Staff Accountant Resume Examples

Jul 18, 2024

|

12 min read

Balancing your future: How to write the perfect staff accountant resume that adds up

Rated by 348 people

Cost Accounting Specialist

Financial Reporting Accountant

Tax Specialist Accountant

Nonprofit Staff Accountant

Forensic Staff Accountant

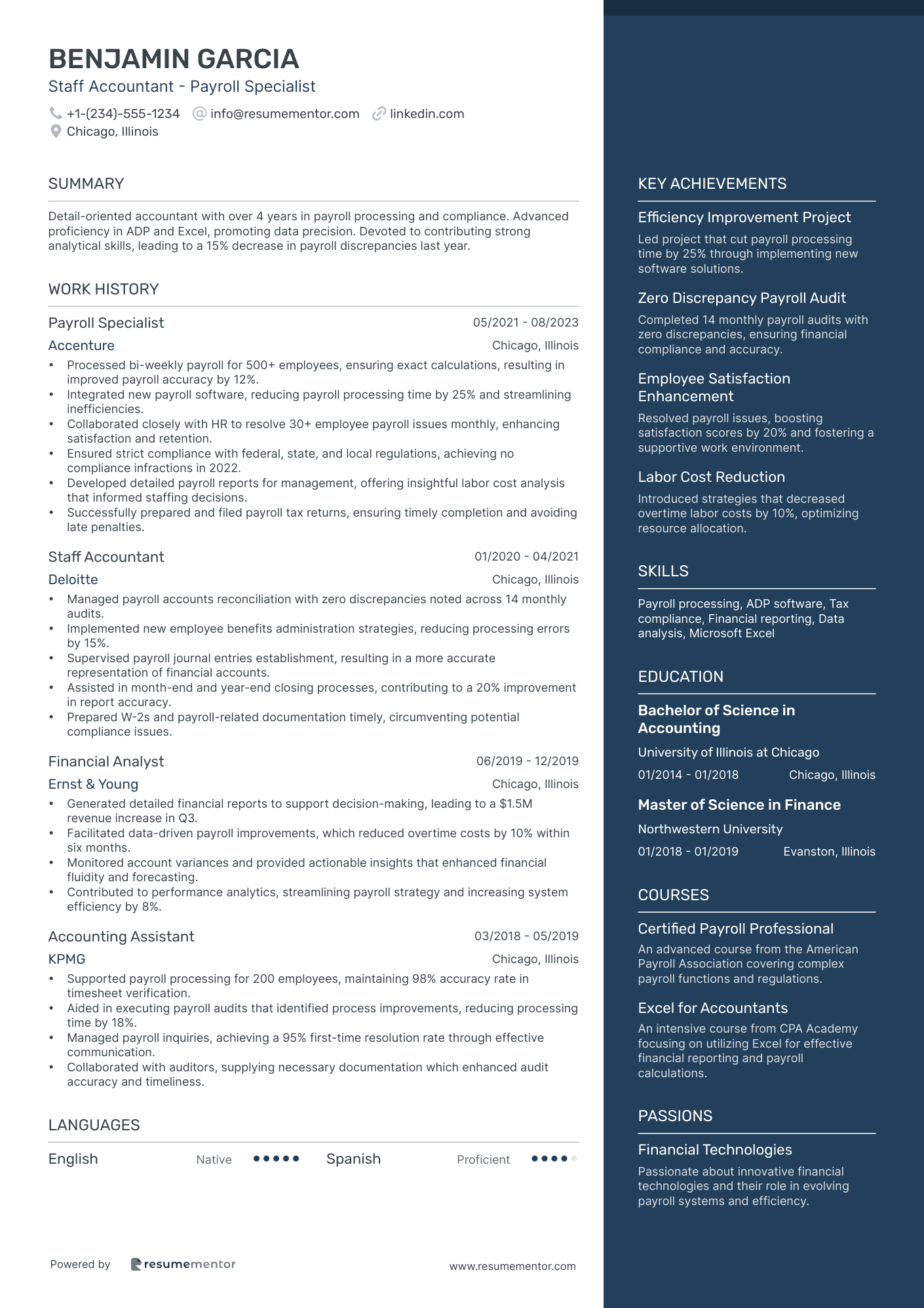

Staff Accountant - Payroll Specialist

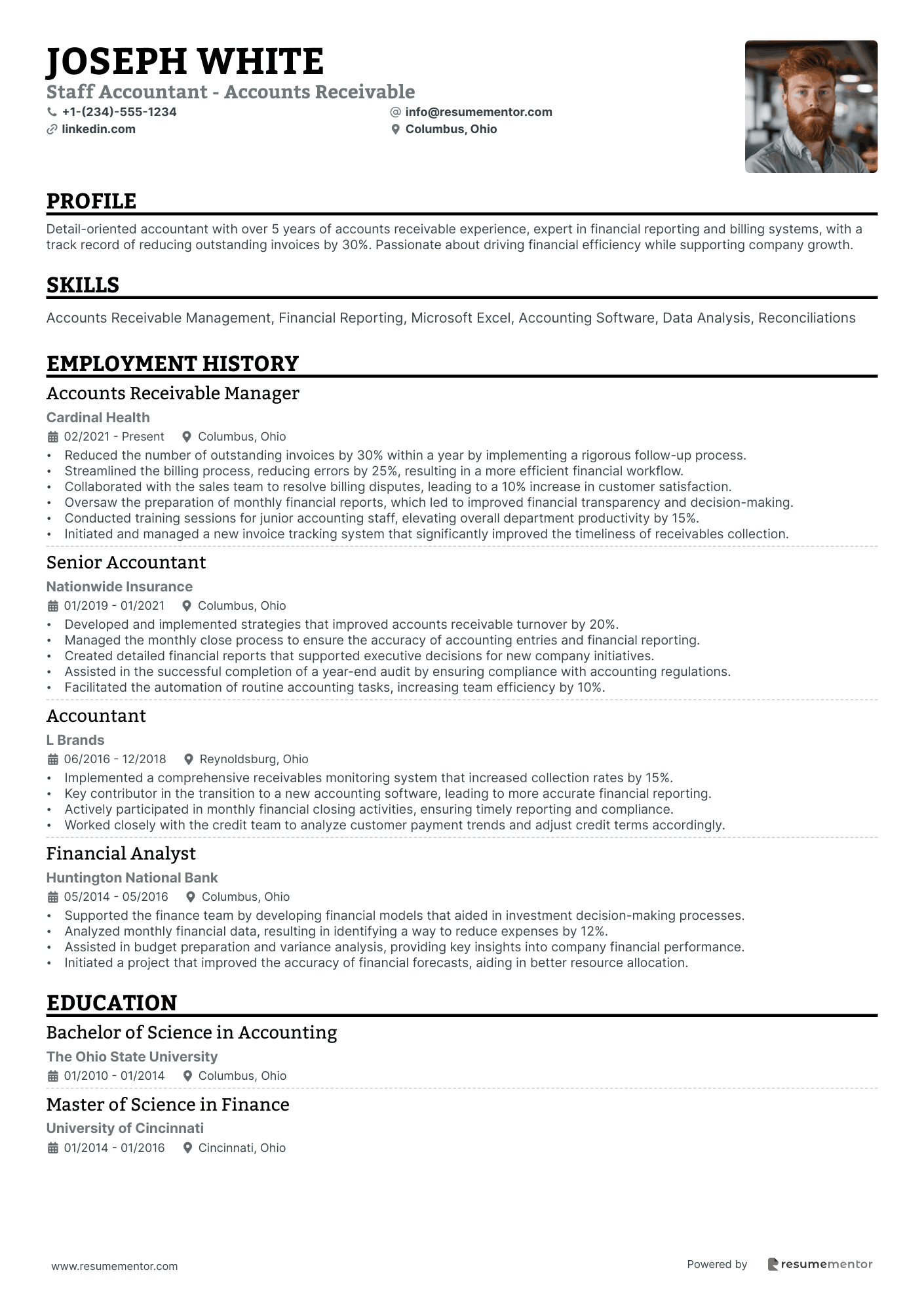

Staff Accountant - Accounts Receivable

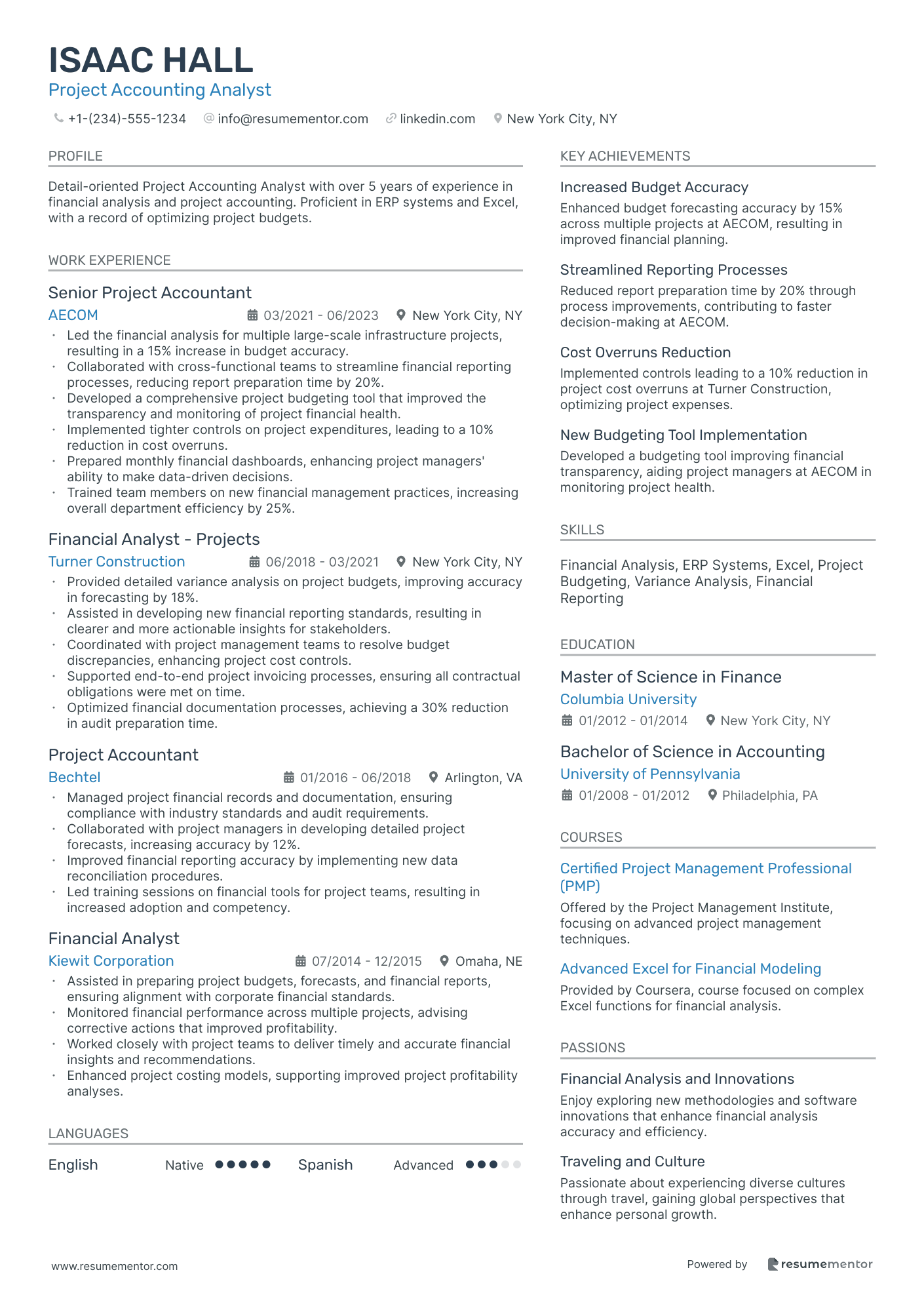

Project Accounting Analyst

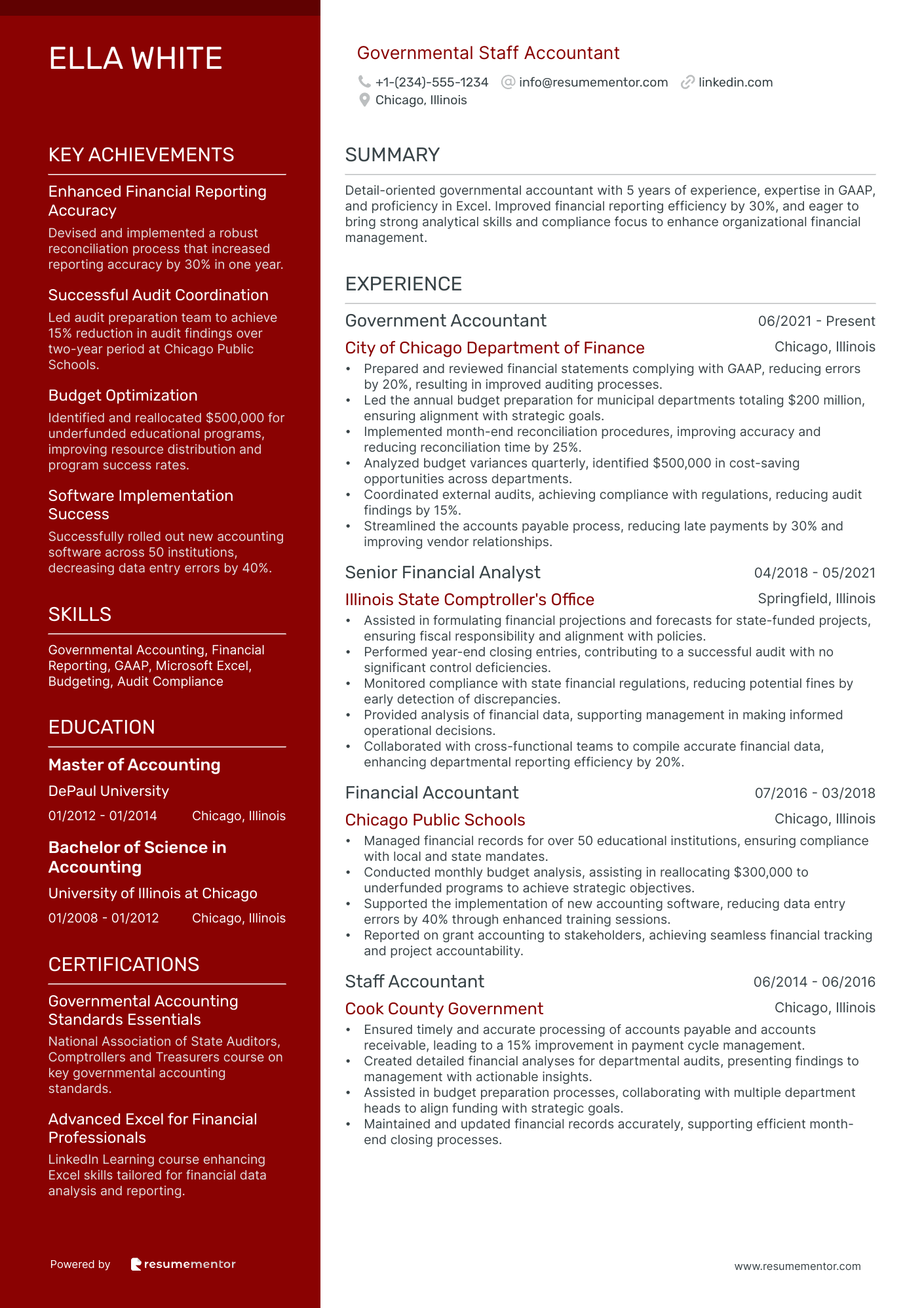

Governmental Staff Accountant

Auditor Accountant

Cost Accounting Specialist resume sample

- •Analyzed cost variance data, resulting in a 15% reduction in material costs by collaborating with purchasing.

- •Streamlined cost reporting processes, reducing report preparation time by 25% through automation and process improvements.

- •Led the month-end closing process, preparing all cost-related journal entries, and achieving a 99% accuracy rate.

- •Collaborated with production to identify $200,000 in potential cost savings annually through labor efficiency improvements.

- •Developed cost control systems, resulting in a 10% decrease in unnecessary spending within the first quarter of implementation.

- •Assisted in the successful implementation of an ERP system, enhancing cost tracking and reporting capabilities across departments.

- •Prepared comprehensive reports on cost variances, achieving a 12% improvement in production cost efficiency.

