Trust and Estate Attorney Resume Examples

Jul 18, 2024

|

12 min read

Seal the Deal: Crafting Your Perfect Trust and Estate Attorney Resume That Stands Out in Job Applications

Rated by 348 people

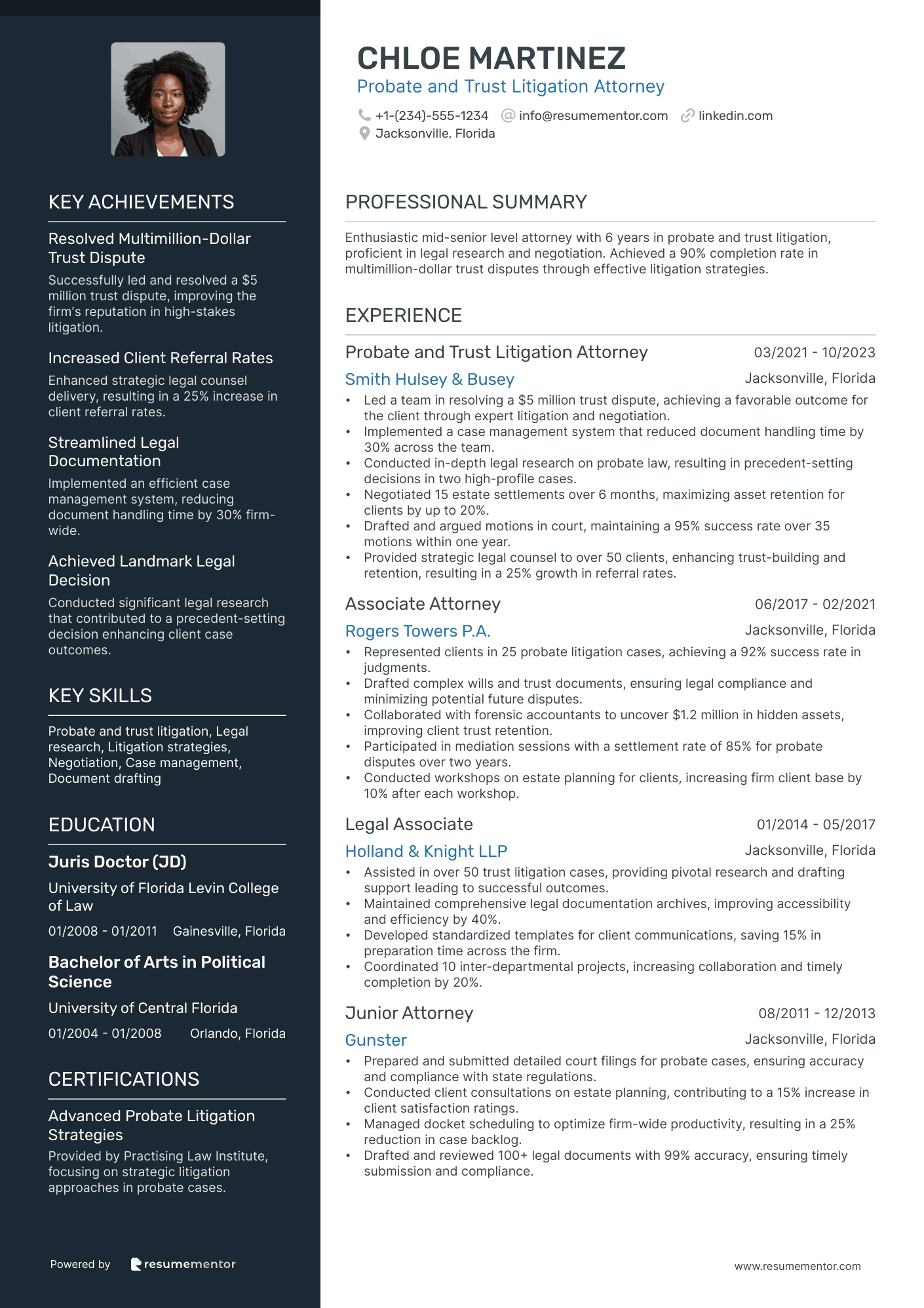

Probate and Trust Litigation Attorney

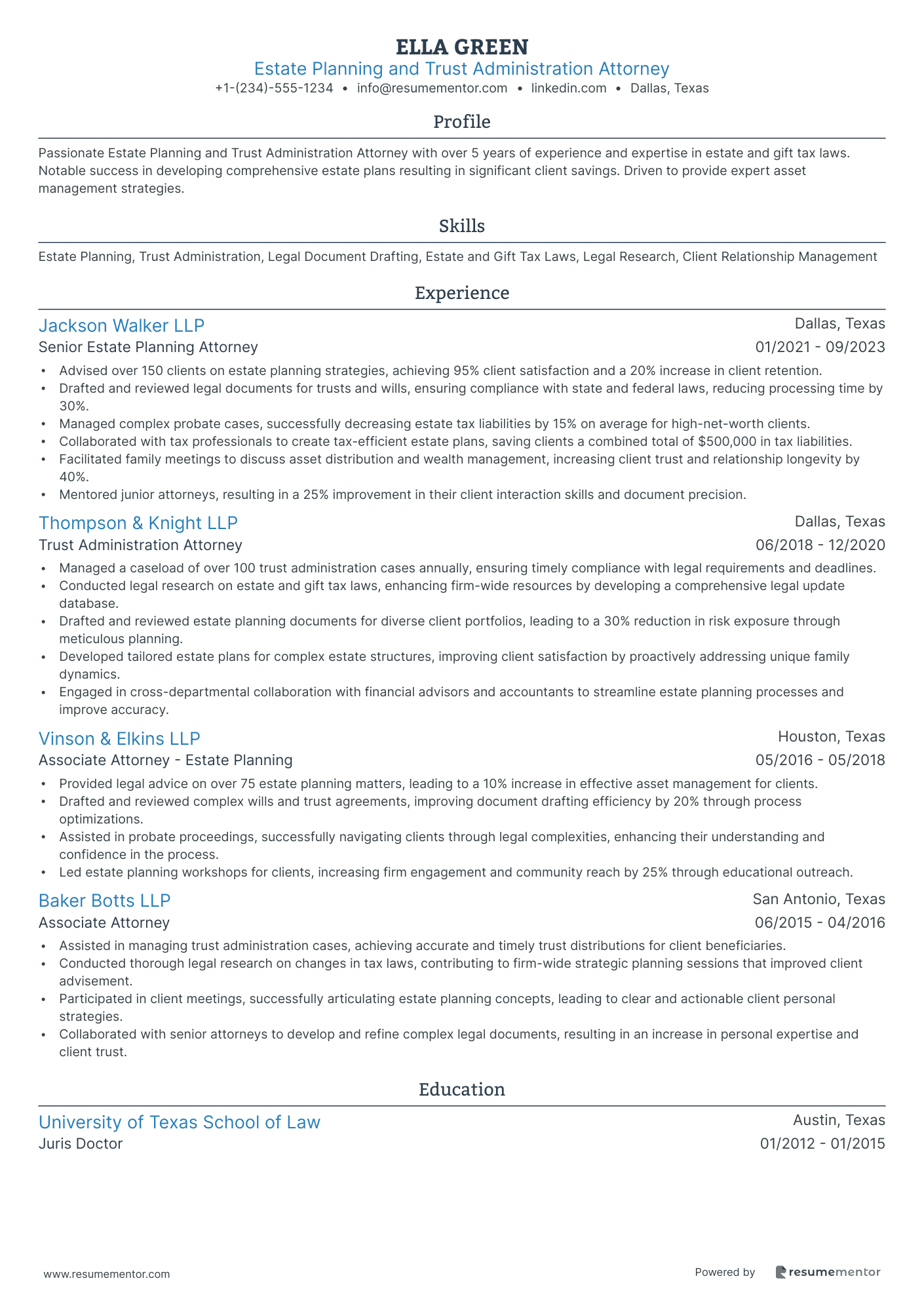

Estate Planning and Trust Administration Attorney

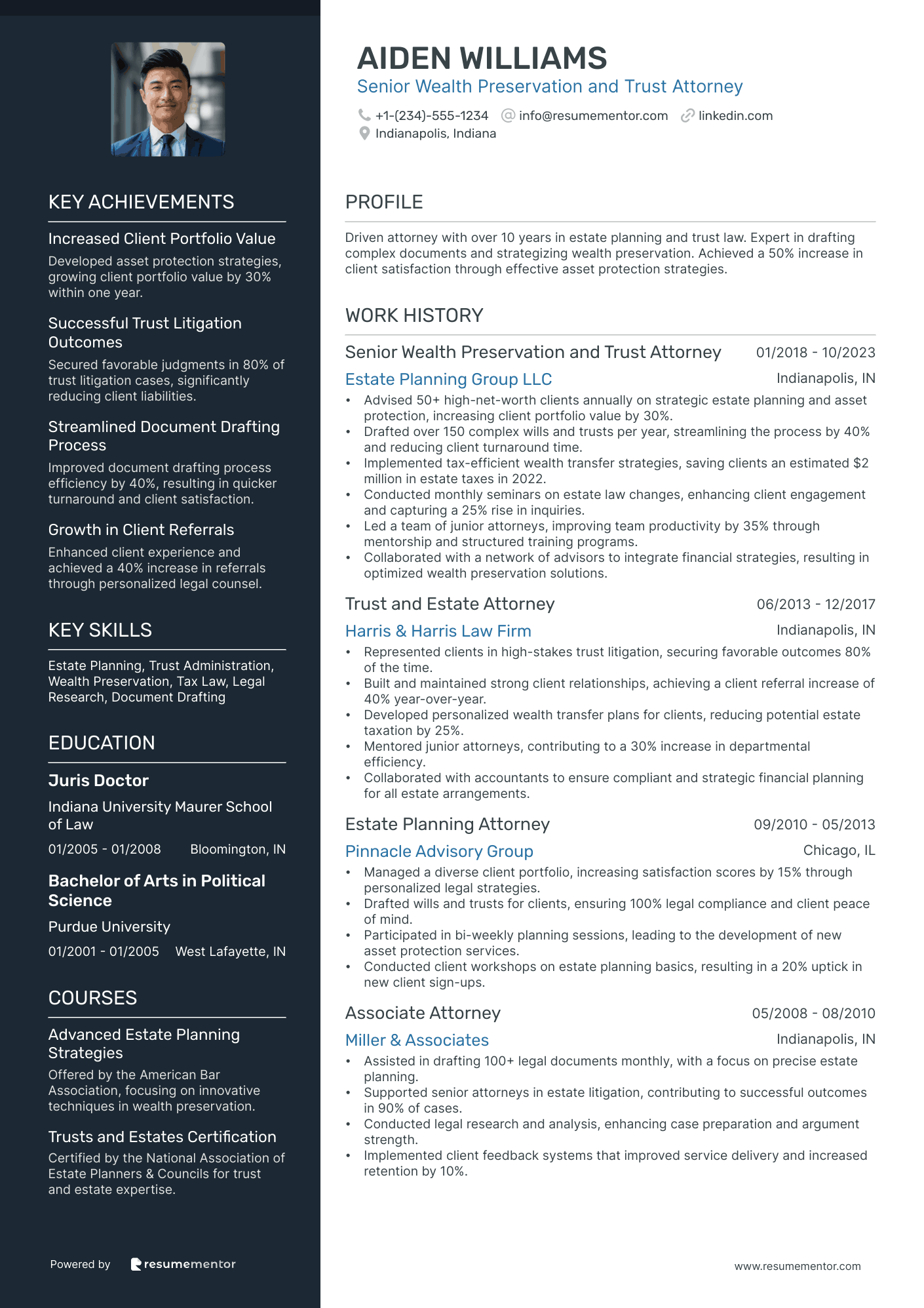

Senior Wealth Preservation and Trust Attorney

International Trust and Estate Planning Attorney

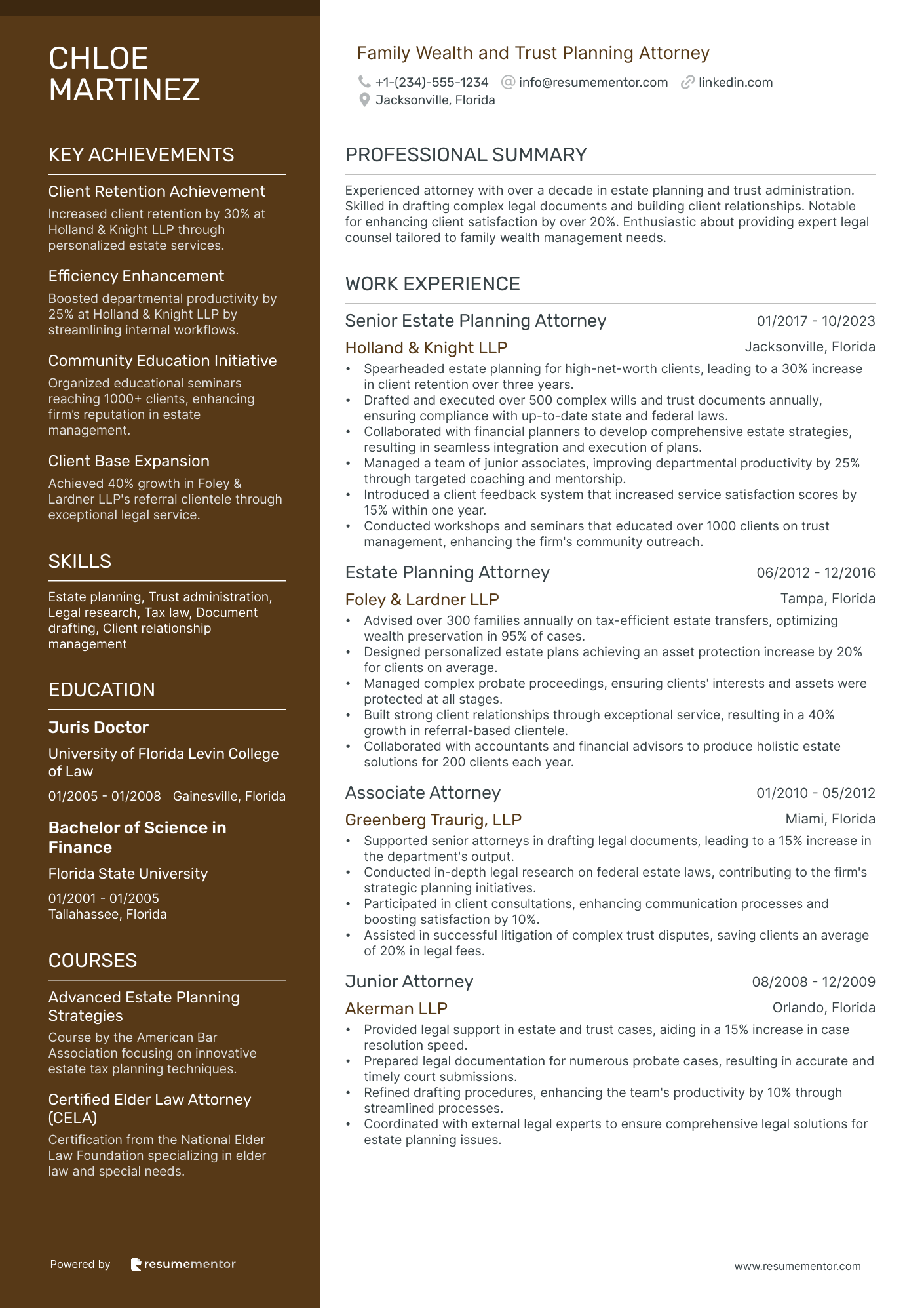

Family Wealth and Trust Planning Attorney

Trust, Probate, and Estate Mediation Attorney

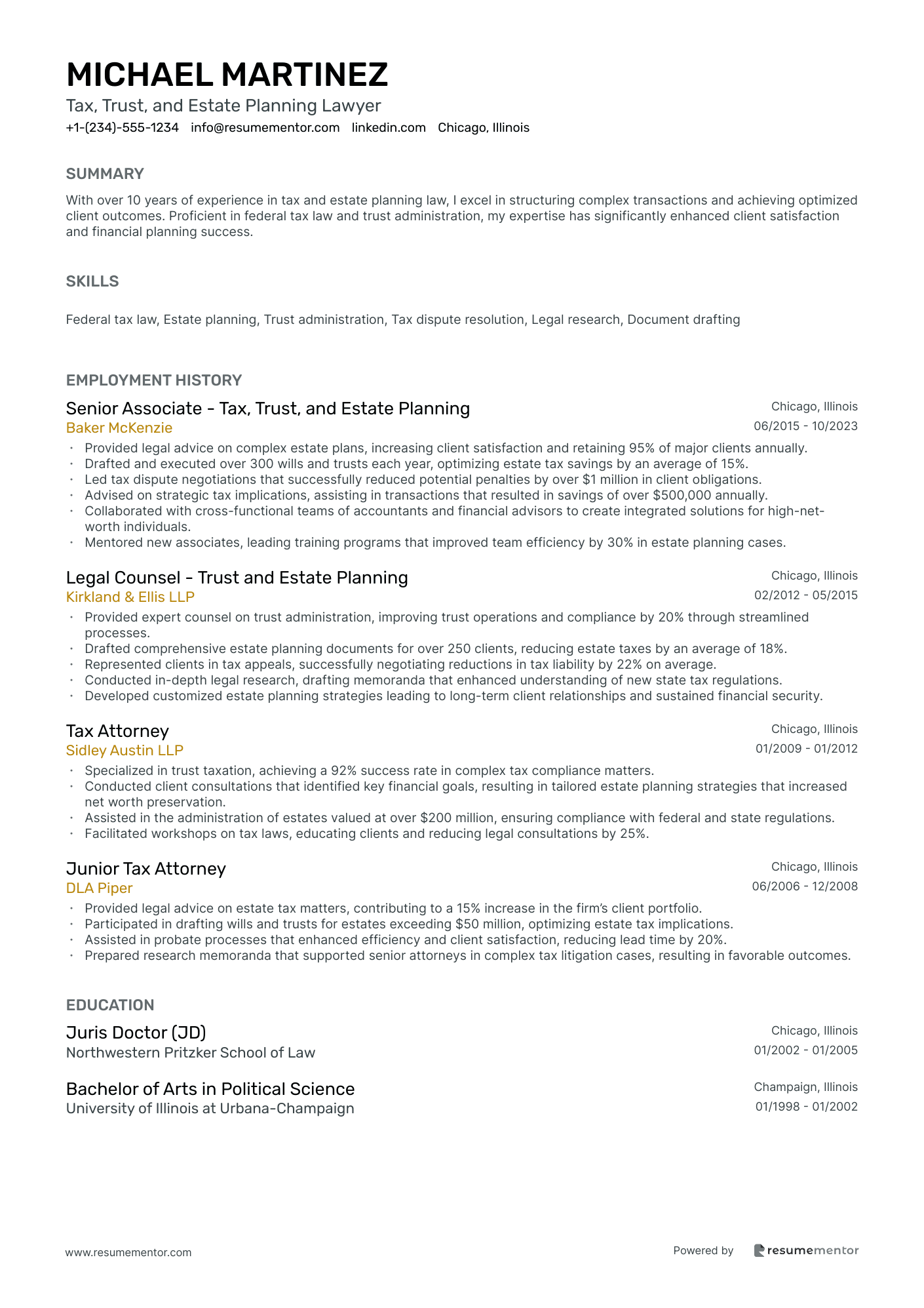

Tax, Trust, and Estate Planning Lawyer

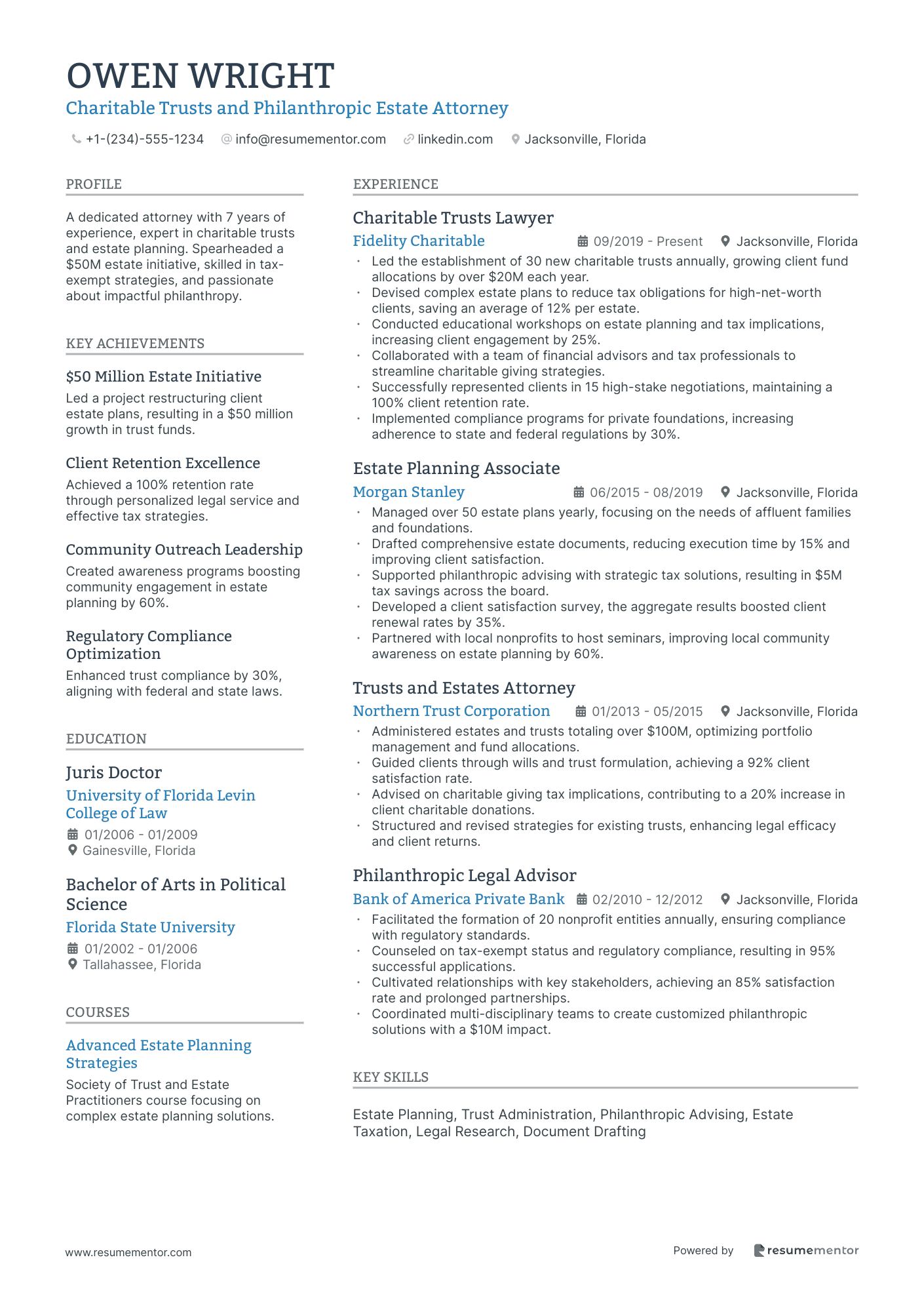

Charitable Trusts and Philanthropic Estate Attorney

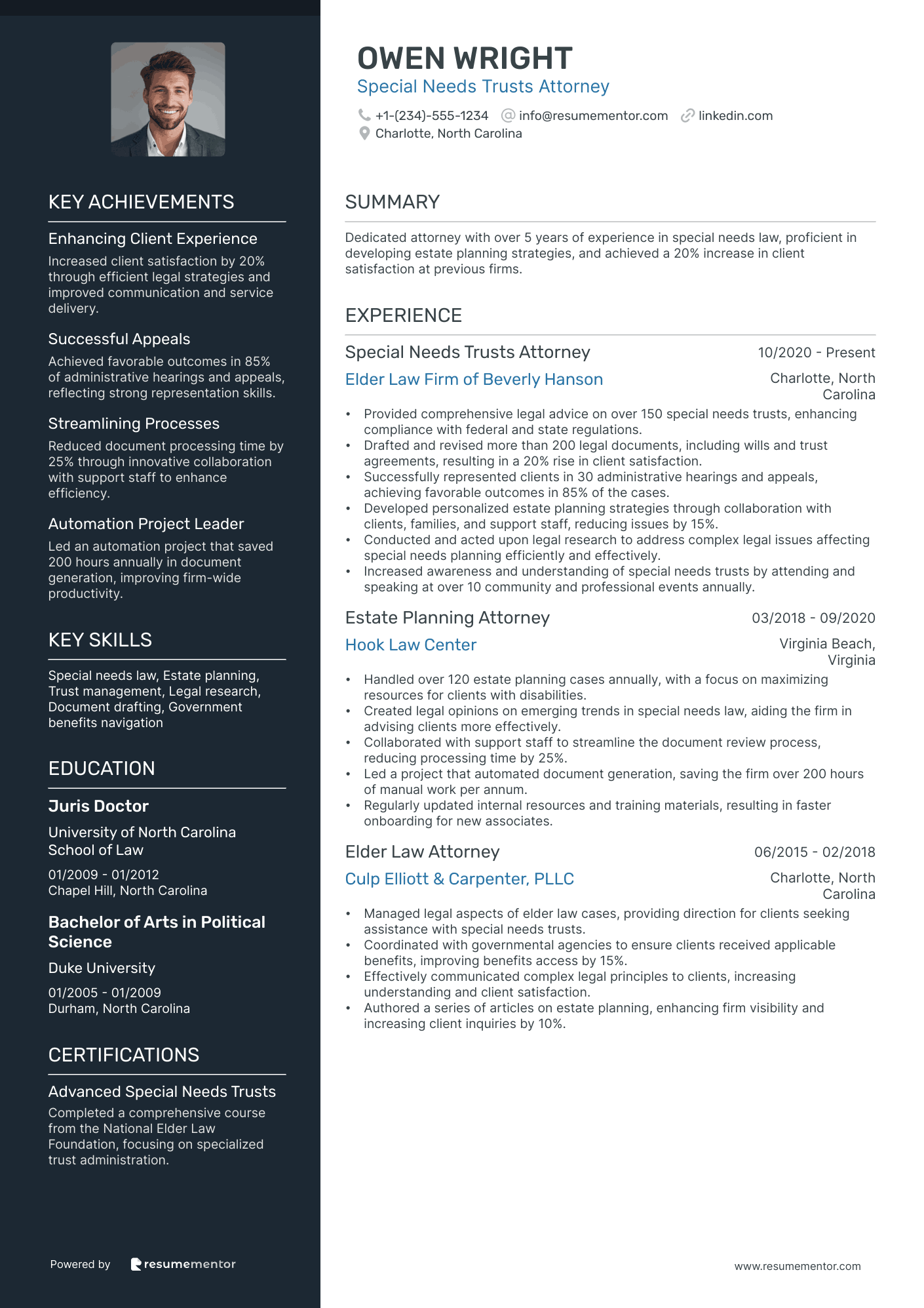

Special Needs Trusts Attorney

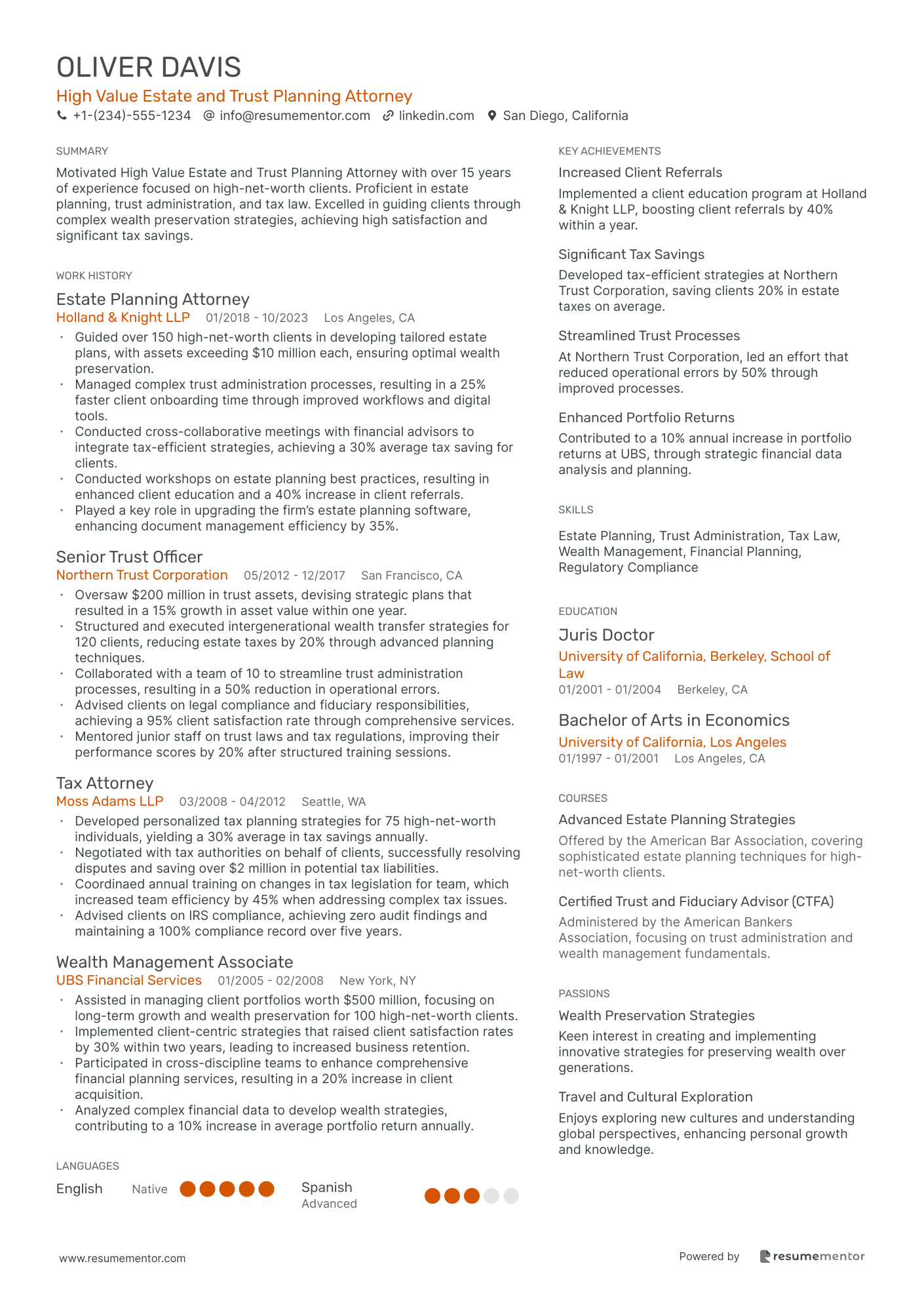

High Value Estate and Trust Planning Attorney

Probate and Trust Litigation Attorney resume sample

