Finance Analyst Resume Examples

Jul 18, 2024

|

12 min read

"Craft a finance analyst resume without breaking the bank: Tips to help you leverage your skills and experience for financial success."

Rated by 348 people

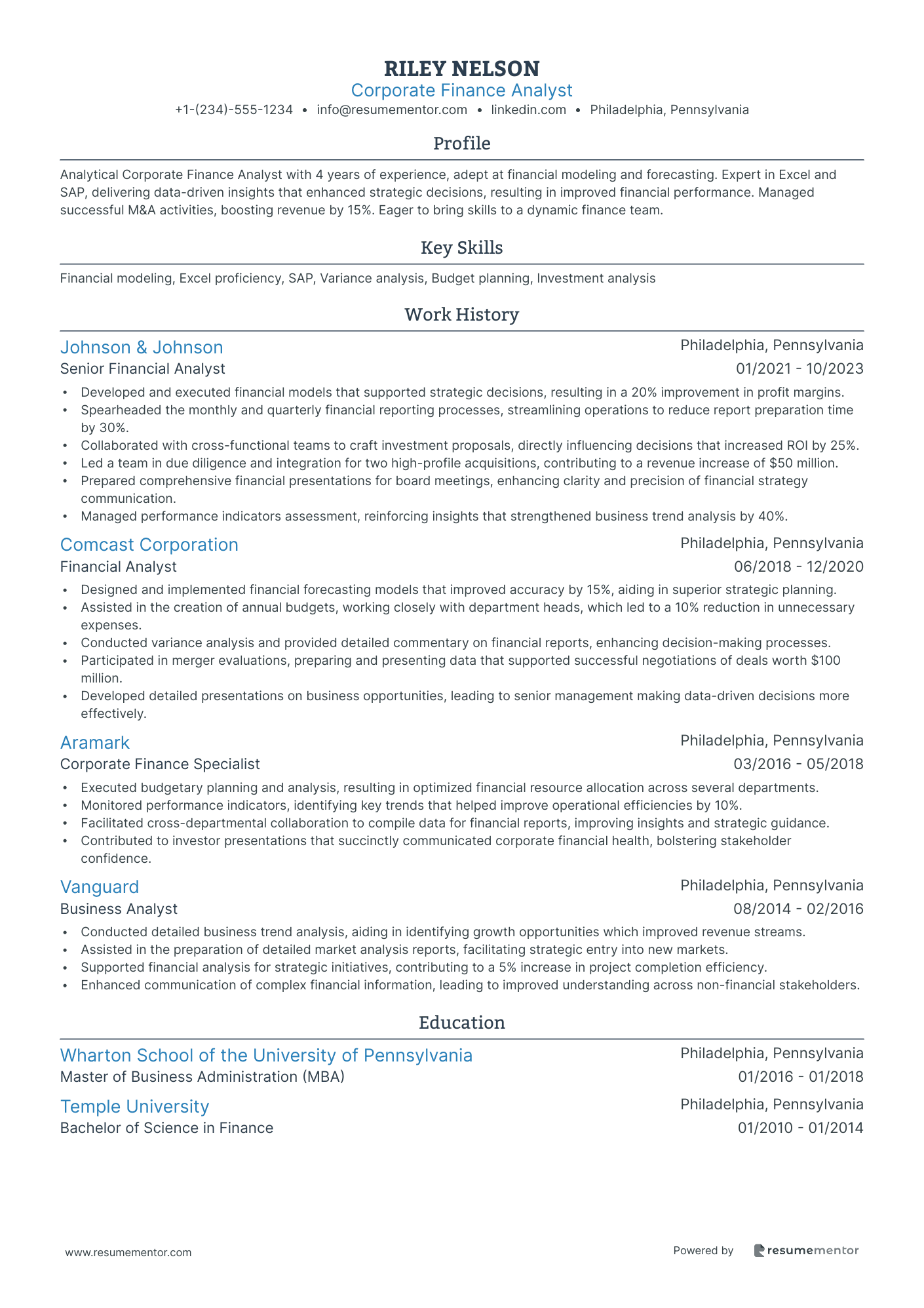

Corporate Finance Analyst

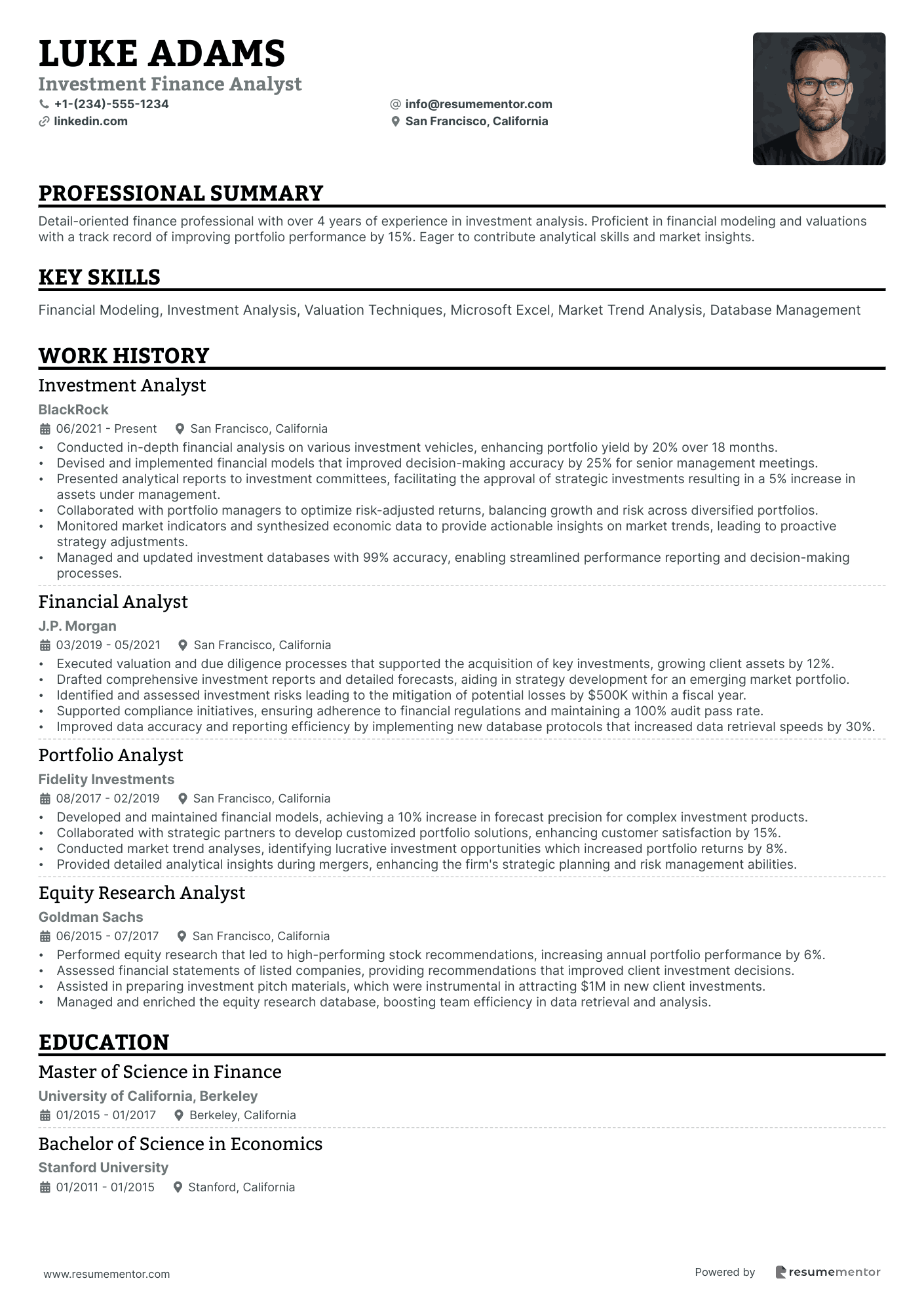

Investment Finance Analyst

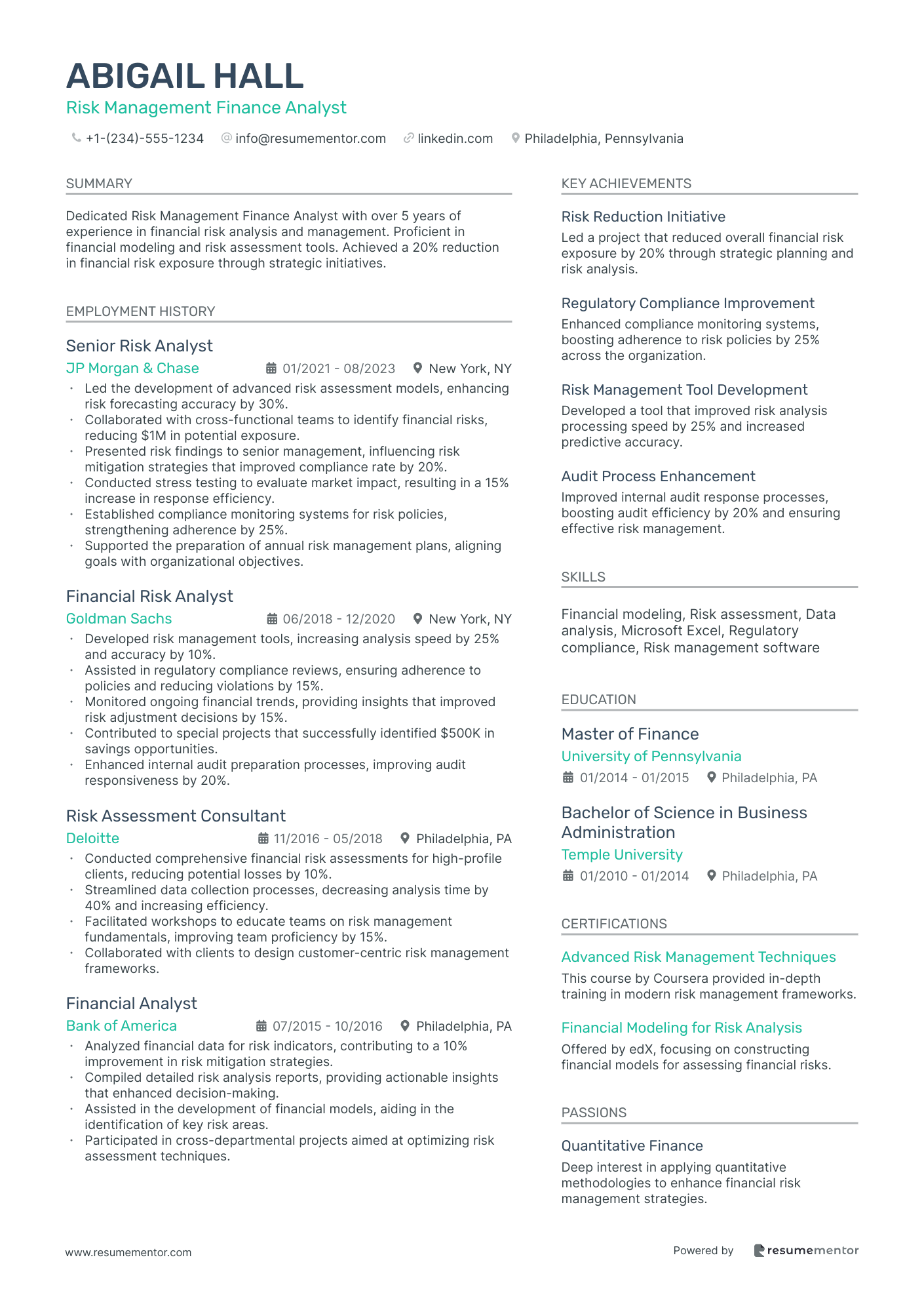

Risk Management Finance Analyst

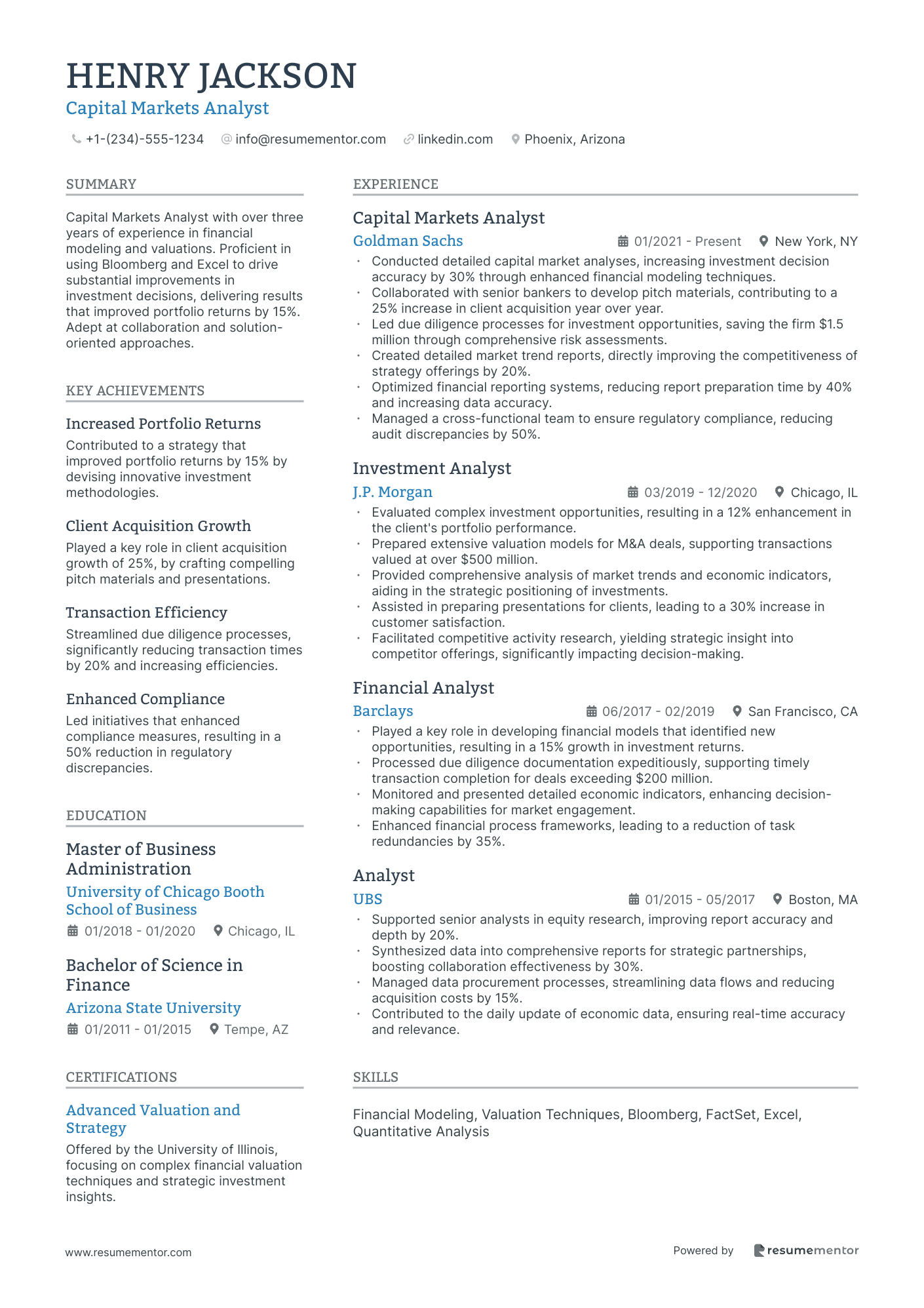

Capital Markets Analyst

Healthcare Finance Analyst

Financial Reporting Analyst

Real Estate Finance Analyst

Portfolio Finance Analyst

Mergers and Acquisitions Finance Analyst

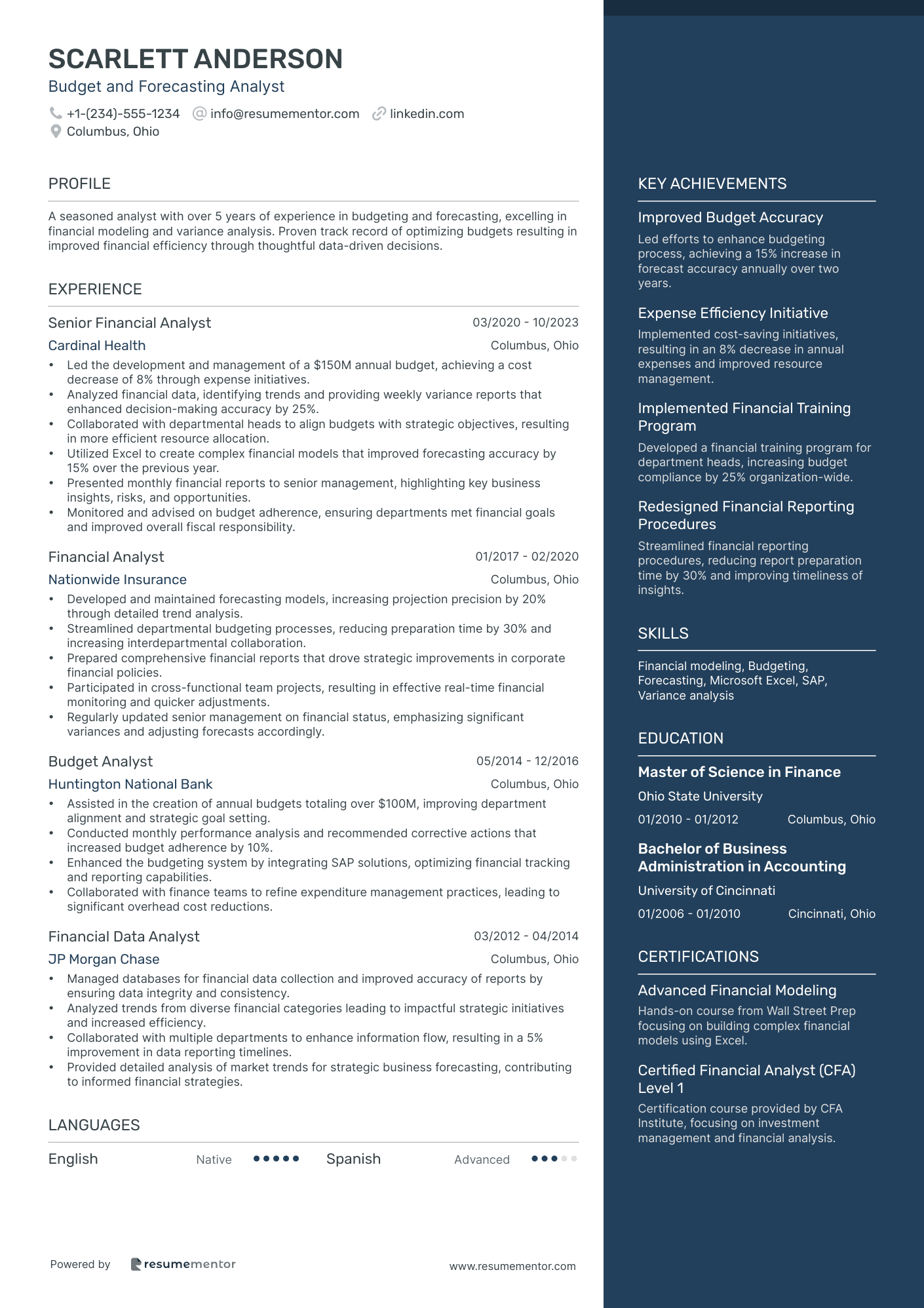

Budget and Forecasting Analyst

Corporate Finance Analyst resume sample

- •Developed and executed financial models that supported strategic decisions, resulting in a 20% improvement in profit margins.

- •Spearheaded the monthly and quarterly financial reporting processes, streamlining operations to reduce report preparation time by 30%.

- •Collaborated with cross-functional teams to craft investment proposals, directly influencing decisions that increased ROI by 25%.

- •Led a team in due diligence and integration for two high-profile acquisitions, contributing to a revenue increase of $50 million.

- •Prepared comprehensive financial presentations for board meetings, enhancing clarity and precision of financial strategy communication.

- •Managed performance indicators assessment, reinforcing insights that strengthened business trend analysis by 40%.

- •Designed and implemented financial forecasting models that improved accuracy by 15%, aiding in superior strategic planning.

- •Assisted in the creation of annual budgets, working closely with department heads, which led to a 10% reduction in unnecessary expenses.

- •Conducted variance analysis and provided detailed commentary on financial reports, enhancing decision-making processes.

- •Participated in merger evaluations, preparing and presenting data that supported successful negotiations of deals worth $100 million.

- •Developed detailed presentations on business opportunities, leading to senior management making data-driven decisions more effectively.

- •Executed budgetary planning and analysis, resulting in optimized financial resource allocation across several departments.

- •Monitored performance indicators, identifying key trends that helped improve operational efficiencies by 10%.

- •Facilitated cross-departmental collaboration to compile data for financial reports, improving insights and strategic guidance.

- •Contributed to investor presentations that succinctly communicated corporate financial health, bolstering stakeholder confidence.

- •Conducted detailed business trend analysis, aiding in identifying growth opportunities which improved revenue streams.

- •Assisted in the preparation of detailed market analysis reports, facilitating strategic entry into new markets.

- •Supported financial analysis for strategic initiatives, contributing to a 5% increase in project completion efficiency.

