Financial Consultant Resume Examples

Jul 18, 2024

|

12 min read

Balancing your background: a step-by-step guide on writing a financial consultant resume that highlights your skills, experience, and expertise.

Rated by 348 people

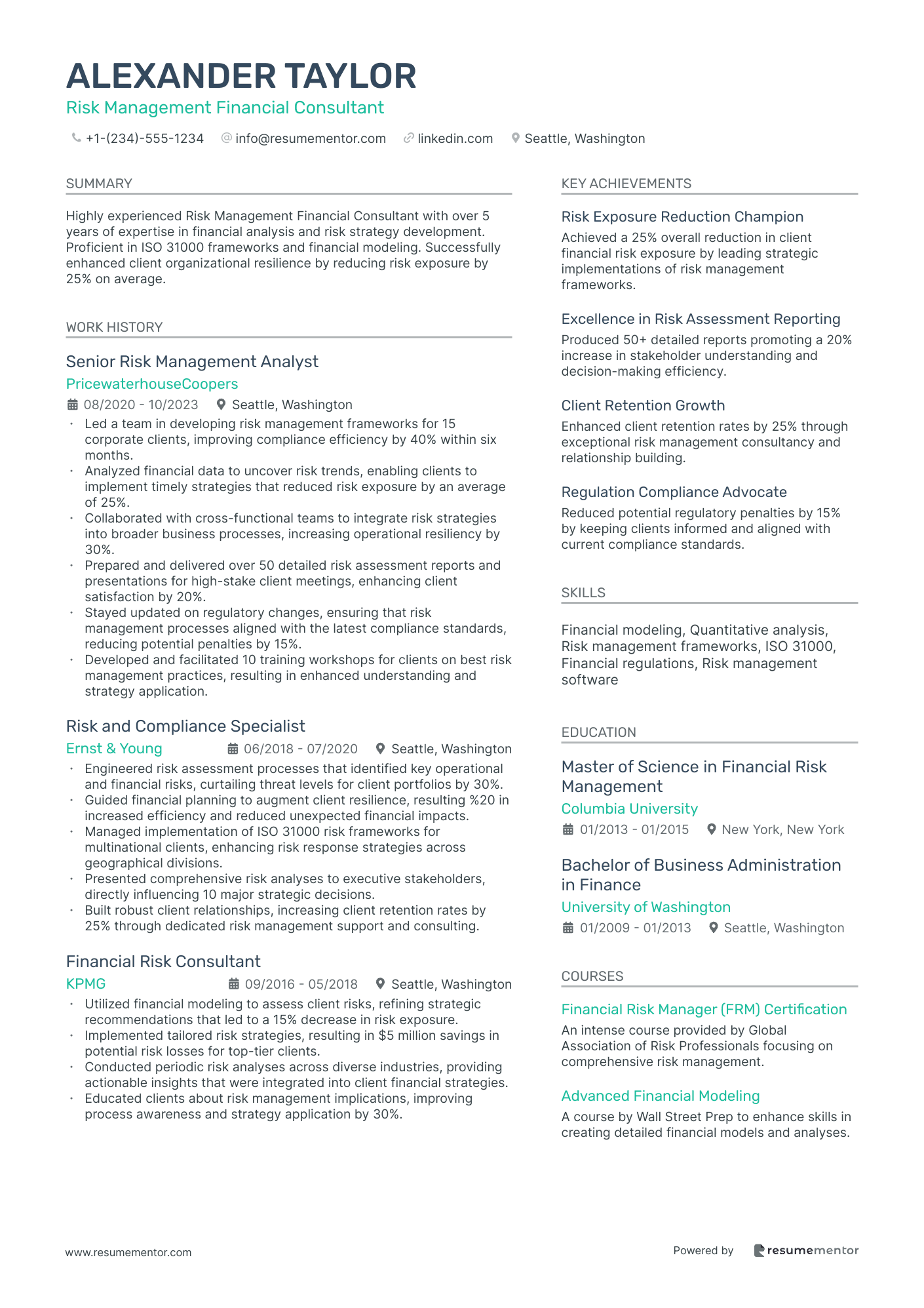

Risk Management Financial Consultant

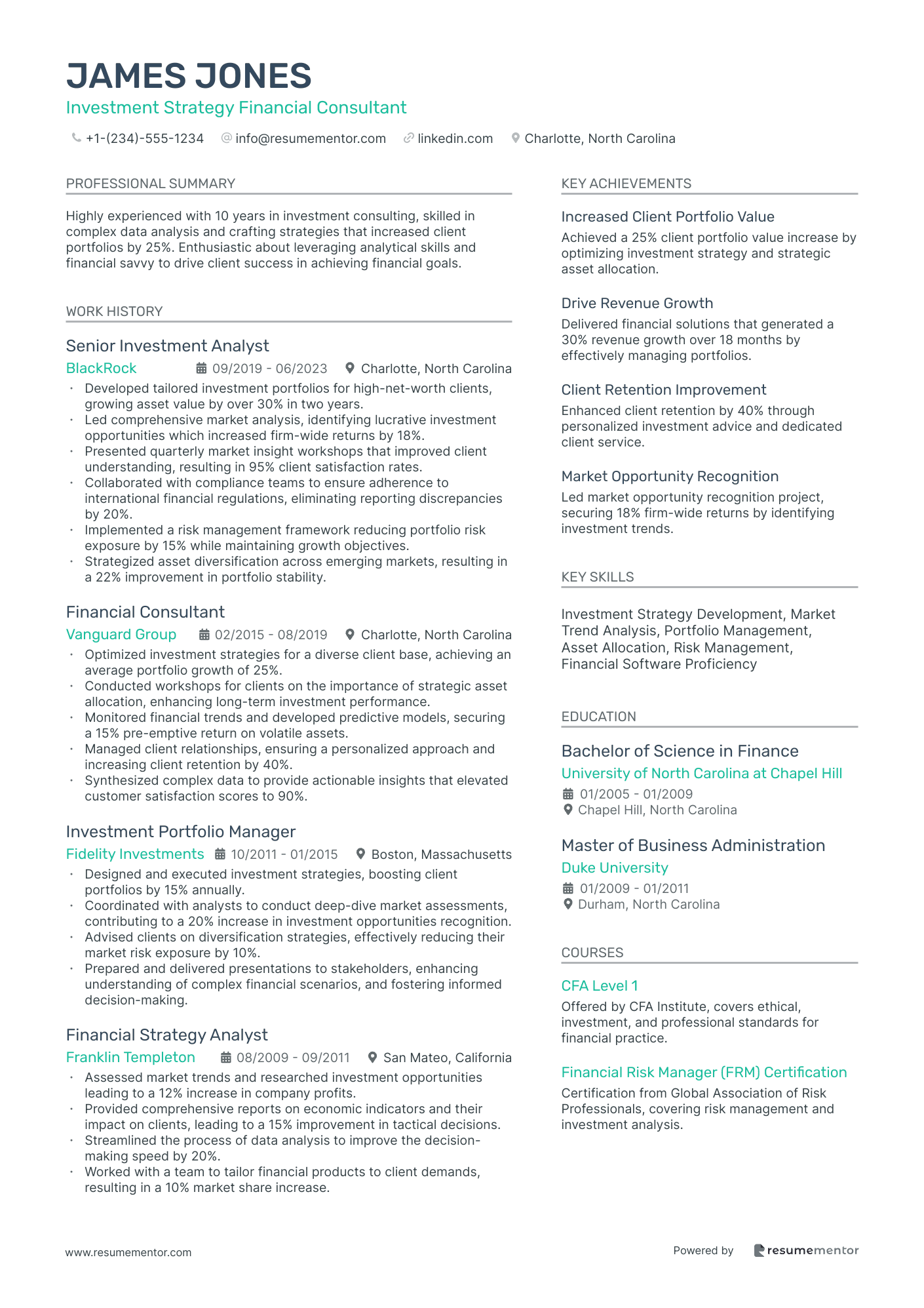

Investment Strategy Financial Consultant

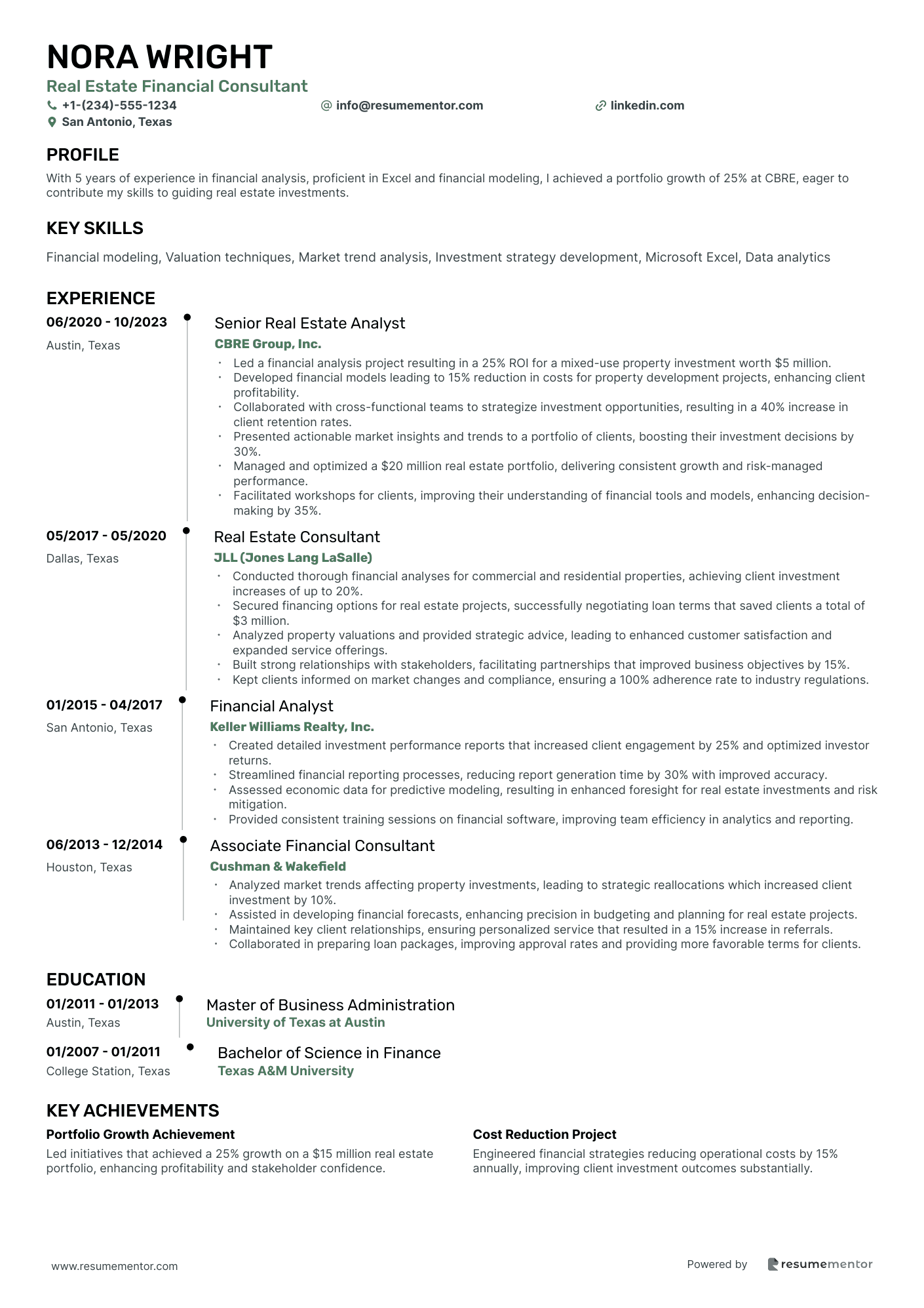

Real Estate Financial Consultant

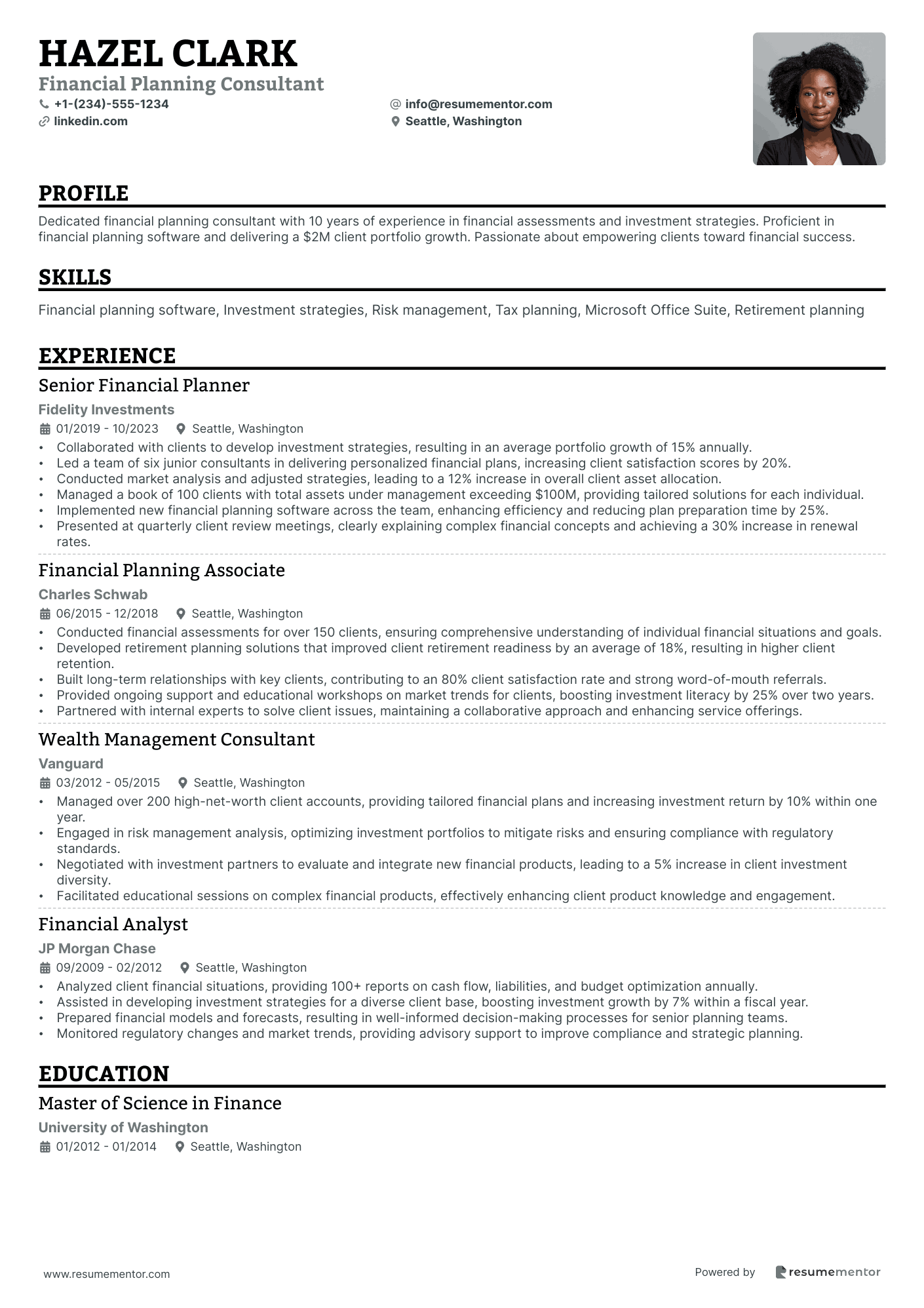

Financial Planning Consultant

Life Insurance Financial Consultant

Taxation Financial Consultant

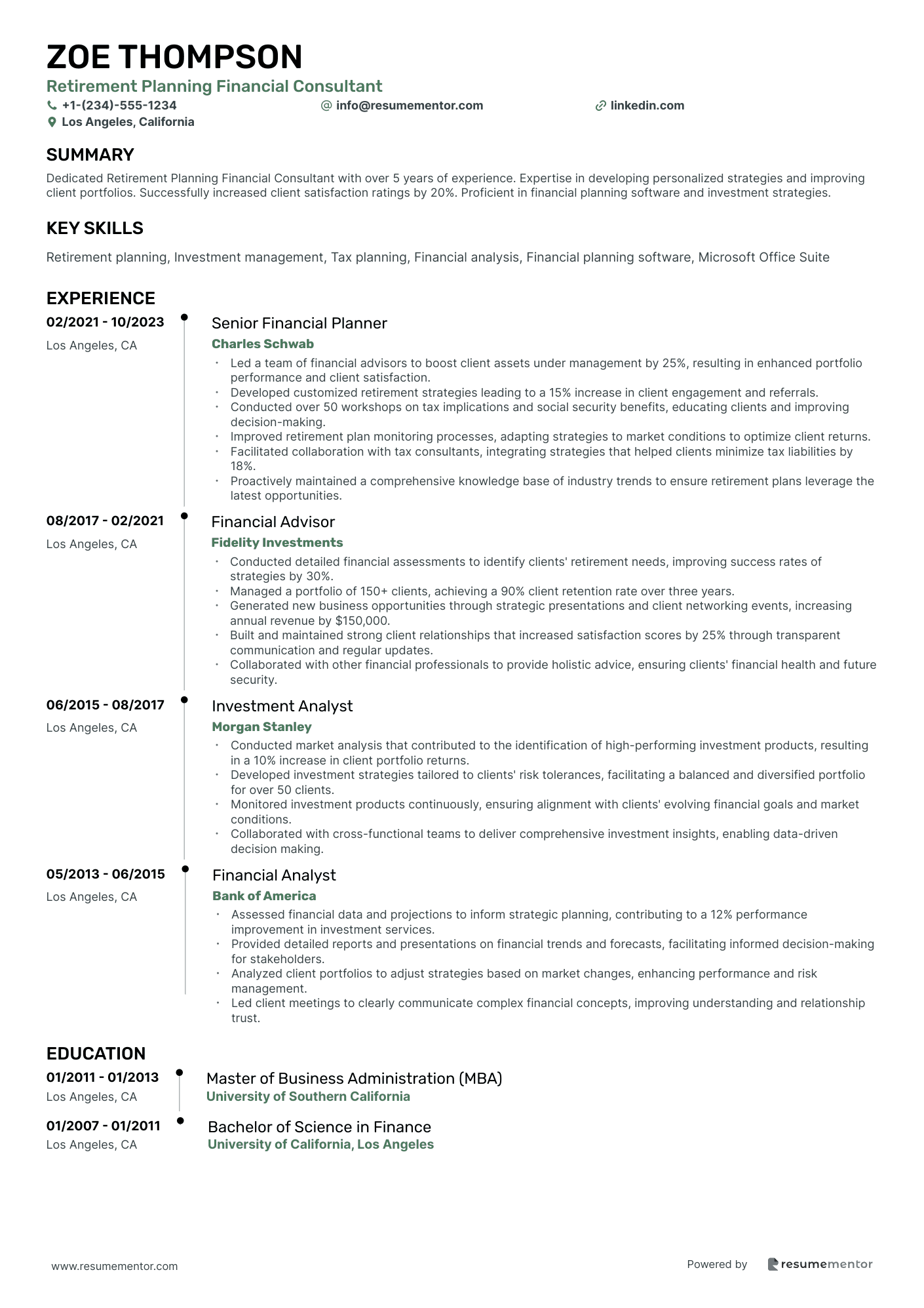

Retirement Planning Financial Consultant

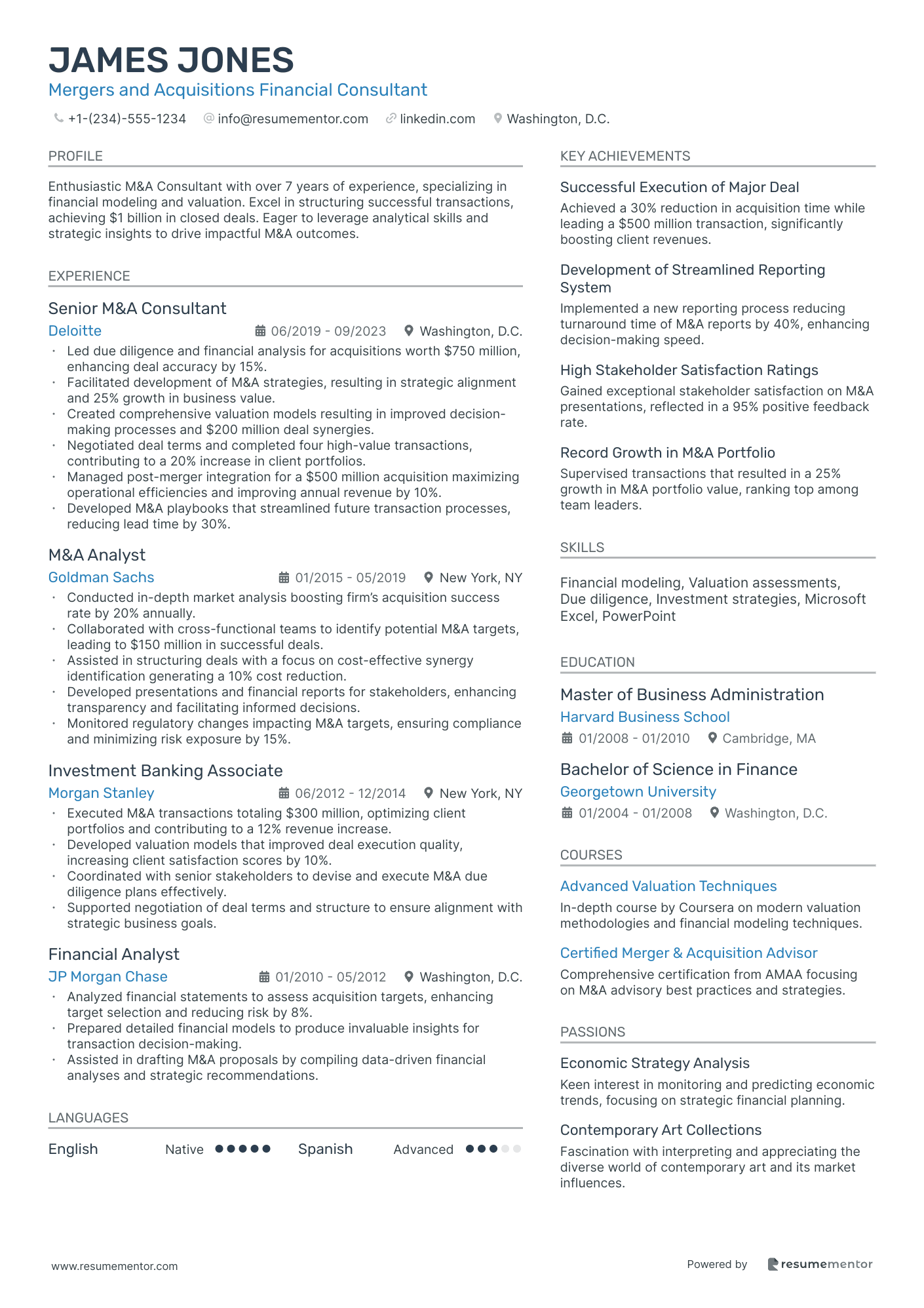

Mergers and Acquisitions Financial Consultant

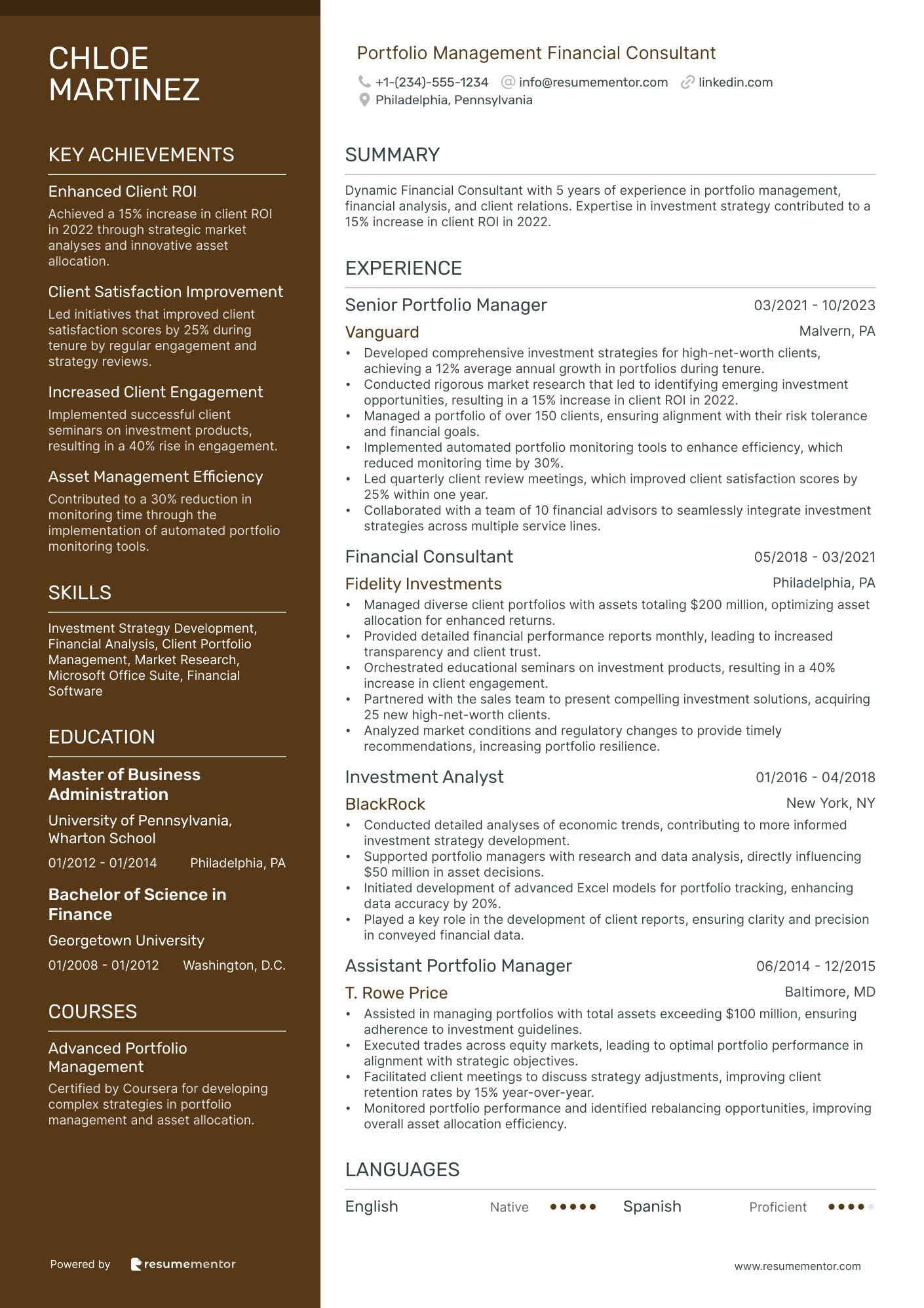

Portfolio Management Financial Consultant

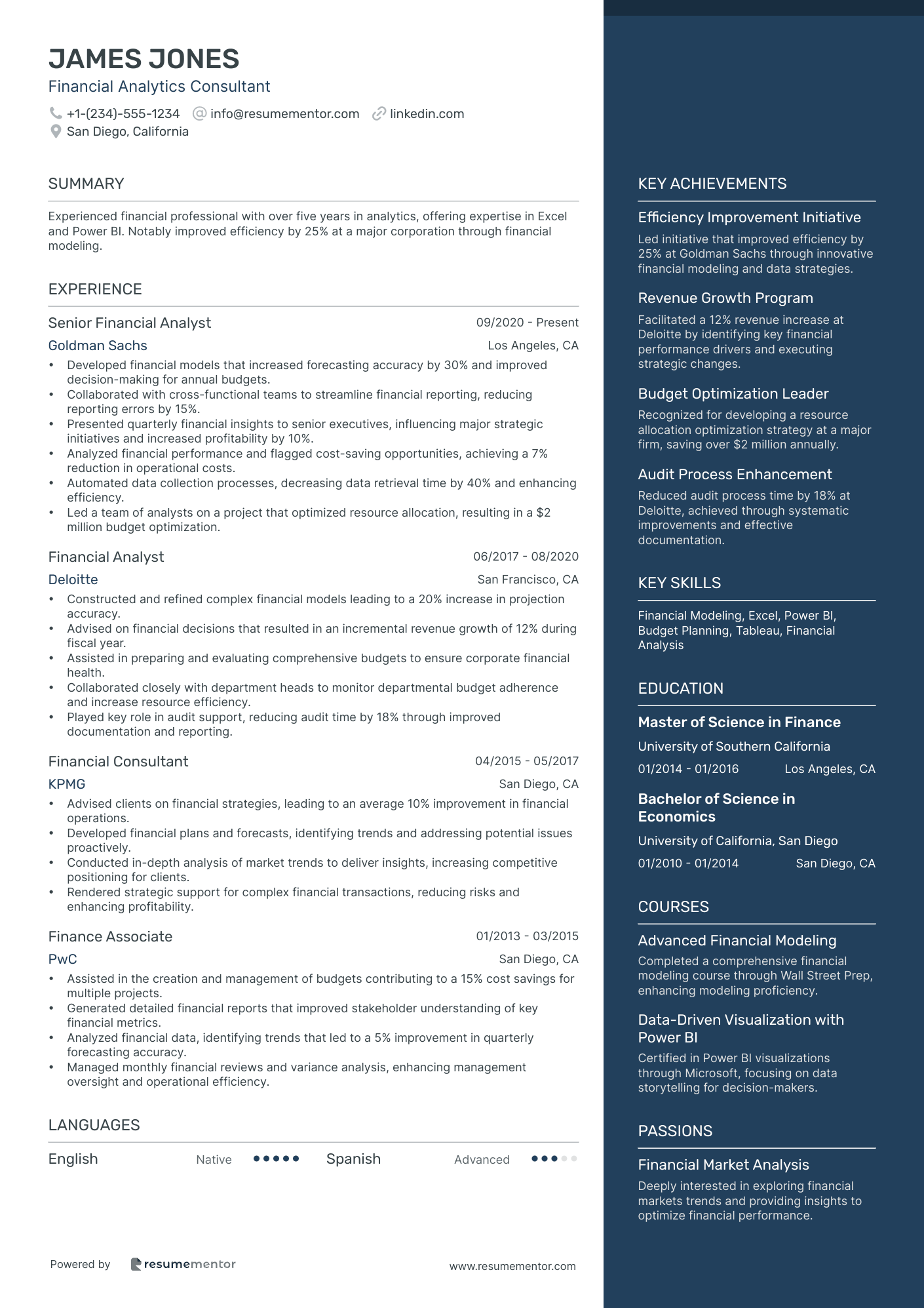

