28+ Banking Resume Examples

Jul 18, 2024

|

12 min read

Craft a banking resume that makes 'cents': Your guide to landing a job in finance. Learn how to highlight your key skills and experience to stand out in the competitive world of banking.

Rated by 348 people

Fresher Banking resume sample

Emphasize any relevant internships, projects, or coursework. Highlight strong analytical and communication skills. Mention any certifications or training in banking or finance. Provide examples of how your coursework or projects prepared you for a role in banking.

- •Assisted in sourcing over 150 profiles weekly, improving recruitment timelines by 20%.

- •Screened and shortlisted candidates, resulting in a 30% increase in interview-to-hire ratio.

- •Drafted and edited HR documents, contributing to the efficiency of onboarding processes.

- •Conducted cold calls to potential candidates, enhancing the candidate pool by 25%.

- •Collaborated with senior HR staff to coordinate team-building activities, boosting employee engagement by 15%.

- •Supported policy drafting initiatives, ensuring compliance with local labor laws and regulations.

- •Managed a recruitment database with 200+ profiles, ensuring data accuracy and access for HR team.

- •Coordinated interview schedules for over 30 candidates monthly, optimizing interviewer availability.

- •Participated in drafting HR policies, enhancing employee understanding and reducing policy-related queries by 10%.

- •Supported general HR activities and administrative tasks, improving daily HR operations.

- •Organized volunteer schedules, ensuring adequate staffing levels for projects.

- •Facilitated communication between volunteers and staff, enhancing project completion rates.

- •Trained new volunteers on procedures and safety protocols.

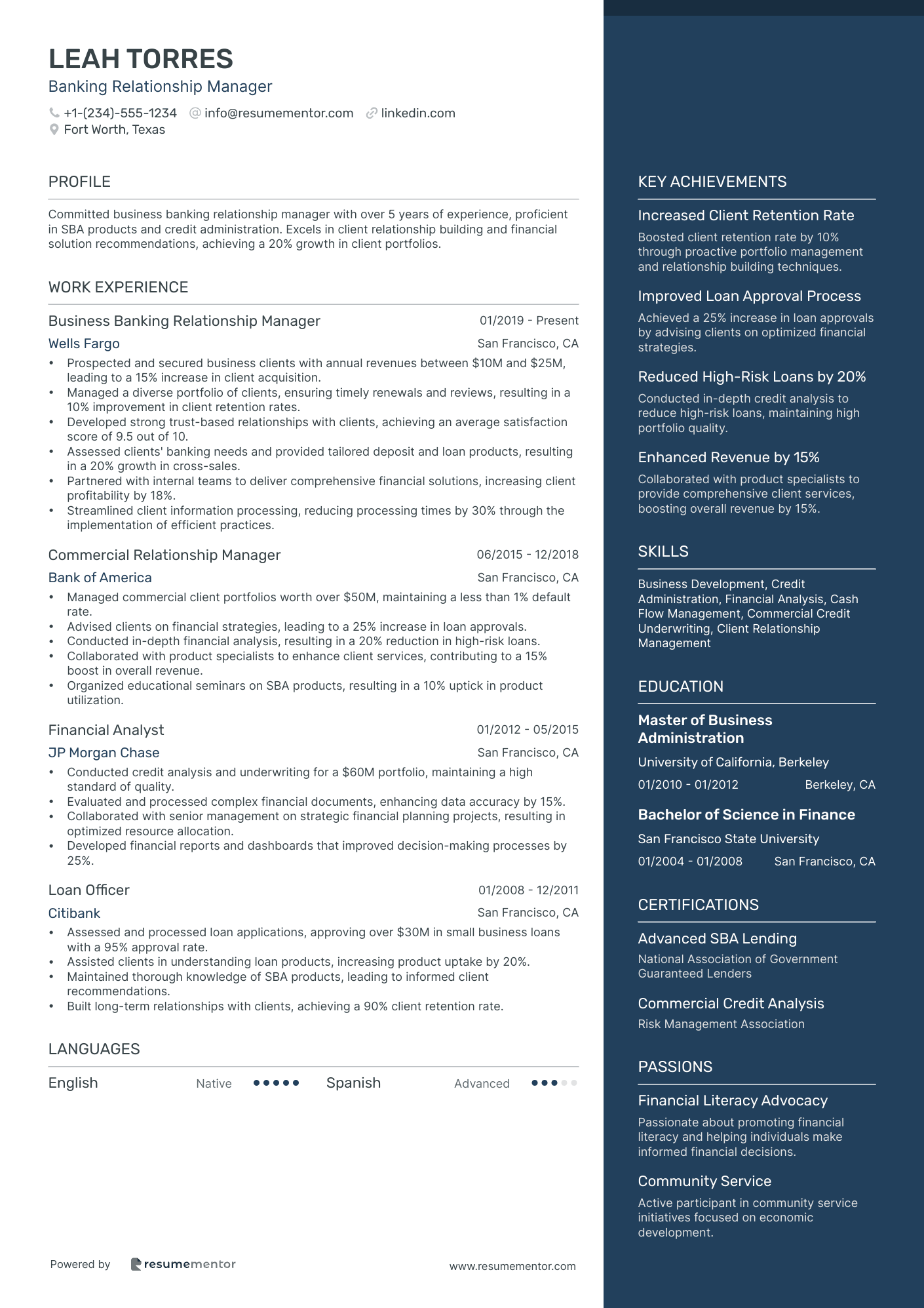

Banking Relationship Manager resume sample

Highlight your experience in client relationship management and sales. Strong networking and negotiation skills are crucial. Mention any relevant certifications in Relationship Management or Client Management. Provide examples using the 'skill-action-result' approach, showing how your skills have driven customer satisfaction and revenue growth.

- •Prospected and secured business clients with annual revenues between $10M and $25M, leading to a 15% increase in client acquisition.

- •Managed a diverse portfolio of clients, ensuring timely renewals and reviews, resulting in a 10% improvement in client retention rates.

- •Developed strong trust-based relationships with clients, achieving an average satisfaction score of 9.5 out of 10.

- •Assessed clients' banking needs and provided tailored deposit and loan products, resulting in a 20% growth in cross-sales.

- •Partnered with internal teams to deliver comprehensive financial solutions, increasing client profitability by 18%.

- •Streamlined client information processing, reducing processing times by 30% through the implementation of efficient practices.

- •Managed commercial client portfolios worth over $50M, maintaining a less than 1% default rate.

- •Advised clients on financial strategies, leading to a 25% increase in loan approvals.

- •Conducted in-depth financial analysis, resulting in a 20% reduction in high-risk loans.

- •Collaborated with product specialists to enhance client services, contributing to a 15% boost in overall revenue.

- •Organized educational seminars on SBA products, resulting in a 10% uptick in product utilization.

- •Conducted credit analysis and underwriting for a $60M portfolio, maintaining a high standard of quality.

- •Evaluated and processed complex financial documents, enhancing data accuracy by 15%.

- •Collaborated with senior management on strategic financial planning projects, resulting in optimized resource allocation.

- •Developed financial reports and dashboards that improved decision-making processes by 25%.

- •Assessed and processed loan applications, approving over $30M in small business loans with a 95% approval rate.

- •Assisted clients in understanding loan products, increasing product uptake by 20%.

- •Maintained thorough knowledge of SBA products, leading to informed client recommendations.

- •Built long-term relationships with clients, achieving a 90% client retention rate.

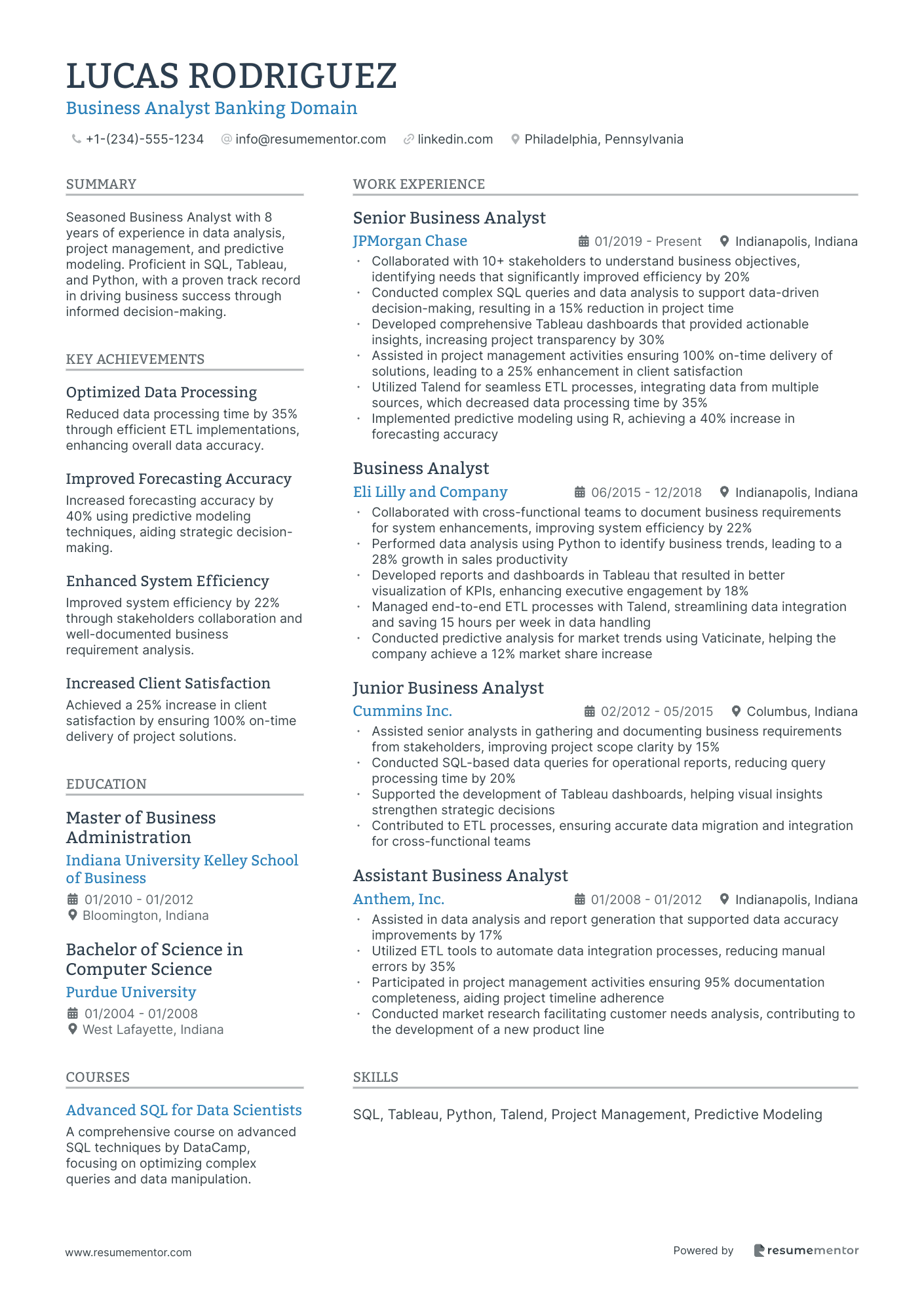

Business Analyst Banking Domain resume sample

Emphasize your analytical skills and experience in banking projects. Highlight your proficiency in data analysis tools and methodologies. Mention any courses or certifications in Business Analysis or Financial Modeling. Use the 'skill-action-result' approach to show how your analyses led to improved operations or cost savings.

- •Collaborated with 10+ stakeholders to understand business objectives, identifying needs that significantly improved efficiency by 20%

- •Conducted complex SQL queries and data analysis to support data-driven decision-making, resulting in a 15% reduction in project time

- •Developed comprehensive Tableau dashboards that provided actionable insights, increasing project transparency by 30%

- •Assisted in project management activities ensuring 100% on-time delivery of solutions, leading to a 25% enhancement in client satisfaction

- •Utilized Talend for seamless ETL processes, integrating data from multiple sources, which decreased data processing time by 35%

- •Implemented predictive modeling using R, achieving a 40% increase in forecasting accuracy

- •Collaborated with cross-functional teams to document business requirements for system enhancements, improving system efficiency by 22%

- •Performed data analysis using Python to identify business trends, leading to a 28% growth in sales productivity

- •Developed reports and dashboards in Tableau that resulted in better visualization of KPIs, enhancing executive engagement by 18%

- •Managed end-to-end ETL processes with Talend, streamlining data integration and saving 15 hours per week in data handling

- •Conducted predictive analysis for market trends using Vaticinate, helping the company achieve a 12% market share increase

- •Assisted senior analysts in gathering and documenting business requirements from stakeholders, improving project scope clarity by 15%

- •Conducted SQL-based data queries for operational reports, reducing query processing time by 20%

- •Supported the development of Tableau dashboards, helping visual insights strengthen strategic decisions

- •Contributed to ETL processes, ensuring accurate data migration and integration for cross-functional teams

- •Assisted in data analysis and report generation that supported data accuracy improvements by 17%

- •Utilized ETL tools to automate data integration processes, reducing manual errors by 35%

- •Participated in project management activities ensuring 95% documentation completeness, aiding project timeline adherence

- •Conducted market research facilitating customer needs analysis, contributing to the development of a new product line

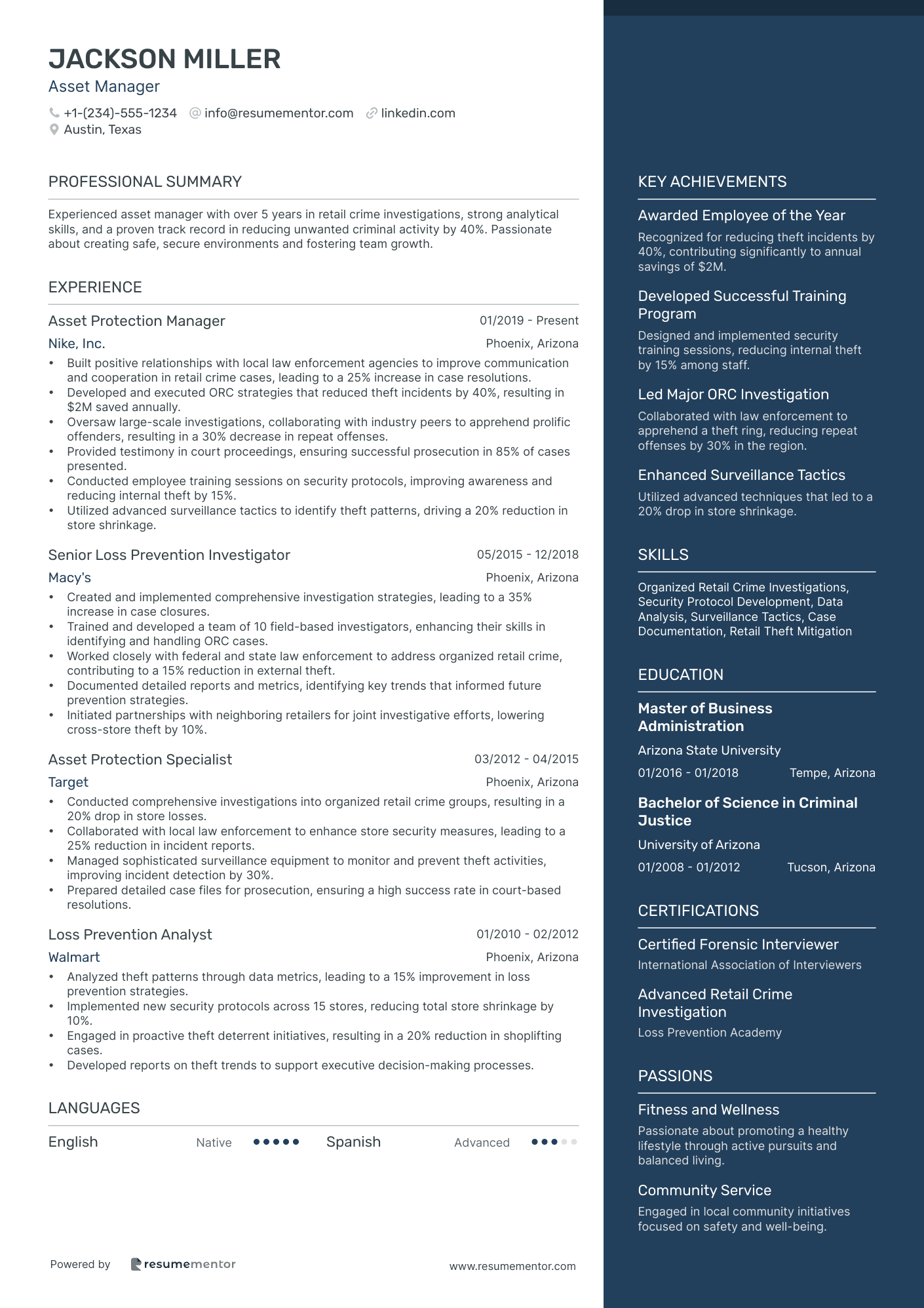

Asset Manager resume sample

Focus on your experience in managing investment portfolios. Detail your skills in financial analysis, risk assessment, and asset allocation. Mention relevant certifications like CFA or Portfolio Management. Provide examples where your strategies resulted in significant asset growth or risk mitigation.

