42+ Finance Resume Examples

Jul 18, 2024

|

12 min read

Master your finance resume: Tips to showcase your wealth of experience and land your dream job in the finance sector.

Rated by 348 people

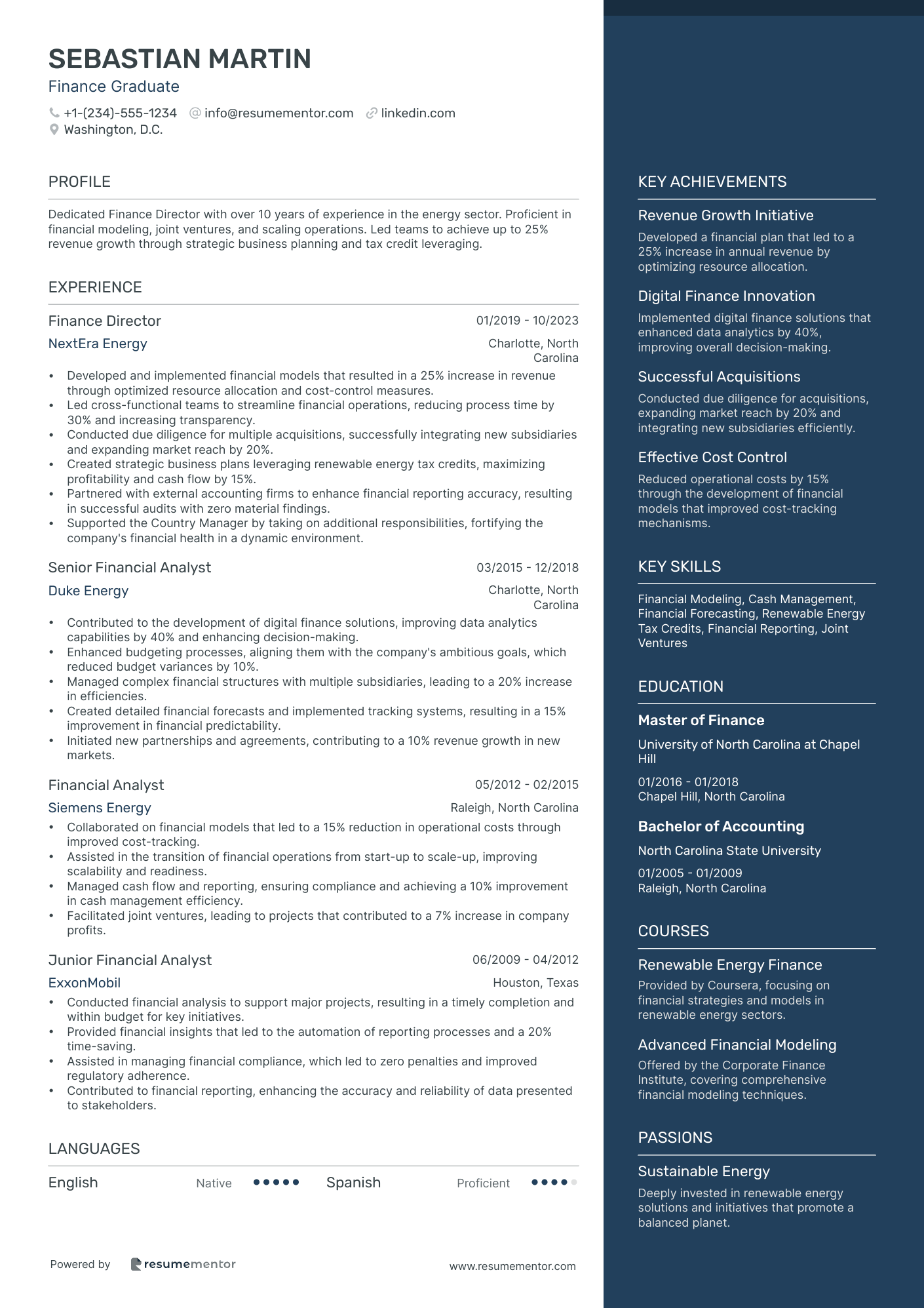

Finance Graduate resume sample

- •Developed and implemented financial models that resulted in a 25% increase in revenue through optimized resource allocation and cost-control measures.

- •Led cross-functional teams to streamline financial operations, reducing process time by 30% and increasing transparency.

- •Conducted due diligence for multiple acquisitions, successfully integrating new subsidiaries and expanding market reach by 20%.

- •Created strategic business plans leveraging renewable energy tax credits, maximizing profitability and cash flow by 15%.

- •Partnered with external accounting firms to enhance financial reporting accuracy, resulting in successful audits with zero material findings.

- •Supported the Country Manager by taking on additional responsibilities, fortifying the company's financial health in a dynamic environment.

- •Contributed to the development of digital finance solutions, improving data analytics capabilities by 40% and enhancing decision-making.

- •Enhanced budgeting processes, aligning them with the company's ambitious goals, which reduced budget variances by 10%.

- •Managed complex financial structures with multiple subsidiaries, leading to a 20% increase in efficiencies.

- •Created detailed financial forecasts and implemented tracking systems, resulting in a 15% improvement in financial predictability.

- •Initiated new partnerships and agreements, contributing to a 10% revenue growth in new markets.

- •Collaborated on financial models that led to a 15% reduction in operational costs through improved cost-tracking.

- •Assisted in the transition of financial operations from start-up to scale-up, improving scalability and readiness.

- •Managed cash flow and reporting, ensuring compliance and achieving a 10% improvement in cash management efficiency.

- •Facilitated joint ventures, leading to projects that contributed to a 7% increase in company profits.

- •Conducted financial analysis to support major projects, resulting in a timely completion and within budget for key initiatives.

- •Provided financial insights that led to the automation of reporting processes and a 20% time-saving.

- •Assisted in managing financial compliance, which led to zero penalties and improved regulatory adherence.

- •Contributed to financial reporting, enhancing the accuracy and reliability of data presented to stakeholders.

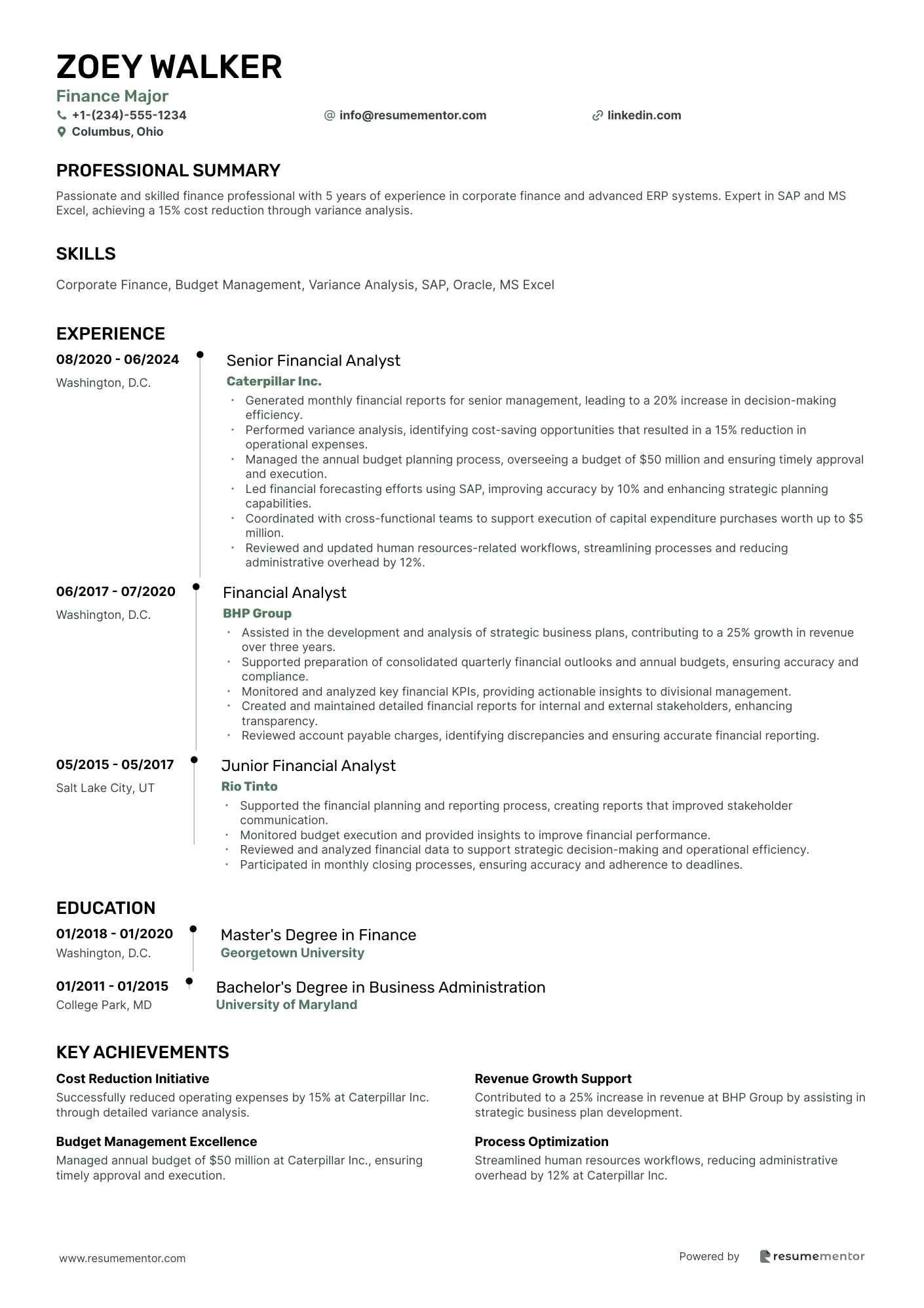

Finance Major resume sample

- •Generated monthly financial reports for senior management, leading to a 20% increase in decision-making efficiency.

- •Performed variance analysis, identifying cost-saving opportunities that resulted in a 15% reduction in operational expenses.

- •Managed the annual budget planning process, overseeing a budget of $50 million and ensuring timely approval and execution.

- •Led financial forecasting efforts using SAP, improving accuracy by 10% and enhancing strategic planning capabilities.

- •Coordinated with cross-functional teams to support execution of capital expenditure purchases worth up to $5 million.

- •Reviewed and updated human resources-related workflows, streamlining processes and reducing administrative overhead by 12%.

- •Assisted in the development and analysis of strategic business plans, contributing to a 25% growth in revenue over three years.

- •Supported preparation of consolidated quarterly financial outlooks and annual budgets, ensuring accuracy and compliance.

- •Monitored and analyzed key financial KPIs, providing actionable insights to divisional management.

- •Created and maintained detailed financial reports for internal and external stakeholders, enhancing transparency.

- •Reviewed account payable charges, identifying discrepancies and ensuring accurate financial reporting.

- •Supported the financial planning and reporting process, creating reports that improved stakeholder communication.

- •Monitored budget execution and provided insights to improve financial performance.

- •Reviewed and analyzed financial data to support strategic decision-making and operational efficiency.

- •Participated in monthly closing processes, ensuring accuracy and adherence to deadlines.

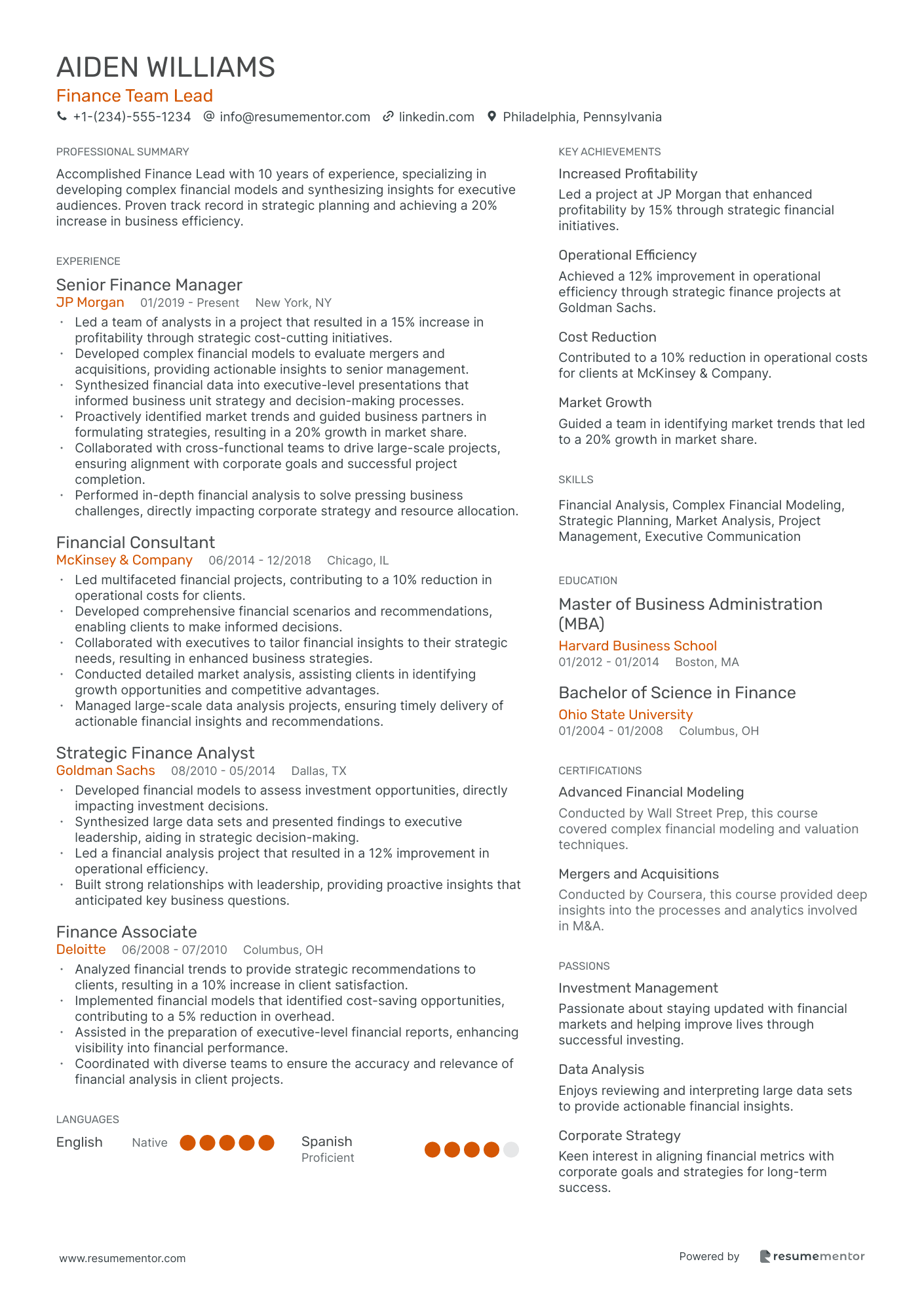

Finance Team Lead resume sample

- •Led a team of analysts in a project that resulted in a 15% increase in profitability through strategic cost-cutting initiatives.

- •Developed complex financial models to evaluate mergers and acquisitions, providing actionable insights to senior management.

- •Synthesized financial data into executive-level presentations that informed business unit strategy and decision-making processes.

- •Proactively identified market trends and guided business partners in formulating strategies, resulting in a 20% growth in market share.

- •Collaborated with cross-functional teams to drive large-scale projects, ensuring alignment with corporate goals and successful project completion.

- •Performed in-depth financial analysis to solve pressing business challenges, directly impacting corporate strategy and resource allocation.

- •Led multifaceted financial projects, contributing to a 10% reduction in operational costs for clients.

- •Developed comprehensive financial scenarios and recommendations, enabling clients to make informed decisions.

- •Collaborated with executives to tailor financial insights to their strategic needs, resulting in enhanced business strategies.

- •Conducted detailed market analysis, assisting clients in identifying growth opportunities and competitive advantages.

- •Managed large-scale data analysis projects, ensuring timely delivery of actionable financial insights and recommendations.

- •Developed financial models to assess investment opportunities, directly impacting investment decisions.

- •Synthesized large data sets and presented findings to executive leadership, aiding in strategic decision-making.

- •Led a financial analysis project that resulted in a 12% improvement in operational efficiency.

- •Built strong relationships with leadership, providing proactive insights that anticipated key business questions.

- •Analyzed financial trends to provide strategic recommendations to clients, resulting in a 10% increase in client satisfaction.

- •Implemented financial models that identified cost-saving opportunities, contributing to a 5% reduction in overhead.

- •Assisted in the preparation of executive-level financial reports, enhancing visibility into financial performance.

- •Coordinated with diverse teams to ensure the accuracy and relevance of financial analysis in client projects.

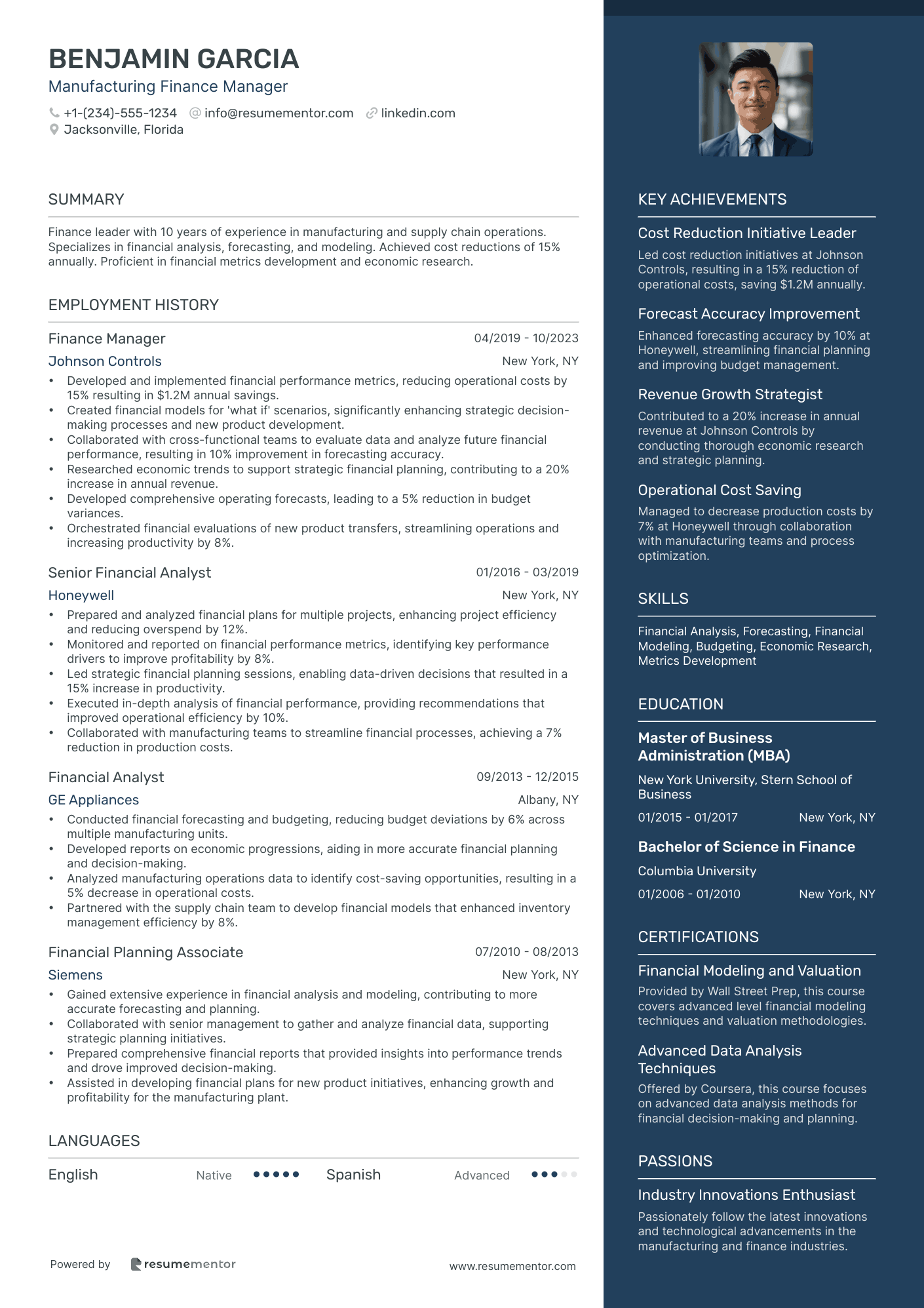

Manufacturing Finance Manager resume sample

- •Developed and implemented financial performance metrics, reducing operational costs by 15% resulting in $1.2M annual savings.

- •Created financial models for 'what if' scenarios, significantly enhancing strategic decision-making processes and new product development.

- •Collaborated with cross-functional teams to evaluate data and analyze future financial performance, resulting in 10% improvement in forecasting accuracy.

- •Researched economic trends to support strategic financial planning, contributing to a 20% increase in annual revenue.

- •Developed comprehensive operating forecasts, leading to a 5% reduction in budget variances.

- •Orchestrated financial evaluations of new product transfers, streamlining operations and increasing productivity by 8%.

- •Prepared and analyzed financial plans for multiple projects, enhancing project efficiency and reducing overspend by 12%.

- •Monitored and reported on financial performance metrics, identifying key performance drivers to improve profitability by 8%.

- •Led strategic financial planning sessions, enabling data-driven decisions that resulted in a 15% increase in productivity.

- •Executed in-depth analysis of financial performance, providing recommendations that improved operational efficiency by 10%.

- •Collaborated with manufacturing teams to streamline financial processes, achieving a 7% reduction in production costs.

- •Conducted financial forecasting and budgeting, reducing budget deviations by 6% across multiple manufacturing units.

- •Developed reports on economic progressions, aiding in more accurate financial planning and decision-making.

- •Analyzed manufacturing operations data to identify cost-saving opportunities, resulting in a 5% decrease in operational costs.

- •Partnered with the supply chain team to develop financial models that enhanced inventory management efficiency by 8%.

- •Gained extensive experience in financial analysis and modeling, contributing to more accurate forecasting and planning.

- •Collaborated with senior management to gather and analyze financial data, supporting strategic planning initiatives.

- •Prepared comprehensive financial reports that provided insights into performance trends and drove improved decision-making.

- •Assisted in developing financial plans for new product initiatives, enhancing growth and profitability for the manufacturing plant.

Merchant Finance Credit Analyst resume sample

- •Spearheaded the budget development and quarterly sales forecasts, achieving a 10% reduction in variance.

- •Partnered with merchandising teams to deliver analytical insights and recommendations, resulting in a 15% increase in profitability.

- •Developed financial models and reporting tools that improved accuracy of sales and margin tracking by 20%.

- •Implemented new technologies and process improvements that increased team efficiency by 25%.

- •Led financial analysis for special merchandise projects, ensuring successful project completion within budget.

- •Presented complex financial data in an understandable format to executives, facilitating data-driven decision-making.

- •Created financial models for merchandize sales and margin, contributing to a 12% growth in annual revenue.

- •Managed budget planning and forecasting processes, reducing planning cycle time by 15%.

- •Conducted detailed financial analysis to uncover business trends, aiding in a 10% improvement in profitability.

- •Supervised the adoption of new analytical tools and technologies, enhancing accuracy of financial reporting.

- •Built strong relationships with merchandising teams to streamline financial operations and achieve strategic goals.

- •Assisted in developing annual budgets and quarterly forecasts, improving forecasting accuracy by 8%.

- •Provided financial insights and analytical support for merchandising projects, achieving a successful project completion rate of 95%.

- •Analyzed sales and margin metrics, identifying key drivers of business performance.

