Senior Accounting Manager Resume Examples

Mar 25, 2025

|

12 min read

Craft a winning accounting manager resume by showcasing your skills and experiences. Make your achievements count so your resume adds up to success in any job application. Tailor your content to highlight leadership and accounting expertise.

Rated by 348 people

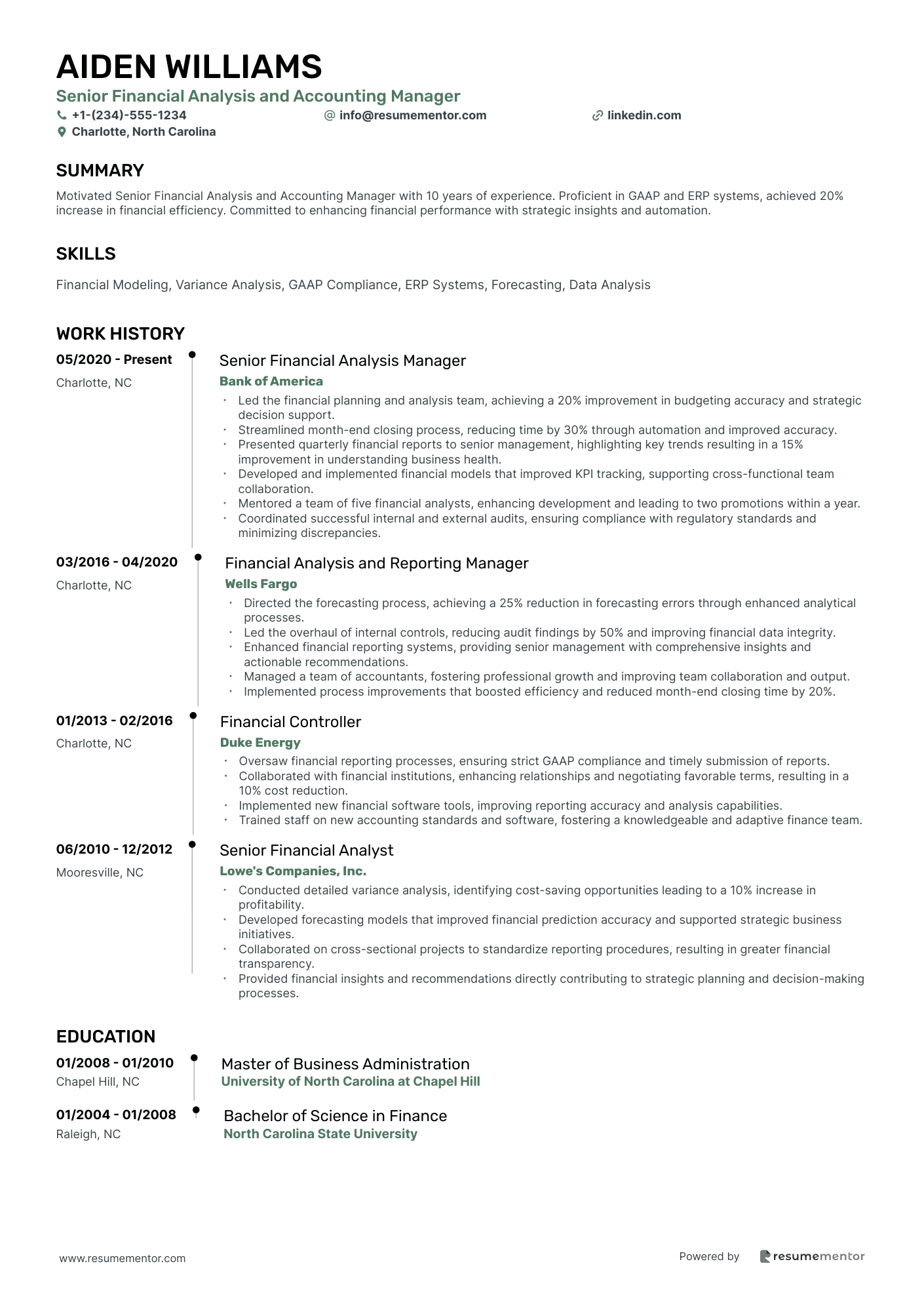

Senior Financial Analysis and Accounting Manager

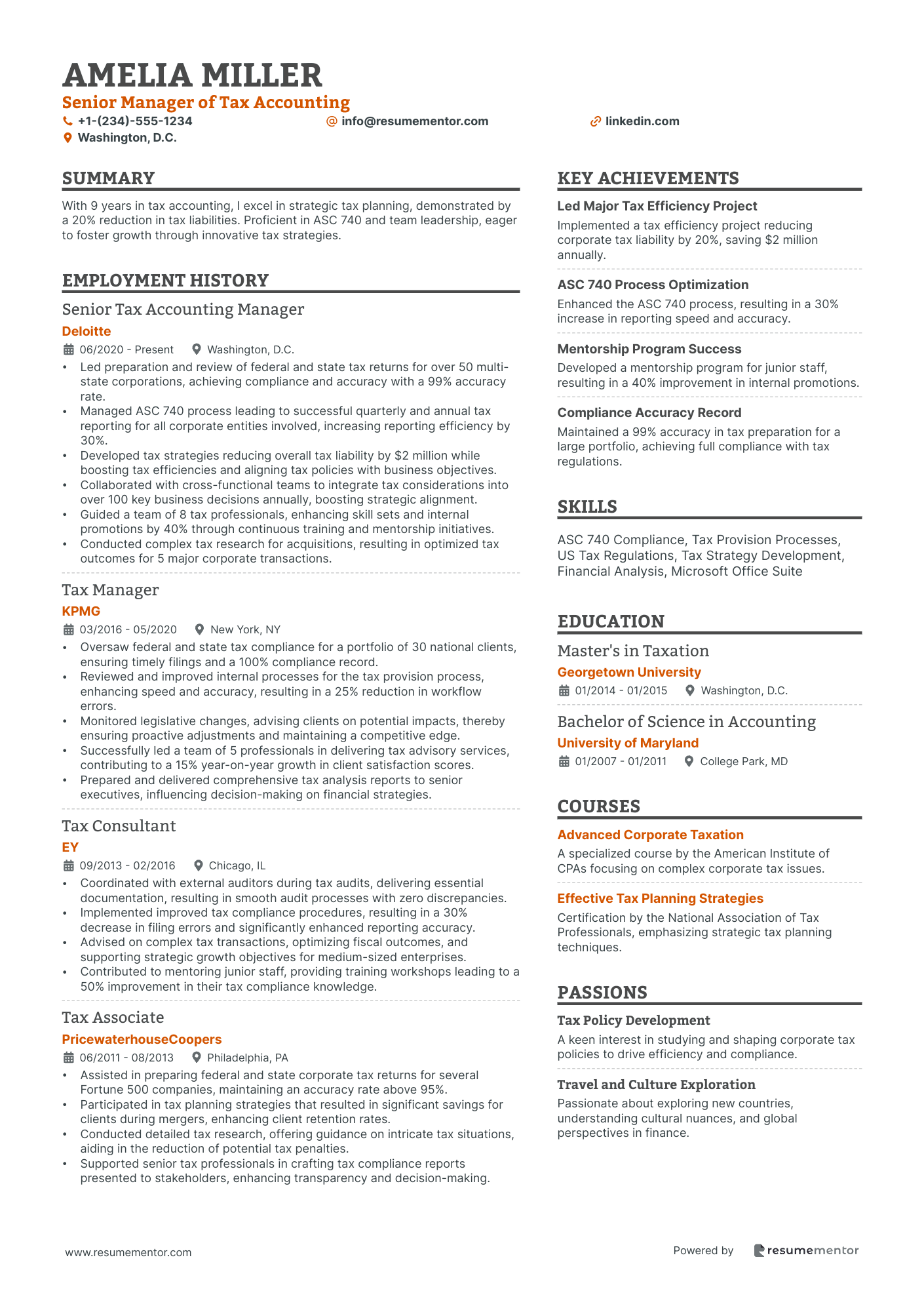

Senior Manager of Tax Accounting

Senior Payroll Accounting Manager

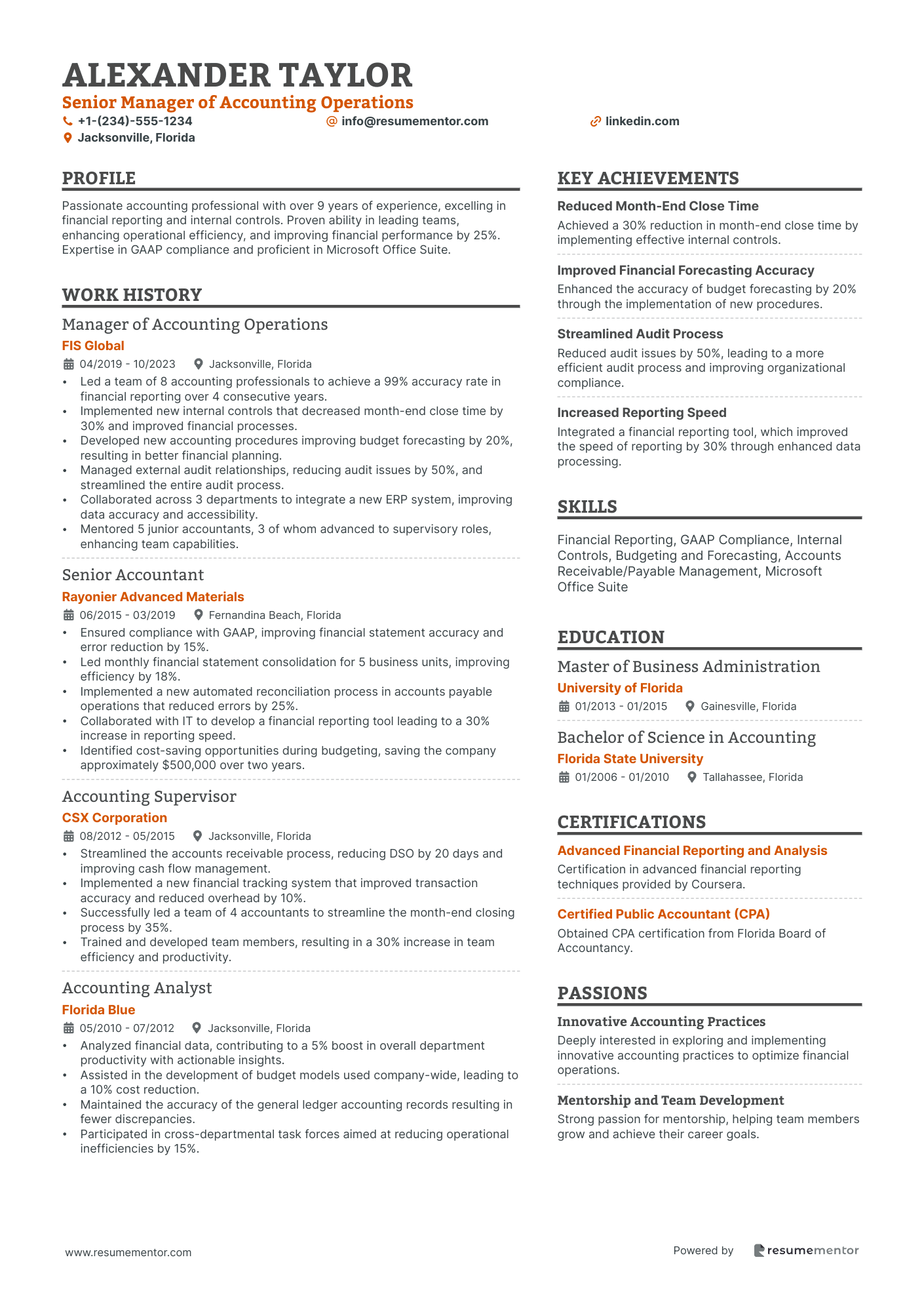

Senior Manager of Accounting Operations

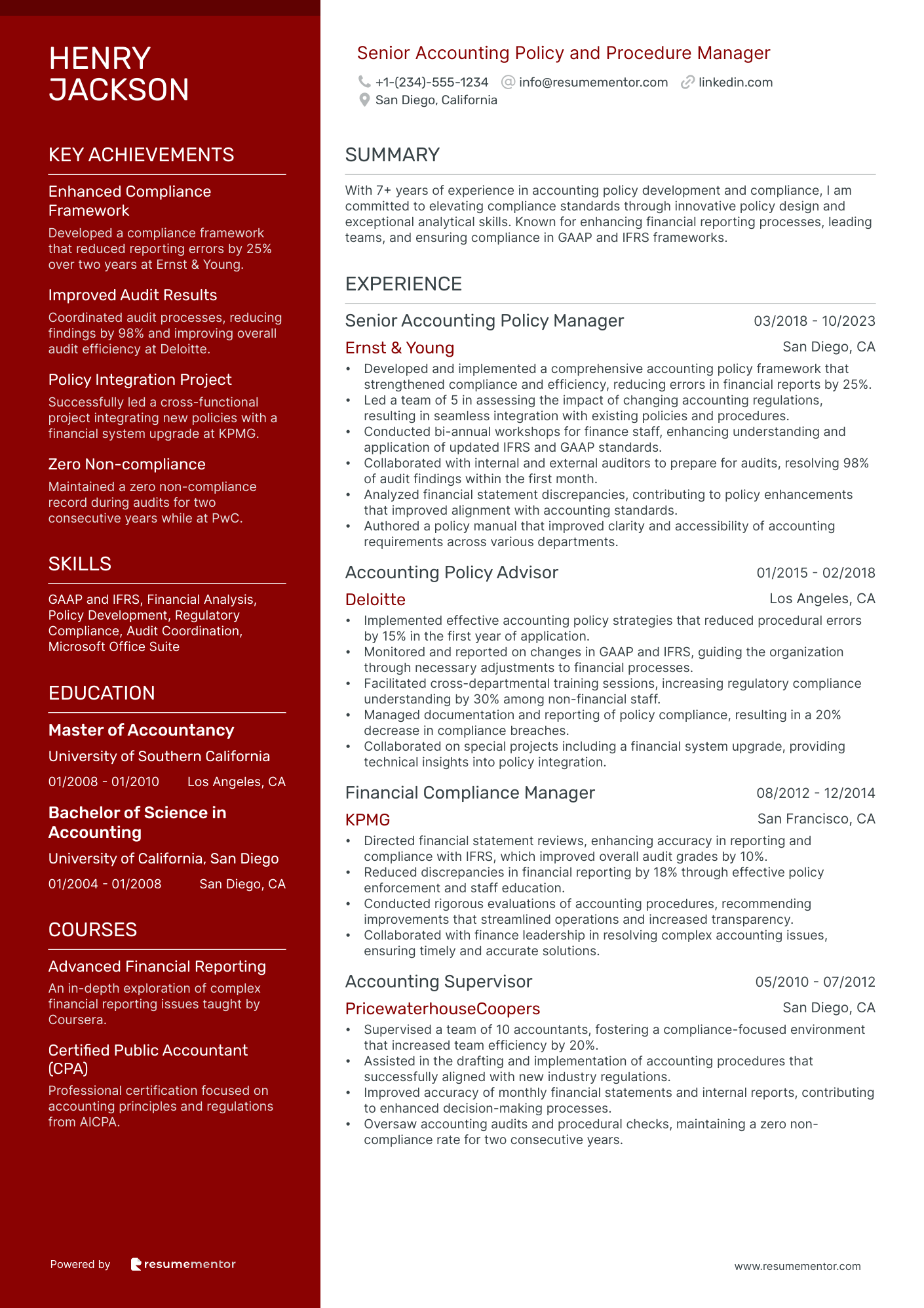