- •Built positive relationships with local law enforcement agencies to improve communication and cooperation in retail crime cases, leading to a 25% increase in case resolutions.

- •Developed and executed ORC strategies that reduced theft incidents by 40%, resulting in $2M saved annually.

- •Oversaw large-scale investigations, collaborating with industry peers to apprehend prolific offenders, resulting in a 30% decrease in repeat offenses.

- •Provided testimony in court proceedings, ensuring successful prosecution in 85% of cases presented.

- •Conducted employee training sessions on security protocols, improving awareness and reducing internal theft by 15%.

- •Utilized advanced surveillance tactics to identify theft patterns, driving a 20% reduction in store shrinkage.

- •Created and implemented comprehensive investigation strategies, leading to a 35% increase in case closures.

- •Trained and developed a team of 10 field-based investigators, enhancing their skills in identifying and handling ORC cases.

- •Worked closely with federal and state law enforcement to address organized retail crime, contributing to a 15% reduction in external theft.

- •Documented detailed reports and metrics, identifying key trends that informed future prevention strategies.

- •Initiated partnerships with neighboring retailers for joint investigative efforts, lowering cross-store theft by 10%.

- •Conducted comprehensive investigations into organized retail crime groups, resulting in a 20% drop in store losses.

- •Collaborated with local law enforcement to enhance store security measures, leading to a 25% reduction in incident reports.

- •Managed sophisticated surveillance equipment to monitor and prevent theft activities, improving incident detection by 30%.

- •Prepared detailed case files for prosecution, ensuring a high success rate in court-based resolutions.

- •Analyzed theft patterns through data metrics, leading to a 15% improvement in loss prevention strategies.

- •Implemented new security protocols across 15 stores, reducing total store shrinkage by 10%.

- •Engaged in proactive theft deterrent initiatives, resulting in a 20% reduction in shoplifting cases.

- •Developed reports on theft trends to support executive decision-making processes.

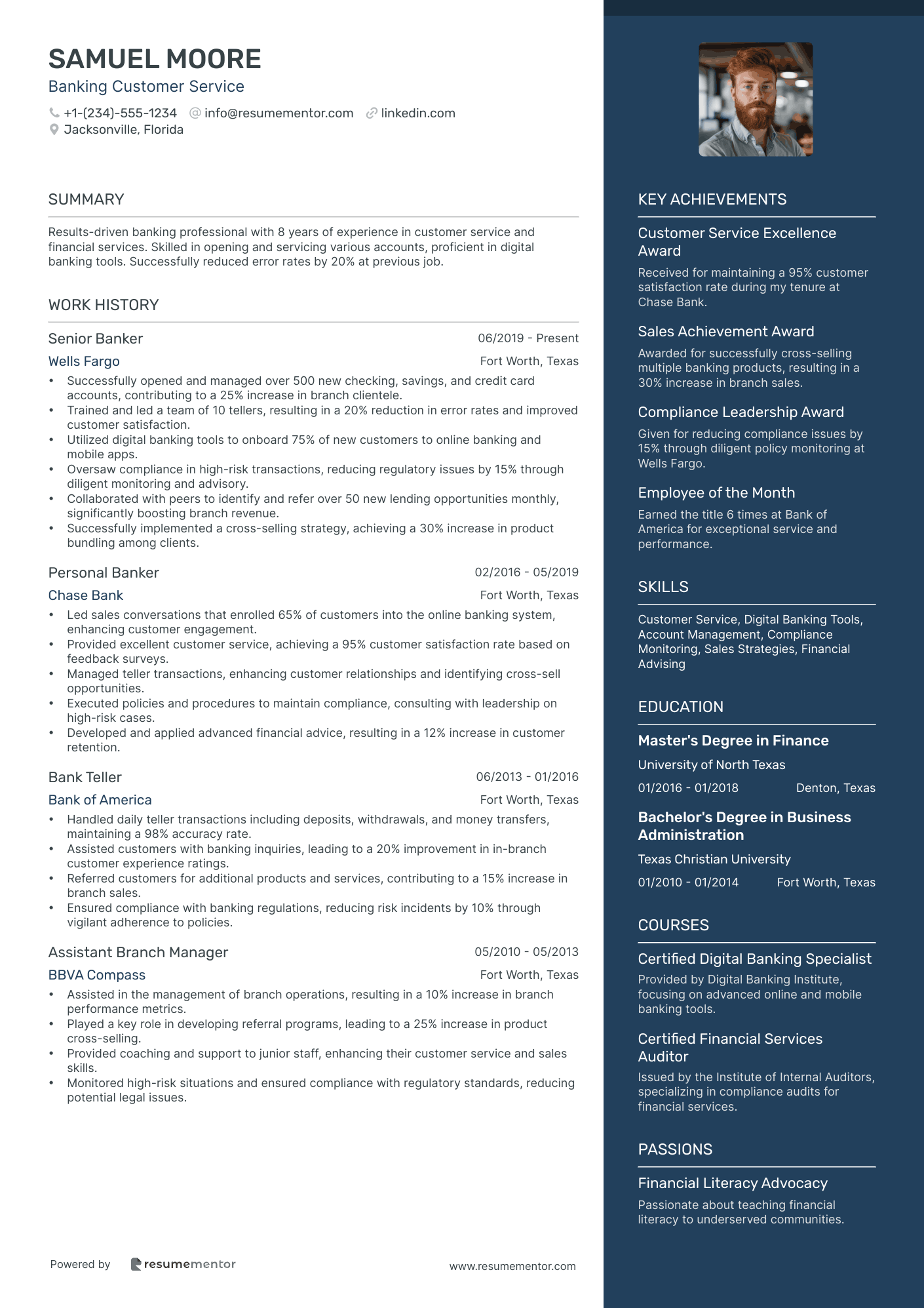

Banking Customer Service resume sample

Highlight your customer service and problem-solving skills. Emphasize experience in handling banking inquiries and transactions. Mention relevant training or certifications in customer service. Use the 'skill-action-result' approach to show how you improved customer satisfaction and loyalty.

- •Successfully opened and managed over 500 new checking, savings, and credit card accounts, contributing to a 25% increase in branch clientele.

- •Trained and led a team of 10 tellers, resulting in a 20% reduction in error rates and improved customer satisfaction.

- •Utilized digital banking tools to onboard 75% of new customers to online banking and mobile apps.

- •Oversaw compliance in high-risk transactions, reducing regulatory issues by 15% through diligent monitoring and advisory.

- •Collaborated with peers to identify and refer over 50 new lending opportunities monthly, significantly boosting branch revenue.

- •Successfully implemented a cross-selling strategy, achieving a 30% increase in product bundling among clients.

- •Led sales conversations that enrolled 65% of customers into the online banking system, enhancing customer engagement.

- •Provided excellent customer service, achieving a 95% customer satisfaction rate based on feedback surveys.

- •Managed teller transactions, enhancing customer relationships and identifying cross-sell opportunities.

- •Executed policies and procedures to maintain compliance, consulting with leadership on high-risk cases.

- •Developed and applied advanced financial advice, resulting in a 12% increase in customer retention.

- •Handled daily teller transactions including deposits, withdrawals, and money transfers, maintaining a 98% accuracy rate.

- •Assisted customers with banking inquiries, leading to a 20% improvement in in-branch customer experience ratings.

- •Referred customers for additional products and services, contributing to a 15% increase in branch sales.

- •Ensured compliance with banking regulations, reducing risk incidents by 10% through vigilant adherence to policies.

- •Assisted in the management of branch operations, resulting in a 10% increase in branch performance metrics.

- •Played a key role in developing referral programs, leading to a 25% increase in product cross-selling.

- •Provided coaching and support to junior staff, enhancing their customer service and sales skills.

- •Monitored high-risk situations and ensured compliance with regulatory standards, reducing potential legal issues.

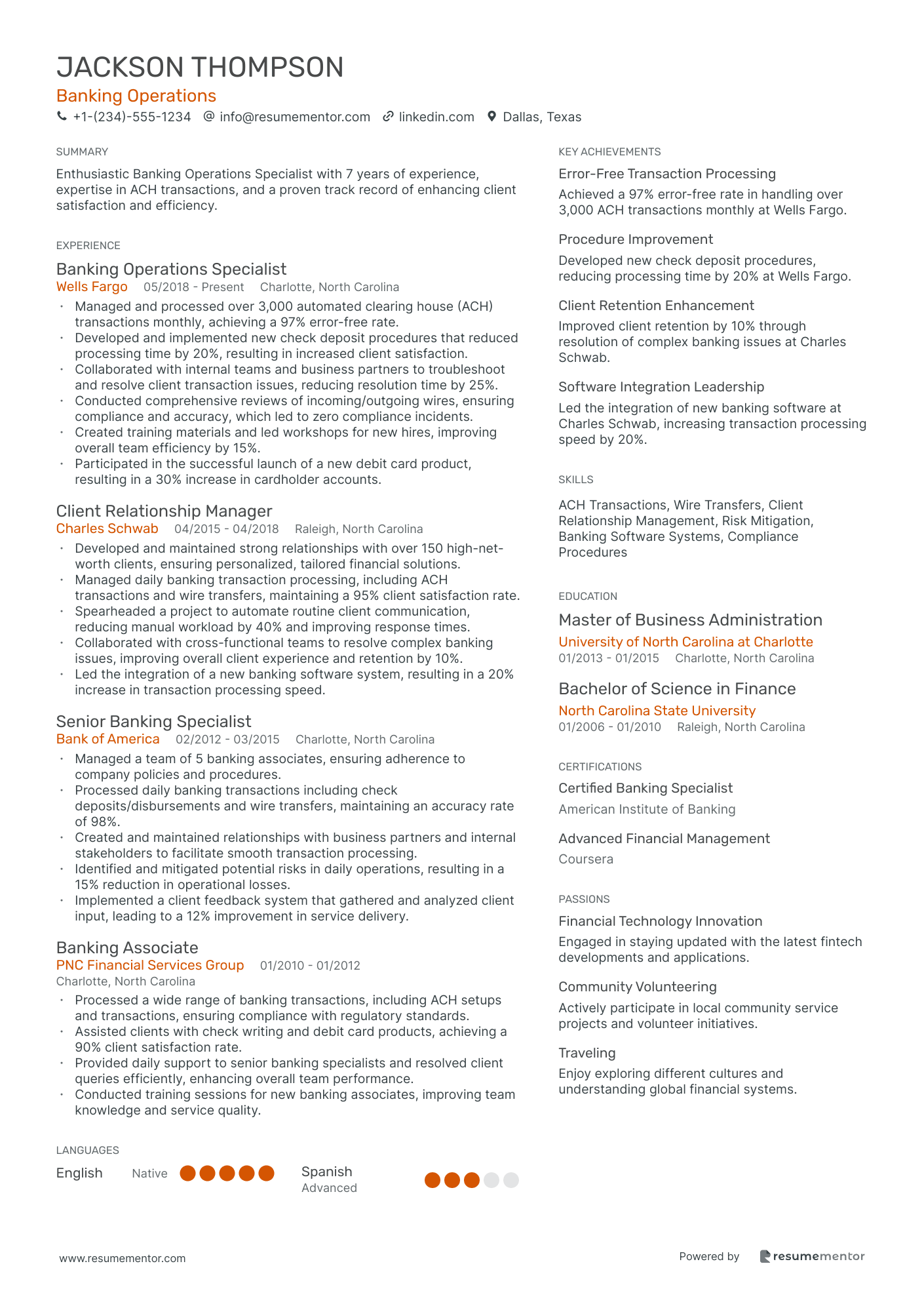

Banking Operations resume sample

Emphasize your experience in banking processes and operational efficiency. Detail skills in process optimization, compliance, and risk management. Mention relevant certifications in Operations Management or Lean Six Sigma. Provide examples where your actions improved operational efficiency or compliance.

- •Managed and processed over 3,000 automated clearing house (ACH) transactions monthly, achieving a 97% error-free rate.

- •Developed and implemented new check deposit procedures that reduced processing time by 20%, resulting in increased client satisfaction.

- •Collaborated with internal teams and business partners to troubleshoot and resolve client transaction issues, reducing resolution time by 25%.

- •Conducted comprehensive reviews of incoming/outgoing wires, ensuring compliance and accuracy, which led to zero compliance incidents.

- •Created training materials and led workshops for new hires, improving overall team efficiency by 15%.

- •Participated in the successful launch of a new debit card product, resulting in a 30% increase in cardholder accounts.

- •Developed and maintained strong relationships with over 150 high-net-worth clients, ensuring personalized, tailored financial solutions.

- •Managed daily banking transaction processing, including ACH transactions and wire transfers, maintaining a 95% client satisfaction rate.

- •Spearheaded a project to automate routine client communication, reducing manual workload by 40% and improving response times.

- •Collaborated with cross-functional teams to resolve complex banking issues, improving overall client experience and retention by 10%.

- •Led the integration of a new banking software system, resulting in a 20% increase in transaction processing speed.

- •Managed a team of 5 banking associates, ensuring adherence to company policies and procedures.

- •Processed daily banking transactions including check deposits/disbursements and wire transfers, maintaining an accuracy rate of 98%.

- •Created and maintained relationships with business partners and internal stakeholders to facilitate smooth transaction processing.

- •Identified and mitigated potential risks in daily operations, resulting in a 15% reduction in operational losses.

- •Implemented a client feedback system that gathered and analyzed client input, leading to a 12% improvement in service delivery.

- •Processed a wide range of banking transactions, including ACH setups and transactions, ensuring compliance with regulatory standards.

- •Assisted clients with check writing and debit card products, achieving a 90% client satisfaction rate.

- •Provided daily support to senior banking specialists and resolved client queries efficiently, enhancing overall team performance.

- •Conducted training sessions for new banking associates, improving team knowledge and service quality.