- •Led a team in resolving a $5 million trust dispute, achieving a favorable outcome for the client through expert litigation and negotiation.

- •Implemented a case management system that reduced document handling time by 30% across the team.

- •Conducted in-depth legal research on probate law, resulting in precedent-setting decisions in two high-profile cases.

- •Negotiated 15 estate settlements over 6 months, maximizing asset retention for clients by up to 20%.

- •Drafted and argued motions in court, maintaining a 95% success rate over 35 motions within one year.

- •Provided strategic legal counsel to over 50 clients, enhancing trust-building and retention, resulting in a 25% growth in referral rates.

- •Represented clients in 25 probate litigation cases, achieving a 92% success rate in judgments.

- •Drafted complex wills and trust documents, ensuring legal compliance and minimizing potential future disputes.

- •Collaborated with forensic accountants to uncover $1.2 million in hidden assets, improving client trust retention.

- •Participated in mediation sessions with a settlement rate of 85% for probate disputes over two years.

- •Conducted workshops on estate planning for clients, increasing firm client base by 10% after each workshop.

- •Assisted in over 50 trust litigation cases, providing pivotal research and drafting support leading to successful outcomes.

- •Maintained comprehensive legal documentation archives, improving accessibility and efficiency by 40%.

- •Developed standardized templates for client communications, saving 15% in preparation time across the firm.

- •Coordinated 10 inter-departmental projects, increasing collaboration and timely completion by 20%.

- •Prepared and submitted detailed court filings for probate cases, ensuring accuracy and compliance with state regulations.

- •Conducted client consultations on estate planning, contributing to a 15% increase in client satisfaction ratings.

- •Managed docket scheduling to optimize firm-wide productivity, resulting in a 25% reduction in case backlog.

- •Drafted and reviewed 100+ legal documents with 99% accuracy, ensuring timely submission and compliance.

Estate Planning and Trust Administration Attorney resume sample

- •Advised over 150 clients on estate planning strategies, achieving 95% client satisfaction and a 20% increase in client retention.

- •Drafted and reviewed legal documents for trusts and wills, ensuring compliance with state and federal laws, reducing processing time by 30%.

- •Managed complex probate cases, successfully decreasing estate tax liabilities by 15% on average for high-net-worth clients.

- •Collaborated with tax professionals to create tax-efficient estate plans, saving clients a combined total of $500,000 in tax liabilities.

- •Facilitated family meetings to discuss asset distribution and wealth management, increasing client trust and relationship longevity by 40%.

- •Mentored junior attorneys, resulting in a 25% improvement in their client interaction skills and document precision.

- •Managed a caseload of over 100 trust administration cases annually, ensuring timely compliance with legal requirements and deadlines.

- •Conducted legal research on estate and gift tax laws, enhancing firm-wide resources by developing a comprehensive legal update database.

