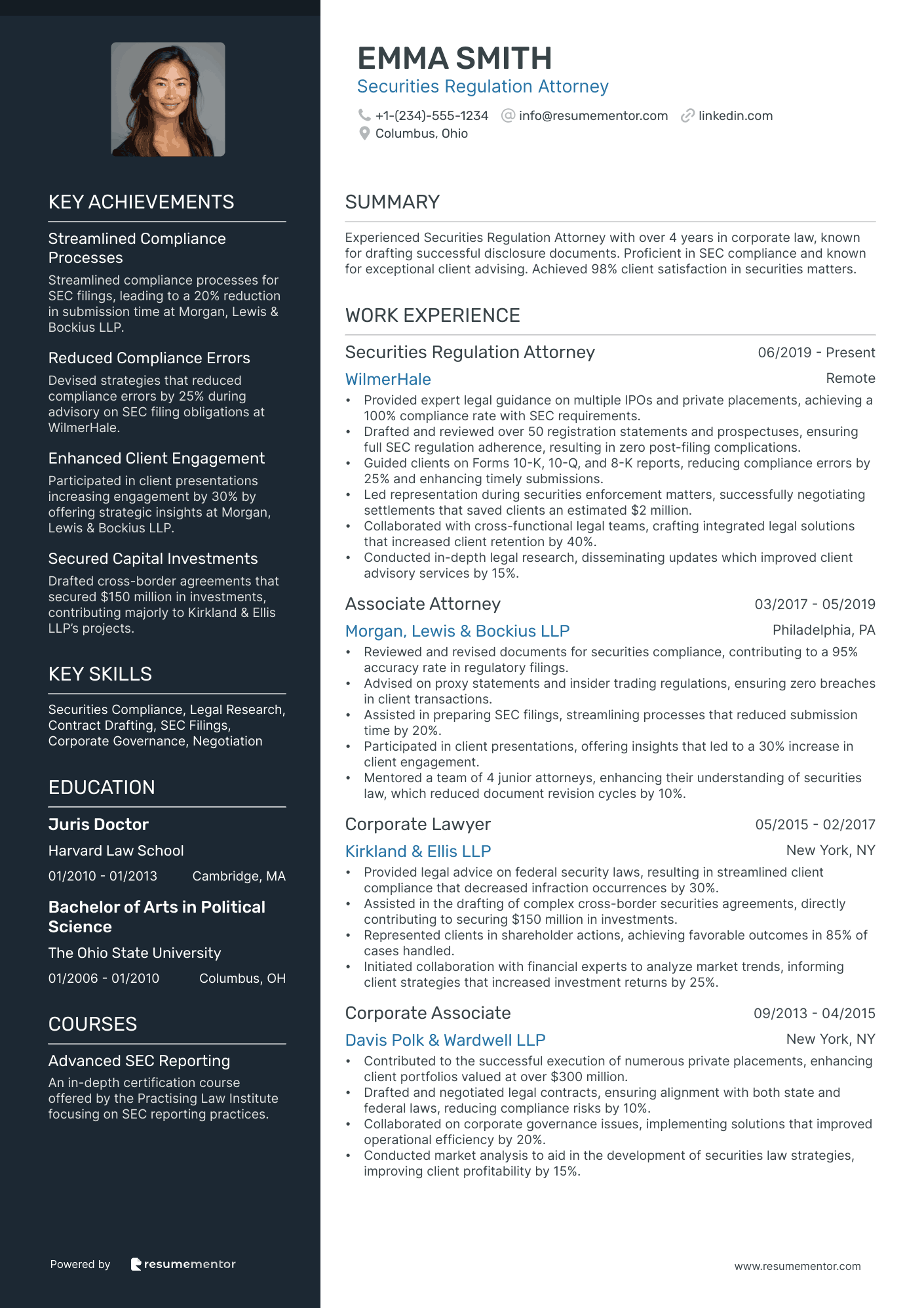

Securities Regulation Attorney resume sample

- •Provided expert legal guidance on multiple IPOs and private placements, achieving a 100% compliance rate with SEC requirements.

- •Drafted and reviewed over 50 registration statements and prospectuses, ensuring full SEC regulation adherence, resulting in zero post-filing complications.

- •Guided clients on Forms 10-K, 10-Q, and 8-K reports, reducing compliance errors by 25% and enhancing timely submissions.

- •Led representation during securities enforcement matters, successfully negotiating settlements that saved clients an estimated $2 million.

- •Collaborated with cross-functional legal teams, crafting integrated legal solutions that increased client retention by 40%.

- •Conducted in-depth legal research, disseminating updates which improved client advisory services by 15%.

