Senior Tax Accountant Resume Examples

Jul 18, 2024

|

12 min read

"Master your resume like a pro with these senior tax accountant resume tips—ace the details and make your skills count!"

Rated by 348 people

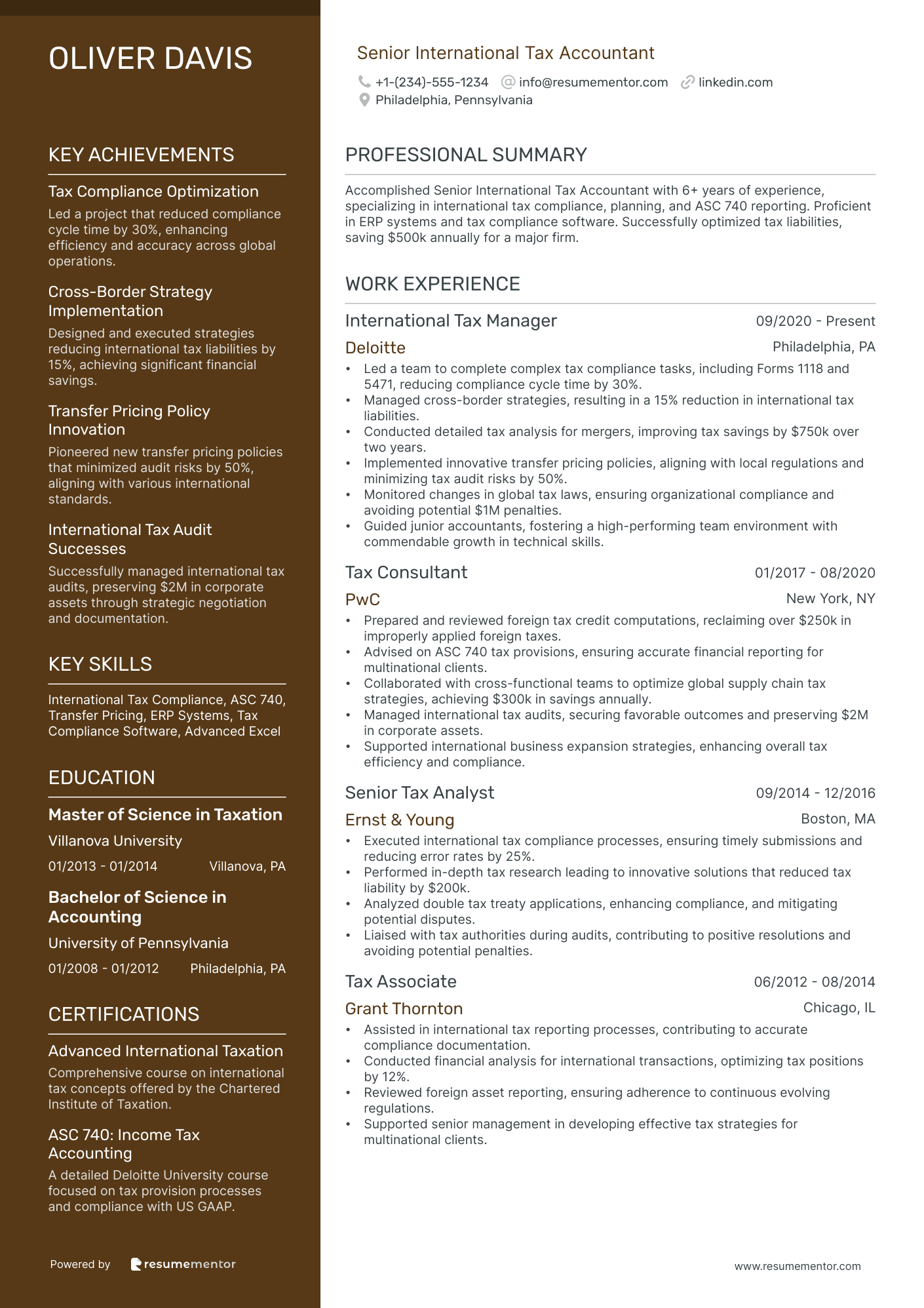

Senior International Tax Accountant

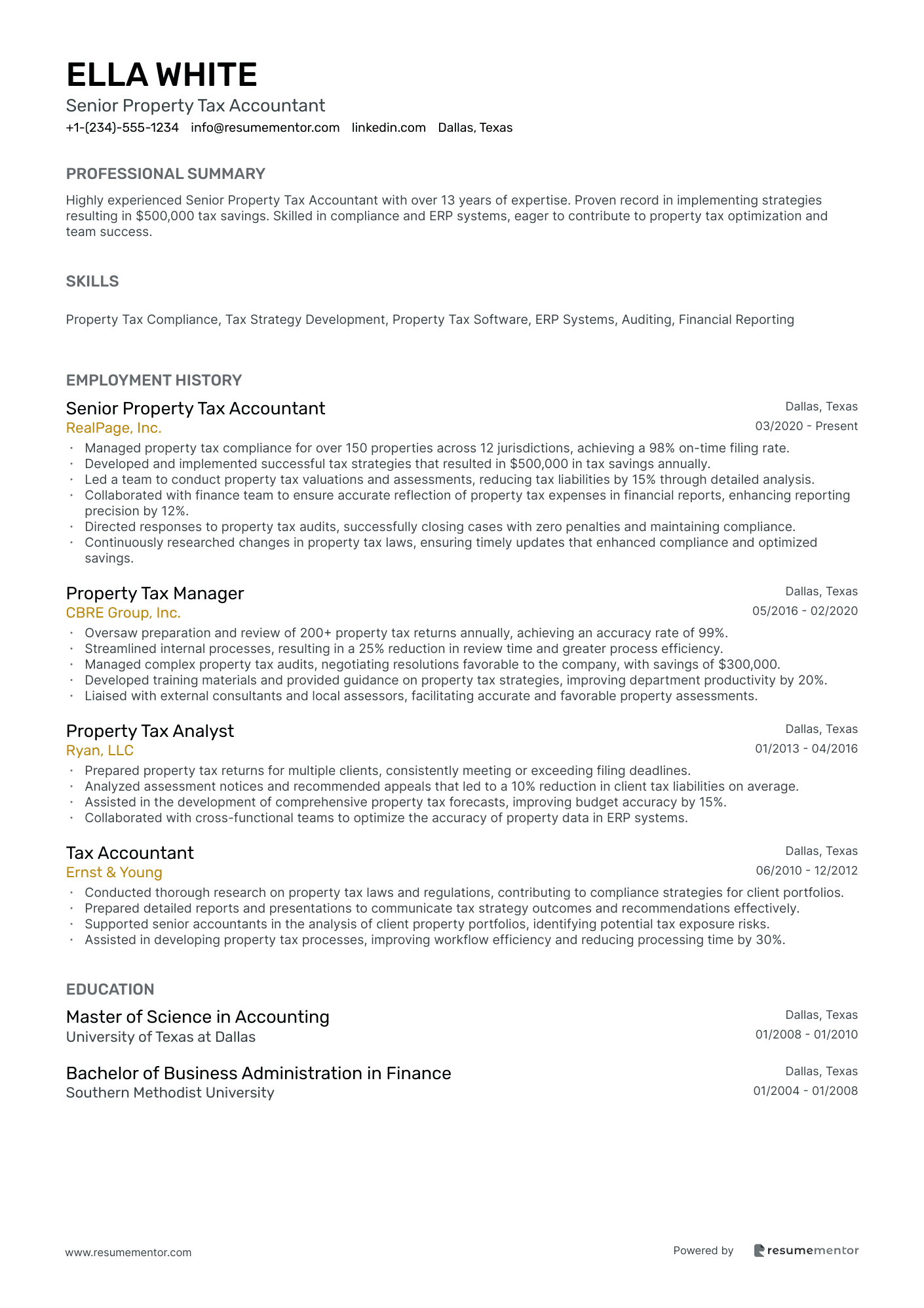

Senior Property Tax Accountant

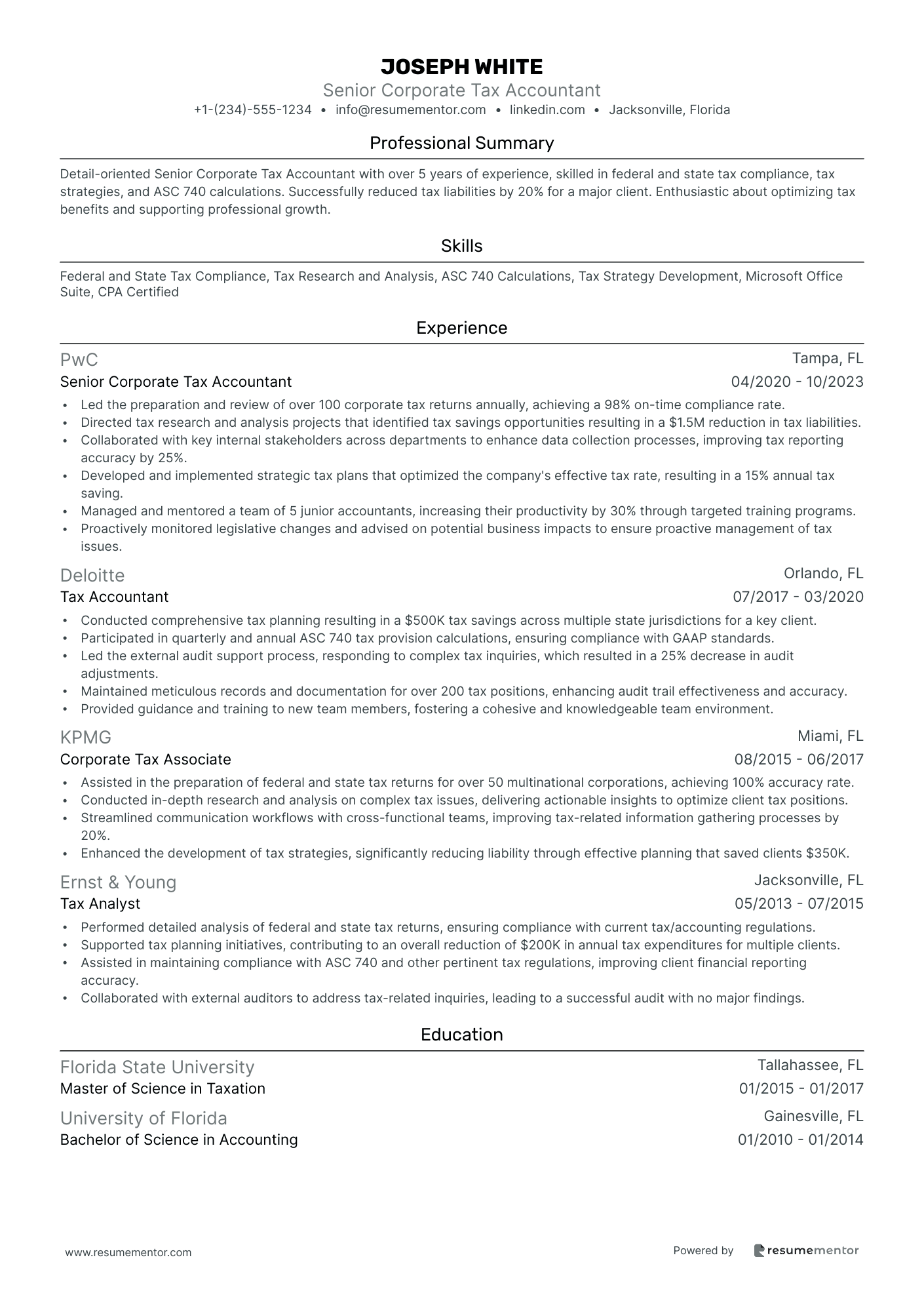

Senior Corporate Tax Accountant

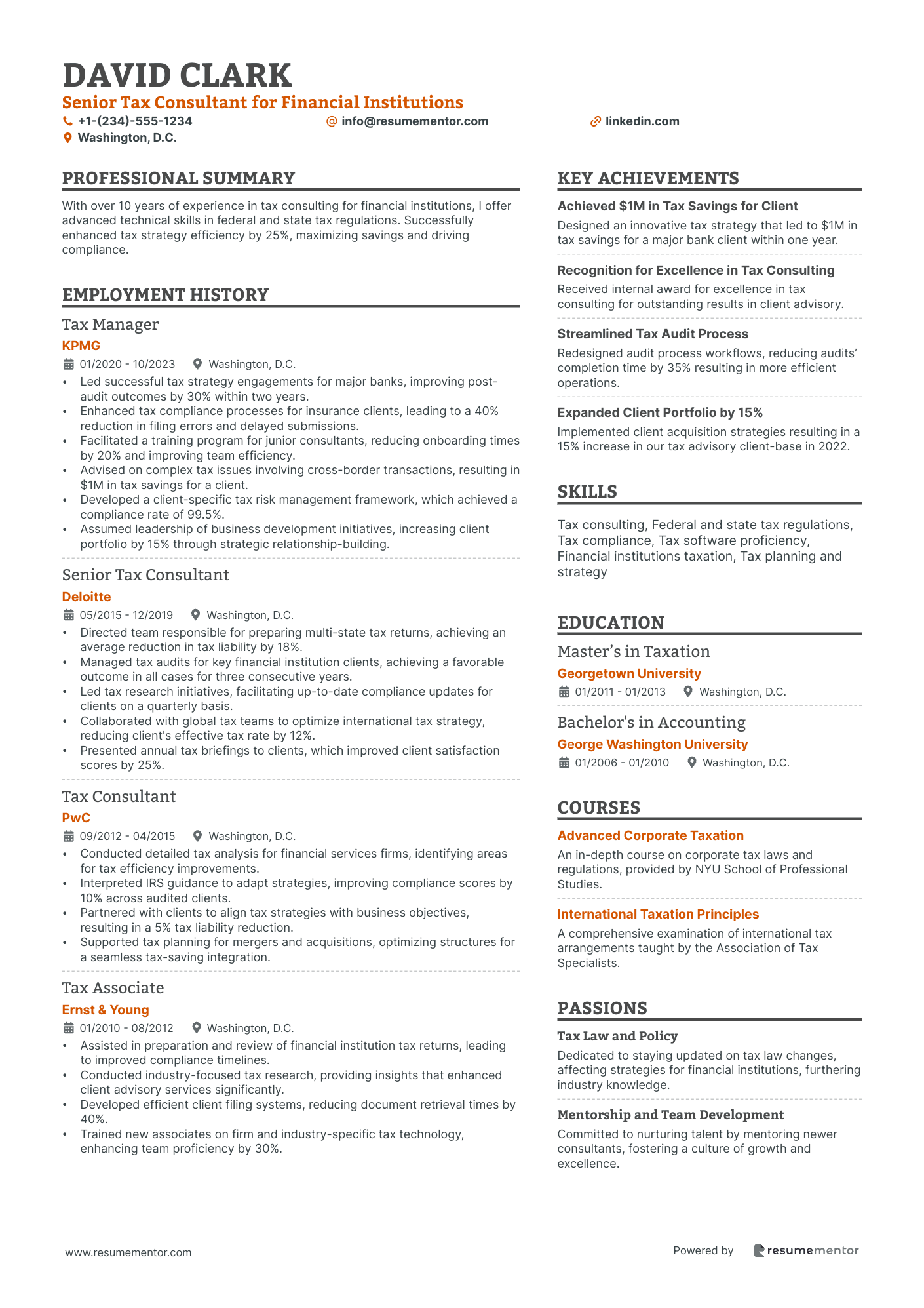

Senior Tax Consultant for Financial Institutions

Senior Merger & Acquisition Tax Accountant

Senior Tax Strategist for High Net-Worth Individuals

Senior Indirect Tax Accountant

Senior Estate Tax Accountant

Senior Tax Accountant for Non-Profit Organizations

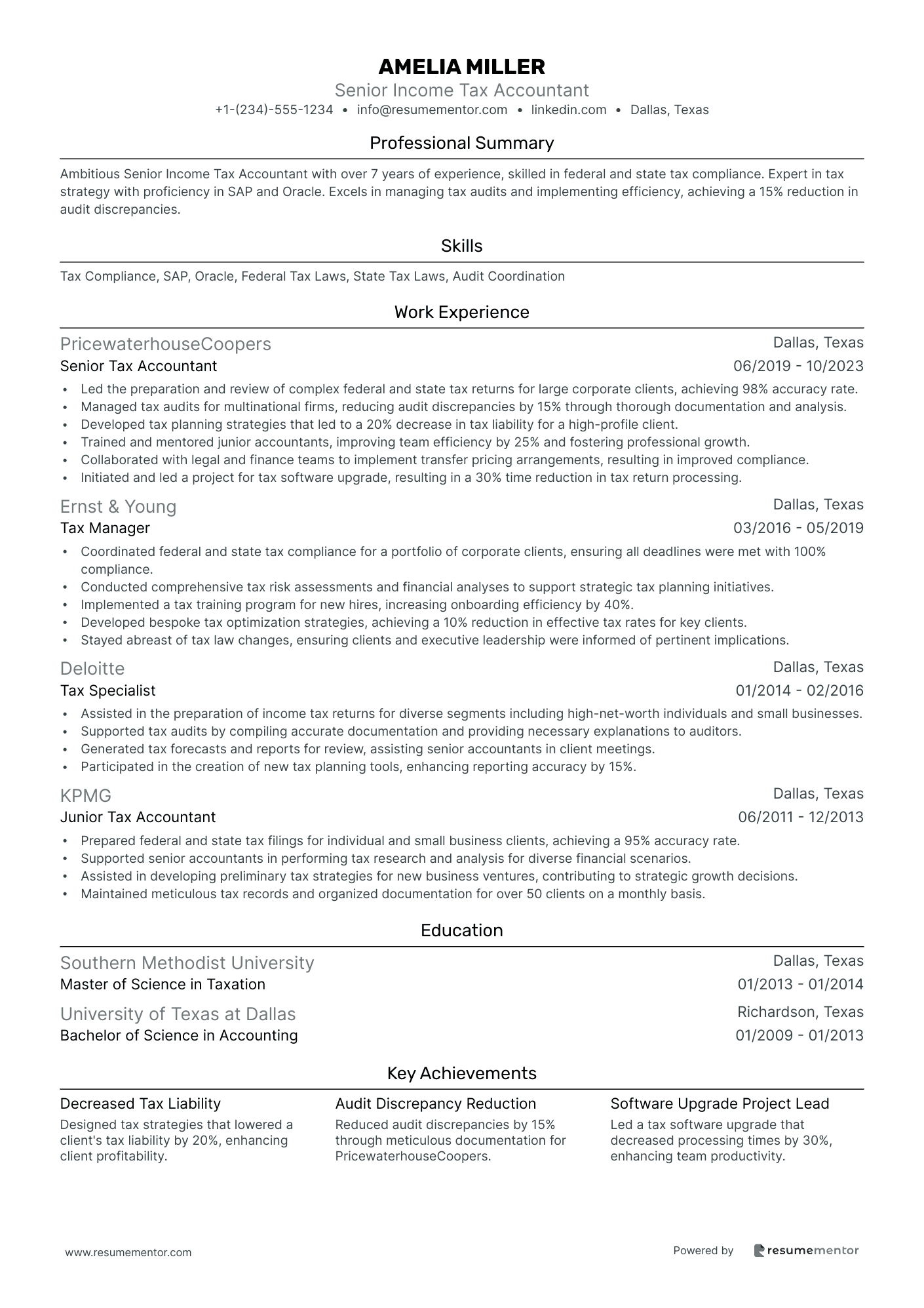

Senior Income Tax Accountant

Senior International Tax Accountant resume sample

- •Led a team to complete complex tax compliance tasks, including Forms 1118 and 5471, reducing compliance cycle time by 30%.

- •Managed cross-border strategies, resulting in a 15% reduction in international tax liabilities.

- •Conducted detailed tax analysis for mergers, improving tax savings by $750k over two years.

- •Implemented innovative transfer pricing policies, aligning with local regulations and minimizing tax audit risks by 50%.

- •Monitored changes in global tax laws, ensuring organizational compliance and avoiding potential $1M penalties.

- •Guided junior accountants, fostering a high-performing team environment with commendable growth in technical skills.

- •Prepared and reviewed foreign tax credit computations, reclaiming over $250k in improperly applied foreign taxes.

- •Advised on ASC 740 tax provisions, ensuring accurate financial reporting for multinational clients.

- •Collaborated with cross-functional teams to optimize global supply chain tax strategies, achieving $300k in savings annually.

- •Managed international tax audits, securing favorable outcomes and preserving $2M in corporate assets.

- •Supported international business expansion strategies, enhancing overall tax efficiency and compliance.

- •Executed international tax compliance processes, ensuring timely submissions and reducing error rates by 25%.

- •Performed in-depth tax research leading to innovative solutions that reduced tax liability by $200k.

- •Analyzed double tax treaty applications, enhancing compliance, and mitigating potential disputes.

- •Liaised with tax authorities during audits, contributing to positive resolutions and avoiding potential penalties.

- •Assisted in international tax reporting processes, contributing to accurate compliance documentation.

- •Conducted financial analysis for international transactions, optimizing tax positions by 12%.

- •Reviewed foreign asset reporting, ensuring adherence to continuous evolving regulations.

- •Supported senior management in developing effective tax strategies for multinational clients.

Senior Property Tax Accountant resume sample

- •Managed property tax compliance for over 150 properties across 12 jurisdictions, achieving a 98% on-time filing rate.

- •Developed and implemented successful tax strategies that resulted in $500,000 in tax savings annually.

- •Led a team to conduct property tax valuations and assessments, reducing tax liabilities by 15% through detailed analysis.

