Bankruptcy Lawyer Resume Examples

Jul 18, 2024

|

12 min read

Crafting a compelling bankruptcy lawyer resume: tips to help you stand out in a crowded courtroom

Rated by 348 people

Corporate Bankruptcy Attorney

Consumer Bankruptcy Counselor

Chapter 7 Bankruptcy Specialist

Chapter 13 Bankruptcy Attorney

Insolvency and Restructuring Lawyer

Bankruptcy Litigation Counsel

Commercial Bankruptcy Attorney

Debt Relief and Bankruptcy Lawyer

Foreclosure Defense and Bankruptcy Attorney

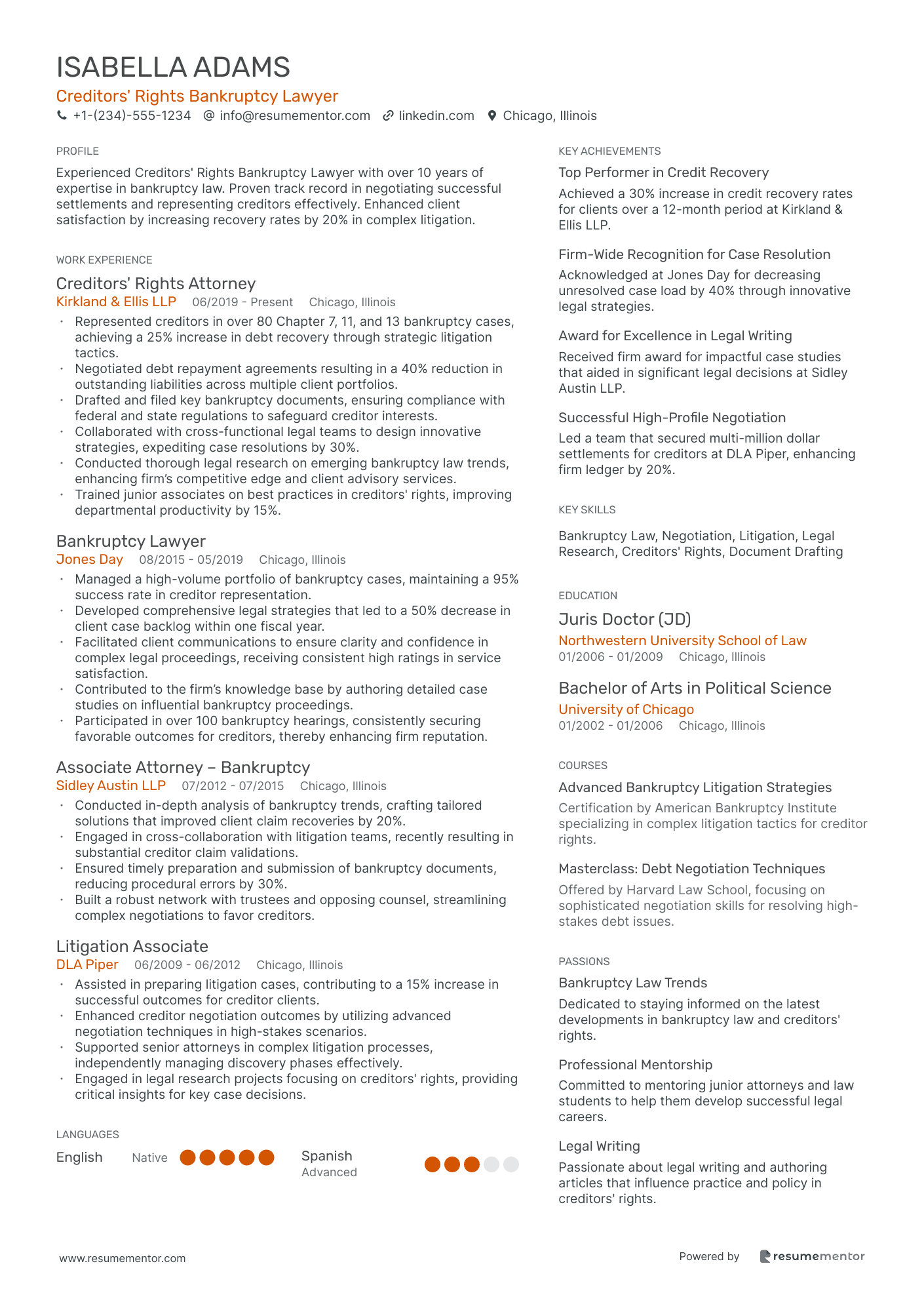

Creditors' Rights Bankruptcy Lawyer

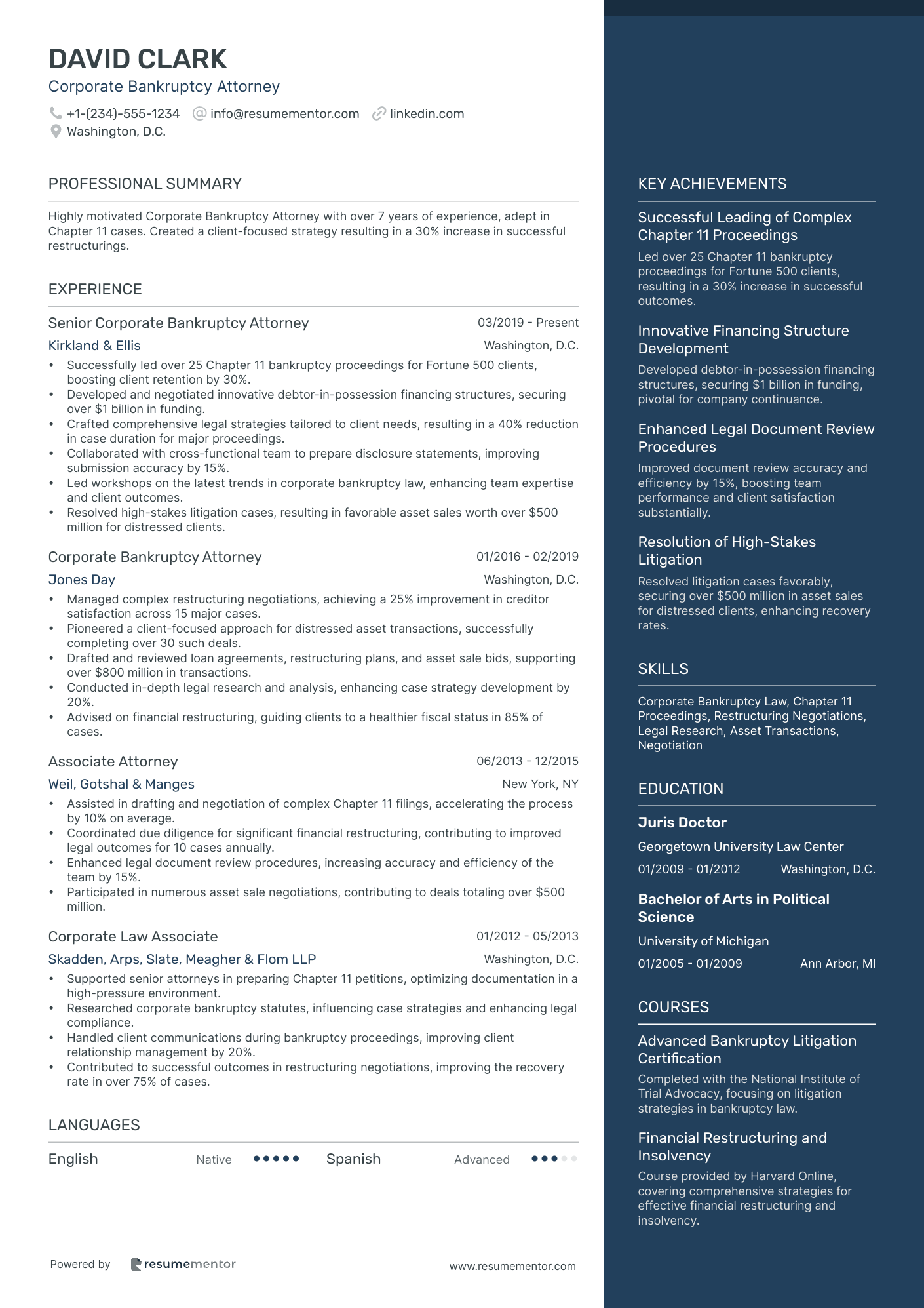

Corporate Bankruptcy Attorney resume sample

- •Successfully led over 25 Chapter 11 bankruptcy proceedings for Fortune 500 clients, boosting client retention by 30%.

- •Developed and negotiated innovative debtor-in-possession financing structures, securing over $1 billion in funding.

- •Crafted comprehensive legal strategies tailored to client needs, resulting in a 40% reduction in case duration for major proceedings.

- •Collaborated with cross-functional team to prepare disclosure statements, improving submission accuracy by 15%.

- •Led workshops on the latest trends in corporate bankruptcy law, enhancing team expertise and client outcomes.