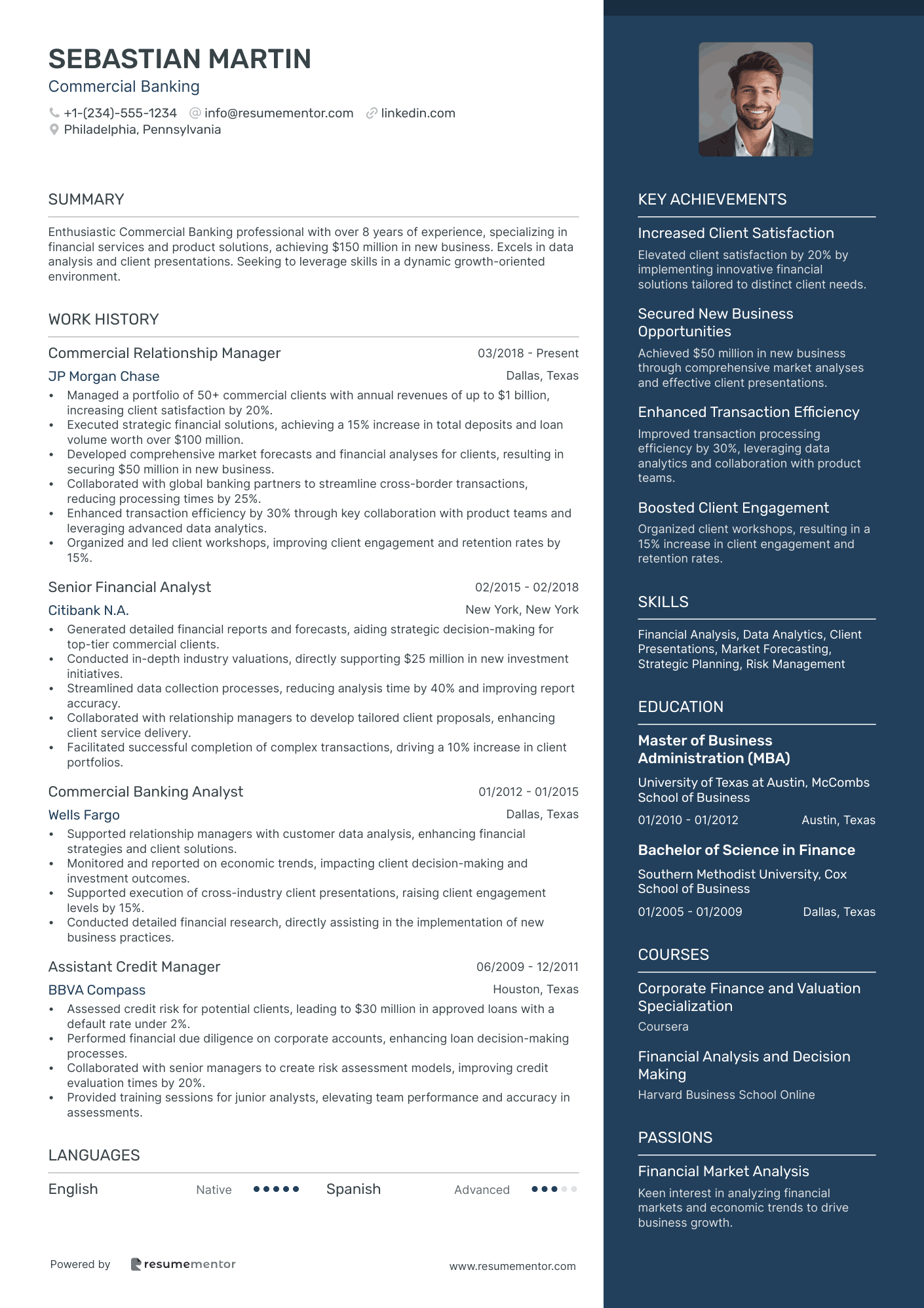

Commercial Banking resume sample

Highlight your experience in business lending and relationship management. Emphasize skills in financial analysis and risk assessment. Mention relevant certifications in Commercial Lending or Credit Analysis. Use the 'skill-action-result' approach to demonstrate your impact on client portfolio growth or risk mitigation.

- •Managed a portfolio of 50+ commercial clients with annual revenues of up to $1 billion, increasing client satisfaction by 20%.

- •Executed strategic financial solutions, achieving a 15% increase in total deposits and loan volume worth over $100 million.

- •Developed comprehensive market forecasts and financial analyses for clients, resulting in securing $50 million in new business.

- •Collaborated with global banking partners to streamline cross-border transactions, reducing processing times by 25%.

- •Enhanced transaction efficiency by 30% through key collaboration with product teams and leveraging advanced data analytics.

- •Organized and led client workshops, improving client engagement and retention rates by 15%.

- •Generated detailed financial reports and forecasts, aiding strategic decision-making for top-tier commercial clients.

- •Conducted in-depth industry valuations, directly supporting $25 million in new investment initiatives.

- •Streamlined data collection processes, reducing analysis time by 40% and improving report accuracy.

- •Collaborated with relationship managers to develop tailored client proposals, enhancing client service delivery.

- •Facilitated successful completion of complex transactions, driving a 10% increase in client portfolios.

- •Supported relationship managers with customer data analysis, enhancing financial strategies and client solutions.

- •Monitored and reported on economic trends, impacting client decision-making and investment outcomes.

- •Supported execution of cross-industry client presentations, raising client engagement levels by 15%.

- •Conducted detailed financial research, directly assisting in the implementation of new business practices.

- •Assessed credit risk for potential clients, leading to $30 million in approved loans with a default rate under 2%.

- •Performed financial due diligence on corporate accounts, enhancing loan decision-making processes.

- •Collaborated with senior managers to create risk assessment models, improving credit evaluation times by 20%.

- •Provided training sessions for junior analysts, elevating team performance and accuracy in assessments.

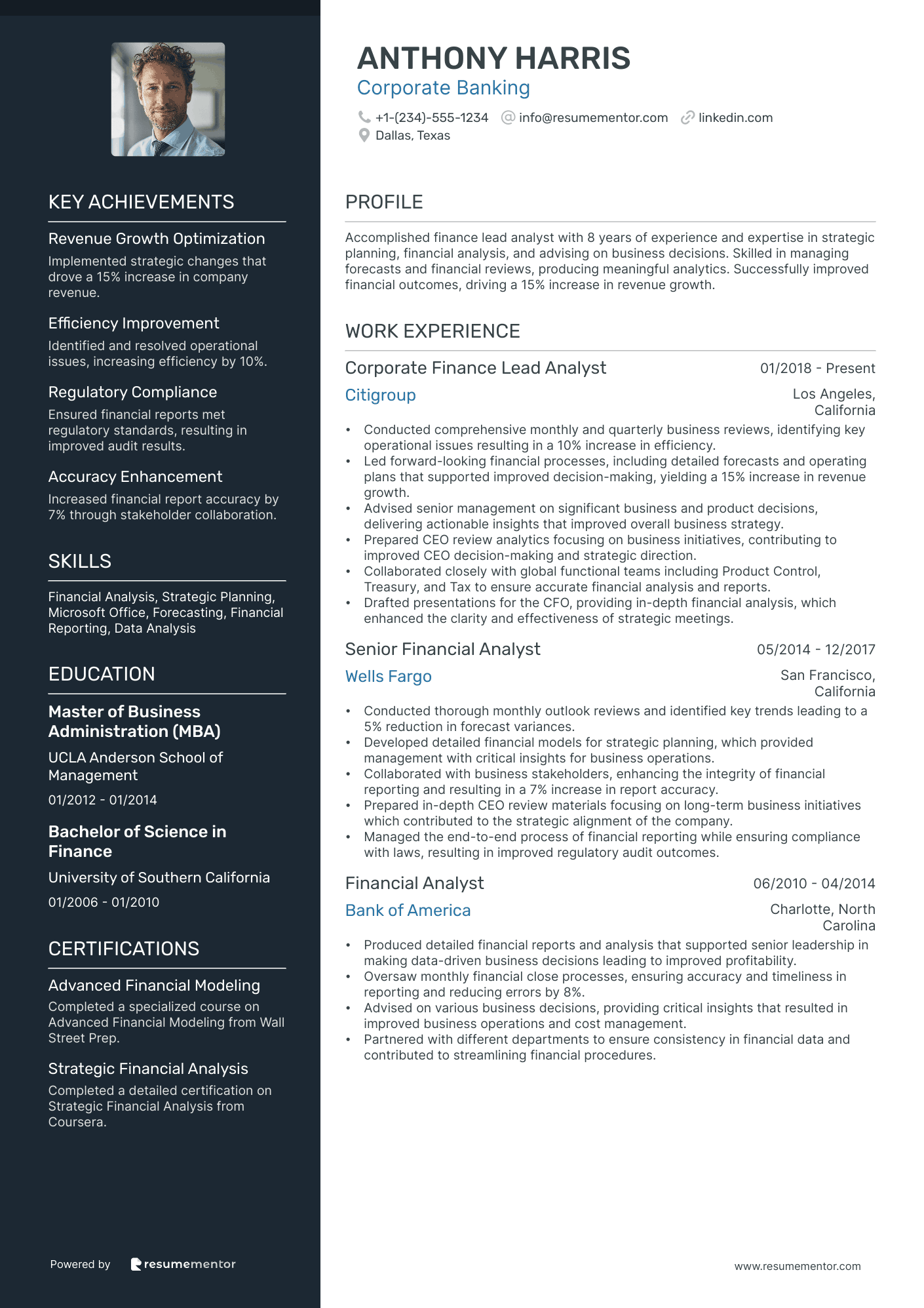

Corporate Banking resume sample

Focus on your experience with large corporate clients. Highlight skills in financial structuring, relationship management, and risk analysis. Mention relevant certifications or training in Corporate Finance. Provide examples where your strategies led to successful deals or portfolio growth.

- •Conducted comprehensive monthly and quarterly business reviews, identifying key operational issues resulting in a 10% increase in efficiency.

- •Led forward-looking financial processes, including detailed forecasts and operating plans that supported improved decision-making, yielding a 15% increase in revenue growth.

- •Advised senior management on significant business and product decisions, delivering actionable insights that improved overall business strategy.

- •Prepared CEO review analytics focusing on business initiatives, contributing to improved CEO decision-making and strategic direction.

- •Collaborated closely with global functional teams including Product Control, Treasury, and Tax to ensure accurate financial analysis and reports.

- •Drafted presentations for the CFO, providing in-depth financial analysis, which enhanced the clarity and effectiveness of strategic meetings.

- •Conducted thorough monthly outlook reviews and identified key trends leading to a 5% reduction in forecast variances.

- •Developed detailed financial models for strategic planning, which provided management with critical insights for business operations.

- •Collaborated with business stakeholders, enhancing the integrity of financial reporting and resulting in a 7% increase in report accuracy.

- •Prepared in-depth CEO review materials focusing on long-term business initiatives which contributed to the strategic alignment of the company.

- •Managed the end-to-end process of financial reporting while ensuring compliance with laws, resulting in improved regulatory audit outcomes.

- •Produced detailed financial reports and analysis that supported senior leadership in making data-driven business decisions leading to improved profitability.

- •Oversaw monthly financial close processes, ensuring accuracy and timeliness in reporting and reducing errors by 8%.

- •Advised on various business decisions, providing critical insights that resulted in improved business operations and cost management.

- •Partnered with different departments to ensure consistency in financial data and contributed to streamlining financial procedures.

- •Assisted in preparing financial performance reports, playing a crucial role in improving the transparency of financial outcomes.

- •Supported forward-looking financial planning processes, helping to enhance the accuracy of the company's strategic and operating plans.

- •Provided support during monthly business reviews, ensuring the availability of accurate data for decision-making.

- •Collaborated with the financial planning team to refine financial models, leading to more precise forecasts and analyses.

Credit Analyst resume sample

Emphasize your analytical skills in evaluating creditworthiness. Highlight experience in financial statement analysis and risk assessment. Mention relevant certifications like Credit Risk Management. Use the 'skill-action-result' approach to show how your analyses led to informed lending decisions and reduced credit risk.

- •Assessed creditworthiness of commercial clients with portfolios averaging $1.5 million, ensuring a 95% approval rate.

- •Conducted financial statement analysis and risk assessments on CRE loans, contributing to a portfolio growth of 12%.

- •Worked alongside senior credit officers to develop customized loan structures for large participation loans over $5 million.

- •Maintained a comprehensive database of financial metrics, resulting in enhanced reporting accuracy and decision-making.

- •Produced detailed credit reports and presented findings to executive management, ensuring informed lending decisions.

- •Collaborated with two other analysts to streamline credit review processes, reducing turnaround time by 30%.

- •Analyzed financial data and prepared reports for commercial credit portfolios worth $1-1.5 million each month.

- •Evaluated loan applications, identifying potential risks, and recommending approvals, resulting in a 20% decrease in default rates.

- •Developed financial models to forecast loan performance and support strategic planning for commercial lending.

- •Facilitated loan committee meetings by providing detailed financial analysis and risk assessments for proposed credits.

- •Maintained compliance with regulatory standards, ensuring all credit assessments met necessary guidelines.

- •Managed a commercial loan portfolio of $25 million, focusing on C&I loans and CRE loans.

- •Identified and mitigated potential risks through comprehensive financial statement analysis and credit reviews.

- •Negotiated loan terms with business clients, securing favorable conditions and fostering positive client relationships.

- •Conducted site visits and collateral evaluations to determine asset values and lending viability.

- •Assessed credit risk for a diverse portfolio of commercial clients, achieving a 98% accuracy rate in credit risk ratings.

- •Collaborated with senior credit officers to develop risk mitigation strategies for higher-risk clients.

- •Monitored and reported on credit performance metrics, identifying trends and providing recommendations for improvement.

- •Assisted in the development and implementation of new credit assessment tools, enhancing overall efficiency.

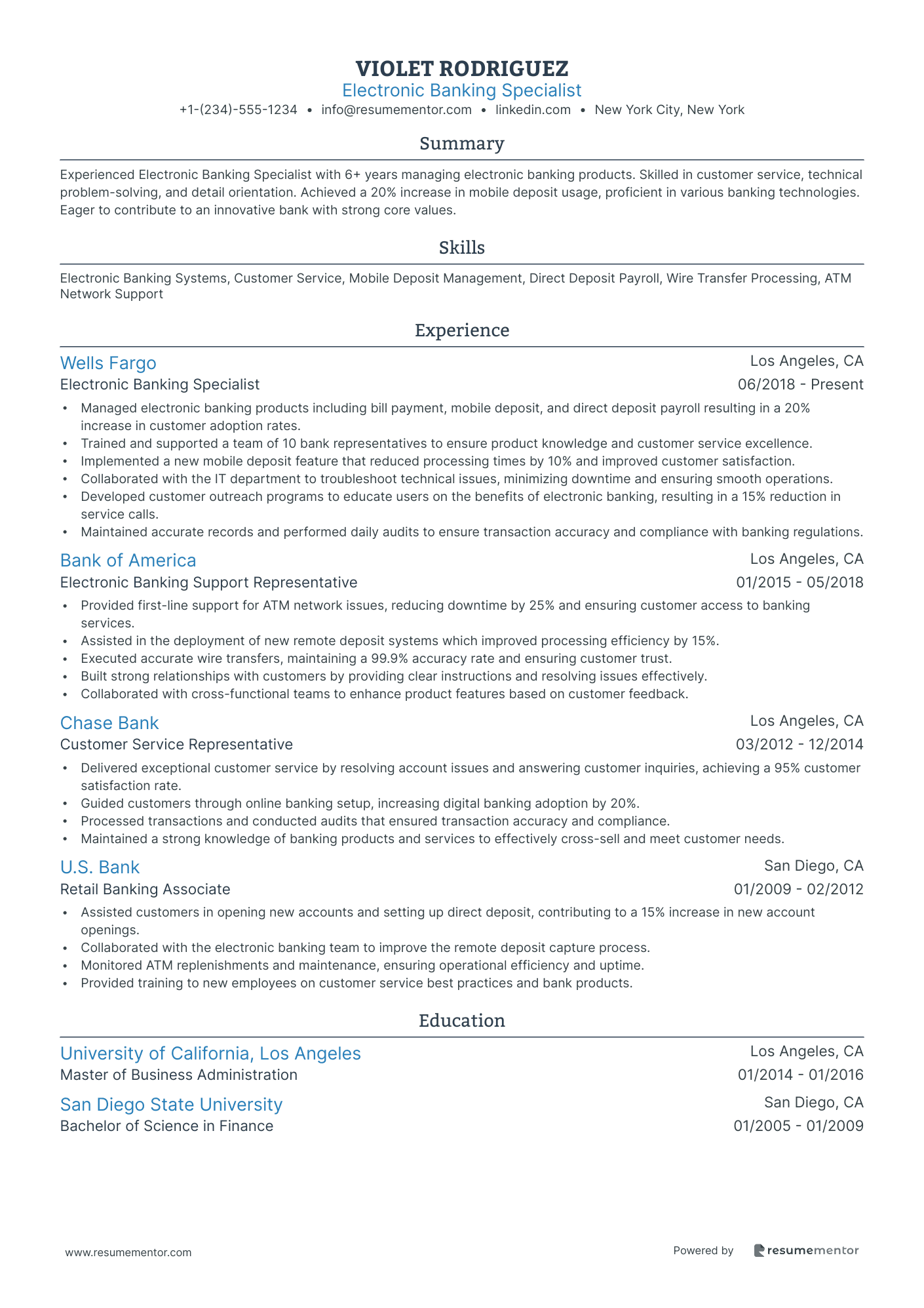

Electronic Banking Specialist resume sample

Focus on your technical skills in electronic banking platforms. Highlight experience in managing online banking services and troubleshooting technical issues. Mention relevant certifications in IT or Electronic Banking. Provide examples of how you enhanced user experience and security.