- •Collaborated with finance team to ensure accurate reflection of property tax expenses in financial reports, enhancing reporting precision by 12%.

- •Directed responses to property tax audits, successfully closing cases with zero penalties and maintaining compliance.

- •Continuously researched changes in property tax laws, ensuring timely updates that enhanced compliance and optimized savings.

- •Oversaw preparation and review of 200+ property tax returns annually, achieving an accuracy rate of 99%.

- •Streamlined internal processes, resulting in a 25% reduction in review time and greater process efficiency.

- •Managed complex property tax audits, negotiating resolutions favorable to the company, with savings of $300,000.

- •Developed training materials and provided guidance on property tax strategies, improving department productivity by 20%.

- •Liaised with external consultants and local assessors, facilitating accurate and favorable property assessments.

- •Prepared property tax returns for multiple clients, consistently meeting or exceeding filing deadlines.

- •Analyzed assessment notices and recommended appeals that led to a 10% reduction in client tax liabilities on average.

- •Assisted in the development of comprehensive property tax forecasts, improving budget accuracy by 15%.

- •Collaborated with cross-functional teams to optimize the accuracy of property data in ERP systems.

- •Conducted thorough research on property tax laws and regulations, contributing to compliance strategies for client portfolios.

- •Prepared detailed reports and presentations to communicate tax strategy outcomes and recommendations effectively.

- •Supported senior accountants in the analysis of client property portfolios, identifying potential tax exposure risks.

- •Assisted in developing property tax processes, improving workflow efficiency and reducing processing time by 30%.

Senior Corporate Tax Accountant resume sample

- •Led the preparation and review of over 100 corporate tax returns annually, achieving a 98% on-time compliance rate.

- •Directed tax research and analysis projects that identified tax savings opportunities resulting in a $1.5M reduction in tax liabilities.

- •Collaborated with key internal stakeholders across departments to enhance data collection processes, improving tax reporting accuracy by 25%.

- •Developed and implemented strategic tax plans that optimized the company's effective tax rate, resulting in a 15% annual tax saving.

- •Managed and mentored a team of 5 junior accountants, increasing their productivity by 30% through targeted training programs.

- •Proactively monitored legislative changes and advised on potential business impacts to ensure proactive management of tax issues.

- •Conducted comprehensive tax planning resulting in a $500K tax savings across multiple state jurisdictions for a key client.

- •Participated in quarterly and annual ASC 740 tax provision calculations, ensuring compliance with GAAP standards.

- •Led the external audit support process, responding to complex tax inquiries, which resulted in a 25% decrease in audit adjustments.

- •Maintained meticulous records and documentation for over 200 tax positions, enhancing audit trail effectiveness and accuracy.