- •Enhanced communication of complex financial information, leading to improved understanding across non-financial stakeholders.

Investment Finance Analyst resume sample

- •Conducted in-depth financial analysis on various investment vehicles, enhancing portfolio yield by 20% over 18 months.

- •Devised and implemented financial models that improved decision-making accuracy by 25% for senior management meetings.

- •Presented analytical reports to investment committees, facilitating the approval of strategic investments resulting in a 5% increase in assets under management.

- •Collaborated with portfolio managers to optimize risk-adjusted returns, balancing growth and risk across diversified portfolios.

- •Monitored market indicators and synthesized economic data to provide actionable insights on market trends, leading to proactive strategy adjustments.

- •Managed and updated investment databases with 99% accuracy, enabling streamlined performance reporting and decision-making processes.

- •Executed valuation and due diligence processes that supported the acquisition of key investments, growing client assets by 12%.

- •Drafted comprehensive investment reports and detailed forecasts, aiding in strategy development for an emerging market portfolio.

- •Identified and assessed investment risks leading to the mitigation of potential losses by $500K within a fiscal year.

- •Supported compliance initiatives, ensuring adherence to financial regulations and maintaining a 100% audit pass rate.

- •Improved data accuracy and reporting efficiency by implementing new database protocols that increased data retrieval speeds by 30%.

- •Developed and maintained financial models, achieving a 10% increase in forecast precision for complex investment products.

- •Collaborated with strategic partners to develop customized portfolio solutions, enhancing customer satisfaction by 15%.

- •Conducted market trend analyses, identifying lucrative investment opportunities which increased portfolio returns by 8%.

- •Provided detailed analytical insights during mergers, enhancing the firm's strategic planning and risk management abilities.

- •Performed equity research that led to high-performing stock recommendations, increasing annual portfolio performance by 6%.

- •Assessed financial statements of listed companies, providing recommendations that improved client investment decisions.

- •Assisted in preparing investment pitch materials, which were instrumental in attracting $1M in new client investments.

- •Managed and enriched the equity research database, boosting team efficiency in data retrieval and analysis.

Risk Management Finance Analyst resume sample

- •Led the development of advanced risk assessment models, enhancing risk forecasting accuracy by 30%.

- •Collaborated with cross-functional teams to identify financial risks, reducing $1M in potential exposure.

- •Presented risk findings to senior management, influencing risk mitigation strategies that improved compliance rate by 20%.

- •Conducted stress testing to evaluate market impact, resulting in a 15% increase in response efficiency.