- •Collaborated with technical teams to enhance financial reporting capabilities and streamline processes.

- •Conducted financial analyses that helped identify cost-saving opportunities, reducing expenses by 7%.

- •Supported budgeting and forecasting processes, contributing to a 5% improvement in financial accuracy.

- •Developed and presented financial presentations to senior management, aiding strategic planning decisions.

- •Identified and mitigated financial risks, resulting in improved financial stability.

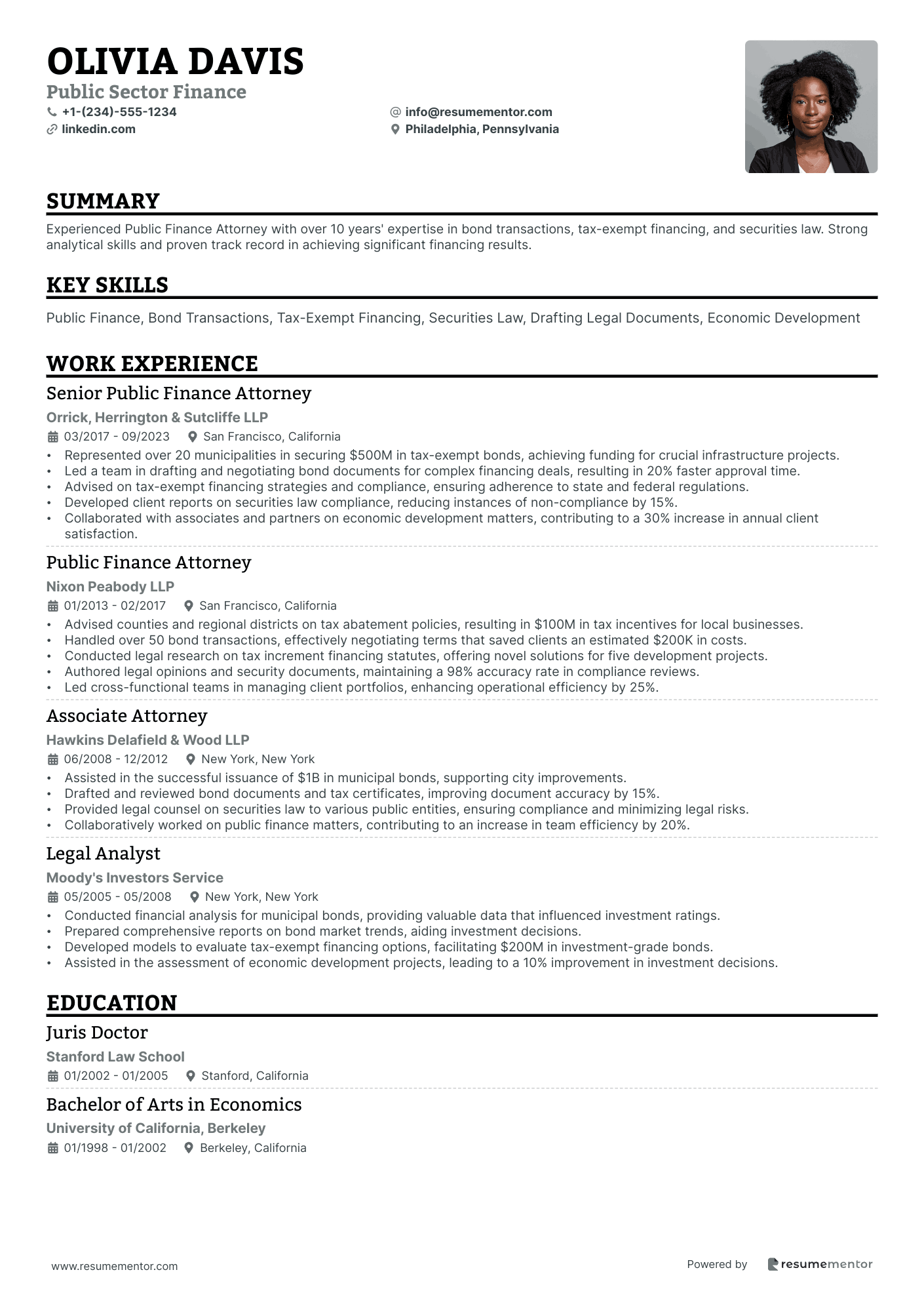

Public Sector Finance resume sample

- •Represented over 20 municipalities in securing $500M in tax-exempt bonds, achieving funding for crucial infrastructure projects.

- •Led a team in drafting and negotiating bond documents for complex financing deals, resulting in 20% faster approval time.

- •Advised on tax-exempt financing strategies and compliance, ensuring adherence to state and federal regulations.

- •Developed client reports on securities law compliance, reducing instances of non-compliance by 15%.

- •Collaborated with associates and partners on economic development matters, contributing to a 30% increase in annual client satisfaction.

- •Advised counties and regional districts on tax abatement policies, resulting in $100M in tax incentives for local businesses.

- •Handled over 50 bond transactions, effectively negotiating terms that saved clients an estimated $200K in costs.

- •Conducted legal research on tax increment financing statutes, offering novel solutions for five development projects.

- •Authored legal opinions and security documents, maintaining a 98% accuracy rate in compliance reviews.

- •Led cross-functional teams in managing client portfolios, enhancing operational efficiency by 25%.

- •Assisted in the successful issuance of $1B in municipal bonds, supporting city improvements.

- •Drafted and reviewed bond documents and tax certificates, improving document accuracy by 15%.

- •Provided legal counsel on securities law to various public entities, ensuring compliance and minimizing legal risks.

- •Collaboratively worked on public finance matters, contributing to an increase in team efficiency by 20%.

- •Conducted financial analysis for municipal bonds, providing valuable data that influenced investment ratings.

- •Prepared comprehensive reports on bond market trends, aiding investment decisions.

- •Developed models to evaluate tax-exempt financing options, facilitating $200M in investment-grade bonds.

- •Assisted in the assessment of economic development projects, leading to a 10% improvement in investment decisions.

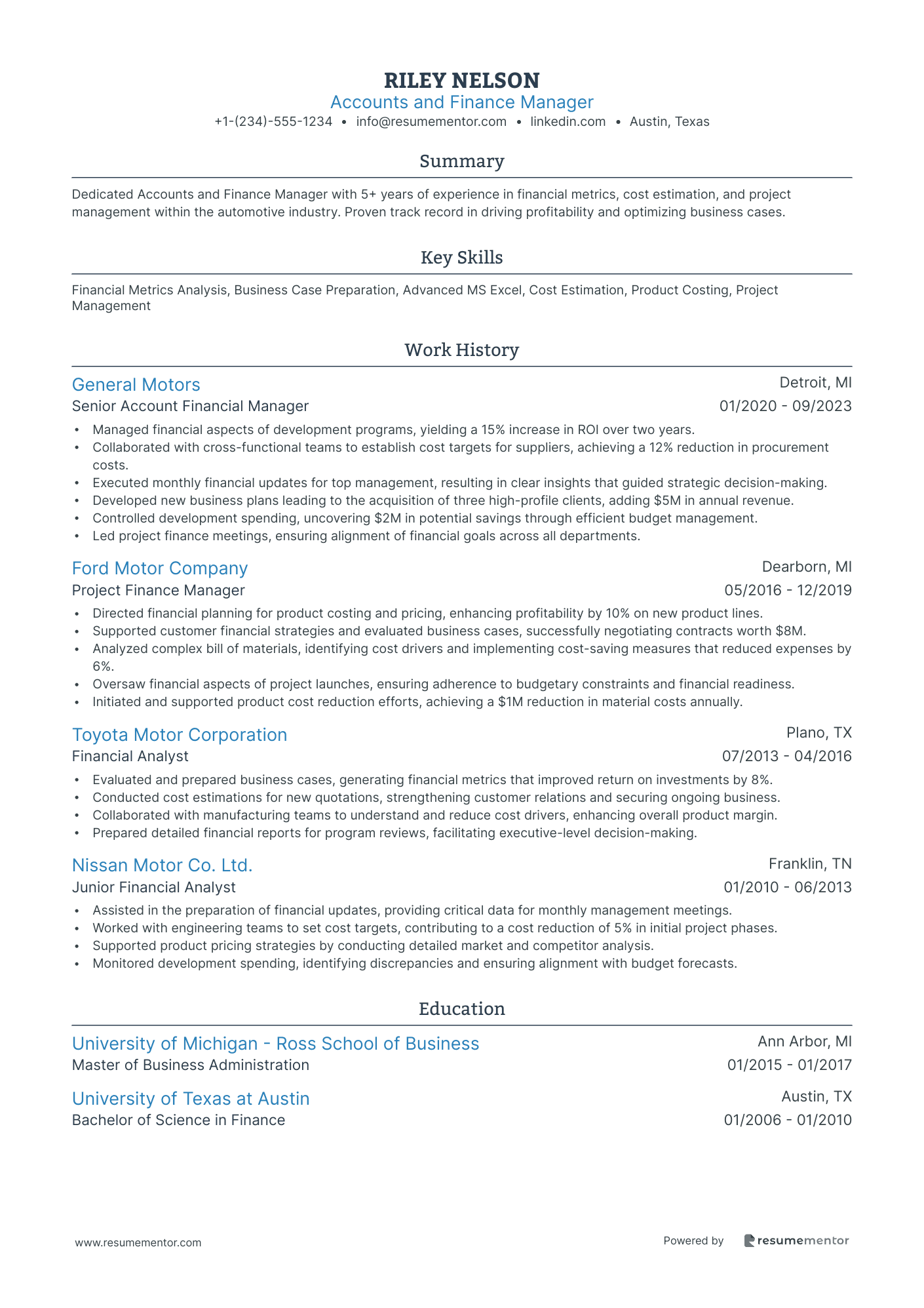

Accounts and Finance Manager resume sample

- •Managed financial aspects of development programs, yielding a 15% increase in ROI over two years.

- •Collaborated with cross-functional teams to establish cost targets for suppliers, achieving a 12% reduction in procurement costs.

- •Executed monthly financial updates for top management, resulting in clear insights that guided strategic decision-making.

- •Developed new business plans leading to the acquisition of three high-profile clients, adding $5M in annual revenue.

- •Controlled development spending, uncovering $2M in potential savings through efficient budget management.

- •Led project finance meetings, ensuring alignment of financial goals across all departments.

- •Directed financial planning for product costing and pricing, enhancing profitability by 10% on new product lines.

- •Supported customer financial strategies and evaluated business cases, successfully negotiating contracts worth $8M.

- •Analyzed complex bill of materials, identifying cost drivers and implementing cost-saving measures that reduced expenses by 6%.

- •Oversaw financial aspects of project launches, ensuring adherence to budgetary constraints and financial readiness.

- •Initiated and supported product cost reduction efforts, achieving a $1M reduction in material costs annually.

- •Evaluated and prepared business cases, generating financial metrics that improved return on investments by 8%.

- •Conducted cost estimations for new quotations, strengthening customer relations and securing ongoing business.

- •Collaborated with manufacturing teams to understand and reduce cost drivers, enhancing overall product margin.

- •Prepared detailed financial reports for program reviews, facilitating executive-level decision-making.

- •Assisted in the preparation of financial updates, providing critical data for monthly management meetings.

- •Worked with engineering teams to set cost targets, contributing to a cost reduction of 5% in initial project phases.

- •Supported product pricing strategies by conducting detailed market and competitor analysis.

- •Monitored development spending, identifying discrepancies and ensuring alignment with budget forecasts.

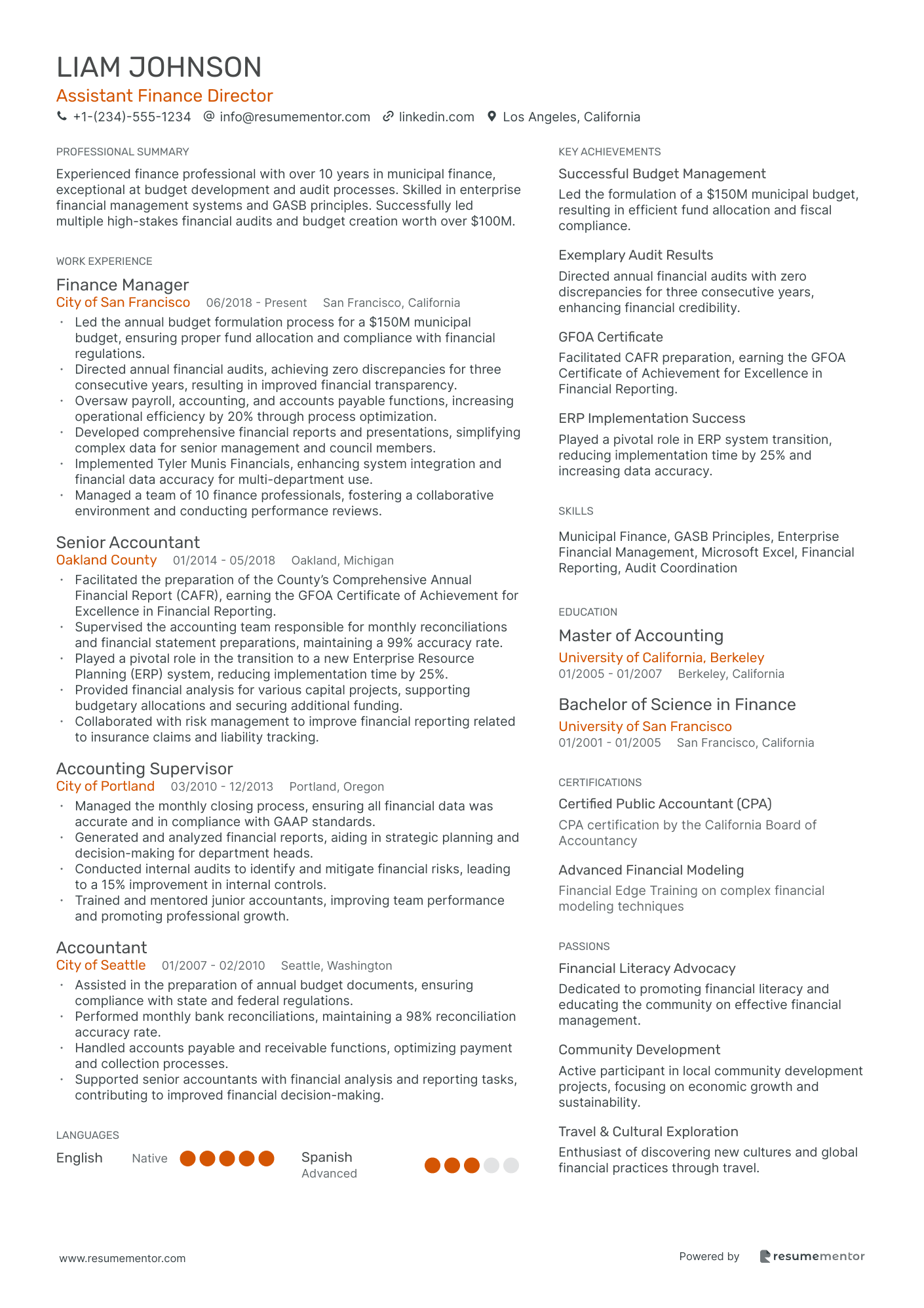

Assistant Finance Director resume sample

- •Led the annual budget formulation process for a $150M municipal budget, ensuring proper fund allocation and compliance with financial regulations.

- •Directed annual financial audits, achieving zero discrepancies for three consecutive years, resulting in improved financial transparency.

- •Oversaw payroll, accounting, and accounts payable functions, increasing operational efficiency by 20% through process optimization.

- •Developed comprehensive financial reports and presentations, simplifying complex data for senior management and council members.

- •Implemented Tyler Munis Financials, enhancing system integration and financial data accuracy for multi-department use.

- •Managed a team of 10 finance professionals, fostering a collaborative environment and conducting performance reviews.

- •Facilitated the preparation of the County’s Comprehensive Annual Financial Report (CAFR), earning the GFOA Certificate of Achievement for Excellence in Financial Reporting.

- •Supervised the accounting team responsible for monthly reconciliations and financial statement preparations, maintaining a 99% accuracy rate.

- •Played a pivotal role in the transition to a new Enterprise Resource Planning (ERP) system, reducing implementation time by 25%.

- •Provided financial analysis for various capital projects, supporting budgetary allocations and securing additional funding.

- •Collaborated with risk management to improve financial reporting related to insurance claims and liability tracking.

- •Managed the monthly closing process, ensuring all financial data was accurate and in compliance with GAAP standards.

- •Generated and analyzed financial reports, aiding in strategic planning and decision-making for department heads.

- •Conducted internal audits to identify and mitigate financial risks, leading to a 15% improvement in internal controls.

- •Trained and mentored junior accountants, improving team performance and promoting professional growth.

- •Assisted in the preparation of annual budget documents, ensuring compliance with state and federal regulations.

- •Performed monthly bank reconciliations, maintaining a 98% reconciliation accuracy rate.

- •Handled accounts payable and receivable functions, optimizing payment and collection processes.

- •Supported senior accountants with financial analysis and reporting tasks, contributing to improved financial decision-making.

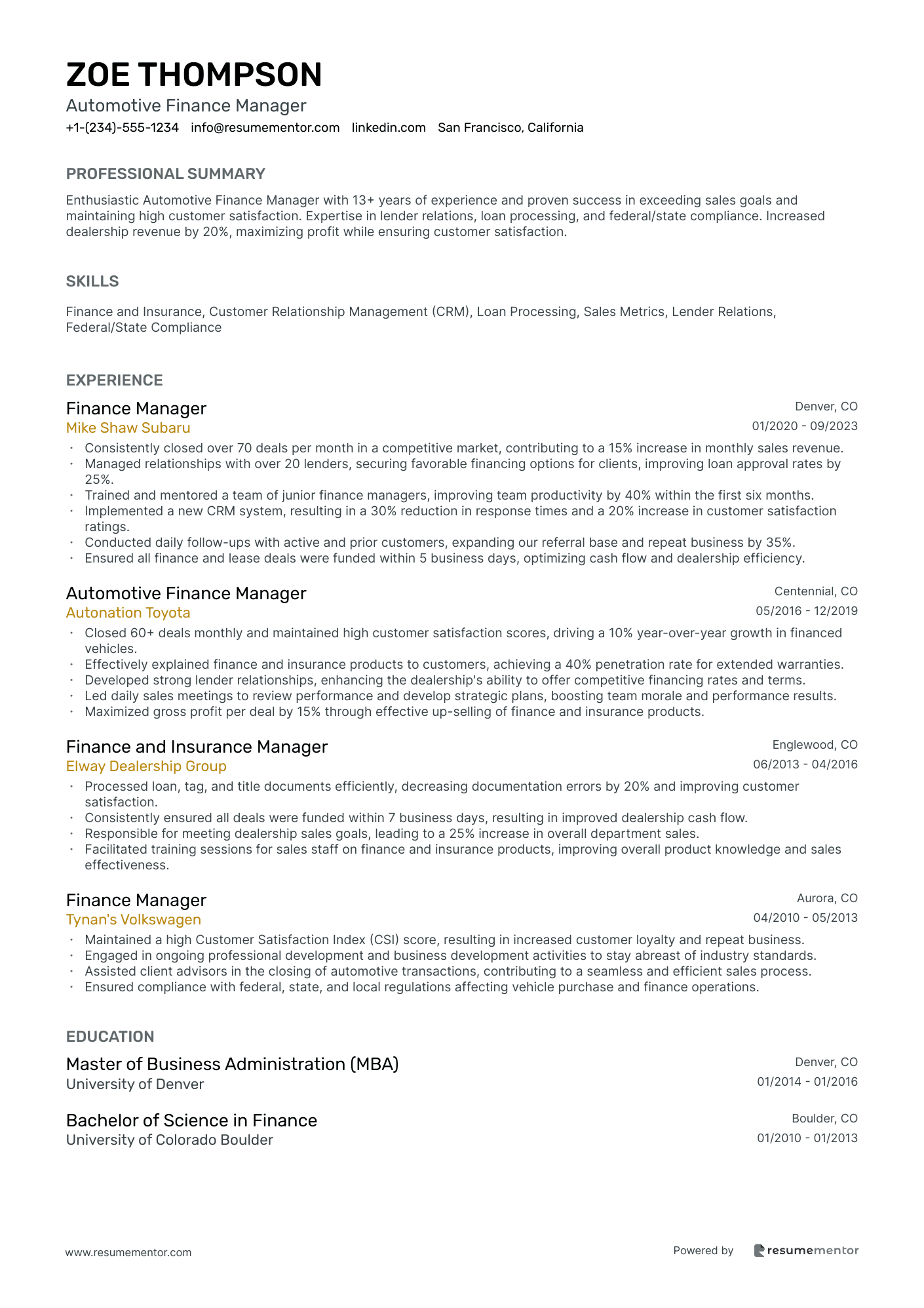

Automotive Finance Manager resume sample

- •Consistently closed over 70 deals per month in a competitive market, contributing to a 15% increase in monthly sales revenue.

- •Managed relationships with over 20 lenders, securing favorable financing options for clients, improving loan approval rates by 25%.

- •Trained and mentored a team of junior finance managers, improving team productivity by 40% within the first six months.

- •Implemented a new CRM system, resulting in a 30% reduction in response times and a 20% increase in customer satisfaction ratings.

- •Conducted daily follow-ups with active and prior customers, expanding our referral base and repeat business by 35%.

- •Ensured all finance and lease deals were funded within 5 business days, optimizing cash flow and dealership efficiency.

- •Closed 60+ deals monthly and maintained high customer satisfaction scores, driving a 10% year-over-year growth in financed vehicles.

- •Effectively explained finance and insurance products to customers, achieving a 40% penetration rate for extended warranties.

- •Developed strong lender relationships, enhancing the dealership's ability to offer competitive financing rates and terms.

- •Led daily sales meetings to review performance and develop strategic plans, boosting team morale and performance results.

- •Maximized gross profit per deal by 15% through effective up-selling of finance and insurance products.

- •Processed loan, tag, and title documents efficiently, decreasing documentation errors by 20% and improving customer satisfaction.

- •Consistently ensured all deals were funded within 7 business days, resulting in improved dealership cash flow.

- •Responsible for meeting dealership sales goals, leading to a 25% increase in overall department sales.

- •Facilitated training sessions for sales staff on finance and insurance products, improving overall product knowledge and sales effectiveness.

- •Maintained a high Customer Satisfaction Index (CSI) score, resulting in increased customer loyalty and repeat business.

- •Engaged in ongoing professional development and business development activities to stay abreast of industry standards.

- •Assisted client advisors in the closing of automotive transactions, contributing to a seamless and efficient sales process.

- •Ensured compliance with federal, state, and local regulations affecting vehicle purchase and finance operations.