- •Reviewed and revised documents for securities compliance, contributing to a 95% accuracy rate in regulatory filings.

- •Advised on proxy statements and insider trading regulations, ensuring zero breaches in client transactions.

- •Assisted in preparing SEC filings, streamlining processes that reduced submission time by 20%.

- •Participated in client presentations, offering insights that led to a 30% increase in client engagement.

- •Mentored a team of 4 junior attorneys, enhancing their understanding of securities law, which reduced document revision cycles by 10%.

- •Provided legal advice on federal security laws, resulting in streamlined client compliance that decreased infraction occurrences by 30%.

- •Assisted in the drafting of complex cross-border securities agreements, directly contributing to securing $150 million in investments.

- •Represented clients in shareholder actions, achieving favorable outcomes in 85% of cases handled.

- •Initiated collaboration with financial experts to analyze market trends, informing client strategies that increased investment returns by 25%.

- •Contributed to the successful execution of numerous private placements, enhancing client portfolios valued at over $300 million.

- •Drafted and negotiated legal contracts, ensuring alignment with both state and federal laws, reducing compliance risks by 10%.

- •Collaborated on corporate governance issues, implementing solutions that improved operational efficiency by 20%.

- •Conducted market analysis to aid in the development of securities law strategies, improving client profitability by 15%.

Investment Management Securities Attorney resume sample

- •Advised on legal and regulatory compliance issues for over 25 mutual funds, achieving a 99% compliance rate.

- •Drafted and reviewed complex offering documents and prospectuses, successfully reducing errors by 30% over 12 months.

- •Collaborated with portfolio managers and compliance professionals, resulting in heightened alignment with regulatory standards.

- •Led SEC regulatory filings, improving on-time submission rates by 20% in one year.

- •Conducted legal research on investment management regulations, significantly enhancing team’s knowledge and readiness.

- •Trained 50+ personnel in legal and regulatory matters, resulting in improved compliance and reduced errors.

- •Managed legal aspects of $2 billion in assets under management, ensuring compliance with relevant laws.

- •Drafted compliance manuals, reducing regulatory non-compliance incidents by 15% within one year.

- •Supervised regulatory inquiries and produced strategic responses, enhancing firm's regulatory relationships.

- •Facilitated monthly legal briefings for executives, improving understanding of securities law changes.

- •Liaised with internal teams to address investment vehicle regulations, boosting team efficiency by 25%.

- •Supported creation of legal frameworks for $500 million private fund, ensuring alignment with SEC requirements.

- •Conducted comprehensive legal research, informing strategies that led to a quashing of a major legal dispute.

- •Reviewed regulatory filings, resulting in zero SEC inquiries over a two-year period.

- •Drafted amendments to investment agreements, improving contractual clarity and client satisfaction.

- •Advised on major corporate transactions involving securities law, contributing to the acquisition of a $1 billion asset.

- •Negotiated and drafted corporate documents for high-value deals, receiving commendation for precision and detail.

- •Developed client-tailored solutions for complex legal issues, enhancing client retention by 10%

- •Led training sessions on new securities regulations, improving team’s adaptation to regulatory changes.