- •Managed electronic banking products including bill payment, mobile deposit, and direct deposit payroll resulting in a 20% increase in customer adoption rates.

- •Trained and supported a team of 10 bank representatives to ensure product knowledge and customer service excellence.

- •Implemented a new mobile deposit feature that reduced processing times by 10% and improved customer satisfaction.

- •Collaborated with the IT department to troubleshoot technical issues, minimizing downtime and ensuring smooth operations.

- •Developed customer outreach programs to educate users on the benefits of electronic banking, resulting in a 15% reduction in service calls.

- •Maintained accurate records and performed daily audits to ensure transaction accuracy and compliance with banking regulations.

- •Provided first-line support for ATM network issues, reducing downtime by 25% and ensuring customer access to banking services.

- •Assisted in the deployment of new remote deposit systems which improved processing efficiency by 15%.

- •Executed accurate wire transfers, maintaining a 99.9% accuracy rate and ensuring customer trust.

- •Built strong relationships with customers by providing clear instructions and resolving issues effectively.

- •Collaborated with cross-functional teams to enhance product features based on customer feedback.

- •Delivered exceptional customer service by resolving account issues and answering customer inquiries, achieving a 95% customer satisfaction rate.

- •Guided customers through online banking setup, increasing digital banking adoption by 20%.

- •Processed transactions and conducted audits that ensured transaction accuracy and compliance.

- •Maintained a strong knowledge of banking products and services to effectively cross-sell and meet customer needs.

- •Assisted customers in opening new accounts and setting up direct deposit, contributing to a 15% increase in new account openings.

- •Collaborated with the electronic banking team to improve the remote deposit capture process.

- •Monitored ATM replenishments and maintenance, ensuring operational efficiency and uptime.

- •Provided training to new employees on customer service best practices and bank products.

Financial Advisor resume sample

Highlight your experience in financial planning and investment advice. Focus on skills in client relationship management and financial product knowledge. Mention certifications like CFP or Financial Planning. Use the 'skill-action-result' approach to show how you've helped clients achieve their financial goals.

- •Developed customized financial plans that increased client investment returns by 25%, focusing on retirement planning and wealth accumulation.

- •Conducted comprehensive financial analysis for over 200 clients, resulting in more accurate risk assessments and tailored financial strategies.

- •Led quarterly portfolio reviews and adjustments, ensuring alignment with market conditions and client goals.

- •Collaborated with tax professionals to implement tax-efficient investment strategies, reducing client tax burdens by an average of 15%.

- •Effectively communicated complex financial concepts in a clear, concise manner, building trust and understanding with a diverse clientele.

- •Cultivated new opportunities within existing client relationships, increasing AUM (Assets Under Management) by 30% within two years.

- •Provided comprehensive financial planning services that met individual client needs, including investment strategies, retirement planning, and estate planning.

- •Managed over $50 million in client assets, monitoring investment portfolios and recommending adjustments to maximize returns.

- •Developed and executed clear, detailed financial plans that aligned with each client's unique goals and risk tolerance.

- •Enhanced client satisfaction by conducting regular meetings to address concerns and update financial plans in real-time.

- •Stayed informed of industry regulations and tax law changes, ensuring compliance and optimizing financial strategies accordingly.

- •Assisted senior financial advisors in managing large portfolios, enhancing client service and support.

- •Conducted market research and analysis, providing valuable insights into investment opportunities and risks.

- •Supported the development of personalized financial plans, ensuring alignment with client objectives and market trends.

- •Participated in client meetings, building strong relationships and improving client retention by 15%.

- •Performed in-depth financial analysis to support investment decisions, resulting in a 10% improvement in portfolio performance.

- •Assisted in the creation and maintenance of financial models, streamlining the investment evaluation process.

- •Monitored market trends and economic indicators to inform investment strategies, contributing to a more dynamic portfolio management process.

- •Supported senior analysts in preparing detailed financial reports and presentations for stakeholders.

Internal Auditor resume sample

Focus on your auditing experience in the banking sector. Highlight skills in risk assessment, compliance, and financial analysis. Mention relevant certifications like CIA or CISA. Provide examples of your auditing work that led to improved compliance or risk management.

- •Led a team of 5 students in analyzing the financial processes and internal controls of various university departments.

- •Conducted 15 interviews with department heads, identifying control weaknesses and recommending over 20 improvements.

- •Developed risk assessment reports that provided actionable insights, improving workflows and efficiency by 10%.

- •Utilized audit software to compile data and generate reports, ensuring accuracy and compliance with university policies.

- •Managed multiple audit engagements simultaneously, leading to the successful completion of projects ahead of schedule.

- •Oversaw the financial operations and budgeting for the society, managing a budget of $50,000.

- •Implemented financial controls and procedures, resulting in a 15% reduction in unnecessary expenditures.

- •Conducted quarterly internal audits to ensure compliance with financial policies, avoiding discrepancies.

- •Collaborated with the executive committee to develop financial strategies that enhanced our fundraising capabilities.

- •Reviewed financial records, ensuring all documentation was accurate and up-to-date.

- •Provided recommendations for improving financial processes and minimizing risks.

Investment Banking Analyst resume sample

Emphasize your skills in financial analysis and modeling. Highlight experience in deal execution and research. Mention relevant certifications like CFA or Financial Modeling. Use the 'skill-action-result' approach to show how your analyses supported successful deals.

- •Managed multiple M&A transactions, resulting in a total deal value of over $300 million.

- •Developed advanced financial models for valuations and scenario analyses, enhancing the accuracy of financial projections by 15%.

- •Led due diligence processes for clients, identifying key risks and opportunities, resulting in streamlined decision-making.

- •Created comprehensive client presentations and marketing materials, successfully securing new business opportunities worth $20 million.

- •Coordinated with various departments to ensure smooth transaction execution and timely deal closure.

- •Conducted in-depth industry and company research to support strategic advisory services, contributing to client satisfaction.

- •Assisted in the preparation and execution of five large M&A transactions, totaling over $200 million in deal value.

- •Developed financial models and valuation analyses, improving efficiency and accuracy by 10%.

- •Conducted detailed industry research and analysis, identifying key trends and providing strategic insights.

- •Collaborated with senior bankers to prepare pitch presentations and materials for potential clients.

- •Maintained and nurtured client and professional relationships, leading to repeat business.

- •Played a key role in the execution of three recapitalization projects worth $150 million.

- •Built detailed financial models for client presentations, enhancing decision-making processes.

- •Organized and attended client meetings, acting as a primary point of contact for key stakeholders.

- •Authored comprehensive market research publications, enhancing the firm's industry knowledge base.

- •Supported the valuation of various healthcare companies, assisting in due diligence and financial analysis.

- •Prepared detailed financial reports, contributing to the accuracy and reliability of client deliverables.

- •Conducted industry-specific business due diligence, ensuring compliance with regulatory standards.

- •Coordinated with cross-functional teams to deliver high-quality financial advisory services to clients.

Investment Banking Assiciate resume sample

- •Led a team of analysts and associates to execute M&A transactions valued over $5 billion, resulting in a 30% year-over-year growth in deal volume.

- •Developed and presented detailed financial models and DCF analyses to senior executives, enhancing decision-making on strategic investments.

- •Managed client relationships, ensuring seamless communication between cross-functional teams, and increased client retention rate by 20%.

- •Spearheaded the valuation analysis for a $2.5 billion tech acquisition, providing in-depth insights that influenced the final deal structure.

- •Supervised the preparation of marketing materials for capital market transactions, contributing to the successful pitch of three high-profile IPOs.

- •Participated in graduate recruiting, selecting top talent which increased team efficiency by 10% over the past year.

- •Assisted in the execution of M&A transactions worth over $3 billion, involving strategic analyses and financial forecasting.

- •Directed detailed valuation analyses including DCF, trading comparables, and LBO analyses, contributing to a successful $800 million acquisition.

- •Collaborated with senior team members and client management teams to discuss strategic alternatives and execute transactions, improving process efficiency by 15%.

- •Generated client presentations and internal committee memoranda that streamlined approval processes, resulting in faster deal closure rates.

- •Trained and mentored new analysts, improving team productivity by 20% through effective guidance and support.

- •Prepared financial analyses and models for M&A transactions, with deal sizes ranging from $50 million to $1 billion.

- •Conducted in-depth market research and valuation analysis, resulting in actionable insights that guided strategic decisions.

- •Supported senior bankers in client meetings and presentations, enhancing relationship management and client satisfaction by 25%.

- •Drafted comprehensive reports and presentations for internal and external stakeholders, which streamlined communication processes.

- •Maintained extensive knowledge of industry trends, contributing to innovative approaches to deal structuring.

- •Created financial models and valuation analyses for diverse sectors, resulting in strategic recommendations for M&A transactions worth $2 billion.

- •Assisted in the preparation of client presentations and internal reports, enhancing the delivery of key financial insights.

- •Worked closely with senior analysts to refine financial models, improving accuracy and reliability by 10%.

- •Managed various research projects that provided crucial data for client advisory, contributing to successful strategic outcomes.

Investment Banking Intern resume sample

Highlight any relevant coursework, projects, or internships. Emphasize analytical and research skills. Mention any certifications or training in finance or investment banking. Provide examples of how your internships or projects prepared you for a role in investment banking.

- •Created financial models and conducted valuations for hypothetical startup scenarios, enhancing skills in financial analysis and valuation techniques.

- •Participated in mock investment pitches and received positive feedback, resulting in a 20% improvement in presentation skills.

- •Led a team of five members on a project to analyze market trends and financial statements, achieving accurate models by an average margin of 5%.

- •Developed industry trend reports which improved member understanding of current financial markets, resulting in a more informed club.

- •Collaborated with classmates to create a financial forecasting model, predicting a 15% market growth in the tech industry.

- •Researched and analyzed financial data for academic papers, contributing to highly detailed and accurate financial models.

- •Compiled data sets and conducted statistical analysis that uncovered key market insights, enhancing research reliability by 12%.

- •Presented research findings to faculty and peers, resulting in the selection of findings for a university-sponsored conference.

- •Worked with a team to create presentation materials summarizing research, facilitating understanding for a non-specialist audience.

- •Developed a financial literacy curriculum for high school students.

- •Tutored students bi-weekly on personal finance and investment fundamentals.

- •Increased students’ test scores by an average of 25% over the semester.

- •Organized financial workshops with attendance exceeding 50 participants.

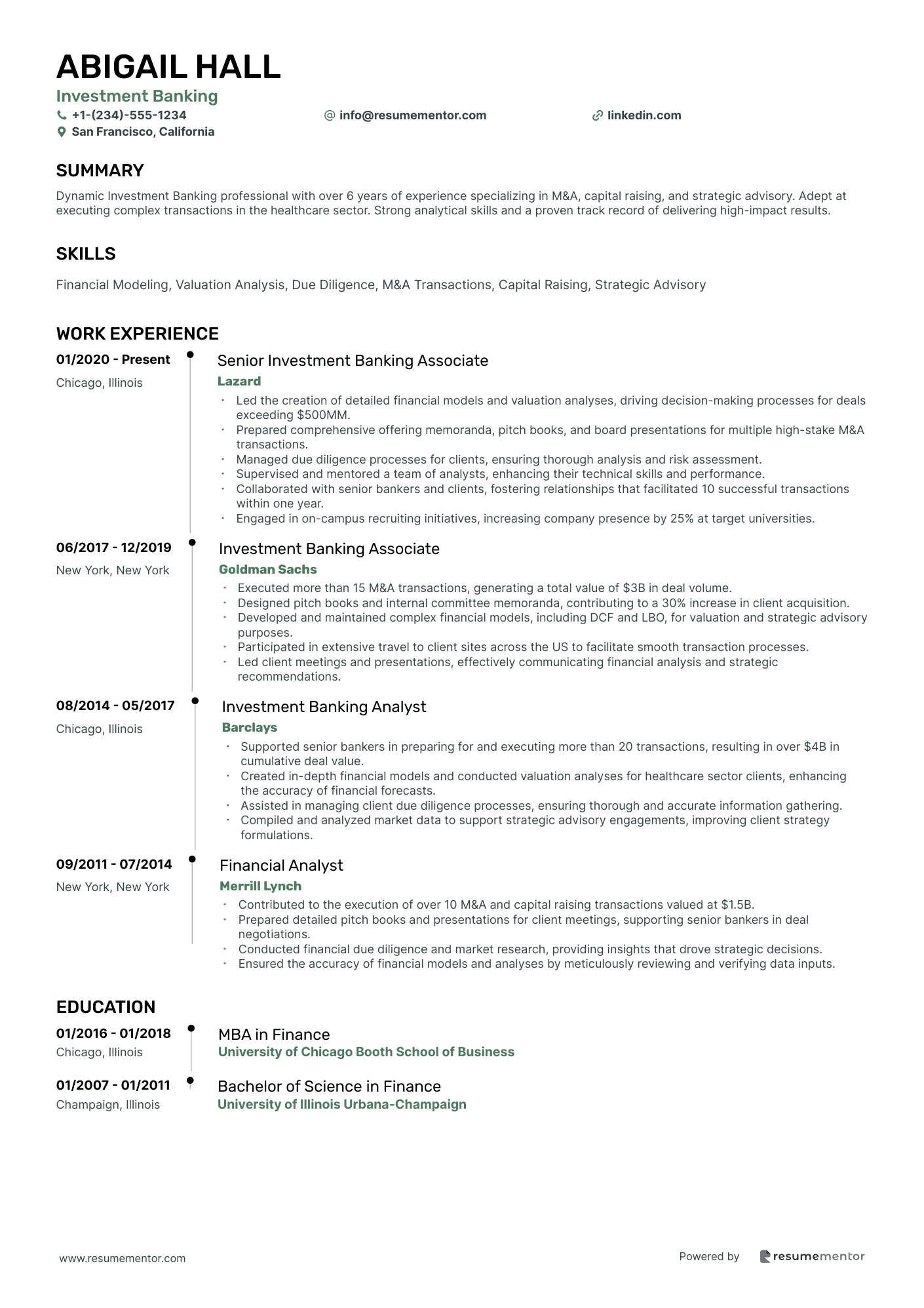

Investment Banking resume sample

Emphasize your experience in deal execution, financial analysis, and client management. Highlight skills in valuation and modeling. Mention relevant certifications or MBA. Use the 'skill-action-result' approach to show how your work led to successful transactions or satisfied clients.

- •Led the creation of detailed financial models and valuation analyses, driving decision-making processes for deals exceeding $500MM.

- •Prepared comprehensive offering memoranda, pitch books, and board presentations for multiple high-stake M&A transactions.

- •Managed due diligence processes for clients, ensuring thorough analysis and risk assessment.

- •Supervised and mentored a team of analysts, enhancing their technical skills and performance.

- •Collaborated with senior bankers and clients, fostering relationships that facilitated 10 successful transactions within one year.

- •Engaged in on-campus recruiting initiatives, increasing company presence by 25% at target universities.

- •Executed more than 15 M&A transactions, generating a total value of $3B in deal volume.

- •Designed pitch books and internal committee memoranda, contributing to a 30% increase in client acquisition.

- •Developed and maintained complex financial models, including DCF and LBO, for valuation and strategic advisory purposes.

- •Participated in extensive travel to client sites across the US to facilitate smooth transaction processes.

- •Led client meetings and presentations, effectively communicating financial analysis and strategic recommendations.

- •Supported senior bankers in preparing for and executing more than 20 transactions, resulting in over $4B in cumulative deal value.

- •Created in-depth financial models and conducted valuation analyses for healthcare sector clients, enhancing the accuracy of financial forecasts.