- •Provided guidance and training to new team members, fostering a cohesive and knowledgeable team environment.

- •Assisted in the preparation of federal and state tax returns for over 50 multinational corporations, achieving 100% accuracy rate.

- •Conducted in-depth research and analysis on complex tax issues, delivering actionable insights to optimize client tax positions.

- •Streamlined communication workflows with cross-functional teams, improving tax-related information gathering processes by 20%.

- •Enhanced the development of tax strategies, significantly reducing liability through effective planning that saved clients $350K.

- •Performed detailed analysis of federal and state tax returns, ensuring compliance with current tax/accounting regulations.

- •Supported tax planning initiatives, contributing to an overall reduction of $200K in annual tax expenditures for multiple clients.

- •Assisted in maintaining compliance with ASC 740 and other pertinent tax regulations, improving client financial reporting accuracy.

- •Collaborated with external auditors to address tax-related inquiries, leading to a successful audit with no major findings.

Senior Tax Consultant for Financial Institutions resume sample

- •Led successful tax strategy engagements for major banks, improving post-audit outcomes by 30% within two years.

- •Enhanced tax compliance processes for insurance clients, leading to a 40% reduction in filing errors and delayed submissions.

- •Facilitated a training program for junior consultants, reducing onboarding times by 20% and improving team efficiency.

- •Advised on complex tax issues involving cross-border transactions, resulting in $1M in tax savings for a client.

- •Developed a client-specific tax risk management framework, which achieved a compliance rate of 99.5%.

- •Assumed leadership of business development initiatives, increasing client portfolio by 15% through strategic relationship-building.

- •Directed team responsible for preparing multi-state tax returns, achieving an average reduction in tax liability by 18%.

- •Managed tax audits for key financial institution clients, achieving a favorable outcome in all cases for three consecutive years.

- •Led tax research initiatives, facilitating up-to-date compliance updates for clients on a quarterly basis.

- •Collaborated with global tax teams to optimize international tax strategy, reducing client's effective tax rate by 12%.

- •Presented annual tax briefings to clients, which improved client satisfaction scores by 25%.

- •Conducted detailed tax analysis for financial services firms, identifying areas for tax efficiency improvements.

- •Interpreted IRS guidance to adapt strategies, improving compliance scores by 10% across audited clients.

- •Partnered with clients to align tax strategies with business objectives, resulting in a 5% tax liability reduction.

- •Supported tax planning for mergers and acquisitions, optimizing structures for a seamless tax-saving integration.

- •Assisted in preparation and review of financial institution tax returns, leading to improved compliance timelines.

- •Conducted industry-focused tax research, providing insights that enhanced client advisory services significantly.

