VP of Finance Resume Examples

Jul 18, 2024

|

12 min read

Nail your VP of finance resume: Tips to balance your skills and experience perfectly to get the top job in the finance world. Ensure your qualifications add up and stand out in the corporate crowd.

Rated by 348 people

VP of Corporate Finance

VP of Strategic Financial Planning

VP of Finance for Global Operations

VP of Finance, Mergers & Acquisitions

VP of Finance and Risk Management

VP of Investment Finance

VP of Finance for Capital Strategy

VP of Financial Compliance and Auditing

VP of Finance and Revenue Generation

VP of Finance for Business Expansion

VP of Corporate Finance resume sample

- •Designed and implemented a capital structuring strategy that improved funding efficiency by 20%, aligning with long-term corporate objectives.

- •Led the FP&A team in developing predictive financial models which increased accuracy in forecasting by 35%.

- •Spearheaded a cross-departmental initiative improving project ROI measurement, resulting in a 15% increase in effective capital allocation.

- •Managed the consolidation of global treasury operations, enhancing liquidity management by 12% across international markets.

- •Developed a comprehensive investor relations strategy, ensuring transparent communication and boosting shareholder confidence by 18%.

- •Mentored a team of 15 finance professionals, improving overall team productivity by 30% through targeted skill development.

- •Effectively supervised a $3 billion capital expenditure budget, ensuring strategic alignment and cost reductions of 10% annually.

- •Revised cash flow management procedures, optimizing liquidity and lowering financial risk exposure by 25%.

- •Collaborated with C-suite executives to redesign investment strategies, resulting in a 5% increase in capital returns.

- •Established and monitored compliance frameworks for financial operations, increasing regulatory adherence by 40%.

- •Advanced financial stakeholder relationships, improving communication processes and fostering trust with banks and investors.

- •Conducted extensive financial modeling and analysis, supporting mergers and acquisitions worth over $500 million.

- •Developed strategic funding initiatives, raising $200 million in capital for future business development purposes.

- •Pioneered an innovative approach to financial forecasting, increasing prediction accuracy by 17%.

- •Reduced departmental overhead costs by implementing an automated reporting system that cut reporting time by 50%.

- •Assisted in the execution of a $1.5 billion bond issuance, contributing to a balanced and effective capital structure.

- •Analyzed company’s profitability metrics, identifying a loss reduction opportunity that saved $1 million annually.

- •Led financial reporting enhancements that improved analytical insights and accelerated the monthly closing process by two days.

- •Developed budgeting models that streamlined expenditure tracking, saving operational costs by 8%.

VP of Strategic Financial Planning resume sample

- •Led a team to develop long-term financial forecasts, increasing forecasting accuracy by 25% over two years.

- •Implemented advanced financial modeling techniques, resulting in a 30% increase in revenue from strategic initiatives.

- •Directed preparation of financial reports for executive team, enhancing decision-making processes and aligning with strategic goals.

- •Collaborated with cross-functional teams to integrate financial goals with business objectives, achieving 20% cost efficiencies.

- •Monitored economic conditions, influencing strategic initiatives that led to a 15% market share growth.

- •Mentored a high-performing team, reducing turnover rates by 40% while fostering continuous improvement.

- •Conducted thorough financial performance analysis, identifying strategic opportunities contributing to a 20% profit increase.

- •Developed financial forecasts and budgets, improving financial planning efficiency by 30% through automation.

- •Prepared and delivered executive presentations, enhancing stakeholder understanding of financial strategy and performance.

- •Implemented risk management strategies that reduced financial exposure by 15%, safeguarding business continuity.

- •Enhanced internal controls and processes, elevating financial data integrity by streamlining reporting systems.

- •Supported strategic financial planning, leading initiatives that improved budgeting accuracy by 20%.

- •Analyzed financial data to identify cost-cutting opportunities, resulting in $500K annual savings.

- •Contributed to strategic discussions, influencing decisions that enhanced service delivery and client satisfaction.

- •Conducted detailed cost-benefit analyses, optimizing resource allocation for multiple strategic projects.

- •Assisted in financial analysis and reporting, supporting successful audits that improved compliance by 15%.

- •Participated in the development of financial models enhancing project valuation accuracy by 25%.

- •Facilitated communication between finance and operational teams, promoting greater fiscal accountability in departments.

- •Contributed to the enhancement of financial reporting systems, increasing data processing speed by 40%.

VP of Finance for Global Operations resume sample

- •Directed global financial planning with a focus on achieving a 15% increase in net income year over year.

- •Led initiatives that streamlined financial reporting processes, which reduced the reporting cycle by 25%.

- •Collaborated with the executive team to develop a financial forecast tool, enhancing predictive accuracy by 30%.

- •Implemented a new financial control system that decreased operational risks by 40% globally.

- •Re-engineered budgeting processes, improving alignment with company-wide strategic goals and achieving operational savings of $8 million.

- •Trained and mentored a team of 20 finance professionals, resulting in a 35% improvement in team productivity.

- •Managed global budgeting processes, aligning with corporate objectives and achieving financial targets with 98% accuracy.

- •Developed strategies to mitigate financial risks, resulting in a savings of $12 million across global operations.

- •Enhanced financial liquidity by implementing advanced treasury functions, improving cash flow by 15%.

- •Led cross-functional teams in the implementation of a Financial Data Management System, reducing data inconsistencies by 28%.

- •Advised senior leadership on long-term financial plans that supported business growth and increased revenue by 22%.

- •Directed the consolidation of financial statements ensuring compliance with international standards, improving reporting accuracy by 20%.

- •Implemented cost-efficiency measures in operations, achieving annual savings of $5 million.

- •Collaborated with global teams to analyze financial trends, providing insights that improved profitability by 10%.

- •Built strong external stakeholder relationships, leading to a successful refinancing project with a reduced interest rate of 1%.

- •Contributed to a project that automated reporting processes, resulting in a 50% time reduction.

- •Analyzed financial data to support strategic decision-making, leading to an increase of 12% in departmental efficiency.

- •Supported the finance team in the successful execution of a budgeting project that aligned with operational goals.

- •Played a key role in the implementation of a new ERP system, enhancing financial reporting capabilities by 30%.

VP of Finance, Mergers & Acquisitions resume sample

- •Spearheaded M&A transactions totaling $1.5 billion annually, enhancing strategic growth and competitive positioning.

- •Led cross-functional teams in integrating new acquisitions, reducing integration time by 25% through innovative processes.

- •Implemented financial frameworks that improved acquisition valuation accuracy by 30%, resulting in enhanced investment decisions.