- •Drafted and reviewed estate planning documents for diverse client portfolios, leading to a 30% reduction in risk exposure through meticulous planning.

- •Developed tailored estate plans for complex estate structures, improving client satisfaction by proactively addressing unique family dynamics.

- •Engaged in cross-departmental collaboration with financial advisors and accountants to streamline estate planning processes and improve accuracy.

- •Provided legal advice on over 75 estate planning matters, leading to a 10% increase in effective asset management for clients.

- •Drafted and reviewed complex wills and trust agreements, improving document drafting efficiency by 20% through process optimizations.

- •Assisted in probate proceedings, successfully navigating clients through legal complexities, enhancing their understanding and confidence in the process.

- •Led estate planning workshops for clients, increasing firm engagement and community reach by 25% through educational outreach.

- •Assisted in managing trust administration cases, achieving accurate and timely trust distributions for client beneficiaries.

- •Conducted thorough legal research on changes in tax laws, contributing to firm-wide strategic planning sessions that improved client advisement.

- •Participated in client meetings, successfully articulating estate planning concepts, leading to clear and actionable client personal strategies.

- •Collaborated with senior attorneys to develop and refine complex legal documents, resulting in an increase in personal expertise and client trust.

Senior Wealth Preservation and Trust Attorney resume sample

- •Advised 50+ high-net-worth clients annually on strategic estate planning and asset protection, increasing client portfolio value by 30%.

- •Drafted over 150 complex wills and trusts per year, streamlining the process by 40% and reducing client turnaround time.

- •Implemented tax-efficient wealth transfer strategies, saving clients an estimated $2 million in estate taxes in 2022.

- •Conducted monthly seminars on estate law changes, enhancing client engagement and capturing a 25% rise in inquiries.

- •Led a team of junior attorneys, improving team productivity by 35% through mentorship and structured training programs.

- •Collaborated with a network of advisors to integrate financial strategies, resulting in optimized wealth preservation solutions.

- •Represented clients in high-stakes trust litigation, securing favorable outcomes 80% of the time.

- •Built and maintained strong client relationships, achieving a client referral increase of 40% year-over-year.

- •Developed personalized wealth transfer plans for clients, reducing potential estate taxation by 25%.

- •Mentored junior attorneys, contributing to a 30% increase in departmental efficiency.

- •Collaborated with accountants to ensure compliant and strategic financial planning for all estate arrangements.

- •Managed a diverse client portfolio, increasing satisfaction scores by 15% through personalized legal strategies.

- •Drafted wills and trusts for clients, ensuring 100% legal compliance and client peace of mind.

- •Participated in bi-weekly planning sessions, leading to the development of new asset protection services.

- •Conducted client workshops on estate planning basics, resulting in a 20% uptick in new client sign-ups.

- •Assisted in drafting 100+ legal documents monthly, with a focus on precise estate planning.

- •Supported senior attorneys in estate litigation, contributing to successful outcomes in 90% of cases.

- •Conducted legal research and analysis, enhancing case preparation and argument strength.

- •Implemented client feedback systems that improved service delivery and increased retention by 10%.

International Trust and Estate Planning Attorney resume sample

- •Advised clients on complex cross-border estate planning, managing over $200M in international assets across 5 jurisdictions.

- •Drafted and reviewed 150+ wills and international trusts, ensuring compliance with various international regulations.

- •Collaborated with global tax advisors to optimize clients' wealth preservation strategies, saving $15M in tax liabilities.

- •Conducted and presented research on recent changes in international estate laws, resulting in updated client advisory frameworks.

- •Led successful litigation efforts in 7 international probate cases, achieving favorable outcomes in 85% of cases.

- •Networked and developed business by hosting 10+ international seminars which attracted an additional 20 high-net-worth clients.

- •Managed cross-border estate plans for clients with assets totaling over $100M, mitigating international tax liabilities.

- •Collaborated with a team of financial planners to develop unified wealth transfer strategies for over 50 global clients.

- •Provided litigation support in contested international trusts, increasing favorable resolutions by 30%.

- •Reviewed and advised on the tax implications of foreign trusts for compliance with U.S. tax laws.

- •Facilitated strategic networking events, resulting in 10% growth in the client base.

- •Drafted and revised over 80 complex estate planning documents, including wills and trusts with global considerations.

- •Counseled clients on U.S.-European tax treaties, enhancing estate strategy accuracy and deferring $5M in taxes.

- •Assisted in navigating probate processes, successfully managing assets worth over $50M across international borders.

- •Conducted extensive legal research on international estate law changes, improving firm’s compliance policies.

- •Developed estate plans for high-net-worth individuals, coordinating with international legal counsel for seamless integration.

- •Advised clients on multi-jurisdictional tax implications, leading to 20% reduction in potential tax assessments.

- •Instrumental in establishing 15+ cross-border trusts, ensuring legal compliance and asset protection.

- •Contributed to firm publications on international estate planning issues, boosting firm’s standing as a thought leader.

Family Wealth and Trust Planning Attorney resume sample

- •Spearheaded estate planning for high-net-worth clients, leading to a 30% increase in client retention over three years.

- •Drafted and executed over 500 complex wills and trust documents annually, ensuring compliance with up-to-date state and federal laws.

- •Collaborated with financial planners to develop comprehensive estate strategies, resulting in seamless integration and execution of plans.

- •Managed a team of junior associates, improving departmental productivity by 25% through targeted coaching and mentorship.

- •Introduced a client feedback system that increased service satisfaction scores by 15% within one year.

- •Conducted workshops and seminars that educated over 1000 clients on trust management, enhancing the firm's community outreach.

- •Advised over 300 families annually on tax-efficient estate transfers, optimizing wealth preservation in 95% of cases.

- •Designed personalized estate plans achieving an asset protection increase by 20% for clients on average.

- •Managed complex probate proceedings, ensuring clients' interests and assets were protected at all stages.

- •Built strong client relationships through exceptional service, resulting in a 40% growth in referral-based clientele.

- •Collaborated with accountants and financial advisors to produce holistic estate solutions for 200 clients each year.

- •Supported senior attorneys in drafting legal documents, leading to a 15% increase in the department's output.

- •Conducted in-depth legal research on federal estate laws, contributing to the firm's strategic planning initiatives.

- •Participated in client consultations, enhancing communication processes and boosting satisfaction by 10%.

- •Assisted in successful litigation of complex trust disputes, saving clients an average of 20% in legal fees.

- •Provided legal support in estate and trust cases, aiding in a 15% increase in case resolution speed.

- •Prepared legal documentation for numerous probate cases, resulting in accurate and timely court submissions.

- •Refined drafting procedures, enhancing the team's productivity by 10% through streamlined processes.

- •Coordinated with external legal experts to ensure comprehensive legal solutions for estate planning issues.

Trust, Probate, and Estate Mediation Attorney resume sample

- •Facilitated over 200 complex estate resolutions through effective mediation, increasing client satisfaction scores by 30%.

- •Successfully negotiated settlements in high-value probate disputes, resulting in 25% faster case resolution times.

- •Developed a streamlined will drafting process, reducing client waiting time by 40% through efficient use of technology.

- •Led a team to implement legal workflow automation, improving operational efficiency by 50% over one year.

- •Provided expert legal advice on trust administration, ensuring compliance with statutes and reducing litigation risk by 20%.

- •Educated and mentored newly hired associates, enhancing team proficiency and increasing department productivity by 15%.

- •Managed over 100 estate planning cases annually, ensuring compliance with state laws and client expectations.

- •Improved mediation processes that reduced probate case backlogs by 20%, enhancing client relations.

- •Pioneered a client engagement program, increasing returning client rates by 35% through personalized service.

- •Advised on complex trust administration, enhancing firm reputation and securing high-profile client retention.

- •Collaborated on a cross-functional committee focused on legal ethics, reducing malpractice claims by 25%.

- •Represented clients in probate court, achieving favorable outcomes in 85% of contested cases.

- •Conducted in-depth research on probate law changes, providing insights that maintained compliance standards.

- •Drafted comprehensive legal documents for estates, reducing processing errors by 40%.

- •Built strong client relationships, resulting in a 50% increase in client referrals.

- •Oversaw trust administration for 50+ estates, ensuring all fiduciary responsibilities were met accurately.

- •Initiated review processes that identified gaps in legal compliance, resulting in a 30% reduction in potential litigation risks.

- •Improved document management systems, enhancing data retrieval speed by 25%.

- •Participated actively in community estate planning workshops, bolstering company image and expanding client base.

Tax, Trust, and Estate Planning Lawyer resume sample

- •Provided legal advice on complex estate plans, increasing client satisfaction and retaining 95% of major clients annually.