- •Assisted in monthly and annual physical inventory audits, ensuring 98% accuracy in inventory costing and valuation.

- •Implemented tracking mechanisms that identified trends, contributing to strategic decisions and 8% increase in profitability.

- •Provided detailed insights for budgeting processes, significantly enhancing cost forecasting accuracy by 20%.

- •Monitored and improved product costing, supporting a strategic reduction in overhead by 7% during tenure.

- •Generated detailed variance analysis reports, highlighting cost-saving opportunities and achieving a cost reduction of 10%.

- •Collaborated with finance and production to resolve discrepancies, resulting in a 15% reduction in cost reporting errors.

- •Supported strategic cost management initiatives, contributing to a 5% increase in overall operational profitability.

- •Worked closely with procurement to streamline supply chain costs, resulting in a $500,000 annual savings.

- •Assisted in developing cost analysis models for manufacturing processes, aiding in a 20% cost analysis improvement.

- •Facilitated regular cost review meetings, driving a structured approach to addressing cost discrepancies and reductions.

- •Participated in process improvement projects, which contributed to a 15% reduction in overhead costs.

- •Ensured inventory costs were accurately reflected in financial statements, maintaining a 98% accuracy rate.

Financial Reporting Accountant resume sample

- •Led the preparation of monthly financial statements, achieving a 10% reduction in reporting errors through enhanced compliance with GAAP.

- •Collaborated with cross-functional teams to improve the accuracy of quarterly forecasts, resulting in a 25% increase in forecast reliability.

- •Coordinated month-end close processes, reducing closing time by 2 days through process optimization and team coordination.

- •Developed and implemented new internal financial controls, reducing financial discrepancies by 20% in yearly audits.

- •Presented comprehensive financial reports to management, highlighting trends that informed strategic financial decisions and increased budget accuracy by 15%.

- •Worked closely with external auditors during annual audits, ensuring financial records and practices met stringent regulatory standards and reduced audit findings by 40%.

- •Streamlined reporting processes, leading to a 30% improvement in the timeliness of monthly financial statement completion.

- •Conducted detailed variance analyses that informed improvements in operational budgeting, enhancing cost efficiency by 18%.

- •Played a key role in the implementation of a new ERP system, improving data integrity and reporting accuracy across the organization.

- •Collaborated with finance and IT teams to fix data discrepancies, achieving a 20% improvement in data accuracy during financial reporting.

- •Responsible for preparing audit schedules, which increased the efficiency of the annual audit process by 15%.

- •Analyzed financial data to support budgeting and investment decisions, increasing return on investment by 12%.