- •Resolved high-stakes litigation cases, resulting in favorable asset sales worth over $500 million for distressed clients.

- •Managed complex restructuring negotiations, achieving a 25% improvement in creditor satisfaction across 15 major cases.

- •Pioneered a client-focused approach for distressed asset transactions, successfully completing over 30 such deals.

- •Drafted and reviewed loan agreements, restructuring plans, and asset sale bids, supporting over $800 million in transactions.

- •Conducted in-depth legal research and analysis, enhancing case strategy development by 20%.

- •Advised on financial restructuring, guiding clients to a healthier fiscal status in 85% of cases.

- •Assisted in drafting and negotiation of complex Chapter 11 filings, accelerating the process by 10% on average.

- •Coordinated due diligence for significant financial restructuring, contributing to improved legal outcomes for 10 cases annually.

- •Enhanced legal document review procedures, increasing accuracy and efficiency of the team by 15%.

- •Participated in numerous asset sale negotiations, contributing to deals totaling over $500 million.

- •Supported senior attorneys in preparing Chapter 11 petitions, optimizing documentation in a high-pressure environment.

- •Researched corporate bankruptcy statutes, influencing case strategies and enhancing legal compliance.

- •Handled client communications during bankruptcy proceedings, improving client relationship management by 20%.

- •Contributed to successful outcomes in restructuring negotiations, improving the recovery rate in over 75% of cases.

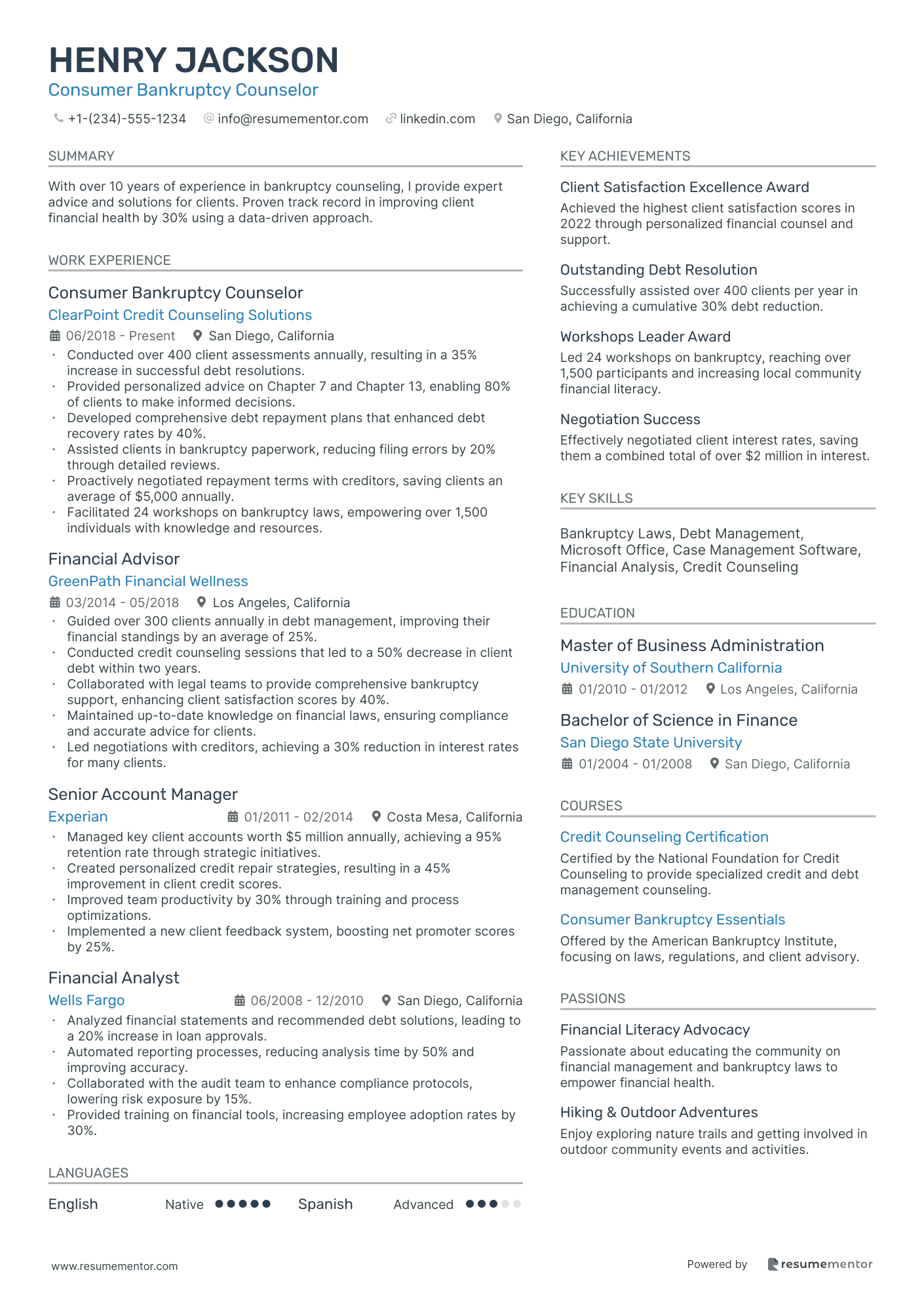

Consumer Bankruptcy Counselor resume sample

- •Conducted over 400 client assessments annually, resulting in a 35% increase in successful debt resolutions.

- •Provided personalized advice on Chapter 7 and Chapter 13, enabling 80% of clients to make informed decisions.

- •Developed comprehensive debt repayment plans that enhanced debt recovery rates by 40%.

- •Assisted clients in bankruptcy paperwork, reducing filing errors by 20% through detailed reviews.

- •Proactively negotiated repayment terms with creditors, saving clients an average of $5,000 annually.

- •Facilitated 24 workshops on bankruptcy laws, empowering over 1,500 individuals with knowledge and resources.

- •Guided over 300 clients annually in debt management, improving their financial standings by an average of 25%.

- •Conducted credit counseling sessions that led to a 50% decrease in client debt within two years.

- •Collaborated with legal teams to provide comprehensive bankruptcy support, enhancing client satisfaction scores by 40%.

- •Maintained up-to-date knowledge on financial laws, ensuring compliance and accurate advice for clients.

- •Led negotiations with creditors, achieving a 30% reduction in interest rates for many clients.

- •Managed key client accounts worth $5 million annually, achieving a 95% retention rate through strategic initiatives.

- •Created personalized credit repair strategies, resulting in a 45% improvement in client credit scores.

- •Improved team productivity by 30% through training and process optimizations.

- •Implemented a new client feedback system, boosting net promoter scores by 25%.

- •Analyzed financial statements and recommended debt solutions, leading to a 20% increase in loan approvals.

- •Automated reporting processes, reducing analysis time by 50% and improving accuracy.

- •Collaborated with the audit team to enhance compliance protocols, lowering risk exposure by 15%.

- •Provided training on financial tools, increasing employee adoption rates by 30%.