Senior Accounting Policy and Procedure Manager

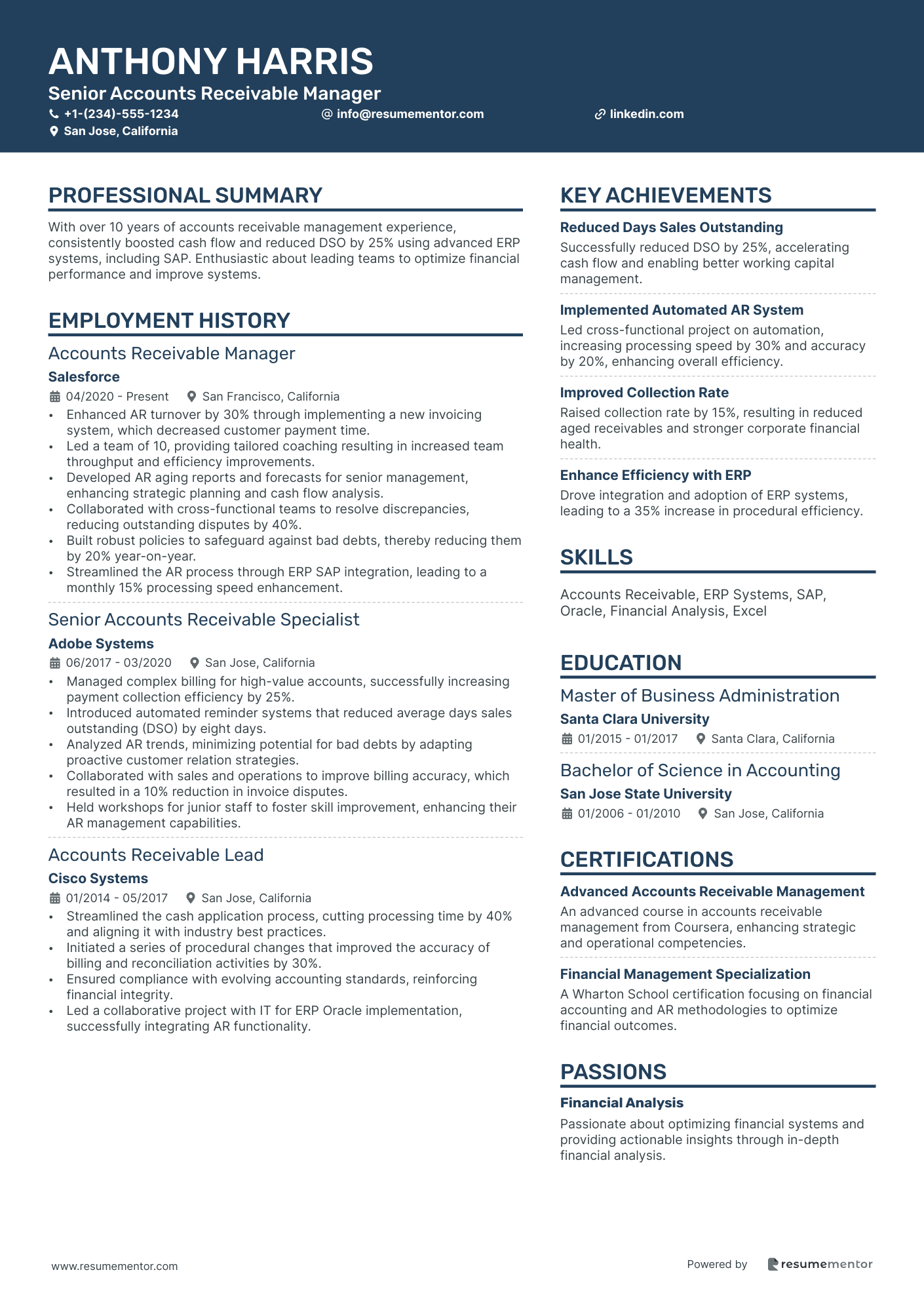

Senior Accounts Receivable Manager

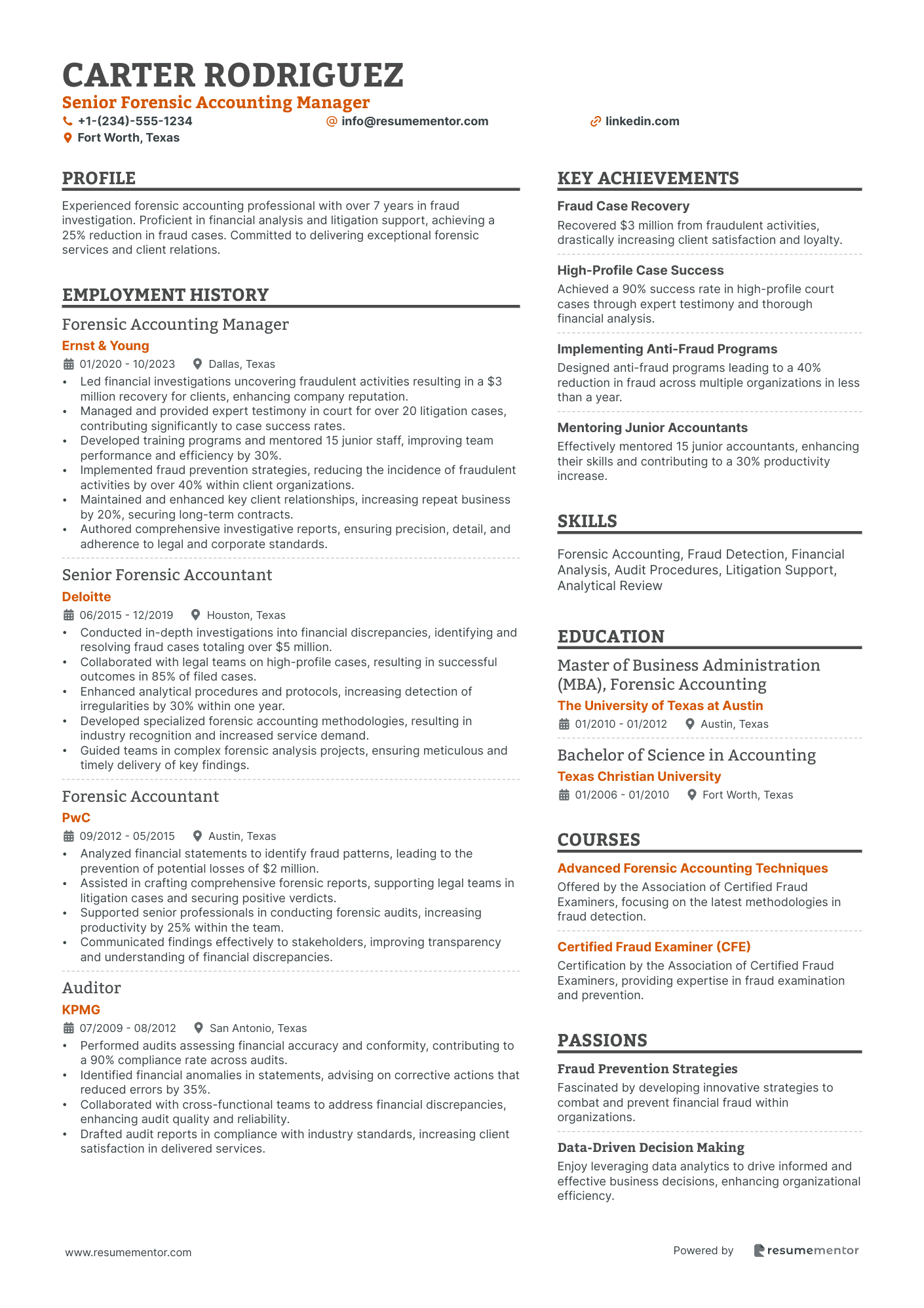

Senior Forensic Accounting Manager

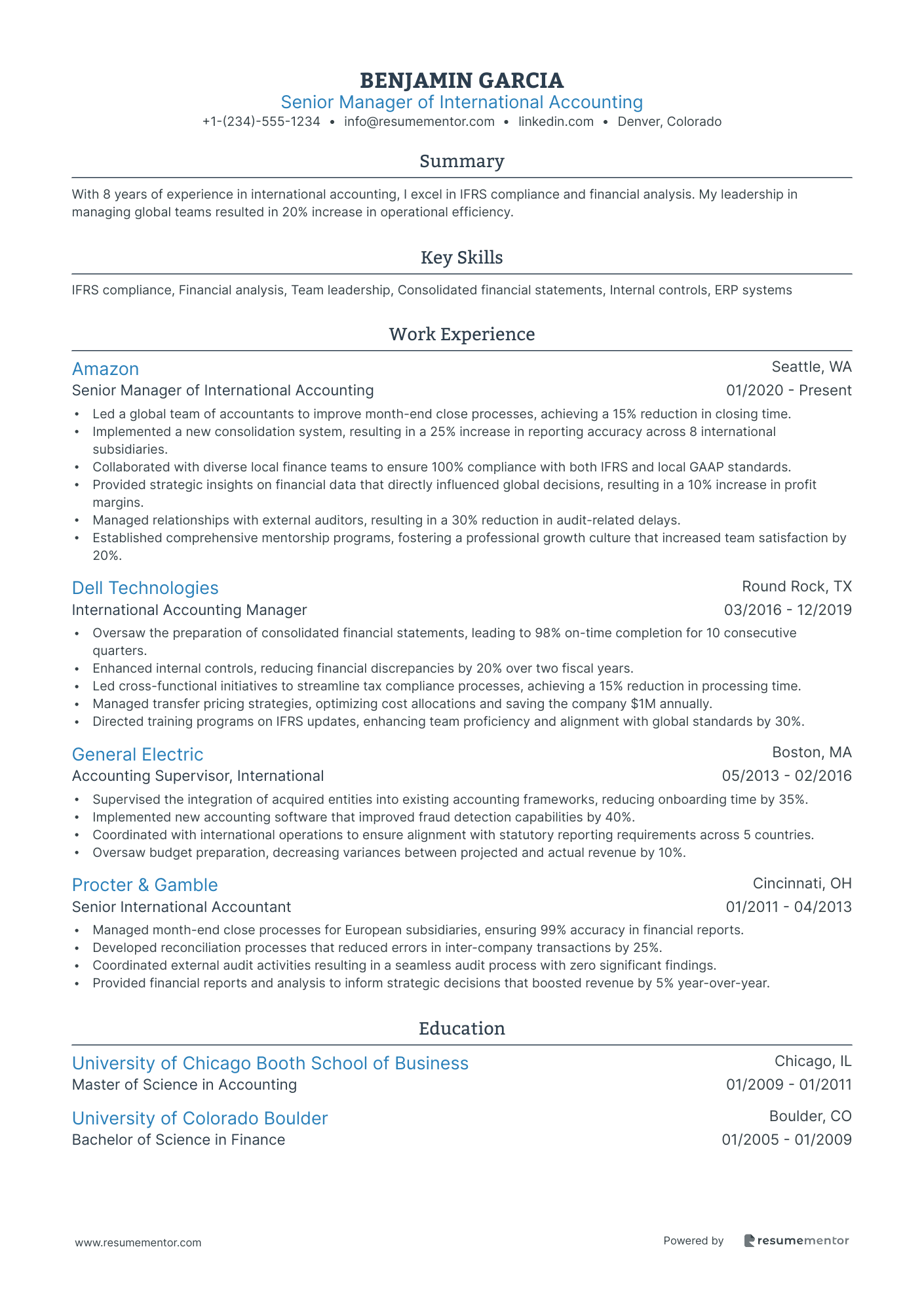

Senior Manager of International Accounting

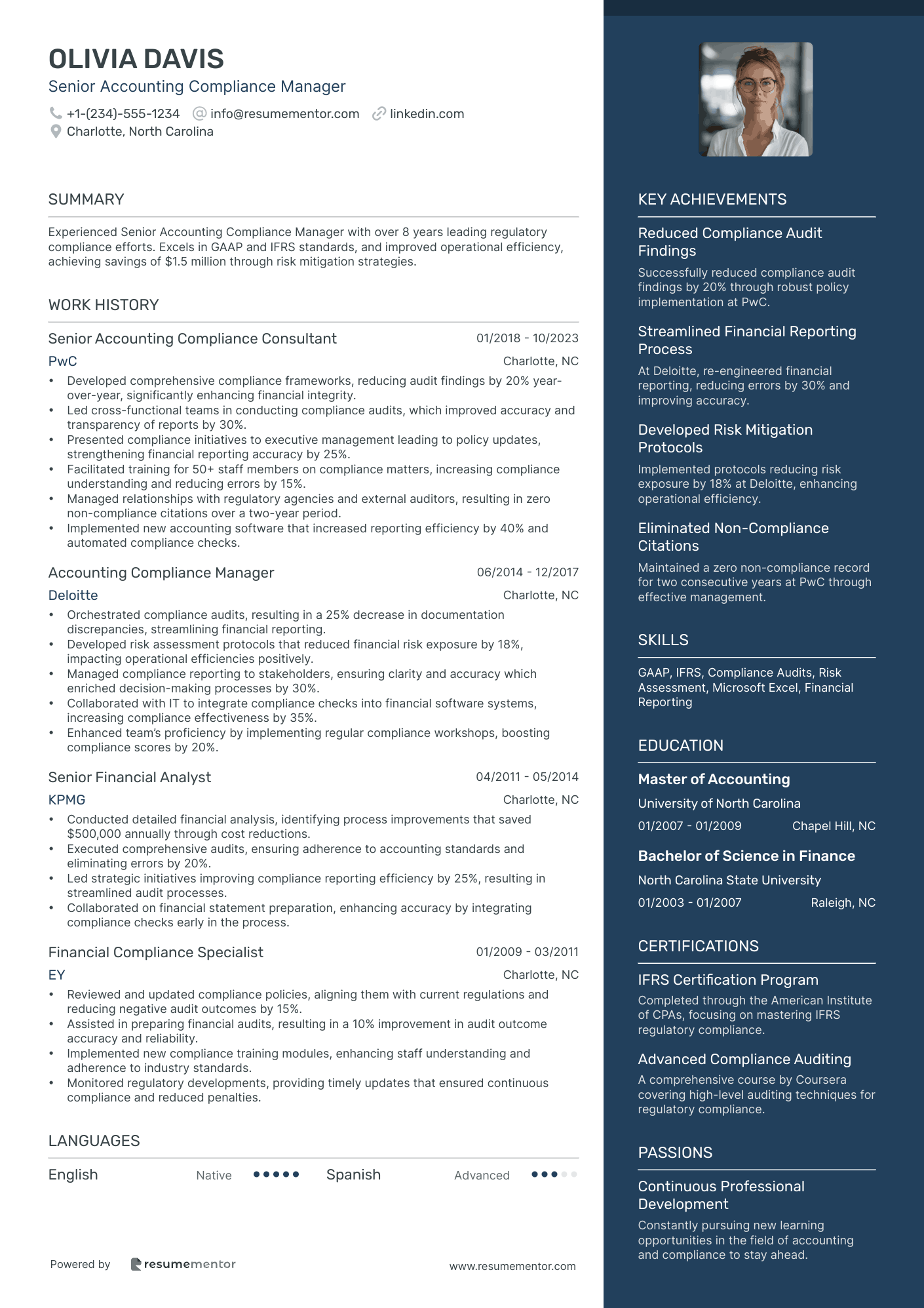