- •Established compliance monitoring systems for risk policies, strengthening adherence by 25%.

- •Supported the preparation of annual risk management plans, aligning goals with organizational objectives.

- •Developed risk management tools, increasing analysis speed by 25% and accuracy by 10%.

- •Assisted in regulatory compliance reviews, ensuring adherence to policies and reducing violations by 15%.

- •Monitored ongoing financial trends, providing insights that improved risk adjustment decisions by 15%.

- •Contributed to special projects that successfully identified $500K in savings opportunities.

- •Enhanced internal audit preparation processes, improving audit responsiveness by 20%.

- •Conducted comprehensive financial risk assessments for high-profile clients, reducing potential losses by 10%.

- •Streamlined data collection processes, decreasing analysis time by 40% and increasing efficiency.

- •Facilitated workshops to educate teams on risk management fundamentals, improving team proficiency by 15%.

- •Collaborated with clients to design customer-centric risk management frameworks.

- •Analyzed financial data for risk indicators, contributing to a 10% improvement in risk mitigation strategies.

- •Compiled detailed risk analysis reports, providing actionable insights that enhanced decision-making.

- •Assisted in the development of financial models, aiding in the identification of key risk areas.

- •Participated in cross-departmental projects aimed at optimizing risk assessment techniques.

Capital Markets Analyst resume sample

- •Conducted detailed capital market analyses, increasing investment decision accuracy by 30% through enhanced financial modeling techniques.

- •Collaborated with senior bankers to develop pitch materials, contributing to a 25% increase in client acquisition year over year.

- •Led due diligence processes for investment opportunities, saving the firm $1.5 million through comprehensive risk assessments.

- •Created detailed market trend reports, directly improving the competitiveness of strategy offerings by 20%.

- •Optimized financial reporting systems, reducing report preparation time by 40% and increasing data accuracy.

- •Managed a cross-functional team to ensure regulatory compliance, reducing audit discrepancies by 50%.

- •Evaluated complex investment opportunities, resulting in a 12% enhancement in the client's portfolio performance.

- •Prepared extensive valuation models for M&A deals, supporting transactions valued at over $500 million.

- •Provided comprehensive analysis of market trends and economic indicators, aiding in the strategic positioning of investments.

- •Assisted in preparing presentations for clients, leading to a 30% increase in customer satisfaction.

- •Facilitated competitive activity research, yielding strategic insight into competitor offerings, significantly impacting decision-making.

- •Played a key role in developing financial models that identified new opportunities, resulting in a 15% growth in investment returns.