- •Created comprehensive budget forecasts for various departments, improving cost-saving initiatives that reduced expenses by 8%.

- •Developed financial models and projections that contributed to strategic initiatives, driving revenue growth of 5%.

- •Provided insights and analyses to management during financial reviews, which were essential in strategic decision-making processes.

- •Assisted in the annual budget preparation process, reducing budget allocation time by 10% through process improvement.

- •Conducted audits of financial documents to maintain compliance with company policies, achieving a compliance rate of 95%.

- •Collaborated with finance teams to develop accurate financial reports that enhanced operational decision-making by 15%.

- •Implemented new accounting procedures that optimized financial reporting processes, cutting error rates by 12%.

Tax Specialist Accountant resume sample

- •Successfully managed the preparation and filing of over 200 corporate tax returns annually, improving compliance by 30%.

- •Led a project to implement tax-saving measures, resulting in a 15% decrease in overall tax liabilities for the company.

- •Conducted extensive tax research that identified new tax-saving opportunities, increasing savings by $250,000 per quarter.

- •Collaborated with the finance team to enhance the accuracy of financial statements, supporting a cleaner audit with zero significant findings.

- •Provided in-depth guidance to other departments on tax-related inquiries, boosting workplace effectiveness by 40%.

- •Optimized tax record management processes, reducing errors in documentation by 20% and response time to tax audits by 15%.

- •Analyzed and filed over 150 individual tax returns per year, maintaining a 98% accuracy rate.

- •Assisted in the quarterly and annual preparation of tax provisions, ensuring compliance and reducing discrepancies by 25%.

- •Developed tax planning strategies that enhanced net efficiency by up to 20% across various client portfolios.

- •Monitored changes in tax legislation, providing timely briefings that improved compliance and strategic planning.

- •Streamlined various tax filing processes, reducing overall processing time by 10% and increasing department efficiency.

- •Prepared federal and state tax returns for a diverse range of clients, achieving a 95% QA review score.

- •Implemented effective tax documentation procedures that facilitated smoother audits, achieving a reduction in audit revisions by 15%.

- •Worked closely with audit teams providing key documentation that resulted in a quicker audit turnaround time by 12%.

- •Researched tax compliance issues for complex transactions, providing solutions that reduced client liabilities by $100,000.

- •Assisted in tax compliance processes for corporate clients, achieving a 90% first-time pass rate from initial filings.

- •Coordinated with departments to ensure timely tax filing and compliance, improving overall compliance timelines by 20%.

- •Conducted quarterly tax assessments, resulting in accurate tax liability forecasts that increased department credibility.

- •Enhanced report generation processes, leading to a 35% reduction in report errors and turnaround time.

Nonprofit Staff Accountant resume sample

- •Streamlined budget preparation processes by implementing a new forecasting software, reducing manual errors by 30% and significantly improving time efficiency.

- •Enhanced accuracy of financial statements by developing a rigorous reconciliation procedure, reducing discrepancies by 40% within 6 months.

- •Spearheaded monthly financial reviews, collaborating with department heads to provide insights that increased cost efficiency by 15%.

- •Oversaw a team in transitioning to a new accounting software, facilitating training sessions that led to a 25% faster adoption rate.

- •Led the external audit process, successfully reducing auditor findings by 35%, resulting in a more streamlined audit.

- •Improved accounts receivable collection timeframe by 20% through the implementation of an automated invoicing system, boosting cash flow.

- •Managed accounts payable and receivable operations, reducing processing time by 25% through revamped workflows.

- •Facilitated grant accounting processes, ensuring compliance with funding restrictions, which increased our grant award success rate by 15%.

- •Prepared financial analyses that aided in strategic planning decisions, contributing to a 10% increase in program funding allocation.

- •Developed and implemented accounting policies that standardized procedures, cutting error rates by 20% across financial documentation.

- •Supervised monthly close procedures, ensuring deadlines were met 98% of the time, and financial data was reliable and timely.

- •Prepared and reconciled monthly financial statements in compliance with GAAP, telling financial story accurately each month.

- •Instrumental in implementing an internal financial audit process, reducing discrepancies in financial reports by 15%.

- •Assisted in streamlining tax filing process, ensuring compliance and timely tax submission, thereby avoiding penalties.

- •Collaborated with program managers to provide financial insights that optimized budgeting efficiency, saving 12% of the annual operating budget.

- •Contributed to the financial integrity of operations by rigorously reconciling bank statements and reducing discrepancies by 18%.

- •Developed processes to monitor and report on assigned grant funds, resulting in 100% compliance with donor restrictions.

- •Managed accounts payable to achieve a 100% on-time payment record over the fiscal year.

- •Assisted in annual budget preparations, helping align department goals with fiscal objectives, achieving alignment with strategic initiatives.

Forensic Staff Accountant resume sample

- •Led financial investigations uncovering fraudulent activities, saving the company $500K in potential losses through precise audit procedures.

- •Developed a comprehensive financial model that increased efficiency by 30% in tracking undisclosed assets.

- •Collaborated with cross-functional teams on high-profile cases, resulting in recovery of lost assets worth $1.5M.

- •Authored over 50 expert reports, enhancing case strength during litigations by delivering substantial evidence.

- •Trained and mentored five junior accountants, improving departmental performance by 15%.

- •Initiated new documentation process, reducing investigation documentation time by 20%, ensuring adherence to standards.

- •Executed detailed audits leading to identification of risks, reducing incident reporting lag by 25% across all clients.

- •Enhanced accuracy of financial statement analysis by 40% through innovative data validation techniques.

- •Engaged with law enforcement and clients to acquire critical information, boosting collaborative efficiency by 20%.

- •Supported litigation processes, producing expert testimony presentations utilized in 10 high-stake cases.

- •Pioneered use of new accounting software, increasing data processing speed by 35% in fraud investigations.

- •Analyzed financial statements to mitigate discrepancies, achieving a 15% reduction in client-reported errors.

- •Utilized Excel to streamline financial modeling, resulting in a 25% increase in workflow efficiency.

- •Contributed to over 30 financial audit reports, improving overall report accuracy by 10%.

- •Facilitated training sessions on financial regulations, increasing team compliance by 50%.

- •Managed financial records for diverse clients, enhancing data accuracy by 12% using advanced accounting software.

- •Supported audit processes by compiling and analyzing data, reducing turnaround time by 35%.

- •Presented detailed reports with financial insights, improving client satisfaction scores by 15%.