- •Coordinated with investment banks and financial institutions to identify and assess over 50 potential acquisition targets.

- •Enhanced finance team effectiveness by 40% through tailored mentorship programs, fostering a high-performance environment.

- •Prepared executive-level reports on M&A strategy and outlook, driving decisions that increased shareholder value significantly.

- •Managed M&A activities across multiple verticals, achieving a 20% growth in company revenue through strategic acquisitions.

- •Conducted in-depth financial analyses and forecasting, improving transaction success rate by 35% and merger outcomes.

- •Collaborated on over 40 integration projects, achieving operational efficiency post-acquisition and reducing costs by 15%.

- •Fostered strong relationships with key financial partners, securing strategic partnerships that expanded market reach.

- •Delivered comprehensive presentations to C-suite executives, informing critical decisions around acquisition strategy.

- •Executed due diligence processes for acquisitions, optimizing financial metrics that led to successful integrations.

- •Managed financial modeling for potential deals, increasing forecasting accuracy by 40% in evaluating acquisition viability.

- •Streamlined operations across acquired entities, leading to a 10% reduction in overheads and enhanced profitability.

- •Collaborated with legal and IT teams to ensure regulatory compliance and effective integration post-acquisition.

- •Assisted in evaluating acquisition targets, providing analytical insights that improved decision-making and strategic alignment.

- •Contributed to the development of long-term financial plans, enhancing corporate governance and fiscal responsibility.

- •Supported integration teams, ensuring seamless transitions and minimizing disruption to business operations.

- •Prepared unit budgets and forecasts, achieving a 99% accuracy rate aligning with company growth targets.

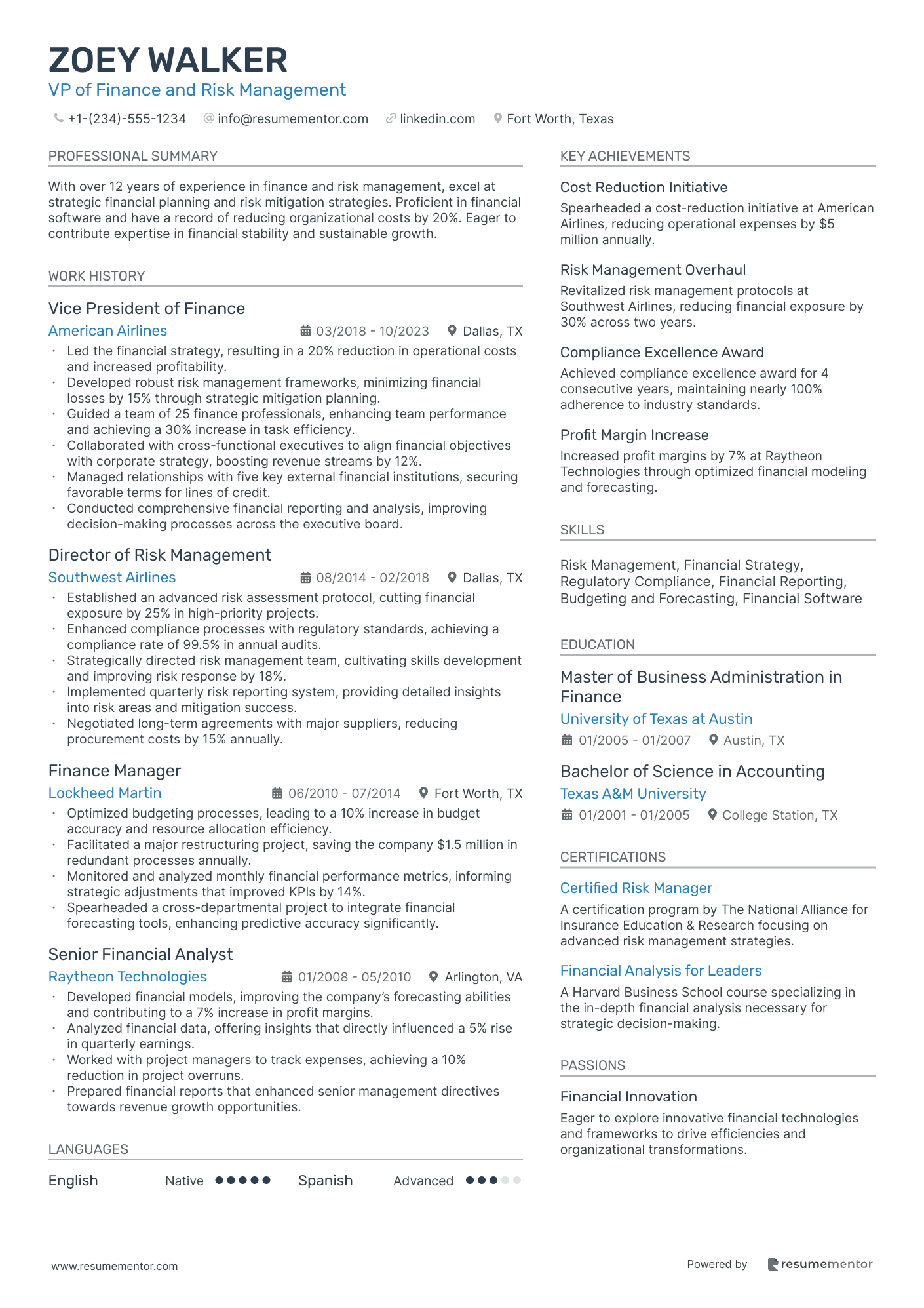

VP of Finance and Risk Management resume sample

- •Led the financial strategy, resulting in a 20% reduction in operational costs and increased profitability.

- •Developed robust risk management frameworks, minimizing financial losses by 15% through strategic mitigation planning.

- •Guided a team of 25 finance professionals, enhancing team performance and achieving a 30% increase in task efficiency.

- •Collaborated with cross-functional executives to align financial objectives with corporate strategy, boosting revenue streams by 12%.

- •Managed relationships with five key external financial institutions, securing favorable terms for lines of credit.

- •Conducted comprehensive financial reporting and analysis, improving decision-making processes across the executive board.

- •Established an advanced risk assessment protocol, cutting financial exposure by 25% in high-priority projects.

- •Enhanced compliance processes with regulatory standards, achieving a compliance rate of 99.5% in annual audits.

- •Strategically directed risk management team, cultivating skills development and improving risk response by 18%.

- •Implemented quarterly risk reporting system, providing detailed insights into risk areas and mitigation success.

- •Negotiated long-term agreements with major suppliers, reducing procurement costs by 15% annually.