- •Drafted and executed over 300 wills and trusts each year, optimizing estate tax savings by an average of 15%.

- •Led tax dispute negotiations that successfully reduced potential penalties by over $1 million in client obligations.

- •Advised on strategic tax implications, assisting in transactions that resulted in savings of over $500,000 annually.

- •Collaborated with cross-functional teams of accountants and financial advisors to create integrated solutions for high-net-worth individuals.

- •Mentored new associates, leading training programs that improved team efficiency by 30% in estate planning cases.

- •Provided expert counsel on trust administration, improving trust operations and compliance by 20% through streamlined processes.

- •Drafted comprehensive estate planning documents for over 250 clients, reducing estate taxes by an average of 18%.

- •Represented clients in tax appeals, successfully negotiating reductions in tax liability by 22% on average.

- •Conducted in-depth legal research, drafting memoranda that enhanced understanding of new state tax regulations.

- •Developed customized estate planning strategies leading to long-term client relationships and sustained financial security.

- •Specialized in trust taxation, achieving a 92% success rate in complex tax compliance matters.

- •Conducted client consultations that identified key financial goals, resulting in tailored estate planning strategies that increased net worth preservation.

- •Assisted in the administration of estates valued at over $200 million, ensuring compliance with federal and state regulations.

- •Facilitated workshops on tax laws, educating clients and reducing legal consultations by 25%.

- •Provided legal advice on estate tax matters, contributing to a 15% increase in the firm’s client portfolio.

- •Participated in drafting wills and trusts for estates exceeding $50 million, optimizing estate tax implications.

- •Assisted in probate processes that enhanced efficiency and client satisfaction, reducing lead time by 20%.

- •Prepared research memoranda that supported senior attorneys in complex tax litigation cases, resulting in favorable outcomes.

Charitable Trusts and Philanthropic Estate Attorney resume sample

- •Led the establishment of 30 new charitable trusts annually, growing client fund allocations by over $20M each year.

- •Devised complex estate plans to reduce tax obligations for high-net-worth clients, saving an average of 12% per estate.

- •Conducted educational workshops on estate planning and tax implications, increasing client engagement by 25%.

- •Collaborated with a team of financial advisors and tax professionals to streamline charitable giving strategies.

- •Successfully represented clients in 15 high-stake negotiations, maintaining a 100% client retention rate.

- •Implemented compliance programs for private foundations, increasing adherence to state and federal regulations by 30%.

- •Managed over 50 estate plans yearly, focusing on the needs of affluent families and foundations.

- •Drafted comprehensive estate documents, reducing execution time by 15% and improving client satisfaction.

- •Supported philanthropic advising with strategic tax solutions, resulting in $5M tax savings across the board.

- •Developed a client satisfaction survey, the aggregate results boosted client renewal rates by 35%.

- •Partnered with local nonprofits to host seminars, improving local community awareness on estate planning by 60%.

- •Administered estates and trusts totaling over $100M, optimizing portfolio management and fund allocations.

- •Guided clients through wills and trust formulation, achieving a 92% client satisfaction rate.

- •Advised on charitable giving tax implications, contributing to a 20% increase in client charitable donations.

- •Structured and revised strategies for existing trusts, enhancing legal efficacy and client returns.

- •Facilitated the formation of 20 nonprofit entities annually, ensuring compliance with regulatory standards.

- •Counseled on tax-exempt status and regulatory compliance, resulting in 95% successful applications.

- •Cultivated relationships with key stakeholders, achieving an 85% satisfaction rate and prolonged partnerships.

- •Coordinated multi-disciplinary teams to create customized philanthropic solutions with a $10M impact.

Special Needs Trusts Attorney resume sample

- •Provided comprehensive legal advice on over 150 special needs trusts, enhancing compliance with federal and state regulations.

- •Drafted and revised more than 200 legal documents, including wills and trust agreements, resulting in a 20% rise in client satisfaction.

- •Successfully represented clients in 30 administrative hearings and appeals, achieving favorable outcomes in 85% of the cases.

- •Developed personalized estate planning strategies through collaboration with clients, families, and support staff, reducing issues by 15%.

- •Conducted and acted upon legal research to address complex legal issues affecting special needs planning efficiently and effectively.

- •Increased awareness and understanding of special needs trusts by attending and speaking at over 10 community and professional events annually.

- •Handled over 120 estate planning cases annually, with a focus on maximizing resources for clients with disabilities.

- •Created legal opinions on emerging trends in special needs law, aiding the firm in advising clients more effectively.

- •Collaborated with support staff to streamline the document review process, reducing processing time by 25%.

- •Led a project that automated document generation, saving the firm over 200 hours of manual work per annum.

- •Regularly updated internal resources and training materials, resulting in faster onboarding for new associates.

- •Managed legal aspects of elder law cases, providing direction for clients seeking assistance with special needs trusts.

- •Coordinated with governmental agencies to ensure clients received applicable benefits, improving benefits access by 15%.

- •Effectively communicated complex legal principles to clients, increasing understanding and client satisfaction.

- •Authored a series of articles on estate planning, enhancing firm visibility and increasing client inquiries by 10%.

- •Advised on tax implications and strategies for high-net-worth clients, improving estate planning outcomes.

- •Drafted over 100 wills and trust documents tailored to individual client needs, ensuring all were legally sound.

- •Analyzed complex tax codes to maximize client benefits, increasing client confidence in firm's capabilities.

- •Collaborated with a team to review and revise estate planning protocols, leading to a more efficient workflow.

High Value Estate and Trust Planning Attorney resume sample

- •Guided over 150 high-net-worth clients in developing tailored estate plans, with assets exceeding $10 million each, ensuring optimal wealth preservation.

- •Managed complex trust administration processes, resulting in a 25% faster client onboarding time through improved workflows and digital tools.

- •Conducted cross-collaborative meetings with financial advisors to integrate tax-efficient strategies, achieving a 30% average tax saving for clients.

- •Conducted workshops on estate planning best practices, resulting in enhanced client education and a 40% increase in client referrals.

- •Played a key role in upgrading the firm’s estate planning software, enhancing document management efficiency by 35%.

- •Oversaw $200 million in trust assets, devising strategic plans that resulted in a 15% growth in asset value within one year.

- •Structured and executed intergenerational wealth transfer strategies for 120 clients, reducing estate taxes by 20% through advanced planning techniques.

- •Collaborated with a team of 10 to streamline trust administration processes, resulting in a 50% reduction in operational errors.

- •Advised clients on legal compliance and fiduciary responsibilities, achieving a 95% client satisfaction rate through comprehensive services.

- •Mentored junior staff on trust laws and tax regulations, improving their performance scores by 20% after structured training sessions.

- •Developed personalized tax planning strategies for 75 high-net-worth individuals, yielding a 30% average in tax savings annually.

- •Negotiated with tax authorities on behalf of clients, successfully resolving disputes and saving over $2 million in potential tax liabilities.

- •Coordinaed annual training on changes in tax legislation for team, which increased team efficiency by 45% when addressing complex tax issues.

- •Advised clients on IRS compliance, achieving zero audit findings and maintaining a 100% compliance record over five years.

- •Assisted in managing client portfolios worth $500 million, focusing on long-term growth and wealth preservation for 100 high-net-worth clients.

- •Implemented client-centric strategies that raised client satisfaction rates by 30% within two years, leading to increased business retention.

- •Participated in cross-discipline teams to enhance comprehensive financial planning services, resulting in a 20% increase in client acquisition.

- •Analyzed complex financial data to develop wealth strategies, contributing to a 10% increase in average portfolio return annually.

As a trust and estate attorney, your resume is your professional instrument, harmonizing your skills, accomplishments, and career aspirations into a compelling document. Turning your specialized knowledge into a concise resume can feel as challenging as condensing an entire estate plan onto a single page. Given the unique intricacies and language of the legal field, showcasing your qualifications and niche expertise in a way that stands out can be tough.

A resume template can help streamline this process. By providing a structured format, templates let you organize your information clearly and effectively, which is crucial in a detail-oriented field like trust and estate law. This organization ensures that your resume is visually cohesive, enabling you to focus on highlighting what truly matters—your core competencies.

When embarking on this journey, consider exploring these resume templates to gain a helpful framework. They take the headache out of formatting, allowing you to dedicate more time to refining your content. Your journey is unique, and with a well-crafted resume, you can precisely and clearly reflect that. By emphasizing your areas of expertise, you create a narrative that resonates with recruiters and opens doors to new opportunities.

Key Takeaways

- Creating a concise resume that balances specialized legal knowledge and professional accomplishments is essential in the trust and estate law field.