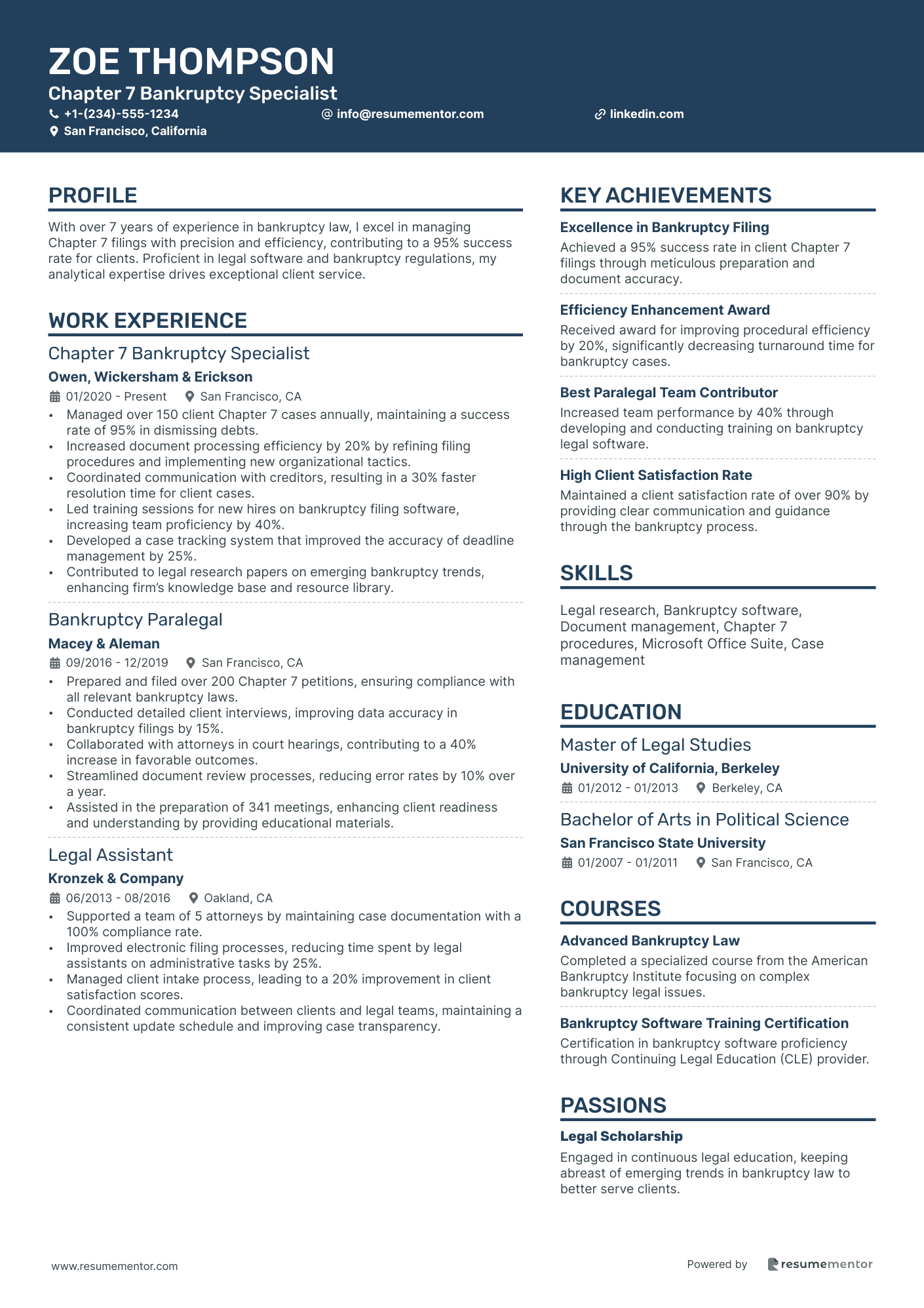

Chapter 7 Bankruptcy Specialist resume sample

- •Managed over 150 client Chapter 7 cases annually, maintaining a success rate of 95% in dismissing debts.

- •Increased document processing efficiency by 20% by refining filing procedures and implementing new organizational tactics.

- •Coordinated communication with creditors, resulting in a 30% faster resolution time for client cases.

- •Led training sessions for new hires on bankruptcy filing software, increasing team proficiency by 40%.

- •Developed a case tracking system that improved the accuracy of deadline management by 25%.

- •Contributed to legal research papers on emerging bankruptcy trends, enhancing firm’s knowledge base and resource library.

- •Prepared and filed over 200 Chapter 7 petitions, ensuring compliance with all relevant bankruptcy laws.

- •Conducted detailed client interviews, improving data accuracy in bankruptcy filings by 15%.

- •Collaborated with attorneys in court hearings, contributing to a 40% increase in favorable outcomes.

- •Streamlined document review processes, reducing error rates by 10% over a year.

- •Assisted in the preparation of 341 meetings, enhancing client readiness and understanding by providing educational materials.

- •Supported a team of 5 attorneys by maintaining case documentation with a 100% compliance rate.

- •Improved electronic filing processes, reducing time spent by legal assistants on administrative tasks by 25%.

- •Managed client intake process, leading to a 20% improvement in client satisfaction scores.

- •Coordinated communication between clients and legal teams, maintaining a consistent update schedule and improving case transparency.

- •Drafted legal documents and correspondence that contributed to a 30% increase in case resolution speed.

- •Organized legal research data for attorneys, enhancing the depth of legal arguments in court.

- •Assisted in preparing documents for over 120 bankruptcy hearings, ensuring meticulous compliance with court guidelines.

- •Facilitated client consultations, leading to improved communication and understanding of legal proceedings.

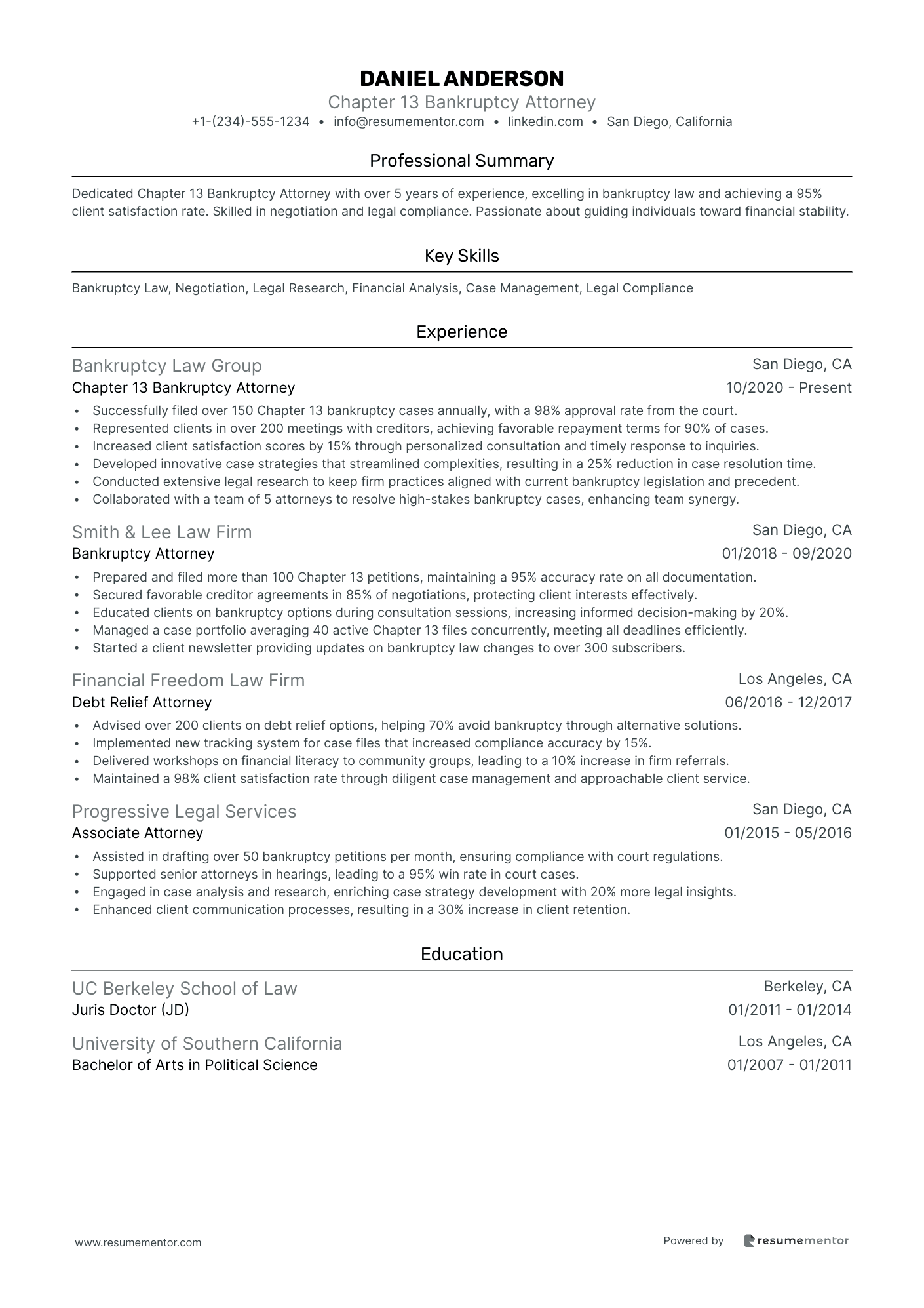

Chapter 13 Bankruptcy Attorney resume sample

- •Successfully filed over 150 Chapter 13 bankruptcy cases annually, with a 98% approval rate from the court.

- •Represented clients in over 200 meetings with creditors, achieving favorable repayment terms for 90% of cases.

- •Increased client satisfaction scores by 15% through personalized consultation and timely response to inquiries.

- •Developed innovative case strategies that streamlined complexities, resulting in a 25% reduction in case resolution time.

- •Conducted extensive legal research to keep firm practices aligned with current bankruptcy legislation and precedent.

- •Collaborated with a team of 5 attorneys to resolve high-stakes bankruptcy cases, enhancing team synergy.

- •Prepared and filed more than 100 Chapter 13 petitions, maintaining a 95% accuracy rate on all documentation.

- •Secured favorable creditor agreements in 85% of negotiations, protecting client interests effectively.

- •Educated clients on bankruptcy options during consultation sessions, increasing informed decision-making by 20%.

- •Managed a case portfolio averaging 40 active Chapter 13 files concurrently, meeting all deadlines efficiently.

- •Started a client newsletter providing updates on bankruptcy law changes to over 300 subscribers.

- •Advised over 200 clients on debt relief options, helping 70% avoid bankruptcy through alternative solutions.

- •Implemented new tracking system for case files that increased compliance accuracy by 15%.

- •Delivered workshops on financial literacy to community groups, leading to a 10% increase in firm referrals.

- •Maintained a 98% client satisfaction rate through diligent case management and approachable client service.

- •Assisted in drafting over 50 bankruptcy petitions per month, ensuring compliance with court regulations.