- •Developed efficient client filing systems, reducing document retrieval times by 40%.

- •Trained new associates on firm and industry-specific tax technology, enhancing team proficiency by 30%.

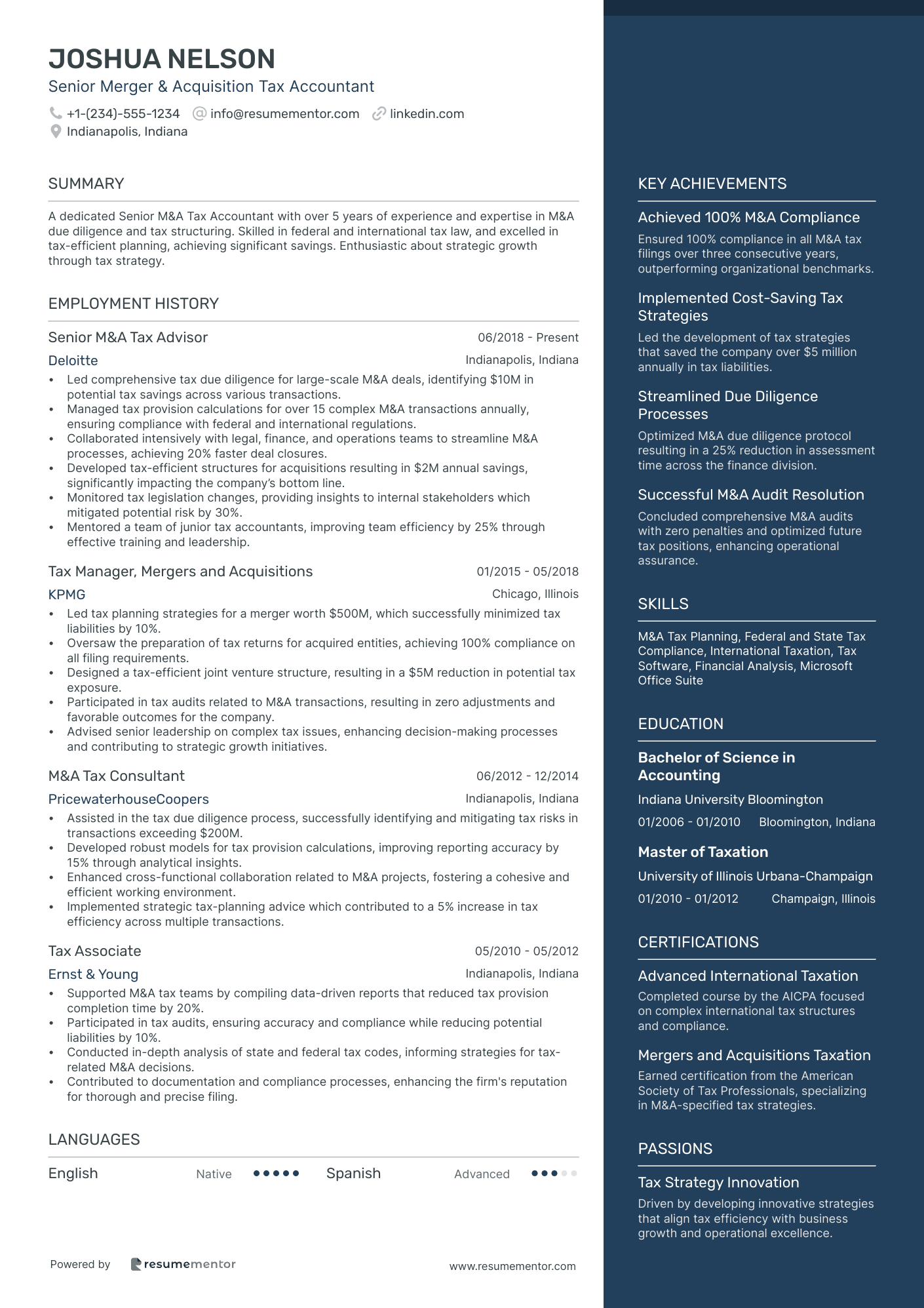

Senior Merger & Acquisition Tax Accountant resume sample

- •Led comprehensive tax due diligence for large-scale M&A deals, identifying $10M in potential tax savings across various transactions.

- •Managed tax provision calculations for over 15 complex M&A transactions annually, ensuring compliance with federal and international regulations.

- •Collaborated intensively with legal, finance, and operations teams to streamline M&A processes, achieving 20% faster deal closures.

- •Developed tax-efficient structures for acquisitions resulting in $2M annual savings, significantly impacting the company’s bottom line.

- •Monitored tax legislation changes, providing insights to internal stakeholders which mitigated potential risk by 30%.

- •Mentored a team of junior tax accountants, improving team efficiency by 25% through effective training and leadership.

- •Led tax planning strategies for a merger worth $500M, which successfully minimized tax liabilities by 10%.

- •Oversaw the preparation of tax returns for acquired entities, achieving 100% compliance on all filing requirements.

- •Designed a tax-efficient joint venture structure, resulting in a $5M reduction in potential tax exposure.

- •Participated in tax audits related to M&A transactions, resulting in zero adjustments and favorable outcomes for the company.

- •Advised senior leadership on complex tax issues, enhancing decision-making processes and contributing to strategic growth initiatives.

- •Assisted in the tax due diligence process, successfully identifying and mitigating tax risks in transactions exceeding $200M.

- •Developed robust models for tax provision calculations, improving reporting accuracy by 15% through analytical insights.

- •Enhanced cross-functional collaboration related to M&A projects, fostering a cohesive and efficient working environment.

- •Implemented strategic tax-planning advice which contributed to a 5% increase in tax efficiency across multiple transactions.

- •Supported M&A tax teams by compiling data-driven reports that reduced tax provision completion time by 20%.

- •Participated in tax audits, ensuring accuracy and compliance while reducing potential liabilities by 10%.

- •Conducted in-depth analysis of state and federal tax codes, informing strategies for tax-related M&A decisions.

- •Contributed to documentation and compliance processes, enhancing the firm's reputation for thorough and precise filing.

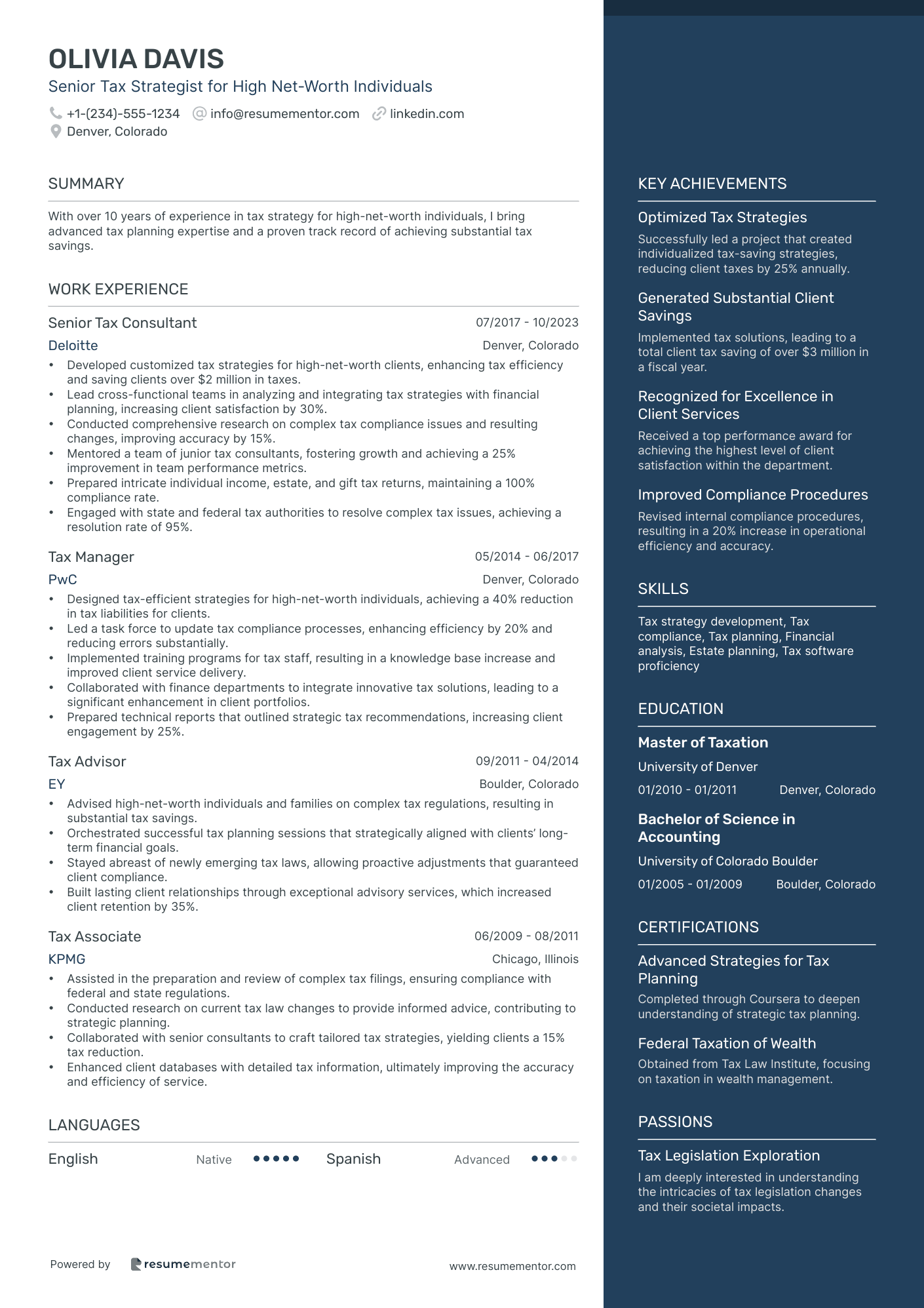

Senior Tax Strategist for High Net-Worth Individuals resume sample

- •Developed customized tax strategies for high-net-worth clients, enhancing tax efficiency and saving clients over $2 million in taxes.