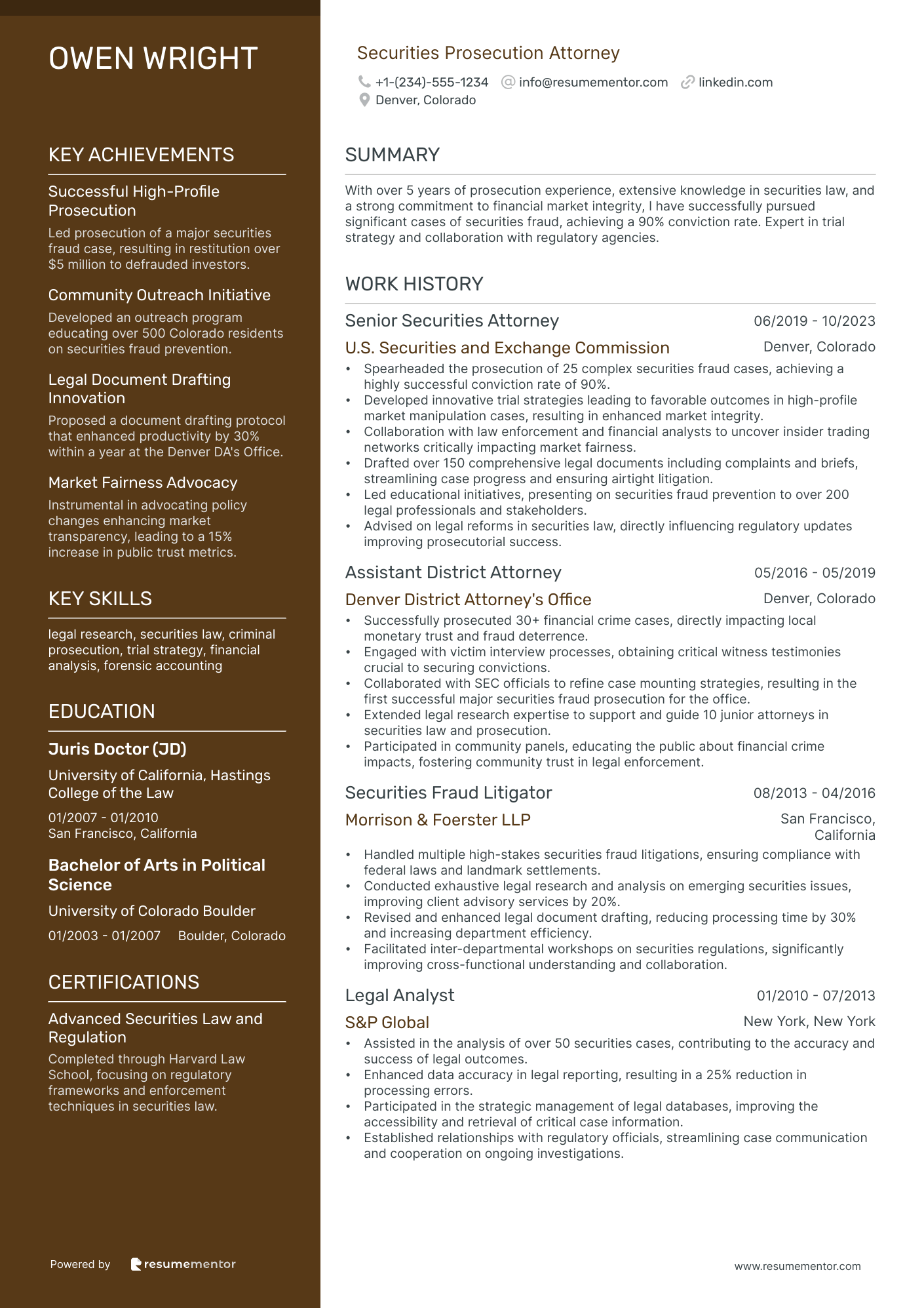

Securities Prosecution Attorney resume sample

- •Spearheaded the prosecution of 25 complex securities fraud cases, achieving a highly successful conviction rate of 90%.

- •Developed innovative trial strategies leading to favorable outcomes in high-profile market manipulation cases, resulting in enhanced market integrity.

- •Collaboration with law enforcement and financial analysts to uncover insider trading networks critically impacting market fairness.

- •Drafted over 150 comprehensive legal documents including complaints and briefs, streamlining case progress and ensuring airtight litigation.

- •Led educational initiatives, presenting on securities fraud prevention to over 200 legal professionals and stakeholders.

- •Advised on legal reforms in securities law, directly influencing regulatory updates improving prosecutorial success.

- •Successfully prosecuted 30+ financial crime cases, directly impacting local monetary trust and fraud deterrence.

- •Engaged with victim interview processes, obtaining critical witness testimonies crucial to securing convictions.

- •Collaborated with SEC officials to refine case mounting strategies, resulting in the first successful major securities fraud prosecution for the office.

- •Extended legal research expertise to support and guide 10 junior attorneys in securities law and prosecution.

- •Participated in community panels, educating the public about financial crime impacts, fostering community trust in legal enforcement.

- •Handled multiple high-stakes securities fraud litigations, ensuring compliance with federal laws and landmark settlements.

- •Conducted exhaustive legal research and analysis on emerging securities issues, improving client advisory services by 20%.

- •Revised and enhanced legal document drafting, reducing processing time by 30% and increasing department efficiency.

- •Facilitated inter-departmental workshops on securities regulations, significantly improving cross-functional understanding and collaboration.

- •Assisted in the analysis of over 50 securities cases, contributing to the accuracy and success of legal outcomes.

- •Enhanced data accuracy in legal reporting, resulting in a 25% reduction in processing errors.

- •Participated in the strategic management of legal databases, improving the accessibility and retrieval of critical case information.

- •Established relationships with regulatory officials, streamlining case communication and cooperation on ongoing investigations.