Financial Analytics Consultant

Risk Management Financial Consultant resume sample

- •Led a team in developing risk management frameworks for 15 corporate clients, improving compliance efficiency by 40% within six months.

- •Analyzed financial data to uncover risk trends, enabling clients to implement timely strategies that reduced risk exposure by an average of 25%.

- •Collaborated with cross-functional teams to integrate risk strategies into broader business processes, increasing operational resiliency by 30%.

- •Prepared and delivered over 50 detailed risk assessment reports and presentations for high-stake client meetings, enhancing client satisfaction by 20%.

- •Stayed updated on regulatory changes, ensuring that risk management processes aligned with the latest compliance standards, reducing potential penalties by 15%.

- •Developed and facilitated 10 training workshops for clients on best risk management practices, resulting in enhanced understanding and strategy application.

- •Engineered risk assessment processes that identified key operational and financial risks, curtailing threat levels for client portfolios by 30%.

- •Guided financial planning to augment client resilience, resulting %20 in increased efficiency and reduced unexpected financial impacts.

- •Managed implementation of ISO 31000 risk frameworks for multinational clients, enhancing risk response strategies across geographical divisions.

- •Presented comprehensive risk analyses to executive stakeholders, directly influencing 10 major strategic decisions.

- •Built robust client relationships, increasing client retention rates by 25% through dedicated risk management support and consulting.

- •Utilized financial modeling to assess client risks, refining strategic recommendations that led to a 15% decrease in risk exposure.

- •Implemented tailored risk strategies, resulting in $5 million savings in potential risk losses for top-tier clients.

- •Conducted periodic risk analyses across diverse industries, providing actionable insights that were integrated into client financial strategies.

- •Educated clients about risk management implications, improving process awareness and strategy application by 30%.

- •Conducted in-depth risk assessments for financial institutions, reducing identified high-risk exposures by 20% through efficient strategies.

- •Collaborated with senior consultants to align risk management frameworks with client business objectives, improving process alignment by 25%.

- •Participated in the development and execution of client risk workshops, increasing practical understanding of financial risk processes.

- •Maintained up-to-date knowledge on financial regulations, aiding client compliance and reducing potential sanction risks by 15%.