- •Lead cross-functional teams in analyzing and integrating tax strategies with financial planning, increasing client satisfaction by 30%.

- •Conducted comprehensive research on complex tax compliance issues and resulting changes, improving accuracy by 15%.

- •Mentored a team of junior tax consultants, fostering growth and achieving a 25% improvement in team performance metrics.

- •Prepared intricate individual income, estate, and gift tax returns, maintaining a 100% compliance rate.

- •Engaged with state and federal tax authorities to resolve complex tax issues, achieving a resolution rate of 95%.

- •Designed tax-efficient strategies for high-net-worth individuals, achieving a 40% reduction in tax liabilities for clients.

- •Led a task force to update tax compliance processes, enhancing efficiency by 20% and reducing errors substantially.

- •Implemented training programs for tax staff, resulting in a knowledge base increase and improved client service delivery.

- •Collaborated with finance departments to integrate innovative tax solutions, leading to a significant enhancement in client portfolios.

- •Prepared technical reports that outlined strategic tax recommendations, increasing client engagement by 25%.

- •Advised high-net-worth individuals and families on complex tax regulations, resulting in substantial tax savings.

- •Orchestrated successful tax planning sessions that strategically aligned with clients’ long-term financial goals.

- •Stayed abreast of newly emerging tax laws, allowing proactive adjustments that guaranteed client compliance.

- •Built lasting client relationships through exceptional advisory services, which increased client retention by 35%.

- •Assisted in the preparation and review of complex tax filings, ensuring compliance with federal and state regulations.

- •Conducted research on current tax law changes to provide informed advice, contributing to strategic planning.

- •Collaborated with senior consultants to craft tailored tax strategies, yielding clients a 15% tax reduction.

- •Enhanced client databases with detailed tax information, ultimately improving the accuracy and efficiency of service.

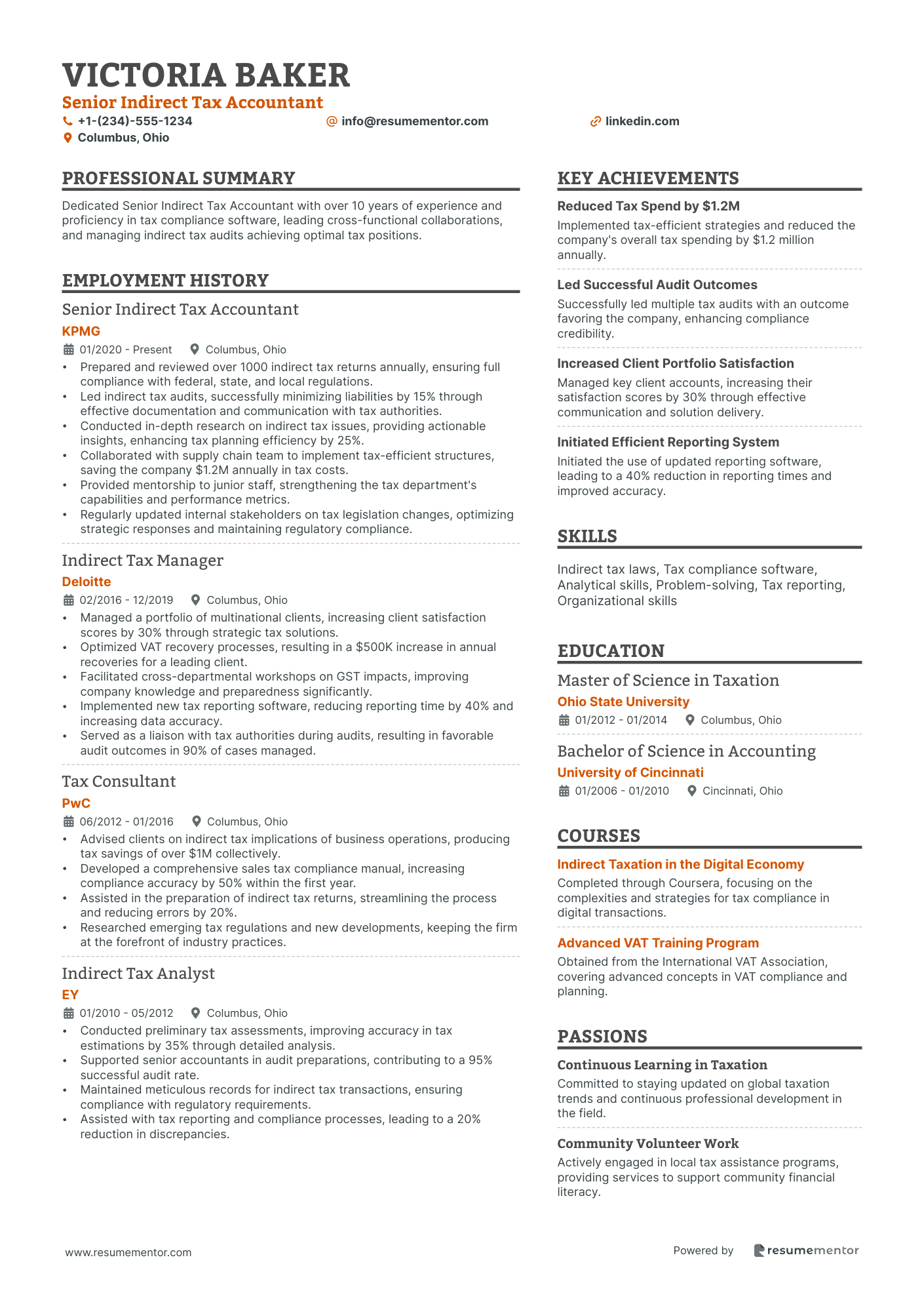

Senior Indirect Tax Accountant resume sample

- •Prepared and reviewed over 1000 indirect tax returns annually, ensuring full compliance with federal, state, and local regulations.

- •Led indirect tax audits, successfully minimizing liabilities by 15% through effective documentation and communication with tax authorities.

- •Conducted in-depth research on indirect tax issues, providing actionable insights, enhancing tax planning efficiency by 25%.

- •Collaborated with supply chain team to implement tax-efficient structures, saving the company $1.2M annually in tax costs.

- •Provided mentorship to junior staff, strengthening the tax department's capabilities and performance metrics.

- •Regularly updated internal stakeholders on tax legislation changes, optimizing strategic responses and maintaining regulatory compliance.

- •Managed a portfolio of multinational clients, increasing client satisfaction scores by 30% through strategic tax solutions.

- •Optimized VAT recovery processes, resulting in a $500K increase in annual recoveries for a leading client.

- •Facilitated cross-departmental workshops on GST impacts, improving company knowledge and preparedness significantly.

- •Implemented new tax reporting software, reducing reporting time by 40% and increasing data accuracy.

- •Served as a liaison with tax authorities during audits, resulting in favorable audit outcomes in 90% of cases managed.

- •Advised clients on indirect tax implications of business operations, producing tax savings of over $1M collectively.

- •Developed a comprehensive sales tax compliance manual, increasing compliance accuracy by 50% within the first year.

- •Assisted in the preparation of indirect tax returns, streamlining the process and reducing errors by 20%.

- •Researched emerging tax regulations and new developments, keeping the firm at the forefront of industry practices.

- •Conducted preliminary tax assessments, improving accuracy in tax estimations by 35% through detailed analysis.

- •Supported senior accountants in audit preparations, contributing to a 95% successful audit rate.

- •Maintained meticulous records for indirect tax transactions, ensuring compliance with regulatory requirements.

- •Assisted with tax reporting and compliance processes, leading to a 20% reduction in discrepancies.