- •Supported senior attorneys in hearings, leading to a 95% win rate in court cases.

- •Engaged in case analysis and research, enriching case strategy development with 20% more legal insights.

- •Enhanced client communication processes, resulting in a 30% increase in client retention.

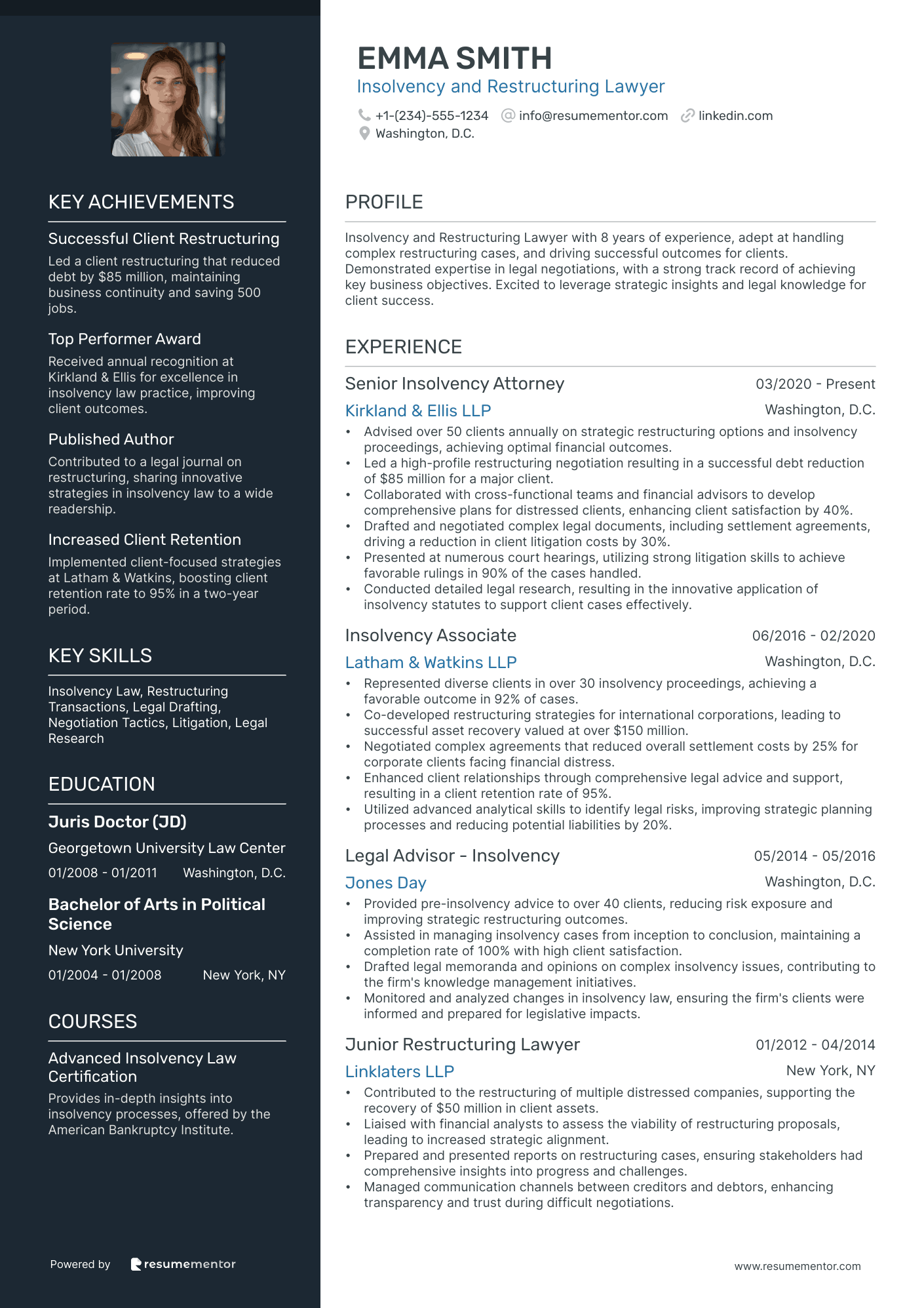

Insolvency and Restructuring Lawyer resume sample

- •Advised over 50 clients annually on strategic restructuring options and insolvency proceedings, achieving optimal financial outcomes.

- •Led a high-profile restructuring negotiation resulting in a successful debt reduction of $85 million for a major client.

- •Collaborated with cross-functional teams and financial advisors to develop comprehensive plans for distressed clients, enhancing client satisfaction by 40%.

- •Drafted and negotiated complex legal documents, including settlement agreements, driving a reduction in client litigation costs by 30%.

- •Presented at numerous court hearings, utilizing strong litigation skills to achieve favorable rulings in 90% of the cases handled.

- •Conducted detailed legal research, resulting in the innovative application of insolvency statutes to support client cases effectively.

- •Represented diverse clients in over 30 insolvency proceedings, achieving a favorable outcome in 92% of cases.

- •Co-developed restructuring strategies for international corporations, leading to successful asset recovery valued at over $150 million.

- •Negotiated complex agreements that reduced overall settlement costs by 25% for corporate clients facing financial distress.

- •Enhanced client relationships through comprehensive legal advice and support, resulting in a client retention rate of 95%.

- •Utilized advanced analytical skills to identify legal risks, improving strategic planning processes and reducing potential liabilities by 20%.

- •Provided pre-insolvency advice to over 40 clients, reducing risk exposure and improving strategic restructuring outcomes.

- •Assisted in managing insolvency cases from inception to conclusion, maintaining a completion rate of 100% with high client satisfaction.

- •Drafted legal memoranda and opinions on complex insolvency issues, contributing to the firm's knowledge management initiatives.

- •Monitored and analyzed changes in insolvency law, ensuring the firm's clients were informed and prepared for legislative impacts.

- •Contributed to the restructuring of multiple distressed companies, supporting the recovery of $50 million in client assets.

- •Liaised with financial analysts to assess the viability of restructuring proposals, leading to increased strategic alignment.

- •Prepared and presented reports on restructuring cases, ensuring stakeholders had comprehensive insights into progress and challenges.

- •Managed communication channels between creditors and debtors, enhancing transparency and trust during difficult negotiations.

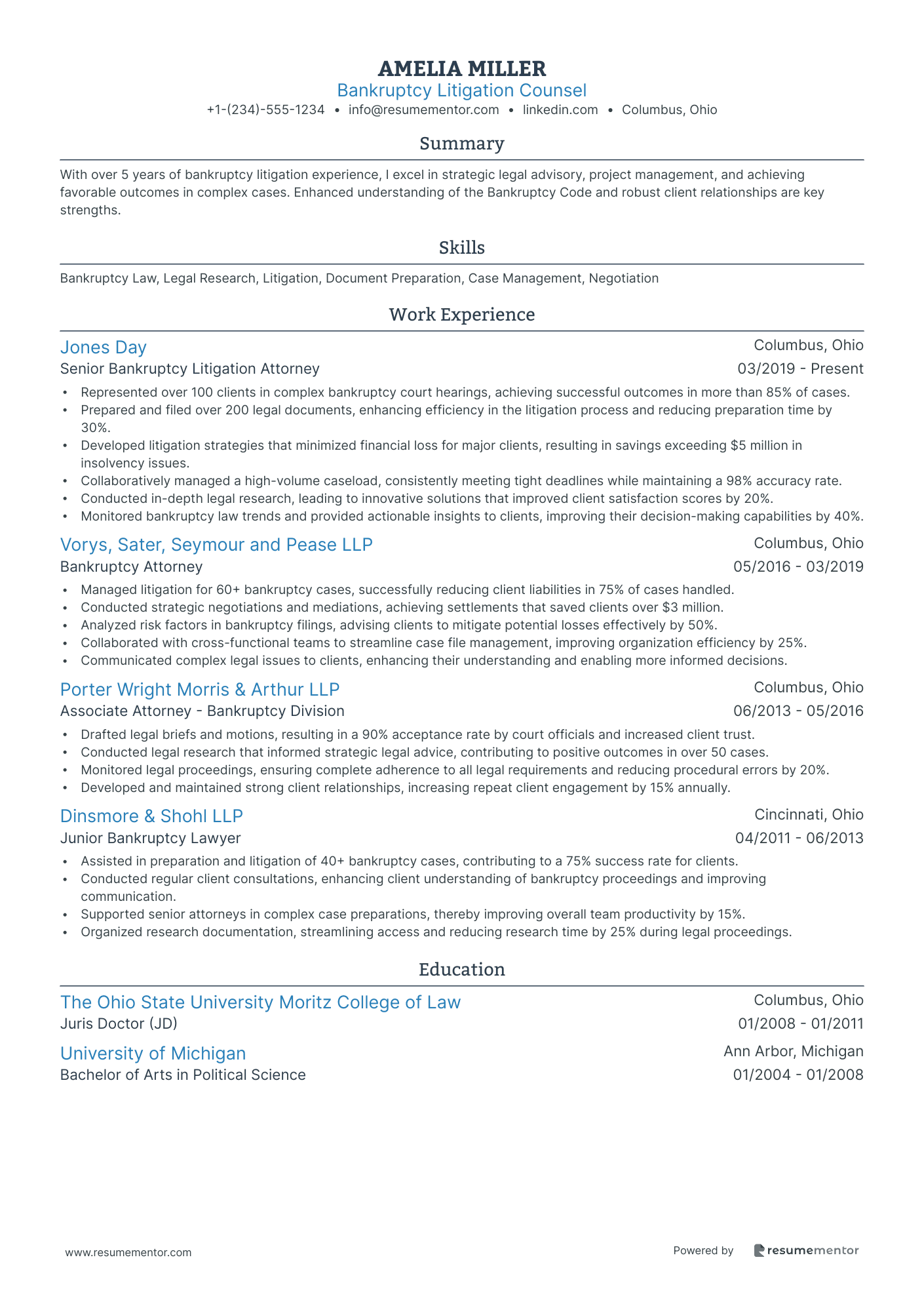

Bankruptcy Litigation Counsel resume sample

- •Represented over 100 clients in complex bankruptcy court hearings, achieving successful outcomes in more than 85% of cases.