- •Optimized budgeting processes, leading to a 10% increase in budget accuracy and resource allocation efficiency.

- •Facilitated a major restructuring project, saving the company $1.5 million in redundant processes annually.

- •Monitored and analyzed monthly financial performance metrics, informing strategic adjustments that improved KPIs by 14%.

- •Spearheaded a cross-departmental project to integrate financial forecasting tools, enhancing predictive accuracy significantly.

- •Developed financial models, improving the company’s forecasting abilities and contributing to a 7% increase in profit margins.

- •Analyzed financial data, offering insights that directly influenced a 5% rise in quarterly earnings.

- •Worked with project managers to track expenses, achieving a 10% reduction in project overruns.

- •Prepared financial reports that enhanced senior management directives towards revenue growth opportunities.

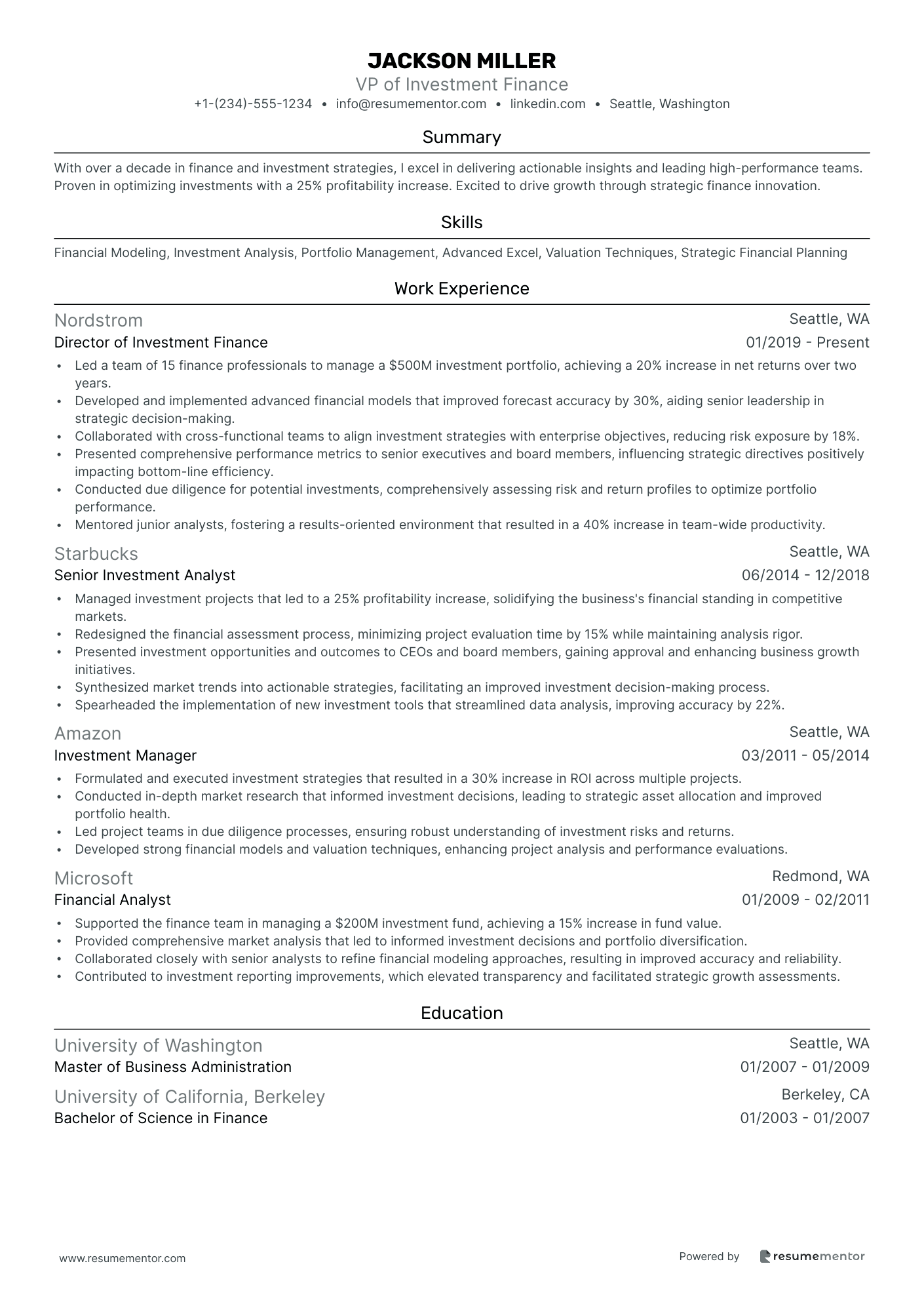

VP of Investment Finance resume sample

- •Led a team of 15 finance professionals to manage a $500M investment portfolio, achieving a 20% increase in net returns over two years.

- •Developed and implemented advanced financial models that improved forecast accuracy by 30%, aiding senior leadership in strategic decision-making.

- •Collaborated with cross-functional teams to align investment strategies with enterprise objectives, reducing risk exposure by 18%.

- •Presented comprehensive performance metrics to senior executives and board members, influencing strategic directives positively impacting bottom-line efficiency.

- •Conducted due diligence for potential investments, comprehensively assessing risk and return profiles to optimize portfolio performance.

- •Mentored junior analysts, fostering a results-oriented environment that resulted in a 40% increase in team-wide productivity.

- •Managed investment projects that led to a 25% profitability increase, solidifying the business's financial standing in competitive markets.

- •Redesigned the financial assessment process, minimizing project evaluation time by 15% while maintaining analysis rigor.

- •Presented investment opportunities and outcomes to CEOs and board members, gaining approval and enhancing business growth initiatives.

- •Synthesized market trends into actionable strategies, facilitating an improved investment decision-making process.

- •Spearheaded the implementation of new investment tools that streamlined data analysis, improving accuracy by 22%.

- •Formulated and executed investment strategies that resulted in a 30% increase in ROI across multiple projects.

- •Conducted in-depth market research that informed investment decisions, leading to strategic asset allocation and improved portfolio health.

- •Led project teams in due diligence processes, ensuring robust understanding of investment risks and returns.

- •Developed strong financial models and valuation techniques, enhancing project analysis and performance evaluations.

- •Supported the finance team in managing a $200M investment fund, achieving a 15% increase in fund value.

- •Provided comprehensive market analysis that led to informed investment decisions and portfolio diversification.

- •Collaborated closely with senior analysts to refine financial modeling approaches, resulting in improved accuracy and reliability.