- •Processed due diligence documentation expeditiously, supporting timely transaction completion for deals exceeding $200 million.

- •Monitored and presented detailed economic indicators, enhancing decision-making capabilities for market engagement.

- •Enhanced financial process frameworks, leading to a reduction of task redundancies by 35%.

- •Supported senior analysts in equity research, improving report accuracy and depth by 20%.

- •Synthesized data into comprehensive reports for strategic partnerships, boosting collaboration effectiveness by 30%.

- •Managed data procurement processes, streamlining data flows and reducing acquisition costs by 15%.

- •Contributed to the daily update of economic data, ensuring real-time accuracy and relevance.

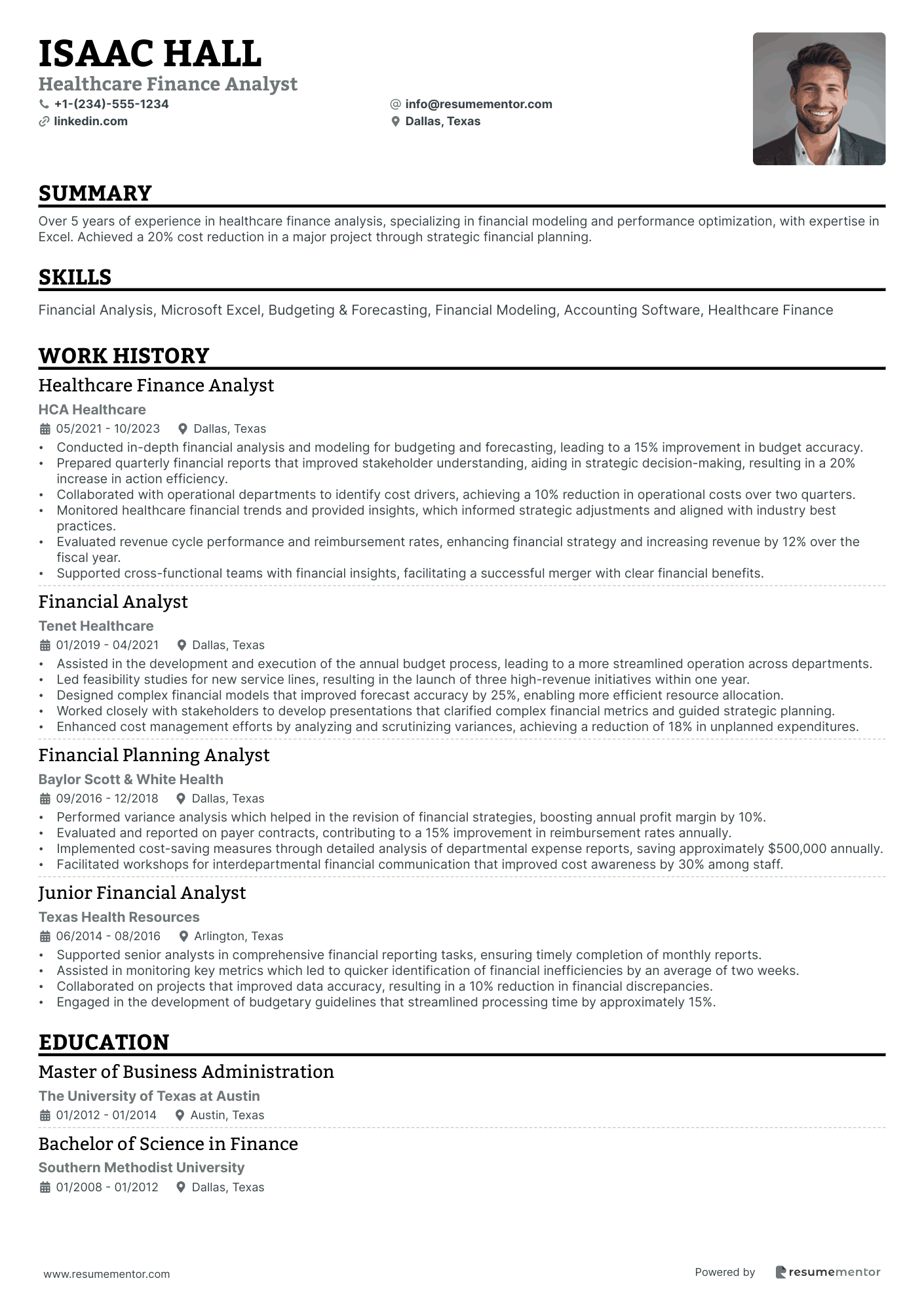

Healthcare Finance Analyst resume sample

- •Conducted in-depth financial analysis and modeling for budgeting and forecasting, leading to a 15% improvement in budget accuracy.

- •Prepared quarterly financial reports that improved stakeholder understanding, aiding in strategic decision-making, resulting in a 20% increase in action efficiency.

- •Collaborated with operational departments to identify cost drivers, achieving a 10% reduction in operational costs over two quarters.

- •Monitored healthcare financial trends and provided insights, which informed strategic adjustments and aligned with industry best practices.

- •Evaluated revenue cycle performance and reimbursement rates, enhancing financial strategy and increasing revenue by 12% over the fiscal year.

- •Supported cross-functional teams with financial insights, facilitating a successful merger with clear financial benefits.

- •Assisted in the development and execution of the annual budget process, leading to a more streamlined operation across departments.

- •Led feasibility studies for new service lines, resulting in the launch of three high-revenue initiatives within one year.

- •Designed complex financial models that improved forecast accuracy by 25%, enabling more efficient resource allocation.

- •Worked closely with stakeholders to develop presentations that clarified complex financial metrics and guided strategic planning.

- •Enhanced cost management efforts by analyzing and scrutinizing variances, achieving a reduction of 18% in unplanned expenditures.

- •Performed variance analysis which helped in the revision of financial strategies, boosting annual profit margin by 10%.

- •Evaluated and reported on payer contracts, contributing to a 15% improvement in reimbursement rates annually.

- •Implemented cost-saving measures through detailed analysis of departmental expense reports, saving approximately $500,000 annually.

- •Facilitated workshops for interdepartmental financial communication that improved cost awareness by 30% among staff.

- •Supported senior analysts in comprehensive financial reporting tasks, ensuring timely completion of monthly reports.

- •Assisted in monitoring key metrics which led to quicker identification of financial inefficiencies by an average of two weeks.

- •Collaborated on projects that improved data accuracy, resulting in a 10% reduction in financial discrepancies.

- •Engaged in the development of budgetary guidelines that streamlined processing time by approximately 15%.