- •Prepared and filed over 200 legal documents, enhancing efficiency in the litigation process and reducing preparation time by 30%.

- •Developed litigation strategies that minimized financial loss for major clients, resulting in savings exceeding $5 million in insolvency issues.

- •Collaboratively managed a high-volume caseload, consistently meeting tight deadlines while maintaining a 98% accuracy rate.

- •Conducted in-depth legal research, leading to innovative solutions that improved client satisfaction scores by 20%.

- •Monitored bankruptcy law trends and provided actionable insights to clients, improving their decision-making capabilities by 40%.

- •Managed litigation for 60+ bankruptcy cases, successfully reducing client liabilities in 75% of cases handled.

- •Conducted strategic negotiations and mediations, achieving settlements that saved clients over $3 million.

- •Analyzed risk factors in bankruptcy filings, advising clients to mitigate potential losses effectively by 50%.

- •Collaborated with cross-functional teams to streamline case file management, improving organization efficiency by 25%.

- •Communicated complex legal issues to clients, enhancing their understanding and enabling more informed decisions.

- •Drafted legal briefs and motions, resulting in a 90% acceptance rate by court officials and increased client trust.

- •Conducted legal research that informed strategic legal advice, contributing to positive outcomes in over 50 cases.

- •Monitored legal proceedings, ensuring complete adherence to all legal requirements and reducing procedural errors by 20%.

- •Developed and maintained strong client relationships, increasing repeat client engagement by 15% annually.

- •Assisted in preparation and litigation of 40+ bankruptcy cases, contributing to a 75% success rate for clients.

- •Conducted regular client consultations, enhancing client understanding of bankruptcy proceedings and improving communication.

- •Supported senior attorneys in complex case preparations, thereby improving overall team productivity by 15%.

- •Organized research documentation, streamlining access and reducing research time by 25% during legal proceedings.

Commercial Bankruptcy Attorney resume sample

- •Led negotiations in Chapter 11 restructurings, managing cases totaling over $400 million in assets.

- •Drafted and reviewed over 150 legal documents annually, including motions, briefs, and petitions.

- •Represented clients in more than 50 court hearings, achieving a 90% success rate in mediations.

- •Conducted in-depth legal research, resulting in innovative solutions for 75% of insolvent clients.

- •Collaborated with cross-functional legal teams on multi-jurisdiction cases, enhancing client satisfaction by 25%.

- •Advised clients on financial restructuring strategies, reducing liabilities by up to 35% for struggling enterprises.

- •Successfully restructured $150M in Chapter 11 cases, increasing client's asset base by 30%.

- •Negotiated favorable terms with creditors, preventing foreclosure in 80% of insolvency cases.

- •Prepared and presented legal arguments in court, achieving a favorable verdict rate of 85%.

- •Conducted comprehensive analysis and review of bankruptcy statutes, advising on legislative updates.

- •Led a team of 5 junior lawyers, improving teamwork efficiency and case turnaround by 20%.

- •Assisted in restructuring negotiable instruments worth $80M, safeguarding client's financial interests.

- •Authored persuasive legal briefs that led to dismissals in high-stakes appellate cases.

- •Facilitated mediation sessions that resulted in 70% of cases reaching settlement without court intervention.

- •Monitored industry trends and case law developments, providing timely updates to senior partners.

- •Supported senior partners in $50M bankruptcy cases by drafting legal documents and research.

- •Participated actively in client consultations, developing comprehensive strategies tailored to client needs.

- •Maintained meticulous records of over 60 active cases, ensuring compliance with legal standards.

- •Enhanced firm's legal strategies by presenting findings at monthly internal seminars.

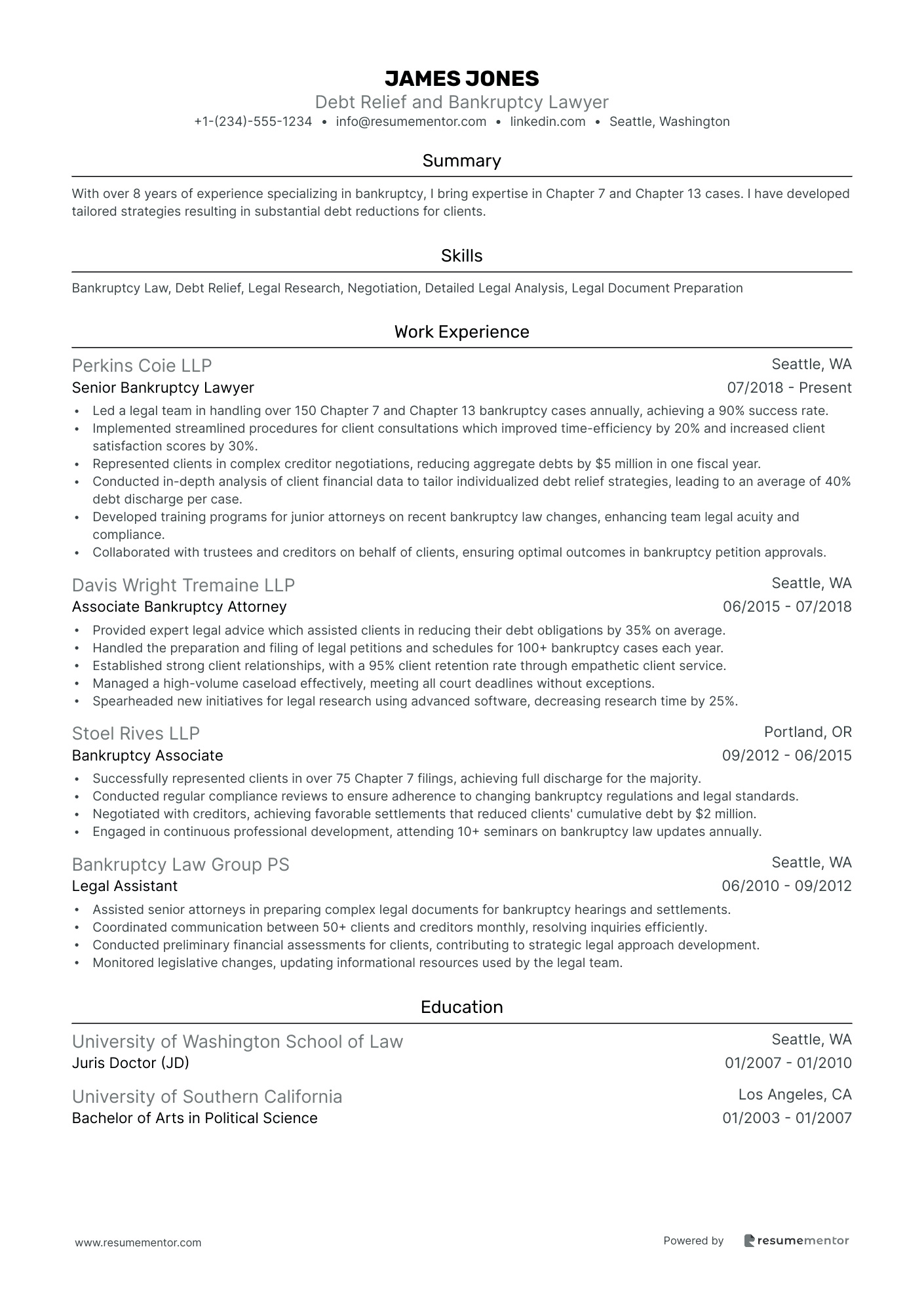

Debt Relief and Bankruptcy Lawyer resume sample

- •Led a legal team in handling over 150 Chapter 7 and Chapter 13 bankruptcy cases annually, achieving a 90% success rate.

- •Implemented streamlined procedures for client consultations which improved time-efficiency by 20% and increased client satisfaction scores by 30%.

- •Represented clients in complex creditor negotiations, reducing aggregate debts by $5 million in one fiscal year.