- •Assisted in managing client due diligence processes, ensuring thorough and accurate information gathering.

- •Compiled and analyzed market data to support strategic advisory engagements, improving client strategy formulations.

- •Contributed to the execution of over 10 M&A and capital raising transactions valued at $1.5B.

- •Prepared detailed pitch books and presentations for client meetings, supporting senior bankers in deal negotiations.

- •Conducted financial due diligence and market research, providing insights that drove strategic decisions.

- •Ensured the accuracy of financial models and analyses by meticulously reviewing and verifying data inputs.

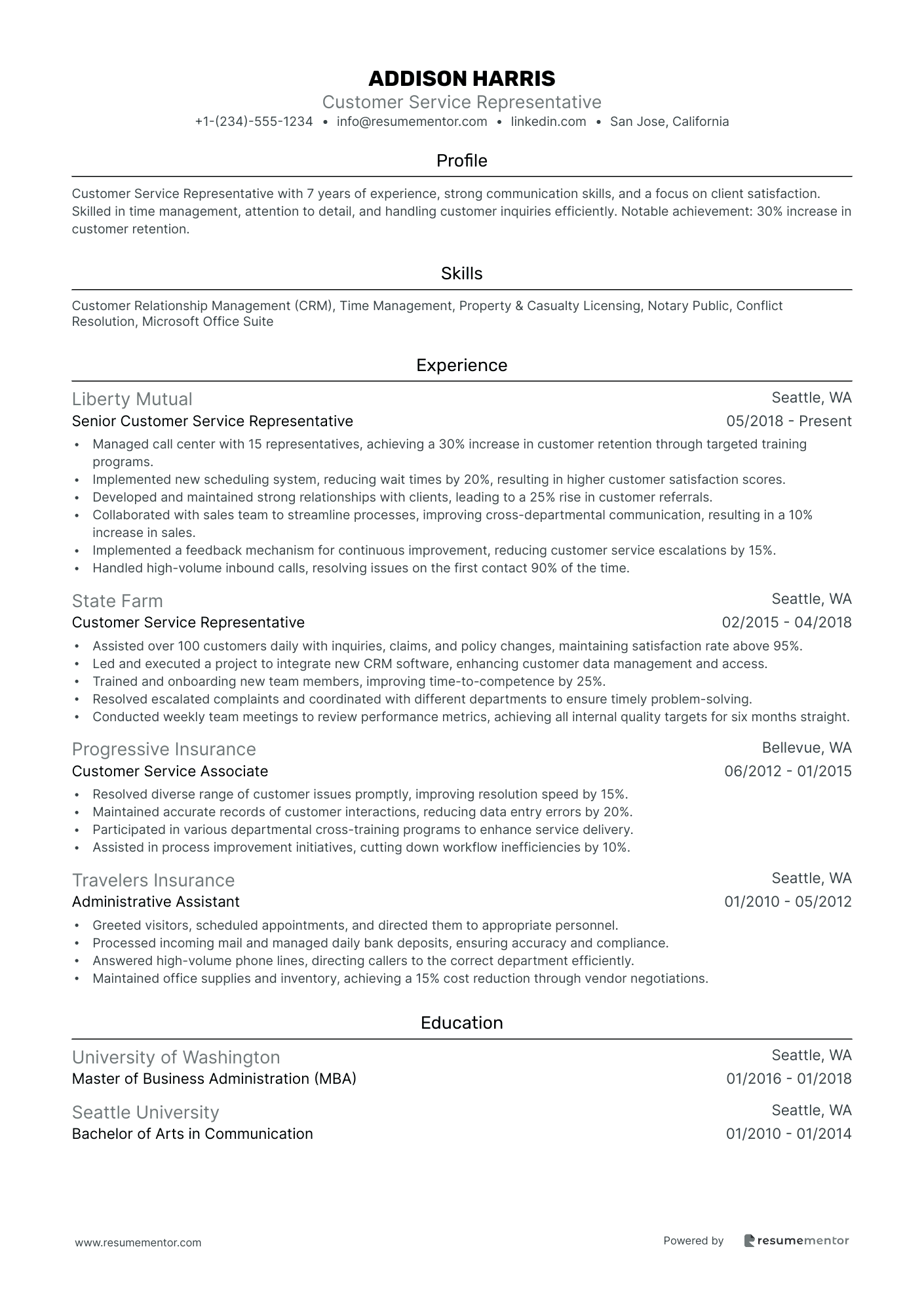

Investment Representative resume sample

Focus on your experience in client servicing and investment advice. Highlight skills in financial product knowledge and relationship management. Mention relevant certifications like Series 7 or CFA. Provide examples where your advice led to client portfolio growth or satisfaction.

- •Managed call center with 15 representatives, achieving a 30% increase in customer retention through targeted training programs.

- •Implemented new scheduling system, reducing wait times by 20%, resulting in higher customer satisfaction scores.

- •Developed and maintained strong relationships with clients, leading to a 25% rise in customer referrals.

- •Collaborated with sales team to streamline processes, improving cross-departmental communication, resulting in a 10% increase in sales.

- •Implemented a feedback mechanism for continuous improvement, reducing customer service escalations by 15%.

- •Handled high-volume inbound calls, resolving issues on the first contact 90% of the time.

- •Assisted over 100 customers daily with inquiries, claims, and policy changes, maintaining satisfaction rate above 95%.

- •Led and executed a project to integrate new CRM software, enhancing customer data management and access.

- •Trained and onboarding new team members, improving time-to-competence by 25%.

- •Resolved escalated complaints and coordinated with different departments to ensure timely problem-solving.

- •Conducted weekly team meetings to review performance metrics, achieving all internal quality targets for six months straight.

- •Resolved diverse range of customer issues promptly, improving resolution speed by 15%.

- •Maintained accurate records of customer interactions, reducing data entry errors by 20%.

- •Participated in various departmental cross-training programs to enhance service delivery.

- •Assisted in process improvement initiatives, cutting down workflow inefficiencies by 10%.

- •Greeted visitors, scheduled appointments, and directed them to appropriate personnel.

- •Processed incoming mail and managed daily bank deposits, ensuring accuracy and compliance.

- •Answered high-volume phone lines, directing callers to the correct department efficiently.

- •Maintained office supplies and inventory, achieving a 15% cost reduction through vendor negotiations.

Loan Officer resume sample

Emphasize your experience in loan origination and client relationship management. Highlight skills in credit analysis and sales. Mention relevant certifications in Loan Processing or Mortgage Lending. Use the 'skill-action-result' approach to show how you facilitated loan approvals and customer satisfaction.

- •Developed and managed relationships with over 100 realtors and builders, increasing loan applications by 30% within one year.

- •Conducted regular first-time homebuyer seminars, resulting in a 25% increase in new loan applications.

- •Traveled weekly to various communities to solicit new business, generating $10M in new loan volume annually.

- •Advised clients on suitable mortgage products, closing 95% of applications received.

- •Reviewed leads daily and contacted prospective customers, achieving a 40% conversion rate.

- •Provided end-to-end support for customers, from application to closing, ensuring a 98% satisfaction score.

- •Originated $15M in loans over 3 years, meeting or exceeding monthly sales goals.

- •Traveled to various realtor offices and builder functions to develop business relationships, resulting in a 20% increase in referrals.

- •Conducted thorough financial analyses for prospective clients, ensuring a 98% loan approval rate.

- •Led a team of junior loan officers, providing mentorship and support to enhance performance.

- •Maintained detailed records within origination systems to ensure transparency and effective communication with clients.

- •Provided expert mortgage advice to over 200 clients, enhancing loan approval rates by 15%.

- •Built strong relationships with local realtors, driving a 25% increase in referral business.

- •Regularly reviewed interest rates and locked loans in line with market conditions, achieving 100% compliance.

- •Conducted client meetings to gather financial information, resulting in tailored mortgage solutions that met individual needs.

- •Assisted in the development of new loan programs, contributing to a diversified mortgage portfolio.

- •Supported senior loan officers in loan origination processes, achieving a 90% loan closure rate.

- •Traveled to local communities for lead generation, resulting in a 10% increase in new loans.

- •Reviewed loan applications daily to ensure compliance with company policies and guidelines.

- •Assisted in organizing community events and seminars, generating new business opportunities.

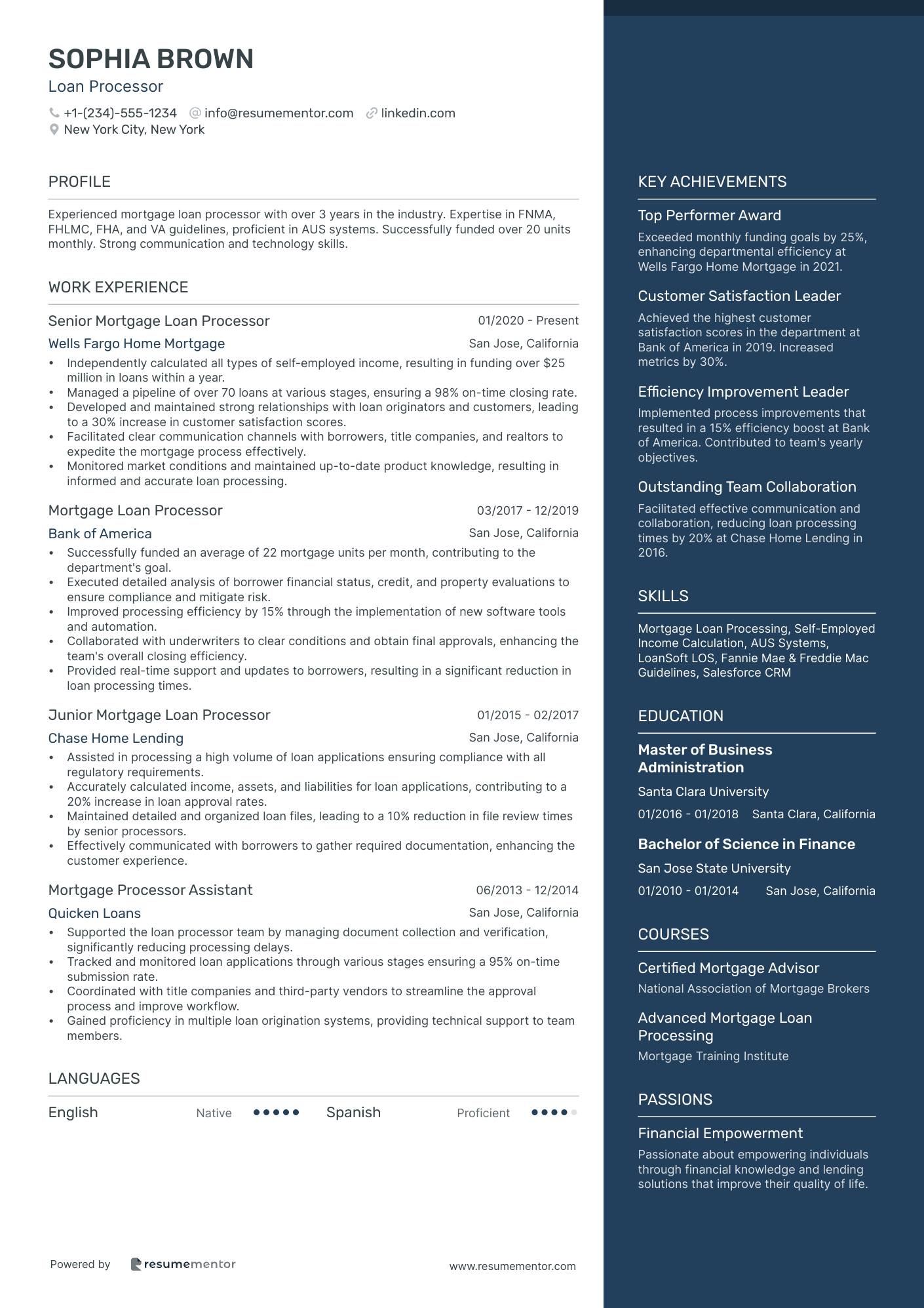

Loan Processor resume sample

Highlight your experience in processing loan applications and documentation. Focus on skills in compliance and detail orientation. Mention relevant certifications in Loan Processing or Mortgage Lending. Provide examples where your accuracy led to smooth loan processing and approval.

- •Independently calculated all types of self-employed income, resulting in funding over $25 million in loans within a year.

- •Managed a pipeline of over 70 loans at various stages, ensuring a 98% on-time closing rate.

- •Developed and maintained strong relationships with loan originators and customers, leading to a 30% increase in customer satisfaction scores.

- •Facilitated clear communication channels with borrowers, title companies, and realtors to expedite the mortgage process effectively.

- •Monitored market conditions and maintained up-to-date product knowledge, resulting in informed and accurate loan processing.

- •Successfully funded an average of 22 mortgage units per month, contributing to the department's goal.

- •Executed detailed analysis of borrower financial status, credit, and property evaluations to ensure compliance and mitigate risk.

- •Improved processing efficiency by 15% through the implementation of new software tools and automation.

- •Collaborated with underwriters to clear conditions and obtain final approvals, enhancing the team's overall closing efficiency.

- •Provided real-time support and updates to borrowers, resulting in a significant reduction in loan processing times.

- •Assisted in processing a high volume of loan applications ensuring compliance with all regulatory requirements.

- •Accurately calculated income, assets, and liabilities for loan applications, contributing to a 20% increase in loan approval rates.

- •Maintained detailed and organized loan files, leading to a 10% reduction in file review times by senior processors.

- •Effectively communicated with borrowers to gather required documentation, enhancing the customer experience.

- •Supported the loan processor team by managing document collection and verification, significantly reducing processing delays.

- •Tracked and monitored loan applications through various stages ensuring a 95% on-time submission rate.

- •Coordinated with title companies and third-party vendors to streamline the approval process and improve workflow.

- •Gained proficiency in multiple loan origination systems, providing technical support to team members.

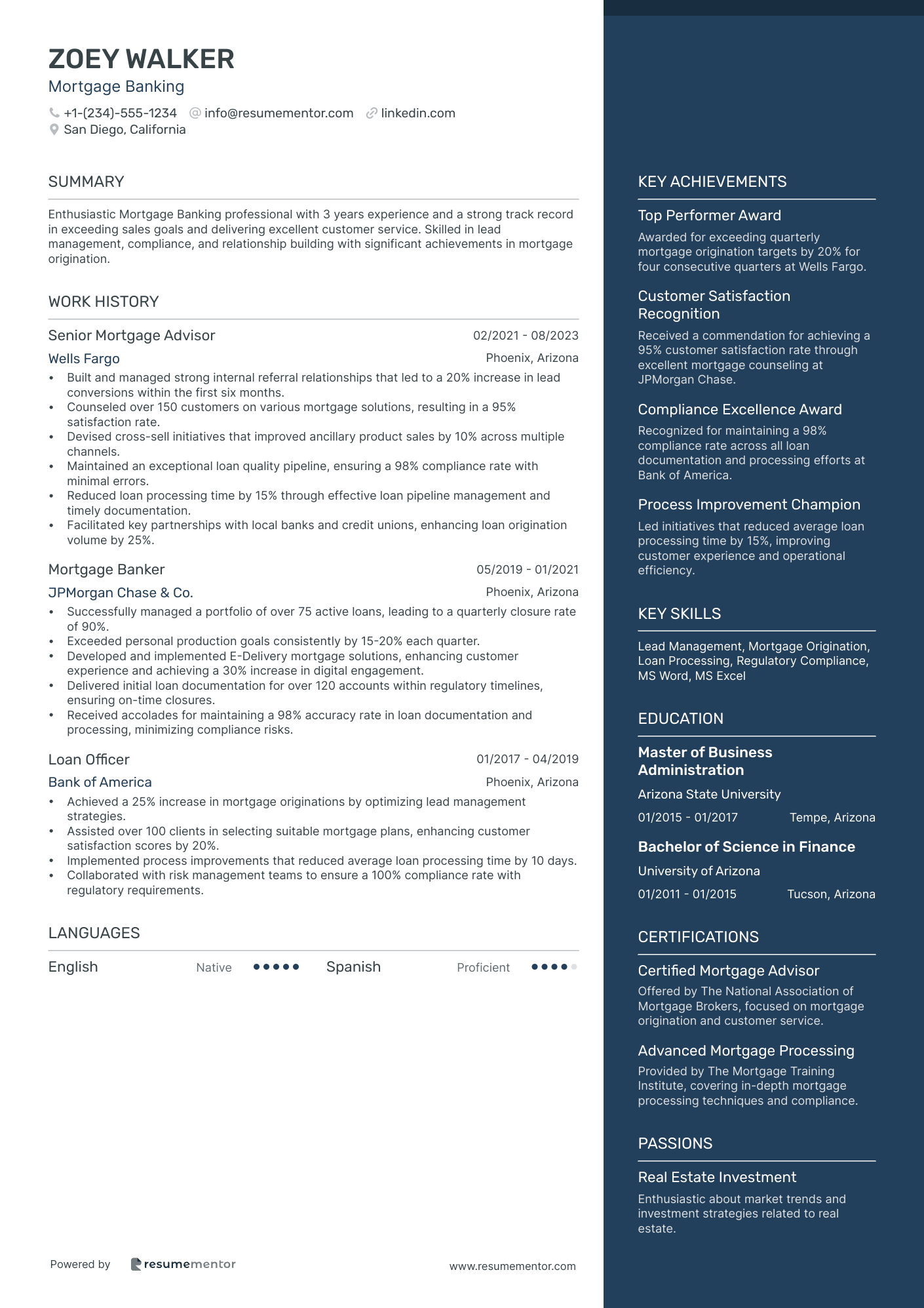

Mortgage Banking resume sample

Focus on your experience in mortgage lending and client relationship management. Highlight skills in financial analysis and compliance. Mention relevant certifications like Mortgage Loan Originator. Use the 'skill-action-result' approach to show how you facilitated mortgage approvals and client satisfaction.