- Utilizing resume templates can help effectively organize this information, enabling focus on core competencies.

- A reverse-chronological format is recommended to showcase recent and relevant legal experience for maximum impact.

- Quantifying achievements in the resume experience section is crucial to demonstrating legal success and client benefits.

- Incorporating certificates and additional sections like languages or volunteer work can enhance a resume by showcasing specialized expertise and personal attributes.

What to focus on when writing your trust and estate attorney resume

A trust and estate attorney resume should clearly convey your legal expertise, dedication, and successful track record in managing estate planning and trust administration. Recruiters need to see how adept you are at handling complex legal matters, building strong client relationships, and solving specific problems related to estates and trusts.

How to structure your trust and estate attorney resume

- Contact Information—It's crucial to present your full name, phone number, email address, and LinkedIn profile prominently at the top of your resume. This information serves as the gateway for potential employers to reach out. Ensure your contact details are current and professional, as first impressions start here. This section should seamlessly introduce the recruiter to who you are, paving the way for a deeper dive into your qualifications.

- Professional Summary—This section should provide a snapshot of your enduring commitment to trust and estate law. Clearly highlight your years of experience, focusing on areas where you’ve demonstrated particular expertise, like estate tax planning or wealth preservation. Express your dedication to client satisfaction and ethical practice, as these are crucial attributes recruiters seek. A well-crafted summary sets the tone for the rest of your resume by presenting your core competencies and career focus.

- Work Experience—Include relevant roles and internships to paint a clear picture of your practical experience within the field. Detail your responsibilities and accomplishments, showing how you applied your skills in estate planning, administration, and trust law. Highlight cases and projects with successful outcomes, demonstrating your ability to produce tangible client benefits. This section builds on your summary by providing evidence of your capabilities in real-world scenarios.

- Education—List your law degree and any relevant undergraduate degrees prominently. Mention honors or distinctions that set you apart. Including courses such as Estate Law or Advanced Trusts reinforces your specialized knowledge. Tying this education to your professional experience supports the depth of your expertise and commitment to the field. This foundation sets the stage for demonstrating your skillset.

- Skills—Focus on essential skills that are critical for trust and estate law, such as client consultation, legal research, document drafting, and risk assessment. Highlight your proficiency with legal software that aids in estate planning, as technology often intersects with this field. This section should complement your work experience and education, showcasing your capability to apply your knowledge effectively.

- Certifications and Licenses—Clearly present your state bar admission and any specialized certifications in estate planning or related areas. This validates your qualifications and reassures potential employers of your professional legitimacy. Certifications can distinguish you from other candidates and often directly relate to the competencies you bring to the table.

Now that we’ve covered the core themes, let's explore each resume section more in-depth, focusing on the ideal format for maximum impact.

Which resume format to choose

In the competitive world of a trust and estate attorney, having a polished resume is essential for making a strong impression. Opting for a reverse-chronological format is particularly effective, as it highlights your recent experience first. This approach puts your most relevant skills and career achievements front and center, demonstrating your value and expertise to potential employers.

Selecting the right fonts can further elevate your resume, contributing to both readability and professionalism. Modern choices like Raleway, Montserrat, and Lato offer clean lines and a contemporary feel, aligning well with the prestigious image of a legal professional without overwhelming the reader with excessive stylization.

Consistency is key in maintaining your resume's presentation, which is why saving your document as a PDF is advisable. This ensures that all formatting remains intact across different devices and software, presenting a coherent and polished document just as you intended.

Maintaining one-inch margins on all sides of your resume provides a balanced and organized layout. This subtle design choice not only enhances readability but also underscores the meticulous attention to detail that is expected in the legal field.

When all these elements are thoughtfully integrated, they create a professional and compelling resume that effectively communicates your qualifications as a trust and estate attorney, capturing the attention of potential employers and setting you apart from the competition.

How to write a quantifiable resume experience section

The experience section of your trust and estate attorney resume plays a vital role in highlighting your legal achievements. By focusing on your expertise and proven success with clients, you can effectively demonstrate your ability to handle complex cases. Start with your most recent position and structure it chronologically to illustrate your professional journey and skill development over time. Limit your experience to the past 10-15 years, ensuring relevance and emphasizing roles that highlight your legal expertise. Tailor your resume to the job ad by using similar language and focusing on experiences that align with the job requirements. Choose strong action words like "advised," "represented," "negotiated," and "achieved" to clearly convey your capabilities.

In crafting this section, include the position, company, location, dates, and notable tasks or achievements for each entry. Ensure each achievement is action- and result-oriented, showcasing the impact of your work. By quantifying your achievements, you provide tangible evidence of your successes, such as growth figures or the time saved for clients. This approach makes it easy for employers to grasp the value of your contributions.

Here's an example of a trust and estate attorney resume experience section:

- •Advised over 200 clients on developing personalized estate plans, resulting in a 30% increase in revenue for the firm.

- •Successfully negotiated settlements in 95% of contested probate cases, saving clients over $2M in potential legal fees.

- •Led a team of 5 attorneys to implement streamlined trust administration processes, reducing case handling time by 20%.

- •Drafted and executed complex trust documents with a 100% accuracy rate, ensuring compliance with federal and state laws.

This experience section excels because it precisely targets the achievements crucial to a trust and estate attorney's success. By starting with the position title and integrating significant metrics, it clearly demonstrates effective client management and firm revenue growth. Each bullet point is thoughtfully crafted, focusing on quantifiable achievements like increased revenue and legal fee savings. These details seamlessly align with the skills highlighted in job descriptions. Additionally, the section emphasizes leadership, problem-solving, and accuracy, which are essential traits for excelling in this specialty. Collectively, these elements create a compelling depiction of your professional impact in the legal field.

Achievement-Focused resume experience section

A trust and estate-focused attorney resume experience section should clearly highlight your achievements and core skills, using a cohesive narrative. Begin by emphasizing the main areas where you excel, such as drafting wills, managing trusts, and advising clients on tax matters. Use strong action words to detail your accomplishments and include measurable outcomes, like increases in client satisfaction or reductions in processing times, to effectively demonstrate your capabilities.

To create a seamless flow, connect your tasks in bullet points that illustrate your impact comprehensively. Each bullet should spotlight a specific achievement, tying your experience to your meticulous attention to detail. Avoid vague language by using clear examples of how you navigated complex cases or enhanced the department's workflow. By consistently focusing on your achievements and providing solid proof of your expertise, you make your resume more appealing and better capture the interest of potential employers.

Trust and Estate Attorney

Law & Co, New York, NY

June 2020 - Present

- Managed estate plans for over 50 clients, resulting in a 20% increase in client retention.

- Drafted and reviewed 100+ wills and trust documents with zero drafting errors.

- Successfully reduced probate processing time by 30% through efficient case management.

- Developed tailored estate strategies that minimized tax liabilities for clients by 15% on average.

Innovation-Focused resume experience section

A resume experience section for a trust and estate attorney with an innovation focus should effectively convey how you’ve introduced creative solutions in the legal field. Start by showcasing your approach to tackling challenges in estate planning or trust management with unique strategies. Keep your descriptions concise yet specific to demonstrate the real impact of your work. Highlight your ability to develop solutions that not only address complex client needs but also drive progress within the field.

Discuss significant legal projects where out-of-the-box thinking led to successful outcomes, making sure to clearly explain your responsibilities. Emphasize how your innovative ideas enhanced client relations or improved firm operations. Use bullet points to present measurable results, like boosting efficiency or increasing client satisfaction. By connecting your experiences to the overall success of the firm, you can illustrate how your innovative approach has positively impacted client relationships and business outcomes.

Trust and Estate Attorney

Global Law Solutions

2018 - Present

- Designed a novel asset protection strategy for high-net-worth clients based on emerging global legal frameworks.

- Pioneered the use of blockchain technology in estate management, reducing administrative costs by 30%.

- Created a risk mitigation model that enhanced client trust by 20% over three years.

- Led a team in restructuring cross-border estate plans, ensuring compliance with varying international laws.

Skills-Focused resume experience section

A skills-focused trust and estate attorney resume experience section should highlight your technical abilities and your knack for handling clients' sensitive matters. Begin with key tasks or accomplishments that demonstrate your expertise in estate planning and trust administration, such as examples where you clearly communicated complex legal concepts, led important estate planning discussions, or effectively represented clients in legal cases. This approach uses straightforward language and strong action verbs to emphasize the positive impact of your skills on both clients and the firm.