Senior Accounting Compliance Manager

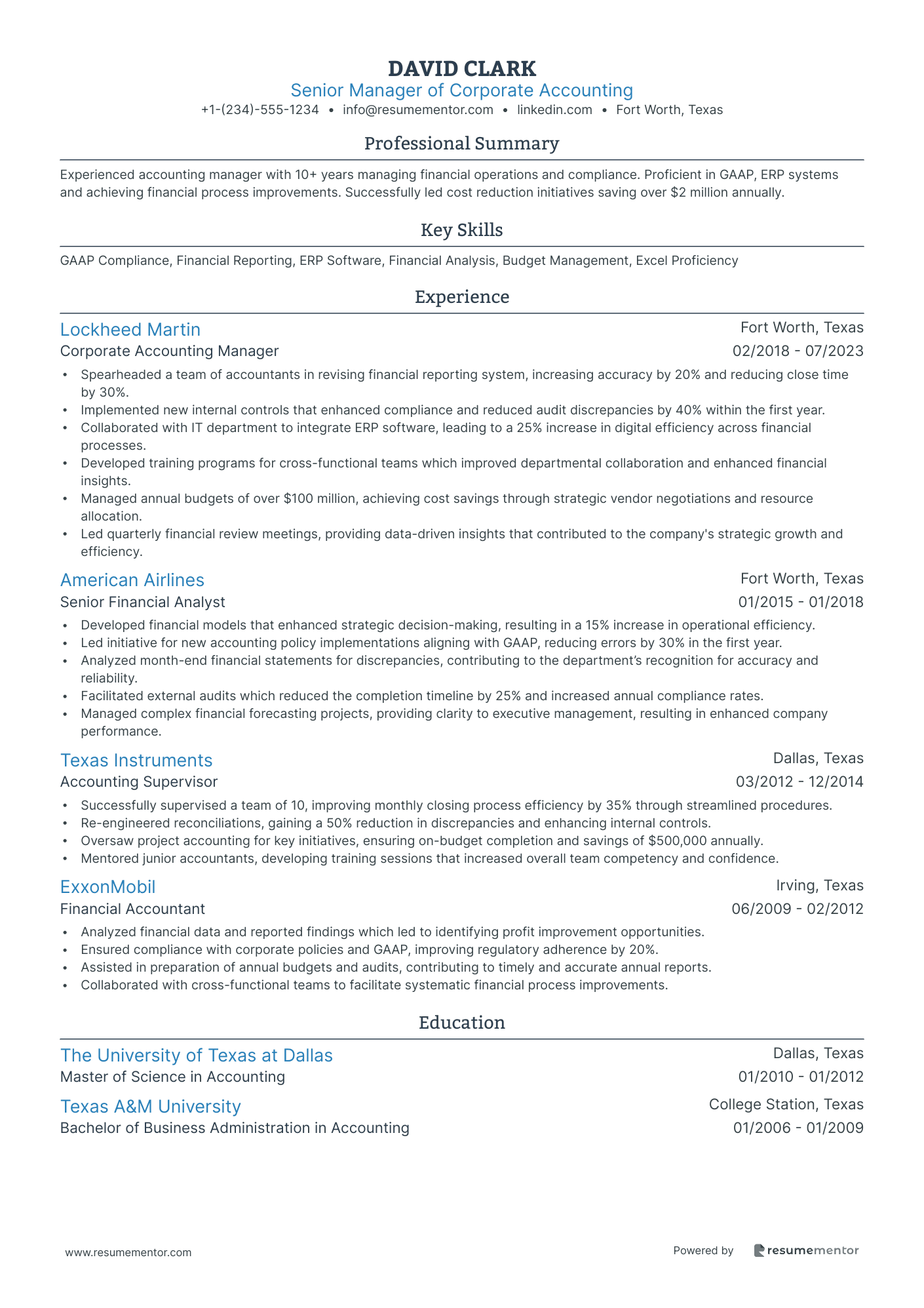

Senior Manager of Corporate Accounting

Senior Financial Analysis and Accounting Manager resume sample

- •Led the financial planning and analysis team, achieving a 20% improvement in budgeting accuracy and strategic decision support.