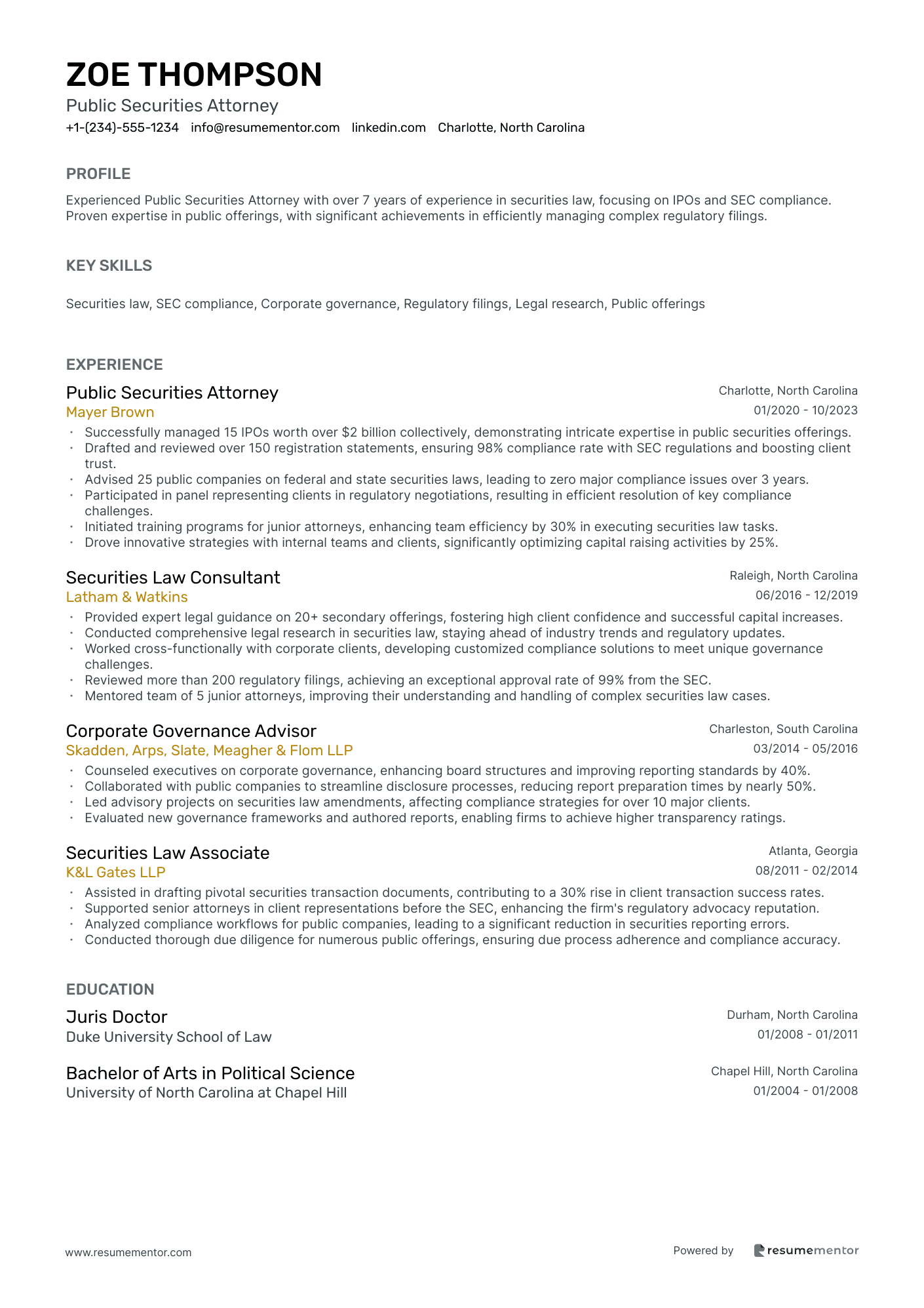

Public Securities Attorney resume sample

- •Successfully managed 15 IPOs worth over $2 billion collectively, demonstrating intricate expertise in public securities offerings.

- •Drafted and reviewed over 150 registration statements, ensuring 98% compliance rate with SEC regulations and boosting client trust.

- •Advised 25 public companies on federal and state securities laws, leading to zero major compliance issues over 3 years.

- •Participated in panel representing clients in regulatory negotiations, resulting in efficient resolution of key compliance challenges.

- •Initiated training programs for junior attorneys, enhancing team efficiency by 30% in executing securities law tasks.

- •Drove innovative strategies with internal teams and clients, significantly optimizing capital raising activities by 25%.

- •Provided expert legal guidance on 20+ secondary offerings, fostering high client confidence and successful capital increases.

- •Conducted comprehensive legal research in securities law, staying ahead of industry trends and regulatory updates.

- •Worked cross-functionally with corporate clients, developing customized compliance solutions to meet unique governance challenges.