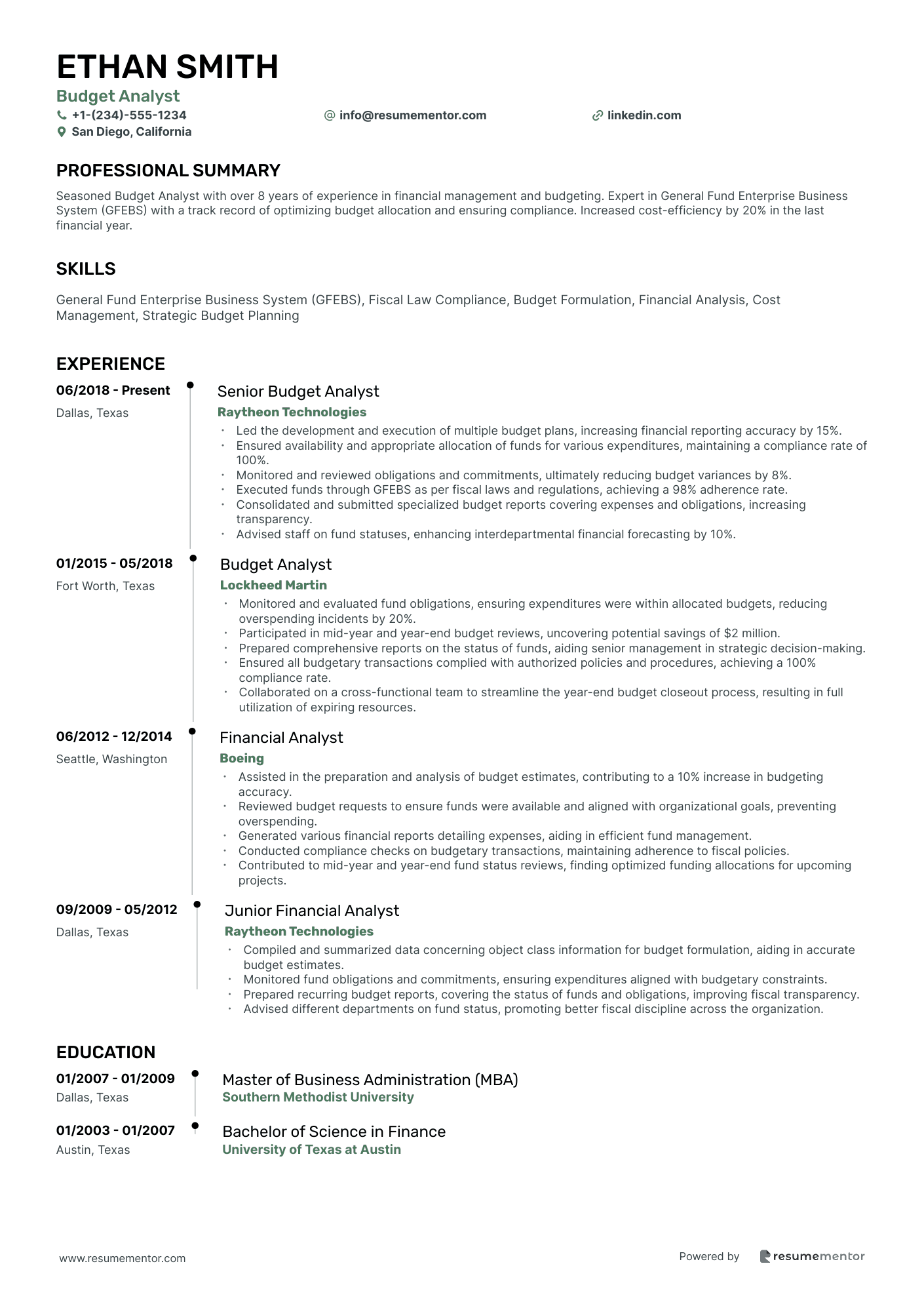

Budget Analyst resume sample

- •Led the development and execution of multiple budget plans, increasing financial reporting accuracy by 15%.

- •Ensured availability and appropriate allocation of funds for various expenditures, maintaining a compliance rate of 100%.

- •Monitored and reviewed obligations and commitments, ultimately reducing budget variances by 8%.

- •Executed funds through GFEBS as per fiscal laws and regulations, achieving a 98% adherence rate.

- •Consolidated and submitted specialized budget reports covering expenses and obligations, increasing transparency.

- •Advised staff on fund statuses, enhancing interdepartmental financial forecasting by 10%.

- •Monitored and evaluated fund obligations, ensuring expenditures were within allocated budgets, reducing overspending incidents by 20%.

- •Participated in mid-year and year-end budget reviews, uncovering potential savings of $2 million.

- •Prepared comprehensive reports on the status of funds, aiding senior management in strategic decision-making.

- •Ensured all budgetary transactions complied with authorized policies and procedures, achieving a 100% compliance rate.

- •Collaborated on a cross-functional team to streamline the year-end budget closeout process, resulting in full utilization of expiring resources.

- •Assisted in the preparation and analysis of budget estimates, contributing to a 10% increase in budgeting accuracy.

- •Reviewed budget requests to ensure funds were available and aligned with organizational goals, preventing overspending.

- •Generated various financial reports detailing expenses, aiding in efficient fund management.

- •Conducted compliance checks on budgetary transactions, maintaining adherence to fiscal policies.

- •Contributed to mid-year and year-end fund status reviews, finding optimized funding allocations for upcoming projects.

- •Compiled and summarized data concerning object class information for budget formulation, aiding in accurate budget estimates.

- •Monitored fund obligations and commitments, ensuring expenditures aligned with budgetary constraints.

- •Prepared recurring budget reports, covering the status of funds and obligations, improving fiscal transparency.

- •Advised different departments on fund status, promoting better fiscal discipline across the organization.

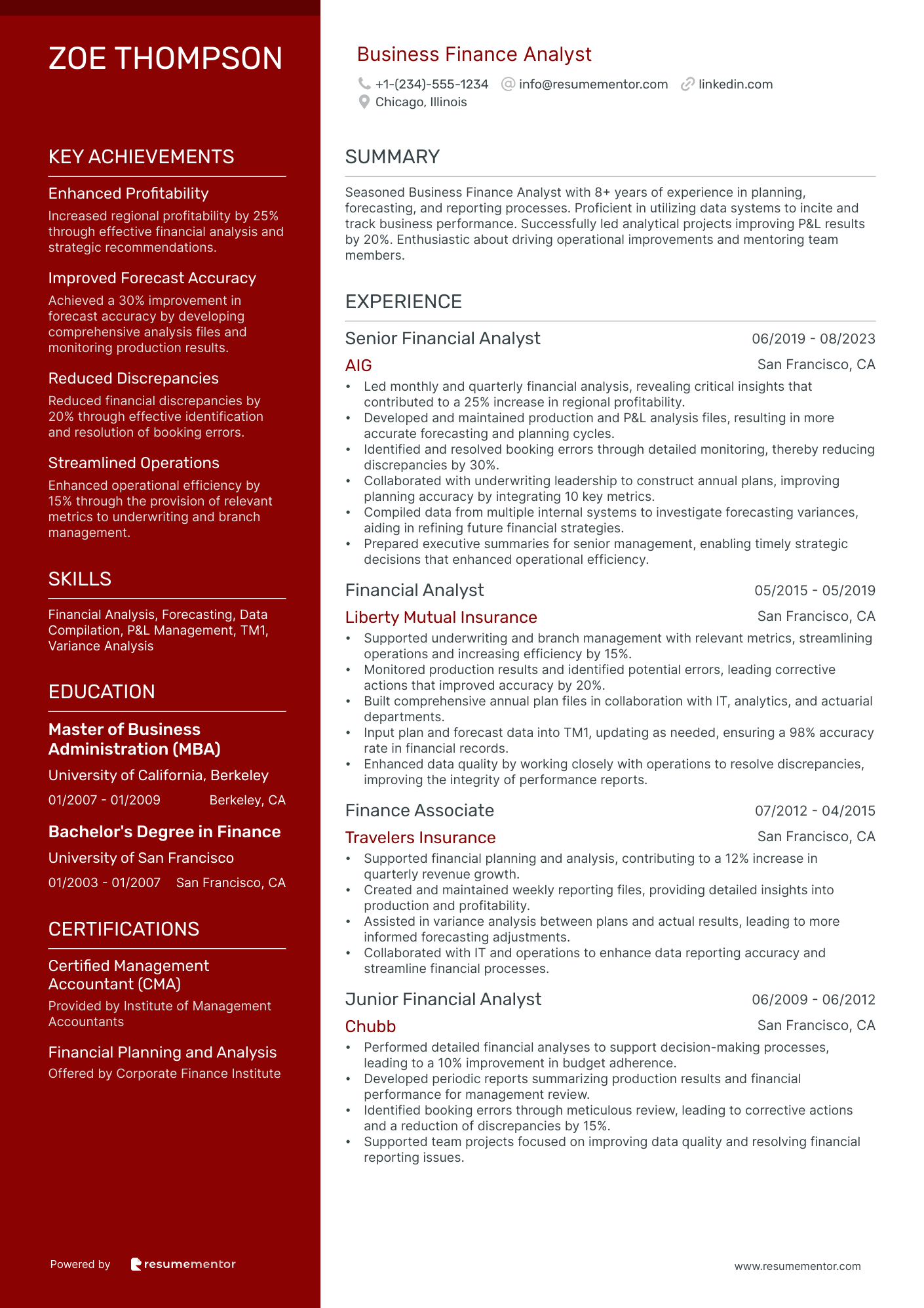

Business Finance Analyst resume sample

- •Led monthly and quarterly financial analysis, revealing critical insights that contributed to a 25% increase in regional profitability.

- •Developed and maintained production and P&L analysis files, resulting in more accurate forecasting and planning cycles.

- •Identified and resolved booking errors through detailed monitoring, thereby reducing discrepancies by 30%.

- •Collaborated with underwriting leadership to construct annual plans, improving planning accuracy by integrating 10 key metrics.

- •Compiled data from multiple internal systems to investigate forecasting variances, aiding in refining future financial strategies.

- •Prepared executive summaries for senior management, enabling timely strategic decisions that enhanced operational efficiency.

- •Supported underwriting and branch management with relevant metrics, streamlining operations and increasing efficiency by 15%.

- •Monitored production results and identified potential errors, leading corrective actions that improved accuracy by 20%.

- •Built comprehensive annual plan files in collaboration with IT, analytics, and actuarial departments.

- •Input plan and forecast data into TM1, updating as needed, ensuring a 98% accuracy rate in financial records.

- •Enhanced data quality by working closely with operations to resolve discrepancies, improving the integrity of performance reports.

- •Supported financial planning and analysis, contributing to a 12% increase in quarterly revenue growth.

- •Created and maintained weekly reporting files, providing detailed insights into production and profitability.

- •Assisted in variance analysis between plans and actual results, leading to more informed forecasting adjustments.

- •Collaborated with IT and operations to enhance data reporting accuracy and streamline financial processes.

- •Performed detailed financial analyses to support decision-making processes, leading to a 10% improvement in budget adherence.

- •Developed periodic reports summarizing production results and financial performance for management review.

- •Identified booking errors through meticulous review, leading to corrective actions and a reduction of discrepancies by 15%.

- •Supported team projects focused on improving data quality and resolving financial reporting issues.

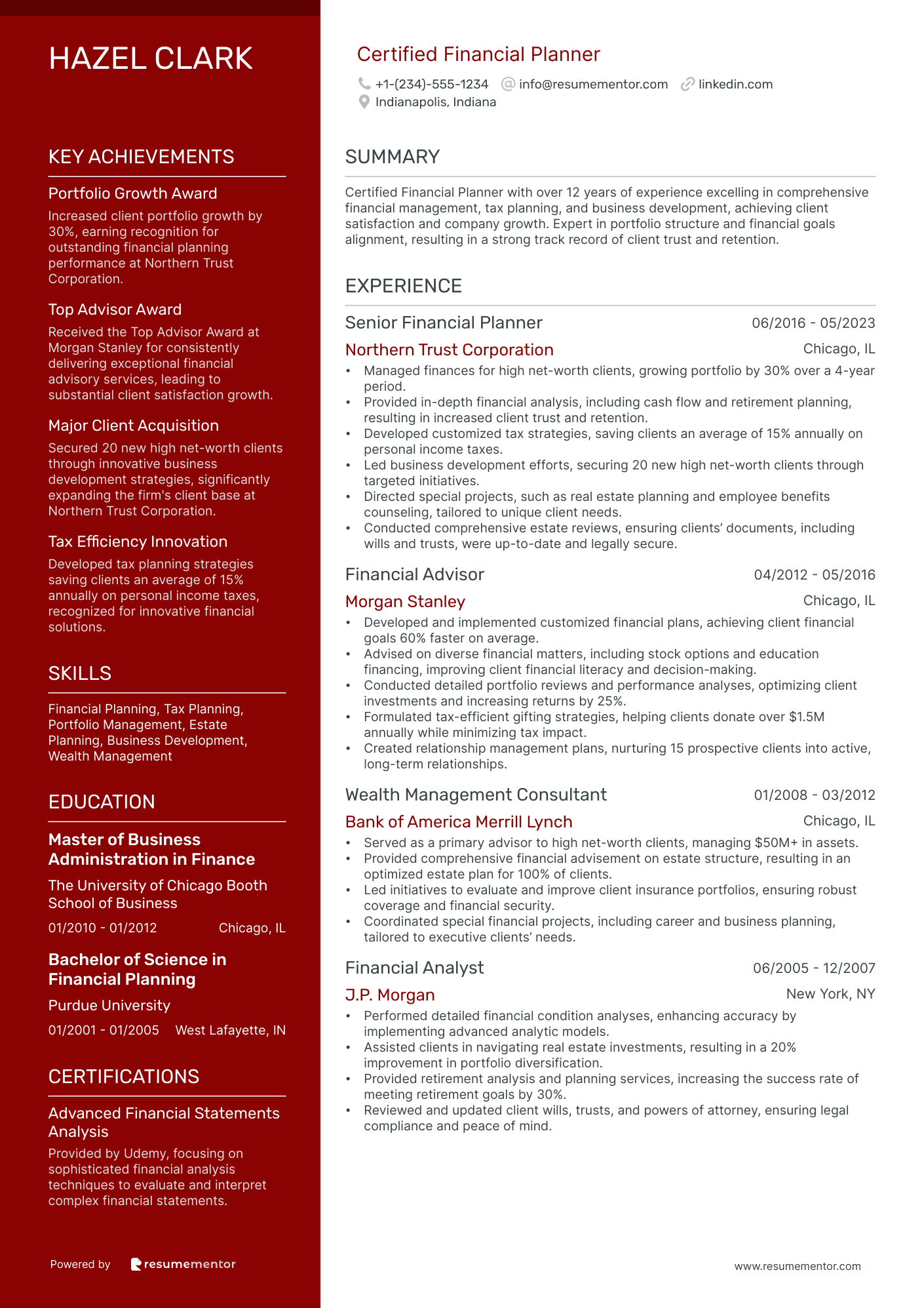

Certified Financial Planner resume sample

- •Managed finances for high net-worth clients, growing portfolio by 30% over a 4-year period.

- •Provided in-depth financial analysis, including cash flow and retirement planning, resulting in increased client trust and retention.

- •Developed customized tax strategies, saving clients an average of 15% annually on personal income taxes.

- •Led business development efforts, securing 20 new high net-worth clients through targeted initiatives.

- •Directed special projects, such as real estate planning and employee benefits counseling, tailored to unique client needs.

- •Conducted comprehensive estate reviews, ensuring clients’ documents, including wills and trusts, were up-to-date and legally secure.

- •Developed and implemented customized financial plans, achieving client financial goals 60% faster on average.

- •Advised on diverse financial matters, including stock options and education financing, improving client financial literacy and decision-making.

- •Conducted detailed portfolio reviews and performance analyses, optimizing client investments and increasing returns by 25%.

- •Formulated tax-efficient gifting strategies, helping clients donate over $1.5M annually while minimizing tax impact.

- •Created relationship management plans, nurturing 15 prospective clients into active, long-term relationships.

- •Served as a primary advisor to high net-worth clients, managing $50M+ in assets.

- •Provided comprehensive financial advisement on estate structure, resulting in an optimized estate plan for 100% of clients.

- •Led initiatives to evaluate and improve client insurance portfolios, ensuring robust coverage and financial security.

- •Coordinated special financial projects, including career and business planning, tailored to executive clients’ needs.

- •Performed detailed financial condition analyses, enhancing accuracy by implementing advanced analytic models.

- •Assisted clients in navigating real estate investments, resulting in a 20% improvement in portfolio diversification.

- •Provided retirement analysis and planning services, increasing the success rate of meeting retirement goals by 30%.

- •Reviewed and updated client wills, trusts, and powers of attorney, ensuring legal compliance and peace of mind.

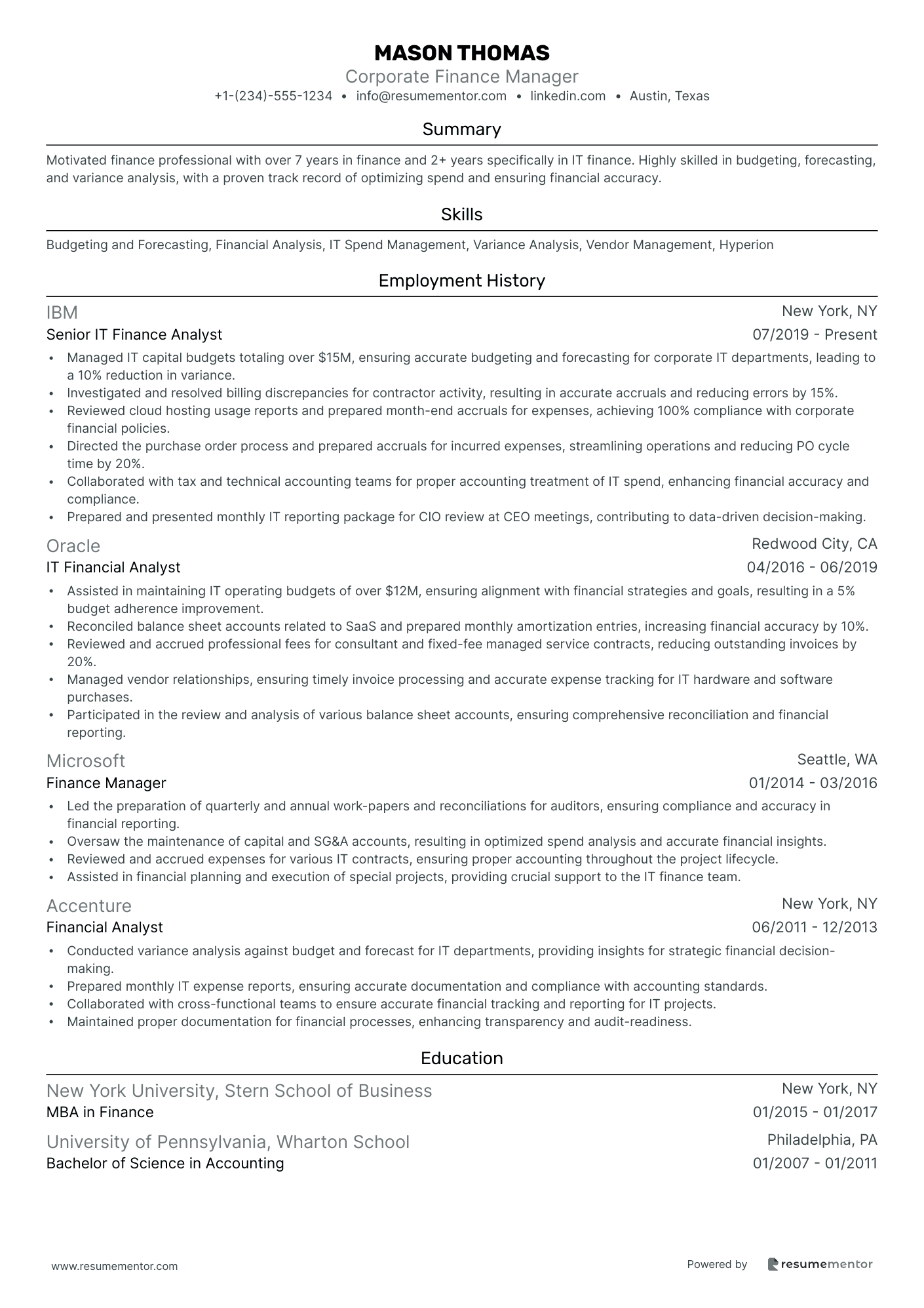

Corporate Finance Manager resume sample

- •Managed IT capital budgets totaling over $15M, ensuring accurate budgeting and forecasting for corporate IT departments, leading to a 10% reduction in variance.

- •Investigated and resolved billing discrepancies for contractor activity, resulting in accurate accruals and reducing errors by 15%.

- •Reviewed cloud hosting usage reports and prepared month-end accruals for expenses, achieving 100% compliance with corporate financial policies.

- •Directed the purchase order process and prepared accruals for incurred expenses, streamlining operations and reducing PO cycle time by 20%.

- •Collaborated with tax and technical accounting teams for proper accounting treatment of IT spend, enhancing financial accuracy and compliance.

- •Prepared and presented monthly IT reporting package for CIO review at CEO meetings, contributing to data-driven decision-making.

- •Assisted in maintaining IT operating budgets of over $12M, ensuring alignment with financial strategies and goals, resulting in a 5% budget adherence improvement.

- •Reconciled balance sheet accounts related to SaaS and prepared monthly amortization entries, increasing financial accuracy by 10%.

- •Reviewed and accrued professional fees for consultant and fixed-fee managed service contracts, reducing outstanding invoices by 20%.

- •Managed vendor relationships, ensuring timely invoice processing and accurate expense tracking for IT hardware and software purchases.

- •Participated in the review and analysis of various balance sheet accounts, ensuring comprehensive reconciliation and financial reporting.

- •Led the preparation of quarterly and annual work-papers and reconciliations for auditors, ensuring compliance and accuracy in financial reporting.

- •Oversaw the maintenance of capital and SG&A accounts, resulting in optimized spend analysis and accurate financial insights.

- •Reviewed and accrued expenses for various IT contracts, ensuring proper accounting throughout the project lifecycle.

- •Assisted in financial planning and execution of special projects, providing crucial support to the IT finance team.

- •Conducted variance analysis against budget and forecast for IT departments, providing insights for strategic financial decision-making.

- •Prepared monthly IT expense reports, ensuring accurate documentation and compliance with accounting standards.

- •Collaborated with cross-functional teams to ensure accurate financial tracking and reporting for IT projects.

- •Maintained proper documentation for financial processes, enhancing transparency and audit-readiness.