- •Streamlined month-end closing process, reducing time by 30% through automation and improved accuracy.

- •Presented quarterly financial reports to senior management, highlighting key trends resulting in a 15% improvement in understanding business health.

- •Developed and implemented financial models that improved KPI tracking, supporting cross-functional team collaboration.

- •Mentored a team of five financial analysts, enhancing development and leading to two promotions within a year.

- •Coordinated successful internal and external audits, ensuring compliance with regulatory standards and minimizing discrepancies.

- •Directed the forecasting process, achieving a 25% reduction in forecasting errors through enhanced analytical processes.

- •Led the overhaul of internal controls, reducing audit findings by 50% and improving financial data integrity.

- •Enhanced financial reporting systems, providing senior management with comprehensive insights and actionable recommendations.

- •Managed a team of accountants, fostering professional growth and improving team collaboration and output.

- •Implemented process improvements that boosted efficiency and reduced month-end closing time by 20%.

- •Oversaw financial reporting processes, ensuring strict GAAP compliance and timely submission of reports.

- •Collaborated with financial institutions, enhancing relationships and negotiating favorable terms, resulting in a 10% cost reduction.

- •Implemented new financial software tools, improving reporting accuracy and analysis capabilities.

- •Trained staff on new accounting standards and software, fostering a knowledgeable and adaptive finance team.

- •Conducted detailed variance analysis, identifying cost-saving opportunities leading to a 10% increase in profitability.

- •Developed forecasting models that improved financial prediction accuracy and supported strategic business initiatives.

- •Collaborated on cross-sectional projects to standardize reporting procedures, resulting in greater financial transparency.

- •Provided financial insights and recommendations directly contributing to strategic planning and decision-making processes.

Senior Manager of Tax Accounting resume sample

- •Led preparation and review of federal and state tax returns for over 50 multi-state corporations, achieving compliance and accuracy with a 99% accuracy rate.

- •Managed ASC 740 process leading to successful quarterly and annual tax reporting for all corporate entities involved, increasing reporting efficiency by 30%.

- •Developed tax strategies reducing overall tax liability by $2 million while boosting tax efficiencies and aligning tax policies with business objectives.

- •Collaborated with cross-functional teams to integrate tax considerations into over 100 key business decisions annually, boosting strategic alignment.

- •Guided a team of 8 tax professionals, enhancing skill sets and internal promotions by 40% through continuous training and mentorship initiatives.

- •Conducted complex tax research for acquisitions, resulting in optimized tax outcomes for 5 major corporate transactions.

- •Oversaw federal and state tax compliance for a portfolio of 30 national clients, ensuring timely filings and a 100% compliance record.

- •Reviewed and improved internal processes for the tax provision process, enhancing speed and accuracy, resulting in a 25% reduction in workflow errors.

- •Monitored legislative changes, advising clients on potential impacts, thereby ensuring proactive adjustments and maintaining a competitive edge.

- •Successfully led a team of 5 professionals in delivering tax advisory services, contributing to a 15% year-on-year growth in client satisfaction scores.

- •Prepared and delivered comprehensive tax analysis reports to senior executives, influencing decision-making on financial strategies.

- •Coordinated with external auditors during tax audits, delivering essential documentation, resulting in smooth audit processes with zero discrepancies.

- •Implemented improved tax compliance procedures, resulting in a 30% decrease in filing errors and significantly enhanced reporting accuracy.

- •Advised on complex tax transactions, optimizing fiscal outcomes, and supporting strategic growth objectives for medium-sized enterprises.

- •Contributed to mentoring junior staff, providing training workshops leading to a 50% improvement in their tax compliance knowledge.

- •Assisted in preparing federal and state corporate tax returns for several Fortune 500 companies, maintaining an accuracy rate above 95%.

- •Participated in tax planning strategies that resulted in significant savings for clients during mergers, enhancing client retention rates.

- •Conducted detailed tax research, offering guidance on intricate tax situations, aiding in the reduction of potential tax penalties.

- •Supported senior tax professionals in crafting tax compliance reports presented to stakeholders, enhancing transparency and decision-making.

Senior Payroll Accounting Manager resume sample

- •Led a team to streamline payroll processes, resulting in a 30% increase in processing efficiency over one year.

- •Developed and implemented new payroll policies, reducing discrepancies by 25% and enhancing compliance with regulatory standards.

- •Managed payroll processing for over 5,000 employees, ensuring timely and accurate payments each cycle.

- •Facilitated payroll audits, achieving zero audit findings over a two-year period through meticulous reporting and reconciliation.

- •Collaborated with Human Resources to integrate new employee data, improving data accuracy by 45%.

- •Mentored a team of 6 payroll professionals, leading to a 40% improvement in individual performance evaluations.

- •Oversaw payroll processing for 3,000 employees, ensuring on-time and error-free payroll cycles.

- •Conducted training sessions for payroll staff, resulting in 50% reduced processing errors and increased team efficiency.

- •Implemented new payroll software solutions, increasing departmental processing speed by 20%.

- •Collaborated with the finance team to reconcile payroll data with financial reports, achieving a 98% accuracy rate.

- •Addressed complex payroll inquiries, resolving 95% of issues within the first 24 hours of submission.

- •Managed payroll data entry for over 2,500 employees, ensuring accuracy and compliance with relevant laws.

- •Reconciled payroll entries with accounting records, achieving 100% balance on quarterly reports.

- •Participated in legislative updates, maintaining up-to-date payroll compliance for state and federal regulations.

- •Reviewed payroll audits and prepared corrective actions, reducing audit discrepancies by 15%.

- •Assisted in processing multi-state payrolls for over 1,500 employees, adhering to state-specific regulatory requirements.

- •Collaborated with HR to update employee records, improving data accuracy by 20%.

- •Analyzed payroll reports, contributing to a 10% reduction in payroll errors annually.

- •Developed advanced payroll reports for management, enhancing financial decision-making processes.

Senior Manager of Accounting Operations resume sample

- •Led a team of 8 accounting professionals to achieve a 99% accuracy rate in financial reporting over 4 consecutive years.

- •Implemented new internal controls that decreased month-end close time by 30% and improved financial processes.

- •Developed new accounting procedures improving budget forecasting by 20%, resulting in better financial planning.

- •Managed external audit relationships, reducing audit issues by 50%, and streamlined the entire audit process.

- •Collaborated across 3 departments to integrate a new ERP system, improving data accuracy and accessibility.

- •Mentored 5 junior accountants, 3 of whom advanced to supervisory roles, enhancing team capabilities.

- •Ensured compliance with GAAP, improving financial statement accuracy and error reduction by 15%.

- •Led monthly financial statement consolidation for 5 business units, improving efficiency by 18%.

- •Implemented a new automated reconciliation process in accounts payable operations that reduced errors by 25%.

- •Collaborated with IT to develop a financial reporting tool leading to a 30% increase in reporting speed.

- •Identified cost-saving opportunities during budgeting, saving the company approximately $500,000 over two years.

- •Streamlined the accounts receivable process, reducing DSO by 20 days and improving cash flow management.

- •Implemented a new financial tracking system that improved transaction accuracy and reduced overhead by 10%.

- •Successfully led a team of 4 accountants to streamline the month-end closing process by 35%.

- •Trained and developed team members, resulting in a 30% increase in team efficiency and productivity.

- •Analyzed financial data, contributing to a 5% boost in overall department productivity with actionable insights.

- •Assisted in the development of budget models used company-wide, leading to a 10% cost reduction.

- •Maintained the accuracy of the general ledger accounting records resulting in fewer discrepancies.

- •Participated in cross-departmental task forces aimed at reducing operational inefficiencies by 15%.

Senior Accounting Policy and Procedure Manager resume sample

- •Developed and implemented a comprehensive accounting policy framework that strengthened compliance and efficiency, reducing errors in financial reports by 25%.

- •Led a team of 5 in assessing the impact of changing accounting regulations, resulting in seamless integration with existing policies and procedures.

- •Conducted bi-annual workshops for finance staff, enhancing understanding and application of updated IFRS and GAAP standards.

- •Collaborated with internal and external auditors to prepare for audits, resolving 98% of audit findings within the first month.

- •Analyzed financial statement discrepancies, contributing to policy enhancements that improved alignment with accounting standards.

- •Authored a policy manual that improved clarity and accessibility of accounting requirements across various departments.

- •Implemented effective accounting policy strategies that reduced procedural errors by 15% in the first year of application.

- •Monitored and reported on changes in GAAP and IFRS, guiding the organization through necessary adjustments to financial processes.

- •Facilitated cross-departmental training sessions, increasing regulatory compliance understanding by 30% among non-financial staff.

- •Managed documentation and reporting of policy compliance, resulting in a 20% decrease in compliance breaches.

- •Collaborated on special projects including a financial system upgrade, providing technical insights into policy integration.