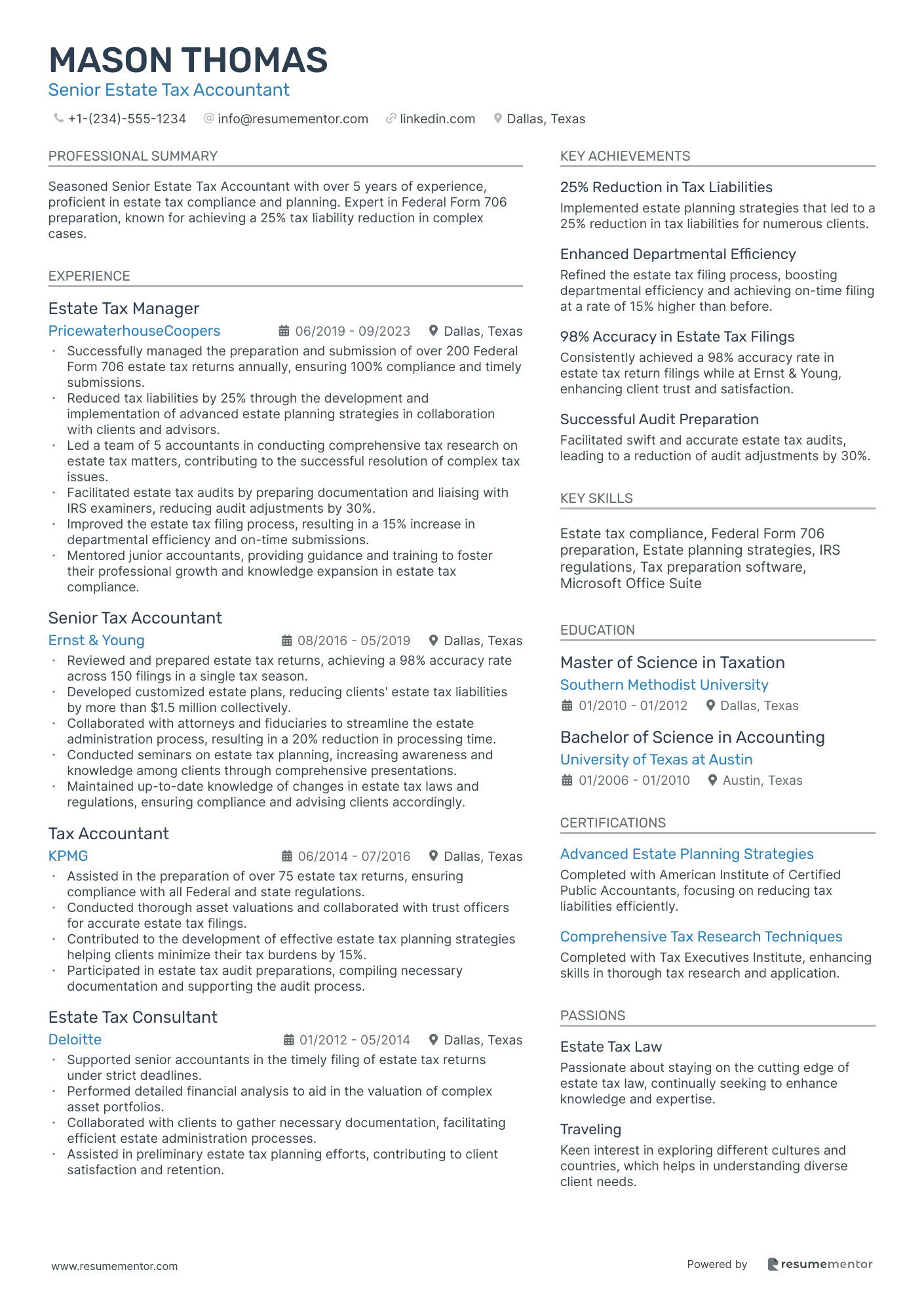

Senior Estate Tax Accountant resume sample

- •Successfully managed the preparation and submission of over 200 Federal Form 706 estate tax returns annually, ensuring 100% compliance and timely submissions.

- •Reduced tax liabilities by 25% through the development and implementation of advanced estate planning strategies in collaboration with clients and advisors.

- •Led a team of 5 accountants in conducting comprehensive tax research on estate tax matters, contributing to the successful resolution of complex tax issues.

- •Facilitated estate tax audits by preparing documentation and liaising with IRS examiners, reducing audit adjustments by 30%.

- •Improved the estate tax filing process, resulting in a 15% increase in departmental efficiency and on-time submissions.

- •Mentored junior accountants, providing guidance and training to foster their professional growth and knowledge expansion in estate tax compliance.

- •Reviewed and prepared estate tax returns, achieving a 98% accuracy rate across 150 filings in a single tax season.

- •Developed customized estate plans, reducing clients' estate tax liabilities by more than $1.5 million collectively.

- •Collaborated with attorneys and fiduciaries to streamline the estate administration process, resulting in a 20% reduction in processing time.

- •Conducted seminars on estate tax planning, increasing awareness and knowledge among clients through comprehensive presentations.

- •Maintained up-to-date knowledge of changes in estate tax laws and regulations, ensuring compliance and advising clients accordingly.

- •Assisted in the preparation of over 75 estate tax returns, ensuring compliance with all Federal and state regulations.

- •Conducted thorough asset valuations and collaborated with trust officers for accurate estate tax filings.

- •Contributed to the development of effective estate tax planning strategies helping clients minimize their tax burdens by 15%.

- •Participated in estate tax audit preparations, compiling necessary documentation and supporting the audit process.

- •Supported senior accountants in the timely filing of estate tax returns under strict deadlines.

- •Performed detailed financial analysis to aid in the valuation of complex asset portfolios.

- •Collaborated with clients to gather necessary documentation, facilitating efficient estate administration processes.

- •Assisted in preliminary estate tax planning efforts, contributing to client satisfaction and retention.

Senior Tax Accountant for Non-Profit Organizations resume sample

- •Prepared and reviewed over 75 federal and state tax returns annually for non-profit organizations, enhancing financial transparency and compliance.

- •Implemented a new financial strategy resulting in a 15% tax liability reduction for clients by optimizing their financial structures.

- •Collaborated with auditing teams to successfully navigate IRS audits for 10 clients, sharing detailed and organized financial reports.

- •Led a team of three junior accountants, boosting their efficiency in tax compliance tasks by over 25% through mentorship and training.

- •Conducted extensive research on changes in IRS regulations, providing actionable insights to clients, safeguarding them against potential risks.

- •Increased client satisfaction scores by 30% through proactive communication and exceptional problem-solving capabilities.

- •Managed the preparation of complex tax returns for over 50 non-profit clients annually, ensuring adherence to IRS guidelines.

- •Advised non-profits on tax mitigation strategies, resulting in a combined annual savings of over $200,000 in tax liabilities.

- •Enhanced the accuracy of financial reporting by implementing an automated system for tax filings, reducing errors by 40%.

- •Provided support during audits by preparing precise documentation, reducing audit times by an average of two weeks per client.

- •Fostered strong client relationships, leading to a 20% increase in client retention and new client acquisition year over year.

- •Conducted tax compliance reviews for large non-profit organizations, identifying potential savings and compliance risks.

- •Played a key role in a project that saved a client $100,000 annually in property tax through strategic consulting.

- •Developed comprehensive tax compliance training for non-profit financial officers, resulting in a 25% improvement in compliance accuracy.

- •Worked with a cross-functional team to implement financial software that streamlined reporting processes, increasing efficiency by 35%.

- •Assisted in the preparation of over 200 Form 990s, ensuring compliance with federal and state requirements for non-profits.

- •Helped develop a tax compliance program for non-profit clients, enhancing their understanding of financial responsibilities.

- •Provided research on tax implications for new non-profit initiatives, contributing to strategic planning efforts.

- •Collaborated with senior accountants on various tax projects, gaining valuable insights into non-profit financial management.

Senior Income Tax Accountant resume sample

- •Led the preparation and review of complex federal and state tax returns for large corporate clients, achieving 98% accuracy rate.

- •Managed tax audits for multinational firms, reducing audit discrepancies by 15% through thorough documentation and analysis.

- •Developed tax planning strategies that led to a 20% decrease in tax liability for a high-profile client.

- •Trained and mentored junior accountants, improving team efficiency by 25% and fostering professional growth.

- •Collaborated with legal and finance teams to implement transfer pricing arrangements, resulting in improved compliance.

- •Initiated and led a project for tax software upgrade, resulting in a 30% time reduction in tax return processing.

- •Coordinated federal and state tax compliance for a portfolio of corporate clients, ensuring all deadlines were met with 100% compliance.

- •Conducted comprehensive tax risk assessments and financial analyses to support strategic tax planning initiatives.

- •Implemented a tax training program for new hires, increasing onboarding efficiency by 40%.

- •Developed bespoke tax optimization strategies, achieving a 10% reduction in effective tax rates for key clients.

- •Stayed abreast of tax law changes, ensuring clients and executive leadership were informed of pertinent implications.

- •Assisted in the preparation of income tax returns for diverse segments including high-net-worth individuals and small businesses.

- •Supported tax audits by compiling accurate documentation and providing necessary explanations to auditors.

- •Generated tax forecasts and reports for review, assisting senior accountants in client meetings.

- •Participated in the creation of new tax planning tools, enhancing reporting accuracy by 15%.

- •Prepared federal and state tax filings for individual and small business clients, achieving a 95% accuracy rate.

- •Supported senior accountants in performing tax research and analysis for diverse financial scenarios.