Investment Strategy Financial Consultant resume sample

- •Developed tailored investment portfolios for high-net-worth clients, growing asset value by over 30% in two years.

- •Led comprehensive market analysis, identifying lucrative investment opportunities which increased firm-wide returns by 18%.

- •Presented quarterly market insight workshops that improved client understanding, resulting in 95% client satisfaction rates.

- •Collaborated with compliance teams to ensure adherence to international financial regulations, eliminating reporting discrepancies by 20%.

- •Implemented a risk management framework reducing portfolio risk exposure by 15% while maintaining growth objectives.

- •Strategized asset diversification across emerging markets, resulting in a 22% improvement in portfolio stability.

- •Optimized investment strategies for a diverse client base, achieving an average portfolio growth of 25%.

- •Conducted workshops for clients on the importance of strategic asset allocation, enhancing long-term investment performance.

- •Monitored financial trends and developed predictive models, securing a 15% pre-emptive return on volatile assets.

- •Managed client relationships, ensuring a personalized approach and increasing client retention by 40%.

- •Synthesized complex data to provide actionable insights that elevated customer satisfaction scores to 90%.

- •Designed and executed investment strategies, boosting client portfolios by 15% annually.

- •Coordinated with analysts to conduct deep-dive market assessments, contributing to a 20% increase in investment opportunities recognition.

- •Advised clients on diversification strategies, effectively reducing their market risk exposure by 10%.

- •Prepared and delivered presentations to stakeholders, enhancing understanding of complex financial scenarios, and fostering informed decision-making.

- •Assessed market trends and researched investment opportunities leading to a 12% increase in company profits.

- •Provided comprehensive reports on economic indicators and their impact on clients, leading to a 15% improvement in tactical decisions.

- •Streamlined the process of data analysis to improve the decision-making speed by 20%.

- •Worked with a team to tailor financial products to client demands, resulting in a 10% market share increase.

Real Estate Financial Consultant resume sample

- •Led a financial analysis project resulting in a 25% ROI for a mixed-use property investment worth $5 million.

- •Developed financial models leading to 15% reduction in costs for property development projects, enhancing client profitability.

- •Collaborated with cross-functional teams to strategize investment opportunities, resulting in a 40% increase in client retention rates.

- •Presented actionable market insights and trends to a portfolio of clients, boosting their investment decisions by 30%.

- •Managed and optimized a $20 million real estate portfolio, delivering consistent growth and risk-managed performance.

- •Facilitated workshops for clients, improving their understanding of financial tools and models, enhancing decision-making by 35%.

- •Conducted thorough financial analyses for commercial and residential properties, achieving client investment increases of up to 20%.

- •Secured financing options for real estate projects, successfully negotiating loan terms that saved clients a total of $3 million.

- •Analyzed property valuations and provided strategic advice, leading to enhanced customer satisfaction and expanded service offerings.

- •Built strong relationships with stakeholders, facilitating partnerships that improved business objectives by 15%.

- •Kept clients informed on market changes and compliance, ensuring a 100% adherence rate to industry regulations.

- •Created detailed investment performance reports that increased client engagement by 25% and optimized investor returns.

- •Streamlined financial reporting processes, reducing report generation time by 30% with improved accuracy.

- •Assessed economic data for predictive modeling, resulting in enhanced foresight for real estate investments and risk mitigation.

- •Provided consistent training sessions on financial software, improving team efficiency in analytics and reporting.

- •Analyzed market trends affecting property investments, leading to strategic reallocations which increased client investment by 10%.

- •Assisted in developing financial forecasts, enhancing precision in budgeting and planning for real estate projects.

- •Maintained key client relationships, ensuring personalized service that resulted in a 15% increase in referrals.

- •Collaborated in preparing loan packages, improving approval rates and providing more favorable terms for clients.

Financial Planning Consultant resume sample

- •Collaborated with clients to develop investment strategies, resulting in an average portfolio growth of 15% annually.

- •Led a team of six junior consultants in delivering personalized financial plans, increasing client satisfaction scores by 20%.

- •Conducted market analysis and adjusted strategies, leading to a 12% increase in overall client asset allocation.

- •Managed a book of 100 clients with total assets under management exceeding $100M, providing tailored solutions for each individual.

- •Implemented new financial planning software across the team, enhancing efficiency and reducing plan preparation time by 25%.

- •Presented at quarterly client review meetings, clearly explaining complex financial concepts and achieving a 30% increase in renewal rates.

- •Conducted financial assessments for over 150 clients, ensuring comprehensive understanding of individual financial situations and goals.

- •Developed retirement planning solutions that improved client retirement readiness by an average of 18%, resulting in higher client retention.

- •Built long-term relationships with key clients, contributing to an 80% client satisfaction rate and strong word-of-mouth referrals.

- •Provided ongoing support and educational workshops on market trends for clients, boosting investment literacy by 25% over two years.

- •Partnered with internal experts to solve client issues, maintaining a collaborative approach and enhancing service offerings.

- •Managed over 200 high-net-worth client accounts, providing tailored financial plans and increasing investment return by 10% within one year.

- •Engaged in risk management analysis, optimizing investment portfolios to mitigate risks and ensuring compliance with regulatory standards.

- •Negotiated with investment partners to evaluate and integrate new financial products, leading to a 5% increase in client investment diversity.

- •Facilitated educational sessions on complex financial products, effectively enhancing client product knowledge and engagement.

- •Analyzed client financial situations, providing 100+ reports on cash flow, liabilities, and budget optimization annually.

- •Assisted in developing investment strategies for a diverse client base, boosting investment growth by 7% within a fiscal year.

- •Prepared financial models and forecasts, resulting in well-informed decision-making processes for senior planning teams.

- •Monitored regulatory changes and market trends, providing advisory support to improve compliance and strategic planning.

Life Insurance Financial Consultant resume sample

- •Exceeded sales targets by 25% for five consecutive quarters, dramatically increasing company revenue.

- •Developed personalized life insurance plans for over 150 clients, enhancing their financial security.

- •Conducted comprehensive needs analyses, resulting in improved client satisfaction by 30%.

- •Collaborated with cross-functional teams to redesign the client onboarding process, reducing onboarding time by 40%.

- •Led community workshops, educating over 200 individuals on the benefits and features of life insurance.

- •Achieved outstanding client retention rates through exceptional relationship management and service delivery.

- •Successfully managed a portfolio of 200 clients, improving client retention rates by 15% annually.

- •Advised clients on life insurance investments, resulting in a 20% growth in their portfolios.

- •Hosted client seminars, effectively increasing product knowledge and driving a 25% increase in sales.

- •Worked closely with team members to consistently provide a superior client experience.

- •Stayed updated on industry trends and product innovations, enhancing the quality of client recommendations.

- •Generated new business by leveraging community events, increasing client base by 50%.

- •Educated potential clients on insurance benefits, leading to a 35% increase in policy sales.

- •Implemented a client follow-up strategy improving client relationship management and retention.

- •Collaborated with team members on projects that enhanced sales processes and efficiency.

- •Assisted clients in developing comprehensive financial plans, resulting in improved financial security.

- •Conducted financial analyses that improved forecasting accuracy by 10%.

- •Collaborated with senior consultants to refine investment advice, boosting client portfolio returns.

- •Engaged in client relationship management, enhancing communication and satisfaction.

Taxation Financial Consultant resume sample

- •Spearheaded a cross-functional team to develop tax strategies that reduced tax liabilities by an average of 15% for high-net-worth clients.

- •Conducted extensive research on emerging tax regulations, presenting findings that informed strategic planning for over 25 top-tier clients, improving compliance.

- •Implemented a new tax review system, resulting in a 30% reduction in processing time while maintaining accuracy and reliability.

- •Provided personalized consultation during IRS audits, achieving a 98% success rate in client case resolutions.

- •Built and maintained strong client relationships, fostering trust and resulting in a 20% increase in repeat business.

- •Collaborated with audit and finance teams on multinational tax obligations, optimizing cross-border reporting compliance.

- •Managed a team of 10, overseeing the preparation and review of tax returns for corporate and individual clients, enhancing team productivity by 25%.

- •Advised clients on international tax matters, leading to efficient cross-border operations, minimizing tax implications by 18%.

- •Developed and conducted training programs on the latest tax regulations for clients, increasing compliance adherence by 40%.