- •Contributed to investment reporting improvements, which elevated transparency and facilitated strategic growth assessments.

VP of Finance for Capital Strategy resume sample

- •Led a dynamic team in developing comprehensive capital strategies resulting in a $150M investment return.

- •Orchestrated the budgeting and forecasting process, achieving a 10% reduction in operational costs through efficiency improvements.

- •Devised innovative financial models that improved long-range planning accuracy by 15% compared to previous years.

- •Collaborated with senior management to evaluate 25 potential merger and acquisition opportunities, leading to three successful acquisitions.

- •Presented critical financial reports to board members that enhanced decision-making processes and stakeholder satisfaction.

- •Cultivated strong relationships with top financial institutions and investors, improving capital access by 20%.

- •Managed analysis of market trends to guide a $200M capital allocation strategy, increasing return by 12% year-on-year.

- •Optimized the company's financial structure, lowering debt interest by 8%, improving overall liquidity status.

- •Executed successful financial planning initiatives for joint ventures, driving a 15% expansion in market presence.

- •Implemented risk assessment practices which resulted in a 20% reduction in potential financial exposure.

- •Trained a team of financial analysts, fostering a culture of performance excellence and innovation, resulting in a 30% increase in team productivity.

- •Developed a robust forecasting model that improved profit projection accuracy by 25%.

- •Facilitated cross-departmental projects, which led to identifying cost-reduction opportunities of $5M annually.

- •Participated in the strategic planning that secured $300M in new capital through equity and debt financing.

- •Revised internal financial governance, increasing compliance standards and reducing audit discrepancies by 50%.

- •Conducted in-depth financial modeling and analysis, achieving a 10% enhancement in cost prediction models.

- •Assessed financial data to support quarterly reporting that contributed to improved transparency for investors.

- •Assisted in capital markets analysis, which informed strategic investment decisions with a positive revenue impact.

- •Supported due diligence for three large-scale mergers, contributing to strategic growth and market consolidation.

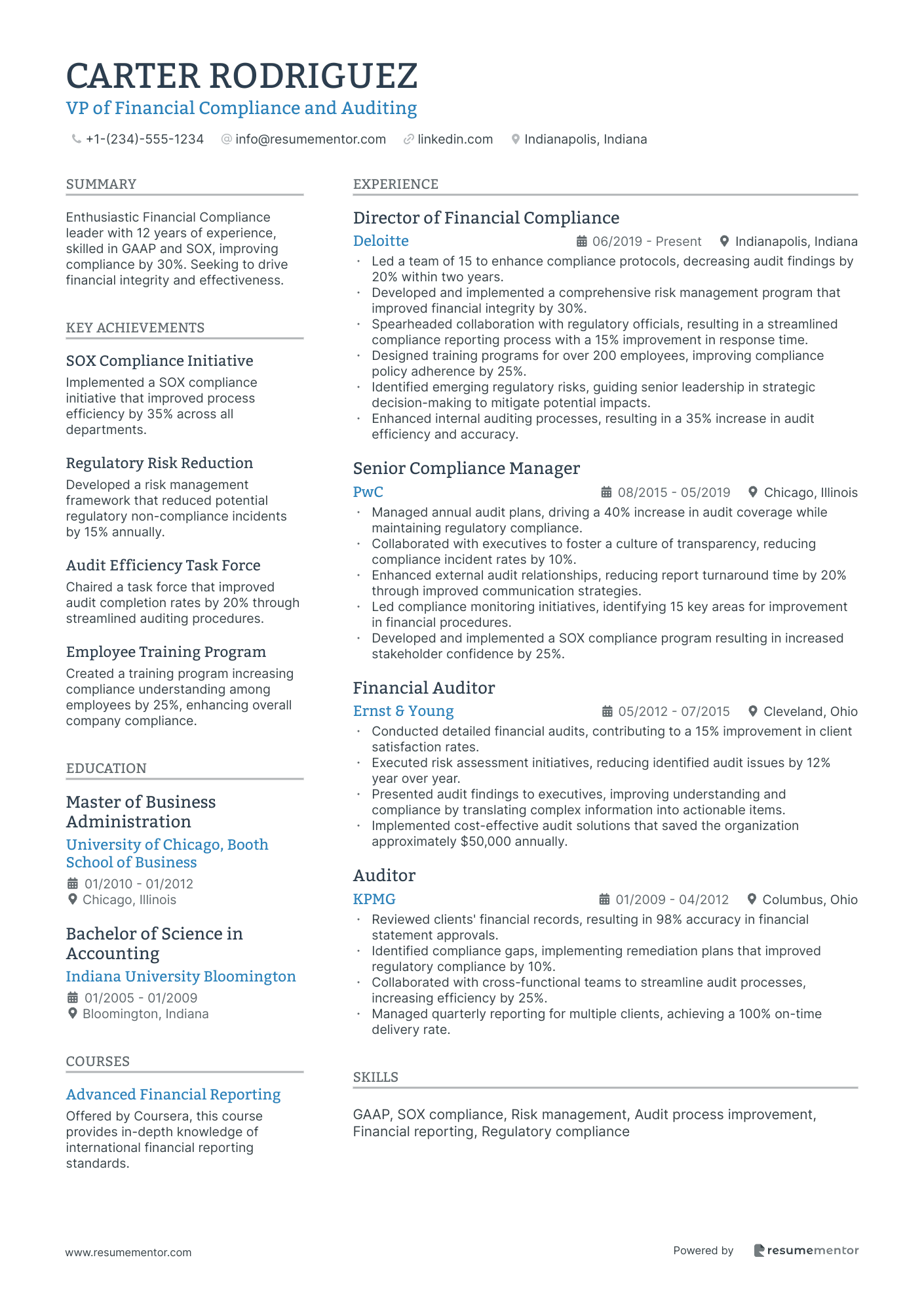

VP of Financial Compliance and Auditing resume sample

- •Led a team of 15 to enhance compliance protocols, decreasing audit findings by 20% within two years.

- •Developed and implemented a comprehensive risk management program that improved financial integrity by 30%.

- •Spearheaded collaboration with regulatory officials, resulting in a streamlined compliance reporting process with a 15% improvement in response time.

- •Designed training programs for over 200 employees, improving compliance policy adherence by 25%.

- •Identified emerging regulatory risks, guiding senior leadership in strategic decision-making to mitigate potential impacts.

- •Enhanced internal auditing processes, resulting in a 35% increase in audit efficiency and accuracy.

- •Managed annual audit plans, driving a 40% increase in audit coverage while maintaining regulatory compliance.