- •Reviewed more than 200 regulatory filings, achieving an exceptional approval rate of 99% from the SEC.

- •Mentored team of 5 junior attorneys, improving their understanding and handling of complex securities law cases.

- •Counseled executives on corporate governance, enhancing board structures and improving reporting standards by 40%.

- •Collaborated with public companies to streamline disclosure processes, reducing report preparation times by nearly 50%.

- •Led advisory projects on securities law amendments, affecting compliance strategies for over 10 major clients.

- •Evaluated new governance frameworks and authored reports, enabling firms to achieve higher transparency ratings.

- •Assisted in drafting pivotal securities transaction documents, contributing to a 30% rise in client transaction success rates.

- •Supported senior attorneys in client representations before the SEC, enhancing the firm's regulatory advocacy reputation.

- •Analyzed compliance workflows for public companies, leading to a significant reduction in securities reporting errors.

- •Conducted thorough due diligence for numerous public offerings, ensuring due process adherence and compliance accuracy.

Crafting a compelling securities attorney resume is essential for standing out in today's competitive legal landscape. Much like navigating complex financial regulations, this process requires both precision and strategy. As a securities attorney, you must effectively present your extensive legal knowledge while also highlighting your deep understanding of the field alongside your critical analytical skills.

This is where using a resume template can be advantageous, as it ensures a clean and professional format that lets your achievements shine. By providing a structured framework, a template allows you to concentrate on showcasing your in-depth, industry-specific experience without getting tangled in design concerns. Explore these resume templates to find a layout that aligns with your professional image and facilitates your career advancement.

A well-crafted resume bridges the gap between your legal accomplishments and your ability to interpret complex regulations, effectively capturing potential employers' attention. Generic language won't convey the depth of your expertise, so it's crucial to maintain clarity and relevance throughout. Your resume is often the first impression you make, particularly in a field that values attention to detail. By honing these elements, you give employers a clear view of your legal aptitude and problem-solving skills.

Key Takeaways

- Crafting a securities attorney resume requires precision, strategy, and a clear presentation of legal knowledge and analytical skills to stand out in a competitive legal environment.

- Utilizing a clean resume template can highlight your achievements by providing structure, allowing you to focus on showcasing industry-specific experiences.

- A strong resume bridges the gap between legal accomplishments and the ability to interpret complex regulations, making a solid first impression demonstrating attention to detail.

- Highlight specific skills and experiences, using quantifiable achievements and impactful verbs, to emphasize your readiness for the job and stand out to potential employers.

- A clear view of technical and soft skills, educational background, and certifications signals to employers your qualifications and commitment to securities law.

What to focus on when writing your securities attorney resume

How to structure your securities attorney resume

- Contact Information: Start with your full name, phone number, email address, and LinkedIn profile. These details are crucial for maintaining open lines of communication. Double-check for accuracy to ensure recruiters can reach you without any hitches—this is vital for the initial impression you make.

- Professional Summary: Follow with a brief introduction that emphasizes your deep knowledge of securities law, highlighting notable achievements like winning significant cases or providing key regulatory advice that set you apart. This section should immediately establish your value proposition—showing why you are the standout candidate among other applicants.

- Education: Build on this by detailing your law degree, relevant coursework, and any certifications such as the Series 7 or Series 63 license. These elements demonstrate your specialized knowledge and commitment to staying informed. Your educational background can set the foundation for your expertise and be a key factor in a recruiter’s decision.

- Experience: Transition into listing your professional roles in reverse chronological order, including firm names, your titles, and the specific responsibilities you managed. Focus on cases, compliance projects, and risk management efforts that showcase your practical expertise in securities. In this section, highlight experiences that illustrate your ability to navigate complex legal landscapes effectively.

- Skills: Continue with skills that are crucial to securities law, emphasizing your knowledge of SEC regulations, corporate governance, and contract negotiation, all of which highlight your readiness to tackle challenges in the field. Tailoring this section to specific skills can reinforce your roles and make your application all the more compelling.

- Licenses and Certifications: Conclude with details of your bar admission and any relevant certifications, reinforcing your qualifications and demonstrating your commitment to the field. These credentials signal to employers that you have not only the knowledge but also the certified ability to handle securities-related legal matters.

Optionally, consider adding sections on publications, professional affiliations, or volunteer work that can further illustrate your dedication and expertise in securities law. Now, let's delve deeper into each section and explore the ideal resume format for a securities attorney.

Which resume format to choose

Creating an impressive resume as a securities attorney involves mastering a few crucial elements. Begin by selecting the reverse-chronological format. This layout is perfect for highlighting your most recent experiences and accomplishments, allowing prospective employers to quickly understand your career journey in securities law. It’s especially effective in showing your growth and expertise in the field.