- •Directed financial statement reviews, enhancing accuracy in reporting and compliance with IFRS, which improved overall audit grades by 10%.

- •Reduced discrepancies in financial reporting by 18% through effective policy enforcement and staff education.

- •Conducted rigorous evaluations of accounting procedures, recommending improvements that streamlined operations and increased transparency.

- •Collaborated with finance leadership in resolving complex accounting issues, ensuring timely and accurate solutions.

- •Supervised a team of 10 accountants, fostering a compliance-focused environment that increased team efficiency by 20%.

- •Assisted in the drafting and implementation of accounting procedures that successfully aligned with new industry regulations.

- •Improved accuracy of monthly financial statements and internal reports, contributing to enhanced decision-making processes.

- •Oversaw accounting audits and procedural checks, maintaining a zero non-compliance rate for two consecutive years.

Senior Accounts Receivable Manager resume sample

- •Enhanced AR turnover by 30% through implementing a new invoicing system, which decreased customer payment time.

- •Led a team of 10, providing tailored coaching resulting in increased team throughput and efficiency improvements.

- •Developed AR aging reports and forecasts for senior management, enhancing strategic planning and cash flow analysis.

- •Collaborated with cross-functional teams to resolve discrepancies, reducing outstanding disputes by 40%.

- •Built robust policies to safeguard against bad debts, thereby reducing them by 20% year-on-year.

- •Streamlined the AR process through ERP SAP integration, leading to a monthly 15% processing speed enhancement.

- •Managed complex billing for high-value accounts, successfully increasing payment collection efficiency by 25%.

- •Introduced automated reminder systems that reduced average days sales outstanding (DSO) by eight days.

- •Analyzed AR trends, minimizing potential for bad debts by adapting proactive customer relation strategies.

- •Collaborated with sales and operations to improve billing accuracy, which resulted in a 10% reduction in invoice disputes.

- •Held workshops for junior staff to foster skill improvement, enhancing their AR management capabilities.

- •Streamlined the cash application process, cutting processing time by 40% and aligning it with industry best practices.

- •Initiated a series of procedural changes that improved the accuracy of billing and reconciliation activities by 30%.

- •Ensured compliance with evolving accounting standards, reinforcing financial integrity.

- •Led a collaborative project with IT for ERP Oracle implementation, successfully integrating AR functionality.

- •Optimized invoice-to-payment processing and reduced reconciliation discrepancies by 15% through rigorous data analysis.

- •Assisted in implementing AR modules on ERP, enhancing system-wide efficiencies and resulting in substantial system upgrades.

- •Facilitated communication lines between finance and sales divisions, contributing to an 18% drop in invoicing errors.

- •Managed monthly ledger reconciliations, ensuring the accuracy and compliance of financial reporting.

Senior Forensic Accounting Manager resume sample

- •Led financial investigations uncovering fraudulent activities resulting in a $3 million recovery for clients, enhancing company reputation.

- •Managed and provided expert testimony in court for over 20 litigation cases, contributing significantly to case success rates.

- •Developed training programs and mentored 15 junior staff, improving team performance and efficiency by 30%.

- •Implemented fraud prevention strategies, reducing the incidence of fraudulent activities by over 40% within client organizations.

- •Maintained and enhanced key client relationships, increasing repeat business by 20%, securing long-term contracts.

- •Authored comprehensive investigative reports, ensuring precision, detail, and adherence to legal and corporate standards.

- •Conducted in-depth investigations into financial discrepancies, identifying and resolving fraud cases totaling over $5 million.

- •Collaborated with legal teams on high-profile cases, resulting in successful outcomes in 85% of filed cases.

- •Enhanced analytical procedures and protocols, increasing detection of irregularities by 30% within one year.

- •Developed specialized forensic accounting methodologies, resulting in industry recognition and increased service demand.

- •Guided teams in complex forensic analysis projects, ensuring meticulous and timely delivery of key findings.

- •Analyzed financial statements to identify fraud patterns, leading to the prevention of potential losses of $2 million.

- •Assisted in crafting comprehensive forensic reports, supporting legal teams in litigation cases and securing positive verdicts.

- •Supported senior professionals in conducting forensic audits, increasing productivity by 25% within the team.

- •Communicated findings effectively to stakeholders, improving transparency and understanding of financial discrepancies.

- •Performed audits assessing financial accuracy and conformity, contributing to a 90% compliance rate across audits.

- •Identified financial anomalies in statements, advising on corrective actions that reduced errors by 35%.

- •Collaborated with cross-functional teams to address financial discrepancies, enhancing audit quality and reliability.

- •Drafted audit reports in compliance with industry standards, increasing client satisfaction in delivered services.

Senior Manager of International Accounting resume sample

- •Led a global team of accountants to improve month-end close processes, achieving a 15% reduction in closing time.

- •Implemented a new consolidation system, resulting in a 25% increase in reporting accuracy across 8 international subsidiaries.

- •Collaborated with diverse local finance teams to ensure 100% compliance with both IFRS and local GAAP standards.

- •Provided strategic insights on financial data that directly influenced global decisions, resulting in a 10% increase in profit margins.

- •Managed relationships with external auditors, resulting in a 30% reduction in audit-related delays.

- •Established comprehensive mentorship programs, fostering a professional growth culture that increased team satisfaction by 20%.

- •Oversaw the preparation of consolidated financial statements, leading to 98% on-time completion for 10 consecutive quarters.

- •Enhanced internal controls, reducing financial discrepancies by 20% over two fiscal years.

- •Led cross-functional initiatives to streamline tax compliance processes, achieving a 15% reduction in processing time.

- •Managed transfer pricing strategies, optimizing cost allocations and saving the company $1M annually.

- •Directed training programs on IFRS updates, enhancing team proficiency and alignment with global standards by 30%.

- •Supervised the integration of acquired entities into existing accounting frameworks, reducing onboarding time by 35%.

- •Implemented new accounting software that improved fraud detection capabilities by 40%.

- •Coordinated with international operations to ensure alignment with statutory reporting requirements across 5 countries.

- •Oversaw budget preparation, decreasing variances between projected and actual revenue by 10%.

- •Managed month-end close processes for European subsidiaries, ensuring 99% accuracy in financial reports.

- •Developed reconciliation processes that reduced errors in inter-company transactions by 25%.

- •Coordinated external audit activities resulting in a seamless audit process with zero significant findings.

- •Provided financial reports and analysis to inform strategic decisions that boosted revenue by 5% year-over-year.

Senior Accounting Compliance Manager resume sample

- •Developed comprehensive compliance frameworks, reducing audit findings by 20% year-over-year, significantly enhancing financial integrity.

- •Led cross-functional teams in conducting compliance audits, which improved accuracy and transparency of reports by 30%.

- •Presented compliance initiatives to executive management leading to policy updates, strengthening financial reporting accuracy by 25%.

- •Facilitated training for 50+ staff members on compliance matters, increasing compliance understanding and reducing errors by 15%.

- •Managed relationships with regulatory agencies and external auditors, resulting in zero non-compliance citations over a two-year period.

- •Implemented new accounting software that increased reporting efficiency by 40% and automated compliance checks.

- •Orchestrated compliance audits, resulting in a 25% decrease in documentation discrepancies, streamlining financial reporting.

- •Developed risk assessment protocols that reduced financial risk exposure by 18%, impacting operational efficiencies positively.

- •Managed compliance reporting to stakeholders, ensuring clarity and accuracy which enriched decision-making processes by 30%.

- •Collaborated with IT to integrate compliance checks into financial software systems, increasing compliance effectiveness by 35%.

- •Enhanced team’s proficiency by implementing regular compliance workshops, boosting compliance scores by 20%.

- •Conducted detailed financial analysis, identifying process improvements that saved $500,000 annually through cost reductions.

- •Executed comprehensive audits, ensuring adherence to accounting standards and eliminating errors by 20%.

- •Led strategic initiatives improving compliance reporting efficiency by 25%, resulting in streamlined audit processes.

- •Collaborated on financial statement preparation, enhancing accuracy by integrating compliance checks early in the process.

- •Reviewed and updated compliance policies, aligning them with current regulations and reducing negative audit outcomes by 15%.

- •Assisted in preparing financial audits, resulting in a 10% improvement in audit outcome accuracy and reliability.

- •Implemented new compliance training modules, enhancing staff understanding and adherence to industry standards.

- •Monitored regulatory developments, providing timely updates that ensured continuous compliance and reduced penalties.

Senior Manager of Corporate Accounting resume sample

- •Spearheaded a team of accountants in revising financial reporting system, increasing accuracy by 20% and reducing close time by 30%.

- •Implemented new internal controls that enhanced compliance and reduced audit discrepancies by 40% within the first year.

- •Collaborated with IT department to integrate ERP software, leading to a 25% increase in digital efficiency across financial processes.