- •Collaborated with executives to foster a culture of transparency, reducing compliance incident rates by 10%.

- •Enhanced external audit relationships, reducing report turnaround time by 20% through improved communication strategies.

- •Led compliance monitoring initiatives, identifying 15 key areas for improvement in financial procedures.

- •Developed and implemented a SOX compliance program resulting in increased stakeholder confidence by 25%.

- •Conducted detailed financial audits, contributing to a 15% improvement in client satisfaction rates.

- •Executed risk assessment initiatives, reducing identified audit issues by 12% year over year.

- •Presented audit findings to executives, improving understanding and compliance by translating complex information into actionable items.

- •Implemented cost-effective audit solutions that saved the organization approximately $50,000 annually.

- •Reviewed clients' financial records, resulting in 98% accuracy in financial statement approvals.

- •Identified compliance gaps, implementing remediation plans that improved regulatory compliance by 10%.

- •Collaborated with cross-functional teams to streamline audit processes, increasing efficiency by 25%.

- •Managed quarterly reporting for multiple clients, achieving a 100% on-time delivery rate.

VP of Finance and Revenue Generation resume sample

- •Led the finance team in implementing a new financial strategy that increased revenue by 20% over three years.

- •Managed the annual budgeting process of $500 million, resulting in a 10% cost reduction across departments.

- •Collaborated with product teams to develop pricing strategies, enhancing profitability by $10 million.

- •Improved financial forecasting processes, enhancing predictive accuracy by 15% and reducing overruns.

- •Streamlined the financial reporting system, decreasing report turnaround time by 25% and increasing stakeholder satisfaction.

- •Presented quarterly financial performance and strategic insights to the board, influencing key business decisions.

- •Identified new revenue opportunities, contributing to a 15% revenue increase in under two years.

- •Oversaw a cross-functional project to integrate AI into revenue forecasting, improving accuracy by 18%.

- •Led a team of 10 analysts in designing revenue models, supporting a $2 million growth in new market segments.

- •Conducted market analysis to refine pricing models, resulting in a $5 million annual revenue improvement.

- •Enhanced internal controls leading to a 30% reduction in compliance breaches and audit findings.

- •Managed financial planning and analysis for a $100 million unit, boosting profitability by 12% year-over-year.

- •Implemented a risk management framework, reducing financial risk by 20% across the division.

- •Guided cost control measures that decreased operational expenses by 8%, improving profit margins.

- •Developed strategic financial presentations for executives, enhancing decision-making effectiveness company-wide.

- •Conducted detailed financial analysis leading to insights that reduced annual cost by $1.5 million.

- •Participated in a project to implement new budgeting software, decreasing budget cycle time by 20%.

- •Improved cash flow management processes resulting in a 15% reduction in the financial liquidity gap.

- •Contributed to the organizational change plan, aligning financial systems with strategic business goals.

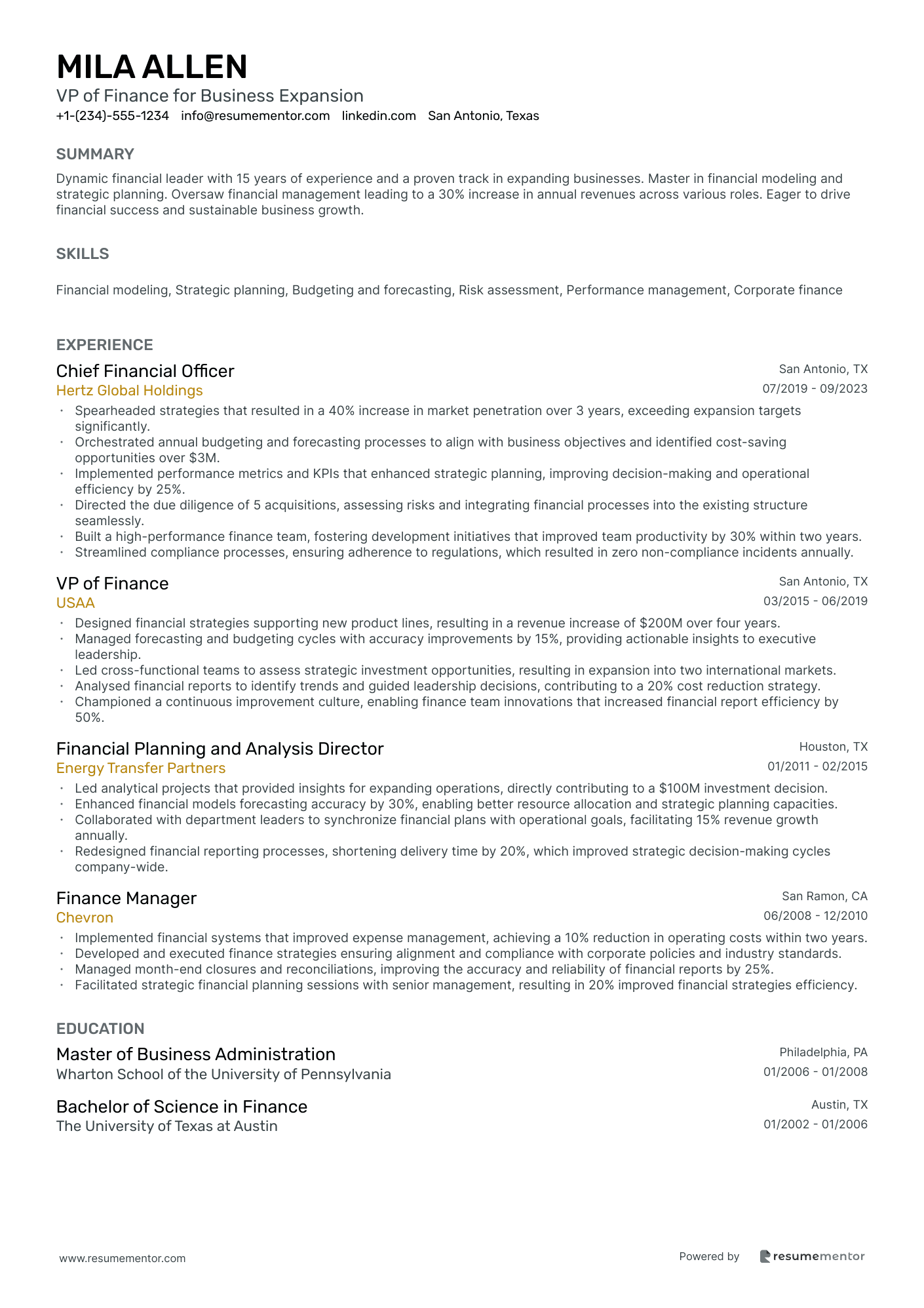

VP of Finance for Business Expansion resume sample

- •Spearheaded strategies that resulted in a 40% increase in market penetration over 3 years, exceeding expansion targets significantly.