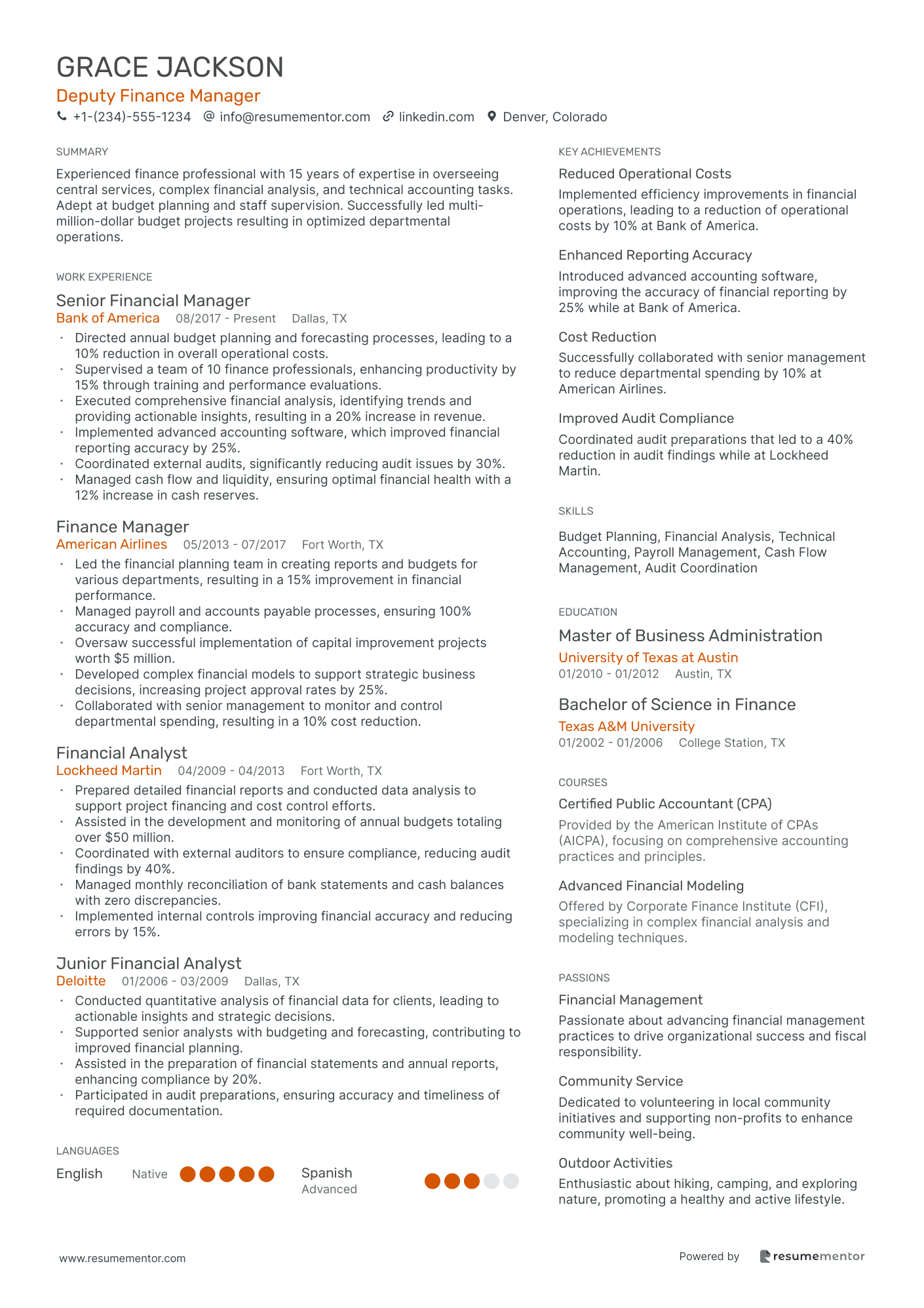

Deputy Finance Manager resume sample

- •Directed annual budget planning and forecasting processes, leading to a 10% reduction in overall operational costs.

- •Supervised a team of 10 finance professionals, enhancing productivity by 15% through training and performance evaluations.

- •Executed comprehensive financial analysis, identifying trends and providing actionable insights, resulting in a 20% increase in revenue.

- •Implemented advanced accounting software, which improved financial reporting accuracy by 25%.

- •Coordinated external audits, significantly reducing audit issues by 30%.

- •Managed cash flow and liquidity, ensuring optimal financial health with a 12% increase in cash reserves.

- •Led the financial planning team in creating reports and budgets for various departments, resulting in a 15% improvement in financial performance.

- •Managed payroll and accounts payable processes, ensuring 100% accuracy and compliance.

- •Oversaw successful implementation of capital improvement projects worth $5 million.

- •Developed complex financial models to support strategic business decisions, increasing project approval rates by 25%.

- •Collaborated with senior management to monitor and control departmental spending, resulting in a 10% cost reduction.

- •Prepared detailed financial reports and conducted data analysis to support project financing and cost control efforts.

- •Assisted in the development and monitoring of annual budgets totaling over $50 million.

- •Coordinated with external auditors to ensure compliance, reducing audit findings by 40%.

- •Managed monthly reconciliation of bank statements and cash balances with zero discrepancies.

- •Implemented internal controls improving financial accuracy and reducing errors by 15%.

- •Conducted quantitative analysis of financial data for clients, leading to actionable insights and strategic decisions.

- •Supported senior analysts with budgeting and forecasting, contributing to improved financial planning.

- •Assisted in the preparation of financial statements and annual reports, enhancing compliance by 20%.

- •Participated in audit preparations, ensuring accuracy and timeliness of required documentation.

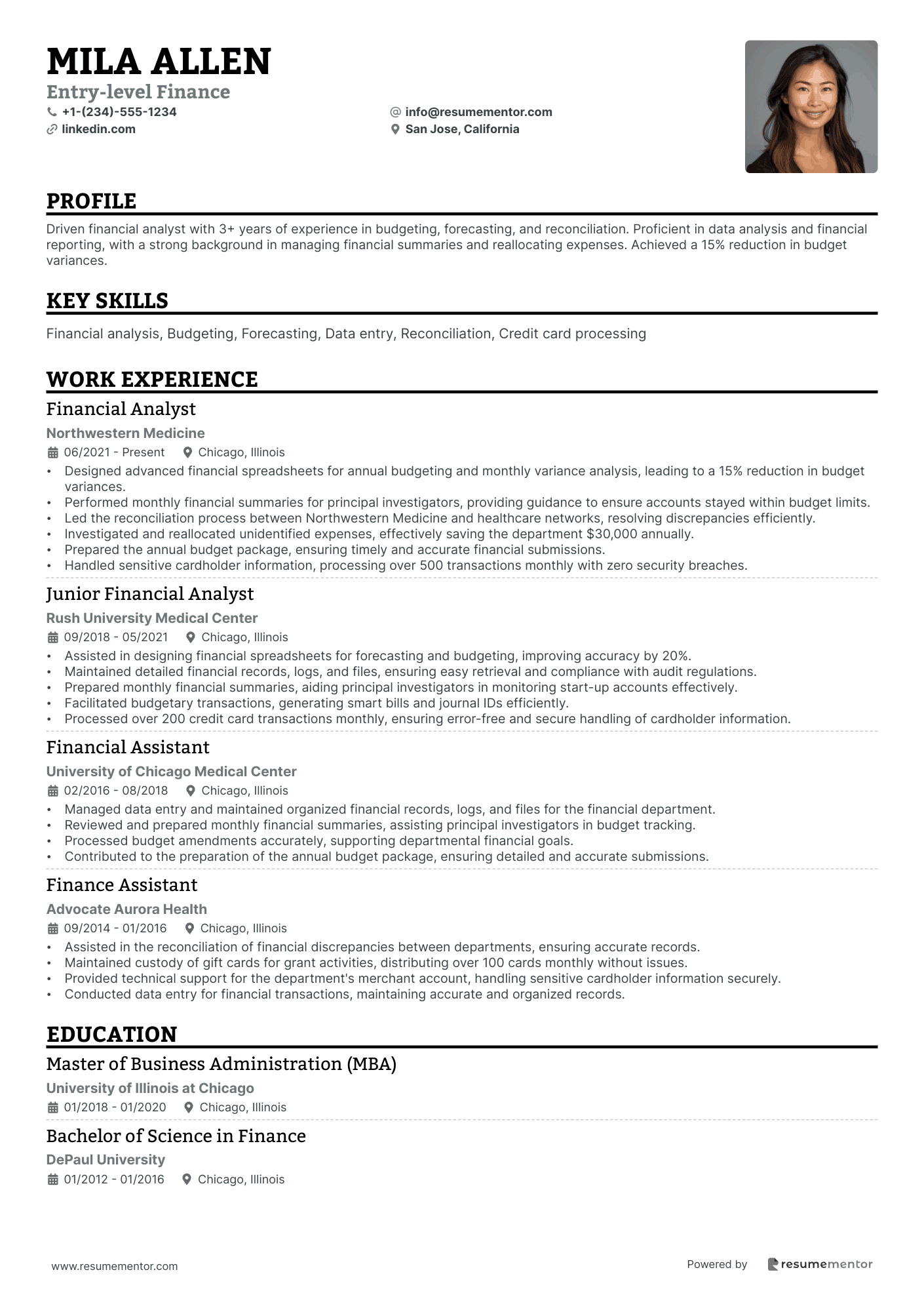

Entry-level Finance resume sample

- •Designed advanced financial spreadsheets for annual budgeting and monthly variance analysis, leading to a 15% reduction in budget variances.

- •Performed monthly financial summaries for principal investigators, providing guidance to ensure accounts stayed within budget limits.

- •Led the reconciliation process between Northwestern Medicine and healthcare networks, resolving discrepancies efficiently.

- •Investigated and reallocated unidentified expenses, effectively saving the department $30,000 annually.

- •Prepared the annual budget package, ensuring timely and accurate financial submissions.

- •Handled sensitive cardholder information, processing over 500 transactions monthly with zero security breaches.

- •Assisted in designing financial spreadsheets for forecasting and budgeting, improving accuracy by 20%.

- •Maintained detailed financial records, logs, and files, ensuring easy retrieval and compliance with audit regulations.

- •Prepared monthly financial summaries, aiding principal investigators in monitoring start-up accounts effectively.

- •Facilitated budgetary transactions, generating smart bills and journal IDs efficiently.

- •Processed over 200 credit card transactions monthly, ensuring error-free and secure handling of cardholder information.

- •Managed data entry and maintained organized financial records, logs, and files for the financial department.

- •Reviewed and prepared monthly financial summaries, assisting principal investigators in budget tracking.

- •Processed budget amendments accurately, supporting departmental financial goals.

- •Contributed to the preparation of the annual budget package, ensuring detailed and accurate submissions.

- •Assisted in the reconciliation of financial discrepancies between departments, ensuring accurate records.

- •Maintained custody of gift cards for grant activities, distributing over 100 cards monthly without issues.

- •Provided technical support for the department's merchant account, handling sensitive cardholder information securely.

- •Conducted data entry for financial transactions, maintaining accurate and organized records.

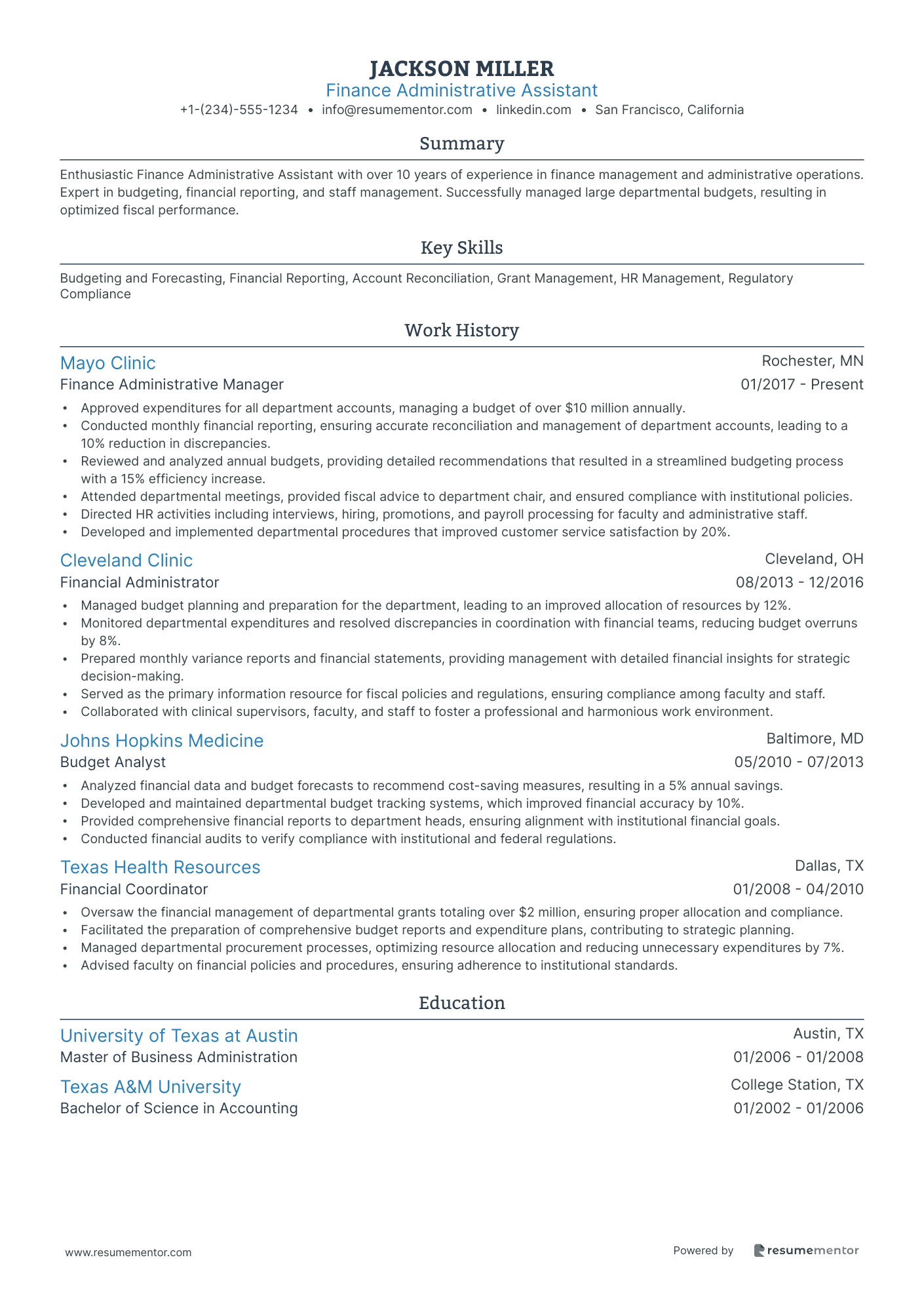

Finance Administrative Assistant resume sample

- •Approved expenditures for all department accounts, managing a budget of over $10 million annually.

- •Conducted monthly financial reporting, ensuring accurate reconciliation and management of department accounts, leading to a 10% reduction in discrepancies.

- •Reviewed and analyzed annual budgets, providing detailed recommendations that resulted in a streamlined budgeting process with a 15% efficiency increase.

- •Attended departmental meetings, provided fiscal advice to department chair, and ensured compliance with institutional policies.

- •Directed HR activities including interviews, hiring, promotions, and payroll processing for faculty and administrative staff.

- •Developed and implemented departmental procedures that improved customer service satisfaction by 20%.

- •Managed budget planning and preparation for the department, leading to an improved allocation of resources by 12%.

- •Monitored departmental expenditures and resolved discrepancies in coordination with financial teams, reducing budget overruns by 8%.

- •Prepared monthly variance reports and financial statements, providing management with detailed financial insights for strategic decision-making.

- •Served as the primary information resource for fiscal policies and regulations, ensuring compliance among faculty and staff.

- •Collaborated with clinical supervisors, faculty, and staff to foster a professional and harmonious work environment.

- •Analyzed financial data and budget forecasts to recommend cost-saving measures, resulting in a 5% annual savings.

- •Developed and maintained departmental budget tracking systems, which improved financial accuracy by 10%.

- •Provided comprehensive financial reports to department heads, ensuring alignment with institutional financial goals.

- •Conducted financial audits to verify compliance with institutional and federal regulations.

- •Oversaw the financial management of departmental grants totaling over $2 million, ensuring proper allocation and compliance.

- •Facilitated the preparation of comprehensive budget reports and expenditure plans, contributing to strategic planning.

- •Managed departmental procurement processes, optimizing resource allocation and reducing unnecessary expenditures by 7%.

- •Advised faculty on financial policies and procedures, ensuring adherence to institutional standards.

Finance Analyst resume sample

- •Reconciled credit card statements and supporting documents, reducing discrepancies by 25% within the first year.

- •Reviewed vendor contracts and purchase orders, ensuring compliance with company procurement policies and obtaining necessary signatures.

- •Evaluated subgrant packages and financial reports, providing detailed analyses that improved financial transparency by 30%.

- •Monitored subgrant budgets and processed timely payments, achieving a 95% on-time payment rate.

- •Established and maintained new projects in financial systems, enhancing budget tracking accuracy by 20%.

- •Assisted in the project closeout process, preparing documentation for annual audits that resulted in zero discrepancies.

- •Monitored outstanding receivables and communicated effectively with Sr. Budget and Contracts Manager, reducing outstanding amounts by 15% within six months.

- •Conducted comprehensive reviews of consultant contracts and provided early notifications of due financial and technical reports.

- •Supported audit preparations and reconciliations that streamlined financial tracking and reporting processes.

- •Ensured proper documentation and filing of all relevant financial items, improving accessibility and organization by 40%.

- •Implemented new financial tracking systems that enhanced project financial reporting accuracy by 25%.

- •Managed grant funding from multiple sources, including USG and foundations, ensuring compliance with 2 CFR 200 guidelines.

- •Processed and tracked grant payments, achieving a 98% accuracy rate in financial disbursement.

- •Reviewed financial reports of subgrant recipients, enhancing financial oversight and accountability.

- •Facilitated smooth communication between finance and program staff, ensuring seamless information flow.

- •Supported budget preparation and financial analysis for various projects, contributing to a 10% cost reduction.

- •Assisted in reconciling accounts and preparing financial reports, enhancing accountability and transparency.

- •Monitored project budgets and expenditures, ensuring compliance with financial policies and guidelines.

- •Prepared documentation for annual audits, resulting in a 100% compliance rate.

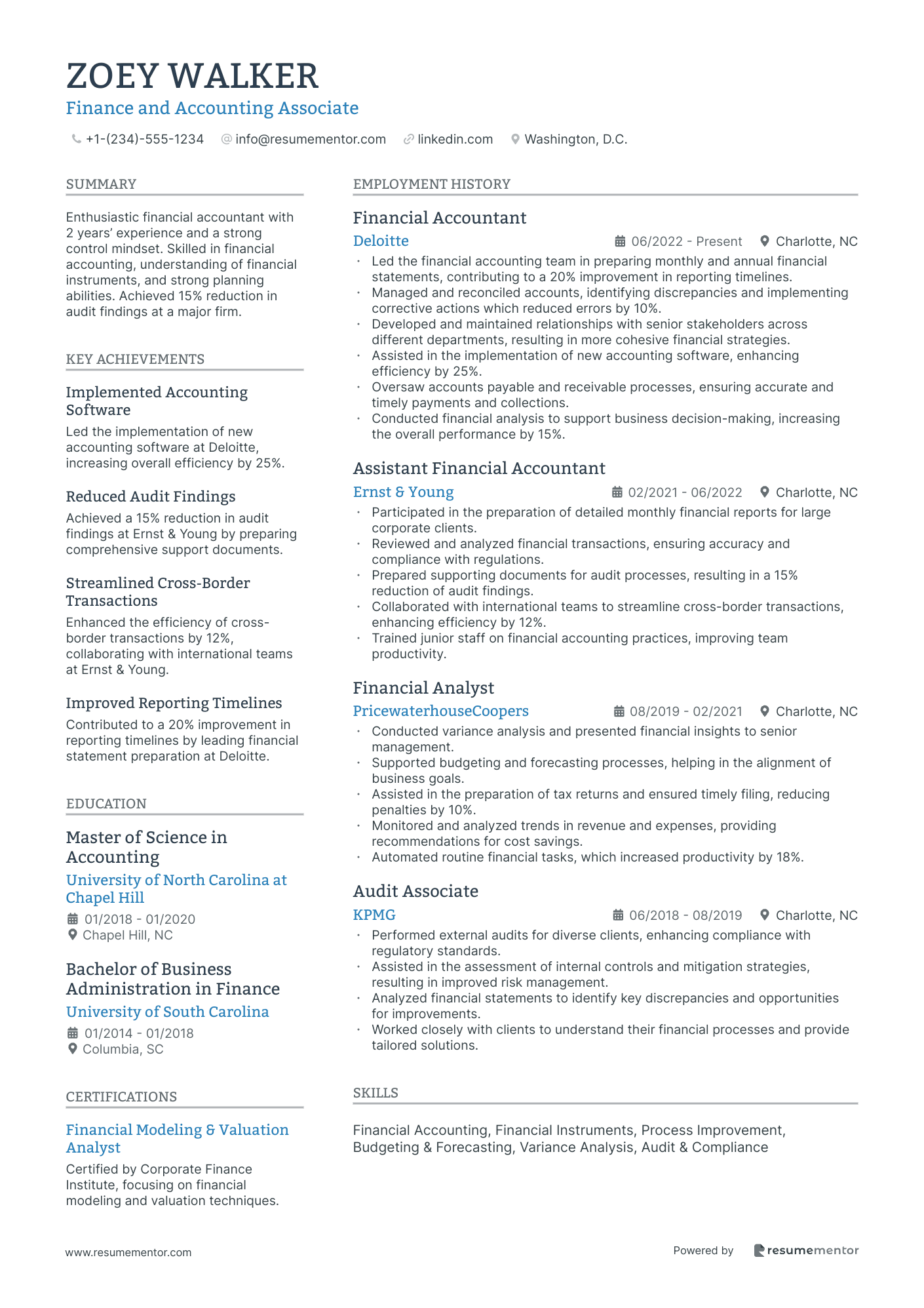

Finance and Accounting Associate resume sample

- •Led the financial accounting team in preparing monthly and annual financial statements, contributing to a 20% improvement in reporting timelines.

- •Managed and reconciled accounts, identifying discrepancies and implementing corrective actions which reduced errors by 10%.

- •Developed and maintained relationships with senior stakeholders across different departments, resulting in more cohesive financial strategies.

- •Assisted in the implementation of new accounting software, enhancing efficiency by 25%.

- •Oversaw accounts payable and receivable processes, ensuring accurate and timely payments and collections.

- •Conducted financial analysis to support business decision-making, increasing the overall performance by 15%.

- •Participated in the preparation of detailed monthly financial reports for large corporate clients.

- •Reviewed and analyzed financial transactions, ensuring accuracy and compliance with regulations.

- •Prepared supporting documents for audit processes, resulting in a 15% reduction of audit findings.

- •Collaborated with international teams to streamline cross-border transactions, enhancing efficiency by 12%.

- •Trained junior staff on financial accounting practices, improving team productivity.

- •Conducted variance analysis and presented financial insights to senior management.

- •Supported budgeting and forecasting processes, helping in the alignment of business goals.

- •Assisted in the preparation of tax returns and ensured timely filing, reducing penalties by 10%.

- •Monitored and analyzed trends in revenue and expenses, providing recommendations for cost savings.

- •Automated routine financial tasks, which increased productivity by 18%.

- •Performed external audits for diverse clients, enhancing compliance with regulatory standards.

- •Assisted in the assessment of internal controls and mitigation strategies, resulting in improved risk management.

- •Analyzed financial statements to identify key discrepancies and opportunities for improvements.

- •Worked closely with clients to understand their financial processes and provide tailored solutions.