- •Developed training programs for cross-functional teams which improved departmental collaboration and enhanced financial insights.

- •Managed annual budgets of over $100 million, achieving cost savings through strategic vendor negotiations and resource allocation.

- •Led quarterly financial review meetings, providing data-driven insights that contributed to the company's strategic growth and efficiency.

- •Developed financial models that enhanced strategic decision-making, resulting in a 15% increase in operational efficiency.

- •Led initiative for new accounting policy implementations aligning with GAAP, reducing errors by 30% in the first year.

- •Analyzed month-end financial statements for discrepancies, contributing to the department’s recognition for accuracy and reliability.

- •Facilitated external audits which reduced the completion timeline by 25% and increased annual compliance rates.

- •Managed complex financial forecasting projects, providing clarity to executive management, resulting in enhanced company performance.

- •Successfully supervised a team of 10, improving monthly closing process efficiency by 35% through streamlined procedures.

- •Re-engineered reconciliations, gaining a 50% reduction in discrepancies and enhancing internal controls.

- •Oversaw project accounting for key initiatives, ensuring on-budget completion and savings of $500,000 annually.

- •Mentored junior accountants, developing training sessions that increased overall team competency and confidence.

- •Analyzed financial data and reported findings which led to identifying profit improvement opportunities.

- •Ensured compliance with corporate policies and GAAP, improving regulatory adherence by 20%.

- •Assisted in preparation of annual budgets and audits, contributing to timely and accurate annual reports.

- •Collaborated with cross-functional teams to facilitate systematic financial process improvements.

As a senior accounting manager, you're like the steady captain steering through the complex seas of financial operations. Yet, when it comes to crafting your resume, it can feel like uncharted waters. You're tasked with distilling your extensive experience and technical skills in finance management into a clear and compelling document. Your resume must act as a beacon, guiding employers to recognize your unique value amidst the crowded job market.

Striking the right balance between detailing your accomplishments and keeping the content concise is essential. Employers are eager to see your leadership capabilities, especially in managing budgets and optimizing financial processes. However, listing every achievement can be overwhelming; this is where a well-organized format becomes critical—ensuring your key skills stand out without getting lost in the details.

Using a resume template is like finding a reliable sail to guide your document's structure and flow. A thoughtfully chosen resume template can streamline the writing process, highlighting your strengths and making sure that your expertise takes center stage.

Given the demands of navigating your career, an unstructured resume should not become an added obstacle. Harness the power of a template to effectively highlight your strengths and lead you to your next opportunity. This approach ensures your focus remains on what truly matters—your leadership in the field of accounting.

Key Takeaways

- Striking a balance between detailing accomplishments and keeping content concise is crucial for a well-organized teacher resume.

- Using a resume template helps streamline the structure and highlight key strengths.

- A reverse-chronological format is effective in showcasing career advancement for senior roles.

- A strong professional summary tailored to the job can capture attention and align with employer needs.

- Incorporating measurable achievements and action verbs in the experience section demonstrates leadership and impact.

What to focus on when writing your senior accounting manager resume

Your senior accounting manager resume should effectively convey your expertise in financial analysis, budget management, and leadership in the accounting field. Demonstrating your ability to navigate complex financial operations while leading teams is crucial. Highlighting your achievements and relevant experiences can make a compelling case for your candidacy.

How to structure your senior accounting manager resume

- **Contact Information** — Begin with your full name, phone number, email address, and LinkedIn profile URL. This section should be straightforward but accurately formatted, ensuring recruiters can easily reach you without sifting through details. A professional email address and an updated LinkedIn profile add credibility and accessibility.

- **Professional Summary** — Offer a concise yet impactful overview of your financial management skills and leadership experience. This is your chance to briefly spotlight key strengths like financial reporting, compliance, and strategic planning. Tailor this section to align with the specific job you’re targeting, demonstrating how your expertise directly benefits the potential employer.

- **Professional Experience** — Clearly present your work history with job titles, company names, locations, and dates. Focus on tangible achievements such as reducing costs, improving financial processes, or leading successful audits. Use specific metrics and examples to illustrate your impact, effectively showing how your contributions have driven success and efficiency in previous roles.

- **Education** — List your degrees in accounting or finance, along with the institutions’ names. Highlighting relevant certifications like CPA or CMA can enhance your credibility, showing you meet industry standards and are prepared for the role’s responsibilities.

- **Skills** — Focus on key skills directly related to accounting management, such as budget forecasting and compliance expertise. Proficiency in accounting software like SAP or QuickBooks is essential, reflecting your competence in leveraging technology to streamline financial operations.

- **Technical Proficiencies** — Describe your experience with accounting systems and tools that demonstrate your ability to handle the technical aspects of accounting. This section affirms your readiness to manage advanced financial operations with efficiency and precision.

Consider adding optional sections for awards, volunteer work, or projects to provide a broader view of your professional background. These additions help illustrate your ability to make wider impacts beyond your direct responsibilities. We'll cover each resume section more in-depth below, ensuring your resume aligns with industry standards and effectively showcases your qualifications.

Which resume format to choose

As a senior accounting manager, using a reverse-chronological resume format works best, as it highlights your career advancement and expertise in a structured way that recruiters appreciate. This format puts your most recent achievements and roles front and center, making it easier for employers to grasp your career trajectory. Choosing the right font also matters for maintaining a professional impression; Raleway, Montserrat, and Lato are excellent choices. These fonts offer a clean and modern look that aligns with your role's demands for precision and clarity without overwhelming the reader.

Always save your resume as a PDF. This ensures that your carefully crafted layout retains its integrity, regardless of where or how it's viewed. PDF files are universally compatible, so they prevent formatting issues that could occur if a file is opened on different software or devices.

One-inch margins are standard and recommended, as they provide enough white space to make your resume legible and appealing to the eye. Proper spacing ensures that your resume doesn’t feel cramped, drawing attention to your key accomplishments and skills. With these considerations in place, your resume will present your qualifications as a senior accounting manager in the best possible light.

How to write a quantifiable resume experience section

The experience section of your senior accounting manager resume is where your leadership skills, achievements, and contributions shine. It’s important to highlight how you manage teams, streamline processes, and drive financial success. Starting with your most recent job and going back 10-15 years helps to provide a comprehensive view of your career while focusing on roles relevant to senior accounting management. Tailoring your resume to fit the job description allows you to emphasize skills and achievements that match the employer's needs. Using action words like "led," "improved," and "achieved" injects energy into your narrative, showcasing your proactive approach.

Here's an example:

- •Led a team of 10 accountants, boosting financial report efficiency by 30%

- •Implemented a new accounts payable system, cutting errors by 25%

- •Saved $1.5M in costs through process optimization

- •Crafted risk management strategies, reducing financial discrepancies by 40%

This experience section effectively emphasizes your strengths by connecting each achievement with proven results, which is key for demonstrating your impact. Each bullet point flows naturally from the last, creating a cohesive picture of your abilities. By tailoring your experience to align with the job description, it makes your resume more persuasive and specific to what the employer requires. This logical organization and attention to relevant detail reflect the expertise and precision needed in a senior accounting role, setting you apart in a competitive field.

Training and Development Focused resume experience section

A training and development-focused senior accounting manager resume experience section should begin by showcasing your notable achievements in these areas. Highlight specific projects where you led training initiatives or developed impactful programs, demonstrating how these efforts improved productivity or efficiency. Clearly describe situations where your strategic training methods made a tangible difference to your team and organization, using simple language for clarity. This approach not only underscores your accounting expertise but also your ability to teach and motivate your team effectively.

In your bullet points, emphasize measurable accomplishments resulting from your training efforts. Describe innovative training methods you introduced and explain their positive impact on team performance, ensuring each point follows logically from the last and clearly illustrates your role and achievements. Employers are drawn to leaders who can drive growth and development, so your past experiences should reflect your ability to inspire and lead others successfully.

Senior Accounting Manager

ABC Financial Services

January 2018 - Present

- Developed and implemented a comprehensive training program that reduced onboarding time by 30%.

- Mentored and coached a team of 10 accountants, resulting in a 15% increase in overall team productivity.

- Created and led bi-weekly training workshops, improving the team's technical skills and knowledge retention.

- Introduced a new software tool and trained staff, decreasing data entry errors by 25%.

Innovation-Focused resume experience section

A senior accounting manager resume experience section should effectively communicate how you've brought innovative ideas to enhance financial processes. Begin by identifying key achievements that illustrate your problem-solving abilities and creative thinking in accounting. Make sure to emphasize initiatives where you led or supported significant changes, focusing on the outcomes and their impact. Use straightforward language to describe these achievements, crafting each bullet point to highlight specific contributions. Whenever possible, integrate metrics to underscore your successes, helping potential employers grasp the tangible benefits of your innovations. This strategy not only showcases your capability to improve accounting operations but also allows employers to envision how you could replicate these results for their organization.

Senior Accounting Manager

Tech Innovators Inc.