Font selection can subtly influence the overall impression your resume makes. Opt for modern choices like Rubic, Lato, or Montserrat to give your resume a fresh and professional appearance. These fonts ensure clarity and readability, which are important when presenting complex legal information and details about your qualifications.

Using PDFs to save your resume is a practical decision. PDFs lock in your formatting, making sure your resume appears polished and consistent on any device or screen. This is crucial in maintaining a professional image when your resume is reviewed by potential employers, such as law firms and corporate legal departments.

Proper margins contribute to the readability and presentation of your resume. One-inch margins are typically ideal, providing sufficient white space that doesn't overwhelm the reader. Adjust the margins slightly only if necessary to accommodate essential information, ensuring your resume remains clean and easy to navigate.

By focusing on these elements—format, font, file type, and margins—you create a resume that effectively showcases your skills and career achievements in securities law. This thoughtful approach ensures that employers can easily recognize your qualifications and expertise.

How to write a quantifiable resume experience section

A strong experience section for a securities attorney resume is your chance to highlight key achievements and skills directly tied to the job you're targeting. To make a powerful impression, arrange your experience in reverse chronological order, with the most recent and relevant positions first. This format emphasizes your latest accomplishments, which are often the most impactful. Focus on roles that showcase your expertise in securities law, underscoring your deep understanding of the field. Tailoring your resume to match the specific job description by incorporating relevant skills and keywords ensures you stand out. Use impactful verbs like "managed," "advised," or "negotiated" to convey action and achievement. Be sure to include quantifiable successes that clearly demonstrate your effectiveness. Typically, include experience from the last 10-15 years, unless older roles are highly relevant to the position you're seeking.

- •Successfully managed compliance for over $2 billion in client assets across multiple portfolios.

- •Advised on 15 major mergers and acquisitions, enhancing client portfolios with a transaction value exceeding $500 million.

- •Led a team of 10 junior attorneys in securities litigation, achieving favorable outcomes in 85% of cases.

- •Developed and implemented a firm-wide training program, increasing compliance knowledge by 30% within 6 months.

This experience section effectively addresses the hiring firm's needs by highlighting specific achievements that demonstrate your prowess as a securities attorney. By including quantifiable results, it provides a clear picture of your impact and the value you have delivered in previous roles. Mentioning the firm's reputation alongside your responsibilities builds credibility and assures potential employers of your background. Each bullet point focuses on action and results, showcasing your engagement in critical securities law functions. Tailoring your experience to align with the job description not only highlights your skills but also showcases your strategic thinking—a vital trait for succeeding as a securities attorney. Emphasizing relevant professional experience reinforces your readiness for significant responsibilities, making your resume stand out in a competitive market.

Technology-Focused resume experience section

A technology-focused securities attorney resume experience section should seamlessly highlight your ability to navigate both legal and technology realms. Begin by showcasing your expertise in securities law while emphasizing projects where you've integrated cutting-edge tech solutions. Share specific examples that underscore your unique qualifications and demonstrate your value within the fast-paced tech landscape.

Next, use strong, active language to clearly describe your responsibilities and achievements, focusing on how you've tackled challenges and driven positive change. Illustrate your involvement in current technology trends like blockchain and fintech, providing concrete examples of your expertise in action. Connect your experiences to paint a cohesive picture of your ability to handle complex, tech-related securities cases effectively.

Technology-Focused Securities Attorney

Innovative Tech Law Group

January 2020 - Present

- Led regulatory compliance for a fintech startup, implementing legal strategies that increased efficiency by 25%.

- Advised on blockchain integration for a major finance company, ensuring all legal aspects adhered to securities laws.

- Pioneered legal frameworks for new tech investments, securing $20M in funding with full compliance.

- Spearheaded digital security protocols for a financial institution, reducing breaches by 50%.

Leadership-Focused resume experience section

A leadership-focused securities attorney resume experience section should effectively convey your ability to guide teams and make impactful decisions. Begin by showcasing leadership roles where your strategies led to tangible results, using action verbs and quantifiable outcomes to illustrate your impact. Each bullet point should connect and build upon the previous ones, creating a cohesive narrative of your leadership journey.

Highlight experiences where you managed legal teams, as these roles demonstrate your mentoring capabilities and ability to lead strategic projects. Incorporate examples of how you improved processes or contributed to cross-departmental collaborations, emphasizing your strategic thinking and client-focused approach. By weaving these elements together, you paint a comprehensive picture of your leadership expertise and the value you bring to any role.