- •Built and managed strong internal referral relationships that led to a 20% increase in lead conversions within the first six months.

- •Counseled over 150 customers on various mortgage solutions, resulting in a 95% satisfaction rate.

- •Devised cross-sell initiatives that improved ancillary product sales by 10% across multiple channels.

- •Maintained an exceptional loan quality pipeline, ensuring a 98% compliance rate with minimal errors.

- •Reduced loan processing time by 15% through effective loan pipeline management and timely documentation.

- •Facilitated key partnerships with local banks and credit unions, enhancing loan origination volume by 25%.

- •Successfully managed a portfolio of over 75 active loans, leading to a quarterly closure rate of 90%.

- •Exceeded personal production goals consistently by 15-20% each quarter.

- •Developed and implemented E-Delivery mortgage solutions, enhancing customer experience and achieving a 30% increase in digital engagement.

- •Delivered initial loan documentation for over 120 accounts within regulatory timelines, ensuring on-time closures.

- •Received accolades for maintaining a 98% accuracy rate in loan documentation and processing, minimizing compliance risks.

- •Achieved a 25% increase in mortgage originations by optimizing lead management strategies.

- •Assisted over 100 clients in selecting suitable mortgage plans, enhancing customer satisfaction scores by 20%.

- •Implemented process improvements that reduced average loan processing time by 10 days.

- •Collaborated with risk management teams to ensure a 100% compliance rate with regulatory requirements.

Mortgage Consultant resume sample

Emphasize your experience in advising clients on mortgage products. Highlight skills in financial analysis and sales. Mention relevant certifications like Mortgage Loan Originator. Provide examples where your advice helped clients secure mortgages and improved satisfaction.

- •Promoted mortgage products and services to new and existing clients, securing a 25% increase in new loan applications.

- •Analyzed comprehensive financial and credit data, recommending loan choices that increased client satisfaction by 20%.

- •Managed the entire loan process, ensuring 99% of loans closed on time, contributing to branch profitability.

- •Provided detailed loan status updates to external customers, achieving a 30% decrease in customer inquiries.

- •Coordinated with the processing and closing teams, resulting in a 10% reduction in loan processing time.

- •Ensured compliance with all company policies and government regulations, maintaining a 100% audit pass rate.

- •Advised clients on suitable mortgage programs, leading to a 15% increase in successful loan applications.

- •Maintained a high degree of visibility in the marketplace, resulting in a 20% growth in client referrals.

- •Received and processed customer applications, achieving an accuracy rate of 98% in loan documentation.

- •Set realistic expectations for clients by clearly explaining policies and procedures, reducing fall-out rates by 12%.

- •Achieved personal production goals, contributing to a 10% increase in branch market share.

- •Promoted mortgage products through various channels, leading to a 10% increase in new client acquisitions.

- •Analyzed detailed client financial data to provide tailored loan recommendations, boosting customer satisfaction.

- •Coordinated client applications with internal teams, facilitating a prompt loan closing process.

- •Monitored loan status and ensured timely communication with clients, improving overall client experience.

- •Received and processed client mortgage applications, maintaining a 95% on-time submission rate.

- •Advised clients on the best mortgage products based on their financial situation, increasing approval rates by 8%.

- •Promoted mortgage services through outreach events, enhancing brand visibility in the local market.

- •Ensured compliance with state and federal regulations, resulting in zero regulatory penalties.

Phone Banking resume sample

Highlight your customer service and communication skills. Emphasize experience in handling banking inquiries and transactions over the phone. Mention relevant training or certifications in phone banking. Use the 'skill-action-result' approach to demonstrate improved customer satisfaction and resolution rates.

- •Managed a team of digital banking specialists, resulting in a 25% increase in online user engagement and a 20% reduction in service queries.

- •Implemented new online banking tools and workflows, enhancing efficiency by 18% and reducing setup time for new clients by 2 hours.

- •Coordinated system updates with Fiserv and other vendors, maintaining 99% uptime, resulting in high client satisfaction.

- •Developed training programs on system changes for employees, elevating team competence by 30% within the first quarter.

- •Directed key projects focusing on digital transformation, achieving a 35% enhancement in client experience metrics.

- •Led customer feedback surveys and applied insights to refine services, thus improving customer retention by 15%.

- •Resolved over 1,000 technical support tickets annually, maintaining a 95% first-call resolution rate, which reduced follow-up queries by 10%.

- •Processed setup and changes for business online services, ensuring a 98% accuracy rate by closely monitoring system maintenance.

- •Integrated new Treasury Management services, contributing to an 18% increase in client utilization.

- •Collaborated with IT teams to navigate system transitions, ensuring minimal service interruption and maintaining operational continuity.

- •Conducted annual reviews of ACH limits and RDC services, ensuring compliance and alignment with client needs.

- •Led a team of digital support specialists, achieving a 40% improvement in response times for client inquiries.

- •Streamlined processes for remote deposit capture and wire services, leading to a 15% increase in efficiency.

- •Executed system updates and provided training, resulting in the successful adoption of new technologies by 90% of the team.

- •Developed documentation standards for online banking platforms, improving internal and client compliance by 10%.

- •Administered client database, ensuring up-to-date records for over 500 business clients.

- •Supported business clients with online banking access, leading to a 92% customer satisfaction rate.

- •Processed client setup and service changes, achieving a 99% accuracy rate by conducting thorough post-setup verifications.

- •Troubleshot client issues with ACH files, enhancing problem resolution rates by 20% through meticulous analysis.

- •Participated in system upgrades and client service projects, ensuring seamless transitions and high user adaptability.

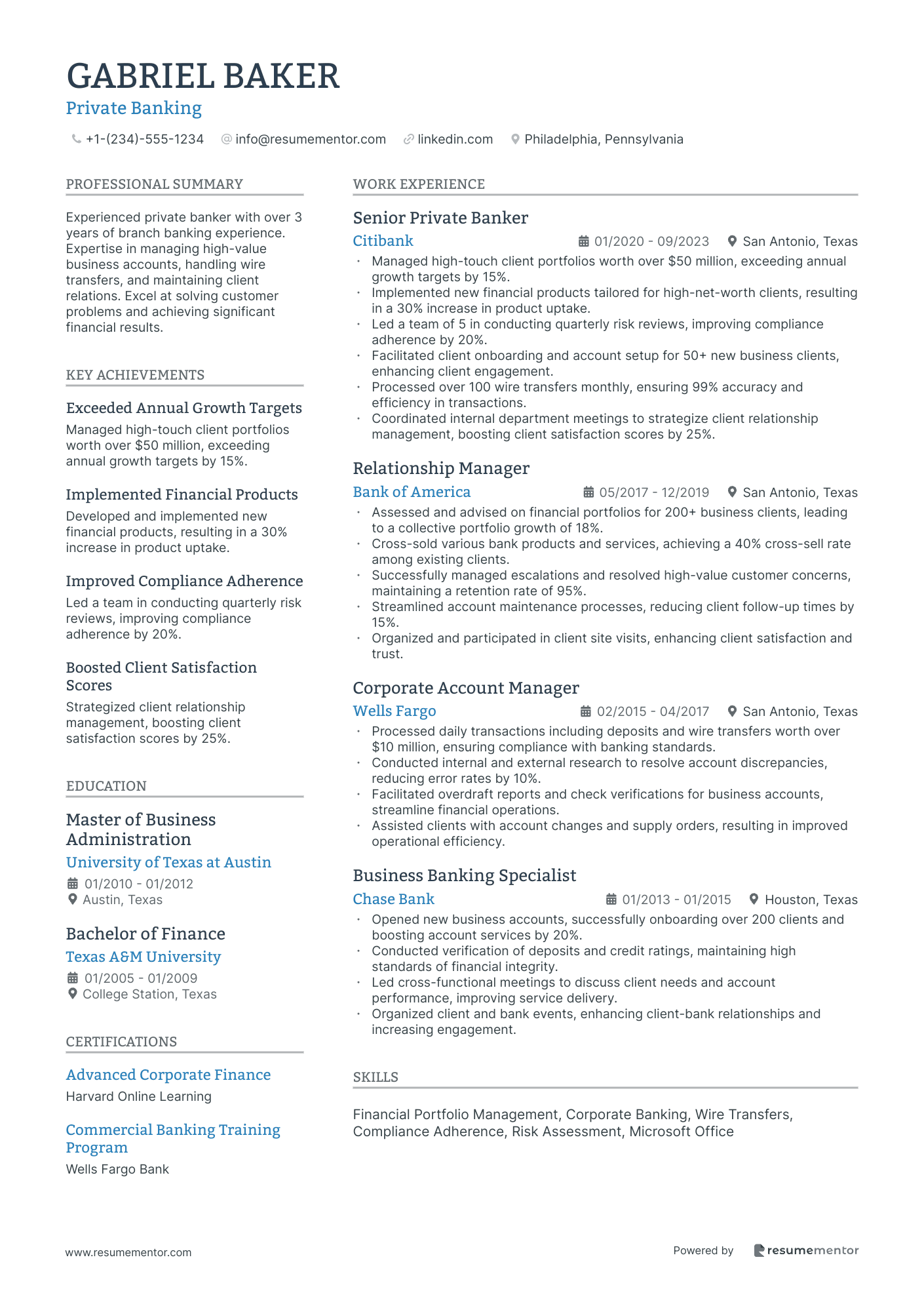

Private Banking resume sample

Focus on your experience managing high-net-worth clients. Highlight skills in wealth management and relationship building. Mention relevant certifications like CFA or Private Banking certification. Provide examples where your services led to client portfolio growth and satisfaction.

- •Managed high-touch client portfolios worth over $50 million, exceeding annual growth targets by 15%.

- •Implemented new financial products tailored for high-net-worth clients, resulting in a 30% increase in product uptake.

- •Led a team of 5 in conducting quarterly risk reviews, improving compliance adherence by 20%.

- •Facilitated client onboarding and account setup for 50+ new business clients, enhancing client engagement.

- •Processed over 100 wire transfers monthly, ensuring 99% accuracy and efficiency in transactions.

- •Coordinated internal department meetings to strategize client relationship management, boosting client satisfaction scores by 25%.

- •Assessed and advised on financial portfolios for 200+ business clients, leading to a collective portfolio growth of 18%.

- •Cross-sold various bank products and services, achieving a 40% cross-sell rate among existing clients.

- •Successfully managed escalations and resolved high-value customer concerns, maintaining a retention rate of 95%.

- •Streamlined account maintenance processes, reducing client follow-up times by 15%.

- •Organized and participated in client site visits, enhancing client satisfaction and trust.

- •Processed daily transactions including deposits and wire transfers worth over $10 million, ensuring compliance with banking standards.

- •Conducted internal and external research to resolve account discrepancies, reducing error rates by 10%.

- •Facilitated overdraft reports and check verifications for business accounts, streamline financial operations.

- •Assisted clients with account changes and supply orders, resulting in improved operational efficiency.

- •Opened new business accounts, successfully onboarding over 200 clients and boosting account services by 20%.

- •Conducted verification of deposits and credit ratings, maintaining high standards of financial integrity.

- •Led cross-functional meetings to discuss client needs and account performance, improving service delivery.

- •Organized client and bank events, enhancing client-bank relationships and increasing engagement.

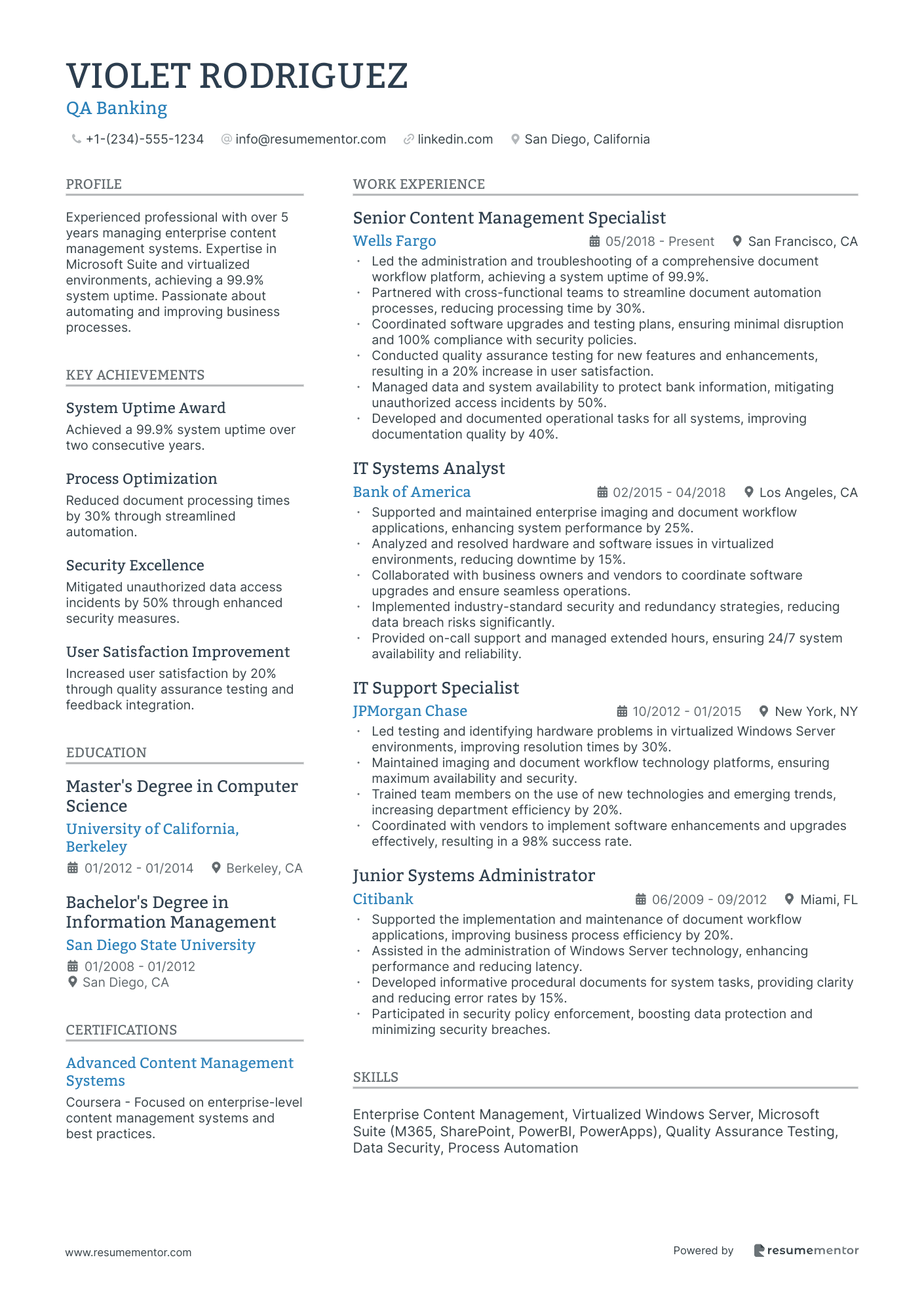

QA banking resume sample

Emphasize your experience in quality assurance within banking. Highlight skills in process improvement and compliance. Mention relevant certifications in Quality Assurance or Six Sigma. Use the 'skill-action-result' approach to show how your work improved banking operations and compliance.