Incorporate any unique experiences or specialized skills, like a deep understanding of tax codes or innovative strategies for reducing estate taxes, to distinguish yourself further. Tailor each bullet point to showcase your contributions to workplace success, whether through increased client satisfaction, process improvements, or ensuring legal compliance. These details convey your strengths as a trust and estate attorney and clarify why you're an excellent choice for the role. Here's an example capturing these crucial elements:

Senior Trust and Estate Attorney

Smith & Associates Law Firm

June 2015 - Present

- Designed comprehensive estate plans for clients, ensuring asset protection and meeting family needs.

- Administered over 100 trust accounts, managing client relationships and maintaining fiduciary duties.

- Collaborated with clients to minimize estate taxes and optimize wealth transfers.

- Represented beneficiaries in court, resolving estate and probate disputes swiftly.

Collaboration-Focused resume experience section

A collaboration-focused trust and estate attorney resume experience section should begin by showcasing your ability to work seamlessly with other professionals, such as accountants and financial advisors, in order to meet client goals. When crafting this section, emphasize your role in team projects, highlighting how working together with other specialists led to successful legal outcomes. By sharing instances where collaboration improved client satisfaction, streamlined processes, or sparked innovative solutions, you illustrate your team-minded approach effectively.

Each bullet point should start with a strong verb to make your contributions clear from the start. Describe specific projects where teamwork made a tangible impact, and don't forget to include measurable successes, such as faster issue resolution times or enhanced client trust. This not only demonstrates your teamwork capabilities but also underscores the value you add in multidisciplinary settings.

Trust and Estate Attorney

Anderson & Associates

January 2019 - Present

- Coordinated with financial advisors and accountants to create estate plans tailored to clients' financial goals.

- Led cross-functional meetings to maintain alignment on clients’ wishes, boosting client satisfaction by 30%.

- Partnered with tax consultants to devise tax-efficient estate structures, saving clients over $1 million collectively.

- Facilitated family meetings to mediate conflicts and develop solutions that respected everyone's interests.

Write your trust and estate attorney resume summary section

A trust and estate attorney-focused resume summary should spotlight your unique skills and experiences effectively. You want to quickly capture the reader's attention by emphasizing your expertise. Take, for instance, this engaging example:

With this, your extensive experience is front and center, instantly appealing to potential employers. It’s not just about what you do but how you do it, so highlighting a client-first approach adds valuable insight into your professional persona. Linking your skills to your qualities can enhance your appeal, showing you as a well-rounded candidate. Understanding the nuances between a resume summary and other types of sections is key to crafting the right message. A resume objective focuses more on your aspirations and fits those just entering the field. Meanwhile, a summary showcases the accomplishments of someone with more experience. Adding depth, a resume profile blends elements of both a summary and an objective. Alternatively, a summary of qualifications breaks down your skills and achievements into bullet points. Choosing the format that aligns with your career stage and target role will make your application shine. When done correctly, this attention to detail in your resume can strongly resonate with hiring managers. Staying concise and relevant helps ensure you make a memorable first impression.

Listing your trust and estate attorney skills on your resume

A skills-focused trust and estate attorney resume should emphasize how your capabilities meet the needs of clients and employers. Start by highlighting your strengths and soft skills, as these demonstrate the personal qualities essential for building client relationships. Hard skills, in contrast, are specific, teachable abilities such as legal writing and tax law expertise, which form the backbone of your professional expertise.

When effectively presented, skills and strengths transform into powerful keywords in your resume. These keywords align with job descriptions, enhancing the chances of your resume passing initial screenings and making a strong impression.

Example skills section in JSON format:

These skills are not only clear and relevant but also meticulously chosen to reflect the core competencies required in trusts and estates law. This demonstrates your focused expertise and readiness to potential employers.

Best hard skills to feature on your trust and estate attorney resume

Trust and estate attorneys should emphasize hard skills that communicate their proficiency in managing the legal and financial aspects of estate planning. These capabilities reassure employers of your readiness to tackle complex client needs.

Hard Skills

- Estate Planning

- Trust Administration

- Tax Law Expertise

- Legal Research

- Litigation Support

- Asset Management

- Document Drafting

- Compliance Knowledge

- Probate Process Understanding

- Financial Analysis

- Risk Assessment

- Fiduciary Law Proficiency

- Business Succession Planning

- Charitable Planning

- Retirement Planning

Best soft skills to feature on your trust and estate attorney resume

Soft skills for a trust and estate attorney should emphasize traits like empathy, strong ethical standards, and effective communication. These qualities ensure you offer both professional legal services and compassionate guidance.

Soft Skills

- Communication

- Empathy

- Problem-Solving

- Negotiation

- Patience

- Attention to Detail

- Ethical Judgment

- Active Listening

- Client-Focused Approach

- Critical Thinking

- Trustworthiness

- Conflict Resolution

- Adaptability

- Multitasking

- Time Management

How to include your education on your resume

An education section is a crucial part of your resume, especially when applying for a position as a trust and estate attorney. This section not only highlights your qualifications but also shows your commitment to the field of law. It should be tailored to the job you are applying for, so it's important to include only relevant education. Including unrelated educational achievements can dilute the focus of your resume. Your GPA can be included if it is strong and adds to your candidacy. If you graduated with honors such as cum laude, it's essential to display this to emphasize your academic success. The degree should be listed clearly and accurately, ensuring the potential employer quickly understands your academic background.

Here is an example of an incorrect education section:

Here is an example of a more effective education section for a trust and estate attorney:

The second example is ideal for a prospective trust and estate attorney. It includes a Juris Doctor degree, relevant to the legal field, and highlights the honor of graduating cum laude, which showcases academic excellence. The section leaves out unnecessary details and irrelevant education, keeping the focus sharp and compelling for your potential employer. This clarity and precision make your qualifications stand out.

How to include trust and estate attorney certificates on your resume

Incorporating a certificates section in your trust and estate attorney resume is crucial as it highlights your specialized expertise and continuous professional development. List the name of each certificate to make it easy for recruiters to identify your qualifications. Include the date you received the certification to show your most recent accomplishments. Add the issuing organization to verify the credibility of your certification. Certificates can also be included in the header to give them an even higher prominence. For example, you could format your header to read: "John Doe, Esq. | Certified Trust and Estate Planner | Bar Member, California State."

This example is effective because it specifies the title of each certification, which directly relates to the trust and estate law field. The inclusion of reputable issuing organizations like the American Bankers Association validates your certification. The specific mention of "Certified Trust and Financial Advisor" and "Estate Planning Law Specialist" demonstrates focused areas of expertise that are crucial for a trust and estate attorney. By following this format, you clearly convey your qualifications and boost your resume’s impact.

Extra sections to include in your trust and estate attorney resume

Crafting an effective resume for a trust and estate attorney involves showcasing your legal expertise, educational background, and relevant experiences. Additionally, including sections like languages, hobbies, volunteer work, and books can provide a well-rounded view of your capabilities and personality.

- Language section — Highlight your fluency in multiple languages and list them with proficiency levels, e.g., Fluent in Spanish and Conversational in French. Demonstrating language skills can offer a competitive edge in serving diverse clients and handling international matters.

- Hobbies and interests section — Add this section to give a glimpse of your personality outside of work, e.g., avid reader, runner, or chess player. Showing your interests can humanize your resume and make you more relatable.

- Volunteer work section — Include volunteer experiences that demonstrate your commitment to community service, e.g., volunteering at legal aid clinics. Participating in volunteer work can enhance your credibility and show your dedication to giving back.

- Books section — List legal and professional books you’ve read or contributed to, e.g., “Estate Planning for Modern Families.” Including a books section can illustrate your ongoing commitment to learning and your industry knowledge.

These additions can make your resume not only comprehensive but also memorable to potential employers.

In Conclusion

In conclusion, crafting a compelling trust and estate attorney resume requires a strategic approach that highlights your legal expertise, client-centric skills, and professional history with precision. By leveraging structured templates, you can present your experience and achievements in a clear and organized manner, making it easier for employers to identify your value. It is essential to prioritize the most relevant information, ensuring that each section—be it work experience, education, or certifications—effectively showcases your abilities and accomplishments. Use strong action words and quantifiable results in your experience section to demonstrate your impact in previous roles. Don't overlook the importance of a persuasive resume summary that captivates potential employers with your qualifications and approach. In addition to the core sections, consider adding extra sections like language skills, volunteer work, and personal interests, which can provide a more comprehensive view of who you are. Remember, a well-crafted resume not only reflects your career accomplishments but also demonstrates your attention to detail and dedication to the field of trust and estate law. By tailoring your resume to reflect your unique skills and experiences, you increase your chances of standing out in a competitive market, ultimately opening doors to new career opportunities.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.