- •Orchestrated annual budgeting and forecasting processes to align with business objectives and identified cost-saving opportunities over $3M.

- •Implemented performance metrics and KPIs that enhanced strategic planning, improving decision-making and operational efficiency by 25%.

- •Directed the due diligence of 5 acquisitions, assessing risks and integrating financial processes into the existing structure seamlessly.

- •Built a high-performance finance team, fostering development initiatives that improved team productivity by 30% within two years.

- •Streamlined compliance processes, ensuring adherence to regulations, which resulted in zero non-compliance incidents annually.

- •Designed financial strategies supporting new product lines, resulting in a revenue increase of $200M over four years.

- •Managed forecasting and budgeting cycles with accuracy improvements by 15%, providing actionable insights to executive leadership.

- •Led cross-functional teams to assess strategic investment opportunities, resulting in expansion into two international markets.

- •Analysed financial reports to identify trends and guided leadership decisions, contributing to a 20% cost reduction strategy.

- •Championed a continuous improvement culture, enabling finance team innovations that increased financial report efficiency by 50%.

- •Led analytical projects that provided insights for expanding operations, directly contributing to a $100M investment decision.

- •Enhanced financial models forecasting accuracy by 30%, enabling better resource allocation and strategic planning capacities.

- •Collaborated with department leaders to synchronize financial plans with operational goals, facilitating 15% revenue growth annually.

- •Redesigned financial reporting processes, shortening delivery time by 20%, which improved strategic decision-making cycles company-wide.

- •Implemented financial systems that improved expense management, achieving a 10% reduction in operating costs within two years.

- •Developed and executed finance strategies ensuring alignment and compliance with corporate policies and industry standards.

- •Managed month-end closures and reconciliations, improving the accuracy and reliability of financial reports by 25%.

- •Facilitated strategic financial planning sessions with senior management, resulting in 20% improved financial strategies efficiency.

Crafting the perfect resume as a VP of Finance is much like managing a complex investment portfolio. You’ve accumulated years of financial expertise and strategic insight, yet transforming that into a polished document poses a challenge. In today’s competitive job market, your resume needs to seamlessly blend your financial skills with your leadership and vision. It’s not just about listing numbers; it’s about weaving a narrative of your career achievements and future potential.

Faced with this task, you might think, “Where do I start?” This is where employing clear planning and structure becomes essential. Utilizing a resume template can streamline the process by providing you with a professional framework. This allows you to pour your energy into crafting the content that matters most.

Your role as a VP of Finance involves mastering financial systems while excelling in budgeting, forecasting, and strategic planning. The real challenge is articulating this blend of leadership and precision in your resume. Through a well-crafted resume, you can create a bridge that connects your past successes with the goals of future employers.

Think of your resume as more than a piece of paper—it’s your gateway to new opportunities. Taking the time to refine your resume can set you apart in a sea of candidates. Let’s jump into creating the resume that truly reflects your worth.

Key Takeaways

- Crafting a VP of Finance resume involves creating a narrative that reflects financial expertise and leadership, seamlessly blending past achievements with future potential.

- A well-structured resume highlights your financial management skills and strategic planning, demonstrating your role in supporting business growth and efficiency improvements.

- A reverse chronological format is recommended to showcase career progression, while clear formatting, such as PDF format and modern fonts, ensures readability and professionalism.

- Include a skills section with both hard and soft skills, ensuring alignment with industry tasks, and incorporate relevant education and certifications to establish credibility.

- Integrating extra sections such as languages, hobbies, volunteer work, and influential books can provide a more comprehensive view of personal and professional attributes.

What to focus on when writing your VP of finance resume

Your VP of Finance resume should seamlessly demonstrate your expertise in financial leadership and strategic decision-making. Start by highlighting your ability to manage budgets efficiently and improve financial processes, which directly supports business growth. This connection will help the recruiter understand your vital role in overseeing financial health and guiding business strategy.

How to structure your VP of finance resume

- Contact Information: At the top of your resume, clear contact details are essential. Your name should be prominent, followed by your phone number and a professional email address. Ensure these are updated to avoid missed opportunities and give the recruiter confidence in reaching you immediately—essential for starting any conversation about your candidacy.

- Professional Summary: This section provides a snapshot of what makes you a strong candidate. Highlight your leadership experience in finance and your strategic planning skills. Recall a few key accomplishments that demonstrate impact. This sets the tone for the recruiter, making them eager to learn more about your background.

- Experience: Use this section to underline your financial management history. Include specific achievements, like how you've optimized budgets or delivered significant cost savings. This section should connect your experiences to measurable results, making it clear how you can contribute to future employers.

- Education: Highlight your degree in finance or a related field with clarity. If you have advanced certifications like CPA or CFA, include these credentials as they underscore your expertise. Your educational background provides the foundation for your skills and experiences.

- Skills: This is where you detail your financial analysis capabilities, budget management, and risk assessment expertise. Use this space to align your skills with your past roles, and include proficiency with financial software to showcase your technical acumen. These skills are the building blocks of your strategy-making ability.

- Leadership: Demonstrate your leadership experience with examples such as leading financial teams and cross-functional projects. Highlight initiatives you've spearheaded and the impact they had. Showcasing these experiences illustrates your capability to lead and influence at a high level.

Now that we've outlined the key sections, we will delve deeper into each to ensure your resume stands out and effectively conveys your capabilities.

Which resume format to choose

Putting together a standout resume for a VP of Finance involves selecting elements that reflect your professional expertise and experience seamlessly. Begin with a reverse chronological format. This structure naturally highlights your career progression and recent pivotal roles, crucial in demonstrating your journey and growth within the finance industry.

Choosing the right fonts plays a subtle yet influential role in how your resume is perceived. Opt for options like Rubik, Lato, and Montserrat. These fonts strike a balance between modern design and professional appeal, ensuring that your resume maintains clarity and readability—an essential aspect when presenting detailed financial data and accomplishments.

Formatting your resume as a PDF is key. This choice ensures your carefully crafted layout remains intact across all devices and platforms, providing a consistent and polished view for potential employers and reflecting the meticulous attention to detail that's critical in finance roles.