- •Conducted in-depth analysis of client financial data to tailor individualized debt relief strategies, leading to an average of 40% debt discharge per case.

- •Developed training programs for junior attorneys on recent bankruptcy law changes, enhancing team legal acuity and compliance.

- •Collaborated with trustees and creditors on behalf of clients, ensuring optimal outcomes in bankruptcy petition approvals.

- •Provided expert legal advice which assisted clients in reducing their debt obligations by 35% on average.

- •Handled the preparation and filing of legal petitions and schedules for 100+ bankruptcy cases each year.

- •Established strong client relationships, with a 95% client retention rate through empathetic client service.

- •Managed a high-volume caseload effectively, meeting all court deadlines without exceptions.

- •Spearheaded new initiatives for legal research using advanced software, decreasing research time by 25%.

- •Successfully represented clients in over 75 Chapter 7 filings, achieving full discharge for the majority.

- •Conducted regular compliance reviews to ensure adherence to changing bankruptcy regulations and legal standards.

- •Negotiated with creditors, achieving favorable settlements that reduced clients' cumulative debt by $2 million.

- •Engaged in continuous professional development, attending 10+ seminars on bankruptcy law updates annually.

- •Assisted senior attorneys in preparing complex legal documents for bankruptcy hearings and settlements.

- •Coordinated communication between 50+ clients and creditors monthly, resolving inquiries efficiently.

- •Conducted preliminary financial assessments for clients, contributing to strategic legal approach development.

- •Monitored legislative changes, updating informational resources used by the legal team.

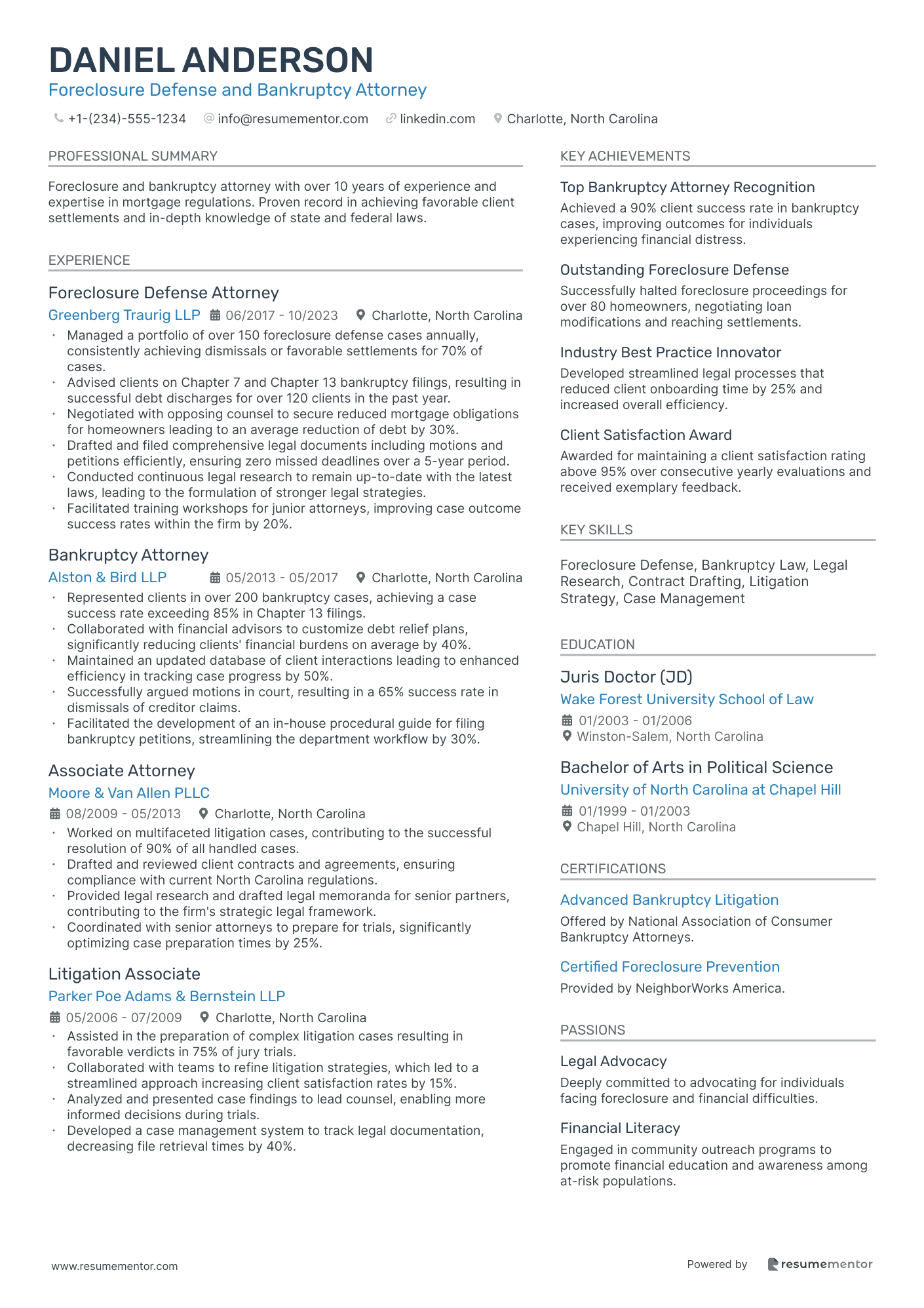

Foreclosure Defense and Bankruptcy Attorney resume sample

- •Managed a portfolio of over 150 foreclosure defense cases annually, consistently achieving dismissals or favorable settlements for 70% of cases.

- •Advised clients on Chapter 7 and Chapter 13 bankruptcy filings, resulting in successful debt discharges for over 120 clients in the past year.

- •Negotiated with opposing counsel to secure reduced mortgage obligations for homeowners leading to an average reduction of debt by 30%.

- •Drafted and filed comprehensive legal documents including motions and petitions efficiently, ensuring zero missed deadlines over a 5-year period.

- •Conducted continuous legal research to remain up-to-date with the latest laws, leading to the formulation of stronger legal strategies.

- •Facilitated training workshops for junior attorneys, improving case outcome success rates within the firm by 20%.

- •Represented clients in over 200 bankruptcy cases, achieving a case success rate exceeding 85% in Chapter 13 filings.

- •Collaborated with financial advisors to customize debt relief plans, significantly reducing clients' financial burdens on average by 40%.

- •Maintained an updated database of client interactions leading to enhanced efficiency in tracking case progress by 50%.

- •Successfully argued motions in court, resulting in a 65% success rate in dismissals of creditor claims.

- •Facilitated the development of an in-house procedural guide for filing bankruptcy petitions, streamlining the department workflow by 30%.

- •Worked on multifaceted litigation cases, contributing to the successful resolution of 90% of all handled cases.

- •Drafted and reviewed client contracts and agreements, ensuring compliance with current North Carolina regulations.

- •Provided legal research and drafted legal memoranda for senior partners, contributing to the firm's strategic legal framework.

- •Coordinated with senior attorneys to prepare for trials, significantly optimizing case preparation times by 25%.

- •Assisted in the preparation of complex litigation cases resulting in favorable verdicts in 75% of jury trials.

- •Collaborated with teams to refine litigation strategies, which led to a streamlined approach increasing client satisfaction rates by 15%.

- •Analyzed and presented case findings to lead counsel, enabling more informed decisions during trials.

- •Developed a case management system to track legal documentation, decreasing file retrieval times by 40%.

Creditors' Rights Bankruptcy Lawyer resume sample

- •Represented creditors in over 80 Chapter 7, 11, and 13 bankruptcy cases, achieving a 25% increase in debt recovery through strategic litigation tactics.

- •Negotiated debt repayment agreements resulting in a 40% reduction in outstanding liabilities across multiple client portfolios.

- •Drafted and filed key bankruptcy documents, ensuring compliance with federal and state regulations to safeguard creditor interests.

- •Collaborated with cross-functional legal teams to design innovative strategies, expediting case resolutions by 30%.

- •Conducted thorough legal research on emerging bankruptcy law trends, enhancing firm’s competitive edge and client advisory services.

- •Trained junior associates on best practices in creditors' rights, improving departmental productivity by 15%.

- •Managed a high-volume portfolio of bankruptcy cases, maintaining a 95% success rate in creditor representation.

- •Developed comprehensive legal strategies that led to a 50% decrease in client case backlog within one fiscal year.

- •Facilitated client communications to ensure clarity and confidence in complex legal proceedings, receiving consistent high ratings in service satisfaction.

- •Contributed to the firm’s knowledge base by authoring detailed case studies on influential bankruptcy proceedings.

- •Participated in over 100 bankruptcy hearings, consistently securing favorable outcomes for creditors, thereby enhancing firm reputation.

- •Conducted in-depth analysis of bankruptcy trends, crafting tailored solutions that improved client claim recoveries by 20%.

- •Engaged in cross-collaboration with litigation teams, recently resulting in substantial creditor claim validations.