- •Performed complex risk assessments to identify client-specific tax-saving opportunities, improving client tax positions.

- •Liaised with federal and state authorities, effectively resolving inquiries and maintaining strong regulatory rapport.

- •Reviewed 150+ tax returns annually, ensuring compliance with federal, state, and local tax laws while reducing error rates by 10%.

- •Assisted in strategizing tax plans for small to medium-sized enterprises, saving an average of 12% in taxes annually.

- •Researched updated tax incentives and credits applicable to clients, contributing to a 30% increase in client satisfaction scores.

- •Served as a key point of contact for audit processes, facilitating a streamlined communication flow between clients and tax authorities.

- •Prepared detailed tax plans for individual clients, achieving an accuracy improvement of 20% year-over-year.

- •Conducted tax research for customized tax-saving strategies, resulting in high client retention rates.

- •Provided exceptional service during client audits, maintaining a 95% success rate in audit negotiations.

- •Facilitated a comprehensive client advisory process, improving knowledge transfer and fostering long-term client relations.

Retirement Planning Financial Consultant resume sample

- •Led a team of financial advisors to boost client assets under management by 25%, resulting in enhanced portfolio performance and client satisfaction.

- •Developed customized retirement strategies leading to a 15% increase in client engagement and referrals.

- •Conducted over 50 workshops on tax implications and social security benefits, educating clients and improving decision-making.

- •Improved retirement plan monitoring processes, adapting strategies to market conditions to optimize client returns.

- •Facilitated collaboration with tax consultants, integrating strategies that helped clients minimize tax liabilities by 18%.

- •Proactively maintained a comprehensive knowledge base of industry trends to ensure retirement plans leverage the latest opportunities.

- •Conducted detailed financial assessments to identify clients' retirement needs, improving success rates of strategies by 30%.

- •Managed a portfolio of 150+ clients, achieving a 90% client retention rate over three years.

- •Generated new business opportunities through strategic presentations and client networking events, increasing annual revenue by $150,000.

- •Built and maintained strong client relationships that increased satisfaction scores by 25% through transparent communication and regular updates.

- •Collaborated with other financial professionals to provide holistic advice, ensuring clients' financial health and future security.

- •Conducted market analysis that contributed to the identification of high-performing investment products, resulting in a 10% increase in client portfolio returns.

- •Developed investment strategies tailored to clients' risk tolerances, facilitating a balanced and diversified portfolio for over 50 clients.

- •Monitored investment products continuously, ensuring alignment with clients' evolving financial goals and market conditions.

- •Collaborated with cross-functional teams to deliver comprehensive investment insights, enabling data-driven decision making.

- •Assessed financial data and projections to inform strategic planning, contributing to a 12% performance improvement in investment services.

- •Provided detailed reports and presentations on financial trends and forecasts, facilitating informed decision-making for stakeholders.

- •Analyzed client portfolios to adjust strategies based on market changes, enhancing performance and risk management.

- •Led client meetings to clearly communicate complex financial concepts, improving understanding and relationship trust.

Mergers and Acquisitions Financial Consultant resume sample

- •Led due diligence and financial analysis for acquisitions worth $750 million, enhancing deal accuracy by 15%.

- •Facilitated development of M&A strategies, resulting in strategic alignment and 25% growth in business value.

- •Created comprehensive valuation models resulting in improved decision-making processes and $200 million deal synergies.

- •Negotiated deal terms and completed four high-value transactions, contributing to a 20% increase in client portfolios.

- •Managed post-merger integration for a $500 million acquisition maximizing operational efficiencies and improving annual revenue by 10%.

- •Developed M&A playbooks that streamlined future transaction processes, reducing lead time by 30%.

- •Conducted in-depth market analysis boosting firm’s acquisition success rate by 20% annually.

- •Collaborated with cross-functional teams to identify potential M&A targets, leading to $150 million in successful deals.

- •Assisted in structuring deals with a focus on cost-effective synergy identification generating a 10% cost reduction.

- •Developed presentations and financial reports for stakeholders, enhancing transparency and facilitating informed decisions.

- •Monitored regulatory changes impacting M&A targets, ensuring compliance and minimizing risk exposure by 15%.

- •Executed M&A transactions totaling $300 million, optimizing client portfolios and contributing to a 12% revenue increase.

- •Developed valuation models that improved deal execution quality, increasing client satisfaction scores by 10%.

- •Coordinated with senior stakeholders to devise and execute M&A due diligence plans effectively.

- •Supported negotiation of deal terms and structure to ensure alignment with strategic business goals.

- •Analyzed financial statements to assess acquisition targets, enhancing target selection and reducing risk by 8%.

- •Prepared detailed financial models to produce invaluable insights for transaction decision-making.

- •Assisted in drafting M&A proposals by compiling data-driven financial analyses and strategic recommendations.

Portfolio Management Financial Consultant resume sample

- •Developed comprehensive investment strategies for high-net-worth clients, achieving a 12% average annual growth in portfolios during tenure.

- •Conducted rigorous market research that led to identifying emerging investment opportunities, resulting in a 15% increase in client ROI in 2022.

- •Managed a portfolio of over 150 clients, ensuring alignment with their risk tolerance and financial goals.

- •Implemented automated portfolio monitoring tools to enhance efficiency, which reduced monitoring time by 30%.

- •Led quarterly client review meetings, which improved client satisfaction scores by 25% within one year.

- •Collaborated with a team of 10 financial advisors to seamlessly integrate investment strategies across multiple service lines.

- •Managed diverse client portfolios with assets totaling $200 million, optimizing asset allocation for enhanced returns.

- •Provided detailed financial performance reports monthly, leading to increased transparency and client trust.

- •Orchestrated educational seminars on investment products, resulting in a 40% increase in client engagement.

- •Partnered with the sales team to present compelling investment solutions, acquiring 25 new high-net-worth clients.

- •Analyzed market conditions and regulatory changes to provide timely recommendations, increasing portfolio resilience.

- •Conducted detailed analyses of economic trends, contributing to more informed investment strategy development.

- •Supported portfolio managers with research and data analysis, directly influencing $50 million in asset decisions.

- •Initiated development of advanced Excel models for portfolio tracking, enhancing data accuracy by 20%.

- •Played a key role in the development of client reports, ensuring clarity and precision in conveyed financial data.

- •Assisted in managing portfolios with total assets exceeding $100 million, ensuring adherence to investment guidelines.

- •Executed trades across equity markets, leading to optimal portfolio performance in alignment with strategic objectives.

- •Facilitated client meetings to discuss strategy adjustments, improving client retention rates by 15% year-over-year.

- •Monitored portfolio performance and identified rebalancing opportunities, improving overall asset allocation efficiency.

Financial Analytics Consultant resume sample

- •Developed financial models that increased forecasting accuracy by 30% and improved decision-making for annual budgets.

- •Collaborated with cross-functional teams to streamline financial reporting, reducing reporting errors by 15%.

- •Presented quarterly financial insights to senior executives, influencing major strategic initiatives and increased profitability by 10%.

- •Analyzed financial performance and flagged cost-saving opportunities, achieving a 7% reduction in operational costs.

- •Automated data collection processes, decreasing data retrieval time by 40% and enhancing efficiency.

- •Led a team of analysts on a project that optimized resource allocation, resulting in a $2 million budget optimization.

- •Constructed and refined complex financial models leading to a 20% increase in projection accuracy.

- •Advised on financial decisions that resulted in an incremental revenue growth of 12% during fiscal year.

- •Assisted in preparing and evaluating comprehensive budgets to ensure corporate financial health.

- •Collaborated closely with department heads to monitor departmental budget adherence and increase resource efficiency.

- •Played key role in audit support, reducing audit time by 18% through improved documentation and reporting.

- •Advised clients on financial strategies, leading to an average 10% improvement in financial operations.

- •Developed financial plans and forecasts, identifying trends and addressing potential issues proactively.

- •Conducted in-depth analysis of market trends to deliver insights, increasing competitive positioning for clients.

- •Rendered strategic support for complex financial transactions, reducing risks and enhancing profitability.

- •Assisted in the creation and management of budgets contributing to a 15% cost savings for multiple projects.

- •Generated detailed financial reports that improved stakeholder understanding of key financial metrics.

- •Analyzed financial data, identifying trends that led to a 5% improvement in quarterly forecasting accuracy.

- •Managed monthly financial reviews and variance analysis, enhancing management oversight and operational efficiency.