Senior Securities Attorney

Wall Street Law Firm

June 2020 - Present

- Managed a team of five attorneys in successful securities litigation, resulting in a 25% increase in the firm’s win rate.

- Strengthened team performance by developing a training program for junior staff, boosting their preparedness and efficiency by 30%.

- Led a firm-wide initiative to streamline filing processes, effectively reducing the case backlog by 40%.

- Enhanced client satisfaction by 20% through strategic collaborations with cross-departmental teams to resolve disputes.

Achievement-Focused resume experience section

A securities attorney-focused resume experience section should highlight the impact of your work by showcasing your most significant achievements. Rather than just listing responsibilities, emphasize the difference you made for clients or your employer. Use specific metrics and numbers to illustrate your expertise and strategic skills, ensuring your successes stand out clearly.

To convey your accomplishments effectively, organize each role by outlining the challenge you faced, the actions you took, and the results you achieved. This storytelling approach helps connect your efforts to tangible outcomes, making it easy to understand the value you bring. Keep your language concise and clear, avoiding complex jargon that might obscure your achievements.

Senior Securities Attorney

Global Law Firm

Jan 2018 - Dec 2022

- Defended high-profile clients in securities fraud cases, saving over $10 million.

- Crafted innovative legal strategies, cutting case resolution time by 30%.

- Secured favorable settlements in over 80% of complex cases.

- Led a team in risk assessments, reducing potential penalties by 40%.

Skills-Focused resume experience section

A skills-focused securities attorney resume experience section should effectively highlight your legal expertise and strategic guidance capabilities for clients. Begin by pinpointing core competencies that are relevant to the roles you're targeting, such as compliance, risk management, and contract negotiation. Use concise, impactful bullet points with strong action verbs to showcase your contributions and successes. By linking your achievements to tangible outcomes, you can effectively emphasize how your efforts resulted in positive financial or legal impacts. Including quantifiable metrics can further underline your effectiveness.

To make your resume stand out, it's essential to focus on highlighting achievements rather than merely listing duties and responsibilities. Be specific about your role in key transactions and projects, tailoring your descriptions to demonstrate how your skills align with the prospective job's requirements. This not only exhibits your expertise but also your adaptability and awareness of industry trends and challenges. Ultimately, potential employers are looking for evidence that you can add value and make strategic decisions that support their objectives.

Senior Securities Attorney

Law Firm XYZ

2015-2020

- Led compliance audits for SEC-regulated entities, reducing potential risks by 30%.

- Provided legal counsel on securities regulation, ensuring adherence to new legislative changes.

- Negotiated and drafted complex contracts, enhancing client trust and securing $1M in business.

- Implemented a training program for junior attorneys, improving department efficiency by 20%.

Write your securities attorney resume summary section

A focused securities attorney resume summary should capture your professional essence and highlight your standout achievements. Keeping it concise, aim for two to three sentences that provide a snapshot of your skills and experiences, along with the value you bring to potential employers. Your summary should underscore your legal expertise and results-driven nature—critical elements for excelling in the field. Consider this example:

This example provides a clear overview of your capabilities in SEC compliance and corporate governance, using results-oriented language that communicates competence and authority. By mentioning specific transactions, you add weight and quantify your achievements, offering employers a tangible sense of your skills.

Describing yourself effectively in a resume summary means using concise language that fits your career stage and aspirations. For those with experience, emphasize your contributions and the impact you've made. If you're newer to the field, focus on your education and potential. Tailoring your summary to the job description ensures it resonates with each potential employer. Understanding the types of resume sections can also guide your writing. A resume objective states career goals, ideal for newcomers or career changers. In contrast, a resume profile blends a summary of past achievements with future aims. A summary of qualifications lists key skills relevant to the role. Each option suits different stages in your career and aligns with your specific application strategy.

Listing your securities attorney skills on your resume

A skills-focused securities attorney resume should seamlessly integrate the skills section within the broader context of your experience and summary sections. Highlighting your strengths and soft skills helps showcase traits like communication and leadership, while hard skills demonstrate specific expertise gained through education and practical experience. For example, mastering securities regulations is a critical hard skill.

Including skills and strengths as resume keywords is vital because employers often seek these keywords to match candidates with job requirements. To ensure your resume stands out, describe your skills accurately and incorporate them throughout your entire document.

Example of a standalone skills section:

This section is effective because it lists abilities relevant to a securities attorney, providing a clear picture of your expertise. When potential employers quickly understand your fit for their needs, each skill becomes a precise reflection of your professional capabilities in the securities field.