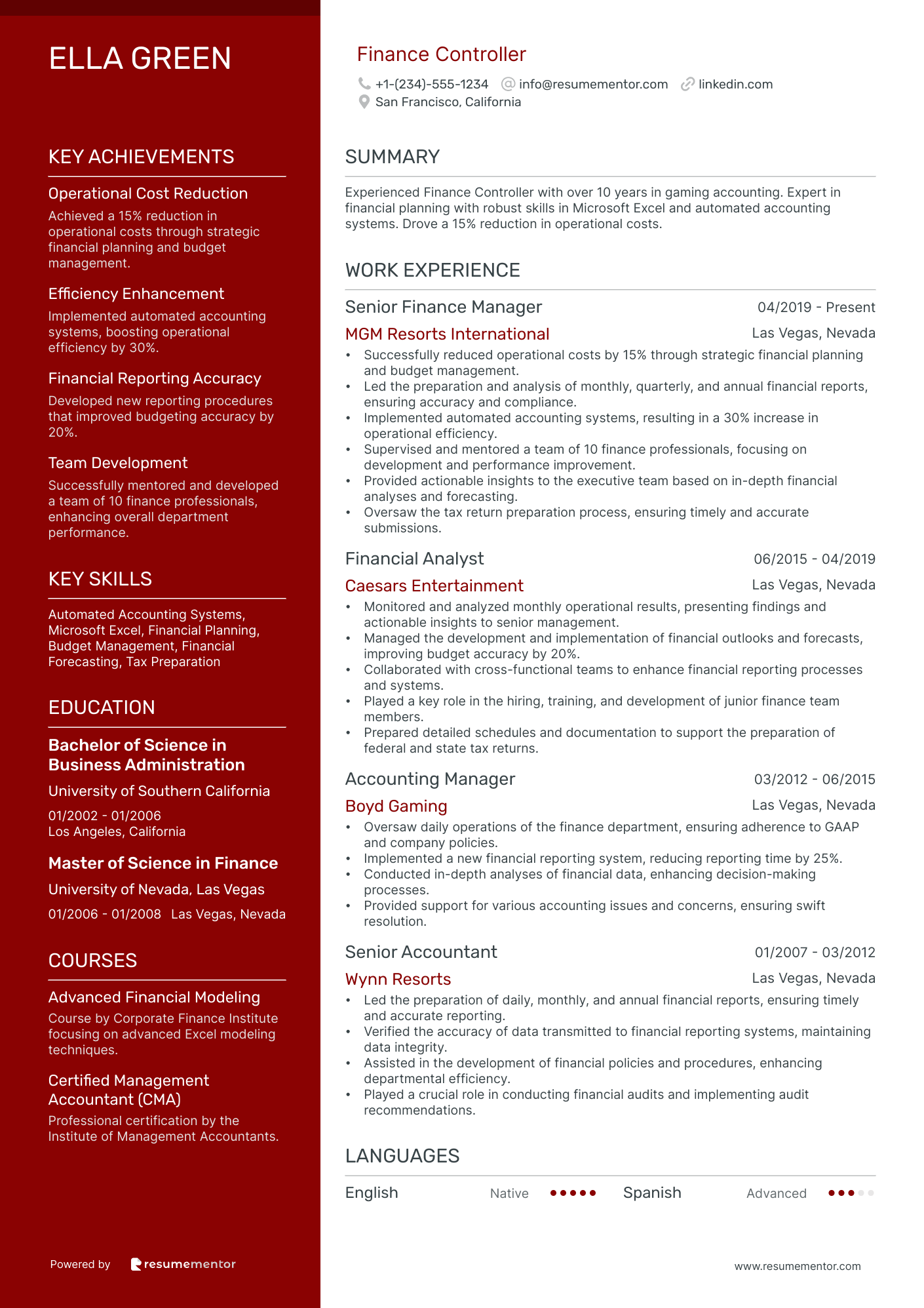

Finance Controller resume sample

- •Successfully reduced operational costs by 15% through strategic financial planning and budget management.

- •Led the preparation and analysis of monthly, quarterly, and annual financial reports, ensuring accuracy and compliance.

- •Implemented automated accounting systems, resulting in a 30% increase in operational efficiency.

- •Supervised and mentored a team of 10 finance professionals, focusing on development and performance improvement.

- •Provided actionable insights to the executive team based on in-depth financial analyses and forecasting.

- •Oversaw the tax return preparation process, ensuring timely and accurate submissions.

- •Monitored and analyzed monthly operational results, presenting findings and actionable insights to senior management.

- •Managed the development and implementation of financial outlooks and forecasts, improving budget accuracy by 20%.

- •Collaborated with cross-functional teams to enhance financial reporting processes and systems.

- •Played a key role in the hiring, training, and development of junior finance team members.

- •Prepared detailed schedules and documentation to support the preparation of federal and state tax returns.

- •Oversaw daily operations of the finance department, ensuring adherence to GAAP and company policies.

- •Implemented a new financial reporting system, reducing reporting time by 25%.

- •Conducted in-depth analyses of financial data, enhancing decision-making processes.

- •Provided support for various accounting issues and concerns, ensuring swift resolution.

- •Led the preparation of daily, monthly, and annual financial reports, ensuring timely and accurate reporting.

- •Verified the accuracy of data transmitted to financial reporting systems, maintaining data integrity.

- •Assisted in the development of financial policies and procedures, enhancing departmental efficiency.

- •Played a crucial role in conducting financial audits and implementing audit recommendations.

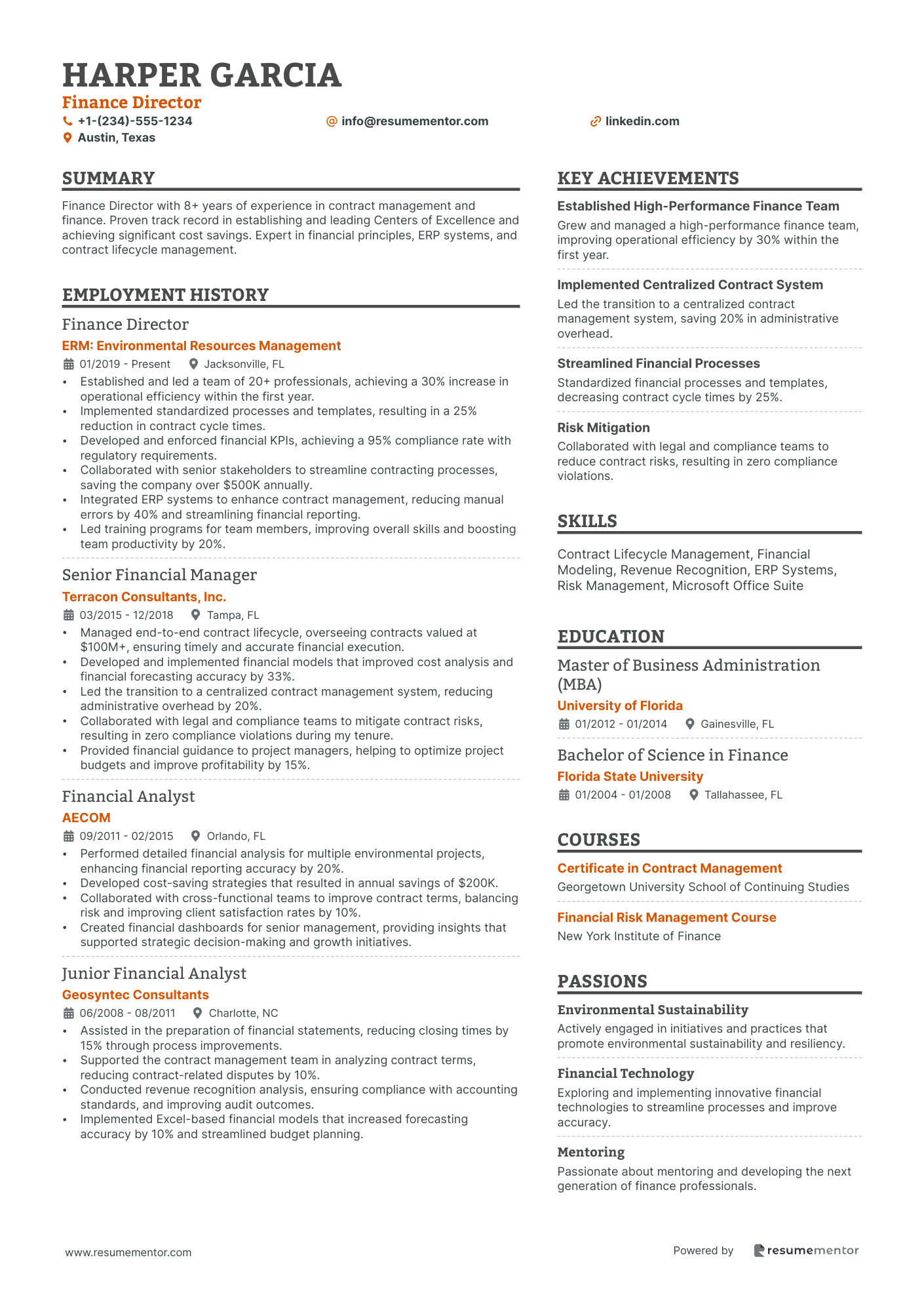

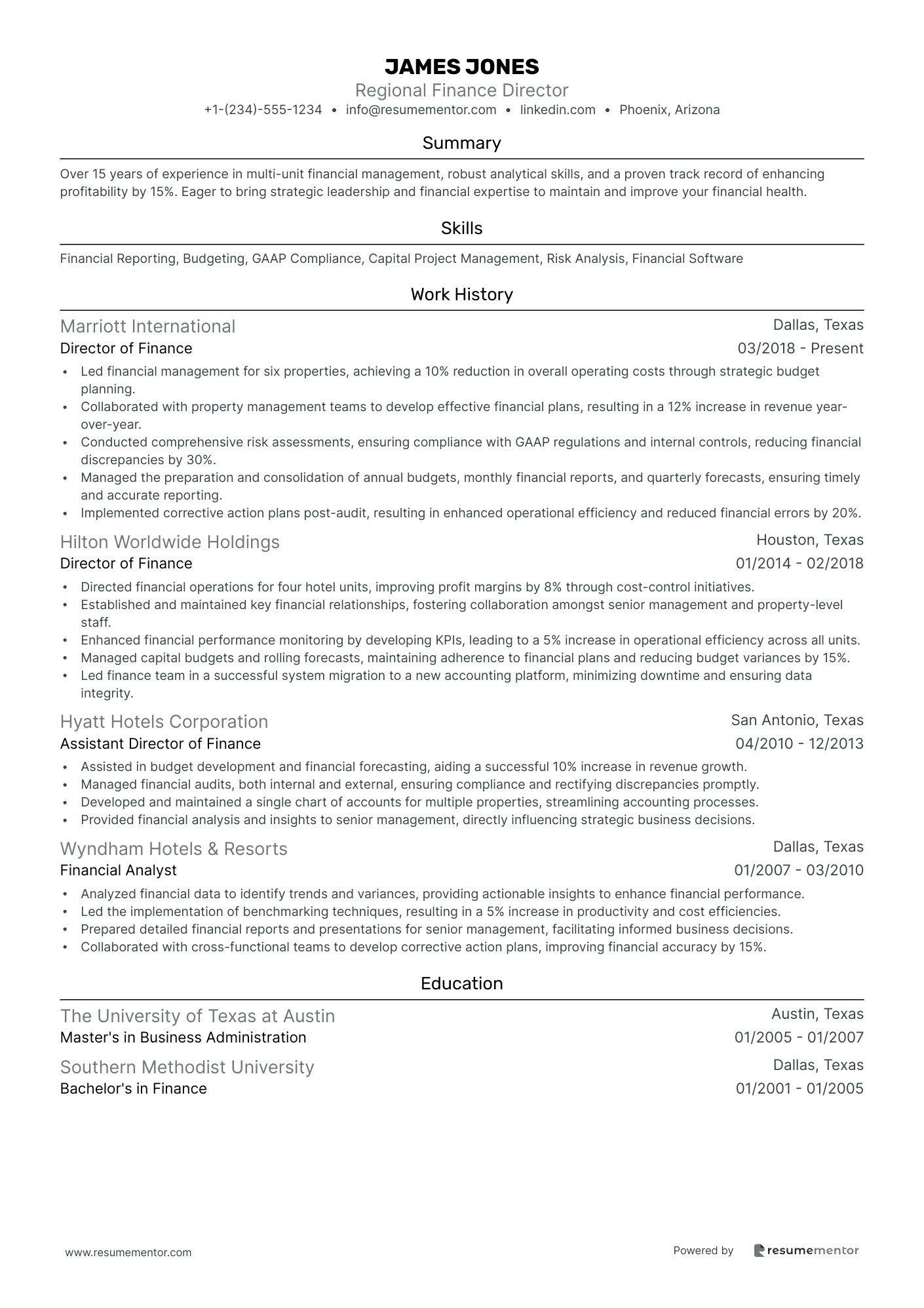

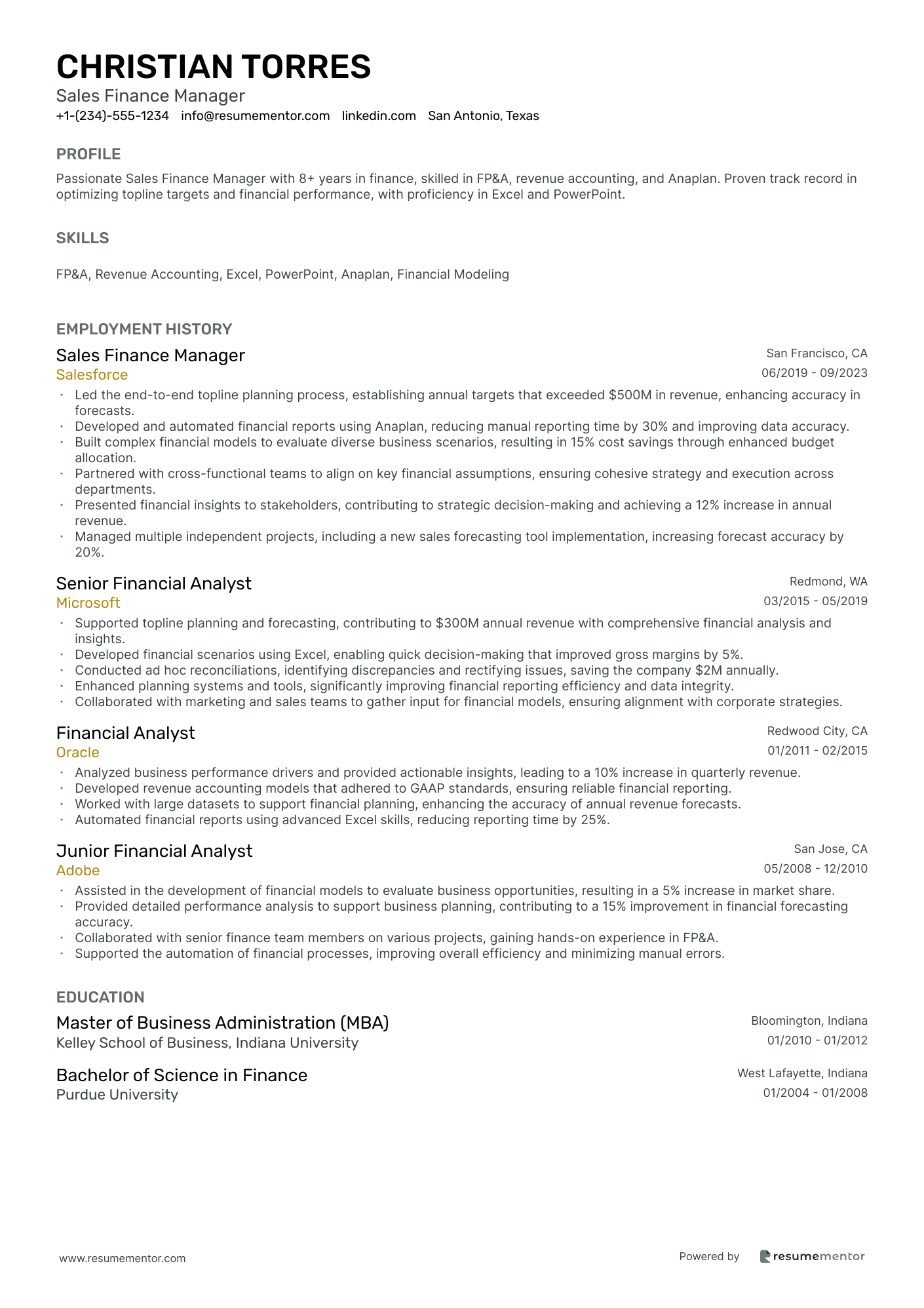

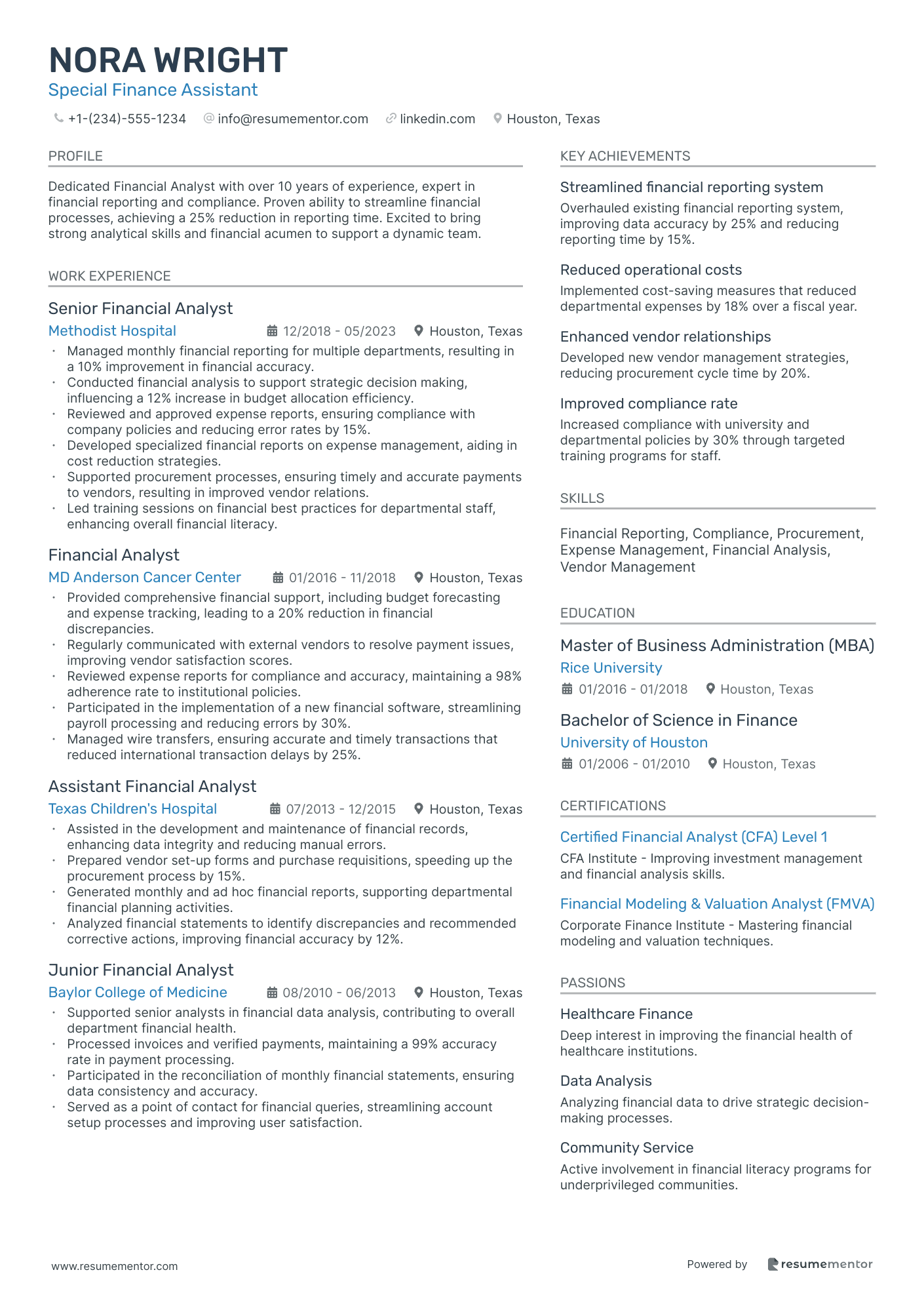

Finance Director resume sample

- •Established and led a team of 20+ professionals, achieving a 30% increase in operational efficiency within the first year.

- •Implemented standardized processes and templates, resulting in a 25% reduction in contract cycle times.

- •Developed and enforced financial KPIs, achieving a 95% compliance rate with regulatory requirements.

- •Collaborated with senior stakeholders to streamline contracting processes, saving the company over $500K annually.

- •Integrated ERP systems to enhance contract management, reducing manual errors by 40% and streamlining financial reporting.

- •Led training programs for team members, improving overall skills and boosting team productivity by 20%.

- •Managed end-to-end contract lifecycle, overseeing contracts valued at $100M+, ensuring timely and accurate financial execution.

- •Developed and implemented financial models that improved cost analysis and financial forecasting accuracy by 33%.

- •Led the transition to a centralized contract management system, reducing administrative overhead by 20%.

- •Collaborated with legal and compliance teams to mitigate contract risks, resulting in zero compliance violations during my tenure.

- •Provided financial guidance to project managers, helping to optimize project budgets and improve profitability by 15%.

- •Performed detailed financial analysis for multiple environmental projects, enhancing financial reporting accuracy by 20%.

- •Developed cost-saving strategies that resulted in annual savings of $200K.

- •Collaborated with cross-functional teams to improve contract terms, balancing risk and improving client satisfaction rates by 10%.

- •Created financial dashboards for senior management, providing insights that supported strategic decision-making and growth initiatives.

- •Assisted in the preparation of financial statements, reducing closing times by 15% through process improvements.

- •Supported the contract management team in analyzing contract terms, reducing contract-related disputes by 10%.

- •Conducted revenue recognition analysis, ensuring compliance with accounting standards, and improving audit outcomes.

- •Implemented Excel-based financial models that increased forecasting accuracy by 10% and streamlined budget planning.

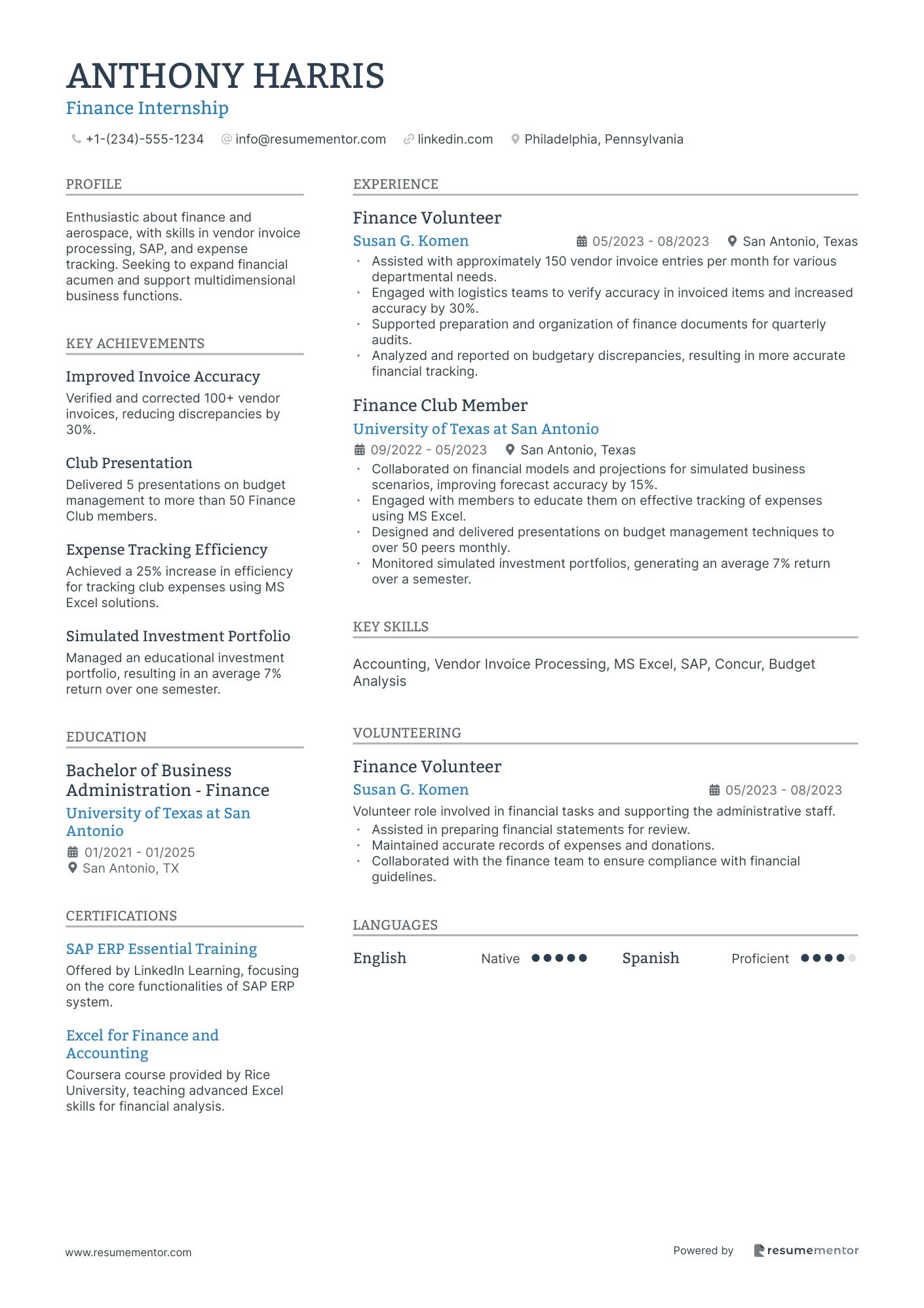

Finance Internship resume sample

- •Assisted with approximately 150 vendor invoice entries per month for various departmental needs.