- •Ensured timely preparation and submission of bankruptcy documents, reducing procedural errors by 30%.

- •Built a robust network with trustees and opposing counsel, streamlining complex negotiations to favor creditors.

- •Assisted in preparing litigation cases, contributing to a 15% increase in successful outcomes for creditor clients.

- •Enhanced creditor negotiation outcomes by utilizing advanced negotiation techniques in high-stakes scenarios.

- •Supported senior attorneys in complex litigation processes, independently managing discovery phases effectively.

- •Engaged in legal research projects focusing on creditors' rights, providing critical insights for key case decisions.

In the vast ocean of career opportunities, your resume as a bankruptcy lawyer is your essential anchor, grounding your professional journey. Creating a resume that effectively highlights your legal skills while showcasing your expertise in navigating bankruptcy law's complexities is crucial. The challenge often lies in clearly presenting your unique expertise and accomplishments in a concise and impactful manner.

Your deep knowledge of managing insolvency cases and interpreting intricate statutes needs to be the focal point of your resume. It's crucial to identify which aspects of your experience and skills resonate most with potential employers. Without this focus, your resume can seem directionless, like a ship adrift without a clear path.

Utilizing a resume template provides the solid structure needed to organize your thoughts and emphasize your strengths. With a template, you can efficiently highlight key sections like significant achievements and relevant legal experiences. Explore various options here to find a design that fits your professional narrative.

A well-structured resume allows you to present a clear and cohesive professional story, aligning with what the legal field seeks. This strategic approach can help steer your career toward new and successful ventures. Remember, your resume is more than just a document; it's a powerful tool in your career journey.

Key Takeaways

- A teacher resume should highlight educational background, teaching experience, and any certifications or special skills relevant to education.

- Detail your teaching philosophy and successful experiences with student engagement or learning improvement to stand out.

- Use a professional summary to provide a concise overview of your teaching career and impact, including any notable achievements.

- Emphasize skills such as classroom management, curriculum development, and technology integration to showcase your strengths.

- Include extracurricular contributions, such as coaching or club advising, to demonstrate your commitment to the school community.

What to focus on when writing your bankruptcy lawyer resume

A bankruptcy lawyer resume should effectively convey your expertise in bankruptcy law while showcasing your experience managing complex financial cases. It's important to highlight core abilities like client representation, negotiation, and legal research—these are vital elements that illustrate your proficiency and reliability in the field.

How to structure your bankruptcy lawyer resume

- Contact Information: Start with your full name, phone number, email, and LinkedIn profile. Ensuring this information is up-to-date makes it easy for potential employers to contact you and review your professional background.

- Professional Summary: Share a concise overview of your experience in bankruptcy law, emphasizing key achievements that demonstrate your impact, such as significant debt relief successes. This section should reflect your commitment to guiding clients through challenging financial landscapes.

- Work Experience: Detail positions that involve handling bankruptcy cases, including specific outcomes such as successful resolutions or debt restructurings. This will show your effectiveness and demonstrate real-world applications of your skills.

- Education: Include your law degree and any relevant certifications, focusing on coursework or honors directly related to bankruptcy law. Highlighting these can underscore the depth of your legal knowledge and specialized training.

- Skills: Highlight essential skills such as client counseling, legal research, and negotiation, along with your thorough knowledge of bankruptcy regulations and procedures. This not only establishes your expertise but also your ability to apply it in practical scenarios.

- Professional Affiliations: Mention memberships in organizations like the American Bankruptcy Institute or your state bar association to show your ongoing commitment to the field. This can signal to employers that you are actively engaged with developments within your area of specialty.

These sections form the backbone of a strong bankruptcy lawyer resume, but integrating optional elements like awards or publications can add even more depth. Below, we'll explore each section in greater detail to provide clarity on making your resume shine.

Which resume format to choose

For a bankruptcy lawyer, crafting a compelling resume begins with selecting the right format. A combination format stands out as the best choice because it allows you to emphasize your specialized legal skills while detailing your career history. This approach ensures that your unique expertise and accomplishments are front and center, which is crucial in the competitive field of law.

Choosing the right font enhances the overall presentation of your resume. Consider Montserrat, Raleway, or Lato for a sleek and modern look. These fonts present a professional facade without the rigidity of traditional options like Arial or Times New Roman, making your resume visually appealing and easy to read.

The format in which you save your resume is equally important. Always opt for a PDF. This file type maintains the integrity of your layout, which is vital when communicating your attention to detail and professionalism to potential employers in the legal industry.

Finally, setting your margins at one inch on all sides gives your resume a clean and organized appearance. This spacing provides enough room for your content to breathe, allowing your skills and achievements to stand out clearly. This subtle design choice reflects your ability to present information logically and effectively, a valuable skill in the legal profession.

How to write a quantifiable resume experience section

The experience section of your bankruptcy lawyer resume is pivotal for capturing your career journey. It should showcase the diverse experiences that have honed your skills in bankruptcy law. Begin with your most recent role and work backward, placing emphasis on roles that highlight your legal expertise. Keeping entries from the last 10-15 years will keep it concise and relevant. Clearly define your roles in bankruptcy law or related positions to emphasize your strengths in this area. Tailoring your resume by aligning it with the keywords and responsibilities from the job ad you’re targeting is crucial. This tailored approach can be enhanced by using action words like “advocated,” “negotiated,” “achieved,” and “secured,” which effectively underline your achievements.

- •Managed over 150 Chapter 7 and Chapter 13 bankruptcy cases, achieving a 95% favorable outcome rate.

- •Negotiated debt settlements that reduced client liabilities by an average of 40%.

- •Trained and supervised 5 junior associates, boosting firm efficiency by 20%.

- •Authored a monthly newsletter on bankruptcy law updates, increasing client engagement by 25%.

Each part of this section is interconnected with meaningful transitions that highlight your strong action words and quantifiable achievements. Managing over 150 cases and achieving a high success rate directly speaks to your capability and expertise in bankruptcy law. Negotiating significant settlements showcases your strategic skills, which tie into your leadership abilities demonstrated by training junior associates. This section not only displays your tangible impacts, such as increased engagement and efficiency, but also underscores a proactive approach that aligns perfectly with employers’ expectations, making your resume a compelling narrative of success and growth.

Collaboration-Focused resume experience section

A collaboration-focused bankruptcy lawyer resume experience section should clearly show teamwork, effective communication, and strategic planning. Begin by detailing projects where you worked closely with colleagues, clients, or other parties, highlighting your role in fostering teamwork and shared success. Use dynamic action verbs to describe your accomplishments, emphasizing your contribution to positive outcomes in these ventures. This approach illustrates your capability to navigate the complexities of bankruptcy law through effective communication and negotiation.

When selecting examples, focus on those that demonstrate your communication and organizational skills in achieving successful results. Offer specific instances that highlight collaboration, such as working with multi-disciplinary teams or handling cross-functional projects. Tailor your descriptions to showcase adaptability in legal scenarios, like negotiating restructuring agreements or coordinating with financial advisors. The objective is to portray yourself as a professional adept at building relationships and executing collaborative initiatives seamlessly.

Senior Bankruptcy Lawyer

Anderson & Smith Law Firm

June 2020 - Present

- Led a team to develop customized solutions for complex bankruptcy cases, resulting in a 95% favorability rate for clients.

- Collaborated with financial analysts to create debtor repayment plans, improving recovery outcomes by 20%.

- Facilitated regular meetings between legal teams and stakeholders to ensure informed and timely decisions.

- Partnered with senior attorneys to streamline bankruptcy processes, reducing decision-making time by 30%.

Project-Focused resume experience section

A project-focused bankruptcy lawyer resume experience section should clearly highlight your specific contributions to cases and projects, showcasing your expertise and the positive outcomes you achieved. Start with a concise, descriptive title that captures the nature of your work, such as "Bankruptcy Litigation" or "Debt Restructuring," and include the timeframe of your experience. In the bullets, vividly illustrate your role by detailing the tasks you handled and the skills you employed, making sure to emphasize the influence you had on each case’s outcome.

It’s important for the bullets to flow logically, showing how you managed complex bankruptcy cases, effectively negotiated creditor settlements, or expertly guided clients through financial restructurings. Whenever possible, include specific figures or outcomes, such as "successfully reduced client liabilities by 30% through strategic negotiations," to help prospective employers quickly grasp your expertise and the tangible results you have accomplished.

Bankruptcy Lawyer

Smith & Associates Law Firm

2019 - 2023

- Represented clients in Chapter 7 and Chapter 11 cases, successfully achieving asset protection and debt discharge for them.

- Led a team to negotiate creditor settlements, reducing liabilities by 30%, saving clients $2 million over the course of a year.

- Prepared and filed bankruptcy petitions, motions, and orders, ensuring compliance with regulatory requirements and deadlines.

- Provided strategic counsel to clients facing insolvency, developing tailored solutions to prevent asset liquidation and preserve business operations.