- •Implemented innovative data storage solutions, resulting in 20% improved accessibility to client records.

Staff Accountant - Payroll Specialist resume sample

- •Processed bi-weekly payroll for 500+ employees, ensuring exact calculations, resulting in improved payroll accuracy by 12%.

- •Integrated new payroll software, reducing payroll processing time by 25% and streamlining inefficiencies.

- •Collaborated closely with HR to resolve 30+ employee payroll issues monthly, enhancing satisfaction and retention.

- •Ensured strict compliance with federal, state, and local regulations, achieving no compliance infractions in 2022.

- •Developed detailed payroll reports for management, offering insightful labor cost analysis that informed staffing decisions.

- •Successfully prepared and filed payroll tax returns, ensuring timely completion and avoiding late penalties.

- •Managed payroll accounts reconciliation with zero discrepancies noted across 14 monthly audits.

- •Implemented new employee benefits administration strategies, reducing processing errors by 15%.

- •Supervised payroll journal entries establishment, resulting in a more accurate representation of financial accounts.

- •Assisted in month-end and year-end closing processes, contributing to a 20% improvement in report accuracy.

- •Prepared W-2s and payroll-related documentation timely, circumventing potential compliance issues.

- •Generated detailed financial reports to support decision-making, leading to a $1.5M revenue increase in Q3.

- •Facilitated data-driven payroll improvements, which reduced overtime costs by 10% within six months.

- •Monitored account variances and provided actionable insights that enhanced financial fluidity and forecasting.

- •Contributed to performance analytics, streamlining payroll strategy and increasing system efficiency by 8%.

- •Supported payroll processing for 200 employees, maintaining 98% accuracy rate in timesheet verification.

- •Aided in executing payroll audits that identified process improvements, reducing processing time by 18%.

- •Managed payroll inquiries, achieving a 95% first-time resolution rate through effective communication.

- •Collaborated with auditors, supplying necessary documentation which enhanced audit accuracy and timeliness.

Staff Accountant - Accounts Receivable resume sample

- •Reduced the number of outstanding invoices by 30% within a year by implementing a rigorous follow-up process.

- •Streamlined the billing process, reducing errors by 25%, resulting in a more efficient financial workflow.

- •Collaborated with the sales team to resolve billing disputes, leading to a 10% increase in customer satisfaction.

- •Oversaw the preparation of monthly financial reports, which led to improved financial transparency and decision-making.

- •Conducted training sessions for junior accounting staff, elevating overall department productivity by 15%.

- •Initiated and managed a new invoice tracking system that significantly improved the timeliness of receivables collection.

- •Developed and implemented strategies that improved accounts receivable turnover by 20%.

- •Managed the monthly close process to ensure the accuracy of accounting entries and financial reporting.

- •Created detailed financial reports that supported executive decisions for new company initiatives.

- •Assisted in the successful completion of a year-end audit by ensuring compliance with accounting regulations.

- •Facilitated the automation of routine accounting tasks, increasing team efficiency by 10%.

- •Implemented a comprehensive receivables monitoring system that increased collection rates by 15%.

- •Key contributor in the transition to a new accounting software, leading to more accurate financial reporting.

- •Actively participated in monthly financial closing activities, ensuring timely reporting and compliance.

- •Worked closely with the credit team to analyze customer payment trends and adjust credit terms accordingly.

- •Supported the finance team by developing financial models that aided in investment decision-making processes.

- •Analyzed monthly financial data, resulting in identifying a way to reduce expenses by 12%.

- •Assisted in budget preparation and variance analysis, providing key insights into company financial performance.

- •Initiated a project that improved the accuracy of financial forecasts, aiding in better resource allocation.

Project Accounting Analyst resume sample

- •Led the financial analysis for multiple large-scale infrastructure projects, resulting in a 15% increase in budget accuracy.

- •Collaborated with cross-functional teams to streamline financial reporting processes, reducing report preparation time by 20%.

- •Developed a comprehensive project budgeting tool that improved the transparency and monitoring of project financial health.

- •Implemented tighter controls on project expenditures, leading to a 10% reduction in cost overruns.

- •Prepared monthly financial dashboards, enhancing project managers' ability to make data-driven decisions.

- •Trained team members on new financial management practices, increasing overall department efficiency by 25%.

- •Provided detailed variance analysis on project budgets, improving accuracy in forecasting by 18%.

- •Assisted in developing new financial reporting standards, resulting in clearer and more actionable insights for stakeholders.

- •Coordinated with project management teams to resolve budget discrepancies, enhancing project cost controls.

- •Supported end-to-end project invoicing processes, ensuring all contractual obligations were met on time.

- •Optimized financial documentation processes, achieving a 30% reduction in audit preparation time.

- •Managed project financial records and documentation, ensuring compliance with industry standards and audit requirements.

- •Collaborated with project managers in developing detailed project forecasts, increasing accuracy by 12%.

- •Improved financial reporting accuracy by implementing new data reconciliation procedures.

- •Led training sessions on financial tools for project teams, resulting in increased adoption and competency.

- •Assisted in preparing project budgets, forecasts, and financial reports, ensuring alignment with corporate financial standards.

- •Monitored financial performance across multiple projects, advising corrective actions that improved profitability.

- •Worked closely with project teams to deliver timely and accurate financial insights and recommendations.

- •Enhanced project costing models, supporting improved project profitability analyses.

Governmental Staff Accountant resume sample

- •Prepared and reviewed financial statements complying with GAAP, reducing errors by 20%, resulting in improved auditing processes.

- •Led the annual budget preparation for municipal departments totaling $200 million, ensuring alignment with strategic goals.

- •Implemented month-end reconciliation procedures, improving accuracy and reducing reconciliation time by 25%.

- •Analyzed budget variances quarterly, identified $500,000 in cost-saving opportunities across departments.

- •Coordinated external audits, achieving compliance with regulations, reducing audit findings by 15%.

- •Streamlined the accounts payable process, reducing late payments by 30% and improving vendor relationships.

- •Assisted in formulating financial projections and forecasts for state-funded projects, ensuring fiscal responsibility and alignment with policies.

- •Performed year-end closing entries, contributing to a successful audit with no significant control deficiencies.

- •Monitored compliance with state financial regulations, reducing potential fines by early detection of discrepancies.

- •Provided analysis of financial data, supporting management in making informed operational decisions.

- •Collaborated with cross-functional teams to compile accurate financial data, enhancing departmental reporting efficiency by 20%.