Finally, maintain uniform margins, ideally set at one inch on all sides. This setup offers ample white space, enhancing readability and projecting a tidy, organized appearance. It reflects the structured approach expected in finance, where precision and organization are paramount.

By integrating these elements thoughtfully, you craft a resume that not only showcases your leadership and expertise in finance but also delivers it in a way that's coherent and visually engaging.

How to write a quantifiable resume experience section

Creating an impressive VP of Finance experience section in your resume is essential for making an impact on potential employers. You should emphasize your strategic financial leadership and notable accomplishments. Start by structuring this section in reverse chronological order, showcasing your most recent and relevant roles first. This helps employers see your career progression clearly. Aim to include about 10-15 years of experience, unless earlier roles are particularly noteworthy for demonstrating growth or responsibility. Tailor your resume to the job ad by aligning your experiences with the specific language and requirements mentioned. Using strong action words such as "spearheaded," "optimized," and "transformed" further highlights your impact. This section serves to underscore your unique value as a finance leader.

Here's a tailored example for a VP of Finance role:

- •Increased annual revenue by 20% through strategic cost management and process improvements.

- •Reduced financial reporting errors by 50% by implementing a new automated system.

- •Led a team of 15 finance professionals, resulting in a 30% improvement in productivity.

- •Devised a debt restructuring plan that reduced interest expenses by $2 million annually.

This example effectively highlights your financial leadership by presenting clear, quantifiable achievements at a major organization. What makes it stand out is how it connects your responsibilities to measurable outcomes, which is exactly what potential employers are looking for. By focusing each bullet point on concrete results, such as boosting revenue or reducing errors, you demonstrate a proven track record of impact. Including details about the size of your team and the financial gains achieved showcases your ability to manage people and resources effectively. This clear and concise language ensures that hiring managers quickly understand your value, making your experience section both informative and engaging.

Project-Focused resume experience section

A project-focused VP of Finance resume experience section should effectively highlight your leadership in driving initiatives that lead to financial growth and improved efficiency. By presenting your strategic thinking and decision-making abilities, you can illustrate how you've successfully steered major projects. This involves managing diverse teams, implementing cost-saving measures, and launching systems that enhance financial outcomes.

To achieve this, use clear and impactful language in your bullet points to describe projects and their results. By quantifying your achievements, you can showcase the tangible benefits you've brought to the organization. Including a variety of examples that reflect different aspects of your expertise, such as budget management or securing compliance, demonstrates your ability to handle projects that align with the company's financial goals, further solidifying your role as a dynamic leader within the organization.

VP of Finance

Global Tech Inc.

2019-2022

- Led a cross-departmental project to cut company costs by 25% through better vendor management.

- Implemented a new budget forecasting system, achieving a 15% improvement in financial predictability.

- Coordinated a team to introduce new financial reporting software, reducing report generation time by 40%.

- Championed a company-wide drive to enhance compliance, culminating in a flawless audit with zero findings.

Innovation-Focused resume experience section

A finance-focused VP of Finance resume experience section should effectively highlight your leadership and strategic strengths, particularly in driving innovation. Begin with concise headings that showcase your contributions to enhancing financial growth through creative solutions and advanced strategies. Demonstrate how you've led cross-functional teams, embraced new technologies, and managed change efficiently. These elements come together to display how you've bolstered financial processes and outcomes within the organization.

In each role, craft bullet points that connect your innovative strategies to tangible results. Use strong action verbs to illustrate how you developed and implemented these financial strategies. Showcasing your ability to find cost-saving opportunities, foster collaboration across departments, and influence critical decisions creates a cohesive picture of your impact. By ensuring that each bullet point clearly demonstrates measurable successes—such as boosting profitability, streamlining operations, or sharpening financial planning—you guide the reader through a narrative of your achievements.

VP of Finance

Tech Innovations Inc.

January 2017 - Present

- Led the design and implementation of an automated financial reporting system, cutting errors by 30% and saving 400 work hours annually.

- Introduced data analytics tools to improve forecasting accuracy, leading to a 15% improvement in budget predictions.

- Negotiated a major vendor contract to slash annual expenses by $1.5 million through strategic cost management.

- Teamed up with IT to create a real-time financial dashboard, speeding up decision-making across departments.

Responsibility-Focused resume experience section

A responsibility-focused VP of Finance resume experience section should effectively tell a compelling story of your professional impact. Begin by pinpointing the areas where you've significantly contributed, such as strategic financial planning or team leadership. Choose the responsibilities that truly made a difference and explain how they drove success in your previous positions. Present these achievements in bullet points for clarity and back them up with numbers or specific outcomes to emphasize your ability to enhance financial efficiency and profitability.

Delve into your leadership and decision-making skills, showcasing examples where your actions led to positive results, such as reducing costs or increasing revenue. Highlight any mentoring or training initiatives you led to demonstrate your capacity to guide and inspire others. Use active and direct language to convey confidence and authority. Together, these elements should vividly illustrate your ability to steer financial strategy and foster growth within an organization.

VP of Finance

Tech Innovators Inc.

June 2018 - August 2023

- Implemented quarterly financial review process, increasing budget accuracy by 15%

- Led negotiations that reduced annual vendor costs by 10%

- Developed financial models that increased forecast accuracy by 20%

- Managed a team of 10 analysts, enhancing team productivity by 25%

Result-Focused resume experience section

A result-focused VP of Finance resume experience section should begin by highlighting your key achievements that align with the role's requirements. It's important to emphasize measurable outcomes rather than just a list of tasks, clearly demonstrating how you contributed to financial strategies, budget management, and process enhancements. Each bullet point should illustrate the positive impact you had on the company’s financial success, using strong action verbs to convey your accomplishments confidently.

Contextualizing your achievements by mentioning challenges you faced or innovative solutions you implemented can offer potential employers insight into your capability to handle complex situations and drive results. Make sure to tailor your resume for each job application, ensuring it remains relevant. This approach not only showcases your expertise but also improves your chances of leaving a lasting impression.

VP of Finance

XYZ Corporation

Jan 2018 - Present

- Raised company revenue by 25% through effective budgeting and cost-control strategies.

- Implemented a new financial reporting system, cutting report generation time by 40%.

- Guided a team of 15 finance professionals during a major acquisition, ensuring a smooth transition.

- Reduced overhead costs by $500,000 annually by streamlining financial operations.