- •Engaged with logistics teams to verify accuracy in invoiced items and increased accuracy by 30%.

- •Supported preparation and organization of finance documents for quarterly audits.

- •Analyzed and reported on budgetary discrepancies, resulting in more accurate financial tracking.

- •Collaborated on financial models and projections for simulated business scenarios, improving forecast accuracy by 15%.

- •Engaged with members to educate them on effective tracking of expenses using MS Excel.

- •Designed and delivered presentations on budget management techniques to over 50 peers monthly.

- •Monitored simulated investment portfolios, generating an average 7% return over a semester.

- •Assisted in preparing financial statements for review.

- •Maintained accurate records of expenses and donations.

- •Collaborated with the finance team to ensure compliance with financial guidelines.

Finance Manager resume sample

- •Map { "bullet": "Led a team of 10 financial analysts, successfully implementing cost-saving measures that reduced expenses by $1.5M annually." }

- •Map { "bullet": "Oversaw the financial planning and analysis for a $200M business unit, resulting in a 20% increase in profitability." }

- •Map { "bullet": "Designed and implemented new financial models that improved forecasting accuracy by 25%." }

- •Map { "bullet": "Managed financial reporting and compliance for international market operations, ensuring adherence to local and global regulations." }

- •Map { "bullet": "Collaborated with cross-functional teams to align financial strategies with company objectives, boosting operational efficiency." }

- •Map { "bullet": "Conducted detailed financial analysis for potential investment opportunities, highlighting key risks and benefits." }

- •Map { "bullet": "Implemented financial controls that reduced operational costs by 12%, equating to $3M in annual savings." }

- •Map { "bullet": "Led budgeting and forecasting activities for a $500M revenue division, achieving a 98% accuracy in the budget adherence." }

- •Map { "bullet": "Developed comprehensive financial reports, providing key insights that informed strategic business decisions." }

- •Map { "bullet": "Played a pivotal role in financial audits, ensuring compliance and eliminating discrepancies, resulting in zero audit findings." }

- •Map { "bullet": "Managed capital expenditure projects worth over $20M, ensuring proper allocation of resources and project completion on time." }

- •Map { "bullet": "Performed detailed financial analysis and reporting, leading to the identification of cost-saving opportunities worth $500K annually." }

- •Map { "bullet": "Supported senior management in decision-making by providing accurate financial data and insights." }

- •Map { "bullet": "Improved financial forecast models, increasing forecast accuracy from 85% to 95%." }

- •Map { "bullet": "Collaborated with department heads to develop annual budgets, ensuring alignment with organizational goals and constraints." }

- •Map { "bullet": "Maintained accurate financial records and performed reconciliations, ensuring compliance with accounting standards." }

- •Map { "bullet": "Assisted in the preparation of monthly financial statements, contributing to timely and accurate reporting." }

- •Map { "bullet": "Conducted variance analysis and provided explanations for budget deviations, aiding in corrective actions." }

- •Map { "bullet": "Supported the implementation of a new ERP system, improving processing efficiency by 30%." }

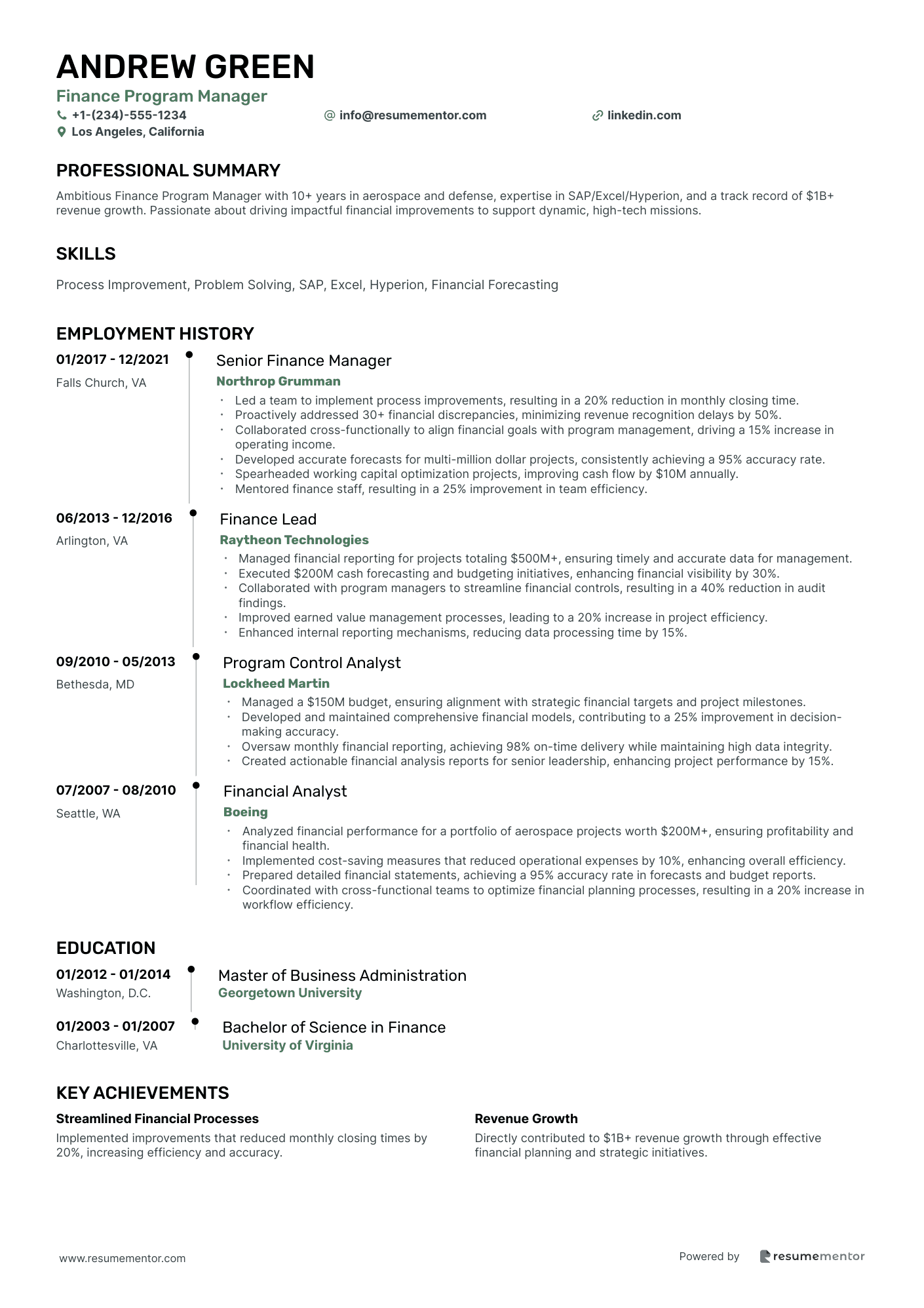

Finance Program Manager resume sample

- •Led a team to implement process improvements, resulting in a 20% reduction in monthly closing time.

- •Proactively addressed 30+ financial discrepancies, minimizing revenue recognition delays by 50%.

- •Collaborated cross-functionally to align financial goals with program management, driving a 15% increase in operating income.

- •Developed accurate forecasts for multi-million dollar projects, consistently achieving a 95% accuracy rate.

- •Spearheaded working capital optimization projects, improving cash flow by $10M annually.

- •Mentored finance staff, resulting in a 25% improvement in team efficiency.

- •Managed financial reporting for projects totaling $500M+, ensuring timely and accurate data for management.

- •Executed $200M cash forecasting and budgeting initiatives, enhancing financial visibility by 30%.

- •Collaborated with program managers to streamline financial controls, resulting in a 40% reduction in audit findings.

- •Improved earned value management processes, leading to a 20% increase in project efficiency.

- •Enhanced internal reporting mechanisms, reducing data processing time by 15%.

- •Managed a $150M budget, ensuring alignment with strategic financial targets and project milestones.

- •Developed and maintained comprehensive financial models, contributing to a 25% improvement in decision-making accuracy.

- •Oversaw monthly financial reporting, achieving 98% on-time delivery while maintaining high data integrity.

- •Created actionable financial analysis reports for senior leadership, enhancing project performance by 15%.

- •Analyzed financial performance for a portfolio of aerospace projects worth $200M+, ensuring profitability and financial health.

- •Implemented cost-saving measures that reduced operational expenses by 10%, enhancing overall efficiency.

- •Prepared detailed financial statements, achieving a 95% accuracy rate in forecasts and budget reports.

- •Coordinated with cross-functional teams to optimize financial planning processes, resulting in a 20% increase in workflow efficiency.

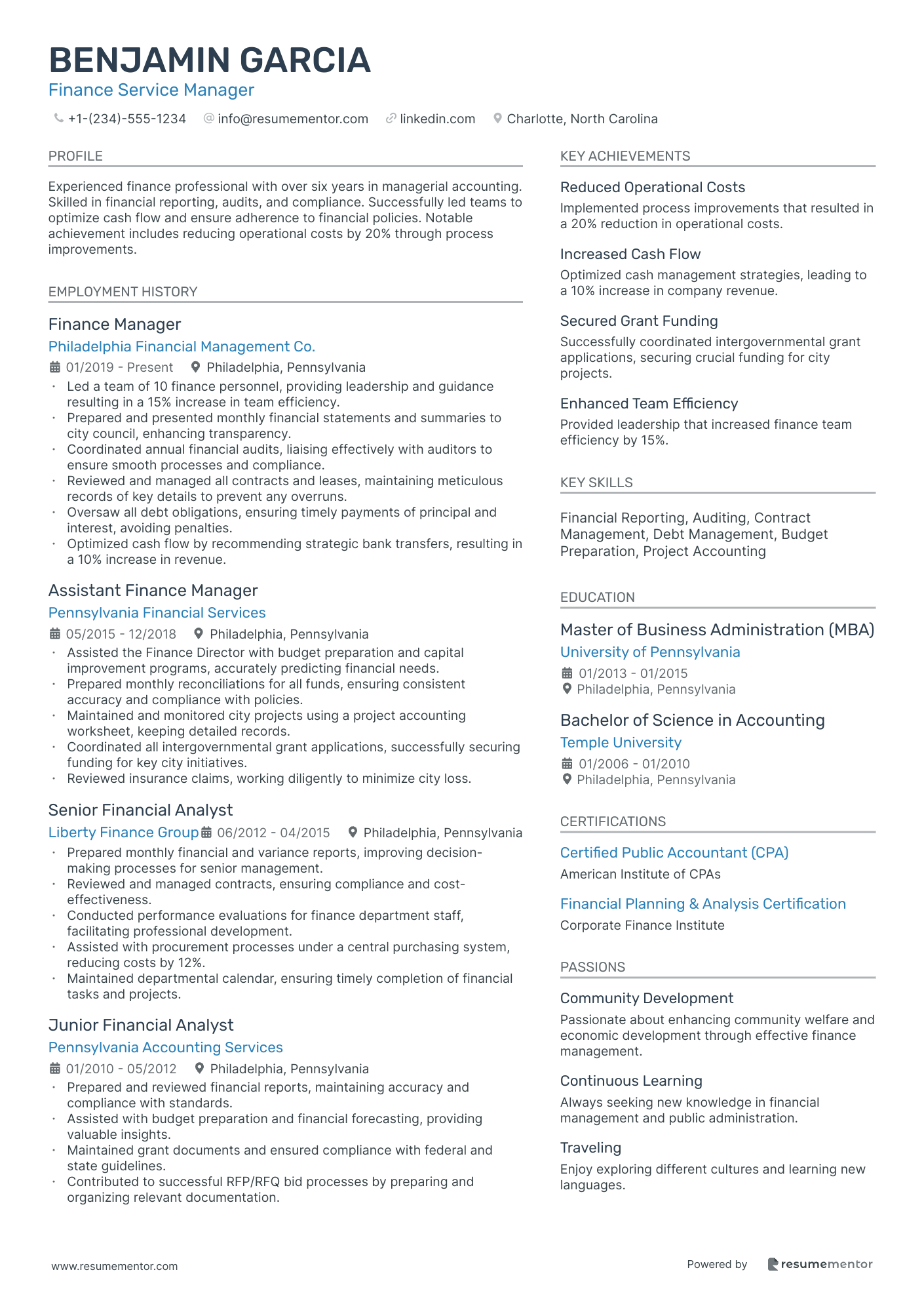

Finance Service Manager resume sample

- •Led a team of 10 finance personnel, providing leadership and guidance resulting in a 15% increase in team efficiency.

- •Prepared and presented monthly financial statements and summaries to city council, enhancing transparency.

- •Coordinated annual financial audits, liaising effectively with auditors to ensure smooth processes and compliance.

- •Reviewed and managed all contracts and leases, maintaining meticulous records of key details to prevent any overruns.

- •Oversaw all debt obligations, ensuring timely payments of principal and interest, avoiding penalties.

- •Optimized cash flow by recommending strategic bank transfers, resulting in a 10% increase in revenue.

- •Assisted the Finance Director with budget preparation and capital improvement programs, accurately predicting financial needs.

- •Prepared monthly reconciliations for all funds, ensuring consistent accuracy and compliance with policies.

- •Maintained and monitored city projects using a project accounting worksheet, keeping detailed records.

- •Coordinated all intergovernmental grant applications, successfully securing funding for key city initiatives.

- •Reviewed insurance claims, working diligently to minimize city loss.

- •Prepared monthly financial and variance reports, improving decision-making processes for senior management.

- •Reviewed and managed contracts, ensuring compliance and cost-effectiveness.

- •Conducted performance evaluations for finance department staff, facilitating professional development.

- •Assisted with procurement processes under a central purchasing system, reducing costs by 12%.

- •Maintained departmental calendar, ensuring timely completion of financial tasks and projects.

- •Prepared and reviewed financial reports, maintaining accuracy and compliance with standards.

- •Assisted with budget preparation and financial forecasting, providing valuable insights.

- •Maintained grant documents and ensured compliance with federal and state guidelines.

- •Contributed to successful RFP/RFQ bid processes by preparing and organizing relevant documentation.

Finance Specialist resume sample

- •Led the integration of a large finance system, resulting in a 20% reduction in processing times and improved efficiency.

- •Developed and managed budgeting plans, which contributed to a 10% cost reduction across departments.

- •Supervised accounts receivable and accounts payable teams, ensuring compliance with financial regulations and internal policies.

- •Conducted training sessions on new finance software, enhancing team productivity by 15%.

- •Handled complex procurement and contract transactions worth over $5M annually.

- •Maintained strong professional relationships with internal departments and external vendors, fostering collaboration.

- •Executed detailed financial analysis for multi-million dollar projects, supporting strategic decision-making.

- •Streamlined financial reporting processes, reducing errors by 30% and saving 5 hours per week.

- •Implemented SAP for financial management, resulting in smoother integration with existing systems.

- •Acted as a key contact for finance-related queries, providing excellent customer service to internal stakeholders.

- •Coached and mentored junior analysts, enhancing the team's overall performance and career development.

- •Managed the full cycle of accounts payable and receivable, ensuring timely and accurate financial transactions.

- •Forecasted budgets and collaborated with department heads to align spending with financial goals.

- •Conducted risk assessments and audits to ensure compliance with federal and state regulations.

- •Utilized advanced finance software to automate recurring tasks, increasing efficiency by 25%.

- •Coordinated monthly financial closings and prepared comprehensive financial statements.

- •Assisted in the development and implementation of a new asset management system, improving tracking accuracy by 20%.

- •Provided thorough financial support during internal audits, ensuring compliance with company policies and standards.

- •Collaborated with multiple units to streamline procurement processes, reducing overall costs by 10% annually.

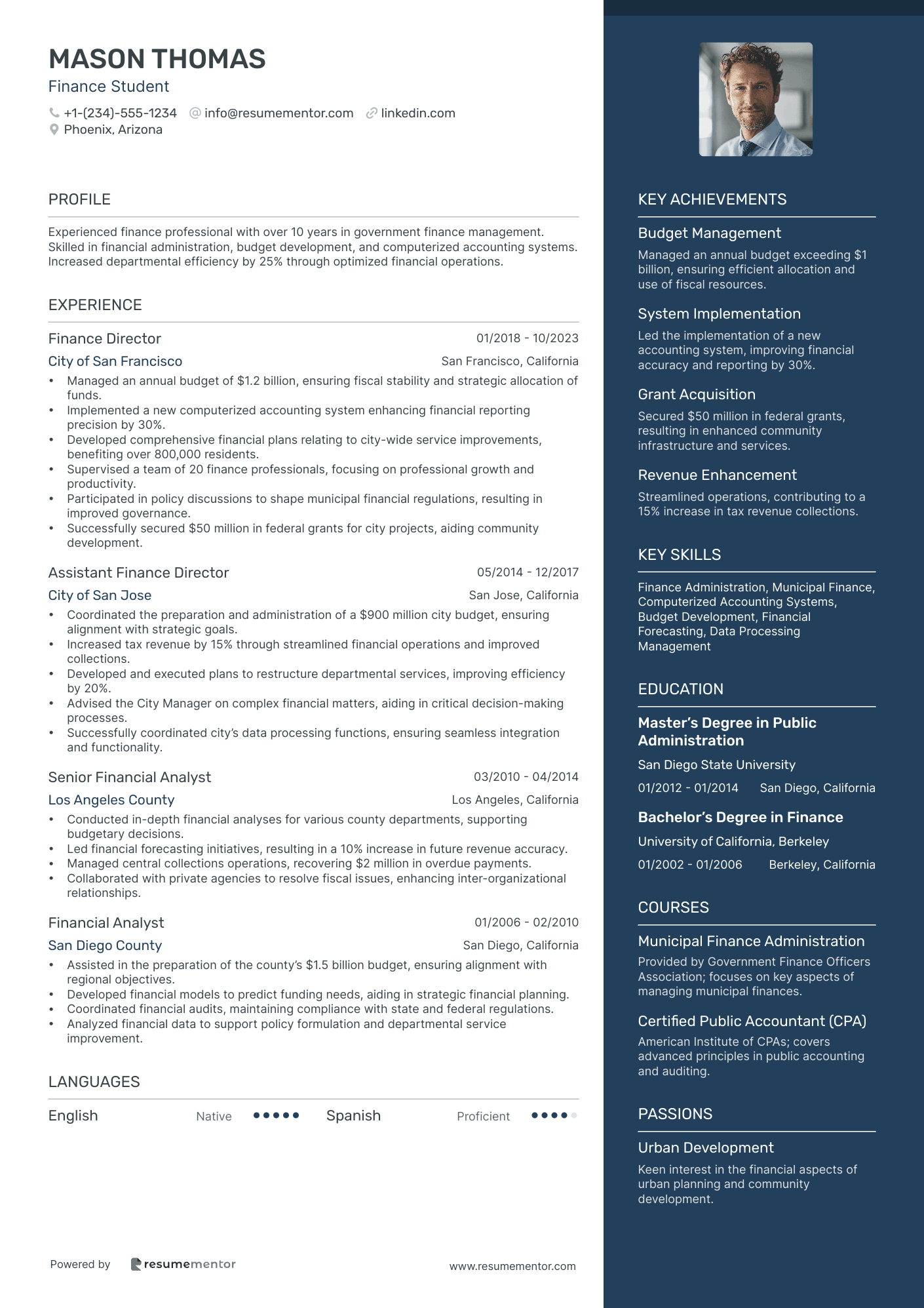

Finance Student resume sample

- •Managed an annual budget of $1.2 billion, ensuring fiscal stability and strategic allocation of funds.

- •Implemented a new computerized accounting system enhancing financial reporting precision by 30%.

- •Developed comprehensive financial plans relating to city-wide service improvements, benefiting over 800,000 residents.

- •Supervised a team of 20 finance professionals, focusing on professional growth and productivity.

- •Participated in policy discussions to shape municipal financial regulations, resulting in improved governance.

- •Successfully secured $50 million in federal grants for city projects, aiding community development.

- •Coordinated the preparation and administration of a $900 million city budget, ensuring alignment with strategic goals.

- •Increased tax revenue by 15% through streamlined financial operations and improved collections.

- •Developed and executed plans to restructure departmental services, improving efficiency by 20%.

- •Advised the City Manager on complex financial matters, aiding in critical decision-making processes.

- •Successfully coordinated city’s data processing functions, ensuring seamless integration and functionality.

- •Conducted in-depth financial analyses for various county departments, supporting budgetary decisions.

- •Led financial forecasting initiatives, resulting in a 10% increase in future revenue accuracy.

- •Managed central collections operations, recovering $2 million in overdue payments.

- •Collaborated with private agencies to resolve fiscal issues, enhancing inter-organizational relationships.

- •Assisted in the preparation of the county’s $1.5 billion budget, ensuring alignment with regional objectives.

- •Developed financial models to predict funding needs, aiding in strategic financial planning.

- •Coordinated financial audits, maintaining compliance with state and federal regulations.

- •Analyzed financial data to support policy formulation and departmental service improvement.

Financial Consultant resume sample

- •Led the successful implementation of high-visibility projects, resulting in a 15% improvement in operational efficiency across multiple service lines.

- •Developed and managed annual budgets totaling $12 million, exceeding financial performance targets by 10%.

- •Facilitated effective communication with executive leadership to align strategic financial initiatives with organizational goals.

- •Mentored junior team members, enhancing their competency by providing targeted training and skill development.

- •Partnered with clinical operations leadership to execute service line-level strategies, enhancing overall financial outcomes.

- •Presented financial reports and performance metrics to all levels of leadership, contributing to informed decision-making processes.

- •Oversaw the financial planning and execution of institutional projects, successfully managing a capital budget of $20 million.

- •Collaborated with medical center leadership to develop strategies for a 12% reduction in operating expenses.

- •Delivered professional presentations to governance bodies, facilitating transparent and strategic financial discussions.

- •Adapted to organizational changes and led continuous improvement initiatives, enhancing overall team performance.

- •Assisted in the development of capital and operating expense budgets, ensuring alignment with institutional goals.

- •Analyzed financial data to support decision-making processes, leading to a 10% increase in budget accuracy.

- •Created detailed financial models for various projects, which improved forecasting accuracy by 15%.

- •Engaged with internal partners across departments to streamline financial operations and reporting.

- •Supported the skills development of junior analysts, enabling a more efficient and knowledgeable team.