- •Managed financial records for over 50 educational institutions, ensuring compliance with local and state mandates.

- •Conducted monthly budget analysis, assisting in reallocating $300,000 to underfunded programs to achieve strategic objectives.

- •Supported the implementation of new accounting software, reducing data entry errors by 40% through enhanced training sessions.

- •Reported on grant accounting to stakeholders, achieving seamless financial tracking and project accountability.

- •Ensured timely and accurate processing of accounts payable and accounts receivable, leading to a 15% improvement in payment cycle management.

- •Created detailed financial analyses for departmental audits, presenting findings to management with actionable insights.

- •Assisted in budget preparation processes, collaborating with multiple department heads to align funding with strategic goals.

- •Maintained and updated financial records accurately, supporting efficient month-end closing processes.

Auditor Accountant resume sample

- •Led audits for 20+ clients annually, ensuring compliance with GAAP, which improved reporting accuracy by 25%.

- •Developed and implemented enhanced risk management processes, reducing financial discrepancies by 30%.

- •Collaborated with cross-functional teams to streamline audit processes, cutting audit completion times by 15%.

- •Prepared detailed audit reports, achieving a 95% positive feedback rate from management on recommendations.

- •Enhanced internal controls, leading to 20% reduction in non-compliance incidents in audited departments.

- •Implemented a new documentation system that improved audit traceability and compliance documentation by 40%.

- •Executed financial audits for mid-sized firms, resulting in a 15% improvement in financial statement accuracy.

- •Assessed and improved internal control systems, leading to a 20% decrease in external audit adjustments.

- •Managed documentation for audits, reducing review time by 10% through more efficient processes.

- •Presented audit findings to senior management, with 80% of recommendations implemented successfully.

- •Trained junior staff on audit standards, increasing team efficiency by 25% in report preparation.

- •Analyzed quarterly financial statements, identifying trends that saved the company 10% in costs over two years.

- •Developed financial models to improve forecasting accuracy by 15%, aiding in budget planning.

- •Collaborated with accounting teams, resulting in streamlined financial processes that reduced errors by 20%.

- •Oversaw compliance with financial regulations, achieving a 100% pass rate in external audits.

- •Assisted senior auditors in audit engagements, improving report accuracy by 10% through in-depth analysis.

- •Participated in audits of financial statements, resulting in adherence to all regulatory requirements.

- •Conducted variance analyses, which improved the accuracy of financial reports by 12%.

- •Reviewed internal controls, providing insights that reduced potential risks by 15%.

As a staff accountant, crafting your resume can sometimes feel like piecing together a complex puzzle, where every detail plays a critical role. It's essential that potential employers quickly recognize your financial acumen and keen attention to detail. A well-chosen resume template can serve as a reliable framework, providing clarity and focus to your presentation. You can begin by exploring resume templates to set a solid foundation.

Clear communication of your abilities is vital, and a streamlined format can make all the difference. Knowing how to present your accounting skills and experience in a compelling way helps you stand out to hiring managers. Avoiding clutter and maintaining focus ensures your resume receives the attention it deserves.

To achieve this, organize your resume to emphasize both your technical accounting knowledge and your problem-solving skills. Each section should be carefully structured to highlight your ability to maintain financial records and prepare reports. This not only reflects your skills but also showcases your unique professional journey.

Implementing these strategies can significantly boost your chances of securing an interview for the job you're targeting. A well-crafted resume becomes more than just a document; it's your ticket to advancing your career and opening new doors. Let’s dive into how you can make yours a standout.

Key Takeaways

- Crafting a standout staff accountant resume involves selecting a clear chronological format, ensuring up-to-date contact information, and including a professional summary that highlights your accounting experience and skills.

- The resume should emphasize work experience with quantifiable achievements, showcasing technical accounting knowledge and problem-solving abilities relevant to the job being applied for.

- Your education section should be concise, listing relevant degrees, institutions, and any honors, with an optional inclusion of a strong GPA to reinforce your academic background.

- Adding a certificates section with details like the certificate title, issuer, and issuance date will highlight specialized skills and ongoing professional development.

- Enhancing the resume with extra sections like language proficiency, volunteer work, and relevant hobbies will provide a fuller picture of your personal and professional attributes, making your resume more memorable.

What to focus on when writing your staff accountant resume

A staff accountant resume should effectively communicate your expertise in managing financial records and supporting decision-making processes. Demonstrating your skills in data analysis and efficient task management is crucial for making a strong impression. Your resume serves as a professional introduction, so making each section relevant and impactful is key.

How to structure your staff accountant resume

- Contact Information: Your resume should begin with your name, phone number, professional email, and LinkedIn profile. This section is more than just numbers and addresses—it's your first impression. Make sure everything is up-to-date and professional, as employers often use this information to contact you and check your online presence.

- Professional Summary: Following your contact information, a professional summary offers a snapshot of your career. This section allows you to introduce your core competencies and professional identity. Explain briefly how your accounting experience and skills make you a strong candidate. The goal is to provide a compelling reason for a recruiter to keep reading.

- Work Experience: Work experience detailing is critical in establishing your practical capabilities. List your past roles, accurately including job titles, company names, and employment dates. Use bullet points to outline key responsibilities and achievements like managing ledgers, conducting audits, and preparing financial reports. This section should make clear how your previous roles have prepared you for this opportunity.

- Education: This section links your professional experience with your academic background. List your degrees and the institutions attended, focusing on accounting or finance-related education. Highlight relevant coursework, honors, or certifications that underscore your qualifications. This helps recruiters see the foundation of your expertise.

- Skills: In this section, highlight your technical and soft skills that are crucial for accounting. Listing proficiency in accounting software like QuickBooks or Excel is essential, as well as skills in financial analysis and general ledger management. Tailoring this section to align with the job description can make a big difference.

- Certifications: Highlighting your certifications is essential for setting you apart from other candidates. Listing credentials like CPA or CMA demonstrates your commitment to the field and provides concrete proof of your expertise in accounting practices. It shows you are not only qualified but also dedicated to staying current in your profession.

Consider adding optional sections like Volunteer Experience or Professional Affiliations to further enrich your resume, especially when they relate to accounting or finance—below, we'll delve into each section more in-depth to craft the perfect staff accountant resume.