Crafting a financial consultant resume is like preparing a seasoned portfolio meant to impress potential clients. Your role balances analytical skills with market insight, but translating that diversity into a resume can be challenging. By clearly expressing your financial know-how and client-driven problem-solving, you can strike the right chord and open doors to new opportunities.

The key is finding a format that highlights your skills without overshadowing your unique qualities. Using a resume template offers this balance, providing a structure that ensures clarity and consistency. Take a look at these resume templates to help craft a resume that accurately reflects your professional journey.

With employers often scanning resumes in seconds, every word must count. Demonstrating your financial expertise through quantifiable achievements, such as increased revenue figures or successful projects, is crucial. A well-crafted resume not only showcases your skills but also sets you apart in the competitive market, highlighting your adaptability and success as a financial consultant.

Key Takeaways

- Crafting a financial consultant resume involves showcasing analytical skills, financial expertise, and quantifiable achievements to make a strong impression.

- Using a well-structured resume format and choosing a modern font can help ensure clarity and professionalism, aiding quick readability for employers.

- Highlight actionable achievements in your experience section with specific numbers to demonstrate your impact and value.

- Both hard and soft skills should be featured to align with employer expectations and improve the likelihood of passing applicant tracking systems.

- Including relevant educational details, certifications, and additional sections like languages or volunteer work can further enhance your credentials.

What to focus on when writing your financial consultant resume

A financial consultant resume should clearly communicate your expertise in financial strategy and analysis to the recruiter. It needs to highlight your ability to offer sound financial advice, manage investments, and analyze data to optimize financial performance. Presenting trust, along with strong analytical skills and strategic thinking, will set you apart in this competitive field.

How to structure your financial consultant resume

- Contact Information: Start with your full name, phone number, email address, and LinkedIn profile—ensuring recruiters can easily reach out to you for that crucial first contact. This information is the gateway to your professional persona and needs to be accurate and up-to-date.

- Professional Summary: Follow with a concise summary that captures your financial consulting experience and key skills like financial modeling or risk assessment—setting the stage for your work experience. This summary should give recruiters an immediate sense of your value and expertise in the financial world, creating an impactful first impression.

- Work Experience: Build on the professional summary by detailing your past roles, focusing on achievements. Use bullet points to highlight how you've improved client portfolios or increased revenue—demonstrating real-world impact. Each point should tell a story of your problem-solving skills and results-driven mindset, painting a clear picture of your contributions to previous workplaces.

- Education: Next, list your degrees and certifications, such as a Bachelor's in Finance or a Certified Financial Planner (CFP) credential—providing a foundation for your expertise. This section underscores the academic backbone that supports your practical skills and professional insights.

- Skills: Complement your educational background with relevant skills like financial analysis, investment strategy, and proficiency in financial software such as Excel or SAP—showcasing your practical capabilities. Highlighting these skills reaffirms your ability to apply knowledge effectively in various financial scenarios.

- Certifications & Licenses: Reinforce your skills by mentioning any certifications like CPA, CFA, or other credentials that demonstrate specialized financial expertise—validating your competency to handle complex financial tasks. This added layer of qualifications can give you an edge, emphasizing your commitment to professional growth.

For additional depth, consider optional sections like "Professional Affiliations," such as membership in the Financial Planning Association, or "Awards and Honors" to highlight special recognitions you've received—adding further distinction to your profile. Below, we will cover each section more in-depth, ensuring your resume format maximally conveys your abilities and potential to recruiters.

Which resume format to choose

Creating a financial consultant resume involves selecting a format that effectively showcases your expertise. A reverse-chronological format is particularly effective. This format highlights your career trajectory by placing your most recent roles at the forefront. For financial consultants, this method underscores your accumulated experience and career progression, key points for potential employers evaluating your suitability.

Once the format is decided, consider your font choice, as it subtly influences the presentation of your resume. Opt for modern fonts like Lato, Montserrat, or Raleway. These fonts are not only easy to read but also convey a sense of professionalism and modernity, complementing the organized structure of your resume.

It's also essential to save your resume as a PDF, a crucial step that ensures your document remains exactly as you formatted it. PDFs capture your layout, fonts, and spacing, preserving your professional presentation across all devices and systems. This reliability makes PDFs the preferred format when applying to roles in the financial industry.

Equally important are the margins, which play a pivotal role in readability. Stick to one-inch margins on all sides to create a clean, organized look. This ensures your resume is not only aesthetically pleasing but also easy to skim, an important consideration when hiring managers are quickly reviewing applications.

By integrating these elements—format, font choice, file type, and margins—your resume will effectively communicate your financial expertise. You'll craft a professional document that aligns with industry standards and stands out to hiring managers in the competitive field of financial consulting.

How to write a quantifiable resume experience section

Your resume's experience section is crucial for grabbing attention as a financial consultant. It's where you lay out your professional journey and demonstrate your expertise through impactful achievements. Start by structuring this section with a clear layout, beginning with your most recent role. It's important to focus on positions relevant to the job you want, typically going back 10-15 years and using job titles that align closely with financial consulting or your desired role.

Tailoring your resume is key because it helps align your experience with the job ad. Use relevant keywords and mirror the language from the listing to make a strong connection. Start each bullet point with action words like "achieved," "improved," "increased," "reduced," and "developed" to show how proactive you are. This not only highlights what you've accomplished but also indicates how you could bring value to a prospective employer.

A well-crafted financial consultant experience section could look like this:

- •Increased client portfolio profitability by 25% over three years through innovative financial strategies.

- •Developed and implemented risk management frameworks that reduced client exposure by 15%.

- •Consulted with 50+ clients yearly, offering tailored financial solutions that boosted satisfaction ratings by 30%.

- •Streamlined financial reporting processes, decreasing analysis turnaround time by 40%.

This experience section stands out because it focuses on achievements that directly reflect your role as a consultant. Each bullet point is packed with specific numbers, making your success measurable and impressive. Using strong action verbs throughout helps illustrate how you actively contributed to your company’s goals. This approach clearly shows the potential impact you could have at your next job, making you more appealing to recruiters. Tailoring is evident with industry-specific language, ensuring that your qualifications align with the role you're targeting, setting you up as a candidate ready to drive financial success.

Innovation-Focused resume experience section

A financial consultant's Innovation-Focused resume experience section should clearly demonstrate your ability to bring fresh ideas and drive positive change within an organization. Begin by clearly listing your dates of employment, job title, and workplace for each position. It's important to highlight how you leveraged innovative solutions to improve processes and outcomes. Describe your role in developing new financial models or systems that enhanced efficiency or boosted profits, emphasizing the original ideas you implemented and their tangible benefits.

When crafting bullet points, it's essential to showcase specific achievements and the steps you took to accomplish them. You might include instances where you led projects that integrated cutting-edge technology into financial operations, thereby addressing unique market challenges. Always quantify your results to show the scale and impact of your initiatives. This approach will allow future employers to appreciate your ability to foster innovation and deliver exceptional results.

Senior Financial Consultant

TechFinance Solutions

June 2020 - Present

- Created a financial forecasting model that boosted prediction accuracy by 20%.

- Introduced new technology that halved the time needed for report generation.

- Led teams to ensure digital transformation aligned with company goals.

- Automated processes that sped up data analysis, improving decision-making.

Training and Development Focused resume experience section

A financial consultant-focused resume experience section should highlight your key roles and the relevant timeframes. Start by showcasing tasks and achievements directly related to training and development, illustrating your impact on employee growth and organizational success. Use action-oriented language to describe initiatives you led, like launching new training programs or conducting workshops, and strive to quantify the impact of your efforts, noting improvements like the number of people trained or performance boosts.

In your bullet points, provide clear and concise insight into your achievements and responsibilities. You might discuss how you tailored training programs based on industry trends or collaborated with various teams to create comprehensive learning modules. Focus on the tangible outcomes of your efforts, such as enhanced productivity or better compliance with financial regulations. Aim to use straightforward, vivid language to help potential employers fully understand your skills and accomplishments within the realm of training and development.

Training & Development Lead

June 2018 - Present

- Developed a new employee training program, cutting onboarding time by 30%

- Led workshops on new financial software, boosting user adoption by 40%

- Created a mentorship program with management, enhancing employee retention by 20%

- Designed custom financial training materials that improved staff efficiency by 25%

Skills-Focused resume experience section

A skills-focused financial consultant resume experience section should highlight the abilities that have driven your past accomplishments. Begin by clearly stating your job title and providing a brief overview of your responsibilities. Then, use bullet points to spotlight key achievements that emphasize measurable results. It's important to use active verbs such as "increased," "improved," or "achieved" to effectively convey the impact of your work. While incorporating industry-specific language can be helpful, avoid jargon that might confuse your reader.