Write your VP of finance resume summary section

A finance-focused VP of Finance resume summary should effectively capture the core of your career while highlighting your most impressive achievements. In this section, you'll want to express your experience, skills, and what sets you apart from other candidates. Emphasizing your financial leadership and ability to drive growth and profitability is key. For instance, if you're an experienced VP of Finance, your summary might read like this:

This summary works well because it succinctly outlines your extensive experience, quantifies achievements, and showcases leadership skills. By doing so, it provides potential employers with a quick view of your capabilities and significant accomplishments. When you describe yourself in a resume summary, aim to highlight your strengths and align them with the employer's needs. This section is different from a resume objective, which often focuses on your career goals rather than past successes. While a resume profile introduces a mix of skills, experiences, and personal traits, a summary of qualifications offers a brief list of your top competencies and achievements. Both the summary and objective are short yet targeted, though a summary emphasizes what you have accomplished while an objective highlights your future goals. Choosing between a summary and an objective depends on your career stage and the specific job role you’re applying for.

Listing your VP of finance skills on your resume

A skills-focused VP of Finance resume should effectively highlight your abilities in a dedicated section, or you can integrate them into the experience and summary sections. Your skills and strengths, such as leadership and communication, demonstrate your capability to collaborate and manage teams successfully. In contrast, hard skills are specific abilities or knowledge areas, like financial analysis and budget management, that showcase your technical proficiency.

Incorporating well-chosen skills and strengths into your resume serves as important keywords. These keywords can help your application stand out to employers and applicant tracking systems by reflecting your capabilities and how you can contribute to the organization's goals.

Here’s a JSON example of a standalone skills section:

This skills section effectively highlights abilities crucial for the VP of Finance role, demonstrating your expertise and readiness to tackle high-level financial responsibilities. Connecting each skill to common industry tasks ensures relevancy and targeted impact.

Best hard skills to feature on your VP of Finance resume

As a VP of Finance, your hard skills should clearly showcase your technical knowledge and strategic acumen. This demonstrates your ability to handle complex financial tasks and contribute significantly to the company’s success.

Hard Skills

- Financial Analysis

- Budget Management

- Strategic Planning

- Risk Management

- Cash Flow Management

- Financial Reporting

- Tax Compliance

- Investment Management

- Accounting Software Proficiency

- Cost Reduction Strategies

- Treasury Management

- Forecasting & Modeling

- Mergers & Acquisitions

- Regulatory Knowledge

- Data Analysis

Best soft skills to feature on your VP of Finance resume

For a VP of Finance, soft skills are crucial as they demonstrate your leadership, communication, and management strengths. These skills highlight your ability to work well in a team and manage various challenges effectively.

Soft Skills

- Leadership

- Communication

- Problem Solving

- Team Management

- Decision Making

- Adaptability

- Negotiation

- Conflict Resolution

- Emotional Intelligence

- Time Management

- Initiative

- Attention to Detail

- Critical Thinking

- Collaboration

- Stakeholder Management

How to include your education on your resume

The education section is an important part of your VP of Finance resume. This section should highlight your academic achievements and be closely tailored to match the job you're applying for. Including only relevant educational backgrounds is crucial; irrelevant education could distract or confuse the recruiter. When noting your GPA, include it only if it enhances your profile, typically if it's above 3.0. Listing your GPA can be done like this: "GPA: 3.8/4.0." If you graduated with honors, such as cum laude, make sure to note that beside your degree, for example: "Bachelor of Science in Finance, cum laude." When listing a degree, concise details such as the degree type, major, and institution are important.

Here's a wrong example of an education section:

- •Member of the Book Club

Here's a right example of an education section with an outstanding VP of Finance resume education section:

The second example is well-suited for a VP of Finance role. It highlights advanced and relevant degrees in business and finance from prestigious institutions. Noting the GPA emphasizes academic excellence, which is a strong point for high-caliber roles. Including honors like cum laude underlines achievement and dedication, which are characteristics highly valued by employers.

How to include VP of finance certificates on your resume

Including a certificates section in your VP of Finance resume is essential. Start by listing the name of each certificate clearly. Include the date you obtained each certificate to show your up-to-date qualifications. Add the issuing organization to give credibility to your skills. This section highlights your specialized knowledge and can set you apart from other candidates.

You can also include certificates in the header of your resume for immediate visibility. For example: "John Doe, CPA, CFA, VP of Finance." This approach emphasizes your qualifications right from the start.

Here is an example of a standalone certificates section:

This example is effective because it includes highly relevant certificates for a VP of Finance. The certificates are well-recognized and directly related to the skills needed for high-level financial management. Including the issuer adds authenticity and sets a strong impression.

Extra sections to include in your VP of finance resume

In the fast-paced world of corporate finance, the role of a VP of Finance demands not only technical expertise but also a well-rounded profile. As you perfect your resume, consider including sections that highlight your language skills, personal interests, volunteer work, and even your favorite books. These aspects can make you stand out and show a prospective employer your multifaceted personality.

Languages section — Highlight fluency in multiple languages to show your ability to communicate in diverse business environments. This can be particularly beneficial in multinational corporations where cross-border transactions are frequent.

Hobbies and interests section — Showcase your hobbies to illustrate a well-rounded personality and potential for creative thinking. Include pursuits that demonstrate leadership, team collaboration, or stress management, like sports or artistic activities.

Volunteer work section — Point out your volunteer roles to underscore your commitment to social responsibility and community service. Mentioning volunteer work can also highlight your leadership skills and ability to balance multiple commitments.

Books section — List influential books you’ve read to show your dedication to continuous learning and intellectual growth. Choose books that are relevant to finance or leadership to underline your commitment to professional development.

Including these sections in your resume can provide a richer picture of who you are as a person and a professional. It can give hiring managers insights into your diverse skills and interests that go beyond typical job experience, making your application more memorable. Ensure the details are pertinent and genuinely reflect your experiences and interests for maximum impact.

In Conclusion

In conclusion, your resume as a VP of Finance serves as more than just a historical document of your career; it is a strategic tool to showcase your expertise and potential. Crafting a compelling resume involves more than simply listing your achievements; it requires constructing a narrative that reflects your leadership in the financial domain. From highlighting measurable successes to demonstrating your strategic vision, your resume should clearly convey your ability to drive financial growth and manage complex projects. Utilize clear formatting and modern design elements to ensure your resume is easily readable and presents a professional image. Tailor each section to reflect the specific skills and experiences that align with the job you're seeking, ensuring that your resume speaks directly to the needs of potential employers. Including sections on education, certifications, and even personal interests can provide a well-rounded view of your capabilities and character, setting you apart in a crowded job market. By investing time and effort into creating this personal marketing tool, you position yourself not only as an experienced candidate but as a visionary leader ready to embrace new opportunities in the world of finance.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.