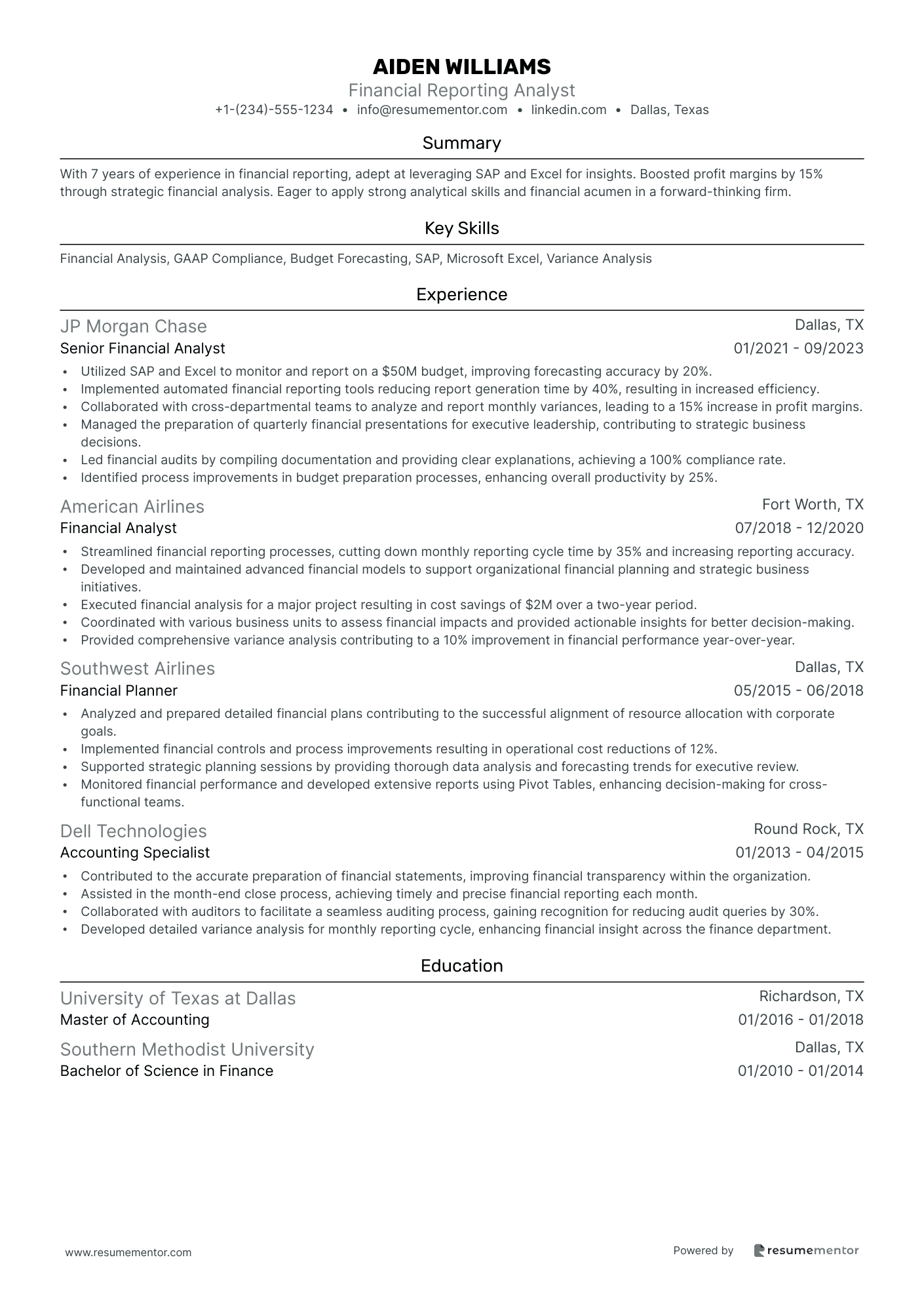

Financial Reporting Analyst resume sample

- •Utilized SAP and Excel to monitor and report on a $50M budget, improving forecasting accuracy by 20%.

- •Implemented automated financial reporting tools reducing report generation time by 40%, resulting in increased efficiency.

- •Collaborated with cross-departmental teams to analyze and report monthly variances, leading to a 15% increase in profit margins.

- •Managed the preparation of quarterly financial presentations for executive leadership, contributing to strategic business decisions.

- •Led financial audits by compiling documentation and providing clear explanations, achieving a 100% compliance rate.

- •Identified process improvements in budget preparation processes, enhancing overall productivity by 25%.

- •Streamlined financial reporting processes, cutting down monthly reporting cycle time by 35% and increasing reporting accuracy.

- •Developed and maintained advanced financial models to support organizational financial planning and strategic business initiatives.

- •Executed financial analysis for a major project resulting in cost savings of $2M over a two-year period.

- •Coordinated with various business units to assess financial impacts and provided actionable insights for better decision-making.

- •Provided comprehensive variance analysis contributing to a 10% improvement in financial performance year-over-year.

- •Analyzed and prepared detailed financial plans contributing to the successful alignment of resource allocation with corporate goals.

- •Implemented financial controls and process improvements resulting in operational cost reductions of 12%.

- •Supported strategic planning sessions by providing thorough data analysis and forecasting trends for executive review.

- •Monitored financial performance and developed extensive reports using Pivot Tables, enhancing decision-making for cross-functional teams.

- •Contributed to the accurate preparation of financial statements, improving financial transparency within the organization.

- •Assisted in the month-end close process, achieving timely and precise financial reporting each month.

- •Collaborated with auditors to facilitate a seamless auditing process, gaining recognition for reducing audit queries by 30%.

- •Developed detailed variance analysis for monthly reporting cycle, enhancing financial insight across the finance department.

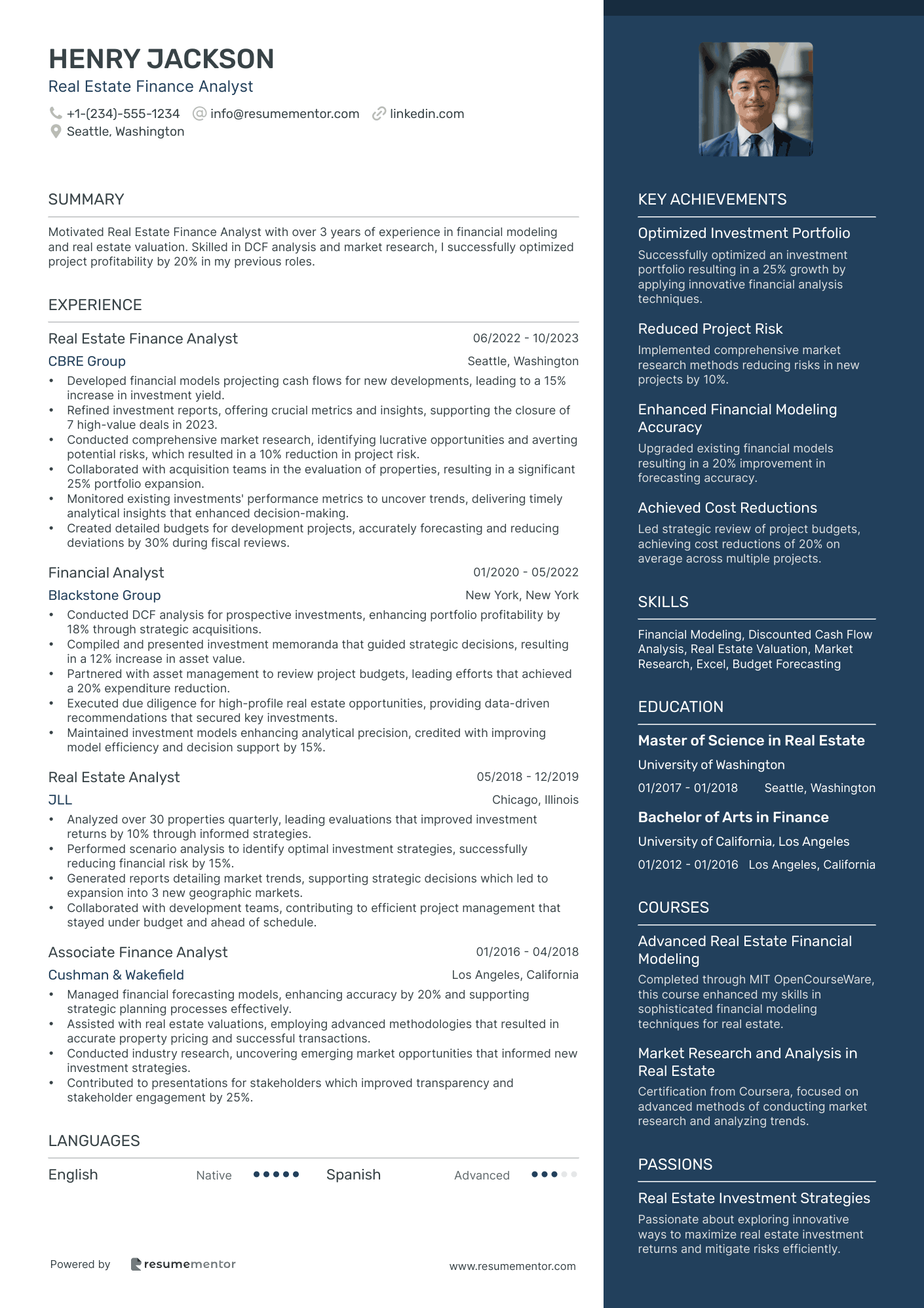

Real Estate Finance Analyst resume sample

- •Developed financial models projecting cash flows for new developments, leading to a 15% increase in investment yield.

- •Refined investment reports, offering crucial metrics and insights, supporting the closure of 7 high-value deals in 2023.

- •Conducted comprehensive market research, identifying lucrative opportunities and averting potential risks, which resulted in a 10% reduction in project risk.

- •Collaborated with acquisition teams in the evaluation of properties, resulting in a significant 25% portfolio expansion.

- •Monitored existing investments' performance metrics to uncover trends, delivering timely analytical insights that enhanced decision-making.

- •Created detailed budgets for development projects, accurately forecasting and reducing deviations by 30% during fiscal reviews.

- •Conducted DCF analysis for prospective investments, enhancing portfolio profitability by 18% through strategic acquisitions.

- •Compiled and presented investment memoranda that guided strategic decisions, resulting in a 12% increase in asset value.

- •Partnered with asset management to review project budgets, leading efforts that achieved a 20% expenditure reduction.

- •Executed due diligence for high-profile real estate opportunities, providing data-driven recommendations that secured key investments.

- •Maintained investment models enhancing analytical precision, credited with improving model efficiency and decision support by 15%.

- •Analyzed over 30 properties quarterly, leading evaluations that improved investment returns by 10% through informed strategies.

- •Performed scenario analysis to identify optimal investment strategies, successfully reducing financial risk by 15%.

- •Generated reports detailing market trends, supporting strategic decisions which led to expansion into 3 new geographic markets.

- •Collaborated with development teams, contributing to efficient project management that stayed under budget and ahead of schedule.