- •Led the administration and troubleshooting of a comprehensive document workflow platform, achieving a system uptime of 99.9%.

- •Partnered with cross-functional teams to streamline document automation processes, reducing processing time by 30%.

- •Coordinated software upgrades and testing plans, ensuring minimal disruption and 100% compliance with security policies.

- •Conducted quality assurance testing for new features and enhancements, resulting in a 20% increase in user satisfaction.

- •Managed data and system availability to protect bank information, mitigating unauthorized access incidents by 50%.

- •Developed and documented operational tasks for all systems, improving documentation quality by 40%.

- •Supported and maintained enterprise imaging and document workflow applications, enhancing system performance by 25%.

- •Analyzed and resolved hardware and software issues in virtualized environments, reducing downtime by 15%.

- •Collaborated with business owners and vendors to coordinate software upgrades and ensure seamless operations.

- •Implemented industry-standard security and redundancy strategies, reducing data breach risks significantly.

- •Provided on-call support and managed extended hours, ensuring 24/7 system availability and reliability.

- •Led testing and identifying hardware problems in virtualized Windows Server environments, improving resolution times by 30%.

- •Maintained imaging and document workflow technology platforms, ensuring maximum availability and security.

- •Trained team members on the use of new technologies and emerging trends, increasing department efficiency by 20%.

- •Coordinated with vendors to implement software enhancements and upgrades effectively, resulting in a 98% success rate.

- •Supported the implementation and maintenance of document workflow applications, improving business process efficiency by 20%.

- •Assisted in the administration of Windows Server technology, enhancing performance and reducing latency.

- •Developed informative procedural documents for system tasks, providing clarity and reducing error rates by 15%.

- •Participated in security policy enforcement, boosting data protection and minimizing security breaches.

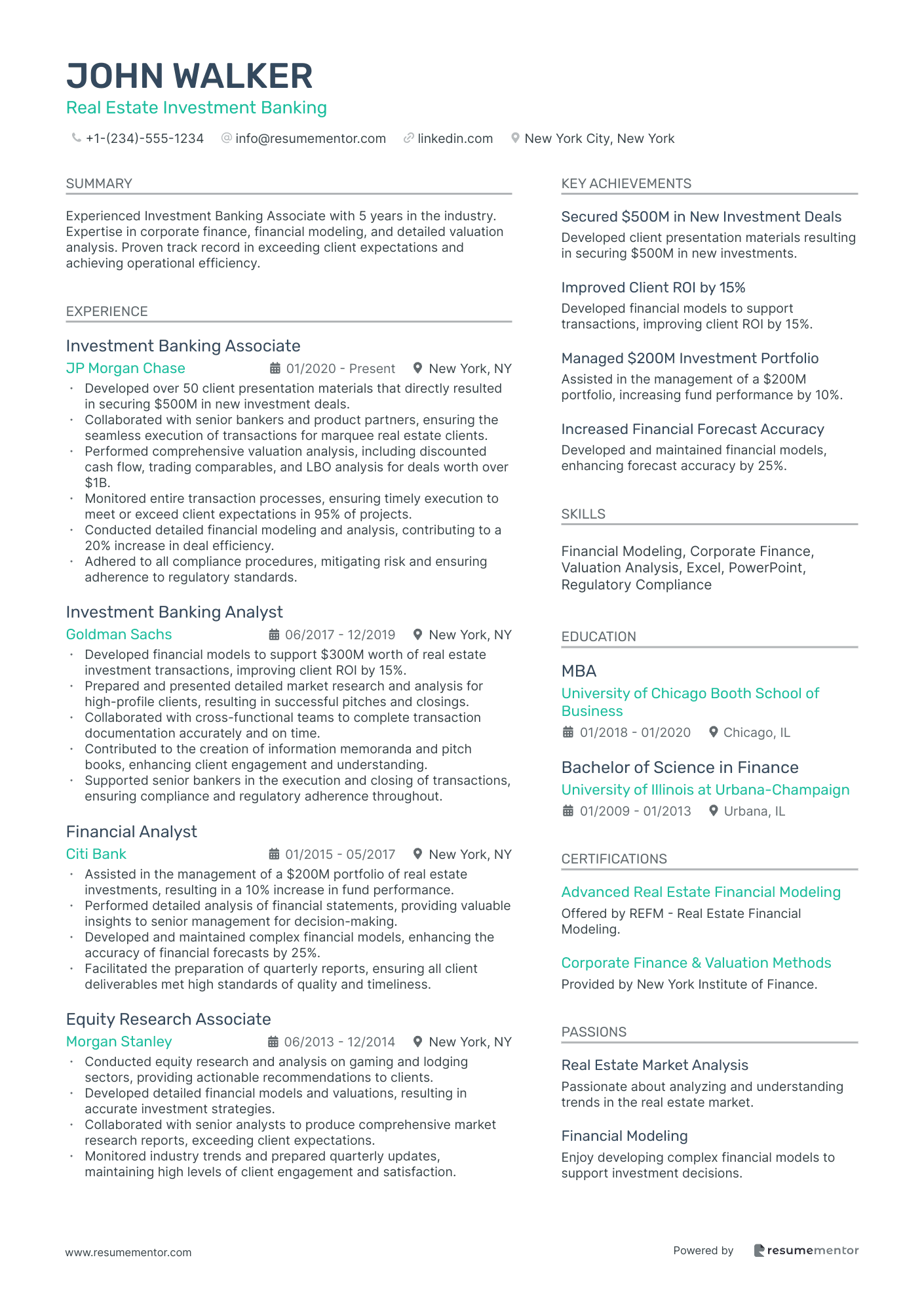

Real Estate Investment Banking resume sample

Highlight your experience in real estate finance and deal structuring. Focus on skills in financial modeling and market analysis. Mention relevant certifications like CFA or Real Estate Finance. Provide examples where your analyses supported successful real estate transactions.

- •Developed over 50 client presentation materials that directly resulted in securing $500M in new investment deals.

- •Collaborated with senior bankers and product partners, ensuring the seamless execution of transactions for marquee real estate clients.

- •Performed comprehensive valuation analysis, including discounted cash flow, trading comparables, and LBO analysis for deals worth over $1B.

- •Monitored entire transaction processes, ensuring timely execution to meet or exceed client expectations in 95% of projects.

- •Conducted detailed financial modeling and analysis, contributing to a 20% increase in deal efficiency.

- •Adhered to all compliance procedures, mitigating risk and ensuring adherence to regulatory standards.

- •Developed financial models to support $300M worth of real estate investment transactions, improving client ROI by 15%.

- •Prepared and presented detailed market research and analysis for high-profile clients, resulting in successful pitches and closings.

- •Collaborated with cross-functional teams to complete transaction documentation accurately and on time.

- •Contributed to the creation of information memoranda and pitch books, enhancing client engagement and understanding.

- •Supported senior bankers in the execution and closing of transactions, ensuring compliance and regulatory adherence throughout.

- •Assisted in the management of a $200M portfolio of real estate investments, resulting in a 10% increase in fund performance.

- •Performed detailed analysis of financial statements, providing valuable insights to senior management for decision-making.

- •Developed and maintained complex financial models, enhancing the accuracy of financial forecasts by 25%.

- •Facilitated the preparation of quarterly reports, ensuring all client deliverables met high standards of quality and timeliness.

- •Conducted equity research and analysis on gaming and lodging sectors, providing actionable recommendations to clients.

- •Developed detailed financial models and valuations, resulting in accurate investment strategies.

- •Collaborated with senior analysts to produce comprehensive market research reports, exceeding client expectations.

- •Monitored industry trends and prepared quarterly updates, maintaining high levels of client engagement and satisfaction.

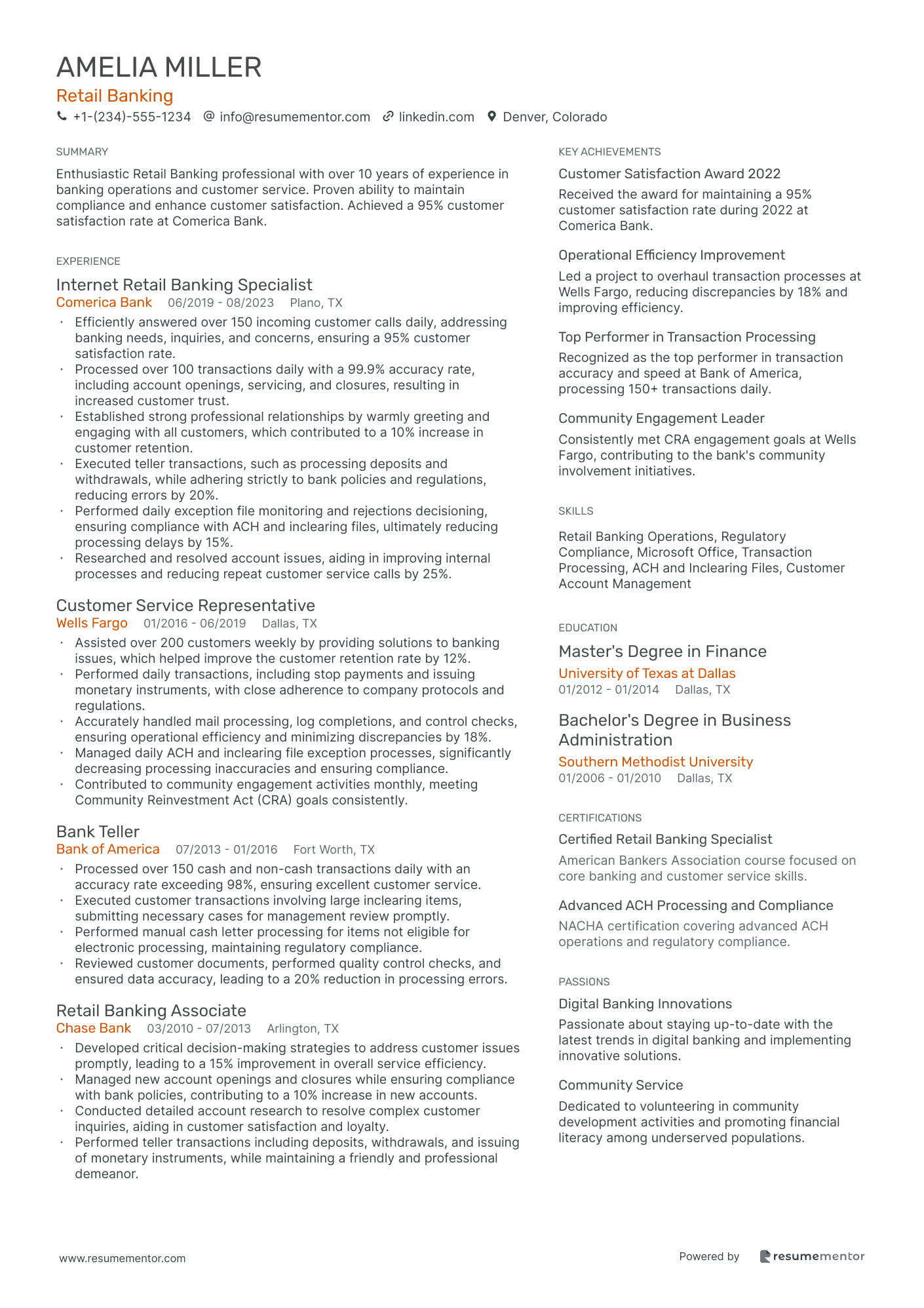

Retail Banking resume sample

Focus on your experience in branch operations and customer service. Highlight skills in sales and relationship management. Mention relevant certifications or training in retail banking. Use the 'skill-action-result' approach to demonstrate your impact on branch performance and customer satisfaction.

- •Efficiently answered over 150 incoming customer calls daily, addressing banking needs, inquiries, and concerns, ensuring a 95% customer satisfaction rate.

- •Processed over 100 transactions daily with a 99.9% accuracy rate, including account openings, servicing, and closures, resulting in increased customer trust.

- •Established strong professional relationships by warmly greeting and engaging with all customers, which contributed to a 10% increase in customer retention.

- •Executed teller transactions, such as processing deposits and withdrawals, while adhering strictly to bank policies and regulations, reducing errors by 20%.

- •Performed daily exception file monitoring and rejections decisioning, ensuring compliance with ACH and inclearing files, ultimately reducing processing delays by 15%.

- •Researched and resolved account issues, aiding in improving internal processes and reducing repeat customer service calls by 25%.

- •Assisted over 200 customers weekly by providing solutions to banking issues, which helped improve the customer retention rate by 12%.

- •Performed daily transactions, including stop payments and issuing monetary instruments, with close adherence to company protocols and regulations.

- •Accurately handled mail processing, log completions, and control checks, ensuring operational efficiency and minimizing discrepancies by 18%.

- •Managed daily ACH and inclearing file exception processes, significantly decreasing processing inaccuracies and ensuring compliance.

- •Contributed to community engagement activities monthly, meeting Community Reinvestment Act (CRA) goals consistently.

- •Processed over 150 cash and non-cash transactions daily with an accuracy rate exceeding 98%, ensuring excellent customer service.

- •Executed customer transactions involving large inclearing items, submitting necessary cases for management review promptly.

- •Performed manual cash letter processing for items not eligible for electronic processing, maintaining regulatory compliance.

- •Reviewed customer documents, performed quality control checks, and ensured data accuracy, leading to a 20% reduction in processing errors.

- •Developed critical decision-making strategies to address customer issues promptly, leading to a 15% improvement in overall service efficiency.

- •Managed new account openings and closures while ensuring compliance with bank policies, contributing to a 10% increase in new accounts.

- •Conducted detailed account research to resolve complex customer inquiries, aiding in customer satisfaction and loyalty.

- •Performed teller transactions including deposits, withdrawals, and issuing of monetary instruments, while maintaining a friendly and professional demeanor.