- •Assisted in developing preliminary tax strategies for new business ventures, contributing to strategic growth decisions.

- •Maintained meticulous tax records and organized documentation for over 50 clients on a monthly basis.

Navigating the job market as a senior tax accountant can feel like solving a complex puzzle, where each piece represents your extensive financial expertise and analytical skills. Condensing this wealth of experience into a compelling resume, however, presents a unique challenge. While you’re used to diving deep into tax codes and crunching numbers, summarizing your professional journey on a single page requires a different set of skills.

Creating a resume that captures your vast experience while also capturing the attention of hiring managers is essential. Effectively communicating the intricacies of tax laws and your strategic thinking requires careful detail. Highlighting your leadership, client success stories, and financial acumen may seem daunting at first, but this is where a well-structured resume template becomes invaluable. Consider exploring these resume templates to ensure your achievements are presented in a professional and organized manner.

Showcasing your ability to manage complex financial accounts and lead teams effectively is important. Your resume should mirror how smoothly you tackle challenges, much like conquering a complex tax scenario with confidence. A polished, organized resume not only underscores your technical expertise but also illustrates your ability to communicate clearly—an essential skill in any senior role. With the right structure, your resume can truly open doors to new opportunities, reflecting the full scope of your experience in every precisely crafted sentence.

Key Takeaways

- A compelling resume for a senior tax accountant should effectively communicate your extensive tax experience and analytical skills while capturing the attention of hiring managers using a well-structured template.

- Highlight tax expertise, problem-solving abilities, leadership in senior roles, and include quantifiable achievements such as successful audits and tax-saving strategies to convey your value.

- Your resume format should be chronological to clearly showcase career progression while using modern fonts for readability, saving the document as a PDF to maintain layout integrity.

- Hard skills such as tax planning, regulatory compliance, advanced Excel, and soft skills like communication and team leadership should be featured prominently to demonstrate your ability to manage complex financial scenarios.

- Include degrees, advanced qualifications like a CPA license, industry-specific certifications, and consider adding sections on professional affiliations or volunteer experience for a holistic view of your professional journey.

What to focus on when writing your senior tax accountant resume

Your senior tax accountant resume should decisively highlight your tax expertise and analytical skills—beginning with clear contact information that includes your full name, reliable phone number, professional email address, and LinkedIn profile link. This ensures potential employers can easily contact you.

In your professional summary, emphasize your extensive experience in tax accounting. Highlight your problem-solving abilities and leadership in senior roles, painting a picture of your competence and reliability in managing complex tax situations—transition into the work experience section by focusing on roles you've held. Detail key achievements such as closing successful audits, implementing tax-saving strategies, and improving compliance. Use data and numbers to quantify these successes, turning your contributions into impactful stories.

In the education section, list your degrees and any relevant coursework or academic achievements that bolster your finance background. Mention any advanced qualifications like a CPA license to illustrate your commitment to professional development in the field. The skills section should focus on showcasing your expertise in tax compliance, financial analysis, and proficiency with critical software like SAP, QuickBooks, and Excel, tying these technical skills to real-world applications you’ve mastered in your roles.

Certifications such as CPA or EA should be highlighted, as they authenticate your credentials and specialization in tax accounting—making your resume stand out in the competitive market. As an integration into your professional journey, you might consider adding sections like "Professional Affiliations" or "Volunteer Experience" to portray a holistic view of your involvement and enthusiasm in the field. With your resume format solidified, we'll delve deeper into each of these sections below to enhance your application.

How to structure your senior tax accountant resume

- Contact Information: Include your full name, phone number, professional email address, and LinkedIn profile link.

- Professional Summary: Highlight your years of experience in tax accounting, focus on key strengths like problem-solving skills, and note any senior roles you've held.

- Work Experience: Detail your tax-related roles with achievements such as successful audits, tax savings, and compliance improvements. Use quantifiable results to add impact.

- Education: List your degree(s), relevant coursework, and educational achievements that strengthen your finance background. Mention your CPA license if applicable.

- Skills: Focus on skills like tax compliance, financial analysis, and software proficiency (e.g., SAP, QuickBooks, Excel).

- Certifications: Include industry-specific certifications, like CPA or EA, which validate your expertise in tax accounting.

Which resume format to choose

As a senior tax accountant, your resume should clearly showcase the depth and breadth of your expertise in the industry. Opting for a chronological format is particularly effective, as it neatly displays your career progression and the practical experience you've accumulated over the years. This format helps recruiters quickly grasp your journey and the roles you've excelled in.

When it comes to font choices, selecting a modern, professional typeface like Raleway, Montserrat, or Lato can enhance readability while adding a polished touch. These fonts strike the right balance between style and clarity, making your resume appealing yet easy to read. In the financial sector, where precision and professionalism are key, your choice of font can subtly underscore these qualities.

Saving your resume as a PDF is another important consideration. PDFs are the gold standard for maintaining layout integrity across different platforms. This ensures that your information is presented exactly as you've designed it, without unexpected shifts or misalignments that can occur in other file formats. This reliability is crucial when submitting documents to employers who may review them on various devices.

Finally, consider the margins of your resume. Keeping them at one inch on all sides provides a clean and organized layout. This spacing not only enhances readability but also avoids the cluttered look that can overwhelm potential employers. A well-structured layout with appropriate margins helps ensure that your skills and achievements stand out effectively to anyone reviewing your resume.

By thoughtfully selecting each element of your resume, you highlight your professionalism and the value you offer as an experienced tax accountant. These choices collectively ensure that your document is both visually appealing and informative, leaving a strong impression on potential employers.

How to write a quantifiable resume experience section

Your experience section will shine by showcasing your strengths as a senior tax accountant, weaving together your achievements and their impacts seamlessly. This part of your resume should clearly illustrate how you've made a difference in past roles, organized with your most recent job listed first. By focusing on relevant jobs from the last 10-15 years, you create a narrative of career growth and expertise. Using clear job titles demonstrates your advancement. Tailor this section to echo the job ad, using similar words and phrases to align your experience with the role. Starting each point with strong action words like "managed," "developed," or "optimized" highlights your contributions, while quantifiable achievements add real weight, showing the concrete benefits you brought to previous employers.

- •Managed tax compliance for more than 20 domestic and international entities, reducing errors by 30%.

- •Developed a tax planning strategy that saved the company $1.2 million each year.

- •Optimized tax filing processes, which trimmed preparation time by 25%.

- •Led a team of 5 accountants to complete audits and filings ahead of deadlines with perfect accuracy.

The experience section above excels by painting a cohesive picture of your role at ABC Corporation. Each bullet point interconnects to demonstrate quantifiable achievements, proving your expertise in tax compliance and strategy. Using action words like "managed," "developed," and "optimized," it reflects your proactive approach and leadership skills. By tailoring this section to highlight the most relevant skills, you effectively attract employers currently seeking a senior tax accountant with a record of delivering impressive results. This seamless narrative of accomplishments and leadership shows exactly how you'll add value to a new company’s tax strategies.

Achievement-Focused resume experience section

A senior tax accountant achievement-focused resume experience section should emphasize your accomplishments and the positive impact you've made in previous roles. Use powerful action verbs and concrete results to immediately draw the reader in, making it clear how your skills benefit the organization. Highlight your ability to generate cost savings, enhance tax compliance, and tackle complex tax scenarios, illustrating your analytical skills and attention to detail.

In each position, group tasks to show where you made the most significant contributions. Include numbers where possible to quantify your impact, creating a vivid picture of your effectiveness. Use straightforward language, avoiding jargon, to express how your work directly improved company outcomes. This method will captivate potential employers and clearly demonstrate your potential value to their team.

Senior Tax Accountant

XYZ Financial Services

January 2018 - Present

- Steered a team to uncover tax-saving opportunities, cutting expenses by 20%.

- Enhanced reporting processes, reducing the month-end close timeline by 3 days.

- Developed a training program for junior accountants, increasing productivity by 15%.

- Collaborated with auditors to ensure compliance, slashing misinformation penalties by 30%.

Growth-Focused resume experience section

A growth-focused senior tax accountant resume experience section should emphasize how your skills and strategies have directly contributed to organizational success. Begin by detailing the innovative solutions you've implemented, such as introducing new tax software, which can significantly boost department efficiency and cut processing times by 30%. Highlight how crafting effective tax strategies not only enhances compliance by 40% but also results in substantial savings, such as $500,000 in penalties avoided.

Demonstrate your leadership capabilities by discussing how you managed a team of five accountants, focusing on their professional growth, which in turn increased productivity by 20%. Collaborate actively with cross-functional teams to uncover tax-saving opportunities, ultimately achieving a 15% reduction in tax liabilities. This tailored approach will showcase your ability to optimize strategies, ensure compliance, and lead teams to success, strengthening the overall narrative of your contributions and growth-oriented mindset.

Senior Tax Accountant

ABC Corp

June 2018 - May 2023

- Led the implementation of a new tax software, cutting processing time by 30% and boosting department efficiency.

- Crafted strategies that enhanced tax compliance by 40%, saving the company $500,000 in penalties.