- •Coordinated multiple high-visibility projects simultaneously, achieving on-time delivery and improved project outcomes.

- •Assisted in the development and execution of financial strategies, contributing to a 9% improvement in service line profitability.

- •Set and managed stakeholder expectations through clear and effective communication.

- •Cultivated internal partnerships, enhancing collaboration and information sharing across various levels of the organization.

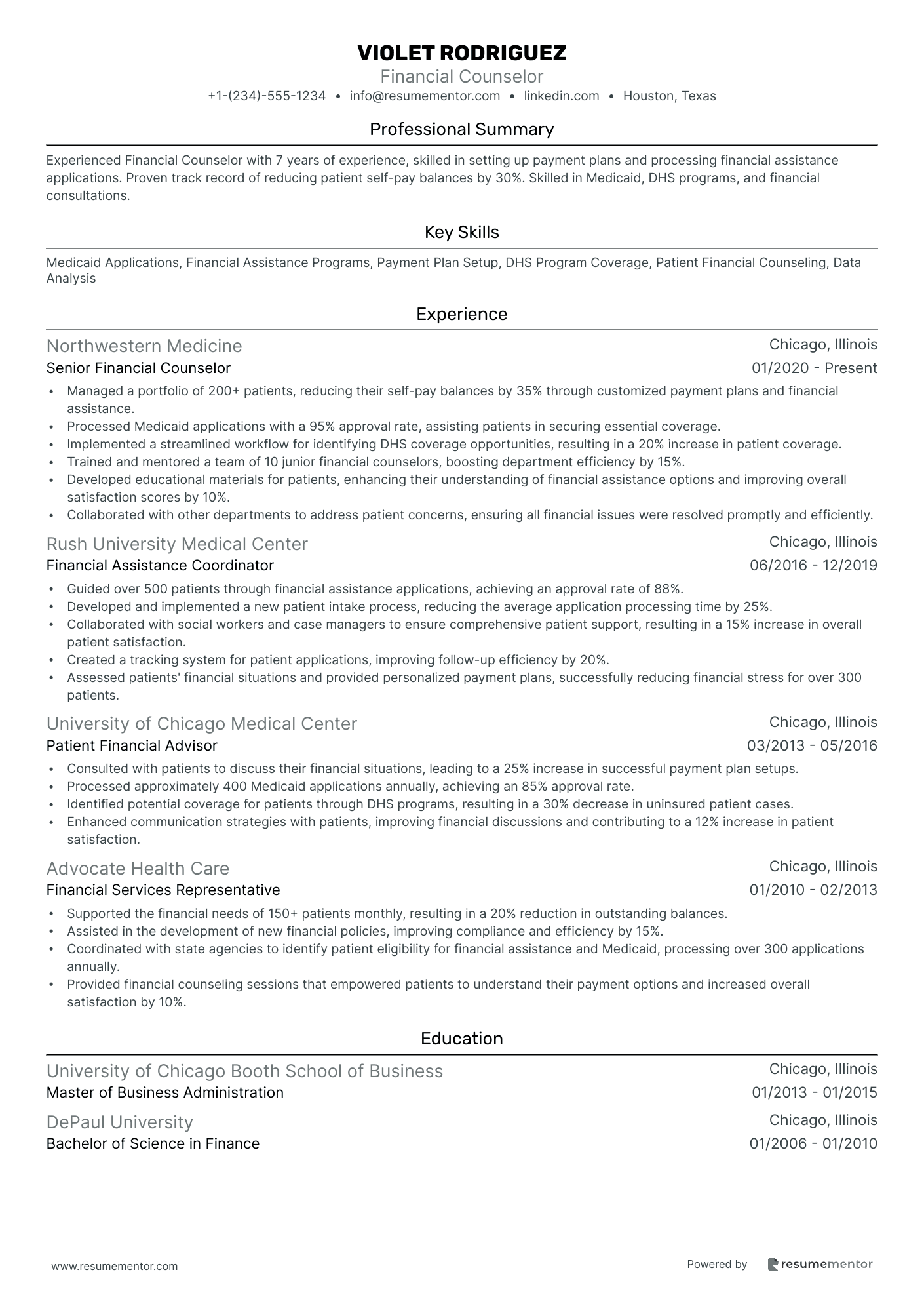

Financial Counselor resume sample

- •Managed a portfolio of 200+ patients, reducing their self-pay balances by 35% through customized payment plans and financial assistance.

- •Processed Medicaid applications with a 95% approval rate, assisting patients in securing essential coverage.

- •Implemented a streamlined workflow for identifying DHS coverage opportunities, resulting in a 20% increase in patient coverage.

- •Trained and mentored a team of 10 junior financial counselors, boosting department efficiency by 15%.

- •Developed educational materials for patients, enhancing their understanding of financial assistance options and improving overall satisfaction scores by 10%.

- •Collaborated with other departments to address patient concerns, ensuring all financial issues were resolved promptly and efficiently.

- •Guided over 500 patients through financial assistance applications, achieving an approval rate of 88%.

- •Developed and implemented a new patient intake process, reducing the average application processing time by 25%.

- •Collaborated with social workers and case managers to ensure comprehensive patient support, resulting in a 15% increase in overall patient satisfaction.

- •Created a tracking system for patient applications, improving follow-up efficiency by 20%.

- •Assessed patients' financial situations and provided personalized payment plans, successfully reducing financial stress for over 300 patients.

- •Consulted with patients to discuss their financial situations, leading to a 25% increase in successful payment plan setups.

- •Processed approximately 400 Medicaid applications annually, achieving an 85% approval rate.

- •Identified potential coverage for patients through DHS programs, resulting in a 30% decrease in uninsured patient cases.

- •Enhanced communication strategies with patients, improving financial discussions and contributing to a 12% increase in patient satisfaction.

- •Supported the financial needs of 150+ patients monthly, resulting in a 20% reduction in outstanding balances.

- •Assisted in the development of new financial policies, improving compliance and efficiency by 15%.

- •Coordinated with state agencies to identify patient eligibility for financial assistance and Medicaid, processing over 300 applications annually.

- •Provided financial counseling sessions that empowered patients to understand their payment options and increased overall satisfaction by 10%.

Financial Management Analyst resume sample

- •Led a team of 5 analysts to perform detailed account reconciliations, improving accuracy by 20% and reducing errors.

- •Implemented a new financial analysis software that streamlined reporting processes, decreasing the time taken by 30%.

- •Managed the financial requirements for debt programs, ensuring compliance with internal and external audits.

- •Collaborated with cross-functional teams to enhance financial transparency, resulting in a 15% reduction in operational costs.

- •Developed comprehensive auditing schedules, which were used as best practices company-wide.

- •Presented financial findings to senior management, influencing strategic business decisions.

- •Conducted monthly account reconciliations for over 100+ accounts, increasing accuracy by 25%.

- •Assisted in the preparation of auditing schedules, enhancing audit readiness and compliance.

- •Worked collaboratively with departments to ensure all financial requirements for various projects were met.

- •Analyzed financial statements, identifying key trends that led to cost-saving strategies.

- •Trained new hires on financial reconciliation processes, improving team performance.

- •Prepared monthly financial reports and analyzed variances, leading to a 10% improvement in budget accuracy.

- •Assisted in the development and implementation of internal controls, ensuring robust financial monitoring.

- •Reconciled intercompany accounts, resulting in streamlined financial processes.

- •Coordinated with external auditors to facilitate smooth auditing processes.

- •Supported senior accountants in day-to-day operations, ensuring timely completion of financial tasks.

- •Conducted detailed variance analysis on financial data, contributing to better financial decision-making.

- •Maintained accurate records of financial transactions, reducing discrepancies significantly.

- •Engaged in continuous improvement initiatives, optimizing financial processes.

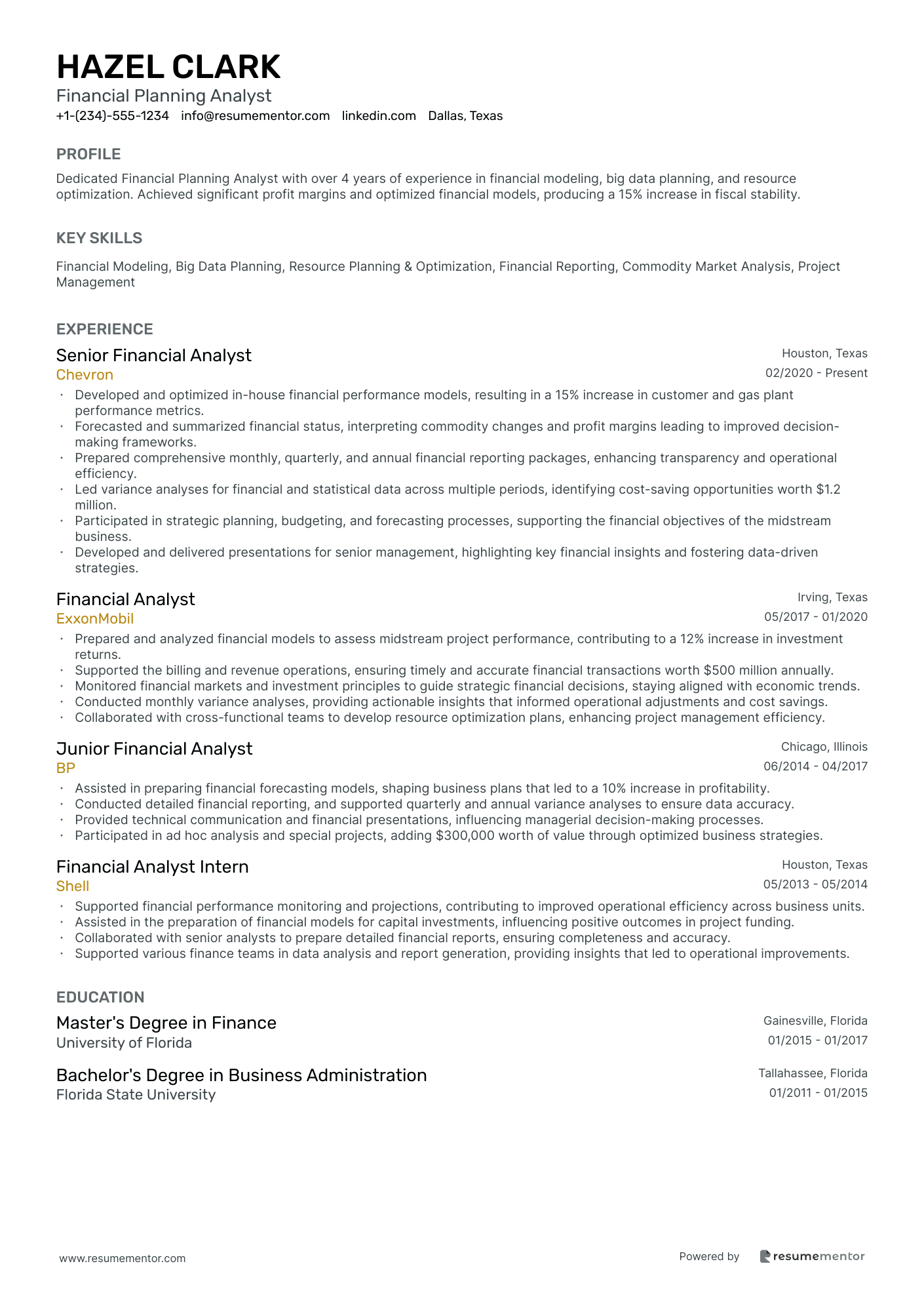

Financial Planning Analyst resume sample

- •Developed and optimized in-house financial performance models, resulting in a 15% increase in customer and gas plant performance metrics.

- •Forecasted and summarized financial status, interpreting commodity changes and profit margins leading to improved decision-making frameworks.

- •Prepared comprehensive monthly, quarterly, and annual financial reporting packages, enhancing transparency and operational efficiency.

- •Led variance analyses for financial and statistical data across multiple periods, identifying cost-saving opportunities worth $1.2 million.

- •Participated in strategic planning, budgeting, and forecasting processes, supporting the financial objectives of the midstream business.

- •Developed and delivered presentations for senior management, highlighting key financial insights and fostering data-driven strategies.

- •Prepared and analyzed financial models to assess midstream project performance, contributing to a 12% increase in investment returns.

- •Supported the billing and revenue operations, ensuring timely and accurate financial transactions worth $500 million annually.

- •Monitored financial markets and investment principles to guide strategic financial decisions, staying aligned with economic trends.

- •Conducted monthly variance analyses, providing actionable insights that informed operational adjustments and cost savings.

- •Collaborated with cross-functional teams to develop resource optimization plans, enhancing project management efficiency.

- •Assisted in preparing financial forecasting models, shaping business plans that led to a 10% increase in profitability.

- •Conducted detailed financial reporting, and supported quarterly and annual variance analyses to ensure data accuracy.

- •Provided technical communication and financial presentations, influencing managerial decision-making processes.

- •Participated in ad hoc analysis and special projects, adding $300,000 worth of value through optimized business strategies.

- •Supported financial performance monitoring and projections, contributing to improved operational efficiency across business units.

- •Assisted in the preparation of financial models for capital investments, influencing positive outcomes in project funding.

- •Collaborated with senior analysts to prepare detailed financial reports, ensuring completeness and accuracy.

- •Supported various finance teams in data analysis and report generation, providing insights that led to operational improvements.

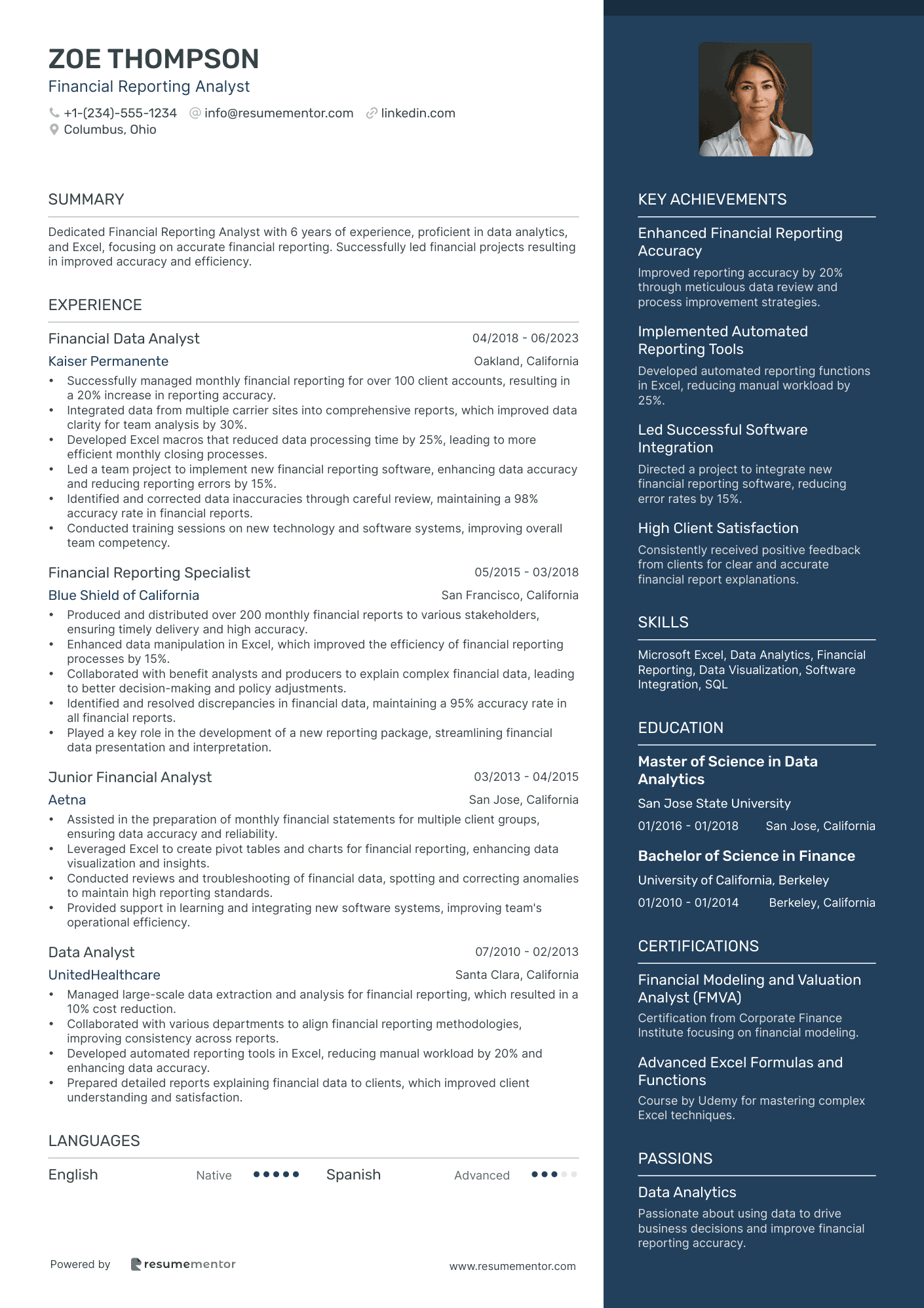

Financial Reporting Analyst resume sample

- •Successfully managed monthly financial reporting for over 100 client accounts, resulting in a 20% increase in reporting accuracy.

- •Integrated data from multiple carrier sites into comprehensive reports, which improved data clarity for team analysis by 30%.

- •Developed Excel macros that reduced data processing time by 25%, leading to more efficient monthly closing processes.

- •Led a team project to implement new financial reporting software, enhancing data accuracy and reducing reporting errors by 15%.

- •Identified and corrected data inaccuracies through careful review, maintaining a 98% accuracy rate in financial reports.

- •Conducted training sessions on new technology and software systems, improving overall team competency.

- •Produced and distributed over 200 monthly financial reports to various stakeholders, ensuring timely delivery and high accuracy.

- •Enhanced data manipulation in Excel, which improved the efficiency of financial reporting processes by 15%.

- •Collaborated with benefit analysts and producers to explain complex financial data, leading to better decision-making and policy adjustments.

- •Identified and resolved discrepancies in financial data, maintaining a 95% accuracy rate in all financial reports.

- •Played a key role in the development of a new reporting package, streamlining financial data presentation and interpretation.

- •Assisted in the preparation of monthly financial statements for multiple client groups, ensuring data accuracy and reliability.

- •Leveraged Excel to create pivot tables and charts for financial reporting, enhancing data visualization and insights.

- •Conducted reviews and troubleshooting of financial data, spotting and correcting anomalies to maintain high reporting standards.

- •Provided support in learning and integrating new software systems, improving team's operational efficiency.

- •Managed large-scale data extraction and analysis for financial reporting, which resulted in a 10% cost reduction.

- •Collaborated with various departments to align financial reporting methodologies, improving consistency across reports.

- •Developed automated reporting tools in Excel, reducing manual workload by 20% and enhancing data accuracy.

- •Prepared detailed reports explaining financial data to clients, which improved client understanding and satisfaction.

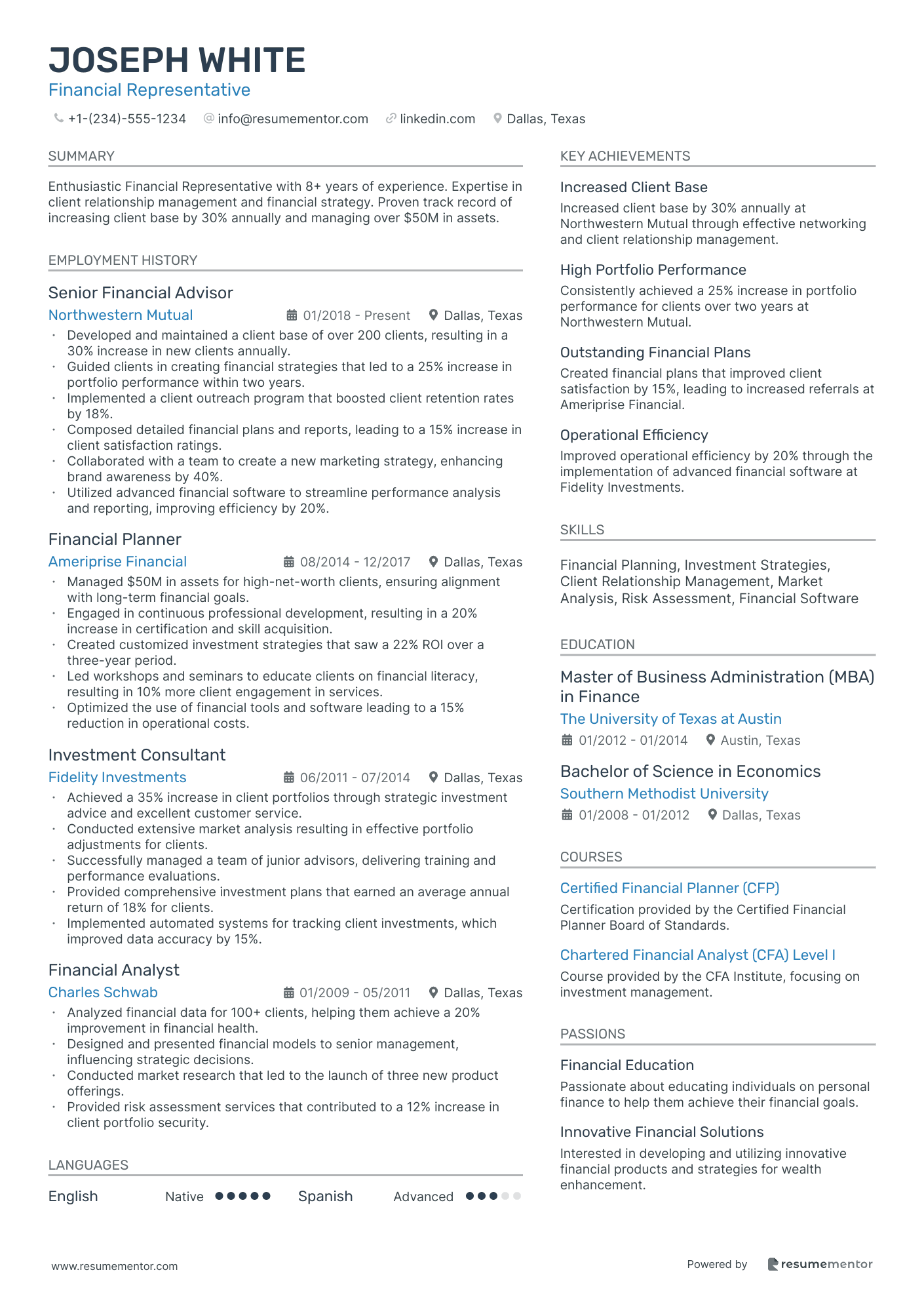

Financial Representative resume sample

- •Developed and maintained a client base of over 200 clients, resulting in a 30% increase in new clients annually.

- •Guided clients in creating financial strategies that led to a 25% increase in portfolio performance within two years.

- •Implemented a client outreach program that boosted client retention rates by 18%.

- •Composed detailed financial plans and reports, leading to a 15% increase in client satisfaction ratings.

- •Collaborated with a team to create a new marketing strategy, enhancing brand awareness by 40%.

- •Utilized advanced financial software to streamline performance analysis and reporting, improving efficiency by 20%.

- •Managed $50M in assets for high-net-worth clients, ensuring alignment with long-term financial goals.

- •Engaged in continuous professional development, resulting in a 20% increase in certification and skill acquisition.

- •Created customized investment strategies that saw a 22% ROI over a three-year period.

- •Led workshops and seminars to educate clients on financial literacy, resulting in 10% more client engagement in services.