Each bullet point should be clear and informative, not just detailing what you did, but illustrating how it benefited the organization. Using quantifiable achievements like numbers and percentages can make your successes more tangible. Relating your skills to real-world examples highlights instances where your expertise directly improved financial outcomes. Throughout the section, ensure that everything you include is relevant to the financial consultant role you're targeting, maintaining coherence and significance with each entry.

Financial Consultant

ABC Financial Services

June 2018 - Present

- Led a team to increase client portfolio returns by 15% over two years.

- Developed a budgeting strategy that cut client expenses by 10%, resulting in $200,000 saved annually.

- Streamlined investment processes, enhancing transaction time by 30%.

- Advised over 50 clients on risk management, enhancing their financial stability.

Growth-Focused resume experience section

A growth-focused financial consultant resume experience section should highlight your ability to drive business expansion and revenue growth through strategic initiatives. Begin by emphasizing your key responsibilities and the tangible outcomes you've achieved. Describe how your strategies have led to significant increases in client portfolios or improvements in financial practices. Each bullet point should reflect a proactive approach, demonstrating your commitment to enhancing business success.

Use simple, clear language to ensure your accomplishments are easily understood, avoiding complex jargon. The connection between your actions and the resulting growth should be evident, illustrating your effectiveness in fostering financial performance. The goal is to allow potential employers to quickly recognize your potential for contributing positively to their organization.

Senior Financial Consultant

Global Financial Advisors

June 2019 - Present

- Increased client asset portfolios by 30% within a year through strategic investment recommendations.

- Implemented tailored financial plans that led to a 25% boost in customer retention and satisfaction.

- Streamlined investment processes, reducing client onboarding time by 15%, enhancing efficiency.

- Advised on cost-saving strategies, contributing to a 10% reduction in operational expenses.

Write your financial consultant resume summary section

A financial consultant-focused resume summary should make a strong first impression by quickly highlighting key aspects of your professional profile. For someone in this role, it’s essential to emphasize your skill set, expertise, and what makes you exceptional. Showcase your years of experience, your mastery in financial planning, and any significant achievements. This can be done effectively by using strong action words and specific examples, like this:

Such a summary provides a snapshot of your professional strengths and accomplishments, giving employers immediate insights without unnecessary detail. To describe yourself effectively, connecting your strengths with past successes is key. Including numerical data to support your achievements demonstrates your impact and value in previous roles. Understanding the differences between a summary and other resume sections can further tailor your approach. While a resume objective focuses on future career goals, a resume profile combines your skills and objectives. A summary of qualifications, on the other hand, highlights key skills in a bullet-point list. Each approach serves a different purpose depending on your career stage and the role you’re applying for. Tailor your resume summary to suit these needs and make your application stand out.

Listing your financial consultant skills on your resume

A skills-focused financial consultant resume should pay careful attention to the skills section, which is vital for showcasing your capabilities. You can opt to create a standalone skills section or integrate these skills into your experience or summary sections. While your strengths and soft skills highlight your ability to communicate, collaborate, and lead effectively, they also connect your professional experiences with your personal attributes. In contrast, hard skills focus on specific financial knowledge or abilities, such as quantitative analysis or financial modeling.

Both types of skills serve as essential resume keywords that attract the attention of hiring managers and applicant tracking systems. These keywords ensure that your resume aligns with employer expectations and increases your chances of being selected.

Example of a standalone skills section:

This skills section is effective because it clearly lists the key competencies necessary for a financial consultant, bridging financial expertise with client management skills.

Best hard skills to feature on your financial consultant resume

Your hard skills should reflect your technical expertise and ability to manage complex financial scenarios. These skills demonstrate proficiency in data analysis, strategic planning, and investment execution.

Hard Skills

- Financial Modeling

- Investment Analysis

- Risk Management

- Portfolio Management

- Quantitative Analysis

- Regulatory Compliance

- Tax Planning

- Financial Reporting

- Data Analysis

- Budget Planning

- Market Research

- Strategic Planning

- Performance Analysis

- Economic Forecasting

- Accounting Principles

Best soft skills to feature on your financial consultant resume

Highlight your soft skills to show your capacity to engage with clients and colleagues. These skills underscore your ability to negotiate, lead, and communicate effectively, which are crucial when advising clients and managing projects.

Soft Skills

- Communication

- Problem-Solving

- Negotiation

- Leadership

- Adaptability

- Time Management

- Critical Thinking

- Teamwork

- Attention to Detail

- Conflict Resolution

- Decision-Making

- Emotional Intelligence

- Initiative

- Customer Service

- Collaboration

How to include your education on your resume

The education section is a crucial part of your resume, especially for a financial consultant role. It needs to highlight your relevant academic background and show you're qualified for the job. Tailor it to fit the job you're applying for, and leave out any irrelevant educational details. When listing your degree, clearly state the type of degree and the field of study. If your GPA is impressive, typically 3.5 or above, you can include it in your resume. Also, if you graduated with honors, such as cum laude, include this information as it adds value to your qualifications.

Here’s an example of a poorly structured education section:

And here’s a well-structured example suitable for a financial consultant:

The second example is effective because it highlights relevant qualifications such as an MBA in Finance, which is critical for a financial consultant role. It includes a strong GPA and cum laude honors, emphasizing academic excellence. This concise presentation of education aligns well with the requirements of the position and supports a strong application.

How to include financial consultant certificates on your resume

A certificates section is an essential part of your financial consultant resume. List the name of the certificate clearly. Include the date you obtained it. Add the issuing organization to lend credibility. You can also feature key certificates in your resume header for a quick glance. For instance, you could write: "Certified Financial Planner (CFP), 2022, Issued by CFP Board."

Here is a well-crafted example of a standalone certificates section:

This is a good example because it lists certificates relevant to financial consultancy. Each certificate is clearly named, with the issuing organization included, which adds weight to your qualifications. This clear and concise format makes it easy for potential employers to see your credentials at a glance.

Extra sections to include in your financial consultant resume

As a financial consultant, crafting a resume that highlights your diverse skill set and experience is crucial. Distinguishing yourself from the competition involves showcasing various aspects of your professional and personal life, which may include additional sections often overlooked. These sections can provide invaluable insights into your abilities, interests, and values.

Language section—List any foreign languages you speak fluently to highlight your ability to work with diverse clients. This shows your adaptability and can significantly expand your market reach.

Hobbies and interests section—Include pursuits such as chess or reading finance journals to underline your analytical skills and passion for the industry. This adds a personal touch and can make you more relatable.

Volunteer work section—Describe any financial literacy programs or community services you’ve participated in to demonstrate your commitment to social responsibility. It underscores your willingness to use your skills for the greater good, which can be appealing to employers.

Books section—Mention influential finance-related books you’ve read to display your ongoing education and dedication to professional development. This shows you are proactive in keeping up-to-date with industry trends and knowledge.

In Conclusion

In conclusion, building an impressive financial consultant resume is a strategic task that requires a balanced combination of skills, experience, and personal attributes. Your resume should present a clear narrative of your career journey, emphasizing your analytical abilities and client-focused problem-solving skills. By choosing the right format, you can ensure that your qualifications are highlighted effectively, allowing hiring managers to see your potential quickly. It is vital to support your achievements with quantifiable evidence, showcasing how you have driven financial success in past roles. Incorporating soft and hard skills reinforces your versatility and capability to meet diverse client needs.

Remember, the education section is not just about listing degrees but presenting your academic background in a way that underscores your expertise in finance. Including professional certifications further solidifies your credibility and demonstrates your commitment to continuous learning. Additionally, optional sections like language abilities and volunteer work can add depth to your profile, making it more relatable and holistic. Tailor each section to align with the job you are aiming for, and understand the nuances between a resume objective, summary, and skills section. Finally, your resume should serve as a concise yet comprehensive portfolio of your career, portraying you as an asset capable of contributing significantly to any financial consulting role.

Related Articles

Continue Reading

Check more recommended readings to get the job of your dreams.

Resume

Resources

Tools

© 2026. All rights reserved.

Made with love by people who care.