Responsibility-Focused resume experience section

A responsibility-focused bankruptcy lawyer resume experience section should highlight the significant roles you've held and the impact of your work in past positions. Begin by demonstrating your capability to handle complex cases and navigate the nuances of bankruptcy law. This includes detailing how you organized client cases, collaborated with creditors, and maintained compliance with legal requirements. Such examples will show future employers that you can effectively manage important tasks and have the dependability required for high-stakes responsibilities.

In your bullet points, start with a clear job title that captures the essence of your work. Then, proceed to explain your main duties with specific examples, such as the volume and categorizations of cases you managed, your communication with clients and stakeholders, and any leadership roles you held within your team. Highlight accomplishments that reveal your expertise in balancing multiple responsibilities, like efficiently managing numerous cases or securing successful bankruptcy outcomes. Through these details, you create a cohesive narrative that illustrates your skills and readiness for challenging roles.

Senior Bankruptcy Attorney

Anderson Law Group

January 2015 - March 2022

- Managed over 100 Chapter 7 and Chapter 13 bankruptcy cases each year, ensuring timely filing and compliance with federal regulations.

- Facilitated communication between clients and creditors to negotiate effective debt resolutions, often achieving settlements below original amounts owed.

- Supervised junior attorneys and paralegal staff, providing guidance on case strategy and filing procedures.

- Conducted detailed reviews of client financial records and prepared the documentation necessary for bankruptcy filings.

Problem-Solving Focused resume experience section

A problem-solving focused bankruptcy lawyer resume experience section should clearly highlight your ability to address and resolve complex legal challenges through strategic solutions. Begin by showcasing cases where your critical thinking and client-focused strategies led to successful outcomes. It's important to demonstrate how you effectively navigate challenges while prioritizing your clients' needs, using your analytical skills and negotiation prowess. Tell stories that reveal the tangible results of your professional interventions, connecting each point to success in real-world applications.

Throughout this section, quantify your achievements to illustrate how your efforts have resulted in concrete improvements. Tailor your narrative to align with the job requirements, emphasizing relevant skills. Use strong action verbs to convey the impact and effectiveness of your work, ensuring a cohesive and compelling picture of your expertise in problem-solving within the field of bankruptcy law.

Bankruptcy Lawyer

Law Firm XYZ

2018 - 2023

- Negotiated settlements that cut client debt by 40%, paving the way for financial recovery.

- Devised strategies that boosted successful Chapter 11 filings by 30%, offering businesses a new start.

- Worked with creditors and clients to resolve disputes, avoiding expensive litigation and protecting client assets.

- Led a team to analyze complex legal data, uncovering additional opportunities for asset protection in bankruptcy cases.

Write your bankruptcy lawyer resume summary section

A well-crafted, experience-focused resume summary for a bankruptcy lawyer should clearly highlight your strengths and experiences while seamlessly guiding the reader through your qualifications. An example to consider might be:

This summary serves as a quick gateway into your professional life, presenting experience and skills in a compact, impactful manner. By immediately stating your years of experience, you establish authority and depth in the field. Following that, your proven track record assures potential employers of your ability to handle significant responsibilities successfully. Skills in negotiation and litigation are highlighted next, showing that you can drive favorable outcomes and secure your clients' interests. Ending with your ability to analyze financial documents and develop debt recovery solutions ties back to your main role, bringing full circle the key competencies that make you an effective bankruptcy lawyer.

Understanding how a resume summary differs from other sections like objectives or profiles can enhance your application. A summary is tailored for seasoned professionals, underscoring accomplishments and skills to provide a comprehensive snapshot of your career. In comparison, a resume objective is better suited for those starting out, focusing on career aspirations and enthusiasm. A resume profile offers a broader picture by combining skills and experiences, while a summary of qualifications delivers quick bullet points highlighting key career moments. Mastering these distinctions can ensure your resume aligns well with your career stage and goals.

Listing your bankruptcy lawyer skills on your resume

A skills-focused bankruptcy lawyer resume should strategically highlight your abilities to capture the interest of employers. You have the option to feature your skills in a standalone section or seamlessly integrate them into your experience or summary. When emphasizing strengths and soft skills, focus on attributes like effective communication and empathy, which are essential for interacting with clients. Hard skills, on the other hand, are measurable abilities such as legal research and case analysis that showcase your technical proficiency. Including these skills and strengths as keywords in your resume can make it more noticeable to recruiters and applicant tracking systems (ATS).

Here's an example of a well-crafted standalone skills section for a bankruptcy lawyer:

A section like this is effective and cohesive because it clearly presents skills that are directly relevant to your role as a bankruptcy lawyer. Each skill is carefully selected to align with what potential employers are seeking, making it easy for them to recognize your qualifications.

Best hard skills to feature on your bankruptcy lawyer resume

Highlighting hard skills on your bankruptcy lawyer resume underscores your legal expertise and technical acumen. These skills show your ability to tackle complex cases and represent your clients effectively.

Hard Skills

- Legal Research

- Case Analysis

- Client Negotiation

- Financial Restructuring

- Court Representation

- Debt Counseling

- Risk Assessment

- Legal Writing

- Bankruptcy Code Knowledge

- Debt Management Planning

- Litigation

- Compliance Understanding

- Contract Review

- Mediation

- Trustee Interactions

Best soft skills to feature on your bankruptcy lawyer resume

Including soft skills on your resume emphasizes your personal strengths and how you engage with others. These attributes highlight your capacity to communicate well and handle challenging situations with professionalism.

Soft Skills

- Communication

- Empathy

- Attention to Detail

- Time Management

- Adaptability

- Problem Solving

- Ethical Judgment

- Listening

- Negotiation

- Stress Management

- Teamwork

- Conflict Resolution

- Patience

- Emotional Intelligence

- Decision Making

How to include your education on your resume

The education section is a crucial part of your bankruptcy lawyer resume. It highlights your qualifications and ensures potential employers see your dedication to your field. Properly tailoring this section to your job application is essential. Focus on relevant education—this means only including qualifications that are directly tied to your legal career. An inconsequential degree could clutter your resume and distract from your applicable achievements. If you have a high GPA, consider including it if it highlights your academic excellence. Listing your honors, such as cum laude, can underscore your commitment and success in your studies. Clearly stating your degree, institution, and dates will provide a straightforward picture of your educational background.

- •Graduated cum laude

The second example is effective due to its precision and relevance. It focuses on a law school education, critical for a bankruptcy lawyer, and includes an impressive GPA that highlights academic success. Listing "cum laude" adds prestige and indicates a high level of achievement. Each component of the education section is directly tied to the role of a lawyer, establishing you as a strong candidate.

How to include bankruptcy lawyer certificates on your resume

Including a certificates section in your bankruptcy lawyer resume is essential. Begin by listing the name of the certificate you’ve earned. Next, include the date you received it to show your recent accomplishments. Add the issuing organization to highlight the credential’s credibility.

If you prefer, you can also include certificates in the header. For example, you can format it as: "James Smith, JD, Certified Insolvency and Restructuring Advisor, 2022."

A well-structured certificates section should look like this:

This example is strong because it includes specific, relevant certificates for a bankruptcy lawyer. The titles are clear, and the issuing organizations add legitimacy. The dates are current, ensuring your skills are up-to-date.

Extra sections to include in your bankruptcy lawyer resume

Crafting a resume for a bankruptcy lawyer involves neatly organizing and highlighting key aspects of your professional and personal life to paint a complete picture for potential employers. Including sections like language skills, hobbies and interests, volunteer work, and books can significantly enhance your resume and make you stand out in a competitive field.

Language skills — Highlight your proficiency in additional languages to show your ability to work with diverse clients. This can enhance your communication capacity and broaden your client base.

Hobbies and interests — Include this section to give potential employers insight into your personality and how you balance work and life. This humanizes your resume and can facilitate connection during interviews.

Volunteer work — Detail your volunteer experiences to showcase your commitment to community and pro bono work. This demonstrates your dedication to social responsibility and can distinguish you as a compassionate lawyer.

Books — List key legal books you have read to show your commitment to continued learning and professional development. This exhibits your dedication to staying updated on legal trends and expanding your knowledge base.

In Conclusion

In conclusion, crafting an effective resume as a bankruptcy lawyer involves more than just listing your past jobs and education. It is about painting a clear, concise picture of your expertise and accomplishments in a way that captures the interest of potential employers. Focus on key areas like your experience in managing complex financial cases, demonstrating your skills in legal research, client negotiation, and courtroom representation. Make sure to highlight your education, particularly any coursework or honors related to bankruptcy law. Consider using a combination resume format to balance your specialized skills with your career history. Don't forget the significance of well-chosen fonts and a clean layout, which can enhance the overall appearance and professionalism of your resume. Incorporating both hard and soft skills, such as legal writing and communication, further accentuates your qualifications. Including sections for certifications, languages, and volunteer work can add depth to your professional story. A polished resume not only showcases your individual strengths but positions you as a competitive candidate in today's legal job market. Remember, your resume serves as the gateway to your career opportunities, so take the time to craft it thoughtfully and strategically.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.