Best hard skills to feature on your securities attorney resume

Technical competence in legal and financial areas is vital for a securities attorney, as it showcases your ability to manage complex legal matters. Consider these top hard skills:

Hard Skills

- Securities Regulation Compliance

- Contract Drafting and Review

- Financial Analysis

- Corporate Governance

- Mergers and Acquisitions

- Litigation Procedures

- Intellectual Property Rights

- Risk Assessment

- Research and Analysis

- Due Diligence

- Investment Strategies

- Tax Law

- Banking Law

- Legal Writing

- Regulatory Affairs

Best soft skills to feature on your securities attorney resume

In addition to hard skills, emphasizing interpersonal and professional traits can greatly enhance your resume. These soft skills help in negotiating, managing relationships, and leading teams effectively. Key soft skills include:

Soft Skills

- Communication

- Negotiation

- Problem-Solving

- Critical Thinking

- Decision-Making

- Leadership

- Time Management

- Adaptability

- Team Collaboration

- Client Relationship Building

- Attention to Detail

- Conflict Resolution

- Emotional Intelligence

- Organizational Skills

- Strategic Thinking

How to include your education on your resume

The education section of your resume is crucial, especially when applying for positions such as a securities attorney. It's one of the first areas potential employers will scrutinize to check your academic credibility. Tailor this section specifically to the job you're applying for, avoiding any irrelevant educational experiences. Importantly, this means listing degrees and accolades that are deemed relevant. When including your GPA, only add it if it's strong and relevant—most often, a GPA of 3.5 or higher is appropriate. If you graduated with honors like "cum laude," include this next to your degree for added impact.

In listing your degrees, start with the highest degree obtained, or the most pertinent to the law field. Now, here’s an example of how not to do it:

Now, for a strong example:

The second example is compelling due to the inclusion of prestigious institutions, a high GPA, and honor recognition. These facts immediately communicate the candidate's qualifications and potential value to a law firm. It highlights the most relevant information, sidestepping unnecessary details. Emphasizing the cum laude distinction and high GPA gives the employer confidence in the candidate's academic abilities, highly relevant for a securities attorney position.

How to include securities attorney certificates on your resume

Incorporating a certifications section in your securities attorney resume can significantly boost your qualifications and make you stand out. You list the name of each certification, include the date it was awarded, and add the issuing organization. These elements paint a complete picture of your expertise and dedication. You can also place your certificates in the header to grab immediate attention. For example:

"Certified Securities Compliance Professional (CSCP) - National Society of Compliance Professionals"

When crafting a separate certifications section, ensure you highlight relevant details. A comprehensive example could be:

This example is good because it lists certifications that are highly relevant to a securities attorney. Each certificate includes both the title and the issuing organization, making it clear and easy to understand. Plus, these certifications are well-recognized in the industry, adding value to your resume. Featuring this section will undoubtedly enhance your credibility as a knowledgeable and skilled securities lawyer.

Extra sections to include in your securities attorney resume

In a rapidly evolving financial market, a skilled securities attorney plays a critical role in guiding both individuals and corporations through the complexities of securities laws and regulations. Building a compelling resume involves showcasing not only your professional expertise but also the unique aspects of your character and experiences that make you a well-rounded candidate.

Language section — Demonstrate your communication skills in multiple languages. Highlight your ability to interact with a diverse range of clients and legal professionals.

Hobbies and interests section — Reflect your personal interests that show you as a well-rounded individual. Indicate qualities such as teamwork or problem-solving which are transferable to your professional work.

Volunteer work section — Display your commitment to community service and ethical considerations. Showcase your active involvement in pro bono work or legal clinics as it demonstrates a dedication to social responsibility.

Books section — Share notable books that have influenced your legal thinking. Highlighting your reading habits underscores your commitment to continual learning and staying informed on legal precedent and market trends.

In Conclusion

In conclusion, crafting an effective resume as a securities attorney requires a strategic approach. A well-organized resume helps communicate your qualifications, showcasing your legal expertise in securities law and your ability to navigate complex regulations. By using a template, you can focus more on your accomplishments and less on design, allowing your achievements to stand out. It is important to include all necessary sections—such as your contact information, professional summary, and detail-oriented experience section—to give employers a comprehensive view of your capabilities. Highlighting both hard and soft skills underscores your competence and adaptability in handling both technical and interpersonal challenges. Showcasing certifications and educational achievements further enhances your credibility in the competitive field of securities law. Including optional sections, such as volunteer work or personal interests, can also provide a more holistic view of your character and professional dedication. Ultimately, a well-crafted resume serves as a bridge, connecting your past experiences and future career opportunities, leaving a strong impression on potential employers who value detail, skill, and commitment. This thoughtful approach not only enhances your chances of securing an interview but also positions you as a prime candidate in the job market.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.