- •Managed financial forecasting models, enhancing accuracy by 20% and supporting strategic planning processes effectively.

- •Assisted with real estate valuations, employing advanced methodologies that resulted in accurate property pricing and successful transactions.

- •Conducted industry research, uncovering emerging market opportunities that informed new investment strategies.

- •Contributed to presentations for stakeholders which improved transparency and stakeholder engagement by 25%.

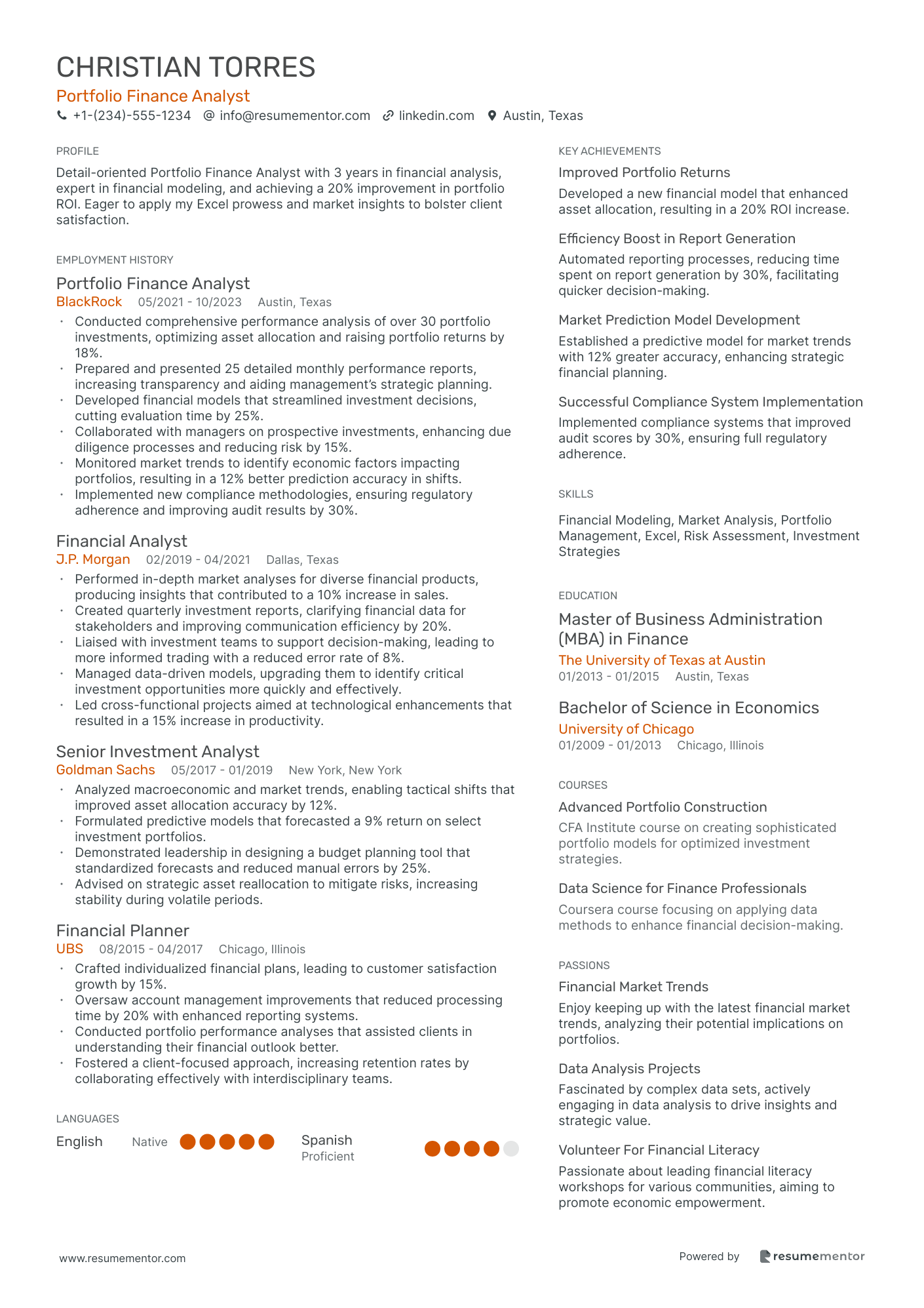

Portfolio Finance Analyst resume sample

- •Conducted comprehensive performance analysis of over 30 portfolio investments, optimizing asset allocation and raising portfolio returns by 18%.

- •Prepared and presented 25 detailed monthly performance reports, increasing transparency and aiding management’s strategic planning.

- •Developed financial models that streamlined investment decisions, cutting evaluation time by 25%.

- •Collaborated with managers on prospective investments, enhancing due diligence processes and reducing risk by 15%.

- •Monitored market trends to identify economic factors impacting portfolios, resulting in a 12% better prediction accuracy in shifts.

- •Implemented new compliance methodologies, ensuring regulatory adherence and improving audit results by 30%.

- •Performed in-depth market analyses for diverse financial products, producing insights that contributed to a 10% increase in sales.

- •Created quarterly investment reports, clarifying financial data for stakeholders and improving communication efficiency by 20%.

- •Liaised with investment teams to support decision-making, leading to more informed trading with a reduced error rate of 8%.

- •Managed data-driven models, upgrading them to identify critical investment opportunities more quickly and effectively.

- •Led cross-functional projects aimed at technological enhancements that resulted in a 15% increase in productivity.

- •Analyzed macroeconomic and market trends, enabling tactical shifts that improved asset allocation accuracy by 12%.

- •Formulated predictive models that forecasted a 9% return on select investment portfolios.

- •Demonstrated leadership in designing a budget planning tool that standardized forecasts and reduced manual errors by 25%.

- •Advised on strategic asset reallocation to mitigate risks, increasing stability during volatile periods.

- •Crafted individualized financial plans, leading to customer satisfaction growth by 15%.

- •Oversaw account management improvements that reduced processing time by 20% with enhanced reporting systems.

- •Conducted portfolio performance analyses that assisted clients in understanding their financial outlook better.

- •Fostered a client-focused approach, increasing retention rates by collaborating effectively with interdisciplinary teams.

Mergers and Acquisitions Finance Analyst resume sample

- •Led the financial modeling and valuation processes for 10 high-profile M&A deals, increasing acquisition success rate by 15%.

- •Collaborated with cross-functional teams to streamline post-merger integrations, resulting in a 20% improvement in operational efficiency.

- •Developed comprehensive financial projections for potential acquisitions, improving decision-making processes for senior executives.

- •Prepared and presented detailed reports on industry trends and valuation methodologies to inform strategic decisions.

- •Enhanced internal M&A databases, resulting in a 25% increase in data retrieval speed and accuracy.

- •Monitored competitor activities and economic conditions to provide insights and recommendations for M&A strategies.

- •Assisted in executing $500 million worth of M&A transactions by leading financial due diligence efforts.

- •Prepared valuation reports and financial models, contributing to a 12% increase in transaction closure efficiency.

- •Managed client relationships and communications, enhancing client trust and securing repeat business.

- •Analyzed financial statements and identified key metrics, supporting successful valuation and integration processes.

- •Created presentation materials that effectively communicated complex financial concepts to non-financial stakeholders.

- •Conducted financial analysis on potential targets, leading to recommendations that increased merger viability by 20%.

- •Participated in team projects to develop financial models that enhanced the accuracy of corporate finance solutions.

- •Monitored industry trends and economic variables to provide actionable insights for M&A strategy development.

- •Collaborated with legal and tax departments to ensure compliance and efficiency in M&A transactions.

- •Guided clients in investment decisions, enhancing portfolio performance by an average of 8% annually.

- •Developed comprehensive financial plans for individuals, resulting in a noticeable increase in client satisfaction.

- •Introduced data-driven analysis techniques that improved the accuracy of financial recommendations.

- •Prepared financial presentations for clients, simplifying complex data to aid investment understanding.

Budget and Forecasting Analyst resume sample

- •Led the development and management of a $150M annual budget, achieving a cost decrease of 8% through expense initiatives.

- •Analyzed financial data, identifying trends and providing weekly variance reports that enhanced decision-making accuracy by 25%.

- •Collaborated with departmental heads to align budgets with strategic objectives, resulting in more efficient resource allocation.

- •Utilized Excel to create complex financial models that improved forecasting accuracy by 15% over the previous year.

- •Presented monthly financial reports to senior management, highlighting key business insights, risks, and opportunities.

- •Monitored and advised on budget adherence, ensuring departments met financial goals and improved overall fiscal responsibility.

- •Developed and maintained forecasting models, increasing projection precision by 20% through detailed trend analysis.

- •Streamlined departmental budgeting processes, reducing preparation time by 30% and increasing interdepartmental collaboration.

- •Prepared comprehensive financial reports that drove strategic improvements in corporate financial policies.