Which resume format to choose

To craft a standout staff accountant resume, starting with the right format is essential. A chronological format is particularly effective, as it highlights your work history and demonstrates your professional growth. This approach is crucial in the accounting field, where stability and progress are valued. Once you've chosen the format, selecting an appropriate font can further enhance your resume’s appeal. Opt for modern choices like Lato, Montserrat, or Raleway, which add a touch of sophistication and ensure your text is clear and professional.

Equally important is the file type. Saving your resume as a PDF ensures that your formatting is preserved, providing a polished look on any device—crucial when your resume may be viewed by hiring managers on various platforms. Margins also play a key role; set them to one inch on all sides. This creates ample white space, making your resume clean and easy to read, which helps in conveying the precision valued in accounting roles.

These elements—format, font, file type, and layout—are interconnected and work together to present you as a detailed, organized professional. They reflect the same level of detail and care you apply in your day-to-day accounting tasks. This cohesive approach to your resume will effectively communicate your attention to detail and professionalism, key attributes for a staff accountant.

How to write a quantifiable resume experience section

Your resume's experience section is where you can highlight your achievements as a staff accountant, showing the full scope of your career. Start by listing your jobs with the most recent ones first, making it easy for recruiters to see your current skills and progression. Focus on the last 10-15 years of your career, emphasizing roles that relate directly to the job you're targeting. Look closely at the job ad and mirror the key skills and responsibilities they ask for in your descriptions. This connection to the job shows how your experience fits seamlessly into what the employer seeks. Use strong action verbs like "managed," "optimized," and "improved" to bring your accomplishments to life.

Emphasizing quantifiable achievements helps paint a vivid picture of your impact, turning your past roles into concrete success stories that potential employers can easily recognize and appreciate. By detailing what you accomplished with numbers or specific outcomes, you move beyond simply listing duties, instead spotlighting your direct contributions. Adding context where possible helps the reader quickly grasp the significance of each achievement.

- •Reduced monthly close process time by 20% through process optimization.

- •Managed accounts payable, reducing errors by 15% with enhanced accuracy checks.

- •Led a team to implement a new accounting software, improving efficiency by 25%.

- •Analyzed financial statements and identified cost-saving opportunities, saving $50,000 annually.

The strength of this experience section lies in its ability to effectively communicate your achievements using real numbers that align with the skills accounting employers prioritize. The use of action verbs like "reduced" and "managed" immediately conveys your active role in delivering these results. Each bullet point connects to a broader picture of your professional impact, clearly illustrating how you can contribute to improving financial operations.

This structured approach makes your latest and most relevant experiences easy to find and understand. Focusing on outcomes rather than tasks underlines your ability to drive positive changes in financial health—exactly what a hiring manager seeks in a staff accountant. By aligning your successes with the job's requirements, you showcase yourself as an ideal candidate for the role.

Industry-Specific Focus resume experience section

A retail-focused staff accountant resume experience section should clearly showcase your suitability for roles in the retail industry. Start each entry by listing your job title and workplace, zeroing in on experiences directly related to retail. Use bullet points to concisely describe your responsibilities and achievements, highlighting tasks that demonstrate your capability to thrive in similar environments. Include any experience with retail-focused accounting software or practices to underscore your expertise in the field.

It's important to emphasize the complexity and reach of your duties, whether you're managing financial records for multiple retail locations, working across departments to ensure successful audits, or using popular accounting software for the industry. Whenever possible, include numbers to quantify your accomplishments, like noting how much time you saved by implementing a new system or increases in productivity. This specificity communicates the tangible benefits you can bring to potential employers. Here's an example of how such an entry might be formatted:

Staff Accountant

ABC Retail Corp

January 2020 - Present

- Managed financial records for over 50 retail locations, ensuring accurate and up-to-date financial data.

- Implemented a new financial reporting system that reduced reporting time by 15%.

- Collaborated with management to rectify audit discrepancies, resulting in improved compliance.

- Developed monthly and yearly financial forecasts, leading to more informed strategic planning.

Leadership-Focused resume experience section

A leadership-focused staff accountant resume experience section should clearly demonstrate your capability to lead and drive positive change. Begin by highlighting moments where you stepped up to guide teams or manage projects, illustrating how these actions contributed significantly to the organization. Use dynamic, action-oriented language to paint a picture of your contributions, specifying instances with tangible outcomes to lend credibility.

Start by listing your position, the company, and the time frame of your employment. Follow with bullet points that vividly depict your leadership skills. Reflect on occasions when you successfully led a team, optimized processes, or achieved important goals. These examples will highlight your ability to effectively lead and show a prospective employer the value you can bring to their team.

Senior Staff Accountant

FinancePro Inc.

June 2020 - Present

- Led a team of 5 junior accountants, creating a supportive and efficient work environment.

- Introduced a new accounting software, boosting efficiency by 20%.

- Created training materials and conducted workshops to improve team skills.

- Managed cross-departmental projects that enhanced the accuracy of financial reporting.

Responsibility-Focused resume experience section

A responsibility-focused staff accountant resume experience section should highlight your ability to handle key accounting tasks while demonstrating your impact on the organization. Start by stating the specific role you held, and then use bullet points to detail your primary responsibilities. Focus on your accomplishments and the results of your work, using strong action verbs like "managed," "analyzed," or "streamlined" to effectively communicate your contributions. Whenever possible, quantify your achievements by mentioning percentages or monetary savings. This helps potential employers clearly see the value you bring to the table.

In developing each point, consider the unique contributions you made to your team or company. Discuss your involvement in areas like financial reporting, budget preparation, or compliance checks, and highlight any improvements or efficiencies you led. This approach ties together your expertise and dedication, effectively making a compelling case to hiring managers that you're the perfect candidate for their staff accountant role.

Staff Accountant

XYZ Corp

March 2020 - Present

- Managed monthly financial closings, ensuring accuracy and timeliness.

- Analyzed account discrepancies, reducing errors by 20%.

- Streamlined payroll processing, saving the company $10,000 annually.

- Prepared detailed budget forecasts, contributing to strategic planning.

Project-Focused resume experience section

A project-focused staff accountant resume experience section should clearly showcase your ability to handle and manage various accounting projects. Begin by highlighting the specific projects you've been involved with, such as financial reporting, budget analysis, or audit preparation. Use strong, active verbs to convey your role and contributions, illustrating how you effectively managed timelines and solved complex issues while steering your team towards achieving project goals.