- Managed a team of five accountants, emphasizing professional development and raising productivity by 20%.

- Partnered with cross-functional teams to uncover tax-saving opportunities, achieving a 15% reduction in tax liabilities.

Problem-Solving Focused resume experience section

A problem-solving-focused senior tax accountant resume experience section should emphasize your ability to address challenges and improve processes. Start by identifying specific issues you've encountered and illustrating how you effectively resolved them through your analytical skills and strategic thinking. Highlight your success in optimizing tax strategies to ensure compliance, providing numbers to support your achievements and reflect the tangible impact you've made.

Ensure the actions you describe naturally flow into the resulting positive changes. Use clear and active language to convey your leadership and initiative, demonstrating how you've developed or improved systems to save costs or increase efficiency. Tailor your examples to align with the potential employer’s needs, ensuring that your experiences resonate with their objectives and demonstrate your value.

Senior Tax Accountant

Global Finance Inc.

2020-2023

- Developed a new tax filing system that reduced errors by 25%, leading to more accurate and timely submissions.

- Led a team that implemented changes in tax strategy, resulting in a 15% reduction in tax liabilities.

- Analyzed complex tax regulations to ensure compliance, preventing potential legal issues and fines.

- Created training sessions for junior accountants to enhance their problem-solving skills, boosting overall efficiency.

Project-Focused resume experience section

A project-focused senior tax accountant resume experience section should clearly showcase your accomplishments and the unique projects you've led or participated in. Begin by detailing the type of project, highlighting both its complexity and scope. This sets the stage for using strong action verbs and specific metrics, demonstrating how your efforts led to outcomes like enhanced efficiency, cost savings, or better compliance. By blending industry-specific terms with simple language, you ensure clarity about your role and its impact.

As you craft your bullet points, aim to offer a comprehensive view of your experience. Touch on mentorship, problem-solving, and tech expertise, illustrating how these skills contributed to the team's success. Show your capability to work both independently and collaboratively, since both are crucial in senior positions. Through these details, illustrate the meaningful difference your work made to the company or clients, subtly aligning with the prospective employer’s expectations.

Senior Tax Accountant

Global Financial Solutions

June 2017 - August 2023

- Led a team of five accountants to efficiently file over 500 tax returns for corporate clients, increasing client satisfaction by 20%.

- Implemented new tax software that reduced processing time by 30%, resulting in faster turnaround and improved accuracy.

- Conducted in-depth analysis of tax regulations to streamline compliance processes, successfully lowering error rates by 15%.

- Mentored junior staff and organized workshops, enhancing the team’s ability to handle complex tax issues.

Write your senior tax accountant resume summary section

A results-focused senior tax accountant resume should begin with a summary that highlights your key strengths and achievements. It's essential to convey your extensive experience and tailor it specifically to the role you're pursuing. Consider this example:

This summary effectively encapsulates your professional journey by weaving together your expertise and notable achievements. It gives potential employers a clear picture of your ability to deliver measurable outcomes, as evidenced by the reduction in operational costs. Demonstrating leadership in team initiatives also reflects your capability to drive projects to success.

When crafting your resume summary, aim to convey your skills using strong, action-oriented language that brings your accomplishments to life. Highlight specific results, showing employers the tangible impact of your contributions.

Understanding the nuances of different resume elements is key to making a strong impression. A resume summary provides an overview suitable for experienced professionals, highlighting key accomplishments. On the other hand, a resume objective focuses on career aspirations and is best for those new to the field. A resume profile might include both personal and professional traits, ideal for showcasing long-term career interests. Meanwhile, a summary of qualifications presents a focused list of skills, beneficial for technical positions. Selecting the right format ensures your resume doesn't just list your skills but tells a compelling story of your career.

Listing your senior tax accountant skills on your resume

A skills-focused senior tax accountant resume should effectively highlight your abilities in a way that's easily understood and relevant. You can choose to present your skills in a dedicated section or integrate them into other areas like your professional experience and summary. This approach helps weave your strengths, such as adaptability and problem-solving, into the fabric of your career story. Hard skills, on the other hand, are specific abilities you can measure, like expertise in tax laws or financial software proficiency.

Incorporating your skills and strengths as resume keywords is crucial. Recruiters often search for these keywords, so aligning your resume with industry-relevant terms boosts your visibility and appeal to potential employers. Here's an example of a standalone skills section to illustrate this concept:

This layout is effective because it presents critical skills relevant to senior tax accounting in a clear and concise manner, making your qualifications easy for recruiters to spot.

Best hard skills to feature on your senior tax accountant resume

When focusing on hard skills, senior tax accountants should demonstrate their technical expertise and problem-solving capacity. These skills should communicate your ability to manage complex tax functions efficiently.

Hard Skills

- Tax Planning

- Financial Reporting

- Regulatory Compliance

- Tax Research and Strategy

- Audit Coordination

- Risk Management

- SAP/ERP Systems

- Advanced Excel

- Tax Software Proficiency

- Financial Analysis

- International Taxation

- GAAP Knowledge

- Budget Management

- Tax Filing and Documentation

- Internal Controls

Best soft skills to feature on your senior tax accountant resume

Soft skills tell a different story. They convey your ability to connect, communicate, and work effectively within a team. These skills demonstrate your interpersonal prowess and adaptability, which are crucial for success.

Soft Skills

- Communication

- Team Leadership

- Critical Thinking

- Problem Solving

- Adaptability

- Time Management

- Attention to Detail

- Negotiation

- Decision Making

- Interpersonal Skills

- Stress Management

- Client Relationship Management

- Initiative

- Conflict Resolution

- Organizational Skills

How to include your education on your resume

The education section is an important part of your senior tax accountant resume. It shows where you’ve gained the necessary knowledge and skills for the job. Tailoring it to the job you’re applying for is essential, meaning any unrelated education should be excluded. If your GPA is above 3.5, you can include it to show your academic performance. Cum laude honors should also be listed as they highlight your accomplishments. When listing your degree, write the full name of the degree and the institution. Now, let's look at some examples to emphasize these points.

- •CPA eligible

The second example is a strong education section. It matches the needs of a senior tax accountant role. The degree is directly relevant to accounting. The cum laude honor provides evidence of high achievement and the GPA of 3.8 is impressive. Listing CPA eligibility as a bullet emphasizes qualifications further. These elements contribute to making the education section highly suitable for a senior tax accountant position.

How to include senior tax accountant certificates on your resume

A certificates section is an important part of your senior tax accountant resume. It shows your expertise and commitment to staying current in your field.

List the name of each certificate in this section. Include the date you earned the certificate. Add the issuing organization along with the certificate. You can also include certificates in the header to grab attention. For example, you might list "CPA, CMA" right after your name.

Here is how to format your certificates section in JSON:

This example is good because it includes relevant certificates for a senior tax accountant. It makes you look skilled and knowledgeable. Each certificate is from a recognized organization, adding credibility. This section also sticks to the facts, making it clear what you have achieved. It helps a hiring manager quickly see your qualifications.

Extra sections to include in your senior tax accountant resume

Crafting a resume for a senior tax accountant requires more than just listing your professional experience and skills. Including various sections like language proficiency, hobbies and interests, volunteer work, and books you have read allows you to present yourself as a well-rounded candidate. This extra information can help hiring managers see your full potential and suitability for their company culture.

Language section—Highlighting your language skills can set you apart, especially if you work with global clients or offices. Mention any certifications or levels of proficiency you have to provide more credibility.

Hobbies and interests section—Sharing hobbies and interests shows that you are a well-rounded person with diverse skills and traits. Include activities that demonstrate teamwork, leadership, or analytical skills relevant to accounting.

Volunteer work section—Describing your volunteer work can reflect positively on your character and commitment to social responsibility. Explain how these experiences have developed your soft skills like communication and problem-solving abilities.

Books section—Listing influential books you’ve read can show your commitment to ongoing education and professional growth. Mention titles related to taxation, accounting, or personal development to emphasize your dedication to the field.

In Conclusion

In conclusion, crafting a standout senior tax accountant resume requires careful attention to detail and a strategic approach. Your resume should effectively communicate the depth of your financial expertise, leadership skills, and problem-solving abilities. Structuring your resume with a clear format—starting with concise contact information and a powerful professional summary—sets the foundation for a compelling application. Highlighting your achievements with quantifiable data allows your contributions to shine, making it easy for hiring managers to see the value you bring.

Focus on showcasing your technical prowess in tax laws, compliance, and financial software alongside soft skills like communication and adaptability. Integrating certifications such as CPA or CMA enhances your credibility and sets you apart in the competitive job market. Consider including extra sections like languages, volunteer work, and relevant books to paint a holistic picture of your abilities and interests.

Opting for a polished, organized design with readable fonts and thoughtful spacing ensures your resume is easy to read and visually appealing. The choices you make in every section contribute to a narrative that clearly outlines your qualifications and readiness for senior roles.

By selecting the right format and focusing on action-oriented language, you can effectively convey your professional journey and potential to prospective employers. This comprehensive, tailored approach ensures your resume not only lists your skills but tells a compelling story of your growth and accomplishments in the field of tax accounting.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.