- •Participated in cross-functional team projects, resulting in effective real-time financial monitoring and quicker adjustments.

- •Regularly updated senior management on financial status, emphasizing significant variances and adjusting forecasts accordingly.

- •Assisted in the creation of annual budgets totaling over $100M, improving department alignment and strategic goal setting.

- •Conducted monthly performance analysis and recommended corrective actions that increased budget adherence by 10%.

- •Enhanced the budgeting system by integrating SAP solutions, optimizing financial tracking and reporting capabilities.

- •Collaborated with finance teams to refine expenditure management practices, leading to significant overhead cost reductions.

- •Managed databases for financial data collection and improved accuracy of reports by ensuring data integrity and consistency.

- •Analyzed trends from diverse financial categories leading to impactful strategic initiatives and increased efficiency.

- •Collaborated with multiple departments to enhance information flow, resulting in a 5% improvement in data reporting timelines.

- •Provided detailed analysis of market trends for strategic business forecasting, contributing to informed financial strategies.

Crafting a finance analyst resume can be like untangling a complex puzzle where your skills are the key pieces. You possess valuable abilities that employers seek, but distilling these into a compelling format often feels challenging. The same analytical skills that make you excel can make it hard to simplify and summarize your achievements.

Choosing the right resume format is your first strategic move, much like selecting the best formula for a spreadsheet calculation. Using a resume template makes the process easier, ensuring a professional and clear presentation that captures the attention of hiring managers. This structure naturally highlights your accomplishments and technical expertise.

In the fast-paced world of finance, your resume must clearly show what sets you apart. By highlighting the impact of your work—how you analyze data, manage risks, and optimize strategies—you're telling a story of success rather than just listing tasks.

The goal is to weave a narrative that connects your skills with the needs of potential employers. With this guide, you'll gain the skills to craft a resume that opens doors in the finance sector. Let’s get started on your journey to success.

Key Takeaways

- Include accurate and professional contact information at the top of the resume to ensure easy communication with employers.

- Write a concise professional summary that presents your skills, experience, and value effectively to grab the recruiter's attention quickly.

- Detail your work experience using bullet points to showcase achievements, quantifiable outcomes, and the positive impact of your roles.

- Highlight your educational background and relevant finance-specific certifications to strengthen your professional profile.

- List both hard and soft skills relevant to financial analysis, ensuring keywords align with job descriptions for better recruiter visibility.

What to focus on when writing your finance analyst resume

A finance analyst resume should effectively communicate your expertise in financial analysis and decision-making to the recruiter. This means showcasing your ability to interpret data and support critical financial decisions while ensuring the format is ATS-friendly.

How to structure your finance analyst resume

- Contact Information: Begin with your full name, phone number, and email address—these basics are crucial for the recruiter to easily reach you. It’s important to ensure this information is accurate and professional, making it easy for potential employers to contact you as they evaluate your application. Consistency in formatting this section gives a polished look at first glance.

- Professional Summary: Follow with a concise overview that ties your skills, experience, and the value you offer together. This section is key for grabbing the recruiter’s attention, serving as your quick pitch. Emphasize specific finance skills such as budgeting and financial forecasting. These details create a strong impression right at the top of your resume and set the tone for the rest.

- Experience: Next, detail your work history, including job titles, company names, and dates. Use bullet points to highlight achievements, like cost savings or improved financial reports, reinforcing the impact you’ve had in previous roles. Quantifying your accomplishments in this way provides concrete evidence of your capabilities and directly supports your professional summary.

- Education: Then, outline your educational background, including degrees and institutions. This section should underline qualifications relevant to financial analysis. Highlight finance-specific certifications like CFA or CPA, which are highly regarded in the industry and will strengthen your professional standing.

- Skills: Complement your experience section by listing targeted finance and analysis skills. This includes proficiency in financial modeling software, statistical analysis, and Excel. By clearly presenting these competencies, you allow the recruiter to immediately see how you can contribute to their company's success using tools and methods relevant to financial analysis.

- Technical Skills: Finally, mention your familiarity with tools like Bloomberg Terminal, SAP, or other finance-related software—these technical proficiencies are essential as they show your ability to perform specific tasks necessary for the role. As we move forward, we'll delve into each section more in-depth, providing a comprehensive guide to perfectly tailoring your finance analyst resume.

Which resume format to choose

Creating a standout resume as a finance analyst involves both strategic content placement and appealing design. Start with the reverse-chronological format, which puts your most recent and relevant experience front and center, a key factor in the finance industry where recent achievements matter. When choosing fonts, opt for modern options like Rubic, Lato, and Montserrat. These fonts enhance readability and give your resume a sleek, professional appearance without overwhelming the reader. Saving your resume as a PDF is crucial, as it locks in your formatting, ensuring it looks polished and consistent on every device. Keep your margins at about one inch to provide ample whitespace, making your document easy to read and visually appealing. Each element of your resume should work together to clearly present your qualifications and help you stand out in the competitive field of finance.

How to write a quantifiable resume experience section

A top-notch finance analyst resume experience section is crucial for making a great impression. It should be tailored and well-organized, highlighting quantifiable achievements to capture attention. Arrange your entries in reverse chronological order, beginning with your most recent job, and focus on the last 10-15 years while selecting roles relevant to your career aspirations. By highlighting job titles that align with your goals and matching them with roles in the job ad, you draw a clear line to where you want to be. Tailoring your resume involves picking skills and keywords seen in job listings, which helps link your past experiences to future opportunities. Action words like "analyzed," "managed," or "developed" paint a vivid picture of your contributions and outcomes. Here is an example:

- •Drove a 15% increase in revenue by analyzing market trends and forecasting financial outcomes.

- •Developed and implemented a budgeting model saving $500K annually.

- •Managed a cross-departmental team in optimizing financial reporting processes, improving efficiency by 30%.

- •Performed risk assessments that reduced financial exposure by $750K within the fiscal year.

This finance analyst experience section excels by connecting clear, relevant accomplishments to the role. Each bullet point is packed with quantifiable outcomes that show your impact on the organization, transforming numbers into a story of success. For instance, a 15% revenue increase or a $500K savings illustrates your capability, establishing a strong credibility and aligning with what employers look for in a finance analyst.

The section's organization includes key details like the job title, company, and timeline, making it easy to see your role and impact. Tailoring these details to showcase directly relevant successes helps show employers exactly how you add value. Action verbs integrate your achievements into a narrative of initiative and leadership, demonstrating how your past roles have prepped you for new challenges.

Project-Focused resume experience section

A project-focused finance analyst resume experience section should clearly demonstrate your strength in managing and completing financial projects. Highlight your problem-solving abilities and analytical skills, along with the project methodologies you utilized. It’s essential to tie these skills to concrete outcomes by adding quantifiable results that showcase the impact of your work. Tailor this part of your resume to align with the job description, emphasizing the skills and achievements most relevant to what the employer seeks.

Connect each bullet point with strong action verbs and detailed accomplishments. Use numbers and clear examples to illustrate how you've improved processes or saved resources. This concise yet detailed approach provides potential employers with a clear picture of your capabilities and value.

Finance Analyst

ABC Financial Services

June 2020 - Present

- Led a cross-functional team to implement a new financial reporting system, cutting month-end closing time by 20%.

- Developed and managed project budgets, consistently coming in under budget by an average of 15%.

- Analyzed complex data sets to aid strategic decisions, resulting in a 10% boost in profitability.

- Partnered with IT to automate manual processes, saving around 200 hours of labor each year.

Skills-Focused resume experience section

A skills-focused finance analyst resume experience section should clearly demonstrate your capabilities and the tangible impact you've had in your roles. Begin by stating your job title, where you worked, and the dates of employment. Your accomplishments and responsibilities should be presented in bullet points, using numbers to emphasize your contributions. By using straightforward language, you can illustrate how your skills have driven company goals forward.

Link your expertise in financial analysis and problem-solving with specific scenarios to show improved efficiency or cost reductions. Each bullet point should build on the last, describing collaborative efforts and the use of tools like Excel and Power BI to enhance results. Finally, underscore how your detailed analysis and insights provided valuable guidance in steering strategic decisions for the company.

Finance Analyst

Tech Solutions Inc.

June 2020 - Present

- Analyzed monthly financial statements, spotting cost-saving opportunities that cut expenses by 15%.

- Collaborated with various teams to enhance budgeting processes, increasing forecast accuracy by 20%.

- Created automated dashboards with Excel and Power BI, making decision-making faster and data clearer.

- Delivered comprehensive variance analysis that equipped management with insights to make informed strategic choices.

Innovation-Focused resume experience section

An innovation-focused finance analyst resume experience section should clearly emphasize your ability to introduce forward-thinking ideas that boost financial efficiency. Start by listing your recent roles, including the dates, job titles, and organizations. To make your accomplishments stand out, illustrate specific examples of innovative solutions you've delivered. Organize these achievements into bullet points for easy reading.