- •Optimized the use of financial tools and software leading to a 15% reduction in operational costs.

- •Achieved a 35% increase in client portfolios through strategic investment advice and excellent customer service.

- •Conducted extensive market analysis resulting in effective portfolio adjustments for clients.

- •Successfully managed a team of junior advisors, delivering training and performance evaluations.

- •Provided comprehensive investment plans that earned an average annual return of 18% for clients.

- •Implemented automated systems for tracking client investments, which improved data accuracy by 15%.

- •Analyzed financial data for 100+ clients, helping them achieve a 20% improvement in financial health.

- •Designed and presented financial models to senior management, influencing strategic decisions.

- •Conducted market research that led to the launch of three new product offerings.

- •Provided risk assessment services that contributed to a 12% increase in client portfolio security.

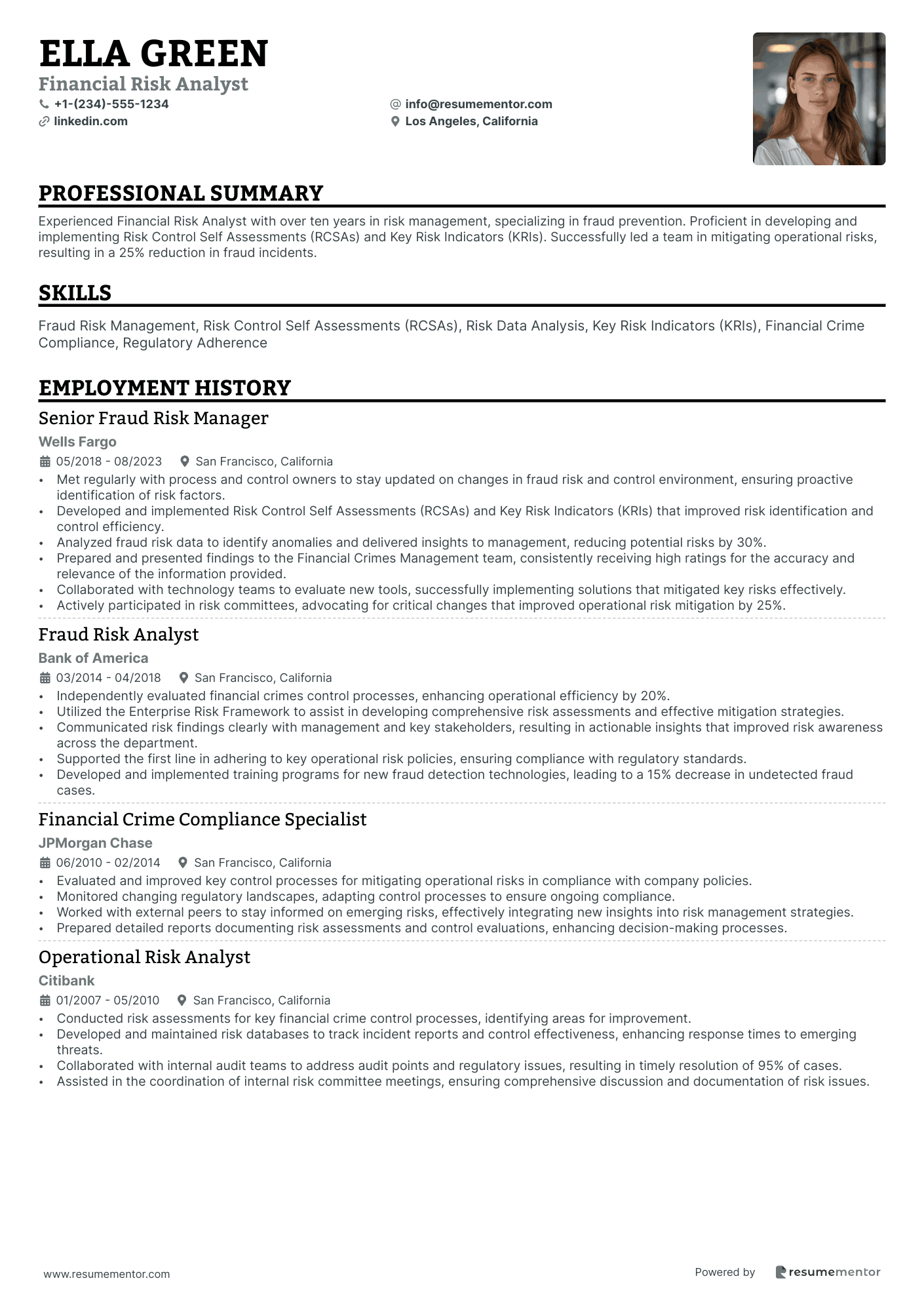

Financial Risk Analyst resume sample

- •Met regularly with process and control owners to stay updated on changes in fraud risk and control environment, ensuring proactive identification of risk factors.

- •Developed and implemented Risk Control Self Assessments (RCSAs) and Key Risk Indicators (KRIs) that improved risk identification and control efficiency.

- •Analyzed fraud risk data to identify anomalies and delivered insights to management, reducing potential risks by 30%.

- •Prepared and presented findings to the Financial Crimes Management team, consistently receiving high ratings for the accuracy and relevance of the information provided.

- •Collaborated with technology teams to evaluate new tools, successfully implementing solutions that mitigated key risks effectively.

- •Actively participated in risk committees, advocating for critical changes that improved operational risk mitigation by 25%.

- •Independently evaluated financial crimes control processes, enhancing operational efficiency by 20%.

- •Utilized the Enterprise Risk Framework to assist in developing comprehensive risk assessments and effective mitigation strategies.

- •Communicated risk findings clearly with management and key stakeholders, resulting in actionable insights that improved risk awareness across the department.

- •Supported the first line in adhering to key operational risk policies, ensuring compliance with regulatory standards.

- •Developed and implemented training programs for new fraud detection technologies, leading to a 15% decrease in undetected fraud cases.

- •Evaluated and improved key control processes for mitigating operational risks in compliance with company policies.

- •Monitored changing regulatory landscapes, adapting control processes to ensure ongoing compliance.

- •Worked with external peers to stay informed on emerging risks, effectively integrating new insights into risk management strategies.

- •Prepared detailed reports documenting risk assessments and control evaluations, enhancing decision-making processes.

- •Conducted risk assessments for key financial crime control processes, identifying areas for improvement.

- •Developed and maintained risk databases to track incident reports and control effectiveness, enhancing response times to emerging threats.

- •Collaborated with internal audit teams to address audit points and regulatory issues, resulting in timely resolution of 95% of cases.

- •Assisted in the coordination of internal risk committee meetings, ensuring comprehensive discussion and documentation of risk issues.

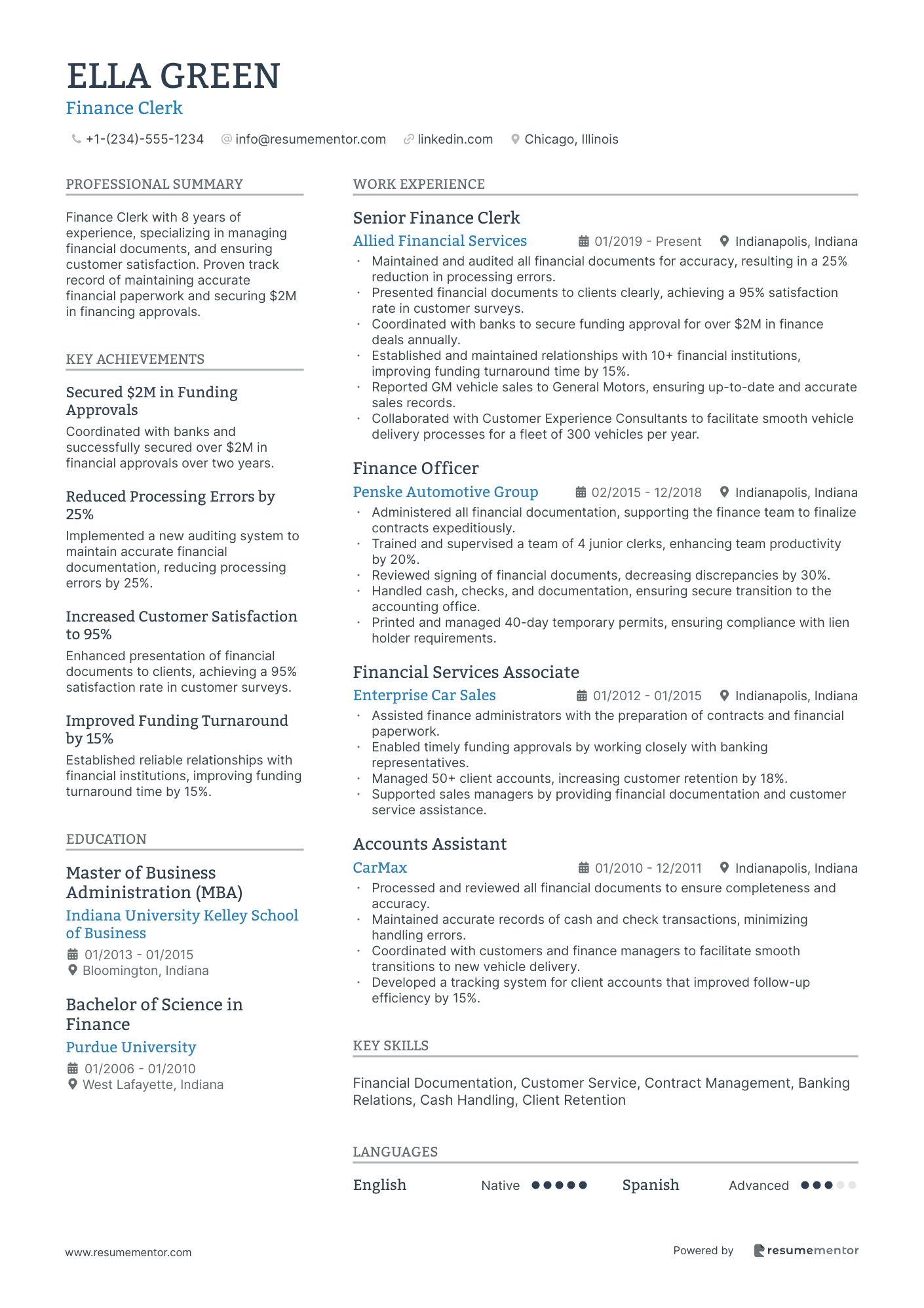

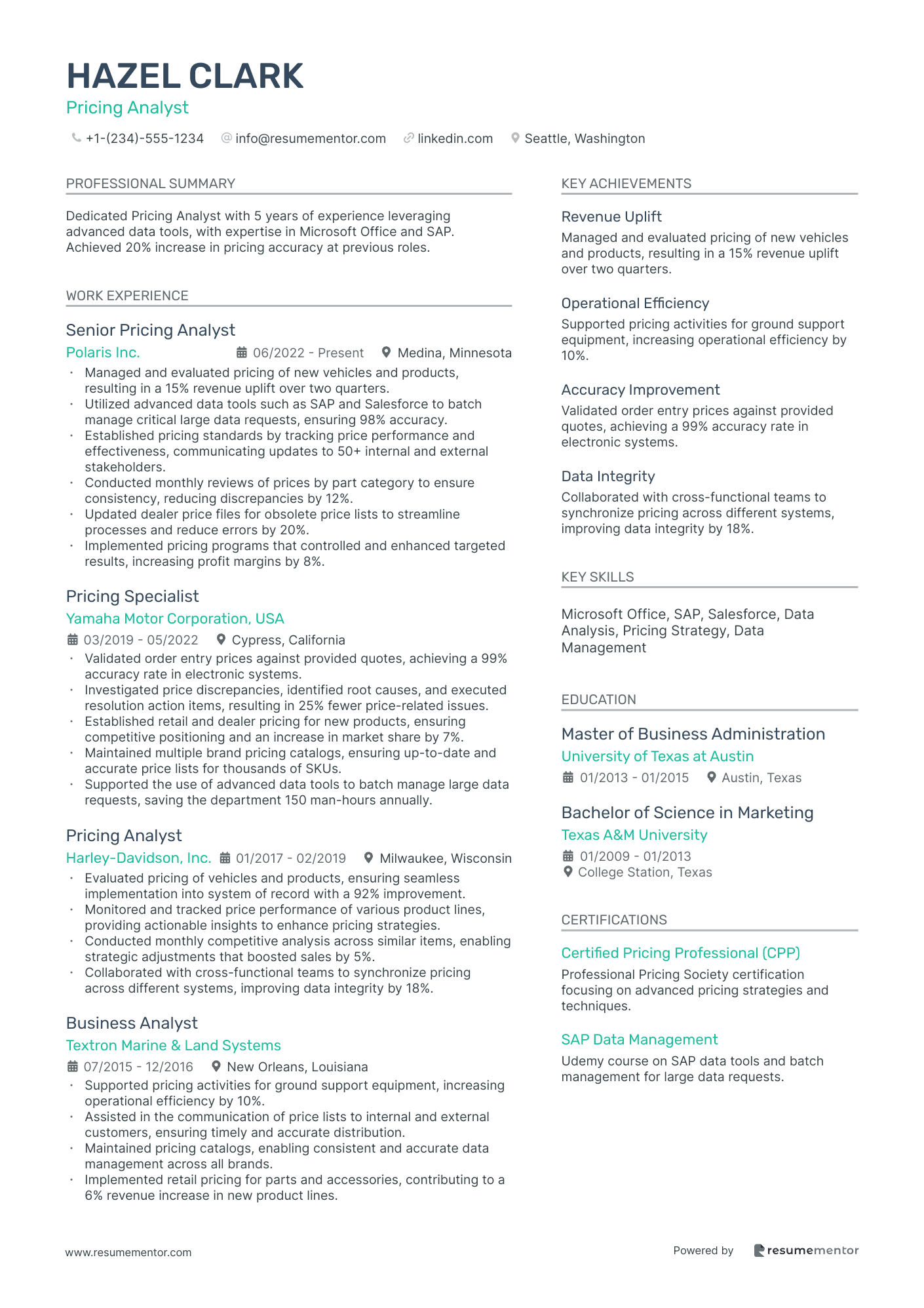

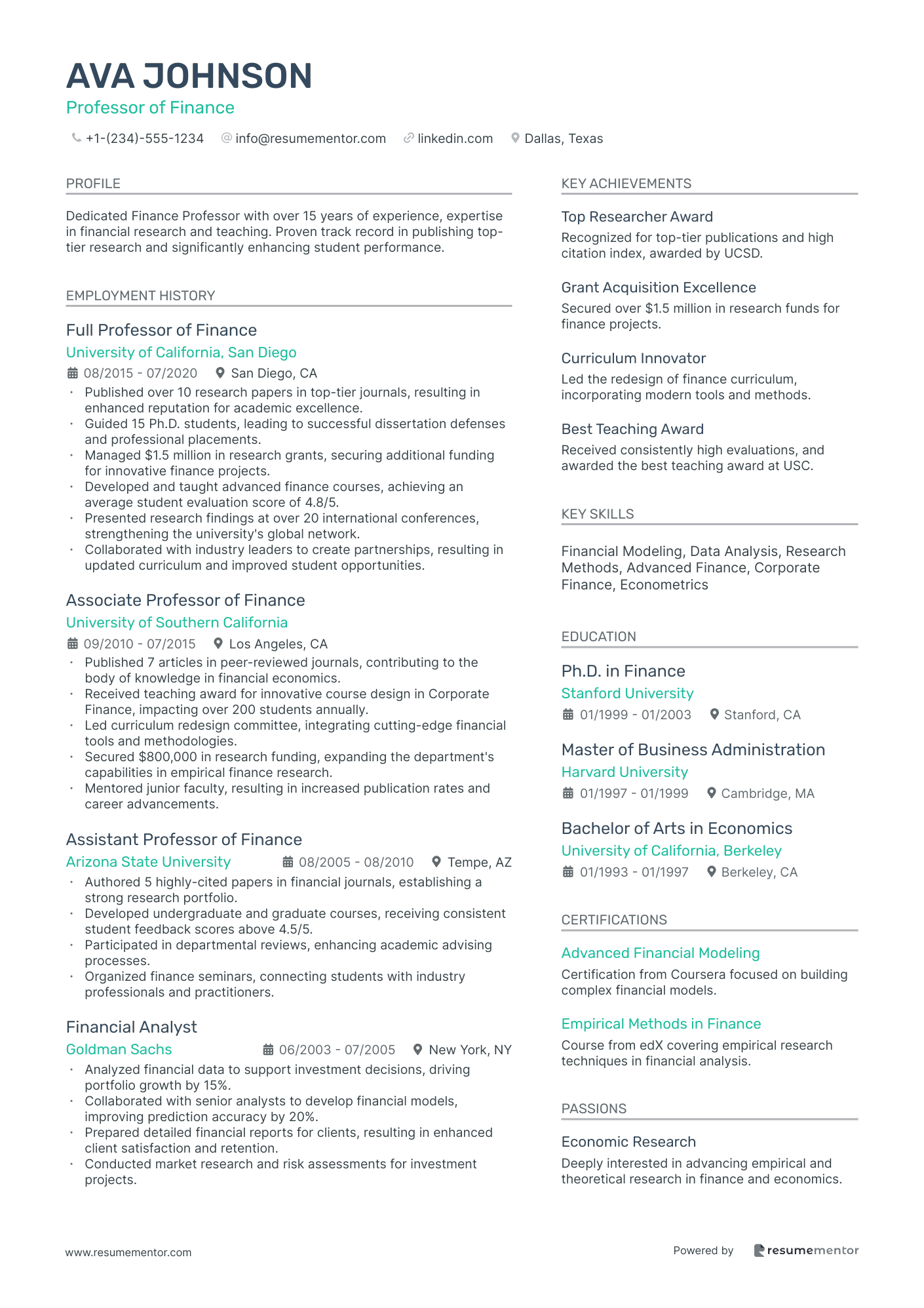

Finance Clerk resume sample

- •Maintained and audited all financial documents for accuracy, resulting in a 25% reduction in processing errors.

- •Presented financial documents to clients clearly, achieving a 95% satisfaction rate in customer surveys.

- •Coordinated with banks to secure funding approval for over $2M in finance deals annually.

- •Established and maintained relationships with 10+ financial institutions, improving funding turnaround time by 15%.

- •Reported GM vehicle sales to General Motors, ensuring up-to-date and accurate sales records.

- •Collaborated with Customer Experience Consultants to facilitate smooth vehicle delivery processes for a fleet of 300 vehicles per year.

- •Administered all financial documentation, supporting the finance team to finalize contracts expeditiously.

- •Trained and supervised a team of 4 junior clerks, enhancing team productivity by 20%.

- •Reviewed signing of financial documents, decreasing discrepancies by 30%.

- •Handled cash, checks, and documentation, ensuring secure transition to the accounting office.

- •Printed and managed 40-day temporary permits, ensuring compliance with lien holder requirements.

- •Assisted finance administrators with the preparation of contracts and financial paperwork.

- •Enabled timely funding approvals by working closely with banking representatives.

- •Managed 50+ client accounts, increasing customer retention by 18%.

- •Supported sales managers by providing financial documentation and customer service assistance.

- •Processed and reviewed all financial documents to ensure completeness and accuracy.

- •Maintained accurate records of cash and check transactions, minimizing handling errors.

- •Coordinated with customers and finance managers to facilitate smooth transitions to new vehicle delivery.

- •Developed a tracking system for client accounts that improved follow-up efficiency by 15%.

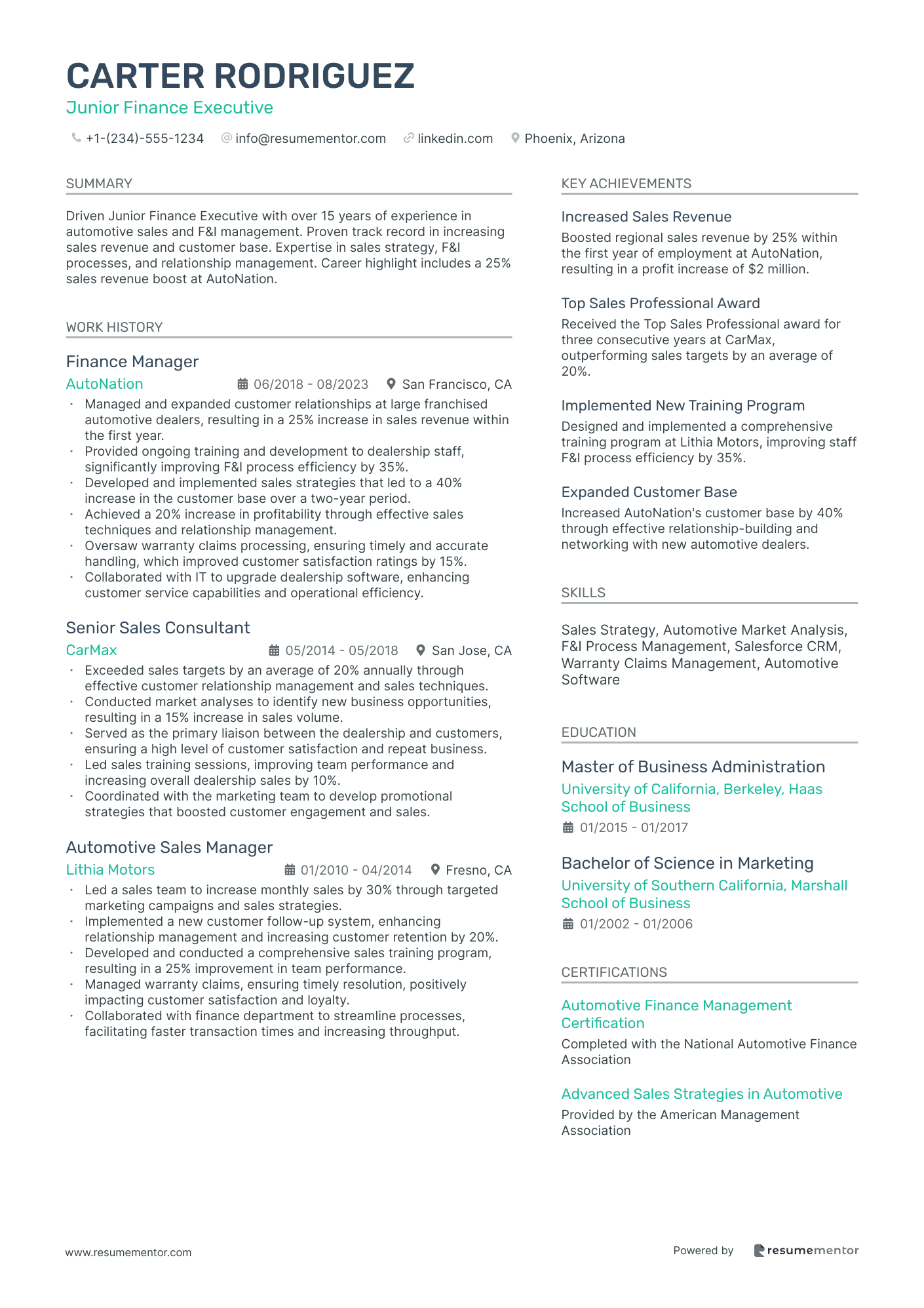

Junior Finance Executive resume sample

- •Managed and expanded customer relationships at large franchised automotive dealers, resulting in a 25% increase in sales revenue within the first year.

- •Provided ongoing training and development to dealership staff, significantly improving F&I process efficiency by 35%.

- •Developed and implemented sales strategies that led to a 40% increase in the customer base over a two-year period.