2018 - Present

- Developed a new budgeting system that reduced processing time by 40% and improved accuracy.

- Pioneered the automation of monthly financial reporting, resulting in a 50% reduction in preparation time.

- Spearheaded a cross-departmental initiative to enhance cost control measures, saving the company over $500,000 annually.

- Implemented a cloud-based accounting software solution that improved data accessibility and collaboration.

Leadership-Focused resume experience section

A leadership-focused senior accounting manager resume experience section should clearly demonstrate how your guidance and strategic decisions have positively impacted your team and company. Begin with specific achievements where your leadership was essential, highlighting how they led to increased efficiency or profitability within the organization. Focus on tangible results, such as enhanced financial reporting accuracy, improved teamwork, or the successful completion of key projects. Maintain clarity by sticking to measurable outcomes that effectively showcase your leadership abilities.

Detail your experience in a way that highlights your unique leadership style and the contributions you have made. Utilize strong action words to describe how you have managed financial operations and effectively led your team toward success. Demonstrate your skills in mentoring team members, setting and meeting goals, and ensuring compliance with financial regulations. Overall, your resume should reflect your commitment to leveraging your leadership skills in order to drive growth and efficiency.

Senior Accounting Manager

ABC Corp.

January 2015 - Present

- Led a team of 10 accountants to increase financial reporting accuracy by 20%.

- Developed a training program that improved team productivity by 15% and reduced errors.

- Spearheaded a cost-reduction initiative that saved the company $500,000 annually.

- Implemented new software that streamlined processes and enhanced collaboration across departments.

Efficiency-Focused resume experience section

A senior accounting manager resume experience section should clearly emphasize your ability to enhance efficiency through streamlined processes and increased productivity. Begin by detailing specific initiatives you led that improved operations, ensuring to include numbers or percentages to illustrate your impact. Highlight your leadership abilities by explaining how you motivated your team to reach these goals, thus showcasing your managerial skills.

When describing your accomplishments, use strong action verbs to vividly convey your proactive approach. Make sure to clearly state the time frame, your job title, and your workplace for each role. Select achievements that directly reflect your dedication to efficiency and demonstrate your leadership capabilities. Here's a structured example to serve as a guide:

Senior Accounting Manager

GreenTech Solutions

June 2019 - July 2023

- Reduced monthly closing time by 30% through automation of reporting processes.

- Led a team of 10 in implementing new budgeting software, decreasing overhead by 15%.

- Established a standardized system to track KPIs, boosting productivity by 25%.

- Developed training programs for staff, cutting errors in financial reports by 20%.

Write your senior accounting manager resume summary section

A results-focused Senior Accounting Manager resume should start with a strong summary that highlights your achievements and experience. This key section sits at the top of your resume, capturing attention immediately, so it's important to make it count. Keep it concise and impactful, focusing on your expertise, key skills, and what you offer to potential employers. Align this summary with the specific job you’re applying for, showcasing how you meet their needs. Consider this example:

This example underscores your ability by focusing on relevant experience and measurable achievements, directly speaking to a company’s desire for leadership and financial expertise. But how do you decide between a summary and other options like an objective? While a summary reflects your past success and skills, an objective focuses on your career goals and aspirations within the role. A resume profile offers more detailed career context, and a summary of qualifications might specifically list skills or certifications. Each section serves a unique purpose, so choose the one that aligns with your career stage. For a seasoned professional like yourself, a well-crafted summary is often the most impactful choice, painting you as the solution to the employer’s needs through a compelling presentation of your skills and achievements.

Listing your senior accounting manager skills on your resume

A skills-focused senior accounting manager resume should effectively highlight the abilities that make you a valuable part of any team. You have multiple ways to showcase your skills; they can stand alone in their own section or be woven into your experience and summary areas for richer context. Your strengths and soft skills demonstrate how well you work with others and handle challenges, adding depth to your professional persona. At the other end, hard skills are the technical talents like mastering accounting software or excelling in financial analysis, emphasizing your proficiency in specific tasks. Both your skills and strengths serve as keywords in your resume to catch the eyes of hiring managers and automated systems searching for qualified candidates.

Here's a straightforward example of how a standalone skills section might appear for a senior accounting manager:

This skills section effectively lists key competencies directly relevant to the role of a senior accounting manager. It succinctly communicates your areas of expertise and the value you add, using straightforward language that anyone can grasp.

Best hard skills to feature on your senior accounting manager resume

Delving into hard skills, these demonstrate your technical proficiency and ability to tackle precise financial tasks, which are crucial for your role. Consider the following:

Hard Skills

- Financial Reporting

- Budget Management

- Tax Strategy

- Managerial Accounting

- Auditing

- Risk Management

- Financial Analysis

- Regulatory Compliance

- ERP Software Proficiency

- Cost Accounting

- Investment Analysis

- Cash Flow Management

- Forecasting

- Tax Compliance

- Performance Metrics

Best soft skills to feature on your senior accounting manager resume

Soft skills reveal how you interact with people and adapt to change, showcasing your leadership and collaborative potential. Here’s what to highlight:

Soft Skills

- Leadership

- Communication

- Problem-Solving

- Decision-Making

- Time Management

- Adaptability

- Team Collaboration

- Conflict Resolution

- Critical Thinking

- Organizational Skills

- Attention to Detail

- Negotiation

- Delegation

- Emotional Intelligence

- Prioritization

How to include your education on your resume

An education section is an important part of your senior accounting manager resume. It showcases your academic background and qualifications, highlighting why you're fit for the job. Always tailor this section to the specific job application, ensuring the information is relevant. Excluding unrelated education helps maintain focus on what matters to potential employers. Including your GPA can be beneficial if it's strong, typically above a 3.5 on a 4.0 scale. Mentioning honors like cum laude can add prestige. When listing degrees, use the full name of the degree and institution.

Here’s an example of what you shouldn’t do:

Now, a strong education section for a senior accounting manager might look like this:

The second example is compelling because it aligns directly with the requirements of a senior accounting manager role. By including a high GPA and an academic honor, it communicates strong performance and dedication. Listing the full degree name and institution also adds a professional touch.

How to include senior accounting manager certificates on your resume

Including a certificates section in a resume is crucial, especially for a senior accounting manager, as it showcases your qualifications and commitment to the profession. List the name of each certificate you have earned. Include the date when each certification was awarded to show your timeline of continuous education. Add the issuing organization for each certificate to emphasize their credibility.

This section can also be included in the header of your resume. For example, in the header, you could write: "CPA, CMA Certified." This highlights your credentials right at the top and grabs the employer's attention.

Here's an example of how a dedicated certificates section should look:

This example is effective because it lists relevant certifications that align with the responsibilities of a senior accounting manager. Each certificate is recognizable within the industry, enhancing your professional image. The section reflects your pursuit of high standards in accounting and management.

Extra sections to include on your senior accounting manager resume

Crafting a comprehensive resume as a senior accounting manager involves more than just listing your work experience and education. It should present a full picture of who you are as a professional and an individual.

Language section — Highlight additional languages that you know to show versatility and cultural awareness. Demonstrating proficiency in other languages can be a big plus when working in diverse teams or handling international accounts.

Hobbies and interests section — Share hobbies that showcase your analytical and meticulous nature. Engaging in activities like chess or puzzles can subtly emphasize your strategic thinking skills.

Volunteer work section — List volunteer work to prove your commitment to community and teamwork. This can reflect positively on your leadership skills and ability to balance various responsibilities.

Books section — Mention books that have impacted your work ethic or perspective on management. This can hint at your continuous learning habit and openness to new ideas.

Including these sections in your resume can give employers a deeper insight into your personality and values, beyond your professional credentials. This well-rounded approach can help you stand out in a competitive job market.

In Conclusion

In conclusion, crafting a senior accounting manager resume requires a keen focus on showcasing both your vast financial expertise and leadership abilities. It's about painting a clear picture of your accomplishments while ensuring your application stands out in a sea of qualified candidates. By utilizing a structured resume format, you can effectively highlight your achievements, skills, and experiences, making it easier for hiring managers to appreciate your unique qualifications. From choosing the right template to emphasizing quantifiable accomplishments, each part of your resume plays a critical role in demonstrating your value. Remember, recruiters appreciate clarity and professionalism, which can be achieved through the careful choice of fonts and layout. A reverse-chronological format particularly works well by placing your most recent achievements front and center. Additionally, your skills section should balance technical abilities with leadership traits, capturing your comprehensive capabilities. Don’t forget to underline the importance of relevant certifications, as they authenticate your expertise and continuous commitment to the field. Lastly, consider adding sections that reflect your personal traits and contributions beyond direct work experience, such as language skills or volunteer activities. These elements contribute to a well-rounded depiction of who you are, helping you connect with potential employers on several levels. By carefully curating each aspect of your resume, you increase your chances of steering your career toward new and rewarding opportunities.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.