In your bullet points, it's crucial to convey how you've enhanced financial processes, led cost-saving projects, and implemented new methods that significantly improved company performance. Your analytical prowess should shine through in how you tackled challenges strategically to achieve better financial results. Strengthen your accomplishments with quantifiable metrics, such as percentage reductions or financial savings, to demonstrate the tangible benefits of your initiatives.

Senior Finance Analyst

Tech Financial Solutions

January 2020 - Present

- Implemented a new budgeting system that reduced forecasting errors by 25%.

- Streamlined reporting processes, decreasing time spent by finance team by 15%.

- Introduced data analytics tools to improve profitability analysis, enhancing decision-making accuracy.

- Led project to automate invoice processing, cutting costs by over $10,000 annually.

Leadership-Focused resume experience section

A leadership-focused finance analyst resume experience section should clearly highlight your ability to guide teams and drive success. Begin each bullet with strong action words that demonstrate the positive impact you've made on projects or within an organization. Ensure your examples are specific, showcasing how you inspired or led others to achieve significant outcomes. Using simple terms and quantifiable results will effectively demonstrate your leadership capabilities in the finance sector.

Focus on standout projects where your leadership played a crucial role, whether it involved coaching team members or spearheading key initiatives. Illustrate how your leadership skills helped achieve business objectives, enhanced team productivity, and improved financial outcomes. This will paint a vivid picture of your leadership strengths and the concrete benefits you've brought to previous roles, reinforcing your value as a finance analyst leader.

Senior Finance Analyst

XYZ Corporation

March 2020 - Present

- Led a team of 5 analysts in revamping the budgeting process, resulting in a 20% cost-saving across departments.

- Spearheaded monthly finance meetings that improved interdepartmental collaboration and strategic alignment.

- Mentored junior analysts, increasing team performance scores by 15% within one fiscal year.

- Developed and implemented a training program that reduced onboarding time for new hires by 30%.

Write your finance analyst resume summary section

A finance-focused resume experience section should begin with a compelling summary that grabs attention right away. This section is your chance to highlight your skills and achievements in a few powerful sentences. Clearly conveying your professional story and the value you bring can make all the difference. A well-crafted summary will entice hiring managers to learn more about you. Reflect on the impact you've made in past roles and emphasize what sets you apart.

Start with the experiences and achievements that matter most to the job you're applying for. Highlight key skills, such as improving financial processes or making accurate forecasts, that align with the job description. Demonstrate your effectiveness with specific metrics and accomplishments.

Take, for example, this finance analyst resume summary:

This summary is effective because it showcases relevant skills and achievements. The focus on measurable improvements amplifies its impact.

If you are just starting out, a resume objective may be more appropriate. Unlike a summary, an objective focuses on your aspirations and what you aim to achieve. It’s important to mention the skills you wish to apply and develop further in your career. On the other hand, a summary is often better for those with experience, as it highlights proven value.

Remember, each part of your resume serves a purpose. Tailor your summary or objective to fit the finance analyst position you're aiming for. Keep it clear, concise, and engaging to make a lasting impression.

Listing your finance analyst skills on your resume

Writing the Skills Section for a Finance Analyst Resume

A skills-focused finance analyst resume should seamlessly integrate your technical and interpersonal abilities. You can opt to have the skills section stand alone or blend it into your experience and summary areas. Highlighting strengths like communication and adaptability reveals your capacity to work well with others and manage changing situations.

In addition, hard skills are crucial—they cover your technical expertise in areas like financial modeling and data analysis. These skills and strengths also act as essential keywords on your resume. Using the right words helps your application align with job requirements and makes it easier for recruiters to find you. This alignment turns your skills into language both people and applicant tracking systems understand.

Here’s a clear example of how a skills section can be structured in JSON format:

This structured format works well because it spotlights the critical finance analyst skills you possess. By focusing only on relevant skills, it presents you as a specialized and competent candidate, aligning with what recruiters prioritize.

Best hard skills to feature on your finance analyst resume

To excel as a finance analyst, your hard skills should showcase your technical prowess and expertise in essential financial tools and processes.

Hard Skills

- Financial Modeling

- Data Analysis

- Budgeting and Forecasting

- Risk Management

- Microsoft Excel

- Financial Reporting

- SQL

- Variance Analysis

- QuickBooks

- Bloomberg Terminal

- Cost Analysis

- Mergers and Acquisitions

- Investment Banking

- Accounting Software

- Tableau

Best soft skills to feature on your finance analyst resume

Soft skills are equally crucial as they demonstrate your ability to interact and handle diverse situations effectively. For a finance analyst, these skills highlight your strengths in teamwork and problem-solving.

Soft Skills

- Communication

- Problem-solving

- Analytical Thinking

- Attention to Detail

- Time Management

- Adaptability

- Team Collaboration

- Conflict Resolution

- Critical Thinking

- Negotiation Skills

- Decision-making

- Emotional Intelligence

- Stress Management

- Leadership

- Self-motivation

How to include your education on your resume

The education section of your finance analyst resume is a crucial component that showcases your academic qualifications. Tailoring this section specifically to the job you are applying for is key. When listing your education, include only degrees and coursework relevant to the position. Unrelated education details can be omitted to maintain focus.

If your GPA is strong, generally above a 3.5 on a 4.0 scale, it is beneficial to include it. When listing cum laude distinctions, such as "magna cum laude" or "summa cum laude," do so next to your degree title to highlight your academic achievements. Ensure your degree is listed with clarity, starting with the degree type, major, institution name, and completion date.

Consider these examples to illustrate the right and wrong way to craft this section.

This example includes education irrelevant to a finance analyst role.

In this second example, the degree is directly relevant and highlights a strong academic performance. Including "magna cum laude" and a high GPA highlights your dedication and excellence in relevant studies, making it a standout education section for a finance analyst position.

How to include finance analyst certificates on your resume

A certificates section is an essential part of your finance analyst resume. Start by listing the name of each certificate you hold. Include the date when you earned it. Add the issuing organization to give it credibility. You can also place key certifications in your resume header to make them immediately visible.

Example:

This example is good because it lists highly relevant certifications for a finance analyst role. The Chartered Financial Analyst (CFA) credential is well-respected in the field, showing deep knowledge of investment analysis and portfolio management. The Financial Risk Manager (FRM) certificate signals expertise in managing financial risk. Including the issuing organizations adds credibility and context to each certificate. This approach highlights your qualifications effectively.

Extra sections to include in your finance analyst resume

When crafting a finance analyst resume, it's important to highlight your relevant skills and experiences effectively. Beyond your core qualifications and work history, including additional sections can help set you apart and add a personal touch to your professional profile.

Language section—List languages you are fluent in, such as “Fluent in Spanish and Mandarin.” Demonstrate language skills relevant to global markets, showcasing your ability to work in diverse financial environments.

Hobbies and interests section—Share hobbies like “Investment Club member” or “Chess enthusiast.” Show your analytical skills and strategic thinking outside the workplace, reflecting your passion for finance.

Volunteer work section—Include experiences like “Financial advisor at a non-profit, 2020-2022.” Highlight your commitment to giving back and your application of financial expertise in volunteer roles.

Books section—Mention relevant finance books you’ve read, such as “Read ‘The Intelligent Investor’ by Benjamin Graham.” Emphasize your continuous learning and deep interest in finance beyond formal education.

In Conclusion

In conclusion, creating a finance analyst resume requires a thoughtful approach that combines clarity, conciseness, and a strategic focus on both the content and format. Your resume serves not only as a document to list your credentials but as a narrative that links your skills and experiences with the needs of employers in the finance sector. By beginning with a compelling summary, you immediately capture the attention of hiring managers, setting the stage for the detailed experiences and achievements that follow. Highlight your proficiency in financial analysis, risk management, and technology; these are key areas that define success in this field.

A well-structured skills section, emphasizing both hard and soft skills, can further differentiate you, showing recruiters that you possess not only the technical acumen they seek but also the interpersonal capabilities to thrive in a team environment. Moreover, a robust education section, inclusive of GPA and any honors, alongside relevant certifications, grounds your resume in transparent qualifications, letting prospective employers see your dedication to the profession. Beyond the standard sections, consider adding extra elements like language proficiency or volunteer work to paint a fuller picture of your capabilities and interests.

Ultimately, each element of your resume should be tailored to mirror the language and demands of the finance analyst role you are targeting. By synthesizing quantifiable successes with a well-articulated narrative, your resume will not only stand out in applicant tracking systems but resonate with hiring managers looking for candidates who can offer both analytical strength and innovative thinking. Remember, your resume is a living document; as you gain new experiences and skills, revisit and revise it, ensuring it reflects your current prowess and future potential. With these insights and strategies, you’ll be well on your way to crafting a resume that not only opens doors but also marks the beginning of a fruitful journey in the finance industry.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.