Be sure to include specific achievements and, if possible, quantify them to paint a clearer picture of your impact. This could mean demonstrating how you enhanced efficiency, reduced costs, or improved accuracy. Mentioning the software or tools you used gives insight into your technical skills and how they contributed to project success. By tailoring each bullet point to emphasize your strengths and ensuring they align with the job you are targeting, your experience section becomes both targeted and relevant.

Staff Accountant

Tech Financial Solutions

June 2020 - Present

- Led a team of five to implement a new financial reporting system, cutting month-end closing time by 30%.

- Coordinated an audit preparation project, achieving a 100% compliance rate with zero findings.

- Executed a budget analysis project, finding cost-saving opportunities that cut expenses by 10%.

- Trained staff on accounting software, boosting efficiency and accuracy in all departments.

Write your staff accountant resume summary section

A results-focused staff accountant resume summary should capture the essence of your professional abilities in just a few sentences. Think of it as a snapshot that demonstrates why you are the ideal candidate for the job. Highlighting your skills with financial statements, regulatory compliance, and accounting software can make a significant impact. Consider this example:

This example works because it combines your experience and key skills, like using QuickBooks, in a clear and concise way. If you're just starting out, you might prefer a resume objective that outlines your career aspirations and what you can bring to a new role. Each section type has its own purpose. While an objective focuses on your goals, a summary presents your accomplishments. A resume profile blends both elements, offering a balanced view. On the other hand, a summary of qualifications lists your skills and experiences in bullet points. Choosing the right format based on your experience can help your resume stand out and capture an employer's attention.

Listing your staff accountant skills on your resume

A skills-focused staff accountant resume should effectively highlight both hard and soft skills to make a powerful impression. When crafting your skills section, you can present it as a standalone area or integrate it into your experience and summary sections. Your strengths and soft skills reflect your interpersonal abilities and character traits, while hard skills are tangible, teachable competencies that directly relate to the job. These skills and strengths often become critical keywords, enhancing your resume's visibility to hiring managers and applicant tracking systems.

Here's an example of how a standalone skills section might look:

This example effectively delivers the core competencies necessary for a staff accountant role. It focuses on essential abilities like financial analysis and proficiency in accounting software, showcasing your industry knowledge and experience in handling typical accounting tasks. These specific skills not only increase your chances with hiring managers but also serve as key search terms to get your resume noticed.

Best hard skills to feature on your staff accountant resume

Hard skills for a staff accountant should showcase your command of accounting principles and tools, demonstrating your capability to manage financial data accurately and efficiently.

Hard Skills

- Financial Analysis

- Budget Management

- Account Reconciliation

- General Ledger Knowledge

- Tax Preparation

- Proficiency in Accounting Software

- Financial Reporting

- Auditing

- Payroll Management

- Regulatory Compliance

- Accounts Payable and Receivable

- Data Entry

- Variance Analysis

- Cost Accounting

- Excel Spreadsheets

Best soft skills to feature on your staff accountant resume

Equally important are your soft skills, which illustrate your ability to collaborate, solve problems, and communicate effectively.

Soft Skills

- Attention to Detail

- Time Management

- Problem-Solving

- Communication

- Organization

- Adaptability

- Teamwork

- Critical Thinking

- Accountability

- Multitasking

- Integrity

- Patience

- Persuasion

- Conflict Resolution

- Reliability

How to include your education on your resume

The education section is an important part of your staff accountant resume. This part gives hiring managers a quick view of your academic background. Tailor it to match the job you are applying for. Avoid including any irrelevant education that does not support your application. If your GPA is strong, consider including it. Write it as “GPA: 3.8/4.0” to make it clear. If you graduated with honors like cum laude, include this to show your academic excellence. When listing a degree, provide the name of your degree, your institution, and the dates you attended. Avoid showing too much information that does not add value.

Here is a wrong example of a standalone education section:

This example is poor because it shows a degree irrelevant to a staff accountant position.

Here is an outstanding example that matches a staff accountant role:

This example is ideal because it showcases a relevant degree in accounting and highlights the candidate's GPA and honors, making their academic achievements clear.

How to include staff accountant certificates on your resume

Including a certificates section in your staff accountant resume is important. Certificates highlight specialized skills and knowledge that set you apart. You can also include certificates in the header to catch the employer's eye right away.

List the name of the certificate to ensure clarity. Include the date you received the certificate to show that your qualifications are up-to-date. Add the issuing organization to validate your credentials. A good example in a resume header could be "Certified Public Accountant (CPA) | Issued by AICPA | 2021."

A strong standalone certificates section might look like this:

This example is effective because it includes relevant certificates for a staff accountant role. It lists each certificate clearly with both the title and issuing organization. This adds credibility and shows your continuous professional development.

Extra sections to include in your staff accountant resume

Embarking on a career as a staff accountant can be both challenging and rewarding. To stand out in this field, it's crucial to craft a resume that highlights not only your technical skills but also your diverse background and unique interests.

- Language section—Include languages you speak fluently to show your ability to communicate with diverse clients. This can broaden your work opportunities and make you an asset to multicultural teams.

- Hobbies and interests section—Add hobbies that showcase your analytical skills, such as chess or puzzle solving, to demonstrate your attention to detail. This section helps illustrate your personality and make your resume more memorable.

- Volunteer work section—List volunteer work, such as helping with community tax preparation services, to show your commitment to societal good and practical experience. This can also highlight your ability to work under pressure and interact with a variety of individuals.

- Books section—Mention relevant books you've read, such as "Financial Accounting for Dummies," to show you stay current and eager to learn. This demonstrates a commitment to continual professional development and a passion for your field.

In Conclusion

In conclusion, crafting a standout resume as a staff accountant is a blend of art and strategy. Your resume should clearly communicate your financial expertise and professional readiness. Start with a strong summary, capturing the essence of your accounting experience and skills. Structure your experience section to emphasize quantifiable achievements using action verbs that bring your work to life. Highlight your academic background, ensuring it aligns with the job's requirements, and don't forget to include certifications that demonstrate your commitment to the field. A well-organized skills section can significantly boost your resume by showcasing both hard and soft skills, essential for succeeding in the accounting world.

Optional sections like volunteer work, languages, and hobbies add depth to your resume, making you stand out as a well-rounded candidate. Consider your audience when selecting your resume format and font to ensure clarity and professionalism. Save your resume as a PDF to maintain its formatting and make it easy to read across different devices. By meticulously attending to each element, your resume will not only capture attention but also effectively convey your suitability for a staff accountant role. Remember, the goal is to present a cohesive and compelling picture of your abilities and potential contributions.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.