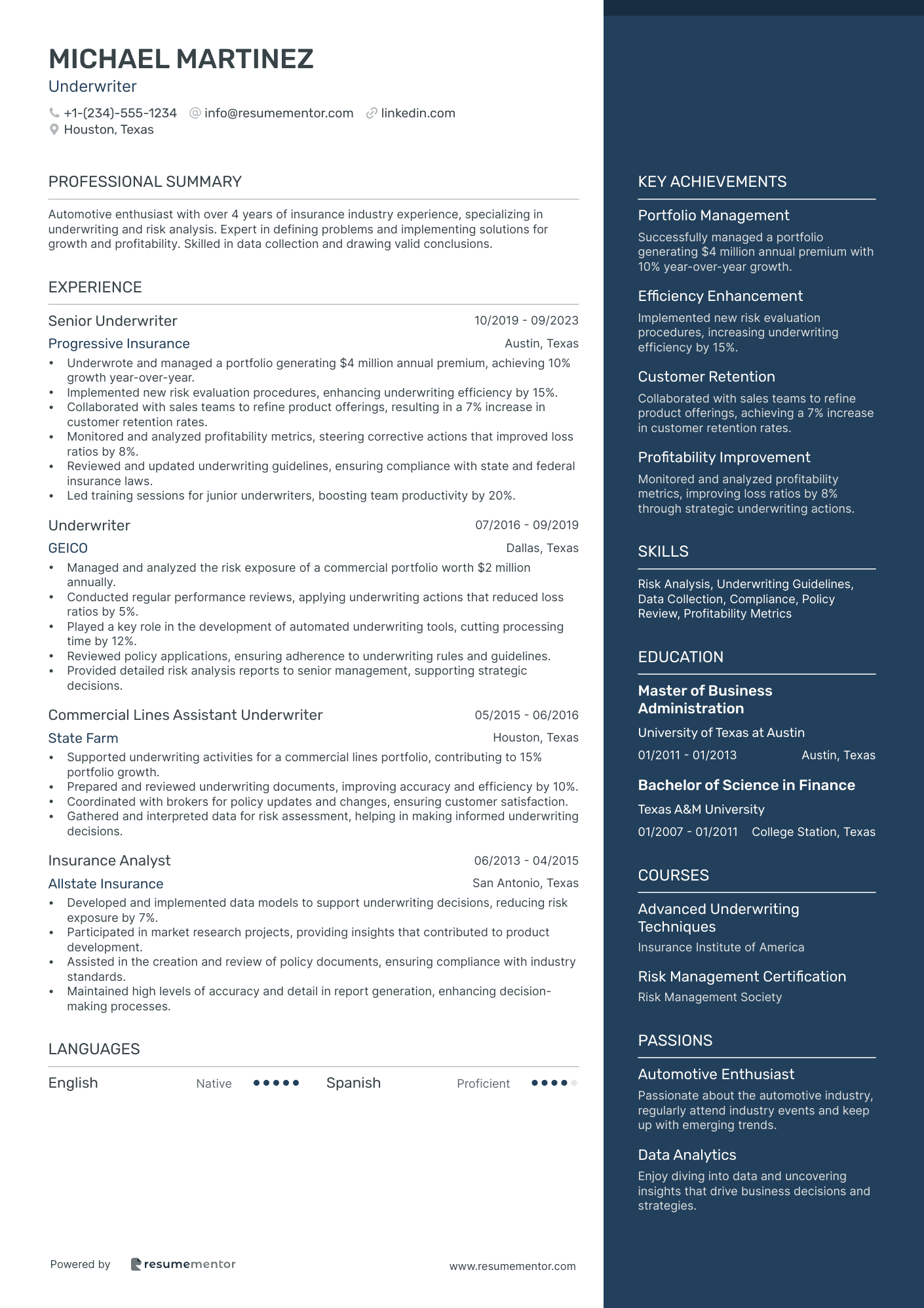

Underwriter resume sample

Emphasize your experience in risk assessment and underwriting decisions. Highlight skills in financial analysis and compliance. Mention relevant certifications like CFA or Underwriting certification. Provide examples where your underwriting decisions led to reduced risk and satisfied clients.

- •Underwrote and managed a portfolio generating $4 million annual premium, achieving 10% growth year-over-year.

- •Implemented new risk evaluation procedures, enhancing underwriting efficiency by 15%.

- •Collaborated with sales teams to refine product offerings, resulting in a 7% increase in customer retention rates.

- •Monitored and analyzed profitability metrics, steering corrective actions that improved loss ratios by 8%.

- •Reviewed and updated underwriting guidelines, ensuring compliance with state and federal insurance laws.

- •Led training sessions for junior underwriters, boosting team productivity by 20%.

- •Managed and analyzed the risk exposure of a commercial portfolio worth $2 million annually.

- •Conducted regular performance reviews, applying underwriting actions that reduced loss ratios by 5%.

- •Played a key role in the development of automated underwriting tools, cutting processing time by 12%.

- •Reviewed policy applications, ensuring adherence to underwriting rules and guidelines.

- •Provided detailed risk analysis reports to senior management, supporting strategic decisions.

- •Supported underwriting activities for a commercial lines portfolio, contributing to 15% portfolio growth.

- •Prepared and reviewed underwriting documents, improving accuracy and efficiency by 10%.

- •Coordinated with brokers for policy updates and changes, ensuring customer satisfaction.

- •Gathered and interpreted data for risk assessment, helping in making informed underwriting decisions.

- •Developed and implemented data models to support underwriting decisions, reducing risk exposure by 7%.

- •Participated in market research projects, providing insights that contributed to product development.

- •Assisted in the creation and review of policy documents, ensuring compliance with industry standards.

- •Maintained high levels of accuracy and detail in report generation, enhancing decision-making processes.

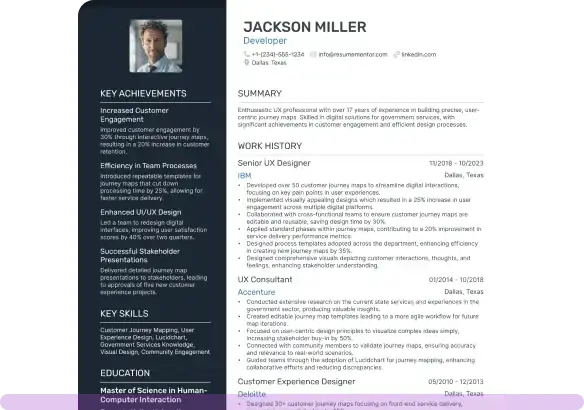

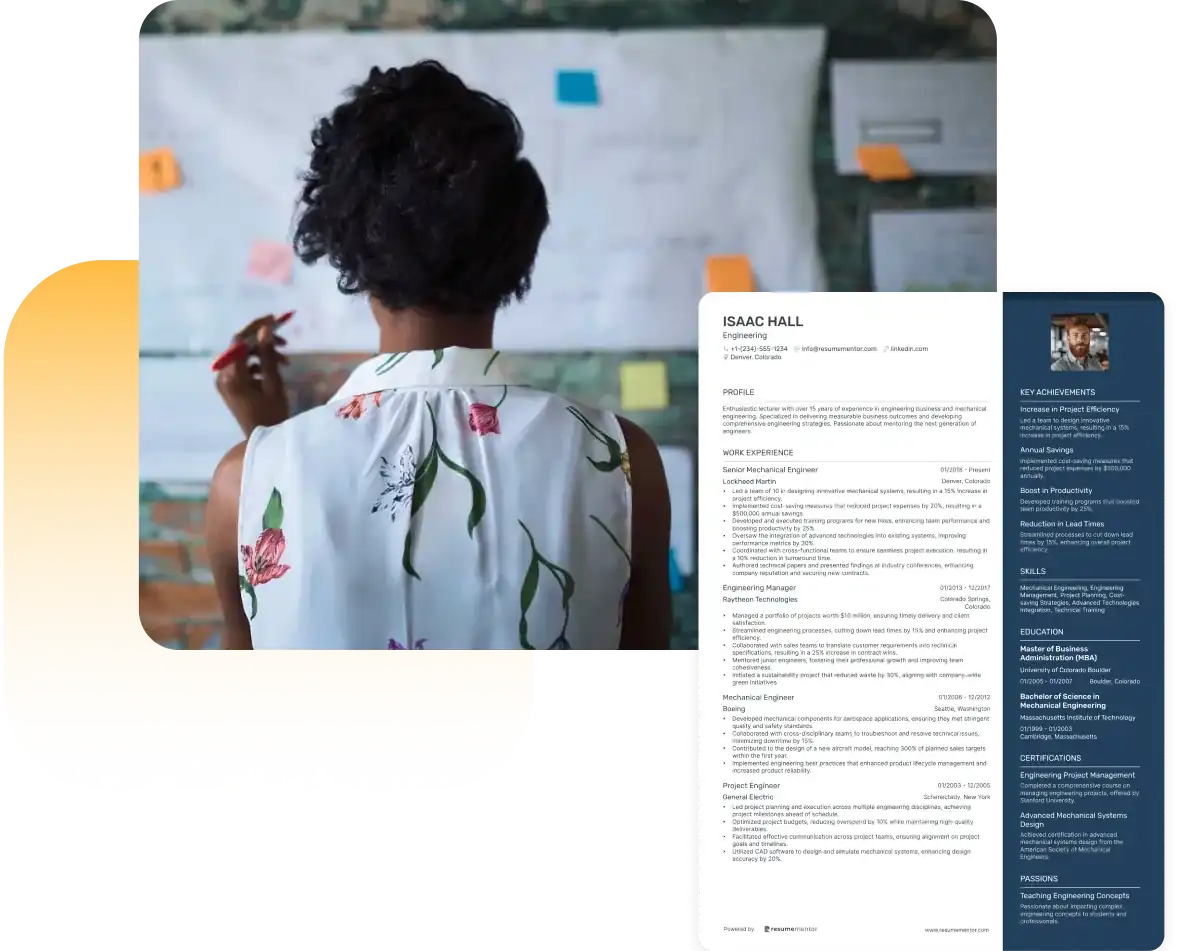

Writing a resume for a career in banking can be as tricky as mastering a complex financial transaction. You may have vast experience, but portraying it on paper can often feel like solving a financial puzzle. Your resume needs to clearly and effectively communicate your qualifications, achievements, and unique skills to potential employers. Without a well-crafted resume, landing that dream banking job might remain just a dream. Common mistakes include inadequate detail, lack of clarity, and poor structure, which can all lead to missed opportunities. To navigate these challenges, you need a specialized approach tailored to the banking sector.

Choosing the right resume template is crucial for a banking career. It ensures that your qualifications and achievements are presented in a format that appeals to hiring managers. A well-structured template highlights your strengths and keeps the reader’s focus sharp and engaged. Don’t gamble with your career; use the right tools to set yourself up for success.

And, guess what? We have more than 700 resume examples to guide you every step of the way. Dive in and discover how to craft a resume that makes you stand out in the banking industry.

Key Takeaways

- Choosing the right resume template is crucial for presenting qualifications and achievements in an appealing format specific to the banking sector.

- A banking resume should clearly convey expertise, dependability, and accomplishments in financial analysis, customer service, and regulatory compliance while including specific achievements and relevant certifications.

- The best format for a banking resume is the reverse-chronological format, emphasizing recent and relevant work experience using modern fonts and saving the resume as a PDF for consistent formatting.

- The experience section should list jobs in reverse-chronological order, using impactful action words and quantifiable results to make each role description stand out.

- Additional sections such as Certificates, Skills, Education, Professional Affiliations, and Volunteer Experience can significantly enhance a banking resume by showcasing a well-rounded and relevant background.

What to focus on when writing your banking resume

A banking resume should clearly convey your expertise, dependability, and accomplishments in the financial sector. It should highlight skills in customer service, financial analysis, and regulatory compliance. To boost its impact, consider adding:

- Specific achievements, like increasing loan approvals by 20%.

- Certifications, like CFA or CPA.

- Technical skills, such as proficiency with banking software.

- Volunteer work related to financial literacy.

Must have information on your banking resume

Creating a compelling banking resume is crucial for standing out in a competitive industry. To ensure your resume is effective and ATS-friendly, you should include these must-have sections:

- Contact Information

- Professional Summary

- Work Experience

- Education

- Skills

- Certifications

Including additional sections like "Professional Affiliations" and "Volunteer Experience" can further enhance your resume and showcase your well-rounded background. Make sure each section is tailored to highlight your expertise and accomplishments in the banking sector.

Which resume format to choose

For a banking resume, the best format is the reverse-chronological format, as it highlights your work experience in a straightforward way, which is what hiring managers in the banking industry prefer. Opt for modern fonts like Rubik and Montserrat instead of the standard Arial and Times New Roman to make your resume stand out in a professional manner. Always save your resume as a PDF to ensure formatting stays intact. Keep your margins at around 1 inch to give your resume a clean look. Use clear section headings that are ATS-friendly, such as "Work Experience," "Education," and "Skills," to ensure your resume passes through automated systems.

A banking resume should include several key sections:

- Contact Information

- Professional Summary

- Work Experience

- Education

- Skills

- Certifications

- Awards and Honors

Resume Mentor's free resume builder takes care of all these details, making it easier for you to create a professional banking resume effortlessly.

What resume format do employers prefer?

Is there a resume format suitable for college grads?

What is a simple resume format?

What are all the resume formats?

How to write a quantifiable resume experience section

Writing the experience section of your banking resume involves more than just listing your previous jobs. You’ll want to pay attention to the order of your entries, how far back in time you go, which job titles to include, resume tailoring, and the action words you use. Start with your most recent job and work backwards, including only the roles relevant to the banking industry.

Keep in mind that employers are interested in recent experience, so it's best to limit yourself to the past 10-15 years. If you have older positions that are highly relevant, it's okay to include them briefly. Always use your official job title, but don't embellish or create misleading titles. Customizing your resume for each job application will also set you apart from other candidates. Use specific, impactful action words such as "achieved," "increased," "managed," and "developed."

Here are two examples of how to write your experience section in a banking resume:

- •Supervised staff

- •Handled customer issues

- •Managed accounts

While the above example isn't entirely bad, it lacks specific details and achievements. It uses generic phrases and doesn't provide context or quantifiable results. Employers might find this bland and uninformative.

Now, here’s a stronger example:

- •Increased customer satisfaction score by 20% through improved service training

- •Led team to achieve a 15% growth in loan applications, contributing to a $1.5 million annual increase

- •Implemented a fraud detection system that reduced fraud incidents by 30%

The second example is much more effective. It focuses on specific achievements and quantifies results, giving potential employers a clear picture of your capabilities and contributions. Using action words and offering clear, data-driven outcomes makes your experiences stand out. This approach not only captures attention but also provides a strong sense of your impact and skills.

Remember, a well-crafted resume experience section can significantly boost your chances of landing a job. Always aim for clarity, relevancy, and achievement-oriented descriptions to showcase your value.

Banking resume experience examples

Ever wondered how many puns it takes to make a banking resume shine? Well, you can bank on these examples to add value to your future job search. Get ready to dive into the world of banking like a financial shark with these stellar experience sections!

Achievement-focused

Showcase the impressive achievements you've accomplished in your banking career. Tailor your points to highlight specific goals met or exceeded.

Senior Financial Analyst

Bank of the Future

Jan 2018 - Dec 2022

- Exceeded annual revenue targets by 10%.

- Managed client portfolios worth over $50 million.

- Recognized as top performer in the team for two consecutive years.

Skills-focused

Spotlight the key skills you've honed in your banking roles. Think about analytical skills, customer service expertise, and proficiency in financial software.

Financial Analyst

Innovative Bank

Mar 2016 - Oct 2021

- Utilized Excel and SQL for data analysis.

- Implemented customer relationship management strategies.

- Conducted financial audits and reported findings to senior management.

Responsibility-focused

Detail the various responsibilities you've taken on. Highlight your ability to multitask and manage complex banking tasks.

Operations Manager

Future Finance Services

Feb 2019 - Present

- Supervised a team of 10 financial advisors.

- Ensured compliance with industry regulations.

- Coordinated with stakeholders to streamline processes.

Project-focused

Elaborate on the specific projects you’ve led or significantly contributed to. Focus on your role and the impact the project had on your company.

Project Manager

TechBank

May 2017 - Aug 2019

- Integrated new fintech solutions to enhance customer experience.

- Reduced processing times by 30% through automation.

- Trained staff on new digital tools and platforms.

Result-focused

Show how you’ve delivered concrete results in your roles. Focus on quantifiable outcomes, such as increased revenues or decreased costs.

Financial Manager

Metro Finance Group

Jul 2015 - Dec 2020

- Outperformed sales targets by 15%.

- Spearheaded a cost analysis project leading to significant savings.

- Increased customer retention rates by 12%.

Industry-Specific Focus

Strengthen your resume by emphasizing your deep understanding of the banking industry. Include experience with regulations, compliance, and market trends.

Compliance Officer

Global Bank Inc.

Sep 2014 - Mar 2019

- Monitored market trends to suggest strategic financial moves.

- Collaborated with regulatory bodies to ensure compliance.

- Redesigned investment portfolio strategies based on market insights.

Problem-Solving focused

Highlight your knack for solving complex problems in banking. Describe challenges you’ve faced and how you effectively overcame them.

Client Solution Advisor

Finance Solutions Ltd.

Jun 2016 - Nov 2018

- Identified and mitigated risks in client portfolios.

- Developed custom financial plans for high-net-worth clients.

- Assisted in the recovery of defaulted accounts.

Innovation-focused